UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Dated 2 November 2023

Commission File Number 333-234096

Sibanye Stillwater Limited

(Translation of registrant’s name into English)

Constantia Office Park

Cnr 14th Avenue and Hendrik Potgieter Road

Bridgeview House, Ground Floor

Weltevreden Park, 1709

South Africa

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| | | |

| Sibanye Stillwater Limited |

| | |

| Date: 2 November 2023 | By: | /s/ Charl Keyter |

| | Name: | Charl Keyter |

| | Title: | Chief Financial Officer |

Exhibit 99.1

Johannesburg, 2 November 2023: Sibanye Stillwater Limited (Sibanye-Stillwater or the Group) (JSE: SSW and NYSE: SBSW) is pleased to provide an operating update for the quarter ended 30 September 2023, Group financial results are only provided on a six-monthly basis.

SALIENT FEATURES - QUARTER ENDED 30 SEPTEMBER 2023 (Q3 2023) COMPARED TO QUARTER ENDED 30 SEPTEMBER 2022 (Q3 2022) | | |

|

|

•Strong financial position and proactive repositioning for changing environment ensures competitiveness |

•Industry leading cost management at SA PGM operations. Moving down industry cost curve increases competitiveness |

•SA gold operations generated R344m (US$19m) adjusted (Adj) EBITDA, a R1.2bn (US$67m) turnaround; ongoing S189 process at Kloof 4 |

•US PGM operations resume planned mine production run rate in October 2023 driving improved outlook for production for Q4 2023 |

•Improved operational performance from the European and Australian regions |

•Century zinc operation contributed positive Adj EBITDA of R53m (US$3m), successfully recovering post regional flooding during Q1 2023 |

•Construction of the Keliber lithium project progressing well: commenced construction at the concentrator and the first open pit |

KEY STATISTICS – GROUP

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| US dollar | | | | | | SA rand |

| Quarter ended | | | | | | Quarter ended |

| Sep 2022 | Jun 2023 | Sep 2023 | | KEY STATISTICS | | Sep 2023 | Jun 2023 | Sep 2022 |

| | | | GROUP | | | | |

| 496 | | 343 | | 163 | | US$m | Adjusted EBITDA1 | Rm | 3,027 | | 6,392 | | 8,455 | |

| 17.05 | | 18.66 | | 18.59 | | R/US$ | Average exchange rate using daily closing rate | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | |

| TABLE OF CONTENTS | Page | | Stock data for the Quarter ended 30 September 2023 |

| | | | |

| | | Number of shares in issue | |

| | | - at 30 September 2023 | 2,830,567,264 |

| | | - weighted average | 2,830,567,264 |

| | | Free Float | 99 | % |

| | | Bloomberg/Reuters | SSWSJ/SSWJ.J |

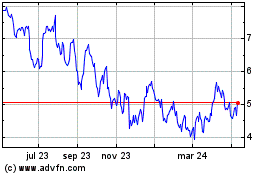

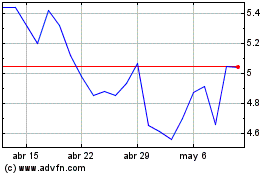

| | | JSE Limited - (SSW) | |

| | | Price range per ordinary share (High/Low) | R25.87 to R33.82 |

| | | Average daily volume | 14,115,662 |

| | | | |

| | | NYSE - (SBSW); one ADR represents four ordinary shares | |

| | | Price range per ADR (High/Low) | US$5.47 to US$7.73 |

| | | Average daily volume | 4,268,600 |

| | | | |

| | | | |

Sibanye-Stillwater Operating update | Quarter ended 30 September 2023 1

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| US dollar | | | | | | SA rand |

| Quarter ended | | | | | | Quarter ended |

| Sep 2022 | Jun 2023 | Sep 2023 | | KEY STATISTICS | | Sep 2023 | Jun 2023 | Sep 2022 |

| | | | AMERICAS REGION | | | | |

| | | | US PGM underground operations | | | | |

| 85,889 | | 104,823 | | 105,546 | | oz | 2E PGM production2,3 | kg | 3,283 | | 3,260 | | 2,671 | |

| 1,811 | | 1,360 | | 1,190 | | US$/2Eoz | Average basket price | R/2Eoz | 22,122 | | 25,378 | | 30,878 | |

| 52 | | 39 | | 21 | | US$m | Adjusted EBITDA1 | Rm | 397 | | 722 | | 895 | |

| 1,815 | | 1,623 | | 1,922 | | US$/2Eoz | All-in sustaining cost4 | R/2Eoz | 35,738 | | 30,280 | | 30,947 | |

| | | | US PGM recycling | | | | |

| 141,560 | | 83,608 | | 72,434 | | oz | 3E PGM recycling2,3 | kg | 2,253 | | 2,601 | | 4,403 | |

| 3,378 | | 2,480 | | 2,215 | | US$/3Eoz | Average basket price | R/3Eoz | 41,177 | | 46,277 | | 57,595 | |

| 22 | | 9 | | 8 | | US$m | Adjusted EBITDA1 | Rm | 147 | | 172 | | 371 | |

| | | | SOUTHERN AFRICA (SA) REGION | | | | |

| | | | PGM operations | | | | |

| 432,143 | | 419,391 | | 451,560 | | oz | 4E PGM production3,5 | kg | 14,045 | | 13,045 | | 13,441 | |

| 2,479 | | 1,698 | | 1,317 | | US$/4Eoz | Average basket price | R/4Eoz | 24,479 | | 31,689 | | 42,269 | |

| 489 | | 259 | | 136 | | US$m | Adjusted EBITDA1 | Rm | 2,532 | | 4,842 | | 8,332 | |

| 1,127 | | 1,041 | | 1,080 | | US$/4Eoz | All-in sustaining cost4 | R/4Eoz | 20,080 | | 19,416 | | 19,211 | |

| | | | Gold operations | | | | |

| 204,672 | | 216,471 | | 197,663 | | oz | Gold produced | kg | 6,148 | | 6,733 | | 6,366 | |

| 1,723 | | 1,975 | | 1,930 | | US$/oz | Average gold price | R/kg | 1,153,448 | | 1,184,973 | | 944,316 | |

| (48) | | 86 | | 19 | | US$m | Adjusted EBITDA1 | Rm | 344 | | 1,601 | | (811) | |

| 2,207 | | 1,800 | | 2,062 | | US$/oz | All-in sustaining cost4 | R/kg | 1,232,600 | | 1,080,135 | | 1,210,049 | |

| | | | EUROPEAN REGION | | | | |

| | | | Sandouville nickel refinery | | | | |

| 1,653 | | 1,884 | | 2,352 | | tNi | Nickel production6 | tNi | 2,352 | | 1,884 | | 1,653 | |

| 22,553 | | 25,815 | | 21,726 | | US$/tNi | Nickel equivalent average basket price7 | R/tNi | 403,895 | | 481,713 | | 384,525 | |

| (14) | | (20) | | (16) | | US$m | Adjusted EBITDA1 | Rm | (296) | | (382) | | (246) | |

| 30,185 | | 36,363 | | 31,514 | | US$/tNi | Nickel equivalent sustaining cost8 | R/tNi | 585,853 | | 678,537 | | 514,654 | |

| | | | AUSTRALIAN REGION | | | | |

| | | | Century zinc retreatment operation9 | | | | |

| — | | 23 | | 25 | | ktZn | Zinc metal produced (payable)10 | ktZn | 25 | | 23 | | — | |

| — | | 1,545 | | 1,708 | | US$/tZn | Average equivalent zinc concentrate price11 | R/tZn | 31,747 | | 28,832 | | — | |

| — | | (23) | | 3 | | US$m | Adjusted EBITDA1 | Rm | 53 | | (433) | | — | |

| — | | 2,013 | | 1,753 | | US$/tZn | All-in sustaining cost4 | R/tZn | 32,587 | | 37,562 | | — | |

1The Group reports adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) based on the formula included in the facility agreements for compliance with the debt covenant formula. Adjusted EBITDA may not be comparable to similarly titled measures of other companies. Adjusted EBITDA is not a measure of performance under IFRS and should be considered in addition to and not as a substitute for other measures of financial performance and liquidity. For a reconciliation of profit/(loss) before royalties and tax to adjusted EBITDA, see "Adjusted EBITDA reconciliation - Quarters"

2The US PGM operations’ underground production is converted to metric tonnes and kilograms, and performance is translated to SA rand (rand). In addition to the US PGM operations’ underground production, the operation treats recycling material which is excluded from the 2E PGM production, average basket price and All-in sustaining cost statistics shown. PGM recycling represents palladium, platinum, and rhodium ounces fed to the furnace

3The Platinum Group Metals (PGM) production in the SA operations is principally platinum, palladium, rhodium and gold, referred to as 4E (3PGM+Au), and in the US operations is principally platinum and palladium, referred to as 2E (2PGM) and US PGM recycling is principally platinum, palladium and rhodium referred to as 3E (3PGM)

4See “Salient features and cost benchmarks - Quarters” for the definition of All-in sustaining cost (AISC)

5The SA PGM production excludes the production associated with the purchase of concentrate (PoC) from third parties. For a reconciliation of the production including third party PoC, refer to the "Reconciliation of operating cost excluding third party PoC for US and SA PGM operations, Total SA PGM operations and Marikana - Quarters"

6The nickel production at the Sandouville nickel refinery operations is principally nickel metal and nickel salts (liquid form), together referred to as nickel equivalent products

7The nickel equivalent average basket price per tonne is the total nickel revenue adjusted for other income less non-product sales divided by the total nickel equivalent tonnes sold

8See "Salient features and cost benchmarks - Quarters Sandouville nickel refinery for a reconciliation of cost of sales before amortisation and depreciation to nickel equivalent sustaining cost

9Century is a leading tailings management and rehabilitation company that currently owns and operates the Century zinc tailings retreatment operation in Queensland, Australia. Century was acquired by the Group on 22 February 2023

10Zinc metal produced (payable) is the payable quantity of zinc metal produced after applying smelter content deductions

11Average equivalent zinc concentrate price is the total zinc sales revenue recognised at the price expected to be received excluding the fair value adjustments divided by the payable zinc metal sold

Sibanye-Stillwater Operating update | Quarter ended 30 September 2023 2

STATEMENT BY NEAL FRONEMAN, CHIEF EXECUTIVE OFFICER OF SIBANYE-STILLWATER The global macro-economic environment remains challenging, and we continue to assess the positioning of our operations for optimal performance and sustainability through the cycle.

