NATIONAL FUEL GAS CO false 0000070145 0000070145 2024-07-31 2024-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 31, 2024

NATIONAL FUEL GAS COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| New Jersey |

|

1-3880 |

|

13-1086010 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

|

|

|

|

6363 Main Street, Williamsville, New York |

|

14221 |

|

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (716) 857-7000

Former name or former address, if changed since last report: Not Applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol |

|

Name of Each Exchange

on Which Registered |

| Common Stock, par value $1.00 per share |

|

NFG |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure. |

On July 31, 2024, National Fuel Gas Company (the “Company”) updated its Investor Presentation. A copy of the presentation is furnished as part of this Current Report as Exhibit 99.

Neither the furnishing of the presentation as an exhibit to this Current Report nor the inclusion in such presentation of any reference to the Company’s internet address shall, under any circumstances, be deemed to incorporate the information available at such internet address into this Current Report. The information available at the Company’s internet address is not part of this Current Report or any other report filed or furnished by the Company with the Securities and Exchange Commission.

In addition to financial measures calculated in accordance with generally accepted accounting principles (“GAAP”), the press release furnished as part of this Current Report as Exhibit 99 contains certain non-GAAP financial measures. The Company believes that such non-GAAP financial measures are useful to investors because they provide an alternative method for assessing the Company’s operating results in a manner that is focused on the performance of the Company’s ongoing operations, for measuring the Company’s cash flow and liquidity, and for comparing the Company’s financial performance to other companies. The Company’s management uses these non-GAAP financial measures for the same purpose, and for planning and forecasting purposes. The presentation of non-GAAP financial measures is not meant to be a substitute for financial measures prepared in accordance with GAAP.

Certain statements contained herein or in the press release furnished as part of this Current Report, including statements regarding estimated future earnings and statements that are identified by the use of the words “anticipates,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “predicts,” “projects,” “believes,” “seeks,” “will” and “may” and similar expressions, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. There can be no assurance that the Company’s projections will in fact be achieved nor do these projections reflect any acquisitions or divestitures that may occur in the future. While the Company’s expectations, beliefs and projections are expressed in good faith and are believed to have a reasonable basis, actual results may differ materially from those projected in forward-looking statements. Furthermore, each forward-looking statement speaks only as of the date on which it is made. In addition to other factors, the following are important factors that could cause actual results to differ materially from those discussed in the forward-looking statements: impairments under the SEC’s full cost ceiling test for natural gas reserves; changes in the price of natural gas; changes in laws, regulations or judicial interpretations to which the Company is subject, including those involving derivatives, taxes, safety, employment, climate change, other environmental matters, real property, and exploration and production activities such as hydraulic fracturing; governmental/regulatory actions, initiatives and proceedings, including those involving rate cases (which address, among other things, target rates of return, rate design, retained natural gas and system modernization), environmental/safety requirements, affiliate relationships, industry structure, and franchise renewal; the Company’s ability to estimate accurately the time and resources necessary to meet emissions targets; governmental/regulatory actions and/or market pressures to reduce or eliminate reliance on natural gas;

increased costs or delays or changes in plans with respect to Company projects or related projects of other companies, as well as difficulties or delays in obtaining necessary governmental approvals, permits or orders or in obtaining the cooperation of interconnecting facility operators; changes in economic conditions, including inflationary pressures, supply chain issues, liquidity challenges, and global, national or regional recessions, and their effect on the demand for, and customers’ ability to pay for, the Company’s products and services; the creditworthiness or performance of the Company’s key suppliers, customers and counterparties; financial and economic conditions, including the availability of credit, and occurrences affecting the Company’s ability to obtain financing on acceptable terms for working capital, capital expenditures and other investments, including any downgrades in the Company’s credit ratings and changes in interest rates and other capital market conditions; changes in price differentials between similar quantities of natural gas sold at different geographic locations, and the effect of such changes on commodity production, revenues and demand for pipeline transportation capacity to or from such locations; the impact of information technology disruptions, cybersecurity or data security breaches; factors affecting the Company’s ability to successfully identify, drill for and produce economically viable natural gas reserves, including among others geology, lease availability and costs, title disputes, weather conditions, water availability and disposal or recycling opportunities of used water, shortages, delays or unavailability of equipment and services required in drilling operations, insufficient gathering, processing and transportation capacity, the need to obtain governmental approvals and permits, and compliance with environmental laws and regulations; the Company’s ability to complete strategic transactions; increasing health care costs and the resulting effect on health insurance premiums and on the obligation to provide other post-retirement benefits; other changes in price differentials between similar quantities of natural gas having different quality, heating value, hydrocarbon mix or delivery date; the cost and effects of legal and administrative claims against the Company or activist shareholder campaigns to effect changes at the Company; negotiations with the collective bargaining units representing the Company’s workforce, including potential work stoppages during negotiations; uncertainty of natural gas reserve estimates; significant differences between the Company’s projected and actual production levels for natural gas; changes in demographic patterns and weather conditions (including those related to climate change); changes in the availability, price or accounting treatment of derivative financial instruments; changes in laws, actuarial assumptions, the interest rate environment and the return on plan/trust assets related to the Company’s pension and other post-retirement benefits, which can affect future funding obligations and costs and plan liabilities; economic disruptions or uninsured losses resulting from major accidents, fires, severe weather, natural disasters, terrorist activities or acts of war, as well as economic and operational disruptions due to third-party outages; significant differences between the Company’s projected and actual capital expenditures and operating expenses; or increasing costs of insurance, changes in coverage and the ability to obtain insurance. The Company disclaims any obligation to update any forward-looking statements to reflect events or circumstances after the date hereof.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

| NATIONAL FUEL GAS COMPANY |

|

|

| By: |

|

/s/ Michael W. Reville |

|

|

Michael W. Reville |

|

|

General Counsel and Secretary |

Dated: July 31, 2024

Investor Presentation Fiscal 2024

– 3rd Quarter Update July 31, 2024 Exhibit 99

National Fuel Gas Company Company

Overview (3) Why National Fuel? (7) Business Updates (12) Supplemental Information Segment Information (19) Rate Case Overview (45) Guidance & Other Financial Information (47)

History of National Fuel Industry

Pioneer Born From Rockefeller’s Standard Oil Company

NFG Today: A Diversified, Integrated

Natural Gas Company Developing our large, high-quality acreage position in Marcellus & Utica shales Providing safe, reliable and affordable service to customers in WNY and NW PA Upstream Exploration & Production Midstream Gathering Pipeline

& Storage Downstream Utility Expanding and modernizing pipeline infrastructure to provide outlets for Appalachian natural gas production ~1.2 Million Net acres in Appalachia ~1.1 Bcf/day Net total production(2) $2.7 Billion Investments since

