Coach, Inc. (NYSE: COH), a leading marketer of modern classic

American accessories, today announced a 33% increase in earnings

per diluted share for its fourth fiscal quarter ended July 1, 2006.

This substantial increase in earnings from the prior year's fourth

quarter reflected a 23% growth in net sales, combined with

significant operating margin improvement. For the full fiscal year,

net sales rose 23% and net income increased 38% versus the prior

fiscal year. During the fourth quarter, net sales were $514

million, 23% higher than generated in the prior year's fourth

quarter. On a constant-exchange-rate basis, net sales increased 25%

in the fourth quarter, excluding the negative currency effects from

translating foreign-denominated sales into U.S. dollars. Net income

rose 31% to $118 million, or $0.31 per diluted share, compared with

$90 million, or $0.23 per share, in the prior year. This was ahead

of the analysts' consensus estimate of $0.29 for the quarter. For

the fiscal year 2006, net sales were $2.1 billion, up 23% from the

$1.7 billion recorded in fiscal year 2005. On a

constant-exchange-rate basis, net sales increased 26% for the

fiscal year, excluding the negative currency effects from

translating foreign-denominated sales into U.S. dollars. Net income

rose to $494 million, up 38% from the $359 million earned in the

prior year. Diluted earnings per share rose 38% to $1.27, versus

$0.92 a year ago, and ahead of analysts' estimates of $1.25. Lew

Frankfort, Chairman and Chief Executive Officer of Coach, Inc.,

said, "I'm extremely pleased with our fiscal fourth quarter and

full year results. This quarter's performance demonstrated a

continuation of the strength we have seen throughout the year, as

our market share continued to grow across all channels and

geographies. Our performance also reflects the vibrancy of the

premium accessory category, notably in the U.S., where we continue

to see double-digit growth." Quarterly operating income totaled

$180 million, up 41% from the $128 million reported in the

comparable year ago period, while operating margin rose to 35.0%, a

440 basis point improvement from the 30.6% reported for the prior

year. During the quarter, gross profit rose 24% to $403 million

from $325 million a year ago. Gross margin expanded by 80 basis

points from 77.6% to 78.4%, driven by gains from supply chain

initiatives and product mix shifts. SG&A expenses as a

percentage of net sales declined 370 basis points to 43.3%,

compared to the 47.0% reported in the year-ago quarter. For the

full year, operating income rose 34% to $765 million, while

operating margin rose to 36.2%, a 270 basis point increase from the

33.5% reported for FY05. During the year, gross profit rose 25.0%

to $1.6 billion, as compared to $1.3 billion a year ago. Gross

margin expanded by 100 basis points from 76.6% to 77.6% while

SG&A expenses as a percentage of net sales declined 180 basis

points from 43.2% to 41.4%. At the end of the fiscal year, the

company had cash and marketable securities of $538 million, as

compared with $505 million a year ago. It should be noted that the

2006 fiscal year end cash balance reflects the repurchase of over

$600 million of Coach common stock during the fiscal year. Fourth

fiscal quarter and full year sales grew in each of Coach's primary

channels of distribution as follows: -- Direct-to-consumer sales

increased 23% to $419 million from $341 million last year. U.S.