Our financial position remains robust and our capital allocation framework remains the guiding principle for growth and diversification opportunities aligned with our strategy. We have maintained our capital discipline in anticipation of weaker market conditions, as highlighted in February 2022. We remain prudent with capital investment and utilising our balance sheet to fund external growth during this challenging period. We are conscious of the necessity of appropriately managing debt, mindful of our leverage position during periods of decreasing, or volatile, profitability and earnings.

After a difficult start to the third quarter, with three tragic fatalities recorded in the first five weeks, the remainder of Q3 2023 was fatality free. It was pleasing to note that the significant gains in our safety performance indicators since 2021 have been maintained, with the other lagging indicators generally stable year-on-year. We look forward to ongoing improvements in the Group safety performance over the remainder of the year, with an intense focus on ending the year without any high impact incidents.

As stated in our recent H1 2023 operating and financial results, we are mindful of the commercial environment and, where necessary, will consider restructuring in areas where commercially viable operations cannot be sustained. In this regard, we recently announced potential restructuring at our SA gold and SA PGM operations. Potential closure or rightsizing of high cost and underperforming shafts will ensure that operations remain profitable and sustainable at current precious metal prices and beyond, while retaining significant leverage to improvements in the commodity price outlook.

Although we repositioned the US PGM operations in mid-2022 in anticipation of the changing macro environment and worsening medium term outlook for the palladium price, the decline in the palladium price during 2023 has surpassed our expectations, dropping lower and faster than anticipated. While the mine production volume run rate at the US PGM operations improved during October 2023, persistent inflation and the continued impact of skills shortages, have resulted in costs remaining significantly higher than planned. Further repositioning is being considered to address these factors which have kept costs at elevated levels.

As guided, the operational performances of the Sandouville nickel refinery (Sandouville refinery) in France and the Century zinc retreatment operation (Century operation) in Australia for Q3 2023 improved, with both operations recovering from disruptions which impacted H1 2023. This improved operational performance resulted in the Century operation contributing positively to Group adjusted EBITDA for Q3 2023, a significant turnaround from adjusted EBITDA losses from Q2 2023.

Despite the improved operational performance, the Sandouville refinery remained loss making, due to continued inflationary cost pressures, elevated maintenance costs and a further decline in the average nickel price. The current operations are not commercially viable at current nickel prices, and management has made notable progress with optimisation studies aimed at securing a sustainable future for the Sandouville refinery. Positively, during these optimisation studies, the European region and Sandouville teams have identified an innovative alternative to the current process and are currently assessing its commercial and technical feasibility. In parallel, we continue to advance the studies on recycling and production of battery grade nickel products.

Addressing losses from these operations will ensure ongoing delivery of our strategy and position us well for future value creation.

In this regard, we have initiated the construction of the lithium concentrator and the development of the Syväjärvi open pit mine in Päiväneva in Finland. This ensures that the Keliber lithium project remains on track to be the first integrated lithium hydroxide supplier in Europe, delivering battery grade metal into the European battery ecosystem by 2026, at a time when we believe there will be increasing deficits in lithium supply.

More details on the capital and expected production profile will be shared by Sibanye-Stillwater at its virtual battery metals investor day on Tuesday, 14 November 2023 with a live presentation shared via webcast (link: https://themediaframe.com/mediaframe/webcast.html?webcastid=jg7r2VtY) and conference call (register on: https://services.choruscall.za.com/DiamondPassRegistration/register?confirmationNumber=2252855&link SecurityString=5ce1569ad) at 13h00 (CAT) / 11h00 (GMT) / 06h00 (EST) / 04h00 (MT).

While the economic outlook remains challenging and uncertain, we are well positioned for continued delivery of shared value for all stakeholders.

SAFE PRODUCTION

The focus on safety continues, with our immediate objective to eliminate fatal and serious injuries through ongoing implementation of our Fatal elimination strategy: critical controls, critical lifesaving behaviours and critical management routines.

Throughout Q3 2023, the safety focus was on advancing the risk reduction journey, implementation of medium and long-term interventions related to the fatal elimination strategy, and continuing to make good progress in reducing the number of serious injuries at the operations.

The serious injury frequency rate (SIFR) (per million hours worked), including the Australian region which was included from May 2023, improved by 12% from an already significantly improved rate of 2.82 for Q3 2022 (10% improvement compared to Q3 2021 at the time) to 2.47 in Q3 2023. Of note is the SIFR at the SA PGM operations which improved from 2.36 in Q3 2022 to 2.10 in Q3 2023, the lowest rate ever achieved by these operations. The Group total recordable injury frequency rate (TRIFR) regressed marginally by 1% year-on-year to 5.28 following significant improvements of 16% from Q3 2021 to Q3 2022. Regrettably, the fatal injury frequency rate (FIFR), regressed from 0.05 for Q3 2022 to 0.07 for Q3 2023 as a result of three fatalities in Q3 2023, two fatalities at the SA gold operations and one fatality at the SA PGM operations, which occurred one day prior to the SA PGM operations achieving a commendable milestone of 10 million shifts without fatalities.

We mourn the tragic loss of our three colleagues. Mr Armando Matias, a Development Miner at Driefontein's Hlanganani shaft, passed away, on 13 July 2023 due to smoke inhalation during the underground fire. On 17 July 2023, Mr. Molemosa Nkopane a Loader Operator at Rustenburg's Khuseleka shaft was fatally injured in a rail bound equipment derailment-related accident. On 1 August 2023, Mr Taelo Ramochela, Special Team Leader Development at Kloof's Masimthembe Shaft passed away due to injuries sustained while conducting an inspection in a boxhole.

Sibanye-Stillwater Operating update | Quarter ended 30 September 2023 3

Amidst the tragic loss of lives during the first 32 days of the quarter, it was encouraging that the rest of the quarter was fatality free and again underpins the need to maintain constant vigilance and focus while implementing our Fatal elimination plan.

The board and management of Sibanye-Stillwater extend heartfelt condolences to the families, friends and colleagues of our deceased colleagues. All incidents are being investigated with relevant stakeholders and appropriate support is being provided to the families of the deceased.

Our core focus remains driving the full implementation of the Fatal elimination strategy from leadership down to all employees, ensuring it is understood and internalised by every single employee, resulting in a safety-first culture that complements and is underpinned by the Group's values.

US PGM operations

The US PGM operations concluded the recovery from the shaft incident at the Stillwater West mine (which resulted in an eight week stoppage during H1 2023), achieving the mined production volume run rate planned as per the repositioning plan during October 2023. An improvement in 2E PGM mined production is therefore forecast for Q4 2023 with an associated reduction in unit costs. Inflationary cost pressures and a reliance on contractors due to the persistent skills shortage in Montana and the USA, is likely to keep costs elevated however, we will continue to assess the changing macro economic and commodity price environment to ensure that the appropriate production and cost structures are in place to ensure the sustainability of the operations.

Mined 2E PGM production from the US PGM operations of 105,546 2Eoz for Q3 2023, was 23% higher than for Q3 2022, which was impacted by the regional flooding in Montana in mid-June 2022. The regional flooding restricted access to the Stillwater mine leading to the suspension of production from the Stillwater West and East mines for eight weeks during Q3 2022, followed by a subsequent production build-up during the remainder of 2022.

Mined tonnes milled for Q3 2023 of 316kt was 31% higher than for Q3 2022 with plant head grade of 11.6g/t for Q3 2023 5% lower than for Q3 2022. The mining operations continue to experience grade challenges due to dilution from difficult ground conditions and mining quality factors related to the high staff attrition rates and skills challenges.

AISC of US$1,922/2Eoz (R35,738/2Eoz) for Q3 2023 was 6% higher than for Q3 2022 (US$1,815, R30,947/2Eoz) due to higher than expected contractor costs and persistently high inflationary cost pressures on stores and other operating costs. Ongoing skills shortages and a reliance on contractors for ore reserve development (ORD), contributed to ORD capital increasing by 33% year-on-year to US$56 million (R1,049 million) and sustaining capital increasing by 88% to US$32 million (R602 million) primarily as a result of the requirement to gain additional flexibility for the operations. ORD costs, which now contribute US$535/2Eoz (R9,939/2Eoz) to AISC, has increased due to higher development rates and contractor premiums due to the need to accelerate development and higher development support costs. Included in the high ORD are other infrastructure costs (vertical alimak raises and raisebore drilling) as well as diamond drilling in order to ensure that stoping remains on reef. Many of these activities are done by contractors at significantly higher cost, supported by maintenance crews, also with a significant component of high-cost contractors. Sustaining capital which contributes US$307/2Eoz (R5,704/2Eoz) was significantly higher due to spending on critical life of mine ventilation improvements at both mines, including fans and a heat exchanger at the East Boulder mine, transport and mining fleet replacement, and expenditure associated with the smelter rebuild for Q4 2023.

Of significant benefit, in terms of the US Inflation Reduction Act (IRA), the US PGM operations qualifies for an IRA credit (45X Advanced Manufacturing Production Credit) equal to 10% of qualifying production costs incurred for critical minerals produced and sold after 31 December 2022, for a period of 10 years. For Q3 2023, management recognised an IRA credit of US$10.8 million (R201 million) against operating costs.

Mine production at the Stillwater operation (West and East mines) of 68,796 2Eoz, was 45% higher than for Q3 2022, reflecting the recovery from the flooding impact during H2 2022, but continued to be impacted by the shaft incident in Q1 2023, grade issues and fleet availability. Mined production volume from the Stillwater mine returned to planned run rates during October 2023. Production from East Boulder of 36,751 2Eoz, was 4% lower than for Q3 2022, impacted by ongoing grade issues, critical skills shortages, particularly mechanical, which affected fleet availability and temporary planned power interruption due to the implementation of the new ventilation arrangements which will improve underground conditions.

The key focus areas for the US PGM operations include infrastructure maintenance scheduling (which is being overhauled), improving fleet availability, addressing the mining mix at the East Boulder mine, minimizing dilution, and implementing ongoing labour retention strategies whilst reducing exposure to significantly higher cost contractors.

