EchoPark Reports All-Time Record Quarterly

Gross Profit, Segment Income, and Adjusted EBITDA*

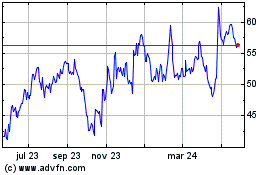

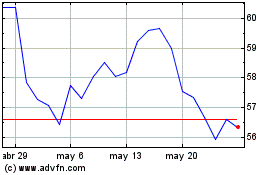

Sonic Automotive, Inc. (“Sonic Automotive,” “Sonic,” the

“Company,” “we” “us” or “our”) (NYSE:SAH), one of the nation’s

largest automotive retailers, today reported financial results for

the third quarter ended September 30, 2024.

Third Quarter 2024 Financial

Summary

- Total revenues of $3.5 billion, down 4% year-over-year; total

gross profit of $543.6 million, down 7% year-over-year

- Reported net income of $74.2 million, up 8% year-over-year

($2.13 earnings per diluted share, up 11% year-over-year)

- Reported net income includes the pre-tax effects of $1.8

million in excess compensation expense paid to our teammates

related to the CDK outage and a $1.5 million charge related to

storm damage, offset partially by a $2.3 million gain related to

sale of real estate at previously closed EchoPark Segment stores,

net of a $0.2 million income tax benefit on the above net

charges

- Reported net income also includes a $31.0 million income tax

benefit associated with an out of period adjustment correcting an

error recorded in connection with the impairment of franchise

assets in a prior period

- Excluding these items, adjusted net income* was $44.0 million,

down 39% year-over-year ($1.26 adjusted earnings per diluted

share*, down 38% year-over-year)

- The carryover effects in July from the CDK Global software

outage are estimated to have reduced third quarter GAAP income

before taxes by approximately $17.2 million, and net income by

approximately $12.7 million, or $0.36 in diluted earnings per share

- Approximately $1.8 million ($0.04 in diluted earnings per

share) of the pre-tax CDK impact during the third quarter was

related to excess compensation paid to our teammates as a result of

the CDK outage, which is included as a reconciling item in the

non-GAAP reconciliation tables below

- Total reported selling, general and administrative (“SG&A”)

expenses as a percentage of gross profit of 72.1% (72.4% on a

Franchised Dealerships Segment basis, 72.9% on an EchoPark Segment

basis, and 63.7% on a Powersports Segment basis)

- Total adjusted SG&A expenses as a percentage of gross

profit* of 71.9% (71.6% on a Franchised Dealerships Segment basis,

77.1% on an EchoPark Segment basis, and 63.7% on a Powersports

Segment basis)

- EchoPark Segment revenues of $544.9 million, down 13%

year-over-year; all-time record quarterly EchoPark Segment total

gross profit of $55.2 million, up 5% year-over-year; EchoPark

Segment retail used vehicle unit sales volume of 17,757, down 7%

year-over-year

- Reported EchoPark Segment income of $5.2 million, up 131%

year-over-year, and adjusted EchoPark Segment income* of $2.9

million, up 124% year-over-year

- EchoPark Segment adjusted EBITDA* of $8.9 million, up 271%

year-over-year

- Excluding closed stores, EchoPark Segment adjusted EBITDA* was

$9.2 million, a 454% improvement from a loss of $2.6 million in the

prior year period

- Sonic’s Board of Directors approved a 17% increase to the

quarterly cash dividend, to $0.35 per share, payable on January 15,

2025 to all stockholders of record on December 13, 2024

* Represents a non-GAAP financial measure —

please refer to the discussion and reconciliation of non-GAAP

financial measures below.

Commentary

David Smith, Chairman and Chief Executive Officer of Sonic

Automotive, stated, “I'm pleased to report that we continued to

build momentum in our EchoPark Segment in the third quarter,

generating all-time record quarterly gross profit, segment income,

and adjusted EBITDA* as a result of the dedicated efforts of our

team and the improving conditions in the used vehicle retail

environment. Overall, the Sonic Automotive team continued to

execute at a high level, despite operational disruptions throughout

July related to the functionality of certain CDK customer lead

applications, inventory management applications and related

third-party application integrations with CDK, which negatively

impacted our Franchised Dealerships Segment results in the third

quarter. With this disruption behind us, we remain confident that

our team, our brand portfolio, and our long-term strategy will

continue to benefit our diversified business and generate long-term

value for our stakeholders.”

Jeff Dyke, President of Sonic Automotive, commented, “I'm very

proud of our team's performance in the third quarter, which not

only drove record segment income in our EchoPark Segment, but also

showcased our franchised dealership team's resilience in managing

through operational disruptions from the CDK outage, manufacturer

stop-sale orders on certain makes and models, and continued

normalization of new vehicle margins. Additionally, the successful

execution of another Sturgis rally by our Powersports team

underscores our commitment to maintaining diverse revenue streams.

Our entire company remains dedicated to delivering an outstanding

guest experience and executing our long-term strategic vision. We

believe that by fostering a culture of excellence and innovation,

we will continue to enhance guest satisfaction and operational

efficiency as we navigate the evolving automotive retail

landscape.”

Heath Byrd, Chief Financial Officer of Sonic Automotive, added,

“Our diversified cash flow streams continued to benefit our overall

financial position in the third quarter, despite operational

disruption from the CDK outage. As of September 30, 2024, we had

approximately $418 million in cash and floor plan deposits on hand,

and approximately $834 million of total liquidity, before

considering unencumbered real estate. We continue to maintain a

conservative balance sheet approach, with the ability to deploy

capital strategically as market conditions evolve.”

Third Quarter 2024 Segment

Highlights

The financial measures discussed below are results for the third

quarter of 2024 with comparisons made to the third quarter of 2023,

unless otherwise noted.

- Franchised Dealerships Segment operating results include:

- Same store revenues down 2%; same store gross profit down

7%

- Same store retail new vehicle unit sales volume up 2%; same

store retail new vehicle gross profit per unit down 35%, to

$3,049

- Same store retail used vehicle unit sales volume down 2%; same

store retail used vehicle gross profit per unit down 17%, to

$1,386

- Same store parts, service and collision repair (“Fixed

Operations”) gross profit up 8%; same store customer pay gross

profit up 4%; same store warranty gross profit up 29%; same store

Fixed Operations gross profit margin up 50 basis points, to

50.2%

- Same store finance and insurance ("F&I") gross profit down

3%; same store F&I gross profit per retail unit of $2,339, down

3%

- On a trailing quarter cost of sales basis, the Franchised

Dealerships Segment had 57 days’ supply of new vehicle inventory

(including in-transit) and 34 days’ supply of used vehicle

inventory

- EchoPark Segment operating results include:

- Revenues of $544.9 million, down 13%; all-time record quarterly

gross profit of $55.2 million, up 5%

- On a same market basis (which excludes closed stores), revenues

were down 3% and gross profit was up 21%

- Retail used vehicle unit sales volume of 17,757, down 7%

- On a same market basis (which excludes closed stores), retail

used vehicle unit sales volume was up 2%

- Reported segment income of $5.2 million, adjusted segment

income* of $2.9 million, and adjusted EBITDA* of $8.9 million

- Closed stores within the segment negatively impacted segment

income by $1.0 million and segment adjusted EBITDA* by $0.3

million

- Excluding closed stores, reported segment income was $6.2

million, adjusted segment income* was $3.9 million, and adjusted

EBITDA* was $9.2 million

- On a trailing quarter cost of sales basis, the EchoPark Segment

had 33 days’ supply of used vehicle inventory

- Powersports Segment operating results include:

- Revenues of $59.4 million, up 4%; gross profit of $17.7

million, down 15%

- Segment income of $4.0 million, down 38%, and adjusted EBITDA*

of $5.8 million, down 27%

* Represents a non-GAAP financial measure -

please refer to the discussion and reconciliation of non-GAAP

financial measures below.

