Expects to deliver growth potential of $20

billion in earnings and $30 billion in cash flow1

Key elements of ExxonMobil’s 2030 plan:

- Increasing Pioneer acquisition average annual synergies by over

50% to more than $3 billion2

- Growing new business earnings potential to $3 billion3

- Adding $7 billion more in structural cost savings vs.

3Q2024

- Increasing Upstream production to 5.4 million oil-equivalent

barrels per day with >60% from advantaged assets

- Growing high-value product sales 80% vs. 2024 that contribute

over 40% of 2030 earnings potential for Product Solutions

- Pursuing up to $30 billion in lower emissions investment

opportunities4

- Investing $27-$29 billion of cash capex in 2025 and $28-$33

billion annually in 2026-2030 to progress attractive long-term

opportunities, with base planned capex roughly flat and

reinvestment rate declining to 40% from 50% over the plan

period5

ExxonMobil today announced its Corporate Plan to 2030, creating

a platform to further extend the company’s track record of

delivering leading shareholder value. The plan reflects the

company’s strategy to leverage its unique set of competitive

advantages and unrivaled opportunities to create significant upside

potential for shareholders. The company expects to deliver

incremental growth potential of $20 billion in earnings and $30

billion in cash flow driven by investing in competitively

advantaged opportunities, continued excellence in execution, and

disciplined cost and capital management.1

“ExxonMobil has a unique set of highly valuable competitive

advantages that equip us to do what few companies have ever done –

create world-scale solutions to society’s biggest challenges,

decade after decade,” said Darren Woods, ExxonMobil Chairman and

CEO. “Our steadfast commitment to strengthening these advantages,

including an unwavering investment in technology, has led to a

history of innovative solutions that meet society’s critical needs,

reduce costs, and grow high-value products. That’s a formula for

profitable growth and shareholder value through and beyond 2030 –

no matter the pace and scale of the energy transition – that truly

puts us in a league of our own.”

Consistent execution of ExxonMobil’s strategy and business

transformation over the past five years has substantially

strengthened its earnings power. On a constant price and margin

basis, the company is generating more than $15 billion in earnings

and more than $20 billion in cash flow vs. 2019, and has delivered

structural cost savings of more than $11 billion year-to-date vs.

2019.6 Cash flow has grown faster than that of any other integrated

oil company (IOC) over the past three- and five-year periods.7 That

outperformance has translated to shareholder value – ExxonMobil’s

total shareholder return leads IOCs year-to-date and over the last

three- and five-year periods.8

Financial strength

Over the next six years, the company expects to generate an

additional $20 billion in earnings potential and $30 billion in

cash flow potential.1 It plans to grow earnings at a CAGR of 10%

and cash flow at 8% and has plans to achieve an additional $7

billion in structural cost savings by simplifying business

processes, optimizing supply chains, further enhancing maintenance

turnaround processes, and modernizing information technology and

data management systems.

The Company’s capital allocation approach prioritizes

competitively advantaged, high-return, low-cost-of-supply

investments. In 2025, the company expects cash capital expenditures

to be in the range of $27 to $29 billion, reflecting the first full

year of Pioneer in the portfolio and investment to build new

businesses with base capex remaining flat. From 2026 to 2030, base

capex is consistent, while capex growth is driven by progressing

advantaged, long-term opportunities in new businesses, and a few

early-stage large projects in the company’s traditional businesses.

The reinvestment rate relative to expected cash flow declines 10

percentage points over the plan period.5

“Through 2030, we plan to deploy about $140 billion to major

projects and the Permian Basin development program,” added Woods.

“We expect this capital to generate returns of more than 30% over

the life of the investments.9 Strong investment returns have driven

42 consecutive years of annual dividend growth, a claim only 4% of

the S&P 500 can make. This is why, when we list our capital

allocation priorities, investing in accretive growth always comes

first.”

Cash flow and earnings growth generate a further $165 billion in

surplus cash over the plan period driving increased shareholder

distributions.10 ExxonMobil has increased its annual dividend per

share for 42 consecutive years, and recently increased its

quarterly dividend by 4 cents per share effective this quarter. The

company continues to expect to repurchase shares at a $20 billion

annual pace in 2025, and today announced plans for a further $20

billion of share repurchases in 2026, assuming reasonable market

conditions.

Upstream

ExxonMobil continues to strengthen its Upstream portfolio of

advantaged assets that offer lower cost of supply and higher

returns. By 2030, at a 2024 dollar real Brent price of $65 per

barrel, a real Henry Hub price of $3 per mmbtu, and a real TTF

price of $6.50 per mmbtu, the company plans to deliver an

additional $9 billion in Upstream annual earnings potential – more

than 50% higher than in 2024.