2E PGM sold for Q3 2023 of 124,882 2Eoz, was 80% higher year-on-year and 18% or 19,336 2Eoz higher than 2E PGM mined production for the quarter, due to the timing of deliveries.

Consistent with the repositioning plan for the US PGM operations to increase the flexibility and the developed state of the underground operations to 18 months, total development increased by 3% to 6.5 kilometres with primary off-reef development 17% higher year-on-year at 1,957 metres and secondary development 2% lower at 4,587 metres. Whilst development rates were impacted by the shaft incident at the Stillwater mine, ORD is improving with development rates achieved in Q3 2023 being the highest since Q1 2022.

Total capital expenditure for Q3 2023 increased by 17% year-on-year to US$100 million (R1,852 million), with 89% of this total spent on ORD and sustaining capital. Project capital was 58% lower at US$11 million(R201 million) in line with the reduced spending on the Stillwater East project. Following on the completion of the Benbow decline on 16 September 2022, remaining project capital spend was on the completion of 56 East holing to the Benbow decline, and the processing plant upgrade (with the first line successfully commissioned).

US PGM recycling operations

The global autocatalyst recycling industry remains depressed mainly as a result of the uncertain global economic outlook, recessionary concerns, and higher interest rates that have inhibited consumer demand for new vehicles. Light duty vehicles (LDV) are remaining in service for extended periods of time with fewer vehicles being scrapped.

Reflecting on these factors, the recycling operations fed an average of 9.5 tonnes per day (tpd) for Q3 2023, 46% lower than for the comparable period in 2022. During Q3 2023, 873 tonnes of material was processed, 46% lower than Q3 2022. At the end of Q3 2023,

Sibanye-Stillwater Operating update | Quarter ended 30 September 2023 4

approximately 24 tonnes of recycle inventory was on hand, an 18 tonne decrease versus the Q3 2022 ending inventory of 42 tonnes. There has been a positive cash inflow over the year as inventory reduced from US$320 million (R5.4 billion) at the beginning of Q1 2023 to US$165 million (R3.1 billion) at the end of Q3 2023.

Recent increases in global auto sales have led to upward revisions in 2023 sales forecasts, offering a promising indicator of an uptick in future recycling volumes. Despite these positive developments, the recycling segment continues to face short term challenges, driving efforts to pursue and achieve volume-driven growth. This includes exploring opportunities beyond the traditional autocatalyst feed sources.

SA PGM operations

The SA PGM operations produced another solid operational performance for Q3 2023, with leading cost management again standing out as a key differentiator in the SA PGM industry. Production of 451,560 4Eoz (excluding third party purchase of concentrate (PoC)) for Q3 2023 was 4% higher than for Q3 2022, due to improved production from the Rustenburg and Marikana operations, which offset lower production from the Kroondal operation as a consequence of the planned closure of the Simunye shaft during 2022. Production (including PoC) was 6% higher year-on-year at 475,555 4Eoz due to third party PoC processing increasing by 44% to 23,995 4Eoz year-on-year.

In contrast to Q3 2022, which was impacted by the beginning of elevated levels of power curtailment imposed by Eskom, no ore stockpiles were reported at the end of Q3 2023 compared with the end of Q3 2022 when underground ore containing approximately 33,000 4Eoz was stockpiled on surface. The Group's strategic response to the load curtailment has been very effective, underpinned by the relative advantage of processing capacity that averts the risk of accumulating "deferred production".

AISC (excluding third-party PoC) for Q3 2023 of R20,080/4Eoz (US$1,080/4Eoz) was just 5% higher than for Q3 2022, below prevailing South African consumer price inflation (CPI) and reflecting ongoing industry-leading cost management. AISC (including PoC) was R20,029/4Eoz (US$1,077/4Eoz) 1% lower year-on-year reflecting the significant decline in PGM prices year-on-year despite the 44% increase in PoC purchases to 23,995 4Eoz . The well contained AISC benefited from a 16% year-on-year increase in by-product credits driven largely by higher chrome prices, and lower royalties which offset ORD and sustaining capital increases of 5% and 4% respectively. A 78% decrease in royalty costs year-on-year was also notable with by-product credits of R2.5bn (US$133 million) for the period exceeding the combined value of royalties, inventory change, ORD and sustaining capital. AISC (including PoC) was also lower with third party PoC cost 28% lower at R565 million (US$30 million) despite an increase in PoC volumes, which were offset by lower PGM prices.

Despite this solid performance, four shafts have become unprofitable following the precipitous decline in the 4E PGM basket price, necessitating restructuring for profitability and sustainability in the longer term (see announcement below of SA PGM Section 189).

Capital expenditure of R1,440 million (US$77 million) for Q3 2023 was 14% higher than for Q3 2022 with ORD 5% higher at R622 million (US$33 million), sustaining capital 4% higher at R484 million (US$26 million) and project capital 61% higher at R334 million (US$18 million) as a result of the 30% increase year-on-year in the project capital (R270 million (US$15 million)) at the K4 project at the Marikana operation and R64 million (US$3 million) spent on the new chrome extraction plant at Platinum Mile during Q3 2023, which is due to be commissioned in Q4 2023.

4E PGM production from the Rustenburg operation for Q3 2023 of 182,022 4Eoz was 1% higher year-on-year with underground production 2% higher and surface production 2% lower. The improvement in underground production was achieved despite difficult ground conditions impacting productivity at the Thembelani shaft and seismic activity during 2022 at the Siphumelele shaft (restricting access to planned production areas). Mining through the Hexriver fault, which has impacted productivity from the Bathopele shaft, has largely been traversed and production is steadily improving. AISC from the Rustenburg operation was again very well contained, increasing by only 1% to R18,701/4Eoz (US$1,006/4Eoz) year-on-year. A 13% increase in by-product credits driven mainly by the chrome price which increased by 28% year-on-year and a 73% decline in royalties offset inflationary cost pressures and a 23% decline in ORD capital. By-product credits from the Rustenburg operation were negatively impacted by port constraints, which restricted chrome sales. The Rustenburg operations continue to move down the cost curve as a result of good cost management and with ground conditions improving, the outlook for sustained production is positive.

4E PGM production for Q3 2023 from the Marikana operation (excluding third party PoC) of 179,014 4Eoz, was 9% higher than for Q3 2022, with underground production and surface production 9% and 12% higher respectively due to lower impact from load curtailment and cable theft than Q3 2022. 4E PGM production (including PoC) of 203,009 4Eoz for Q3 2023 was 13% higher than for Q3 2022 with PoC increasing by 44% year-on-year to 23,995 4Eoz due to higher contractual deliveries from third parties. AISC (excluding third party PoC) for Q3 2023 of R22,607/4Eoz (US$1,216/4Eoz) increased by only 4%, primarily due to higher production, which largely offset an increase in ORD of 19% to R473 million(US$25 million) and a 14% increase in sustaining capital to R276 million (US$15 million). The year-on-year increase in ORD and sustaining capital at Marikana is primarily due to the ramp-up of the K4 shaft. Since K4 commenced stoping and development operations outside the main shaft infrastructure in March 2023, on reef development was expensed in working costs with off reef development capitalised as ORD. While the K4 project remains in build-up phase, unit operating costs, ORD and sustaining capital remain temporarily elevated, but are expected to reduce as production builds up, benefiting costs from the Marikana operation. AISC (including PoC) for Q3 2023 at Marikana declined by 6% compared with Q3 2022 to R22,196/4Eoz (US$1,194/4Eoz). Other factors resulting in lowering the AISC were a 33% increase in by-product credits, royalties which were 89% lower due to lower commodity prices and the cost of PoC from third parties, which was 28% lower than for Q3 2022 at R565 million (US$30 million) due to the lower basket price, despite higher PoC volumes.

4E PGM production from the Kroondal operation of 47,600 4Eoz for Q3 2023 was 1% lower than for the comparable period in 2022 due to the Simunye shaft reaching the end of its life and winding down main production activities (ceasing during Q4 2022) and reduced productivity and increased dilution from the Bambanani shaft which is mining through a shear zone. AISC of R18,550/4Eoz (US$998/4Eoz) was 20% higher than for Q3 2022 primarily due to lower production, higher inflationary costs as highlighted above as well as higher support costs, due to the mining through adverse ground conditions at the shear zone. By-product credits were also 37% lower due to lower chrome production associated with the termination of primary mining at the Simunye shaft and reduced offtake from a contracted party. Chrome production is expected to increase in future.

Attributable 4E PGM production from Mimosa of 29,060 4Eoz was 1% higher than Q3 2022. AISC increased by 10% year-on-year to US$1,359/4Eoz (R25,258/4Eoz) due to inflationary pressures being experienced in Zimbabwe, in particular electricity costs which rose for exporters by 40% in October 2022, the first increase since 2014. Sustaining capital remained elevated at US$14 million (R266 million)

Sibanye-Stillwater Operating update | Quarter ended 30 September 2023 5

primarily associated with the ongoing construction of the new tailings storage facility (TSF) which is due to be commissioned between December 2023 and March 2024.

PGM production from Platinum Mile in Q3 2023 of 13,864 4Eoz was 13% higher year-on-year due to a 14% increase in yield as a result of higher grade coupled with improved recoveries. AISC at Platinum Mile declined by 5% year-on-year to R10,747/4Eoz (US$578/4Eoz), primarily as a result of higher 4E PGM production. Project capital spend of R64 million (US$3 million) in Q3 2023 was incurred on expenditure on the chrome extraction plant which is expected to be commissioned in December 2023 with total capital spend forecast at R130 million (US$7 million). This plant is planned to produce around 240,000 tonnes of chrome per year.

Chrome sales from the SA PGM operations for Q3 2023 of approximately 554kt were 1% lower than Q3 2022. The chrome price received increased by 28% year-on-year to US$290/tonne (Q3 2022: US$227/tonne), underpinning a 25% increase in chrome revenue to R1.0 billion (US$56 million).

