UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the

Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material Pursuant to

§ 240.14a-12 |

PGT INNOVATIONS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ¨ | Fee paid previously with preliminary

materials. |

| ¨ | Fee computed on table in exhibit

required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

[The

following material was used by PGT Innovations, Inc. (“PGTI”) in its discussion with investors and employees, in connection

with the proposed acquisition of PGTI by MIWD Holding Company LLC]

Master Q&A

| 1. | Why did PGTI decide to sell? |

| o | This is a unique opportunity to provide our shareholders with significant near-term value for $42 per share at a significant premium

of ~60% to October 9, 2023, the last trading day of PGTI common stock before media speculation about its potential sale. |

| o | Our Board of Directors is fully committed to maximizing shareholder value and unanimously determined this transaction was in the best

interest of all shareholders. |

| o | MITER Brands is a residential window and door manufacturer that provides a portfolio of window and door brands for the new construction

and replacement segments. |

| o | Koch Equity Development, the principal investment and acquisition arm of Koch Industries, Inc., is a current investor in MITER Brands. |

| 3. | Why did the Board decide to sell to MITER, instead of to Masonite? |

| o | After thoughtful discussions and consideration, PGTI’s Board of Directors unanimously concluded that the revised MITER proposal

is superior to the agreement with Masonite, providing enhanced value and strong contractual protections. |

| 4. | What is MITER’s relationship with Koch Industries? |

| o | Koch Equity Development, the principal investment and acquisition arm of Koch Industries, Inc., is a current investor in MITER Brands. |

| 5. | When is the transaction expected to close? What approvals will be needed? |

| o | We expect the transaction to close mid-year 2024, subject to receipt of necessary approvals and other closing conditions. |

| o | The transaction is subject to regulatory approval and approval by PGTI shareholders. |

| 6. | Is this an indication that the PGTI leadership doesn’t have faith in our future as a public company? |

| o | This announcement is a testament to our team’s stellar execution of PGTI’s value-creation strategy. |

| o | Having evaluated various opportunities against our standalone prospects, as is our obligation, the Board determined this transaction

with MITER is in the best interests of the Company and our shareholders. |

| 7. | How will being a part of a private company change the business strategy? |

| o | Until the transaction closes, which is expected to happen mid-year 2024, subject to receipt of necessary

approvals and other closing conditions, PGTI and MITER remain separate companies and nothing about the way we work will change. |

| o | It’s too early to speculate on specifics. |

| Investors/Financial Communities |

| 8. | Masonite’s stock has fallen substantially. How did that factor into your decision-making process? |

| o | It is something the Board considered. |

| o | The MITER proposal represented a ~5.6% premium to the value of the agreement with Masonite based on the value of Masonite’s

closing stock price on January 16th. |

| 9. | Why do you now believe MITER’s proposal is superior? Did $1.00 really make that much of a difference? |

| o | MITER meaningfully improved the terms of their prior proposal, including the total consideration as well as greater certainty of closing

and stronger protections for PGTI shareholders should the transaction not close. |

| o | The improved consideration that represents a ~60% premium PGTI’s undisturbed stock price on October 9, 2023, and a ~5.6% premium

to the value of the agreement with Masonite based on their current stock price. |

| o | MITER also committed to pay, on behalf of PGTI, the $84 million termination fee to Masonite that was owed for terminating our agreement

with Masonite to enter into the agreement with MITER, in addition to agreeing to certain other contractual provisions that greatly enhanced

closing certainty for PGTI stockholders. |

| 10. | You originally had concerns about MITER’s ability to close a transaction. Are those concerns now gone? |

| o | We were able to negotiate adequate resolutions to certain contractual provisions that greatly enhance the likelihood of the transaction

closing. We are not at all concerned about the risk of this transaction not closing. |

| 11. | What are your expectations for 2024 – for both PGTI and the markets PGTI competes in? Do you think it’ll be a good

year? Did the Board take these projections into consideration when evaluating MITER’s proposal? |

| o | This transaction does not change our view for the year ahead. |

| o | Additional details regarding the background of the transaction, including the factors the Board considered when evaluating MITER’s