Dividend

Sonic’s Board of Directors approved a 17% increase to the

quarterly cash dividend, to $0.35 per share, payable on January 15,

2025 to all stockholders of record on December 13, 2024.

Third Quarter 2024 Earnings Conference

Call

Senior management will hold a conference call today at 11:00

A.M. (Eastern). Investor presentation and earnings press release

materials will be accessible beginning prior to the conference call

on the Company’s website at ir.sonicautomotive.com.

To access the live webcast of the conference call, please go to

ir.sonicautomotive.com and select the webcast link at the top of

the page. For telephone access to this conference call, please dial

(877) 407-8289 (domestic) or +1 (201) 689-8341 (international) and

ask to be connected to the Sonic Automotive Third Quarter 2024

Earnings Conference Call. Dial-in access remains available

throughout the live call; however, to ensure you are connected for

the full call we suggest dialing in at least 10 minutes before the

start of the call. A webcast replay will be available following the

call for 14 days at ir.sonicautomotive.com.

About Sonic Automotive

Sonic Automotive, Inc., a Fortune 500 company based in

Charlotte, North Carolina, is on a quest to become the most

valuable diversified automotive retail and service brand in

America. Our Company culture thrives on creating, innovating, and

providing industry-leading guest experiences, driven by strategic

investments in technology, teammates, and ideas that ultimately

fulfill ownership dreams, enrich lives, and deliver happiness to

our guests and teammates. As one of the largest automotive and

powersports retailers in America, we are committed to delivering on

this goal while pursuing expansive growth and taking progressive

measures to be the leader in these categories. Our new platforms,

programs, and people are set to drive the next generation of

automotive and powersports experiences. More information about

Sonic Automotive can be found at www.sonicautomotive.com and

ir.sonicautomotive.com.

About EchoPark

Automotive

EchoPark Automotive is one of the most comprehensive retailers

of nearly new pre-owned vehicles in America today. Our unique

business model offers a best-in-class shopping and utilizes one of

the most innovative technology-enabled sales strategies in our

industry. Our approach provides a personalized and proven

guest-centric buying process that consistently delivers

award-winning guest experiences and superior value to car buyers

nationwide, with savings of up to $3,000 versus the competition.

Consumers have responded by putting EchoPark among the top national

pre-owned vehicle retailers in products, sales, and service, while

receiving the 2023 Consumer Satisfaction Award from DealerRater.

EchoPark’s mission is in the name: Every Car, Happy Owner. This

drives the experience for guests and differentiates EchoPark from

the competition. More information about EchoPark Automotive can be

found at www.echopark.com.

Forward-Looking

Statements

Included herein are forward-looking statements, including

statements regarding anticipated future EchoPark profitability and

anticipated future EchoPark adjusted EBITDA. There are many factors

that affect management’s views about future events and trends of

the Company’s business. These factors involve risks and

uncertainties that could cause actual results or trends to differ

materially from management’s views, including, without limitation,

the ultimate impact of the CDK outage on the Company, economic

conditions in the markets in which we operate, supply chain

disruptions and manufacturing delays, labor shortages, the impacts

of inflation and increases in interest rates, new and used vehicle

industry sales volume, future levels of consumer demand for new and

used vehicles, anticipated future growth in each of our operating

segments, the success of our operational strategies, the rate and

timing of overall economic expansion or contraction, the

integration of recent or future acquisitions, and the risk factors

described in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2023 and other reports and information filed

with the United States Securities and Exchange Commission (the

“SEC”). The Company does not undertake any obligation to update

forward-looking information, except as required under federal

securities laws and the rules and regulations of the SEC. Due to

rounding, numbers presented throughout this and other documents may

not add up precisely to the totals provided and percentages may not

precisely reflect the absolute figures.

Non-GAAP Financial

Measures

This press release and the attached financial tables contain

certain non-GAAP financial measures as defined under SEC rules,

such as adjusted net income, adjusted earnings per diluted share,

adjusted SG&A expenses as a percentage of gross profit,

adjusted segment income, and adjusted EBITDA. As required by SEC

rules, the Company has provided reconciliations of these non-GAAP

financial measures to the most directly comparable GAAP financial

measures in the schedules included in this press release. The

Company believes that these non-GAAP financial measures improve the

transparency of the Company’s disclosures and provide a meaningful

presentation of the Company’s results.

Sonic Automotive, Inc.

Results of Operations

(Unaudited)

Results of Operations -

Consolidated

Three Months Ended September

30,

Better / (Worse)

Nine Months Ended September

30,

Better / (Worse)

2024

2023

% Change

2024

2023

% Change

(In millions, except per share

amounts)

Revenues:

Retail new vehicles

$

1,566.8

$

1,573.5

—

%

$

4,575.2

$

4,624.4

(1

)%

Fleet new vehicles

22.2

23.2

(4

)%

68.0

70.4

(3

)%

Total new vehicles

1,589.0

1,596.7

—

%

4,643.2

4,694.8

(1

)%

Used vehicles

1,180.7

1,340.4

(12

)%

3,582.5

3,991.2

(10

)%

Wholesale vehicles

67.2

79.3

(15

)%

215.8

256.3

(16

)%

Total vehicles

2,836.9

3,016.4

(6

)%

8,441.5

8,942.3

(6

)%

Parts, service and collision repair

479.0

453.4

6

%

1,369.8

1,327.6

3

%

Finance, insurance and other, net

175.6

173.7

1

%

517.2

517.7

—

%

Total revenues

3,491.5

3,643.5

(4

)%

10,328.5

10,787.6

(4

)%

Cost of sales:

Retail new vehicles

(1,479.2

)

(1,442.1

)

(3

)%

(4,293.4

)

(4,213.5

)

(2

)%

Fleet new vehicles

(21.6

)

(22.3

)

3

%

(65.7

)

(67.3

)

2

%

Total new vehicles

(1,500.8

)

(1,464.4

)

(2

)%

(4,359.1

)

(4,280.8

)

(2

)%

Used vehicles

(1,139.5

)

(1,288.1

)

12

%

(3,449.6

)

(3,877.4

)

11

%

Wholesale vehicles

(68.5

)

(80.7

)

15

%

(218.5

)

(255.8

)

15

%

Total vehicles

(2,708.8

)

(2,833.2

)

4

%

(8,027.2

)

(8,414.0

)

5

%

Parts, service and collision repair

(239.1

)

(228.1

)

(5

)%

(682.4

)

(669.0

)

(2

)%

Total cost of sales

(2,947.9

)

(3,061.3

)

4

%

(8,709.6

)

(9,083.0

)

4

%

Gross profit

543.6

582.2

(7

)%

1,618.9

1,704.6

(5

)%

Selling, general and administrative

expenses

(392.1

)

(409.6

)

4

%

(1,177.4

)

(1,214.2

)

3

%

Impairment charges

—

—

NM

(2.4

)

(62.6

)

NM

Depreciation and amortization

(37.9

)

(35.2

)

(8

)%

(111.1

)

(105.7

)

(5

)%

Operating income (loss)

113.6

137.4

(17

)%

328.0

322.1

2

%

Other income (expense):

Interest expense, floor plan

(23.0

)

(17.4

)

(32

)%

(65.4

)

(48.9

)

(34

)%

Interest expense, other, net

(29.8

)

(29.0

)

(3

)%

(88.1

)

(86.2

)