2010 4.5 MMDth Daily interstate pipeline capacity under contract 754,000 Utility customers ~$900 Million Investments in safety since 2010 Note: This presentation includes forward-looking statements. Please review the safe harbor for forward looking

statements at the end of this presentation. (1) Twelve months ended June 30, 2024. A reconciliation of Adjusted EBITDA to Net Income as presented on the Consolidated Statement of Income and Earnings Reinvested in the Business is included at the end

of this presentation. (2) Average net production for the three months ended June 30, 2024. 50% 38% 12% Adjusted EBITDA(1)

Non-Regulated Business Overview

Exploration & Production Segment (Upstream) Gathering Segment (Midstream) Seneca Resources Company Total Net Acres (Pennsylvania): ~1.2 million(1) Total Proved Reserves: 4.5 Tcfe (as of 9/30/2023) Current Net Production: ~1.1 Bcf/d(2) Firm

Transportation Capacity: ~1 Bcf/d to premium markets Decades of Marcellus and Utica development inventory National Fuel Gas Midstream Company Total Throughput: 1.3 Bcf/d(3) (including third party) Greater than 2 Bcf/d of gathering capacity ~400

miles of gathering pipeline 24 compressor stations Interconnections with 7 major pipelines Western Development Area – 925,000 Acres Eastern Development Area – 313,000 Acres Reported as of June 30, 2024. Average net production for the

three months ended June 30, 2024. Average throughput for the three months ended June 30, 2024.

Regulated Business Overview Pipeline

& Storage Segment (Midstream) Utility Segment (Downstream) Regulated by Federal Energy Regulatory Commission (FERC) Total Rate Base: $1.6 Billion(1) ~2,600 miles of pipeline / 29 storage fields National Fuel Gas Supply Corporation: Firm

Contracted Storage Capacity: 71 Bcf Firm Contracted Transportation Capacity: 3.4 Bcf / day(2) Empire Pipeline, Inc.: Firm Contracted Transportation Capacity: ~1.0 Bcf / day(2) Interconnections with 8 major interstate pipelines New York Jurisdiction

540,000 customers Regulated by the New York Public Service Commission (NYPSC) Pennsylvania Jurisdiction 214,000 customers Regulated by the Pennsylvania Public Utilities Commission (PAPUC) Total Rate Base: $1.2 Billion(1) Fiscal 2023 Total

Throughput: ~134 Bcf Provides more than 90% of the space heating load in operating footprint Represents the latest available information in regulatory filings. Supply and Empire rate base amounts are as of 12/31/2023. NY is as of 8/31/2023 and PA is

as of 12/31/2023. Contracted capacity disclosed annually as of September 30, 2023.

Why National Fuel? Optimized capital

allocation Lower cost of capital Operational synergies Improved profitability Targeting significant rate base growth from system modernization and expansion High-grading upstream development and increasing capital efficiencies Responsibly Reduce

Emissions Continued progress toward emissions reduction targets Enhanced GHG disclosures on sustainability initiatives 122 years of dividend payments 54 years of dividend increases New share repurchase program Long-Standing History of Shareholder

Returns Responsibly Reducing Emissions Visibility on Long-Term EPS & FCF Growth Strong Integrated Returns

Integrated Model Enhances Returns

Integrated Business Model Benefits… Operations: Lower cost structure Financial: Lower cost of capital Strategic: Optimized capital allocation Commercial: Greater revenue/ margin Strong Integrated Returns Visibility on Long-Term EPS & FCF

Growth Responsibly Reducing Emissions Long History of Shareholder Returns (1) Source: Bloomberg for the TTM ending September 30th. …Drive Strong Performance Since 2017 NFG vs. S&P 500: +2% NFG vs. E&P Peers: +8% NFG vs. Utility Peers:

+ 6% NFG’s ROCE outperforms peers and broader market, on average, over a multi-year period Decrease driven by non-cash impairments S&P O&G Index NFG S&P 500 UTY

Strong Value Proposition Driven by

Earnings & Cash Flow Outlook (1) NYMEX based on flat price assumptions per year and remainder of FY24 at $2.40. Includes current hedge positions as of June 30, 2024 and excludes acquisitions. Note: The Company defines free cash flow as net cash

provided by operating activities, less net cash used in investing activities, adjusted for acquisitions and divestitures. See non-GAAP financial measures information at the end of this presentation. Assumes current hedges. Assumes no pricing-related

curtailments. Non-Regulated Free Cash Flow(1) Strong Integrated Returns Visibility on Long-Term EPS & FCF Growth Responsibly Reducing Emissions Long History of Shareholder Returns 7-10% CAGR Regulated Adjusted Operating Results Increasing well

productivity from prolific EDA expected to deliver 0% - 5% production growth with decreasing capital Hedging portfolio provides near-term visibility to growing free cash flow generation Strong natural gas price outlook drives growth, with

significant opportunity to capture higher natural gas prices Significant FCF Generation Expected to Provide Flexibility Stable, predictable growth from the regulated Utility and Pipeline & Storage segments supports increasing dividend Robust

growth in FY25 driven by ongoing rate making activity propelling 2025E adjusted EPS growth >10% Beyond FY25, expect adjusted EPS growth to moderate to 5-7%, similar to average annual rate base growth Increasing EPS Expected to Drive Future

Dividend Growth Regulated Businesses Non-Regulated Businesses >10% NYMEX $3.25 $3.75 $4.25 ($ millions) Consolidated 3-Year CAGR (24E-27E)

Long-Standing History of Returning

Capital to Shareholders ~4% Dividend Yield ~2% Share Buyback Yield ~6% Total Return of Capital 54 Years Consecutive Dividend Increases 122 Years Consecutive Payments $2.06 per share $0.19 per share Stable, Growing Dividend … …Plus Share

Buyback $200 MM Share Repurchase Program approved in March 2024 Target completion date by end of fiscal 2025(3) Purchased ~$29 MM and 527K shares year-to-date through June 30th Over $1.5 Billion Returned to Shareholders Over Last 10 Years (1) Strong

Integrated Returns Visibility on Long-Term EPS & FCF Growth Responsibly Reducing Emissions Long History of Shareholder Returns (2) As of July 30th, 2024. Share buyback yield assumes the $200 MM repurchase program is executed ratably between

March 2024 and September 2025. Completion subject to a number of factors, including but not limited to stock price, market conditions, applicable securities laws, including SEC Rule 10b-18, corporate and regulatory requirements, and capital and

liquidity needs.