comparable store sales for the quarter rose 18.5%, with retail

stores up 10.9% and factory store sales up 29.0%. In Japan, sales

rose 20% on a constant-currency basis, while dollar sales rose 12%

due to a weaker yen. Coach achieved mid-single-digit increases in

comparable location sales in Japan for the quarter. For the full

year, direct to consumer sales rose 23% to $1.6 billion from $1.3

billion generated in fiscal 2005. Overall, North American

comparable store sales for the fiscal year increased 20.7%, with

retail stores up 12.3% and factory stores up 31.9%, while

comparable locations sales in Japan rose mid-single-digit. For the

year, sales in Japan rose 22% on a constant-currency basis, while

dollar sales rose 12%, impacted by the exchange rate. -- Indirect

sales increased 23% to $96 million in the fourth quarter from the

$78 million reported for the prior year. For the year, indirect

sales rose 24% to $501 million, up from $403 million recorded for

fiscal 2005. Results for both the quarter and fiscal year reflected

strong gains in all indirect businesses, including U.S. department

stores and International wholesale. Mr. Frankfort added, "The

strength of our fourth quarter results was reflected in all of our

businesses. Our successful spring and summer offerings drove our

performance, as we continued to improve productivity through our

well-received product offerings. In April, our Soho Optic Signature

fabrication was introduced in a seasonal palette in several

strong-selling handbag, accessory and footwear styles. For May, we

launched a new summer program, which included soft totes in classic

Signature and Optic Signature shoulder totes. And in June we

brought in new Signature Patchwork and Tie Dye offerings - both

perennial favorites." "In Japan, we were particularly pleased with

the outstanding sales and market share growth in FY06, which we

achieved despite an absence of growth in the category. Our rapidly

expanding sales in Japan reflect the success of our distribution

strategy - notably the acceleration of new openings, along with the

expansion of highly productive shop-in-shops." During the fourth

quarter of fiscal 2006, the company opened 12 U.S. Coach retail

stores - including three in new markets for Coach - and three

factory stores, while closing one factory location, bringing the

total to 218 retail stores and 86 factory stores at July 1, 2006.

This was a net increase of 25 Coach retail stores from the 193 in

operation a year ago. Also during the quarter, one retail store

location was expanded, bringing the total number of completed

retail store expansions this year to seven. In Japan, seven new

locations were opened in the fourth quarter and one was closed,

bringing the total to 122 at fiscal year end. This was a net

increase of 16 locations from the 106 at year-end 2005. In

addition, Coach expanded four locations during the fourth quarter,

bringing the year end total to nine expansions in Japan. The

company also announced that it repurchased and retired 15.6 million

shares of common stock at an average cost of $31.20 during the

fourth fiscal quarter, bringing the year-to-date total to 19.1

million shares of common stock repurchased at an average cost of

$31.50. At this time, approximately $150 million remains available

for future repurchases under the company's repurchase program,

which expires in June 2007. Mr. Frankfort noted, "During fiscal

2007, Coach will be introducing three new major lifestyle

platforms, which we are especially excited about, after a year

spent successfully evolving established collections. The first,

Signature Stripe, is a new weekend collection centered around a

group of reversible totes. This collection was just launched last

month and became an instant success. Additional platforms debuting

this year will be Legacy this fall, featuring a return to our

heritage in rich leathers and iconic hardware, and Ergo, a

lightweight, sophisticated group for spring." "While fiscal 2007

has just begun, our strong start bodes well for the year. We're

confident that our proven growth strategies, built upon our

leadership position, will continue to deliver excellent returns in

the seasons ahead and over our planning horizon," Mr. Frankfort

concluded. Coach updated guidance for fiscal 2007 and now estimates

sales of about $2.5 billion for the year, an increase of about 19%.

Operating income is expected to rise over 20% with an operating

margin of nearly 37%. Earnings per share are forecasted to rise to

at least $1.55, up 22% from last year and ahead of the analysts'

consensus of $1.53 for the year. In addition, the company

introduced its first fiscal quarter outlook, with sales targeted to

be at about $535 million, an increase of at least 19%, and earnings

per share projected to be about $0.30, a gain of about 25%. This

compares to the consensus earnings estimate of $0.29 for the first

quarter. Coach will host a conference call to review these results

at 8:30 a.m. (EDT) today, August 1, 2006. Interested parties may

listen to the webcast by accessing www.coach.com/investors on the

Internet or dialing into 1-888-405-2080 and asking for the Coach

earnings call led by Andrea Shaw Resnick, VP of Investor Relations.

A telephone replay will be available starting at 12:00 noon today,

for a period of five business days. The number to call is

1-866-352-7723. A webcast replay of the earnings conference call

will also be available for five business days on the Coach website.

Coach, with headquarters in New York, is a leading American

marketer of fine accessories and gifts for women and men, including

handbags, women's and men's small leathergoods, business cases,

weekend and travel accessories, footwear, watches, outerwear,

sunwear, and related accessories. Coach is sold worldwide through

Coach stores, select department stores and specialty stores,

through the Coach catalog in the U.S. by calling 1-800-223-8647 and

through Coach's website at www.coach.com. Coach's shares are traded

on The New York Stock Exchange under the symbol COH. This press

release contains forward-looking statements based on management's

current expectations. These statements can be identified by the use

of forward-looking terminology such as "may," "will," "should,"

"expect," "intend," "estimate," "are positioned to," "continue,"