Consultations regarding possible restructuring of the SA PGM operations

Subsequent to quarter end on 25 October, Sibanye-Stillwater announced that it would consult with affected employees regarding the possible restructuring of four shafts at the SA PGM operations. Two of the shafts, the Simunye shaft at the Kroondal operation and the 4B shaft at the Marikana operation are mature, with the Simunye shaft ceasing production in 2022 and the 4B shaft at the end of its operating life due to the depletion of available economic ore reserves. The remaining two shafts, the Siphumelele shaft at the Rustenburg operation and the Rowland shaft at the Marikana operation, require restructuring to achieve sustainable production and cost levels. The proposed restructuring and shaft closures could potentially affect 4,095 employees and contractors (3,500 employees and 595 contractors), including support services employees.

The full announcement can be found here: https://thevault.exchange/?get_group_doc=245/1698223380-ssw-section189-notice-SA-PGM-operations-25Oct2023.pdf.

The K4 Project

The K4 project is ahead of schedule. Underground infrastructure and mine development progressed in line with plan for the quarter with surface infrastructure on track. K4 is incorporating several innovations aimed at developing a modern flagship underground mine, such as development end and in stope lighting as well as surface noise zoning. At full production, K4 will be the largest operating shaft in the SA PGM operations with a life-of-mine in excess of fifty years. K4 produced 10,043 4Eoz in Q3 2023 (914 4Eoz in Q3 2022). Production is expected to accelerate as further ore drawpoints (boxholes) are commissioned. Project capital expenditure, primarily on ORD, was R270 million (US$15 million) in Q3 2023, 30% higher year-on-year. Project capital guidance of R920 million (US$51 million) is unchanged for 2023 with R657 million (US$36 million) spent year-to-date.

SA gold operations

The build-up of gold production from the SA gold managed operations during H2 2022 following the industrial action and lockout during H1 2022 impacted Q3 2022 production and unit costs. Normalisation of production from Q4 2022 and exposure to a higher gold price drove a significant turnaround from the managed SA gold operations during H1 2023, underlining what an important contribution SA gold operations can make to the bottom line during periods of production stability. During Q3 2023 however, the managed SA gold operations suffered two significant incidents which impacted production.

•On 12 July 2023, a fire at Driefontein 5 shaft disrupted operations at both Driefontein 1 and 5 shafts. While most of the crews at Driefontein 1 were operational by the beginning of August 2023, the Driefontein 5 shaft crews were only gradually introduced back into the working places when it was safe to enter from 27 September 2023 after the fire had been extinguished and the ventilation had cleared all noxious gasses

•In a second incident, on 30 July 2023, the Kloof 4 shaft, which had been operationally constrained by seismicity and cooling (associated with the chilled water reticulation circuit), was further impacted by an incident in the shaft caused when the ascending counterweight of the shaft conveyance encountered an unknown obstruction in the shaft, resulting in a number of ballast plates falling down the shaft, damaging the shaft infrastructure and preventing production from the 4 shaft area

Production from the SA gold operations (including DRDGOLD) for Q3 2023 of 6,148kg (197,663oz) was 3% lower compared to Q3 2022, with gold production (excluding DRDGOLD) decreasing by 1% to 4,864kg (156,381oz). The decline in production was primarily due to the impact of the incidents mentioned above as well as the closure of Beatrix 4 shaft at the end of 2022.

AISC (including DRDGOLD) of R1,232,600/kg (US$2,062/oz) was 2% higher than for Q3 2022 with AISC (excluding DRDGOLD) 3% lower at R1,301,975/kg (US$2,178/oz). The decrease in AISC (excluding DRDGOLD) was a function of a 6% increase in gold sold year-on-year, which offset inflationary cost pressures on consumables and contractor rates and annual electricity tariff increases which rose 19% higher year-on-year. In addition, ORD capital increased by 43% to R677 million (US$36 million) due to higher development rates compared with Q3 2022 when the operations were resuming after the strike and lockout.

Capital expenditure for Q3 2023 (excluding DRDGOLD) increased by 9% to R1.3 billion (US$71 million) compared to the same period in 2022 (affected by strike and lockout), with ORD increasing by 43% and corporate and project spend decreasing by 13% to R379 million (US$20 million). Project capital mainly comprised R330 million (US$18 million) at the Burnstone project. Sustaining capital declined by 14% to R255 million (US$14 million) mainly due to investment in lamp room upgrades at all the operations during Q3 2022 and electrical and winder upgrades which commenced during the industrial action in 2022 when the facilities and equipment were not in use.

Underground production for Q3 2023 from the Driefontein operation decreased by 11% to 1,452kg (46,683oz) compared to the same period in 2022, primarily due to the fire at 5 shaft which also impacted 1 shaft production, and reduced mineable face length at 4 Shaft following seismicity and resultant safety stoppages which are expected to persist to the end of the year. This impacted production by 132kg (4,244oz) for Q3 2023. The impact of the lost production at 5 shaft due to the fire and the impact on 1 shaft was 798kg (25,656oz) during the quarter. Production from 5 Shaft recommenced in late September 2023 on a phased basis and is forecast to build up to full production by December 2023. AISC of R1,455,137/kg (US$2,435/oz) for Q3 2023 was 20% higher as a result of 2% lower gold sold, inflationary impacts as highlighted earlier which resulted in total operating costs increasing by 12%. ORD costs increased by 63% due to higher development to increase mining flexibility and sustaining capital increased by 20% due to a change of scope in the 4 shaft pillar

Sibanye-Stillwater Operating update | Quarter ended 30 September 2023 6

project (additional support work on 32/33 level tunnel and shaft infrastructure and new underground workshops), winder rope purchases and a water management project.

Underground production from the Kloof operation increased by 35% in Q3 2023 to 1,882kg (60,508oz) despite the major disruption at the Kloof 4 shaft due to the shaft incident, which impacted production by 790kg (25,399oz). Increased production from the main and 8 shafts offset lower production from 4 shaft. The underground yield increased by 25% to 5.16 g/t, with the yield for Q3 2022 diluted by the build up in production from mining areas which stood dormant for three months. Production from surface sources of 234kg (7,523oz), was 23% higher year-on-year as a result of higher grade surface areas being processed. AISC of R1,193,820/kg (US$1,997/oz) was 22% lower due to a 44% increase in gold sold year-on-year. Operating costs were effectively managed following the Kloof 4 shaft incident by requesting employees affected by the shaft incident to take annual leave, limiting stores expenditure to shaft repair work and issuing a force majeure notice to non-critical contractors. ORD increased by 41% to R246 million (US$13 million) on the back of a 55% increase in off-reef development while sustaining capital decreased by 28% to R108 million (US$6 million) due to lower spend following the Kloof 4 shaft suspension, which also resulted in reduced project capital investment.

Underground production of 933kg (29,997oz) in Q3 2023 from the Beatrix operation was 29% lower than for Q3 2022 primarily due to the closure of the Beatrix 4 shaft in Q1 2023, which resulted in approximately 193kg (6,205oz) less production relative to Q3 2022. AISC of R1,343,011/kg (US$2,247/oz) was 6% lower than for Q3 2022, due to total operating costs declining by 32% to R1.1billion (US$59 million) primarily as a result of the closure of the high cost Beatrix 4 shaft.

Tonnes milled by DRDGOLD for Q3 2023 decreased 21% year-on-year, however due to a 12% increase in grade, gold production of 1,284kg (41,282oz) was 12% lower than in Q3 2022. The decrease in the tonnes milled is as a result of load curtailment, the reclamation of final remnant and clean-up material at operating sites nearing depletion at Ergo, Driefontein 5 shaft and the Far West Gold Recoveries on the West Rand. The increase in yield is associated with higher grade remnant material that is typically encountered during the final stages of reclamation and clean up, and the reclamation of high grade sand material at Ergo. Lower tonnes milled coupled with inflationary increases in key consumables and higher electricity costs, plus increased security costs and additional machine hire costs to enable the reclamation of final remnant material resulted in operating costs per tonne increasing by 45% to R198/tonne (US$11/tonne). This resulted in higher AISC of R963,694/kg (US$1,612/oz) which increased by 26% year-on-year due to the above increase in working costs and industry wide inflationary effects. DRDGOLD project capital also increased from R53 million (US$3 million) in Q3 2022 to R152 million (US$8 million) in Q3 2023 with spending on the solar power plant.

Consultations regarding possible restructuring of the Kloof 4 shaft

On 14 September 2023, organised labour and other potentially affected stakeholders were notified that the company would be entering into consultation in terms of S189A of the Labour Relations Act (S189) regarding the possible restructuring of its SA gold operations pursuant to operational constraints and ongoing losses over an extended period at the Kloof 4 shaft. The possible restructuring of the Kloof 4 shaft could potentially affect 2,389 employees and 581 contractor employees. The consultation process is proceeding as planned.

The full announcement can be found here: https://thevault.exchange/?get_group_doc=245/1694682564-ssw-Section-189-NoticeKloof-4-Shaft14Sep2023.pdf

The Burnstone project

The development rate at Burnstone improved in Q3 2023 but the project remains behind schedule due to delays caused by the strike in 2022. Development is expected to accelerate as hoisting constraints have been alleviated with commencement of vertical shaft hoisting imminent. The project has been replanned with an increased development profile to enable additional production from areas of higher geological confidence. Steady state mining is now expected a year later than the Board approved plan for the restart of the Burnstone project in February 2021 with design optimisation done on the life-of-mine designs to improve ore handling and increase mining flexibility. Project capital guidance remains unchanged at R1.6 billion (US$90 million) with R1.1 billion (US$63 million) spent year-to-date and R330 million (US$18 million) spent in Q3 2023, 5% higher than Q3 2022.

European region

Sandouville nickel refinery

The Sandouville nickel refinery had an improved operating performance for Q3 2023 with operational stability achieved during Q3 2023 after several disruptions in Q3 2022 which extended into H1 2023. In Q3 2023, the Sandouville nickel refinery produced 2,352 tonnes of nickel equivalent production, comprising 1,925 tonnes of nickel metal, 92% higher than for Q3 2022 and 427 tonnes of nickel salts (650 tonnes in Q3 2022) at a nickel equivalent sustaining cost of US$31,514/tNi (R585,853/tNi), 4% higher than for Q3 2022.

Operational issues at the cathode unit which impacted H1 2023, have been resolved resulting in production stabilising during Q3 2023. Overall, the plant is now stable, both from process and reliability points of view, with nickel recovery improving by 4% to 98.8%. Production, however, was impacted by heavy rainfall in Q3 2023.