Continued Progress Toward Methane

Intensity Targets Latest Corporate Responsibility Report Provides Enhanced GHG Disclosures on Sustainability Initiatives All emissions reduction targets based on 2020 baseline. Measured using calendar 2022 emissions data, as reported in

Company’s 2022 Corporate Responsibility Report. Total GHG emissions largely flat vs. 2020 despite significant production and throughput growth. Total methane emissions decreased by ~7%. Target: 40% Progress Since 2020: 27% E&P Progress

Since 2020: 14% Gathering Progress Since 2020: 18% P&S Progress Since 2020: 8% Utility 2030 Methane Intensity Reduction Targets Target: 30% Target: 50% Target: 30% National Fuel Gas Company Targets 25% reduction in GHG emissions by 2030 Progress

since 2020: 1% increase in total GHG emissions(2) Ongoing Sustainability Initiatives Responsible gas certifications Pneumatic device replacement Equipment upgrades at existing facilities Use of best-in-class emissions controls for new facilities (1)

Strong Integrated Returns Visibility on Long-Term EPS & FCF Growth Responsibly Reducing Emissions Long History of Shareholder Returns

Business Updates

(1) DSIC tracker allows recovery on

incremental system investments after July 31, 2024, subject to attaining rate year plant balance of $781.3 million and earning below a statewide ROE target (currently 10.15%). Regulatory Update: Significant Rate Case Activity New York: Filed a rate

case in October 2023 for new rates effective October 1, 2024 (FY 2025) Proposed $88.8 million base rate increase ($83.0 million in March rebuttal filing) Multi-year settlement negotiations are ongoing Key drivers: Continue rate base growth from

modernization program: proposed $1.03 billion Seek higher returns: proposed 9.8% ROE and 52% Equity / 48% Debt Recover impact of inflation on operating expenses Utility – NY Supply: Settlement approved by FERC on 6/11/24 New rates went into

effect 2/1/24 $56 million expected increase in revenue on annualized basis Maintains existing depreciation rates No comeback or moratorium period Ability to file a rate case at any time P&S – Supply Pennsylvania: Joint Settlement reached

on first rate case in PA since 2007 Achieved $23 million revenue requirement (~80% of filed position) New weather normalization adjustment mechanism New rates became effective August 1, 2023 Eligible for Distribution System Improvement Charge (DSIC)

when net plant targets are hit after July 31, 2024(1) Utility – PA Rate Case Pending $23M increase in Revenue $56M increase in Revenue Significant Growth

Regulated Businesses Further Propel

Long-Term Growth Infrastructure modernization program Ongoing expansion opportunities Emissions reductions initiatives Timely rate recovery and supportive ratemaking constructs minimize regulatory lag Factors Driving Long-Term Growth ~6% CAGR ~5-7%

Avg. Expected Annual Rate Base Growth Beyond FY23

EDA Transition Creates Differentiated

Upstream Value EDA Transition High-grading development plan with higher capital efficiencies and cash flow generation EDA wells deliver >2x the well productivity versus legacy WDA program(1) 24 EDA wells turned in line (TIL) since transition

began (May 2023) Access to multiple, premium out-of-basin markets through owned firm transportation Well productivity is measured within the first five years that a well comes online. Western Development Areas (WDA) Legacy Development Area Primarily

Owned in Fee (No Royalty) Eastern Development Areas (EDA) Development Focus Area 10+ Years Low-Risk Inventory EDA – 313,000 Acres WDA– 925,000 Acres

Enverus 2022 Actuals Enverus 2022

Actuals Seneca Estimates Seneca + Gathering Estimates EDA: Best in Basin Performance & Breakevens FY22 is based on actual data. FY23 to FY26 data is projected until 12 months after the last pad has been online. Source: FY22 data is based on

Enverus Intelligence Research for NFG and peers. Peers include Apex Energy, AR, Arsenal, Ascent Resources, CHK, CNX, CTRA, Encino Energy, EQT, GPOR, Greylock Energy, HG Energy, NNE, Olympus Energy, PennEnergy, REP, RRC, Snyder Brothers, SWN, Tug

Hill. FY23 to FY25 NFG data is based on estimates. >10 years of prolific EDA inventory at expected development pace % of EDA TILs: ~30% ~50% ~60% ~80% ~100% Seneca EDA 2022/2023 NE / SW Appalachia Peer Program Productivity Increasing

Significantly Best-in-Class Well Performance Already Low Breakevens Continue to Improve

Capital Allocation Priorities Drive

Spending Levels (2) Total Capital Expenditures include Corporate and All Other. A reconciliation to Capital Expenditures as presented on the Consolidated Statement of Cash Flows is included at the end of this presentation. FY20 reflects the netting

of $283 million in E&P segment and $223 million in the Gathering segment related to the acquisition of Appalachian upstream assets in July 2020. FY23 reflects the netting of $150 million in the E&P segment related to the acquisition of

Appalachian upstream assets. Capital Expenditures by Segment ($ millions)(1) Capital Allocation Priorities $120 - $140 $95 - $110 $150 - $175 Organic Investments Responsibly Manage the Balance Sheet Return of Capital to Shareholders Highly Strategic

M&A Invest in regulated growth via modernization and pipeline expansions Maintain 0-5% growth in upstream/gathering Maintain investment grade credit rating Target optimal rate making capital structure Uphold 54-year history of dividend increases

Value-accretive share repurchases Upstream/Gathering: Integrated opportunities geographically proximate to existing operations Regulated: Growth to balance business mix (2) $495 - $525 $95 - $110

Maintaining Strong Balance Sheet

& Liquidity $5.8 Billion Total Capitalization as of June 30, 2024 Net Debt / Adjusted EBITDA(1) Capitalization Debt Maturity Profile by Fiscal Year ($MM) Liquidity as of June 30, 2024 Net Debt is net of cash and temporary cash investments.

Reconciliations of Net Debt and Adjusted EBITDA to Net Income are included at the end of this presentation. $300 MM term loan was drawn in April 2024 and replaced outstanding commercial paper. Committed Credit Facilities Term Loan (Matures Feb 2026)

Short-term Debt Outstanding Available Short-term Credit Facilities Cash Balance Total Liquidity $ 1,300 MM (300MM) 0 MM 1,000 MM 81 MM $ 1,081 MM Current Credit Ratings Debt S&P BBB- Moody’s Baa3 Fitch BBB Investment Grade Credit Rating

Quickly de-levered after 2020 Shell acquisition. $300 (2)

Exploration & Production &

Gathering Overview Seneca Resources Company, LLC National Fuel Gas Midstream Company, LLC Supplemental Information: Segment Overview

Focused on Capital Efficiency and FCF

Generation Near-Term Strategy Capital Expenditures ($ MM)(1) Net Production (Bcfe) Moderating activity levels beyond fiscal 2024 to target 0% to 5% production growth Development program focused on the EDA to maximize returns and capital efficiency

EDA Tioga: most active development area focused on Utica and Marcellus EDA Lycoming: modest development focused on Marcellus WDA: limited development focused on Utica A reconciliation to Capital Expenditures as presented on the Consolidated

Statement of Cash Flows is included at the end of this presentation. FY23 reflects the netting of $150 million related to acquisition of upstream assets and acreage. E&P and Gathering +10% -13% EDA – 313,000 Acres WDA– 925,000

Acres

Integration Drives Industry Leading

Cost Structure Seneca Cash OpEx ($/Mcfe) G&A estimate represents the midpoint of the G&A guidance ranges for fiscal 2024. The total of the two LOE components represents the midpoint of the LOE guidance ranges for fiscal 2024. (2) E&P and