(2

)%

Other income (expense), net

—

0.2

NM

(0.5

)

0.3

NM

Total other income (expense)

(52.8

)

(46.2

)

(14

)%

(154.0

)

(134.8

)

(14

)%

Income (loss) before taxes

60.8

91.2

(33

)%

174.0

187.3

(7

)%

Provision for income taxes - benefit

(expense)

13.4

(22.8

)

159

%

(16.6

)

(47.8

)

65

%

Net income (loss)

$

74.2

$

68.4

8

%

$

157.4

$

139.5

13

%

Basic earnings (loss) per common share

$

2.18

$

1.96

11

%

$

4.63

$

3.94

18

%

Basic weighted-average common shares

outstanding

34.0

34.9

3

%

34.0

35.4

4

%

Diluted earnings (loss) per common

share

$

2.13

$

1.92

11

%

$

4.52

$

3.85

17

%

Diluted weighted-average common shares

outstanding

34.9

35.6

2

%

34.8

36.2

4

%

Dividends declared per common share

$

0.30

$

0.30

—

%

$

0.90

$

0.86

5

%

NM = Not Meaningful

Franchised Dealerships Segment -

Reported

Three Months Ended September

30,

Better / (Worse)

Nine Months Ended September

30,

Better / (Worse)

2024

2023

% Change

2024

2023

% Change

(In millions, except unit and

per unit data)

Revenues:

Retail new vehicles

$

1,539.9

$

1,546.7

—

%

$

4,510.8

$

4,550.9

(1

)%

Fleet new vehicles

22.2

23.2

(4

)%

68.0

70.4

(3

)%

Total new vehicles

1,562.1

1,569.9

—

%

4,578.8

4,621.3

(1

)%

Used vehicles

701.4

780.7

(10

)%

2,162.8

2,322.8

(7

)%

Wholesale vehicles

42.4

51.4

(18

)%

139.1

165.3

(16

)%

Total vehicles

2,305.9

2,402.0

(4

)%

6,880.7

7,109.4

(3

)%

Parts, service and collision repair

458.9

431.8

6

%

1,333.2

1,289.0

3

%

Finance, insurance and other, net

122.4

126.0

(3

)%

366.3

375.4

(2

)%

Total revenues

2,887.2

2,959.8

(2

)%

8,580.2

8,773.8

(2

)%

Gross Profit:

Retail new vehicles

83.5

125.5

(33

)%

272.5

396.5

(31

)%

Fleet new vehicles

0.6

0.9

(33

)%

2.3

3.1

(26

)%

Total new vehicles

84.1

126.4

(33

)%

274.8

399.6

(31

)%

Used vehicles

34.6

42.6

(19

)%

114.1

127.9

(11

)%

Wholesale vehicles

(1.1

)

(1.5

)

27

%

(1.8

)

(0.8

)

(125

)%

Total vehicles

117.6

167.5

(30

)%

387.1

526.7

(27

)%

Parts, service and collision repair

230.7

215.1

7

%

670.4

640.1

5

%

Finance, insurance and other, net

122.4

126.0

(3

)%

366.3

375.4

(2

)%

Total gross profit

470.7

508.6

(7

)%

1,423.8

1,542.2

(8

)%

Selling, general and administrative

expenses

(340.5

)

(338.3

)

(1

)%

(1,027.0

)

(985.5

)

(4

)%

Impairment charges

—

—

NM

(1.0

)

—

NM

Depreciation and amortization

(31.5

)

(28.2

)

(12

)%

(91.6

)

(82.8

)

(11

)%

Operating income (loss)

98.7

142.1

(31

)%

304.2

473.9

(36

)%

Other income (expense):

Interest expense, floor plan

(18.7

)

(12.9

)

(45

)%

(52.5

)

(34.7

)

(51

)%

Interest expense, other, net

(28.5

)

(27.9

)

(2

)%

(84.1

)

(82.2

)

(2

)%

Other income (expense), net

0.1

0.2

NM

(0.6

)

0.2

NM

Total other income (expense)

(47.1

)

(40.6

)

(16

)%

(137.2

)

(116.7

)

(18

)%

Income (loss) before taxes

51.6

101.5

(49

)%

167.0

357.2

(53

)%

Add: Impairment charges

—

—

NM

1.0

—

NM

Segment income (loss)

$

51.6

$

101.5

(49

)%

$

168.0

$

357.2

(53

)%

Unit Sales Volume:

Retail new vehicles

27,391

26,869

2

%

79,200

78,766

1

%

Fleet new vehicles

406

469

(13

)%

1,299

1,500

(13

)%

Total new vehicles

27,797

27,338

2

%

80,499

80,266

—

%

Used vehicles

24,940

25,541

(2

)%

76,274

75,845

1

%

Wholesale vehicles

4,973

5,163

(4

)%

15,326

16,162

(5

)%

Retail new & used vehicles

52,331

52,410

—

%

155,474

154,611

1

%

Used-to-New Ratio

0.91

0.95

(4

)%

0.96

0.96

—

%

Gross Profit Per Unit:

Retail new vehicles

$

3,047

$

4,672

(35

)%

$

3,441

$

5,034

(32

)%

Fleet new vehicles

$

1,596

$

2,046

(22

)%

$

1,743

$

2,059

(15

)%

New vehicles

$

3,026

$

4,627

(35

)%

$

3,413

$

4,978

(31

)%

Used vehicles

$

1,386

$

1,666

(17

)%

$

1,497

$

1,685

(11

)%

Finance, insurance and other, net

$

2,340

$

2,403

(3

)%

$

2,356

$

2,428

(3

)%

NM = Not Meaningful

Note: Reported Franchised Dealerships

Segment results include (i) same store results from the “Franchised

Dealerships Segment - Same Store” table below and (ii) the effects

of acquisitions, open points, dispositions and holding company

impacts for the periods reported. All currently operating

franchised dealership stores are included within the same store

group as of the first full month following the first anniversary of

the store’s opening or acquisition.

Franchised Dealerships Segment - Same

Store

Three Months Ended September

30,

Better / (Worse)

Nine Months Ended September

30,

Better / (Worse)

2024

2023

% Change

2024

2023

% Change

(In millions, except unit and

per unit data)

Revenues:

Retail new vehicles

$

1,539.8

$

1,542.8

—

%

$

4,502.1

$

4,502.8

—

%

Fleet new vehicles

22.2

23.2

(4

)%

68.0

69.6

(2

)%

Total new vehicles

1,562.0

1,566.0

—

%

4,570.1

4,572.4

—

%

Used vehicles

701.2

778.0

(10

)%

2,155.0

2,295.4

(6

)%

Wholesale vehicles

42.2

51.1

(17

)%

138.5

163.0

(15

)%

Total vehicles

2,305.4

2,395.1

(4

)%

6,863.6

7,030.8

(2

)%

Parts, service and collision repair

458.8

430.5

7

%

1,329.6

1,276.3

4

%

Finance, insurance and other, net

122.4

125.9

(3

)%

365.5

371.8

(2

)%

Total revenues

2,886.6

2,951.5

(2

)%

8,558.7

8,678.9

(1

)%

Gross Profit:

Retail new vehicles

83.5

125.4

(33

)%

272.3

392.9

(31

)%

Fleet new vehicles

0.6

1.0

(40

)%

2.3

3.1

(26

)%

Total new vehicles

84.2

126.3

(33

)%

274.5

396.1

(31

)%

Used vehicles

34.6

42.4

(18

)%

114.3

126.6

(10

)%

Wholesale vehicles

(1.3

)

(1.3

)

—

%

(1.7

)