The more stable operational performance has led to lower variable costs per tonne of nickel produced, with lower specific consumption of energy and reagents. While input prices have decreased recently, they remain elevated due to global uncertainty and gas prices remain elevated due to the Russia Ukraine war. Sales were impacted by lower nickel prices due to a general oversupply of nickel cathode and a slowdown of the plating industry that led to lower premiums for Q3 2023.

In order to restore profitability, a new innovative alternative to the current process is being explored. The Sandouville team is currently assessing its commercial and technical feasibility. Further details on this alternative will be available during Q1 2024. Sibanye-Stillwater continues with the deployment of its strategy in France, advancing studies on three complementary processes:

•PGM autocatalyst recycling using European feedstocks (study results due in Q1 2024)

•Producing battery grade nickel sulphate

•Battery metals recycling

Further announcements will be made on these developments as the studies progress to the next phases.

Sibanye-Stillwater Operating update | Quarter ended 30 September 2023 7

Keliber lithium project

The Keliber lithium project progressed significantly during Q3 2023. On 6 October 2023, Sibanye-Stillwater announced Board approval for the construction of the concentrator and the development of the Syväjärvi open pit mine in Päiväneva. Delivery of ore from the Syväjärvi open pit mine will be timed to coincide with the commissioning of the concentrator. Higher capital expenditures will now be incurred to meet the environmental permit requirements. The capital expenditure for the concentrator is now forecasted at €230 million (R4.5 billion), €10 million (R195 million) higher than the previous estimate.

In addition capital expenditure for the Keliber lithium refinery increased by €59 million (R1.2 billion) to €418 million (R8.2 billion) due to changes to the effluent water treatment process at the Keliber lithium refinery. The amended technology was added into the flowsheet to ensure compliance with environmental permits, which will also result in increased recoveries. Despite the higher capital requirements, the adjustment has not had a negative impact on the net present value of the project due to the positive impact of the expected recoveries. The updated aggregated project capital for the Keliber project is estimated at €656 million (R12.8 billion) (2023 real terms) including contingencies (previously €588 million in 2022 real terms).

Further progress in Q3 2023:

•Recruitments according to plan with a headcount of 67 at the end of September with potential to grow the team by over 20 professionals by year end. Overall headcount is planned to grow to 200 by the end of 2024

•Active cooperation and participation with the local community and relevant stakeholders including holding a public event in Kaustinen, sponsoring local sport clubs and cultural events such as Kaustinen folk music festival, cooperation with local schools continued with presentations and negotiations on future training and job opportunities, and public road maintenance and transportation discussed at the Regional Councils' Traffic Day

•In Q3 2023, 28 diamond drill holes totalling 5,407 metres were completed at the Rapasaari, Syväjärvi and Leviäkangas East target areas with two drill rigs. The best assayed intercepts are all associated with the Tuoreetsaaret deposit including 86.35 m @ 1.08 % Li2O

•The update of the Mineral Resources estimate continued in Q3 2023. The Mineral Resource estimates of seven deposits - Syväjärvi, Rapasaari, Länttä, Outovesi, Emmes, Tuoreetsaaret and Leviäkangas - will be updated, and the final results are due in 2024. As a part of regional lithium exploration, seasonal boulder mapping and till sampling continued in Q3 2023

•Debt funding for the balance of the project is advancing with the target facility increased from €300 million to €500 million

•Project capital expenditure for 2023 is lower than initially guided (see update under Operating guidance below) with the delta of the capital expenditure moving to 2024 due to the later than estimated commencement of the concentrator during 2023

Australian region

Century zinc retreatment operation

Sibanye-Stillwater acquired full ownership of New Century Resources Limited during H1 2023, enhancing the Group's exposure to tailings

retreatment and complementing our existing investment in DRDGOLD. The integration of the Australian regional structures and assets into Sibanye-Stillwater is progressing well.

Production from the Century operation recovered strongly from the flood impacted H1 2023. For Q3 2023, the Century operation produced 25kt of zinc metal (payable), an increase from the 23kt produced in Q2 2023. AISC for Q3 2023 of US$1,753/tZn (R32,587/tZn) was 13% lower than for Q2 2023, resulting in a significant financial turnaround, with the Century operation recording a R53 million (US$3 million) adjusted EBITDA profit compared with an R433 million (US$23 million) loss for the previous quarter (Q2 2023). The Century operation invested US$2 million (R34 million) on capital expenditure in Q3 2023.

OPERATING GUIDANCE FOR 2023*

Mined 2E PGM production at the US PGM operations is forecast to be between 420,000 2Eoz and 430,000 2Eoz, with AISC between US$1,750/2Eoz and US$1,825/2Eoz (R31,500/2Eoz to R32,850/2Eoz). Capital expenditure is forecast to be between US$320 million and US$340 million (R5.76 billion to R6.12 billion), including approximately US$35 million (R630 million) project capital.

3E PGM production from the US PGM recycling operations is forecast to between 350,000 3Eoz and 400,000 3Eoz fed for the year. Capital expenditure is forecast to be about US$1.4 million (R25 million).

Forecast 4E PGM production from the SA PGM operations for 2023 remains unchanged at between 1.7 million 4Eoz and 1.8 million 4Eoz including third party PoC, with AISC between R20,800/4Eoz and R21,800/4Eoz (US$1,156/4Eoz to US$1,211/4Eoz) - excluding the cost of third party PoC. Capital expenditure is forecast at R5.4 billion (US$300 million) for the year, including project capital of R920 million (US$51 million) for the K4 project.

Gold production from the managed SA gold operations (excluding DRDGOLD) for 2023 is forecast at between 19,500kg (625koz) and 20,500kg (660koz). AISC is still forecast to be between R1,190,000/kg and R1,290,000/kg (US$2,056/oz to US$2,230/oz) due to lower production as a result of the incidents mentioned above. Capital expenditure is forecast at R5.4 billion (US$300 million), including R1.6 billion (US$90 million) of project capital expenditure for the Burnstone project.

Production from the Sandouville nickel refinery is forecast at between 7.0 kilotonnes to 7.5 kilotonnes of nickel equivalent product (Ni) at a nickel equivalent AISC of between €33,715/tNi and €34,588/tNi (R657,000/tNi to R675,000/tNi) with capital expenditure of €14 million (R273million).

The capital expenditure forecast for the Keliber lithium project for 2023 has been reduced from €231 million (R4.5 billion) to €130 million (R2.3 billion). With the commencement of the construction of the concentrator in Q4 2023, most of the capex budgeted for 2023, will now occur in 2024.

* The guidance has been translated where relevant at an average exchange rate of R18.00/US$ and R19.50/€

NEAL FRONEMAN

CHIEF EXECUTIVE OFFICER

Sibanye-Stillwater Operating update | Quarter ended 30 September 2023 8

SALIENT FEATURES AND COST BENCHMARKS - QUARTERS US and SA PGM operations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | US and SA PGM operations1 | US PGM operations | Total SA PGM operations1 | Rustenburg | Marikana1 | Kroondal | Plat Mile | Mimosa |

| | | Under- ground2 | Total | Under-

ground | Surface | Under-

ground | Surface | Under-

ground | Surface | Attribu-table | Surface | Attribu-table |

| Production | | | | | | | | | | | | | | |

| Tonnes milled/treated | kt | Sep 2023 | 9,711 | | 316 | | 9,394 | | 4,457 | | 4,937 | | 1,643 | | 1,420 | | 1,709 | | 869 | | 755 | | 2,649 | | 351 | |

| | Jun 2023 | 9,469 | | 287 | | 9,182 | | 4,210 | | 4,972 | | 1,572 | | 1,390 | | 1,557 | | 918 | | 727 | | 2,665 | | 354 | |

| | Sep 2022 | 9,625 | | 241 | | 9,383 | | 4,303 | | 5,081 | | 1,666 | | 1,418 | | 1,515 | | 927 | | 782 | | 2,736 | | 340 | |

| Plant head grade | g/t | Sep 2023 | 2.33 | | 11.59 | | 2.02 | | 3.32 | | 0.84 | | 3.46 | | 1.01 | | 3.61 | | 0.95 | | 2.34 | | 0.72 | | 3.36 | |

| | Jun 2023 | 2.28 | | 12.48 | | 1.96 | | 3.29 | | 0.83 | | 3.38 | | 1.03 | | 3.67 | | 0.95 | | 2.22 | | 0.69 | | 3.47 | |

| | Sep 2022 | 2.21 | | 12.23 | | 1.96 | | 3.30 | | 0.82 | | 3.34 | | 1.03 | | 3.70 | | 0.87 | | 2.33 | | 0.69 | | 3.52 | |

| Plant recoveries | % | Sep 2023 | 76.64 | | 90.10 | | 74.01 | | 85.36 | | 34.07 | | 86.43 | | 52.16 | | 86.47 | | 28.32 | | 83.85 | | 22.61 | | 76.62 | |

| | Jun 2023 | 75.62 | | 91.31 | | 72.48 | | 85.53 | | 29.04 | | 86.49 | | 41.86 | | 87.03 | | 25.15 | | 81.56 | | 20.67 | | 78.30 | |

| | Sep 2022 | 75.59 | | 89.25 | | 73.19 | | 85.09 | | 32.61 | | 86.52 | | 52.47 | | 87.06 | | 25.94 | | 82.17 | | 20.30 | | 74.44 | |

| Yield | g/t | Sep 2023 | 1.78 | | 10.44 | | 1.49 | | 2.83 | | 0.29 | | 2.99 | | 0.53 | | 3.12 | | 0.27 | | 1.96 | | 0.16 | | 2.57 | |

| | Jun 2023 | 1.72 | | 11.40 | | 1.42 | | 2.81 | | 0.24 | | 2.92 | | 0.43 | | 3.19 | | 0.24 | | 1.81 | | 0.14 | | 2.72 | |

| | Sep 2022 | 1.67 | | 10.92 | | 1.43 | | 2.81 | | 0.27 | | 2.89 | | 0.54 | | 3.22 | | 0.23 | | 1.91 | | 0.14 | | 2.62 | |