Gathering (2) Seneca + Gathering Cash OpEx ($/Mcfe) $0.47 Reduction

Long Runway of Development

Opportunities in the EDA 1 2 Utica Development Marcellus Development Exploration & Production: Low-risk development locations: ~200 Utica, 80 Marcellus Gathering infrastructure: NFG Midstream Tioga gathering systems Numerous marketing

opportunities: Ability to utilize Seneca’s firm transportation capacity: Empire Tioga County Extension, Leidy South and Northeast Supply Diversification (Tioga Pathway 2026) Gathering: Seneca and third-party production sources, system capacity

up to 970,000 Dth per day Exploration & Production: Low-risk development locations: ~20 Marcellus Gathering infrastructure: NFG Midstream Trout Run Firm transportation capacity: Atlantic Sunrise (Transco) Gathering: Seneca and third-party

production sources, system capacity up to 585,000 Dth per day Expected to generate third-party revenues of $10 – $15 million for fiscal 2024 and 2025 Tioga County, PA Lycoming County, PA 1 2 EDA E&P and Gathering

High Quality Acreage in WDA,

Primarily Owned in Fee Potential for 600+ Marcellus Shale and 500+ Utica Shale well locations Large gathering system with multiple interconnects provides access to firm transportation portfolio that reaches premium markets Highly contiguous fee

acreage (no royalty) enhances economics and provides development flexibility Beechwood area results provide long-term development optionality Western Development Area (WDA) Highlights Marcellus & Utica Trend Fairways(1) (1) The Utica Shale lies

approximately 5,000 feet beneath Seneca’s WDA Marcellus acreage. Gathering System Map WDA Gathering Total investment to date ~$400 MM Seneca production source, system capacity up to 750K Dth/d Minimal gathering pipelines and compression

investment required to support Seneca’s near-term development program Utica Trend Marcellus Trend E&P and Gathering

E&P and Gathering Production

Supported by Long-Term Contracts To Canada, Dawn, TPG-200 (45% of total) To Mid-Atlantic, SE US (20% of total) To NY, NJ, Northeast (35% of total) ~1 Bcf/d of Firm Transportation NE Supply Diversification (TGP) 50,000 Dth/d (Canada-Dawn) (EDA-Tioga)

Niagara Expansion (TGP & NFG - Supply) Canada-Dawn & TGP 200 170,000 Dth/d (WDA) Atlantic Sunrise (Transco) Mid-Atlantic & Southeast U.S. 189,405 Dth/d (EDA-Lycoming) Incremental Firm Sales Contracts(1) Will continue to layer-in firm

sales deals to reduce in-basin spot exposure Leidy South (Transco & NFG - Supply) Transco Zone 6 Non-NY 330,000 Dth/d *Capacity can be utilized by all three producing areas (WDA, EDA-Tioga, and EDA-Lycoming) Tioga County Extension (NFG - Empire)

Canada-Dawn & NY Markets 200,000 Dth/d (EDA Tioga) Firm Sales Portfolio Fiscal 2024 - 2025 Represents approximate base firm sales contracts not tied to firm transportation capacity. Base firm sales are either fixed priced or priced at an index

(e.g., NYMEX ) +/- a fixed basis and do not carry any transportation costs.

Fiscal 2024 Sales Mix Provides

Near-Term Price Certainty Q4 Volumes: Fixed Price 18 Bcfe, NYMEX-Linked 67 Bcfe, Index 5 Bcfe. NYMEX-Linked and Index prices are shown as differentials to NYMEX and $ per MMBtu. Price certainty defined as volumes where the price is locked in through

either a fixed price firm sale or a NYMEX-linked firm sale paired with a NYMEX swap. Floor protection defined as volumes where a floor price is locked in through a NYMEX-linked firm sale paired with a NYMEX collar. The average realized price, which

includes differentials, is: floor of $2.56 and cap of $3.13. E&P and Gathering ($1.21) ($0.66) $2.43 $2.60 103 Bcfe Firm Sales & Production Cadence Price Realizations with Hedging (Net Bcfe, $ per MMBtu) ~390 - 400 NYMEX Floor: $3.22 Cap:

$3.79 ($0.79) $1.50 (2) (3) (1) Differential to NYMEX 96 Bcfe

Fiscal 2025 Sales Portfolio Provides

High Degree of Price Certainty Q1 Volumes: Fixed Price 20 Bcfe, NYMEX-Linked 64 Bcfe, Index 7 Bcfe. Q2 Volumes: Fixed Price 20 Bcfe, NYMEX-Linked 62 Bcfe, Index 8 Bcfe. Q3 Volumes: Fixed Price 19 Bcfe, NYMEX-Linked 49 Bcfe, Index 22 Bcfe. Q4

Volumes: Fixed Price 19 Bcfe, NYMEX-Linked 50 Bcfe, Index 21 Bcfe. NYMEX-Linked and Index prices are shown as differentials to NYMEX and $ per MMBtu. Price certainty defined as volumes where the price is locked in through either a fixed price firm

sale or a NYMEX-linked firm sale paired with a NYMEX swap. Floor protection defined as volumes where a floor price is locked in through a NYMEX-linked firm sale paired with a NYMEX collar. The average realized price, which includes differentials,

is: floor of $2.74 and cap of $3.85. E&P and Gathering ($0.93) ($0.93) ($0.69) ($0.69) $2.51 $2.51 $2.66 Firm Sales & Production Cadence(1) Price Realizations with Hedging (Net Bcfe, $ per MMBtu) ~400 - 420 NYMEX Floor: $3.43 Cap: $4.54

($0.82) $2.30 (2) (3) Differential to NYMEX ($0.94) ($0.71) $2.44 ($1.06) ($0.70) $2.43

Hedging Program: Disciplined with

Upside Potential Significant Opportunity to Capture Value From Increasing Natural Gas Prices Methodical approach of layering in hedges over time Protect near-term earnings and cash flows while maintaining upside Maintain the strength of our

investment grade credit profile E&P and Gathering 75- 80% 55- 60% ~40% ~27% Assumes ~410 Bcf of production per year. Note: FY24 is percent hedged for the remaining three months. (1) ~73% ~60%

Industry-Leading Focus on

Sustainability E&P and Gathering Responsible Gas Certifications, Methane Detection & Biodiversity Equitable Origin – EO100TM Standard for Responsible Energy Development Certifications Certification focuses on three emissions management

criteria: Methane Intensity Company Practices to Manage Methane Emissions Emissions Monitoring Technology Deployment MiQ (100% of Appalachian Assets – Re-Certified August 2023) 100% of natural gas production certified and re-verified in

December 2023 Achieved peer-leading “A” certification grade Methane Detection Standard pad design includes fixed gas detection systems installed near production equipment Regular Audio-Visual-Olfactory inspections of all assets Quarterly

