Stock Market News for July 31, 2013 - Market News

31 Julio 2013 - 9:40AM

Zacks

Mixed results from major companies

pushed the Dow Jones marginally into the red. Investors also took a

cautious stance ahead of the two-day FOMC meeting. The S&P 500

and the Nasdaq finished in the green, but only just. This was due

to positive investor sentiment towards the technology sector. On

the domestic front, Conference Board Consumer Confidence Index and

S&P/Case-Schiller home prices were released. On the

international front, economic sentiment index for July of the Euro

Zone region reached its highest level in 15 months. Of the top ten

S&P 500 industry groups, technology stocks gained the most.

For a look at the issues currently

facing the markets, make sure to read today’s Ahead of Wall Street

article.

The Dow Jones Industrial Average

(DJI) lost 0.01% to close the day at 15,520.59. The S&P 500

increased 0.04% to finish yesterday’s trading session at 1,685.96.

The tech-laden Nasdaq Composite Index rose 0.5% to end at 3,616.47.

The fear-gauge CBOE Volatility Index (VIX) remained unchanged at

13.39. Consolidated volumes on the New York Stock Exchange,

American Stock Exchange and Nasdaq were roughly 5.9 billion shares,

below 2013’s average of 6.4 billion shares. Declining stocks

outnumbered the advancers. For the 49% that declined, only 47%

advanced.

About 60% of the S&P 500

companies have declared their results, out of which earnings of

nearly 67.4% have beaten the Streets estimates. Benchmarks

oscillated between small gains and losses during Tuesday’s trading

session. Pfizer disclosed results which marginally beat the

Street’s estimates, while Merck missed expectations. Results from

Coach Inc also dampened investor sentiment. Investors were also

cautious regarding the outcome of the two-day FOMC meeting. The

focus is now on the fate of the bond purchase program which helped

benchmarks reach their highest level several times in the first

quarter.

Pfizer Inc. (NYSE:PFE) disclosed

its second quarter results which marginally beat estimates.

Adjusted income of the company declined 10% to $4 billion or 56

cents a share. Sales of the company came in at $12.97 billion, down

7%. Low sales are attributable to declining sale of its off-patent

cholesterol fighter product named Lipitor. Another drug company,

Merck & Co., Inc. (NYSE:MRK) reported profits of $906 million

or 30 cents per share, 50% down year over year. Revenues of the

company declined 11% to $11.01 billion. Revenues of the company

were negatively affected by the foreign currency headwinds to the

extent of 3%. Low revenues of the company are attributable to

declining sales of allergy and asthma drug Singulair.

Shares of Sprint Nextel Corporation

(NYSE:S) surged nearly 7.3% despite posting operating loss of $874

million. However, revenues of the company came in at $7.2 billion,

an increase of 8% year over year. The company was also successful

in gaining back the 4 million subscribers it lost when the

connection was discontinued.

Shares of Coach, Inc. (NYSE:COH)

dropped 7.9% after it reported disappointing results. Net income of

the company declined to $221.3 million or 78 cents a share,

compared to year-ago figures of $251.4 million or 86 cents per

share. Excluding one-time items, Coach garnered profits of 89 cents

a share, in line with the Street’s estimates.

On the domestic front, the Consumer

Board Confidence Index for July dropped marginally to 80.3 compared

to 82.1 in June. The index was also below the consensus estimate of

80.9. Additionally, the Expectations Index dropped to 84.7 from

91.1 recorded in the previous month. However, the Present Situation

Index improved to 73.6 from 68.7 recorded during last

month.

The S&P/Case-Schiller Home

Prices Indices for 10- and 20- City composites for May increased

month over month to 2.5% and 2.4%, respectively. Annually, the 10-

and 20- City Composites increased 11.8% and 12.2%, respectively.

These were the highest year over year gains posted since March

2006. Among all the cities, home prices at Dallas and Denver broke

the record levels which were set during the housing bubble.

On the international front, the

economic sentiment index of the Euro Zone region in July touched a

15- month high. Economic sentiment came in at 92.5 in July ahead of

June 2013’s figure of 91.3. However, it fell marginally short of

estimates of 92.6. The barometer measuring Euro Zone’s business

climate index increased significantly to -0.53 from previous

month’s figure of -0.67. Of the five largest economies in Euro Zone

region, confidence in Netherlands dropped. Confidence in Germany,

France and Spain grew 0.7, 1.2 and 1.2 points, respectively.

The technology sector was the

biggest gainer among the S&P 500 industry groups. The

Technology SPDR (XLK) gained 0.5%. Shares of Apple Inc.

(NASDAQ:AAPL), Microsoft Corporation (NASDAQ:MSFT), Intel

Corporation (NASDAQ:INTC), Google Inc. (NASDAQ:GOOG) and Yahoo!

Inc. (NASDAQ:YHOO) gained 1.2%, 1.0%, 0.6%, 1.0% and 0.4%,

respectively.

APPLE INC (AAPL): Free Stock Analysis Report

COACH INC (COH): Free Stock Analysis Report

GOOGLE INC-CL A (GOOG): Free Stock Analysis Report

INTEL CORP (INTC): Free Stock Analysis Report

MICROSOFT CORP (MSFT): Free Stock Analysis Report

PFIZER INC (PFE): Free Stock Analysis Report

SPRINT CORP (S): Free Stock Analysis Report

YAHOO! INC (YHOO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

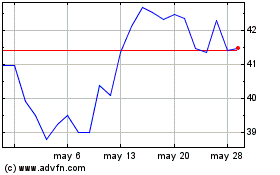

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Ago 2024 a Sep 2024

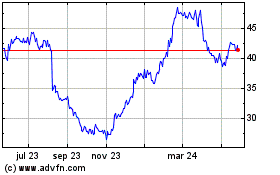

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Sep 2023 a Sep 2024