U.S. Bancorp announces planned leadership, structural changes for payments business

30 Octubre 2024 - 11:15AM

Business Wire

Reporting alignment for CFO also moves to

CEO

U.S. Bancorp (NYSE: USB), parent company of U.S. Bank, announced

today that Chief Financial Officer John Stern now will report

directly to Chairman and CEO Andy Cecere, and shared a new

leadership structure for its payments and money movement businesses

under President Gunjan Kedia.

“An important part of achieving our company goals is ensuring we

have a strong, aligned leadership team setting our strategy and

helping us grow,” said Cecere. “When leadership changes occur, we

take our time to look inside and outside the company for talent,

implement our succession plans, and adjust how our teams are

structured if we see new opportunities to better meet business

needs.”

John Stern, senior executive vice president and chief financial

officer, will begin reporting to Chairman and CEO Andy Cecere

directly. This change is effective immediately and reflects Stern’s

leadership in the CFO role during the past year. Stern, 46, was

named CFO in 2023. He previously served as president of the

company’s global corporate trust and custody business and before

that had been the corporate treasurer for nearly eight years.

Meanwhile, the company continues to prepare for Vice Chair of

Payment Services Shailesh Kotwal’s previously announced retirement

in the first half of next year and has decided to adjust its

operating model to reflect the size, scale and strategic importance

of the payments business to the company.

“We have worked closely with Shailesh and internal and external

partners to fully understand the competitive landscape and our

opportunities within the payments space,” said Kedia. “We

consistently heard that we have an attractive payments franchise,

and we have a unique opportunity to leverage our strength to

grow.”

As a result, moving forward, the Payment Services business will

be organized into two divisions: Payments: Merchant and

Institutional (PMI) and Payments: Consumer and Small Business

(PCS). The leaders of each team will report to Kedia in due course

as the transition plan for Kotwal’s retirement is implemented.

Mark Runkel, 48, senior executive vice president and chief

transformation officer, will lead the PMI business effective in

early January. This team will include Merchant Payments Services,

Corporate Payment and Treasury Solutions, and Payments Europe.

Runkel has rich experience working closely with the company’s

merchant and institutional payments businesses in his prior credit

and risk roles. Runkel has been a member of the U.S. Bank team

since 2002.

“Mark is a trusted and collaborative leader with a deep

one-company mindset, strong risk and financial discipline, and

broad knowledge of our businesses aided by a keen focus on

execution,” Kedia said. “In his current role as chief

transformation officer, he has been instrumental in driving our

Union Bank integration and supporting growth through

interconnectivity across the company. He will work with Shailesh on

a smooth and disciplined transition plan and continue to serve on

our Managing Committee.”

Runkel is expected to transition into the new role in early

January, and at that time, the work he has been overseeing will

move to Terry Dolan, 63, who will continue to lead the company’s

administration office and steward its strategy, digital, corporate

social responsibility, Impact Finance, marketing and communications

functions.

The company is actively recruiting for the head of PCS, who will

be responsible for personal and small business debit and credit

cards, Elan, cobrand, and all related functions including business

line risk and credit/collections. U.S. Bank expects to fill the

position in the first half of 2025.

“These are important changes that will help us accelerate our

growth strategy and capitalize on the inflection point we have

reached due to our investments and disciplined approach to

delivering financial results,” added Cecere. “We look forward to

the contributions these leaders will make to the organization for

years to come.”

About U.S. Bank

U.S. Bancorp, with more than 70,000 employees and $686 billion

in assets as of September 30, 2024, is the parent company of U.S.

Bank National Association. Headquartered in Minneapolis, the

company serves millions of customers locally, nationally and

globally through a diversified mix of businesses including consumer

banking, business banking, commercial banking, institutional

banking, payments and wealth management. U.S. Bancorp has been

recognized for its approach to digital innovation, community

partnerships and customer service, including being named one of the

2024 World’s Most Ethical Companies and Fortune’s most admired

superregional bank. Learn more at usbank.com/about.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030220531/en/

Investors: George Andersen, Director of Investor Relations, U.S.

Bancorp Investor Relations george.andersen@usbank.com

Media: Jeff Shelman, U.S. Bank Public Affairs and Communications

jeffrey.shelman@usbank.com

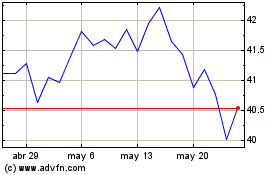

US Bancorp (NYSE:USB)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

US Bancorp (NYSE:USB)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025