Leak Detection and Repair (LDAR) surveys of all assets Piloting continuous emissions monitoring equipment Achieved “A” certification grade - the highest certification level available Biodiversity Surface Footprint Neutral Program focuses

on restoring, enhancing, or protecting biodiversity by returning one acre of land to the environment for every acre disturbed Voluntary initiatives focused on pollinator and tree plantings, streambank stabilization, and enhancing aquatic wildlife

100% of gathering system assets certified in 2023 Seneca is participating in AMI’s 2024 Monitoring Plan AMI is a proactive, basin-wide initiative designed to enhance methane monitoring & emission reductions AMI includes aerial surveys of

operator assets as well as non-oil & gas assets

Pipeline & Storage Overview

National Fuel Gas Supply Corporation Empire Pipeline, Inc. Supplemental Information: Segment Overview

Pipeline & Storage Segment

Overview Disclosed annually as of September 30, 2023. As of December 31, 2023, calculated from National Fuel Gas Supply Corporation’s and Empire Pipeline, Inc.’s 2023 FERC Form-2 reports, respectively. Empire Pipeline, Inc. National Fuel

Gas Supply Corporation Empire Pipeline Supply Corp. Contracted Capacity(1): Firm Transportation: 3,408 MDth per day Firm Storage: 70,693 MDth (fully subscribed) Rate Base(2): ~$1,244 million FERC Rate Proceeding Status: Rate case settled in Q2 FY24

and approved by FERC June 11, 2024 New rates went into effect as of February 1, 2024 Contracted Capacity(1): Firm Transportation: 1,048 MDth per day Firm Storage: 3,753 MDth (fully subscribed) Rate Base(2): ~$317 million FERC Rate Proceeding Status:

Rates in effect since January 2019 Must file for new rates no later than May 1, 2025 Pipeline & Storage

Pipeline & Storage Customer Mix

Firm Transport Customer Transportation by Shipper Type(1) Affiliated Customer Mix (Contracted Capacity) Disclosed annually as of 9/30/2023. Pipeline & Storage

Pipeline Modernization &

Expansion Projects Propel Growth A reconciliation to Capital Expenditures as presented on the Consolidated Statement of Cash Flows is included at the end of this presentation. FY24E and FY25E capex is presented at mid-point of guidance. Investments

Support Long-Term Rate Base Growth of ~5-7% Pipeline & Storage ~8% YOY Growth from Modernization Rate Base Growth Drivers Long-term modernization and emission reduction spending of ~$100-150 MM per year Expansion projects drive further growth

potential, such as the Tioga Pathway Project (Fiscal 2026)

Tioga Pathway Project – Organic

Growth Capacity: 190,000 Dth/day Estimated annual revenue: ~$15 million (underpinned by 15-year agreement with Seneca) Estimated capital cost: ~$100 million A portion of the capital to be allocated to modernization facilities Facilities (all in

Pennsylvania) include: Approximately 20 miles of new pipeline Approximately 4 miles of replacement/modernization of 20” pipeline Target in-service date: late calendar year 2026 Regulatory process: FERC 7(c) Application (expected August 2024)

Pipeline & Storage Project provides long-term revenue growth for Supply, while providing an additional outlet for Seneca’s EDA development

Continued Expansion of the Supply

Corp. Line N System Over the past four years, the company has successfully placed into service several projects which have added: Contracted firm transport: 158,000 Dth/d Contracted firm storage: 267,000 Dth Combined annual revenue: ~$7 million

Pipeline & Storage Mercer Rover Holbrook Columbia Interconnect Recent Expansion of Line N Additional Line N Expansion Opportunities Interconnectivity of the system to other long-haul pipelines and on-system load provides on-going opportunity to

transport additional volumes Evaluating potential projects for end users, as well as projects for producers and marketers that could reach various markets, including to Rover and TGP Pipeline at Mercer

Northern Access Project Delivery

points: 350,000 Dth/d to Chippawa (TCPL interconnect) 140,000 Dth/d to East Aurora (TGP 200 line) Regulatory/legal status: Feb. 2017 – FERC 7(c) certificate issued Aug. 2018 – FERC issued Order finding that NY DEC waived water quality

certification (WQC) Apr. 2019 – FERC denied rehearing of WQC waiver order (upholding waiver finding) Mar. 2021 – U.S. Second Circuit Court of Appeals dismissed appeal of FERC waiver orders Jun. 2022 – FERC granted extension of

certificate until December 31, 2024 To Dawn NE US (TGP 200) Pipeline & Storage

Utility Overview National Fuel Gas

Distribution Corporation Supplemental Information: Segment Overview

New York & Pennsylvania Service

Territories New York Last Rate Case: Currently pending, settlement discussions ongoing Total Customers(1): ~540,000 Allowed ROE: 8.7% (NY PSC Rate Case Order, April 2017) Rate Mechanisms: Revenue Decoupling Weather Normalization Low Income Rates

Merchant Function Charge (Uncollectibles Adj.) 90/10 Sharing (Large Customers) System Modernization / Improvement Trackers(2) Pennsylvania Last Rate Case: 2023 (rates effective August 1, 2023) Total Customers(1): ~214,000 Allowed ROE: Black-box

settlement (2023) - $23 MM rate increase Rate Mechanisms: Weather Normalization (added Aug. 1, 2023), subject to 3% deadband Low Income Rates Merchant Function Charge (Uncollectibles Adj.) Eligible for Distribution System Improvement Charge (DSIC)

Modernization Tracker Disclosed annually as of September 30, 2023. Applied to new plant placed in service through September 30, 2024. Utility

NY Utility Rate Case Status Rate Case

is Ongoing with New Rates Expected to Start October 1, 2024 Utility Filed case on October 31, 2023; National Fuel’s base rates have not changed since the last base rate case was litigated in 2017 Rebuttal testimony filed March 22, 2024;

Settlement discussions ongoing Proposed base rate increase = $83.0 million ($67.1 million net margin revenues)(1) 28.8% increase in base delivery revenues (23.0% net margin revenues) 12.0% increase in operating revenues Proposed Base Revenue

Increase Key Drivers Proposed Capital Structure and Returns: Capital Structure = 48% debt / 52% equity Return on Equity = 9.8% Increasing rate base and depreciation expense associated with higher plant in-service Total Rate Base in Rate Year =

~$1.03 billion(1) Maintain leak prone pipe replacement target at 110 miles per year O&M expense inflation (e.g., labor and benefits) Implement elements of Long-Term Plan filed with NY PSC in July 2023 (e.g. Hybrid Heating, Demand Response, RNG

and RSNG pilots) Seeking approval for uncollectible expense tracker The Company filed rebuttal testimony and exhibits on March 22, 2024 revising the requested base rate increase from $88.8 million to $83.0 million. Refer to NY PSC case docket

23-G-0627. Utility

First utility in the state to submit

a LTP (Long-Term Plan) NY PSC implemented NFG’s LTP with modifications in December 2023 Includes an “All-of-the-Above Pathway” for an affordable and practical way to meet the State’s climate goals LTP includes Hybrid Heating,

Demand Response, RNG and RSNG pilots System modernization NFG continues to receive support for accelerated and proactive investments in the replacement of leak prone pipe Current modernization tracker reduces regulatory lag on rate base growth

Supportive rate mechanisms include: Weather normalization – Adjusts billings based on temperature variances compared to average weather Revenue Decoupling – Separates usage from revenue for initiatives such as energy conservation

Industrial 90/10 – Symmetrical sharing for large commercial and industrial customer margin NY Regulatory Environment Continues to Prioritize Access to Safe, Reliable and Affordable Energy NY Utility Regulated Environment Utility

Customer Affordability New York

Pennsylvania Based on 2023 average monthly residential bill data posted on company websites required by the NYPSC. Based on analysis of 2024 PAPUC Annual Rate Comparison Report, which includes data for average monthly residential bills for 2023.