"project," "guidance," "forecast," "anticipated," or comparable

terms. Future results may differ materially from management's

current expectations, based upon risks and uncertainties such as

expected economic trends, the ability to anticipate consumer

preferences, the ability to control costs, etc. Please refer to

Coach's latest Annual Report on Form 10-K for a complete list of

risk factors. -0- *T COACH, INC. ----------- CONDENSED CONSOLIDATED

STATEMENTS OF INCOME ---------------------------------------------

For the Quarters and Years Ended July 1, 2006 and July 2, 2005

-------------------------------------------------------------- (in

thousands, except per share data)

------------------------------------- (unaudited) -----------

QUARTER ENDED YEAR ENDED -----------------------

----------------------- July 1, July 2, July 1, July 2, 2006 2005

2006 2005 ----------- ----------- ----------- ----------- Net sales

$ 514,355 $ 418,660 $2,111,501 $1,710,423 Cost of sales 111,282

93,704 472,622 399,652 ---------- ---------- ---------- ----------

Gross profit 403,073 324,956 1,638,879 1,310,771 Selling, general

and administrative expenses 222,956 196,776 874,275 738,208

---------- ---------- ---------- ---------- Operating income

180,117 128,180 764,604 572,563 Interest income, net 9,628 4,836

32,623 15,760 ---------- ---------- ---------- ---------- Income

before income taxes and minority interest 189,745 133,016 797,227

588,323 Income taxes 72,103 43,053 302,950 216,070 Minority

interest, net of tax - 107 - 13,641 ---------- ----------

---------- ---------- Net income $ 117,642 $ 89,856 $ 494,277 $

358,612 ========== ========== ========== ========== Net income per

share Basic $ 0.31 $ 0.24 $ 1.30 $ 0.95 ========== ==========

========== ========== Diluted $ 0.31 $ 0.23 $ 1.27 $ 0.92

========== ========== ========== ========== Shares used in

computing net income per share Basic 376,706 377,632 379,635

378,670 ========== ========== ========== ========== Diluted 384,227

389,130 388,495 390,191 ========== ========== ========== ==========

----------------------------------------------------------------------

Supplemental information Net income, as reported $ 117,642 $ 89,856

$ 494,277 $ 358,612 Add back Stock Option Expense (after tax) 9,443

7,709 36,262 30,040 Net income, ex Stock Option Expense $ 127,085 $

97,565 $ 530,539 $ 388,652 Pro forma as adjusted basic net income,

ex stock option expense, per share $ 0.34 $ 0.26 $ 1.40 $ 1.03 Pro

forma as adjusted diluted net income, ex stock option expense, per

share $ 0.33 $ 0.25 $ 1.37 $ 1.00

----------------------------------------------------------------------

COACH, INC. ----------- CONDENSED CONSOLIDATED BALANCE SHEETS

------------------------------------- At July 1, 2006 and July 2,

2005 -------------------------------- (in thousands) --------------

(unaudited) ----------- July 1, July 2, 2006 2005 -----------

----------- ASSETS Cash, cash equivalents and short term

investments $ 537,565 $ 383,051 Receivables 84,361 65,399

Inventories 233,494 184,419 Other current assets 119,062 76,491

---------- ---------- Total current assets 974,482 709,360 Property

and equipment, net 298,531 203,862 Long term investments - 122,065

Other noncurrent assets 353,507 334,870 ---------- ---------- Total

assets $1,626,520 $1,370,157 ========== ========== LIABILITIES AND

STOCKHOLDERS' EQUITY Accounts payable $ 79,819 $ 64,985 Accrued

liabilities 261,835 188,234 Subsidiary credit facilities - 12,292

Current portion of long-term debt 170 150 ---------- ----------

Total current liabilities 341,824 265,661 Long-term debt 3,100

3,270 Other liabilities 92,862 45,306 Stockholders' equity

1,188,734 1,055,920 ---------- ---------- Total liabilities and

stockholders' equity $1,626,520 $1,370,157 ========== ========== *T

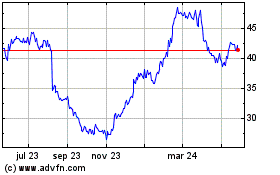

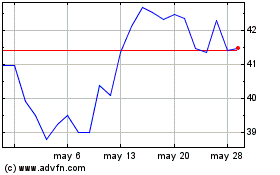

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024