0.1

(1,800

)%

Total vehicles

117.5

167.4

(30

)%

387.1

522.8

(26

)%

Parts, service and collision repair

230.4

214.1

8

%

667.8

632.9

6

%

Finance, insurance and other, net

122.4

125.9

(3

)%

365.5

371.8

(2

)%

Total gross profit

$

470.3

$

507.4

(7

)%

$

1,420.4

$

1,527.5

(7

)%

Unit Sales Volume:

Retail new vehicles

27,387

26,774

2

%

79,016

77,639

2

%

Fleet new vehicles

406

469

(13

)%

1,299

1,471

(12

)%

Total new vehicles

27,793

27,243

2

%

80,315

79,110

2

%

Used vehicles

24,934

25,426

(2

)%

75,973

74,777

2

%

Wholesale vehicles

4,968

5,127

(3

)%

15,242

15,913

(4

)%

Retail new & used vehicles

52,321

52,200

—

%

154,989

152,416

2

%

Used-to-New Ratio

0.91

0.95

(4

)%

0.96

0.96

—

%

Gross Profit Per Unit:

Retail new vehicles

$

3,049

$

4,682

(35

)%

$

3,446

$

5,061

(32

)%

Fleet new vehicles

$

1,596

$

2,046

(22

)%

$

1,743

$

2,131

(18

)%

New vehicles

$

3,028

$

4,637

(35

)%

$

3,418

$

5,006

(32

)%

Used vehicles

$

1,386

$

1,669

(17

)%

$

1,505

$

1,694

(11

)%

Finance, insurance and other, net

$

2,339

$

2,411

(3

)%

$

2,358

$

2,440

(3

)%

Note: All currently operating franchised

dealership stores are included within the same store group as of

the first full month following the first anniversary of the store’s

opening or acquisition.

EchoPark Segment - Reported

Three Months Ended September

30,

Better / (Worse)

Nine Months Ended September

30,

Better / (Worse)

2024

2023

% Change

2024

2023

% Change

(In millions, except unit and

per unit data)

Revenues:

Retail new vehicles

$

—

$

—

—

%

$

—

$

1.0

(100

)%

Used vehicles

470.3

554.8

(15

)%

1,402.0

1,651.3

(15

)%

Wholesale vehicles

23.8

26.6

(11

)%

74.4

89.1

(16

)%

Total vehicles

494.1

581.4

(15

)%

1,476.4

1,741.4

(15

)%

Finance, insurance and other, net

50.8

45.3

12

%

145.2

136.4

6

%

Total revenues

544.9

626.7

(13

)%

1,621.6

1,877.8

(14

)%

Gross Profit:

Retail new vehicles

—

—

—

%

—

0.1

(100

)%

Used vehicles

4.4

7.3

(40

)%

14.4

(18.8

)

177

%

Wholesale vehicles

—

0.2

(100

)%

(0.7

)

1.3

(154

)%

Total vehicles

4.4

7.5

(41

)%

13.7

(17.4

)

179

%

Finance, insurance and other, net

50.8

45.3

12

%

145.2

136.4

6

%

Total gross profit

55.2

52.8

5

%

158.9

119.0

34

%

Selling, general and administrative

expenses

(40.2

)

(58.6

)

31

%

(123.1

)

(199.0

)

38

%

Impairment charges

—

—

NM

(1.4

)

(62.6

)

NM

Depreciation and amortization

(5.4

)

(6.1

)

11

%

(16.4

)

(20.4

)

20

%

Operating income (loss)

9.6

(11.9

)

181

%

18.0

(163.0

)

111

%

Other income (expense):

Interest expense, floor plan

(3.7

)

(4.3

)

14

%

(11.3

)

(13.6

)

17

%

Interest expense, other, net

(0.7

)

(0.7

)

—

%

(2.0

)

(2.5

)

20

%

Other income (expense), net

—

—

NM

—

—

NM

Total other income (expense)

4.4

(5.0

)

188

%

13.3

(16.1

)

183

%

Income (loss) before taxes

5.2

(16.9

)

131

%

4.7

(179.1

)

103

%

Add: Impairment charges

—

—

NM

1.4

62.6

NM

Segment income (loss)

$

5.2

$

(16.9

)

131

%

$

6.1

$

(116.5

)

105

%

Unit Sales Volume:

Retail new vehicles

—

—

—

%

—

11

(100

)%

Used vehicles

17,757

19,050

(7

)%

52,379

56,114

(7

)%

Wholesale vehicles

2,720

2,740

(1

)%

8,307

8,891

(7

)%

Gross Profit Per Unit:

Total used vehicle and F&I

$

3,111

$

2,767

12

%

$

3,047

$

2,095

45

%

NM = Not Meaningful

EchoPark Segment - Same Market

Three Months Ended September

30,

Better / (Worse)

Nine Months Ended September

30,

Better / (Worse)

2024

2023

% Change

2024

2023

% Change

(In millions, except unit and

per unit data)

Revenues:

Used vehicles

$

470.3

$

497.2

(5

)%

$

1,392.4

$

1,340.9

4

%

Wholesale vehicles

23.8

24.2

(2

)%

71.2

68.4

4

%

Total vehicles

494.1

521.4

(5

)%

1,463.6

1,409.3

4

%

Finance, insurance and other, net

51.4

41.0

25

%

146.2

111.9

31

%

Total revenues

545.5

562.4

(3

)%

1,609.8

1,521.2

6

%

Gross Profit:

Used vehicles

4.4

4.7

(6

)%

14.8

(9.3

)

259

%

Wholesale vehicles

—

0.4

(100

)%

—

1.8

(100

)%

Total vehicles

4.4

5.1

(14

)%

14.8

(7.5

)

297

%

Finance, insurance and other, net

51.4

41.0

25

%

146.2

111.9

31

%

Total gross profit

$

55.8

$

46.1

21

%

$

161.0

$

104.4

54

%

Unit Sales Volume:

Used vehicles

17,757

17,454

2

%

52,016

46,534

12

%

Wholesale vehicles

2,720

2,491

9

%

8,098

7,012

15

%

Gross Profit Per Unit:

Total used vehicle and F&I

$

3,145

$

2,621

20

%

$

3,096

$

2,203

41

%

Note: All currently operating EchoPark

stores in a local geographic market are included within the same

market group as of the first full month following the first

anniversary of the market's opening.

Powersports Segment - Reported

Three Months Ended September

30,

Better / (Worse)

Nine Months Ended September

30,

Better / (Worse)

2024

2023

% Change

2024

2023

% Change

(In millions, except unit and

per unit data)

Revenues:

Retail new vehicles

$

26.9

$

26.8

—

%

$

64.4

$

72.5

(11

)%

Used vehicles

9.0

4.9

84

%

17.6

17.1

3

%

Wholesale vehicles

1.1

1.3

(15

)%

2.3

1.9

21

%

Total vehicles

37.0

33.0

12

%

84.3

91.5

(8

)%

Parts, service and collision repair

20.1

21.6

(7

)%

36.6

38.6

(5

)%

Finance, insurance and other, net

2.3

2.4

(4

)%

5.8

5.9

(2

)%

Total revenues

59.4

57.0

4

%

126.7

136.0

(7

)%

Gross Profit:

Retail new vehicles

4.1

5.9

(31

)%

9.3

14.3

(35

)%

Used vehicles

2.2

2.4

(8

)%

4.3

4.7

(9

)%

Wholesale vehicles

(0.1

)

(0.1

)

—

%

(0.2

)