PGM production3 | 4Eoz - 2Eoz | Sep 2023 | 557,106 | | 105,546 | | 451,560 | | 406,135 | | 45,425 | | 157,977 | | 24,045 | | 171,498 | | 7,516 | | 47,600 | | 13,864 | | 29,060 | |

| | Jun 2023 | 524,214 | | 104,823 | | 419,391 | | 380,861 | | 38,530 | | 147,723 | | 19,264 | | 159,863 | | 7,049 | | 42,329 | | 12,217 | | 30,946 | |

| | Sep 2022 | 518,032 | | 85,889 | | 432,143 | | 388,460 | | 43,683 | | 154,797 | | 24,641 | | 156,873 | | 6,723 | | 48,120 | | 12,319 | | 28,670 | |

PGM sold4 | 4Eoz - 2Eoz | Sep 2023 | 549,696 | | 124,882 | | 424,814 | | | | 141,322 | | 15,060 | | 179,811 | 47,600 | | 13,864 | | 27,157 | |

| | Jun 2023 | 508,429 | | 102,856 | | 405,573 | | | | 114,826 | | 16,561 | | 187,994 | 42,329 | | 12,217 | | 31,646 | |

| | Sep 2022 | 471,994 | | 69,534 | | 402,460 | | | | 137,246 | | 16,578 | | 160,115 | 48,120 | | 12,319 | | 28,082 | |

Price and costs5 | | | | | | | | | | | | | |

Average PGM basket price6 | R/4Eoz - R/2Eoz | Sep 2023 | 23,933 | | 22,122 | | 24,479 | | | | 24,670 | | 23,050 | | 24,481 | 24,968 | | 23,044 | | 23,343 | |

| | Jun 2023 | 30,313 | | 25,378 | | 31,689 | | | | 32,269 | | 27,153 | | 31,741 | 32,564 | | 27,980 | | 27,972 | |

| | Sep 2022 | 40,485 | | 30,878 | | 42,269 | | | | 43,331 | | 34,278 | | 42,033 | 44,972 | | 33,714 | | 33,412 | |

| Average PGM basket price6 | US$/4Eoz - US$/2Eoz | Sep 2023 | 1,287 | | 1,190 | | 1,317 | | | | 1,327 | | 1,240 | | 1,317 | 1,343 | | 1,240 | | 1,256 | |

| | Jun 2023 | 1,624 | | 1,360 | | 1,698 | | | | 1,729 | | 1,455 | | 1,701 | 1,745 | | 1,499 | | 1,499 | |

| | Sep 2022 | 2,374 | | 1,811 | | 2,479 | | | | 2,541 | | 2,010 | | 2,465 | 2,638 | | 1,977 | | 1,960 | |

Operating cost7,9 | R/t | Sep 2023 | 1,226 | | 7,140 | | 1,019 | | | | 2,021 | | 363 | 1,654 | 1,244 | | 66 | | 1,812 | |

| | Jun 2023 | 1,123 | | 6,333 | | 953 | | | | 2,035 | | 245 | | 1,560 | 1,186 | | 59 | | 1,730 | |

| | Sep 2022 | 1,043 | | 7,504 | | 871 | | | | 1,764 | | 279 | | 1,459 | 1,049 | | 58 | | 1,493 | |

| Operating cost7 | US$/t | Sep 2023 | 66 | | 384 | | 55 | | | | 109 | | 20 | | 89 | 67 | | 4 | | 97 | |

| | Jun 2023 | 60 | | 339 | | 51 | | | | 109 | | 13 | | 84 | 64 | | 3 | | 93 | |

| | Sep 2022 | 61 | | 440 | | 51 | | | | 103 | | 16 | | 86 | 62 | | 3 | | 88 | |

| Operating cost7 | R/4Eoz - R/2Eoz | Sep 2023 | 21,723 | | 21,384 | | 21,808 | | | | 21,022 | | 21,460 | | 23,814 | 19,727 | | 12,623 | | 21,886 | |

| | Jun 2023 | 20,747 | | 17,353 | | 21,663 | | | | 21,649 | | 17,650 | | 23,120 | 20,364 | | 12,769 | | 19,809 | |

| | Sep 2022 | 19,793 | | 21,085 | | 19,518 | | | | 18,986 | | 16,071 | | 21,767 | 17,041 | | 12,907 | | 17,719 | |

| Operating cost7 | US$/4Eoz - US$/2Eoz | Sep 2023 | 1,169 | | 1,150 | | 1,173 | | | | 1,131 | | 1,154 | | 1,281 | 1,061 | | 679 | | 1,177 | |

| | Jun 2023 | 1,112 | | 930 | | 1,161 | | | | 1,160 | | 946 | | 1,239 | 1,091 | | 684 | | 1,062 | |

| | Sep 2022 | 1,161 | | 1,237 | | 1,145 | | | | 1,114 | | 943 | | 1,277 | 999 | | 757 | | 1,039 | |

All-in sustaining cost8,9 | R/4Eoz - R/2Eoz | Sep 2023 | 23,210 | | 35,738 | | 20,080 | | | | 18,701 | 22,607 | 18,550 | | 10,747 | | 25,258 | |

| | Jun 2023 | 21,724 | | 30,280 | | 19,416 | | | | 18,121 | 21,574 | 18,403 | | 10,886 | | 22,329 | |

| | Sep 2022 | 21,271 | | 30,947 | | 19,211 | | | | 18,435 | 21,785 | 15,399 | | 11,283 | | 21,032 | |

| All-in sustaining cost8 | US$/4Eoz - US$/2Eoz | Sep 2023 | 1,249 | | 1,922 | | 1,080 | | | | 1,006 | 1,216 | 998 | | 578 | | 1,359 | |

| | Jun 2023 | 1,164 | | 1,623 | | 1,041 | | | | 971 | 1,156 | 986 | | 583 | | 1,197 |

| | Sep 2022 | 1,248 | | 1,815 | | 1,127 | | | | 1,081 | 1,278 | 903 | | 662 | | 1,234 |

All-in cost8,9 | R/4Eoz - R/2Eoz | Sep 2023 | 24,223 | | 37,642 | | 20,871 | | | | 18,701 | 24,115 | 18,550 | | 15,364 | | 25,258 | |

| | Jun 2023 | 22,710 | | 32,235 | | 20,139 | | | | 18,121 | 22,940 | 18,805 | | 13,833 | | 22,329 | |

| | Sep 2022 | 22,582 | | 36,000 | | 19,726 | | | | 18,441 | 23,051 | 15,399 | | 11,283 | | 21,032 | |

| All-in cost8 | US$/4Eoz - US$/2Eoz | Sep 2023 | 1,303 | | 2,025 | | 1,123 | | | | 1,006 | 1,297 | 998 | | 826 | | 1,359 | |

| | Jun 2023 | 1,217 | | 1,728 | | 1,079 | | | | 971 | 1,229 | 1,008 | | 741 | | 1,197 | |

| | Sep 2022 | 1,324 | | 2,111 | | 1,157 | | | | 1,082 | 1,352 | 903 | | 662 | | 1,234 | |

Capital expenditure5 | | | | | | | | | | | | | |

| Ore reserve development | Rm | Sep 2023 | 1,671 | | 1,049 | | 622 | | | | 149 | 473 | — | | — | | — | |

| | Jun 2023 | 1,749 | | 1,050 | | 699 | | | | 190 | 509 | — | | — | | — | |

| | Sep 2022 | 1,313 | | 723 | | 590 | | | | 194 | 396 | — | | — | | — | |

| Sustaining capital | Rm | Sep 2023 | 1,086 | | 602 | | 484 | | | | 154 | 276 | 59 | | (5) | | 266 | |

| | Jun 2023 | 853 | | 418 | | 435 | | | | 145 | 229 | 64 | | (3) | | 273 | |

| | Sep 2022 | 758 | | 293 | | 465 | | | | 140 | 242 | 80 | | 3 | | 258 | |

| Corporate and projects | Rm | Sep 2023 | 535 | | 201 | | 334 | | | | — | 270 | — | | 64 | | — | |

| | Jun 2023 | 482 | | 205 | | 277 | | | | — | 224 | 17 | | 36 | | — | |

| | Sep 2022 | 642 | | 434 | | 208 | | | | 1 | 207 | — | | — | | — | |

| Total capital expenditure | Rm | Sep 2023 | 3,292 | | 1,852 | | 1,440 | | | | 303 | 1,019 | 59 | | 59 | | 266 | |

| | Jun 2023 | 3,084 | | 1,673 | | 1,411 | | | | 335 | 962 | 81 | | 33 | | 273 | |

| | Sep 2022 | 2,713 | | 1,450 | | 1,263 | | | | 335 | 845 | 80 | | 3 | | 258 | |

| Total capital expenditure | US$m | Sep 2023 | 177 | | 100 | | 77 | | | | 16 | 55 | 3 | | 3 | | 14 | |

| | Jun 2023 | 165 | | 90 | | 76 | | | | 18 | 52 | 4 | | 2 | | 15 | |

| | Sep 2022 | 159 | | 85 | | 74 | | | | 20 | 50 | 5 | | — | | 15 | |

Average exchange rate for the quarters ended 30 September 2023, 30 June 2023 and 30 September 2022 was R18.59/US$, R18.66/US$ and R17.05/US$, respectivelyFigures may not add as they are rounded independently

Sibanye-Stillwater Operating update | Quarter ended 30 September 2023 9

1The US and SA PGM operations, Total SA PGM operation and Marikana excludes the production and costs associated with the purchase of concentrate (PoC) from third parties. For a reconciliation of the Operating cost, AISC and AIC excluding third party PoC, refer to “Reconciliation of operating cost excluding third party PoC for US and SA PGM operations, Total SA PGM operations and Marikana - Quarters” and “Reconciliation of AISC and AIC excluding third party PoC for US and SA PGM operations, Total SA PGM operations and Marikana – Quarters”

2The US PGM operations’ underground production is converted to metric tonnes and kilograms, and performance is translated into rand. In addition to the US PGM operations’ underground production, the operation treats recycling material which is excluded from the statistics shown above and is detailed in the PGM recycling table below

3Production per product – see prill split in the table below

4PGM sold includes the third party PoC ounces sold

5The US and SA PGM operations and Total SA PGM operations’ unit cost benchmarks and capital expenditure exclude the financial results of Mimosa, which is equity accounted and excluded from revenue and cost of sales