offer, will be available in our proxy statement when it is filed with the SEC. |

| 12. | How are you sure you got the best price? |

| o | Our Board engaged with MITER and many other potential buyers to maximize value for shareholders, culminating in today’s announcement

with MITER for $42.00 per share. |

| o | As we shared, we engaged with MITER as our Board unanimously determined that MITER’s proposal from January 2, 2024 for $41.50

per share would reasonably be expected to lead to a superior proposal. |

| o | We are pleased that our discussions with MITER resulted in an agreement that provides PGTI with even greater value. |

| o | Further details regarding the background of the transaction will be available in the proxy statement when it is filed with the SEC. |

| 13. | Did you give Masonite a chance to counter? Doesn’t Masonite have 4 business days to match? |

| o | As per the terms of the merger agreement, Masonite was informed of the Board’s determination that MITER’s revised proposal

constituted a “superior proposal,” as defined by the agreement. Masonite waived its right to improve the terms of its offer,

and both Masonite and PGTI have agreed to terminate their merger agreement. |

| 14. | Does this mean the agreement with Masonite is terminated? |

| o | Yes, and we have entered into a new definitive merger agreement with MITER. |

| 15. | Does this now mean you owe Masonite the $84 million termination fee? |

| o | Yes, and MITER has paid the termination fee due to Masonite on PGTI’s behalf. |

| 16. | When will the PGTI shareholder vote take place? Do you expect any challenges with receiving shareholder approval from either PGTI?

|

| o | PGTI shareholders will vote on the transaction. No further approval is required from MITER shareholders. |

| o | No shareholder vote date has been set yet. We plan to schedule the meeting once we have cleared the proxy statement with the SEC. |

| o | We believe shareholders will see that this is a unique opportunity for significant value at a premium of ~60% to PGTI’s undisturbed

share price on October 9, 2023. |

| 17. | Do you anticipate any issues with the FTC and antitrust approval? |

| o | We are confident that the deal is procompetitive and will benefit the companies’ respective customers. |

| o | Our focus is on successfully completing this transaction to create a premier door and premium window company. |

| 18. | What happened to our combination with Masonite? |

| o | After thoughtful discussions and consideration between the Board of Directors and both parties, the Board unanimously concluded that

the revised MITER proposal constituted a “superior proposal,” as defined by our merger agreement with Masonite and is in the

best interest of all shareholders. |

| o | Consistent with our merger agreement with Masonite, we gave Masonite the opportunity to improve the terms of its offer. They informed

us that they were waiving that right. |

| o | As such, we terminated our merger agreement with Masonite and entered into a new, definitive agreement with MITER for $42 in cash

per PGTI share. |

| 19. | What will happen to my stock? What will happen to my RSUs or other options? |

| o | Upon close of the transaction, all PGTI shareholders will receive $42 per share in cash. |

| o | Any unvested equity you currently hold will vest upon closing of the transaction, which is expected

to be by mid-year 2024, subject to receipt of necessary approvals and other closing conditions, provided you remain employed with the

company through that date. |

| o | Any equity awards issued after signing will be entitled to the merger consideration of $42.00 per share

upon vesting (plus interest accrued on the basis of prime rate as published in the Wall Street Journal in effect at the effective time

of the merger). |

| 20. | Who is MITER? What are their culture and values? |

| o | MITER Brands is a nationwide supplier of precision-built and energy-efficient windows and doors, serving homeowners, distributors

and dealers, architects, builders, and contractors. |

| o | MITER is an owner operated business with family first values. They place a heavy emphasis on creating mutually beneficial relationships

with their team members, customers, suppliers, and local communities. |

| 21. | Who will lead PGTI’s operations going forward? Who from PGTI management will continue with the combined company after the

transaction closes? |

| o | It’s still early days. Those decisions will be made down the line as part of the integration process. |

| 22. | What does this transaction mean for me? |

| o | Until the transaction closes, which is expected to be by mid-year 2024, subject to receipt of necessary approvals and other closing

conditions, PGTI and MITER remain separate companies and nothing about the way we work will change. |

| o | Upon the close of the transaction, shareholders of PGTI will receive $42 in cash for each share of PGTI common stock they own. |