—

(100

)%

Total vehicles

6.2

8.2

(24

)%

13.4

19.0

(29

)%

Parts, service and collision repair

9.2

10.2

(10

)%

17.0

18.5

(8

)%

Finance, insurance and other, net

2.3

2.4

(4

)%

5.8

5.9

(2

)%

Total gross profit

17.7

20.8

(15

)%

36.2

43.4

(17

)%

Selling, general and administrative

expenses

(11.3

)

(12.7

)

11

%

(27.3

)

(29.7

)

8

%

Depreciation and amortization

(1.1

)

(0.9

)

(22

)%

(3.1

)

(2.5

)

(24

)%

Operating income (loss)

5.3

7.2

(26

)%

5.8

11.2

(48

)%

Other income (expense):

Interest expense, floor plan

(0.7

)

(0.2

)

(250

)%

(1.6

)

(0.6

)

(167

)%

Interest expense, other, net

(0.6

)

(0.4

)

(50

)%

(1.9

)

(1.5

)

(27

)%

Other income (expense), net

—

—

NM

—

0.1

NM

Total other income (expense)

(1.3

)

(0.6

)

(117

)%

(3.5

)

(2.0

)

(75

)%

Income (loss) before taxes

4.0

6.6

(39

)%

2.3

9.2

(75

)%

Add: Impairment charges

—

—

NM

—

—

NM

Segment income (loss)

$

4.0

$

6.6

(39

)%

$

2.3

$

9.2

(75

)%

Unit Sales Volume:

Retail new vehicles

1,266

1,391

(9

)%

3,304

3,894

(15

)%

Used vehicles

777

837

(7

)%

1,708

1,972

(13

)%

Wholesale vehicles

99

93

6

%

130

150

(13

)%

Gross Profit Per Unit:

Retail new vehicles

$

3,249

$

4,213

(23

)%

$

2,820

$

3,680

(23

)%

Used vehicles

$

2,798

$

2,833

(1

)%

$

2,537

$

2,407

5

%

Finance, insurance and other, net

$

1,136

$

1,075

6

%

$

1,157

$

1,006

15

%

NM = Not Meaningful

Powersports Segment - Same

Store

Three Months Ended September

30,

Better / (Worse)

Nine Months Ended September

30,

Better / (Worse)

2024

2023

% Change

2024

2023

% Change

(In millions, except unit and

per unit data)

Revenues:

Retail new vehicles

$

26.9

$

26.8

—

%

$

63.9

$

72.3

(12

)%

Used vehicles

9.0

4.9

84

%

17.0

16.6

2

%

Wholesale vehicles

1.1

1.3

(15

)%

2.2

1.8

22

%

Total vehicles

37.0

33.0

12

%

83.1

90.7

(8

)%

Parts, service and collision repair

20.1

21.6

(7

)%

35.9

38.3

(6

)%

Finance, insurance and other, net

2.3

2.4

(4

)%

5.7

5.9

(3

)%

Total revenues

59.4

57.0

4

%

124.7

134.9

(8

)%

Gross Profit:

Retail new vehicles

4.1

5.9

(31

)%

9.2

14.3

(36

)%

Used vehicles

2.2

2.4

(8

)%

4.2

4.6

(9

)%

Wholesale vehicles

(0.1

)

(0.1

)

—

%

(0.3

)

(0.1

)

(200

)%

Total vehicles

6.2

8.2

(24

)%

13.1

18.8

(30

)%

Parts, service and collision repair

9.2

10.2

(10

)%

16.7

18.3

(9

)%

Finance, insurance and other, net

2.3

2.4

(4

)%

5.7

5.9

(3

)%

Total gross profit

$

17.7

$

20.8

(15

)%

$

35.5

$

43.0

(17

)%

Unit Sales Volume:

Retail new vehicles

1,266

1,391

(9

)%

3,287

3,887

(15

)%

Used vehicles

777

837

(7

)%

1,635

1,929

(15

)%

Wholesale vehicles

99

93

6

%

127

149

(15

)%

Retail new & used vehicles

2,043

2,228

(8

)%

4,922

5,816

(15

)%

Used-to-New Ratio

0.61

0.60

2

%

0.50

0.50

—

%

Gross Profit Per Unit:

Retail new vehicles

$

3,249

$

4,213

(23

)%

$

2,790

$

3,674

(24

)%

Used vehicles

$

2,798

$

2,833

(1

)%

$

2,556

$

2,397

7

%

Finance, insurance and other, net

$

1,136

$

1,075

6

%

$

1,163

$

1,007

15

%

Note: All currently operating powersports

stores are included within the same store group as of the first

full month following the first anniversary of the store’s opening

or acquisition.

Non-GAAP Reconciliation - Consolidated

- SG&A Expenses

Three Months Ended September

30,

Better / (Worse)

2024

2023

Change

% Change

(In millions)

Reported:

Compensation

$

252.2

$

256.0

$

3.8

1

%

Advertising

21.5

22.5

1.0

4

%

Rent

8.9

11.7

2.8

24

%

Other

109.5

119.4

9.9

8

%

Total SG&A expenses

$

392.1

$

409.6

$

17.5

4

%

Adjustments:

Acquisition and disposition-related gain

(loss)

$

2.3

$

—

Excess compensation related to CDK

outage

(1.8

)

—

Storm damage charges

(1.5

)

—

Gain (loss) on exit of leased

dealerships

—

(3.9

)

Severance and long-term compensation

charges

—

(0.9

)

Total SG&A adjustments

$

(1.0

)

$

(4.8

)

Adjusted:

Total adjusted SG&A expenses

$

391.1

$

404.8

$

13.7

3

%

Reported:

SG&A expenses as a % of gross

profit:

Compensation

46.4

%

44.0

%

(240

)

bps

Advertising

4.0

%

3.9

%

(10

)

bps

Rent

1.6

%

2.0

%

40

bps

Other

20.1

%

20.5

%

40

bps

Total SG&A expenses as a % of gross

profit

72.1

%

70.4

%

(170

)

bps

Adjustments:

Acquisition and disposition-related gain

(loss)

0.5

%

—

%

Excess compensation related to CDK

outage

(0.4

)%

—

%

Storm damage charges

(0.3

)%

—

%

Gain (loss) on exit of leased

dealerships

—

%

(0.7

)%

Severance and long-term compensation

charges

—

%

(0.2

)%

Total effect of adjustments

(0.2

)%

(0.9

)%

Adjusted:

Total adjusted SG&A expenses as a % of

gross profit

71.9

%

69.5

%

(240

)

bps

Reported:

Total gross profit

$

543.6

$

582.2

$

(38.6

)

(7

)%

Non-GAAP Reconciliation - Consolidated

- SG&A Expenses (Continued)

Nine Months Ended September

30,

Better / (Worse)

2024

2023

Change

% Change

(In millions)

Reported:

Compensation

$

750.3

$

775.8

$

25.5

3

%

Advertising

65.5

71.4

5.9

8

%

Rent

25.9

34.5

8.6

25

%

Other

335.7

332.5

(3.2

)

(1

)%

Total SG&A expenses

$

1,177.4

$

1,214.2

$

36.8

3

%

Adjustments:

Acquisition and disposition-related gain

(loss)

$

2.9

$

20.7

Closed store accrued expenses

(2.1

)

—

Excess compensation related to CDK

outage

(11.4

)

—

Storm damage charges

(5.1

)

(1.9

)

Gain (loss) on exit of leased

dealerships

3.0

(4.3

)

Severance and long-term compensation

charges

(5.0

)

(5.1

)

Total SG&A adjustments

$

(17.7

)

$

9.4

Adjusted:

Total adjusted SG&A expenses

$

1,159.7

$

1,223.6

$

63.9

5

%

Reported:

SG&A expenses as a % of gross

profit:

Compensation

46.3

%

45.5

%

(80

)

bps

Advertising

4.0

%

4.2

%

20

bps

Rent

1.6

%

2.0

%

40

bps

Other

20.8

%

19.5

%

(130

)

bps

Total SG&A expenses as a % of gross

profit

72.7

%

71.2

%

(150

)

bps

Adjustments:

Acquisition and disposition-related gain

(loss)

0.2

%

0.4

%

Closed store accrued expenses

(0.1

)%

—

%

Excess compensation related to CDK

outage

(0.8

)%

—

%

Storm damage charges

(0.3

)%

—

%

Gain (loss) on exit of leased

dealerships

0.2

%

(0.1

)%

Severance and long-term compensation

charges

(0.3

)%

(0.1

)%

Total effect of adjustments

(1.2

)%

0.2

%

Adjusted:

Total adjusted SG&A expenses as a % of

gross profit

71.5

%

71.4

%

(20

)

bps

Reported:

Total gross profit

$

1,618.9

$

1,704.6

$

(85.7

)

(5

)%

Adjustments:

Excess compensation related to CDK

outage

$

2.0

$

—

Used vehicle inventory valuation

adjustment

—

10.0

Total adjustments

$

2.0

$

10.0

Adjusted:

Total adjusted gross profit

$

1,620.9

$

1,714.6

$

(93.7

)

(5

)%

Non-GAAP Reconciliation - Franchised

Dealerships Segment - SG&A Expenses

Three Months Ended September

30,

Better / (Worse)

2024

2023

Change

% Change

(In millions)

Reported:

Compensation

$

220.2

$

216.9

$

(3.3

)

(2

)%

Advertising

13.7

11.0

(2.7

)

(25

)%

Rent

9.2

10.2

1.0

10

%

Other

97.4

100.2

2.8

3

%

Total SG&A expenses

$

340.5

$

338.3

$

(2.2

)

(1

)%

Adjustments:

Excess compensation related to CDK

outage

(1.8

)

—

Storm damage charges

$

(1.5

)

$

—

Total SG&A adjustments

$

(3.3

)

$

—

Adjusted:

Total adjusted SG&A expenses

$

337.2

$

338.3

$

1.1

—

%

Reported:

SG&A expenses as a % of gross

profit:

Compensation

46.8

%

42.6

%

(420

)

bps

Advertising

2.9

%

2.2

%

(70

)

bps

Rent

2.0

%

2.0

%

—

bps

Other

20.7

%

19.7

%

(100

)

bps

Total SG&A expenses as a % of gross

profit

72.4

%

66.5

%

(590

)

bps

Adjustments:

Excess compensation related to CDK

outage

(0.4

)%

—

%

Storm damage charges

(0.4

)%

—

%

Total effect of adjustments

(0.8

)%

—

%

Adjusted:

Total adjusted SG&A expenses as a % of

gross profit

71.6

%

66.5

%

(510

)

bps

Reported:

Total gross profit

$

470.7

$

508.6

$

(37.9

)

(7

)%

Non-GAAP Reconciliation - Franchised

Dealerships Segment - SG&A Expenses (Continued)

Nine Months Ended September

30,

Better / (Worse)

2024

2023

Change

% Change

(In millions)

Reported:

Compensation

$

658.5

$

649.7

$

(8.8

)

(1

)%

Advertising

43.2

29.7

(13.5

)

(45

)%

Rent

29.6

29.8

0.2

1

%

Other

295.7

276.3

(19.4

)

(7

)%

Total SG&A expenses

$

1,027.0

$

985.5

$

(41.5

)

(4

)%

Adjustments:

Acquisition and disposition-related gain

(loss)

$

—

$

20.9

Excess compensation related to CDK

outage

(11.0

)

—

Storm damage charges

(5.1

)

(1.9

)

Severance and long-term compensation

charges

(2.2

)

—

Total SG&A adjustments

$

(18.3

)

$

19.0

Adjusted:

Total adjusted SG&A expenses

$

1,008.7

$

1,004.5

$

(4.2

)

—

%

Reported:

SG&A expenses as a % of gross

profit:

Compensation

46.3

%

42.1

%

(420

)

bps

Advertising

3.0

%

1.9

%

(110

)

bps

Rent

2.1

%

1.9

%

(20

)

bps

Other

20.7

%

18.0

%

(270

)

bps

Total SG&A expenses as a % of gross

profit

72.1

%

63.9

%

(820

)

bps

Adjustments:

Acquisition and disposition-related gain

(loss)

—

%

1.3

%

Excess compensation related to CDK

outage

(0.8

)%

—

%

Storm damage charges

(0.4

)%

(0.1

)%

Severance and long-term compensation

charges

(0.2

)%

—

%

Total effect of adjustments

(1.4

)%

1.2

%

Adjusted:

Total adjusted SG&A expenses as a % of

gross profit

70.7

%

65.1

%

(560

)

bps

Reported:

Total gross profit

$

1,423.8

$

1,542.2

$

(118.4

)

(8

)%

Adjustments:

Excess compensation related to CDK

outage

$

2.0

$

—

Total adjustments

$

2.0

$

—

Adjusted:

Total adjusted gross profit

$

1,425.8

$

1,542.2

$

(116.4

)

(8

)%

Non-GAAP Reconciliation - EchoPark

Segment - SG&A Expenses

Three Months Ended September

30,

Better / (Worse)

2024

2023

Change

% Change

(In millions)

Reported:

Compensation

$

23.5

$

30.0

$

6.5

22

%

Advertising

7.4

10.9

3.5

32

%

Rent

0.7

2.1

1.4

67

%

Other

8.6

15.6

7.0

45

%

Total SG&A expenses

$

40.2

$

58.6

$

18.4

31

%

Adjustments:

Acquisition and disposition-related gain

(loss)

$

2.3

$

—

Gain (loss) on exit of leased

dealerships

—

(3.9

)

Severance and long-term compensation

charges

—

(0.9

)

Total SG&A adjustments

$

2.3

$

(4.8

)

Adjusted:

Total adjusted SG&A expenses

$

42.5

$

53.8

$

11.3

21

%

Reported:

SG&A expenses as a % of gross

profit:

Compensation

42.6

%

56.9

%

1,430

bps

Advertising

13.5

%

20.5

%

700

bps

Rent

1.3

%

3.9

%

260

bps

Other

15.5

%

29.8

%

1,430

bps

Total SG&A expenses as a % of gross

profit

72.9

%

111.1

%

3,820

bps

Adjustments:

Acquisition and disposition-related gain

(loss)

4.2

%

—

%

Gain (loss) on exit of leased

dealerships

—

%

(7.5

)%

Severance and long-term compensation

charges

—

%

(1.7

)%

Total effect of adjustments

4.2

%

(9.2

)%

Adjusted:

Total adjusted SG&A expenses as a % of

gross profit

77.1

%

101.9

%

2,480

bps

Reported:

Total gross profit

$

55.2

$

52.8

$

2.4

5

%

Non-GAAP Reconciliation - EchoPark

Segment - SG&A Expenses (Continued)

Nine Months Ended September

30,

Better / (Worse)

2024

2023

Change

% Change

(In millions)

Reported:

Compensation

$

72.0

$

105.1

$

33.1

31

%

Advertising

21.0

40.3

19.3

48

%

Rent

(2.7

)

5.3

8.0

151

%

Other

32.8

48.3

15.5

32

%

Total SG&A expenses

$

123.1

$

199.0

$

75.9

38

%

Adjustments:

Acquisition and disposition-related gain

(loss)

$

2.9

$

(0.3

)

Closed store accrued expenses

(2.1

)

—

Excess compensation related to CDK

outage

(0.4

)