6The average PGM basket price is the PGM revenue per 4E/2E ounce, prior to a purchase of concentrate adjustment

7Operating cost is the average cost of production and operating cost per tonne is calculated by dividing the cost of sales, before amortisation and depreciation and change in inventory in a period by the tonnes milled/treated in the same period, and operating cost per ounce (and kilogram) is calculated by dividing the cost of sales, before amortisation and depreciation and change in inventory in a period, by the PGM produced in the same period. For a reconciliation of unit operating cost, see “Unit operating cost - Quarters"

8All-in cost is calculated in accordance with the World Gold Council guidance. All-in cost excludes income tax, costs associated with merger and acquisition activities, working capital, impairments, financing costs, one-time severance charges and items needed to normalise earnings. All-in cost is made up of All-in sustaining cost, being the cost to sustain current operations, given as a sub-total in the All-in cost calculation, together with corporate and major capital expenditure associated with growth. All-in sustaining cost per ounce (and kilogram) and All-in cost per ounce (and kilogram) are calculated by dividing the All-in sustaining cost and All-in cost, respectively, in a period by the total 4E/2E PGM produced in the same period. For a reconciliation of cost of sales, before amortisation and depreciation to All-in cost, see “All-in costs - Quarters”

9Operating cost, all-in sustaining costs and all-in costs, are not measures of performance under IFRS. As a result, such measures should not be considered in isolation or as alternatives to any other measure of financial performance presented in accordance with IFRS. Non-IFRS measures are the responsibility of the Board

Mining - PGM Prill split including third party PoC, excluding recycling operations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| US AND SA PGM OPERATIONS | TOTAL SA PGM OPERATIONS | US PGM OPERATIONS |

| Sep 2023 | Jun 2023 | Sep 2022 | Sep 2023 | Jun 2023 | Sep 2022 | Sep 2023 | Jun 2023 | Sep 2022 |

| | % | | % | | % | | % | | % | | % | | % | | % | | % |

| Platinum | 306,959 | | 53 | % | 288,639 | | 52 | % | 286,103 | | 54 | % | 282,763 | | 59 | % | 265,168 | 60 | % | 265,975 | | 59 | % | 24,196 | | 23 | % | 23,471 | | 22 | % | 20,128 | | 23 | % |

| Palladium | 223,255 | | 38 | % | 213,734 | | 39 | % | 200,137 | | 37 | % | 141,905 | | 30 | % | 132,382 | 30 | % | 134,376 | | 30 | % | 81,350 | | 77 | % | 81,352 | | 78 | % | 65,761 | | 77 | % |

| Rhodium | 42,851 | | 7 | % | 39,649 | | 7 | % | 40,296 | | 8 | % | 42,851 | | 9 | % | 39,649 | 9 | % | 40,296 | | 9 | % | | | | | | |

| Gold | 8,036 | | 1 | % | 7,825 | | 1 | % | 8,216 | | 2 | % | 8,036 | | 2 | % | 7,825 | 2 | % | 8,216 | | 2 | % | | | | | | |

| PGM production 4E/2E | 581,101 | | 100 | % | 549,847 | | 100 | % | 534,752 | | 100 | % | 475,555 | | 100 | % | 445,024 | 100 | % | 448,863 | | 100 | % | 105,546 | | 100 | % | 104,823 | | 100 | % | 85,889 | | 100 | % |

| Ruthenium | 67,800 | | | 63,158 | | | 64,192 | | | 67,800 | | | 63,158 | | 64,192 | | | | | | | | |

| Iridium | 16,836 | | | 16,016 | | | 16,034 | | | 16,836 | | | 16,016 | | 16,034 | | | | | | | | |

| Total 6E/2E | 665,737 | | | 629,021 | | | 614,978 | | | 560,191 | | | 524,198 | | 529,089 | | | 105,546 | | | 104,823 | | | 85,889 | | |

Figures may not add as they are rounded independently

| | | | | | | | | | | | | | |

| US PGM Recycling |

| Unit | Sep 2023 | Jun 2023 | Sep 2022 |

| Average catalyst fed/day | Tonne | 9.5 | 11.2 | | 17.7 | |

| Total processed | Tonne | 873 | 1,014 | | 1,630 | |

| Tolled | Tonne | — | | — | | — | |

| Purchased | Tonne | 873 | 1,014 | | 1,630 | |

| PGM fed | 3Eoz | 72,434 | 83,608 | | 141,560 | |

| PGM sold | 3Eoz | 77,679 | 74,041 | | 162,659 | |

| PGM tolled returned | 3Eoz | 2,091 | 2,520 | | 4,715 | |

Sibanye-Stillwater Operating update | Quarter ended 30 September 2023 10

SALIENT FEATURES AND COST BENCHMARKS - QUARTERS (continued)

SA gold operations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | SA OPERATIONS |

| | | Total SA gold | Driefontein | Kloof | Beatrix | Cooke | DRDGOLD |

| | | Total | Under-

ground | Surface | Under-

ground | Surface | Under-

ground | Surface | Under-

ground | Surface | Surface | Surface |

| Production | | | | | | | | | | | | | |

| Tonnes milled/treated | kt | Sep 2023 | 8,245 | | 966 | | 7,279 | | 251 | | 13 | | 365 | | 481 | | 350 | | 33 | | 1,121 | | 5,632 | |

| | Jun 2023 | 7,670 | | 1,120 | | 6,550 | | 357 | | 23 | | 389 | | 331 | | 374 | | 115 | | 1,110 | | 4,972 | |

| | Sep 2022 | 10,237 | | 1,117 | | 9,120 | | 290 | | 123 | | 336 | | 620 | | 490 | | 18 | | 1,202 | | 7,157 | |

| Yield | g/t | Sep 2023 | 0.75 | | 4.42 | | 0.26 | | 5.77 | | 3.37 | | 5.16 | | 0.49 | | 2.66 | | 0.21 | | 0.28 | | 0.23 | |

| | Jun 2023 | 0.88 | | 4.50 | | 0.26 | | 5.71 | | 0.65 | | 4.97 | | 0.36 | | 2.86 | | 0.21 | | 0.28 | | 0.25 | |

| | Sep 2022 | 0.62 | | 3.90 | | 0.22 | | 5.65 | | 0.41 | | 4.14 | | 0.31 | | 2.69 | | — | | 0.27 | | 0.20 | |

| Gold produced | kg | Sep 2023 | 6,148 | | 4,267 | | 1,881 | | 1,452 | | 43 | | 1,882 | | 234 | | 933 | | 7 | | 313 | | 1,284 | |

| | Jun 2023 | 6,733 | | 5,045 | | 1,688 | | 2,040 | | 15 | | 1,935 | | 119 | | 1,070 | | 24 | | 308 | | 1,222 | |

| | Sep 2022 | 6,366 | | 4,354 | | 2,012 | | 1,640 | | 50 | | 1,393 | | 190 | | 1,321 | | — | | 319 | | 1,453 | |

| oz | Sep 2023 | 197,663 | | 137,187 | | 60,476 | | 46,683 | | 1,382 | | 60,508 | | 7,523 | | 29,997 | | 225 | | 10,063 | | 41,282 | |

| | Jun 2023 | 216,471 | | 162,200 | | 54,270 | | 65,588 | | 482 | | 62,212 | | 3,826 | | 34,401 | | 772 | | 9,902 | | 39,288 | |

| | Sep 2022 | 204,672 | | 139,984 | | 64,687 | | 52,727 | | 1,608 | | 44,786 | | 6,109 | | 42,471 | | — | | 10,256 | | 46,715 | |

| Gold sold | kg | Sep 2023 | 6,178 | | 4,349 | | 1,829 | | 1,495 | | 43 | | 1,931 | | 205 | | 923 | | 7 | | 307 | | 1,267 | |

| | Jun 2023 | 6,801 | | 5,107 | | 1,694 | | 2,105 | | 18 | | 1,917 | | 122 | | 1,085 | | 24 | | 308 | | 1,222 | |

| | Sep 2022 | 6,070 | | 4,095 | | 1,975 | | 1,524 | | 48 | | 1,314 | | 174 | | 1,257 | | — | | 311 | | 1,442 | |

| oz | Sep 2023 | 198,627 | | 139,824 | | 58,804 | | 48,065 | | 1,382 | | 62,083 | | 6,591 | | 29,675 | | 225 | | 9,870 | | 40,735 | |

| | Jun 2023 | 218,657 | | 164,194 | | 54,463 | | 67,677 | | 579 | | 61,633 | | 3,922 | | 34,884 | | 772 | | 9,902 | | 39,288 | |

| | Sep 2022 | 195,155 | | 131,657 | | 63,498 | | 48,998 | | 1,543 | | 42,246 | | 5,594 | | 40,413 | | — | | 9,999 | | 46,361 | |

| Price and costs | | | | | | | | | | | | | |

| Gold price received | R/kg | Sep 2023 | 1,153,448 | | | | 1,153,446 | 1,153,090 | 1,152,688 | 1,153,094 | 1,154,696 | |

| | Jun 2023 | 1,184,973 | | | | 1,182,760 | 1,185,875 | 1,186,655 | 1,181,818 | 1,186,579 | |

| | Sep 2022 | 944,316 | | | | 944,020 | 944,220 | 942,721 | 945,338 | 945,908 | |

| Gold price received | US$/oz | Sep 2023 | 1,930 | | | | 1,930 | 1,929 | 1,929 | 1,929 | 1,932 | |

| | Jun 2023 | 1,975 | | | | 1,971 | 1,977 | 1,978 | 1,970 | 1,978 | |

| | Sep 2022 | 1,723 | | | | 1,722 | 1,722 | 1,720 | 1,725 | 1,726 | |

Operating cost1,3 | R/t | Sep 2023 | 784 | | 4,953 | | 230 | | 6,948 | | 783 | | 5,277 | | 397 | | 3,184 | | 429 | | 308 | | 198 | |

| | Jun 2023 | 791 | | 4,081 | | 229 | | 4,616 | | 478 | | 4,964 | | 384 | | 2,650 | | 279 | | 298 | | 200 | |

| | Sep 2022 | 645 | | 4,573 | | 163 | | 5,623 | | 359 | | 5,388 | | 305 | | 3,393 | | 1,222 | | 214 | | 137 | |