| o | We are committed to keeping you informed. In the meantime, please do not hesitate to reach out to your manager with any immediate

questions. |

| 23. | Will we undergo a name change? |

| o | After the transaction closes, which is expected to be by mid-year 2024, subject to receipt of necessary

approvals and other closing conditions, we will be a part of MITER. |

| o | It’s still early days. Those decisions will be made down the line as part of the integration process. |

| 24. | Do you expect job cuts as a result of this transaction? When will I know if I have a job at the combined

company? |

| o | Until the transaction closes, which is expected to be by mid-year 2024, subject to receipt of necessary

approvals and other closing conditions, PGTI and MITER remain separate companies and nothing about the way we work will change. |

| o | An integration team will be established to develop plans about how our companies will come together. |

| o | It’s too early to speculate on specifics. |

| 25. | Will be adding or divesting product lines? |

| o | Until the transaction closes, which is expected to be by mid-year 2024, subject to receipt of necessary approvals and other closing

conditions, PGTI and MITER remain separate companies and nothing about the way we work with you will change. |

| o | MITER is committed to continuing to serve PGTI existing customers. |

| 26. | Will there be severance and/or outplacement assistance for employees whose jobs are negatively impacted

by the transaction? |

| o | Until the transaction closes, which is expected to happen mid-year 2024, subject to receipt of necessary approvals and other closing

conditions, PGTI and MITER remain separate companies and nothing about the way either of us works with you changes. |

| 27. | How will this transaction affect my compensation and benefits? Should we expect changes in our PTO?

|

| o | Until the transaction closes, which is expected to be by mid-year 2024, subject to receipt of necessary

approvals and other closing conditions, PGTI and MITER remain separate companies and nothing about the way we work will change. |

| 28. | Will there be changes to my role or reporting structure? |

| o | Until the transaction closes, which is expected to be by mid-year 2024, subject to receipt of necessary

approvals and other closing conditions, PGTI and MITER remain separate companies and nothing about the way we work will change. |

| o | The best thing all of us can do now is to stay focused on our day-to-day responsibilities, serving customers and producing the high-quality

products that we are known for. |

| 29. | Will PGTI still be headquartered in Tampa, or will this change? Will any facilities be closed as a result of this transaction? |

| o | Until the transaction closes, which is expected to be by mid-year 2024, subject to receipt of necessary approvals and other closing

conditions, PGTI and MITER remain separate companies and nothing about the way either of us works will change. |

| o | An integration team will be established to develop plans about how our companies will come together. |

| o | It’s too early to speculate what the combined company will look like. |

| 30. | Do you anticipate any changes to our community commitments? |

| o | Today’s announcement is just the first step in the process. |

| o | Until the transaction closes, which is expected to be by mid-year 2024, subject to receipt of necessary approvals and other closing

conditions, Masonite and PGTI remain separate companies and nothing about the way either of us works with you changes. |

| 31. | When will be able to meet leaders from MITER? Can I contact MITER employees about the deal? |

| o | We look forward to introducing you to Matt DeSoto, MITER’s President and CEO. |

| o | Until the transaction closes, which is expected to be by mid-year 2024, PGTI and MITER remain separate

and independent companies. |

| o | We ask that you NOT contact any MITER employees unless explicitly asked to do so by the

integration team. |

| 32. | How does the transaction affect our current product offerings and business lines? Are we going to

sell off other parts of our business? |

| o | Until the transaction closes, which is expected to be by mid-year 2024, subject to receipt of necessary

approvals and other closing conditions, PGTI and MITER remain separate companies and nothing about the way we work will change. |

| 33. | What do I tell customers/partners? |

| o | Customers and business partners will be receiving a note from Jeff informing them of the news. |

| o | Employees who manage relationships with our customers and partners will be provided with specific talking points to help guide conversations. |

| 34. | When will integration start? What will it involve? How will be kept updated on progress and decisions? |

| o | An integration team led will be established to develop plans of how the companies will come together. |

| o | While integration planning will start soon, formal integration cannot begin until the transaction closes, which is expected to be

by mid-year 2024, subject to receipt of necessary approvals and other closing conditions. |