Utility #3 Out of 9 Gas Utilities(1) #1 Out of 6 Gas Utilities(2)

Utility Continues its Significant

Investments in Safety (1) A reconciliation to Capital Expenditures as presented on the Consolidated Statement of Cash Flows is included at the end of this presentation. Increase from FY23 to FY24E is partially due to the estimated impact of New York

State’s Roadway Excavation Quality Assurance Act (“REQAA”) which will continue to increase investment costs in future years. Long-Standing Focus on Distribution System Safety and Reliability Utility Modernization Spending in NY

Expected to Add $8 - $9 MM in Gross Margin in FY 2024 (2)

Long-Standing Pipeline Replacement

& Modernization NY 9,817 miles PA 4,832 miles Miles of Utility Main Pipeline Replaced(2) Utility Mains by Material(1) (1) All values are reported on a calendar year basis, as of December 31, 2023, as required by the DOT. (2) All values are

reported on a fiscal year basis, as required by the NYPSC and PAPUC. Utility

Baseline emissions & emissions

reduction targets are calculated pursuant to the reporting methodology under the EPA GHG Reporting Program (current Subpart W, and using AR5), primarily Distribution pipeline mains & services. New York Climate Leadership and Community Protection

Act, enacted in 2019. Targets Exceed Those Included in New York State Climate Act (CLCPA)(2) Reductions Primarily Driven by Ongoing Modernization of Mains and Services Utility Targeting Substantial Emissions Reductions 2030 75% Significant

Reductions in Utility GHG Emissions to Date, Driven by System Modernization Efforts GHG Reduction Targets, Continuing Focus on Lowering Carbon Footprint ~67% Reduction Since 1990 (484,000 Metric Tons CO2e) Utility GHG Emissions Reduction Targets(1)

(Based on 1990 EPA Subpart W Emissions) 90% 2050 Utility

Promoting Renewable & Certified

Natural Gas Awarded four RNG grants for $1.1 million through the Utility’s Area Development Program First on-system project goes online. Production volumes ~50,000 Mcf/year. Through Fiscal 2020 Future Distribution Corporation received approval

from NY and PA utility commissions to accept RNG into its distribution system Final Scoping Plan adopted by New York Climate Action Council includes consideration of alternative fuels and technologies in future gas system planning Low Carbon

Resources Initiative (LCRI) expected to provide opportunities for NFG to leverage technology acceleration within its regional footprint Continuing to Work with Regulators and Third Parties to Advance Zero and Low Carbon Opportunities Utility Advance

RNG opportunities in the Utility Long-Term Plan July 2021 Currently Three site locations under construction. By end of 2025, anticipated RNG volumes of 386,000 Mcf/year. Certified Natural Gas Pilot Programs: Pennsylvania(1) Term: Three-year pilot

program ending on July 31, 2027 Certification Providers and Levels: MiQ Grade A or Grade B, or OGMP 2.0 Level 4 or Level 5 Certification Cap Premium: Annual spend not to exceed $175,000 Cap on certification premium not to exceed $0.07/Dth/day New

York(2) Proposed: Three-year pilot program Certification Providers and Levels: MiQ Grade A or Grade B OGMP 2.0 Level 4 or Level 5 Certification Cap Premium: Annual spend not to exceed $300,000 Pennsylvania CNG pilot program was approved via 1307 (f)

Settlement R-2024-3045177. New York CNG pilot program details are as proposed in current New York Rate Case. RNG (Renewable Natural Gas) Progress:

Rate Case Overview Supplemental

Information

Rate Case Overview: Timing and Status

Supply Empire NY PA Regulatory Agency (Governed by) FERC FERC NY PSC PAPUC Timing/ Status Settlement approved by FERC June 11, 2024 New rates went into effect February 1, 2024 No moratorium or comeback period Rates in effect since January 1, 2019

Must file for new rates by May 1, 2025 Filed rate case October 31, 2023 Anticipant new rates effective October 1, 2024 Rate case is ongoing Settlement approved in June 2023 Rates in effect since August 1, 2023 Rate base(1) (in millions) $1,244 $317

$823 Requested à $1,030 $412 Equity Ratio Not stated – Black box settlement Not stated – Black box settlement NY PSC Rate Case April 2017 à 43% Requested à 52% Not stated – Black box settlement Authorized ROE Not

Stated – Black box settlement Not Stated – Black box settlement NY PSC Rate Case April 2017 à 8.7% Requested à 9.8% Not Stated – Black box settlement Pipeline & Storge Utility Represents the latest available

information in regulatory filings. Supply and Empire rate base amounts are as of 12/31/2023. NY is as of 8/31/2023 and PA is as of 12/31/2023. Recent updates in orange

Guidance & Other Financial

Information Supplemental Information

Fiscal 2025 Earnings Guidance Updated

FY2024 Earnings Guidance $5.00 to $5.10/share(1) $5.75 to $6.25/share Preliminary FY2025 Earnings Guidance 400 - 420 Bcfe (increase from 395 - 400 in fiscal 2024) ~$2.62 - $2.66/Mcf(2) (increase from ~$2.44 in fiscal 2024) Key Guidance Drivers Net

Production Realized natural gas prices (after-hedge) Pipeline & Storage Utility Pending Rate Case Outcome $415 - $435 million (~$18 MM increase from fiscal 2024) Pipeline & Storage Revenues Tax Rate Effective Tax Rate 24.5 - 25% (increase

from ~24.5% in fiscal 2024) Pipeline & Storage Depreciation Expense 2 - 3% increase G&A Expense $0.18 - $0.19/Mcf (increase from ~$0.18 in fiscal 2024) DD&A Expense $0.70 - $0.74/Mcf (increase from ~$0.71 in fiscal 2024) ~5% increase

Pipeline & Storage O&M Expense Non-Regulated Regulated $245 - $255 million (~$5 MM increase from fiscal 2024) Gathering Revenues Gathering O&M Expense ~$0.10/ Mcf of throughput (increase from ~$0.09 in fiscal 2024) Exploration &

Production Gathering Pipeline & Storage Utility LOE Expense $0.68 - $0.70/Mcf (consistent with ~$0.69 in fiscal 2024) Utility Operating Income Excludes items impacting comparability. See Comparable GAAP Financial Measure Slides &