—

Gain (loss) on exit of leased

dealerships

3.0

(4.3

)

Severance and long-term compensation

charges

(2.8

)

(5.1

)

Total SG&A adjustments

$

0.6

$

(9.7

)

Adjusted:

Total adjusted SG&A expenses

$

123.7

$

189.3

$

65.6

35

%

Reported:

SG&A expenses as a % of gross

profit:

Compensation

45.3

%

88.4

%

4,310

bps

Advertising

13.2

%

33.9

%

2,070

bps

Rent

(1.7

)%

4.4

%

610

bps

Other

20.6

%

40.5

%

1,990

bps

Total SG&A expenses as a % of gross

profit

77.4

%

167.2

%

8,980

bps

Adjustments:

Acquisition and disposition-related gain

(loss)

1.9

%

(0.6

)%

Closed store accrued expenses

(1.4

)%

—

%

Excess compensation related to CDK

outage

(0.3

)%

—

%

Gain (loss) on exit of leased

dealerships

2.0

%

(9.0

)%

Severance and long-term compensation

charges

(1.9

)%

(10.8

)%

Total effect of adjustments

0.4

%

(20.4

)%

Adjusted:

Total adjusted SG&A expenses as a % of

gross profit

77.8

%

146.8

%

6,900

bps

Reported:

Total gross profit

$

158.9

$

119.0

$

39.9

34

%

Adjustments:

Used vehicle inventory valuation

adjustment

$

—

$

10.0

Total adjustments

$

—

$

10.0

Adjusted:

Total adjusted gross profit

$

158.9

$

129.0

$

29.9

23

%

Non-GAAP Reconciliation - Powersports

Segment - SG&A Expenses

Three Months Ended September

30,

Better / (Worse)

2024

2023

Change

% Change

(In millions)

Reported:

Compensation

$

8.4

$

9.1

$

0.7

8

%

Advertising

0.4

0.6

0.2

33

%

Rent

(1.1

)

(0.6

)

0.5

(83

)%

Other

3.6

3.6

—

—

%

Total SG&A expenses

$

11.3

$

12.7

$

1.4

11

%

Reported:

SG&A expenses as a % of gross

profit:

Compensation

47.8

%

44.0

%

(380

)

bps

Advertising

2.5

%

2.9

%

40

bps

Rent

(6.4

)%

(2.9

)%

350

bps

Other

19.8

%

17.1

%

(270

)

bps

Total SG&A expenses as a % of gross

profit

63.7

%

61.1

%

(260

)

bps

Reported:

Total gross profit

$

17.7

$

20.8

$

(3.1

)

(15

)%

Nine Months Ended September

30,

Better / (Worse)

2024

2023

Change

% Change

(In millions)

Reported:

Compensation

$

19.8

$

21.0

$

1.2

6

%

Advertising

1.2

1.4

0.2

14

%

Rent

(1.0

)

(0.6

)

0.4

(67

)%

Other

7.3

7.9

0.6

8

%

Total SG&A expenses

$

27.3

$

29.7

$

2.4

8

%

Reported:

SG&A expenses as a % of gross

profit:

Compensation

54.7

%

48.4

%

(630

)

bps

Advertising

3.4

%

3.2

%

(20

)

bps

Rent

(2.8

)%

(1.2

)%

160

bps

Other

20.2

%

18.1

%

(210

)

bps

Total SG&A expenses as a % of gross

profit

75.5

%

68.5

%

(700

)

bps

Reported:

Total gross profit

$

36.2

$

43.4

$

(7.2

)

(17

)%

Non-GAAP Reconciliation - Franchised

Dealerships Segment - Income (Loss) Before Taxes and Segment Income

(Loss)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

% Change

2024

2023

% Change

(In millions)

Reported:

Income (loss) before taxes

$

51.6

$

101.5

(49

)%

$

167.0

$

357.2

(53

)%

Add: Impairment charges

—

—

1.0

—

Segment income (loss)

$

51.6

$

101.5

(49

)%

$

168.0

$

357.2

(53

)%

Adjustments:

Acquisition and disposition-related (gain)

loss

$

—

$

—

$

—

$

(20.9

)

Excess compensation related to CDK

outage

1.8

—

13.0

—

Storm damage charges

1.5

—

5.1

1.9

Severance and long-term compensation

charges

—

—

2.2

—

Total pre-tax adjustments

$

3.3

$

—

$

20.3

$

(19.0

)

Adjusted:

Segment income (loss)

$

54.9

$

101.5

(46

)%

$

188.3

$

338.2

(44

)%

Non-GAAP Reconciliation - EchoPark

Segment - Income (Loss) Before Taxes and Segment Income

(Loss)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

% Change

2024

2023

% Change

(In millions)

Reported:

Income (loss) before taxes

$

5.2

$

(16.9

)

131

%

$

4.7

$

(179.1

)

103

%

Add: Impairment charges

—

—

1.4

62.6

Segment income (loss)

$

5.2

$

(16.9

)

131

%

$

6.1

$

(116.5

)

105

%

Adjustments:

Acquisition and disposition-related (gain)

loss

$

(2.3

)

$

—

$

(2.9

)

$

0.3

Closed store accrued expenses

—

—

2.1

—

Excess compensation related to CDK

outage

—

—

0.4

—

Loss (gain) on exit of leased

dealerships

—

3.9

(3.0

)

4.3

Severance and long-term compensation

charges

—

0.9

2.8

5.1

Used vehicle inventory valuation

adjustment

—

—

—

10.0

Total pre-tax adjustments

$

(2.3

)

$

4.8

$

(0.6

)

$

19.7

Adjusted:

Segment income (loss)

$

2.9

$

(12.1

)

124

%

$

5.5

$

(96.8

)

106

%

Non-GAAP Reconciliation - Powersports

Segment - Income (Loss) Before Taxes and Segment Income

(Loss)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

% Change

2024

2023

% Change

(In millions)

Reported:

Income (loss) before taxes

$

4.0

$

6.6

(39

)%

$

2.3

$

9.2

(75

)%

Add: Impairment charges

—

—

—

—

Segment income (loss)

$

4.0

$

6.6

(39

)%

$

2.3

$

9.2

(75

)%

Non-GAAP Reconciliation - Consolidated

- Net Income (Loss) and Diluted Earnings (Loss) Per Share

Three Months Ended September

30, 2024

Three Months Ended September

30, 2023

Weighted-

Average

Shares

Amount

Per

Share

Amount

Weighted-

Average

Shares

Amount

Per

Share

Amount

(In millions, except per share

amounts)

Reported net income (loss), diluted

shares, and diluted earnings (loss) per share

34.9

$

74.2

$

2.13

35.6

$

68.4

$

1.92

Adjustments:

Acquisition and disposition-related gain

(loss)

$

(2.3

)

$

—

Excess compensation related to CDK

outage

1.8

—

Storm damage charges

1.5

—

Loss (gain) on exit of leased

dealerships

—

3.9

Severance and long-term compensation

charges

—

0.9

Total pre-tax adjustments

$

1.0

$

4.8

Tax effect of above items

(0.2

)

(1.2

)

Non-recurring tax items

$

(31.0

)

$

—

Adjusted net income (loss), diluted

shares, and diluted earnings (loss) per share

34.9

$

44.0

$

1.26

35.6

$

72.0

$

2.02

Nine Months Ended September

30, 2024

Nine Months Ended September

30, 2023

Weighted-

Average

Shares

Net Income (Loss)

Per

Share

Amount

Weighted-

Average

Shares

Net Income (Loss)

Per

Share

Amount

(In millions, except per share

amounts)