| o | Beyond that, it is too early to speculate on specifics. |

| o | As we’ve promised you throughout this process, we are committed to keeping you informed as much as permitted and will share

additional information as appropriate. |

| 35. | What do I do if someone from the media or outside the company approaches me to ask about the transaction? |

| o | Please direct any inquiries from outside third parties to them to

Craig Henderson (CHenderson@pgtinnovations.com). |

Cautionary Statement Regarding Forward-Looking Statements

This communication contains “forward-looking

statements” within the United States Private Securities Litigation Reform Act of 1995. You can identify these statements and other

forward-looking statements in this document by words such as “may,” “will,” “should,”

“can,” “could,” “anticipate,” “estimate,” “expect,” “predict,”

“project,” “future,” “potential,” “intend,” “plan,” “assume,”

“believe,” “forecast,” “look,” “build,” “focus,” “create,” “work,”

“continue,” “target,” “poised,” “advance,” “drive,”

“aim,” “forecast,” “approach,” “seek,” “schedule,” “position,”

“pursue,” “progress,” “budget,” “outlook,” “trend,” “guidance,”

“commit,” “on track,” “objective,” “goal,” “strategy,” “opportunity,”

“ambitions,” “aspire” and similar expressions, and variations or negative of such terms or other variations

thereof. Words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking

statements.

Forward-looking statements by their nature address

matters that are, to different degrees, uncertain, such statements regarding the transactions contemplated by the Agreement and Plan of

Merger, dated as of January 16, 2024, among PGTI, MIWD Holding Company LLC and RMR MergeCo, Inc. (the “Transaction”),

including the expected time period to consummate the Transaction. All such forward-looking statements are based upon current plans, estimates,

expectations and ambitions that are subject to risks, uncertainties and assumptions, many of which are beyond the control of PGTI, that

could cause actual results to differ materially from those expressed in such forward-looking statements. Key factors that could cause

actual results to differ materially include, but are not limited to, the expected timing and likelihood of completion of the Transaction,

including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the Transaction; the occurrence

of any event, change or other circumstances that could give rise to the termination of the definitive agreement; the possibility that

PGTI’s stockholders may not approve the Transaction; the risk that the parties may not be able to satisfy the conditions to the

Transaction in a timely manner or at all; risks related to disruption of management time from ongoing business operations due to the Transaction;

the risk that any announcements relating to the Transaction could have adverse effects on the market price of PGTI’s common stock;

the risk that the Transaction and its announcement could have an adverse effect on the parties’ business relationships and business

generally, including the ability of PGTI to retain customers and retain and hire key personnel and maintain relationships with their suppliers

and customers, and on their operating results and businesses generally; the risk of unforeseen or unknown liabilities; customer, shareholder,

regulatory and other stakeholder approvals and support; the risk of potential litigation relating to the Transaction that could be instituted

against PGTI or its directors and/or officers; the risk associated with third party contracts containing material consent, anti-assignment,

transfer or other provisions that may be related to the Transaction which are not waived or otherwise satisfactorily resolved; the risk

of rating agency actions and PGTI’s ability to access short- and long-term debt markets on a timely and affordable basis; the risk

of various events that could disrupt operations, including severe weather, such as droughts, floods, avalanches and earthquakes, cybersecurity

attacks, security threats and governmental response to them, and technological changes; the risks of labor disputes, changes in labor

costs and labor difficulties; and the risks resulting from other effects of industry, market, economic, legal or legislative, political

or regulatory conditions outside of PGTI’s control. All such factors are difficult to predict and are beyond our control, including

those detailed in PGTI’s annual reports on Form 10-K, quarterly reports on Form 10-Q and Current Reports on Form 8-K that are available

on PGTI’s website at https://pgtinnovations.com and on the website of the Securities Exchange Commission (“SEC”)

at http://www.sec.gov. PGTI’s forward-looking statements are based on assumptions that PGTI’s believes to be reasonable but

that may not prove to be accurate. Other unpredictable or factors not discussed in this communication could also have material adverse

effects on forward-looking statements. PGTI does not assume an obligation to update any forward-looking statements, except as required

by applicable law. These forward-looking statements speak only as of the date hereof.