Reconciliations at the end of this presentation. Assumes NYMEX pricing of $3.25/MMBtu and in-basin spot pricing of $2.30/MMBtu for fiscal 2025, and reflects the impact of existing financial hedges, firm sales and firm transportation contracts. +19%

Financial Results and Major Drivers

Adjusted Operating Results(1) Excludes items impacting comparability. See Comparable GAAP Financial Measure Slides & Reconciliations at the end of this presentation. Consolidated Adjusted EBITDA includes Corporate & All Other. A

reconciliation of Adjusted EBITDA to Net Income, by segment, as presented on the Consolidated Statement of Income and Earnings Reinvested in the Business is included at the end of this presentation. Adjusted EBITDA(2) ($ per share) FY24 Major

Drivers E&P and Gathering: Natural Gas Prices Natural Gas Production & Gathering Throughput P&S: Impact of Supply Rate Case Increase Utility: Impact of Pennsylvania Rate Increase ($ millions)

Safe Harbor For Forward Looking

Statements This presentation may contain “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995, including statements regarding future prospects, plans, objectives, goals, projections, estimates

of gas quantities, strategies, future events or performance and underlying assumptions, capital structure, anticipated capital expenditures, completion of construction projects, projections for pension and other post-retirement benefit obligations,

impacts of the adoption of new accounting rules, and possible outcomes of litigation or regulatory proceedings, as well as statements that are identified by the use of the words “anticipates,” “estimates,”

“expects,” “forecasts,” “intends,” “plans,” “predicts,” “projects,” “believes,” “seeks,” “will,” “may,” and similar expressions.

Forward-looking statements involve risks and uncertainties which could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. The Company’s expectations, beliefs and projections are

expressed in good faith and are believed by the Company to have a reasonable basis, but there can be no assurance that management’s expectations, beliefs or projections will result or be achieved or accomplished. In addition to other factors,

the following are important factors that could cause actual results to differ materially from those discussed in the forward-looking statements: impairments under the SEC's full cost ceiling test for natural gas reserves; changes in the price of

natural gas; changes in laws, regulations or judicial interpretations to which the Company is subject, including those involving derivatives, taxes, safety, employment, climate change, other environmental matters, real property, and exploration and

production activities such as hydraulic fracturing; governmental/regulatory actions, initiatives and proceedings, including those involving rate cases (which address, among other things, target rates of return, rate design, retained natural gas and

system modernization), environmental/safety requirements, affiliate relationships, industry structure, and franchise renewal; the Company’s ability to estimate accurately the time and resources necessary to meet emissions targets;

governmental/regulatory actions and/or market pressures to reduce or eliminate reliance on natural gas; increased costs or delays or changes in plans with respect to Company projects or related projects of other companies, as well as difficulties or

delays in obtaining necessary governmental approvals, permits or orders or in obtaining the cooperation of interconnecting facility operators; changes in economic conditions, including inflationary pressures, supply chain issues, liquidity

challenges, and global, national or regional recessions, and their effect on the demand for, and customers’ ability to pay for, the Company’s products and services; the creditworthiness or performance of the Company’s key

suppliers, customers and counterparties; financial and economic conditions, including the availability of credit, and occurrences affecting the Company’s ability to obtain financing on acceptable terms for working capital, capital expenditures

and other investments, including any downgrades in the Company’s credit ratings and changes in interest rates and other capital market conditions; changes in price differentials between similar quantities of natural gas sold at different

geographic locations, and the effect of such changes on commodity production, revenues and demand for pipeline transportation capacity to or from such locations; the impact of information technology disruptions, cybersecurity or data security

breaches; factors affecting the Company’s ability to successfully identify, drill for and produce economically viable natural gas reserves, including among others geology, lease availability and costs, title disputes, weather conditions, water

availability and disposal or recycling opportunities of used water, shortages, delays or unavailability of equipment and services required in drilling operations, insufficient gathering, processing and transportation capacity, the need to obtain

governmental approvals and permits, and compliance with environmental laws and regulations; the Company's ability to complete strategic transactions; increasing health care costs and the resulting effect on health insurance premiums and on the

obligation to provide other post-retirement benefits; other changes in price differentials between similar quantities of natural gas having different quality, heating value, hydrocarbon mix or delivery date; the cost and effects of legal and

administrative claims against the Company or activist shareholder campaigns to effect changes at the Company; negotiations with the collective bargaining units representing the Company's workforce, including potential work stoppages during

negotiations; uncertainty of natural gas reserve estimates; significant differences between the Company’s projected and actual production levels for natural gas; changes in demographic patterns and weather conditions (including those related

to climate change); changes in the availability, price or accounting treatment of derivative financial instruments; changes in laws, actuarial assumptions, the interest rate environment and the return on plan/trust assets related to the

Company’s pension and other post-retirement benefits, which can affect future funding obligations and costs and plan liabilities; economic disruptions or uninsured losses resulting from major accidents, fires, severe weather, natural

disasters, terrorist activities or acts of war, as well as economic and operational disruptions due to third-party outages; significant differences between the Company’s projected and actual capital expenditures and operating expenses; or

increasing costs of insurance, changes in coverage and the ability to obtain insurance. Forward-looking statements include estimates of gas quantities. Proved gas reserves are those quantities of gas which, by analysis of geoscience and engineering

data, can be estimated with reasonable certainty to be economically producible under existing economic conditions, operating methods and government regulations. Other estimates of gas quantities, including estimates of probable reserves, possible

reserves, and resource potential, are by their nature more speculative than estimates of proved reserves. Accordingly, estimates other than proved reserves are subject to substantially greater risk of being actually realized. Investors are urged to

consider closely the disclosure in our Form 10-K available at www.nationalfuel.com. You can also obtain this form on the SEC’s website at www.sec.gov. Forward-looking and other statements in this presentation regarding methane and greenhouse

gas reduction plans and goals are not an indication that these statements are necessarily material to investor or required to be disclosed in our filings with the SEC. In addition, historical, current and forward-looking statements regarding methane

and greenhouse gas emissions may be based on standards for measuring progress that are still developing, internal controls, and processes that continue to evolve and assumptions that are subject to change in the future. For a discussion of the risks

set forth above and other factors that could cause actual results to differ materially from results referred to in the forward-looking statements, see “Risk Factors” in the Company’s Form 10-K for the fiscal year ended September

30, 2023, and the Forms 10-Q for the quarter ended December 31, 2023, March 31, 2024, and June 30, 2024. The Company disclaims any obligation to update any forward-looking statements to reflect events or circumstances after the date thereof or to

reflect the occurrence of unanticipated events.