| US$/t | Sep 2023 | 42 | | 266 | | 12 | | 374 | | 42 | | 284 | | 21 | | 171 | | 23 | | 17 | | 11 | |

| | Jun 2023 | 42 | | 219 | | 12 | | 247 | | 26 | | 266 | | 21 | | 142 | | 15 | | 16 | | 11 | |

| | Sep 2022 | 38 | | 268 | | 10 | | 330 | | 21 | | 316 | | 18 | | 199 | | 72 | | 13 | | 8 | |

| R/kg | Sep 2023 | 1,051,074 | | 1,121,865 | | 890,484 | | 1,203,168 | | 232,558 | | 1,022,848 | | 816,239 | | 1,195,070 | | 2,000,000 | | 1,102,236 | | 868,380 |

| | Jun 2023 | 901,084 | | 905,847 | | 886,848 | | 808,333 | | 733,333 | | 997,933 | | 1,067,227 | | 925,234 | | 1,333,333 | | 1,074,675 | | 815,057 | |

| | Sep 2022 | 1,036,601 | | 1,173,404 | | 740,557 | | 995,732 | | 880,000 | | 1,300,790 | | 994,737 | | 1,259,652 | | — | | 805,643 | | 673,090 | |

| US$/oz | Sep 2023 | 1,759 | | 1,877 | | 1,490 | | 2,013 | | 389 | | 1,711 | | 1,366 | | 2,000 | | 3,346 | | 1,844 | | 1,453 | |

| | Jun 2023 | 1,502 | | 1,510 | | 1,478 | | 1,347 | | 1,222 | | 1,663 | | 1,779 | | 1,542 | | 2,222 | | 1,791 | | 1,359 | |

| | Sep 2022 | 1,891 | | 2,141 | | 1,351 | | 1,816 | | 1,605 | | 2,373 | | 1,815 | | 2,298 | | — | | 1,470 | | 1,228 | |

All-in sustaining cost2,3 | R/kg | Sep 2023 | 1,232,600 | | | | 1,455,137 | 1,193,820 | 1,343,011 | 1,169,381 | 963,694 | |

| | Jun 2023 | 1,080,135 | | | | 1,071,597 | 1,190,289 | 1,064,022 | 1,120,130 | 910,802 | |

| | Sep 2022 | 1,210,049 | | | | 1,215,013 | 1,527,554 | 1,424,025 | 861,736 | 765,603 | |

| All-in sustaining cost2 | US$/oz | Sep 2023 | 2,062 | | | | 2,435 | 1,997 | 2,247 | 1,957 | 1,612 | |

| | Jun 2023 | 1,800 | | | | 1,786 | 1,984 | 1,774 | 1,867 | 1,518 | |

| | Sep 2022 | 2,207 | | | | 2,216 | 2,787 | 2,598 | 1,572 | 1,397 | |

All-in cost2,3 | R/kg | Sep 2023 | 1,319,197 | | | | 1,455,137 | 1,213,483 | 1,343,011 | 1,169,381 | 1,083,662 | |

| | Jun 2023 | 1,197,324 | | | | 1,071,597 | 1,207,945 | 1,064,022 | 1,120,130 | 1,129,296 | |

| | Sep 2022 | 1,293,245 | | | | 1,215,013 | 1,598,118 | 1,424,025 | 861,736 | 802,358 | |

| All-in cost2 | US$/oz | Sep 2023 | 2,207 | | | | 2,435 | 2,030 | 2,247 | 1,957 | 1,813 | |

| | Jun 2023 | 1,996 | | | | 1,786 | 2,013 | 1,774 | 1,867 | 1,882 | |

| | Sep 2022 | 2,359 | | | | 2,216 | 2,915 | 2,598 | 1,572 | 1,464 | |

| Capital expenditure | | | | | | | | | | | | | |

| Ore reserve development | Rm | Sep 2023 | 677 | | | | 339 | 246 | 92 | — | | — | |

| | Jun 2023 | 745 | | | | 411 | 249 | 85 | — | | — | |

| | Sep 2022 | 472 | | | | 208 | 174 | 90 | — | | — | |

| Sustaining capital | Rm | Sep 2023 | 367 | | | | 131 | 108 | 16 | — | | 112 | |

| | Jun 2023 | 362 | | | | 110 | 109 | 27 | — | | 115 | |

| | Sep 2022 | 409 | | | | 109 | 150 | 37 | — | | 113 | |

Corporate and projects4 | Rm | Sep 2023 | 531 | | | | — | 42 | — | — | | 152 | |

| | Jun 2023 | 760 | | | | — | 36 | — | — | | 267 | |

| | Sep 2022 | 488 | | | | — | 105 | — | — | | 53 | |

| Total capital expenditure | Rm | Sep 2023 | 1,576 | | | | 470 | 396 | 108 | — | | 264 | |

| | Jun 2023 | 1,867 | | | | 521 | 394 | 112 | — | | 382 | |

| | Sep 2022 | 1,369 | | | | 317 | 429 | 127 | — | | 166 | |

| Total capital expenditure | US$m | Sep 2023 | 85 | | | | 25 | 21 | 6 | — | | 14 | |

| | Jun 2023 | 100 | | | | 28 | 21 | 6 | — | | 20 | |

| | Sep 2022 | 80 | | | | 19 | 25 | 7 | — | | 10 | |

Average exchange rates for the quarters ended 30 September 2023, 30 June 2023 and 30 September 2022 was R18.59/US$, R18.66/US$ and R17.05/US$, respectivelyFigures may not add as they are rounded independently

1Operating cost is the average cost of production and operating cost per tonne is calculated by dividing the cost of sales, before amortisation and depreciation and change in inventory in a period by the tonnes milled/treated in the same period, and operating cost per kilogram (and ounce) is calculated by dividing the cost of sales, before amortisation and depreciation and change in inventory in a period by the gold produced in the same period

Sibanye-Stillwater Operating update | Quarter ended 30 September 2023 11

2All-in cost is calculated in accordance with the World Gold Council guidance. All-in cost excludes income tax, costs associated with merger and acquisition activities, working capital, impairments, financing costs, one time severance charges and items needed to normalise earnings. All-in cost is made up of All-in sustaining cost, being the cost to sustain current operations, given as a sub-total in the All-in cost calculation, together with corporate and major capital expenditure associated with growth. All-in sustaining cost per kilogram (and ounce) and All-in cost per kilogram (and ounce) are calculated by dividing the All-in sustaining cost and All-in cost, respectively, in a period by the total gold sold over the same period. For a reconciliation of cost of sales before amortisation and depreciation to All-in cost, see “All-in costs – Quarters”

3Operating cost, all-in sustaining costs and all-in costs, are not measures of performance under IFRS. As a result, such measures should not be considered in isolation or as alternatives to any other measure of financial performance presented in accordance with IFRS. Non-IFRS measures are the responsibility of the Board

4Corporate project expenditure for the quarters ended 30 September 2023, 30 June 2023 and 30 September 2022 was R337 million (US$18 million), R457 million (US$24 million) and R330 million (US$19 million), respectively, the majority of which related to the Burnstone project

SALIENT FEATURES AND COST BENCHMARKS - QUARTERS (continued)

European operations

| | | | | | | | | | | | | | | | | | | | |

| Sandouville nickel refinery |

| Metals split | | |

| Sep 2023 | Jun 2023 | Sep 2022 |

| Volumes produced (tonnes) | | | | | | |

Nickel salts1 | 427 | | 18 | % | 359 | | 19 | % | 650 | | 39 | % |

| Nickel metal | 1,925 | | 82 | % | 1,525 | | 81 | % | 1,003 | | 61 | % |

| Total Nickel Production tNi | 2,352 | | 100 | % | 1,884 | | 100 | % | 1,653 | | 100 | % |

Nickel cakes2 | 103 | | | 97 | | 68 | | |

Cobalt chloride (CoCl2)3 | 46 | | | 30 | | 37 | | |

Ferric chloride (FeCl3)3 | 409 | | | 348 | | 321 | | |

| | | | | | |

| Volumes sales (tonnes) | | | | | | |

Nickel salts1 | 287 | | 15 | % | 364 | | 18 | % | 529 | | 31 | % |

| Nickel metal | 1,664 | | 85 | % | 1,714 | | 82 | % | 1,177 | | 69 | % |

| Total Nickel Sold tNi | 1,951 | | 100 | % | 2,078 | | 100 | % | 1,706 | | 100 | % |

Nickel cakes2 | — | | | 2 | | | | |

Cobalt chloride (CoCl2)3 | 41 | | | 34 | | 51 | |

Ferric chloride (FeCl3)3 | 409 | | | 348 | | 321 | |

| | | | | | | | | | | | | | |

| Nickel equivalent basket price | Unit | Sep 2023 | Jun 2023 | Sep 2022 |

| | | | |

| | | | |

Nickel equivalent average basket price4 | R/tNi | 403,895 | | 481,713 | | 384,525 | |

| US$/tNi | 21,726 | | 25,815 | | 22,553 | |

| | | | | | | | | | | | | | |

| | | | |

| Nickel equivalent sustaining cost | Rm | Sep 2023 | Jun 2023 | Sep 2022 |

| Cost of sales, before amortisation and depreciation | | 1,100 | | 1,407 | | 882 | |

| | | | |

| | | | |

| Share-based payments | | (7) | | 11 | | — | |

| Rehabilitation interest and amortisation | | 2 | | 1 | | 1 | |

| Leases | | 5 | | 5 | | 15 | |

| Sustaining capital expenditure | | 82 | | 51 | | 23 | |

| Less: By-product credit | | (39) | | (65) | | (43) | |

Nickel equivalent sustaining cost5 | | 1,143 | | 1,410 | | 878 | |

| Nickel Products sold | tNi | 1,951 | | 2,078 | | 1,706 | |

Nickel equivalent sustaining cost5 | R/tNi | 585,853 | | 678,537 | | 514,654 | |

| US$/tNi | 31,514 | | 36,363 | | 30,185 | |

| | | | |

Nickel recovery yield6 | % | 98.82 | % | 97.46 | % | 95.04 | % |

Average exchange rates for the quarters ended 30 September 2023, 30 June 2023 and 30 September 2022 was R18.59/US$, R18.66/US$ and R17.05/US$, respectively

Figures may not add as they are rounded independently