Additional Information and

Where to Find It

In connection

with the Transaction, PGTI will file with the SEC a proxy statement on Schedule 14A. The definitive proxy statement will be sent to the

stockholders of PGTI seeking their approval of the Transaction and other related matters.

INVESTORS

AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT ON SCHEDULE 14A WHEN IT BECOMES AVAILABLE, AS WELL AS ANY OTHER RELEVANT

DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE PROXY STATEMENT, BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION REGARDING PGTI, THE TRANSACTION AND RELATED MATTERS.

Investors and security holders may obtain free

copies of these documents, including the proxy statement, and other documents filed with the SEC by PGTI through the website maintained

by the SEC at http://www.sec.gov. Copies of documents filed with the SEC by PGTI will be made available free of charge by accessing PGTI’s

website at https://pgtinnovations.com or by contacting PGTI by submitting a message at https://ir.pgtinnovations.com/investor-contact

or by mail at 1070 Technology Drive, North Venice, FL 34275.

Participants

in the Solicitation

PGTI, its directors, executive officers and other

persons related to PGTI may be deemed to be participants in the solicitation of proxies from PGTI’s stockholders in connection with

the Transaction. Information about the directors and executive officers of PGTI and their ownership of PGTI common stock is also set forth

in PGTI’s definitive proxy statement in connection with its 2023 Annual Meeting of Stockholders, as filed with the SEC on April

10, 2023 (and which is available at https://www.sec.gov/Archives/edgar/data/1354327/000119312523126009/d442491ddef14a.htm), PGTI’s

Current Report on Form 8-K filed with the SEC on July 3, 2023 (and which is available at https://www.sec.gov/Archives/edgar/data/1354327/000095010323009816/dp196528_8k.htm),

PGTI’s Current Report on Form 8-K filed with the SEC on August 8, 2023 (and is available at https://www.sec.gov/Archives/edgar/data/1354327/000095010323011731/dp198129_8k.htm),

PGTI’s Current Report on Form 8-K filed with the SEC on November 6, 2023 (and is available at https://www.sec.gov/Archives/edgar/data/1354327/000095010323016034/dp202537_8k.htm),

and PGTI’s Current Report on Form 8-K filed with the SEC on January 2, 2024 (and is available at https://www.sec.gov/Archives/edgar/data/1354327/000095010324000038/dp204648_8k.htm).

Information about the directors and executive officers of PGTI, their ownership of PGTI common stock, and PGTI’s transactions with

related persons is set forth in the sections entitled “Directors, Executive Officers and Corporate Governance,” “Security

Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters,” and “Certain Relationships and Related

Transactions, and Director Independence” included in PGTI’s annual report on Form 10-K for the fiscal year ended December

31, 2022, which was filed with the SEC on February 27, 2023 (and which is available at https://www.sec.gov/Archives/edgar/data/1354327/000095017023004543/pgti-20221231.htm),

and in the sections entitled “Board Highlights” and “Security Ownership of Certain Beneficial Owners and Management”

included in PGTI’s definitive proxy statement in connection with its 2023 Annual Meeting of Stockholders, as filed with the SEC

on April 28, 2023 (and which is available at https://www.sec.gov/Archives/edgar/data/1354327/000119312523126009/d442491ddef14a.htm). Additional

information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security

holdings or otherwise, will be included in the proxy statement and other relevant materials to be filed with the SEC in connection with

the proposed transaction when they become available. Free copies of these documents may be obtained as described in the preceding paragraph.

No Offer or Solicitation

This communication is not intended to and shall not constitute an offer

to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or the solicitation of any vote

of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except

by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

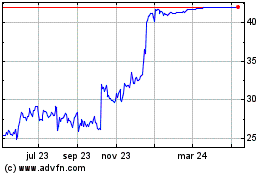

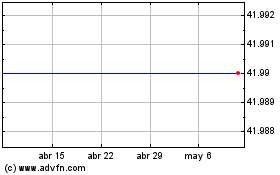

PGT (NYSE:PGTI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

PGT (NYSE:PGTI)

Gráfica de Acción Histórica

De May 2023 a May 2024