Hedge Portfolio & Capped Firm

Sales 4Q 2024 1Q 2025 2Q 2025 3Q 2025 4Q 2025 FY 2026 FY 2027 FY 2028 Swaps Units Volume MMBtu 38,670 33,730 31,650 24,825 24,825 40,635 21,750 1,750 Wtd. Avg. Floor $ / MMBtu $3.35 $3.42 $3.49 $3.54 $3.54 $3.95 $4.16 $4.16 Collars

Volume MMBtu 14,400 11,920 13,305 15,930 15,930 50,595 3,560 -- Wtd. Avg. Ceiling $ / MMBtu $3.79 $4.37 $4.61 $4.58 $4.58 $4.68 $4.76 -- Wtd. Avg. Floor $ / MMBtu $3.22 $3.40 $3.47 $3.43 $3.43 $3.48 $3.53 -- Fixed Price Physical Volume MMBtu 18,577

20,377 20,615 19,602 19,885 76,661 59,118 21,936 Wtd. Avg. Floor $ / MMBtu $2.43 $2.44 $2.44 $2.51 $2.52 $2.44 $2.50 $2.68 Capped Firm Sales Volume MMBtu 2,744 2,732 2,668 2,697 2,727 919 -- --

NYMEX Cap $ / MMBtu $2.92 $2.92 $2.92 $2.92 $2.92 $2.92 $2.92 $2.92 Volume MMBtu 1,568 1,561 1,524 1,541 1,558 5,836 5,913 504 NYMEX Cap $ / MMBtu $4.95 $4.95 $4.95 $4.95 $4.95 $4.95 $4.95 $4.95 Volume MMBtu 1,913 1,905 1,860 1,881 1,902 7,121 7,215

7,265 NYMEX Cap $ / MMBtu $7.00 $7.00 $7.00 $7.00 $7.00 $7.00 $7.00 $7.00

Firm Transportation Commitments

Volume (Dth/d) Production Source Delivery Market Demand Charges ($/Dth) Gas Marketing Strategy Northeast Supply Diversification Tennessee Gas Pipeline Niagara Expansion TGP & NFG - Supply Leidy South / FM100 WMB – Transco; NFG - Supply

50,000 158,000 EDA – Tioga WDA – CRV WDA – CRV EDA - Lycoming 12,000 Canada (Dawn) Canada (Dawn) TGP 200 (PA) $0.46 (3rd party) NFG pipelines - $0.24 3rd party - $0.40 $0.18 (NFG pipelines) Firm Sales Contracts Dawn/NYMEX Currently

In-Service Firm Sales Contracts Dawn/NYMEX Atlantic Sunrise WMB - Transco 189,405 EDA - Lycoming Mid-Atlantic/ Southeast $0.73 (3rd party) Firm Sales Contracts NYMEX/Market Indices 330,000 Transco Zone 6 NNY $0.66 (3rd Party) Firm Sales Contracts

Transco Zone 6 NNY/NYMEX Tioga County Extension NFG – Empire EDA – Tioga Firm Sales Contracts TGP 200 (NY)/NYMEX/Dawn Eastern EDA – Tioga Capacity release $0.19 (3rd Party) 100,000 In-Basin 158,000 42,000 TGP 200 (NY) Canada (Dawn)

NFG pipelines - $0.23 NFG pipelines - $0.23 3rd party - $0.15

Comparable GAAP Financial Measure

Slides & Reconciliations This presentation contains certain non-GAAP financial measures. For pages that contain non-GAAP financial measures, pages containing the most directly comparable GAAP financial measures and reconciliations are provided

in the slides that follow. The Company believes that its non-GAAP financial measures are useful to investors because they provide an alternative method for assessing the Company’s ongoing operating results or liquidity and for comparing the

Company’s financial performance to other companies. The Company’s management uses these non-GAAP financial measures for the same purpose, and for planning and forecasting purposes. The presentation of non-GAAP financial measures is not

meant to be a substitute for financial measures prepared in accordance with GAAP. Management defines adjusted operating results as reported GAAP earnings before items impacting comparability. Management defines adjusted EBITDA as reported GAAP

earnings before the following items: interest expense, income taxes, depreciation, depletion and amortization, other income and deductions, impairments, and other items reflected in operating income that impact comparability. The revised earnings

guidance range does not include the impact of certain items that impacted the comparability of earnings during the nine months ended June 30, 2024, including: (1) the after tax impairment of oil and gas properties, which reduced earnings by $1.57

per share; (2) after-tax unrealized losses on a derivative asset, which reduced earnings by $0.04 per share; and (3) after-tax unrealized gains on other investments, which increased earnings by $0.02 per share. While the Company expects to record

certain adjustments to unrealized gain or loss on a derivative asset and unrealized gain or loss on investments during the three months ending September 30, 2024, the amounts of these and other potential adjustments and charges, including ceiling

test impairments, are not reasonably determinable at this time. As such, the Company is unable to provide earnings guidance other than on a non-GAAP basis. Management defines free cash flow as net cash provided by operating activities, less net cash

used in investing activities, adjusted for acquisitions and divestitures. The Company is unable to provide a reconciliation of projected free cash flow as described in this presentation to its respective comparable financial measure calculated in

accordance with GAAP without unreasonable efforts. This is due to our inability to reliably predict the comparable GAAP projected metrics, including operating income and total production costs, given the unknown effect, timing, and potential

significance of certain income statement items.

Non-GAAP Reconciliations –

Adjusted EBITDA

Non-GAAP Reconciliations –

Adjusted EBITDA, by Segment

Non-GAAP Reconciliations –

Adjusted Operating Results Three Months Ended June 30, (in thousands except per share amounts) 2024 2023 Reported GAAP Earnings $ (54,158) $ 92,620 Items impacting comparability: Impairment of oil and gas properties (E&P) $ 200,696

— Tax impact of impairment of oil and gas properties $ (55,686) — Unrealized (gain) loss on derivative asset (E&P) $ 1,186 $ 1,430 Tax impact of unrealized (gain) loss on derivative asset $ (325) $ (392) Unrealized (gain) loss on

other investments (Corporate / All Other) $ 15 $ (355) Tax impact of unrealized (gain) loss on other investments $ (3) $ 74 Adjusted Operating Results $ 91,725 $ 93,377 Reported GAAP Earnings Per Share $ (0.59) $ 1.00 Items impacting comparability:

Impairment of oil and gas properties, net of tax (E&P) $ 1.58 — Unrealized (gain) loss on derivative asset, net of tax (E&P) $ 0.01 $ 0.01 Rounding $ (0.01) — Adjusted Operating Results Per Share $ 0.99 $ 1.01

Non-GAAP Reconciliations – Free

Cash Flow

Reconciliation – Capital

Expenditures

Reconciliation – E&P

Operating Expenses

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

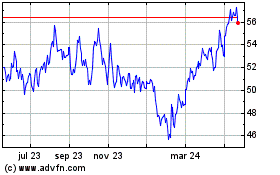

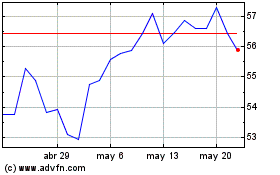

National Fuel Gas (NYSE:NFG)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

National Fuel Gas (NYSE:NFG)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024