Reported net income (loss), diluted

shares, and diluted earnings (loss) per share

34.8

$

157.4

$

4.52

36.2

$

139.5

$

3.85

Adjustments:

Acquisition and disposition-related gain

(loss)

$

(2.9

)

$

(20.7

)

Closed store accrued expenses

2.1

—

Excess compensation related to CDK

outage

13.4

—

Storm damage charges

5.1

1.9

Impairment charges

2.4

62.6

Loss (gain) on exit of leased

dealerships

(3.0

)

4.3

Severance and long-term compensation

charges

5.0

5.1

Used vehicle inventory valuation

adjustment

—

10.0

Total pre-tax adjustments

$

22.1

$

63.2

Tax effect of above items

(5.8

)

(15.6

)

Non-recurring tax items

$

(31.0

)

$

—

Adjusted net income (loss), diluted

shares, and diluted earnings (loss) per share

34.8

$

142.7

$

4.10

36.2

$

187.1

$

5.17

Non-GAAP Reconciliation - Adjusted

EBITDA

Three Months Ended September

30, 2024

Three Months Ended September

30, 2023

Franchised Dealerships

Segment

EchoPark Segment

Powersports Segment

Total

Franchised Dealerships

Segment

EchoPark Segment

Powersports Segment

Total

(In millions)

Net income (loss)

$

74.2

$

68.4

Provision for income taxes

(13.4

)

22.8

Income (loss) before taxes

$

51.6

$

5.2

$

4.0

$

60.8

$

101.5

$

(16.9

)

$

6.6

$

91.2

Non-floor plan interest (1)

27.1

0.7

0.6

28.4

26.2

0.7

0.4

27.3

Depreciation and amortization (2)

32.8

5.3

1.2

39.3

29.9

6.1

0.9

36.9

Stock-based compensation expense

5.5

—

—

5.5

6.7

—

—

6.7

Loss (gain) on exit of leased

dealerships

—

—

—

—

—

3.9

—

3.9

Severance and long-term compensation

charges

—

—

—

—

—

0.9

—

0.9

Excess compensation related to CDK

outage

1.8

—

—

1.8

—

—

—

—

Acquisition and disposition related (gain)

loss

—

(2.3

)

—

(2.3

)

0.2

0.1

—

0.3

Storm damage charges

1.5

—

—

1.5

—

—

—

—

Adjusted EBITDA

$

120.3

$

8.9

$

5.8

$

135.0

$

164.5

$

(5.2

)

$

7.9

$

167.2

Nine Months Ended September

30, 2024

Nine Months Ended September

30, 2023

Franchised Dealerships

Segment

EchoPark Segment

Powersports Segment

Total

Franchised Dealerships

Segment

EchoPark Segment

Powersports Segment

Total

(In millions)

Net income (loss)

$

157.4

$

139.5

Provision for income taxes

16.6

47.8

Income (loss) before taxes

$

167.0

$

4.7

$

2.3

$

174.0

$

357.2

$

(179.1

)

$

9.2

$

187.3

Non-floor plan interest (1)

79.8

2.0

1.9

83.7

77.4

2.5

1.6

81.5

Depreciation & amortization (2)

95.8

16.3

3.1

115.2

87.6

20.4

2.4

110.4

Stock-based compensation expense

15.8

—

—

15.8

17.3

—

—

17.3

Loss (gain) on exit of leased

dealerships

—

(3.0

)

—

(3.0

)

—

4.3

—

4.3

Impairment charges

1.0

1.4

—

2.4

—

62.6

—

62.6

Loss on debt extinguishment

0.6

—

—

0.6

—

—

—

—

Severance and long-term compensation

charges

2.2

2.9

—

5.1

—

5.1

—

5.1

Excess compensation related to CDK

outage

13.0

0.4

—

13.4

—

—

—

—

Acquisition and disposition related (gain)

loss

(0.3

)

(3.3

)

—

(3.6

)

(20.7

)

0.3

—

(20.4

)

Storm damage charges

5.1

—

—

5.1

1.9

—

—

1.9

Used vehicle inventory valuation

adjustment

—

—

—

—

—

10.0

—

10.0

Closed store accrued expenses

$

—

$

2.1

$

—

$

2.1

$

—

$

—

$

—

$

—

Adjusted EBITDA

$

380.0

$

23.5

$

7.3

$

410.8

$

520.7

$

(73.9

)

$

13.2

$

460.0

(1)

Includes interest expense, other, net in

the accompanying consolidated statements of operations, net of any

amortization of debt issuance costs or net debt discount/premium

included in (2) below.

(2)

Includes the following line items from the

accompanying consolidated statements of cash flows: depreciation

and amortization of property and equipment; debt issuance cost

amortization; and debt discount amortization, net of premium

amortization.

Non-GAAP Reconciliation - EchoPark Segment Operations and

Closed Stores

Three Months Ended September

30, 2024

Three Months Ended September

30, 2023

Better / (Worse) %

Change

EchoPark

Operations

Closed

Stores

Total

EchoPark

Segment

EchoPark

Operations

Closed

Stores

Total

EchoPark

Segment

EchoPark

Operations

Closed

Stores

Total

EchoPark

Segment

(In millions, except unit and

per unit data)

Total revenues

$

545.5

$

(0.6

)

$

544.9

$

562.4

$

64.3

$

626.7

(3

)%

(101

)%

(13

)%

Total gross profit

$

55.8

$

(0.6

)

$

55.2

$

46.1

$

6.7

$

52.8

21

%

(109

)%

5

%

Income (loss) before taxes

$

5.6

$

(0.4

)

$

5.2

$

(8.7

)

$

(8.2

)

$

(16.9

)

164

%

95

%

131

%

Non-floor plan interest (1)

0.6

0.1

0.7

0.3

0.4

0.7

NM

NM

NM

Depreciation and amortization (2)

5.3

—

5.3

5.8

0.3

6.1

NM

NM

NM

Acquisition and disposition-related (gain)

loss

(2.3

)

—

(2.3

)

—

0.1

0.1

NM

NM

NM

Loss (gain) on exit of leased

dealerships

—

—

—

—

3.9

3.9

NM

NM

NM

Severance and long-term compensation

charges

—

—

—

—

0.9

0.9

NM

NM

NM

Adjusted EBITDA

$

9.2

$

(0.3

)

$

8.9

$

(2.6

)

$

(2.6

)

$

(5.2

)

454

%

88

%

271

%

Used vehicle unit sales volume

17,757

—

17,757

17,454

1,596

19,050

2

%

(100

)%

(7

)%

Total used vehicle and F&I gross

profit per unit

$

3,145

$

—

$

3,111

$

2,621

$

4,333

$

2,767

20

%

(100

)%

12

%

NM = Not Meaningful

Non-GAAP Reconciliation - EchoPark

Segment Operations and Closed Stores (Continued)

Nine Months Ended September

30, 2024

Nine Months Ended September

30, 2023

Better / (Worse) %

Change

EchoPark

Operations

Closed

Stores

Total

EchoPark

Segment

EchoPark

Operations

Closed

Stores

Total

EchoPark

Segment

EchoPark

Operations

Closed

Stores

Total

EchoPark

Segment

(In millions, except unit and

per unit data)

Total revenues

$

1,609.8

$

11.8

$

1,621.6

$

1,521.3

$

356.5

$

1,877.8

6

%

(97

)%

(14

)%

Total gross profit

$

160.8

$

(1.9

)

$

158.9

$

94.1

$

24.9

$

119.0

71

%

(108

)%

34

%

Income (loss) before taxes

$

12.2

$

(7.5

)

$

4.7

$

(88.0

)

$

(91.1

)

$

(179.1

)

114

%

92