With the Pioneer acquisition, the company reached its target of

having more than 50% of its total Upstream production from

advantaged assets (Permian, Guyana, and LNG) three years earlier

than planned. By 2030, more than 60% of the company’s production is

expected to come from these advantaged assets, which are expected

to grow by an additional 1.2 million oil-equivalent barrels per day

(Moebd) during that period. Total Upstream production is expected

to reach 5.4 Moebd by 2030, even as the company plans to lower its

operated Upstream emissions intensity 40-50% versus 2016.11

Following its acquisition and integration of Pioneer, ExxonMobil

expects to achieve more than $3 billion in annual synergies, a more

than 50% increase from prior guidance. The company now has the

largest contiguous acreage position in the Permian Basin with

double the number of low-cost net drilling locations versus the

next closest competitor.12 The company is applying its technology

advantage to increase capital efficiency and resource recovery and

expects to roughly double production in the Permian Basin to

approximately 2.3 Moebd by 2030.

ExxonMobil also announced plans for two additional developments

in Guyana, Hammerhead and Longtail, bringing the total number of

developments to eight by 2030. Total production capacity in Guyana,

on an investment basis, is expected to reach 1.7 million barrels

per day with gross production growing to 1.3 million barrels per

day by 2030.

ExxonMobil has four world-class LNG projects under development

and expects to surpass 40 million metric tons per annum of LNG

sales by 2030. The addition of these projects further expands the

company’s global LNG footprint and market access. The company

expects to achieve first LNG sales from the Golden Pass development

in the United States and from the Qatar North Field East expansion

project near the end of 2025. It also is targeting final investment

decisions at Papua New Guinea’s Papua project in 2025 and at

Mozambique’s Rovuma development in 2026.

Product Solutions

ExxonMobil’s Product Solutions business is expected to grow

annual earnings potential by an additional $8 billion by 2030, at

average 2010-2019 margins – a 10% CAGR. About half of the earnings

growth is expected to come from advantaged projects and high-value

products to meet society’s needs today and well into the

future.

The company is on track to start up six advantaged projects in

2025, as many as in the prior five years combined. These projects

drive significant volume and mix improvements and include the China

chemical complex; a hydrofiner in Fawley, U.K.; the Singapore resid

upgrade project; a renewable diesel project in Strathcona, Canada;

additional advanced plastics recycling units in Baytown, Texas; and

an expansion of the ProxximaTM thermoset resin manufacturing

facilities in East Texas.

ProxximaTM has unique properties that will drive substitution in

existing markets and expand into new applications like structural

composites and steel substitutes – areas where traditional resins

struggle to compete. The company is investing in facilities to

produce more ProxximaTM feedstock with plans to ramp up capacity to

nearly 200,000 metric tons per year by 2030.

ExxonMobil also is growing its carbon materials venture to

capture attractive opportunities in battery anode markets.

ExxonMobil developed an advanced coke product that delivers a

higher performance, differentiated graphite. The result is a

battery with up to 30% higher capacity, 30% faster charging time,

and extended battery life. The company is working with automobile

manufacturers to test this new product, with plans to have its

first commercial-scale plant online in 2028 to meet the growing

demand for electric vehicle batteries and their components.

Low Carbon Solutions

ExxonMobil is pursuing up to $30 billion of low emission

opportunities between 2025 and 2030, with almost 65% spent on

reducing emissions for third-party customers. Execution of these

opportunities is contingent on the right policy and regulation as

well as continued technology and market development. ExxonMobil is

pacing investments in new ventures to balance opportunities and

risks as markets develop.

ExxonMobil’s Low Carbon Solutions business focuses on three

primary verticals: carbon capture and storage, hydrogen, and

lithium. These opportunities align with ExxonMobil’s core

competencies.

The company is developing the world’s first large-scale carbon

capture and storage system, which includes a high-capacity CO2

pipeline network connecting emitters from many industries to

permanent subsurface storage capacity throughout the U.S. Gulf

Coast.

ExxonMobil expects its low-carbon hydrogen facility in Baytown

to be the world’s largest, producing up to 1 billion cubic feet of

virtually carbon-free hydrogen per day with about 98% of the CO2

captured and stored. Some of this hydrogen will be used to produce

over a million metric tons per year of low-carbon ammonia. The

company is working toward a final investment decision in 2025 with

the potential to start operations in 2029.

The company is building foundational projects that work with the

right policy, today’s technology, and today’s infrastructure. At

the same time, ExxonMobil is developing new technologies to reduce

the cost of emission reductions, which is the only way to achieve

deployment at scale. With supportive policy and growing market

interest, the company expects its Low Carbon Solutions business to

grow earnings contributions by $2 billion in 2030 versus 2024.

Supporting materials for this press release are available on the

ExxonMobil Investor Relations site.

About ExxonMobil

ExxonMobil, one of the largest publicly traded international

energy and petrochemical companies, creates solutions that improve

quality of life and meet society’s evolving needs.

The corporation’s primary businesses - Upstream, Product

Solutions and Low Carbon Solutions – provide products that enable

modern life, including energy, chemicals, lubricants, and lower

emissions technologies. ExxonMobil holds an industry-leading

portfolio of resources, and is one of the largest integrated fuels,

lubricants, and chemical companies in the world. ExxonMobil also

owns and operates the largest CO2 pipeline network in the United

States. In 2021, ExxonMobil announced Scope 1 and 2 greenhouse gas

emission-reduction plans for 2030 for operated assets, compared to

2016 levels. The plans are to achieve a 20-30% reduction in

corporate-wide greenhouse gas intensity; a 40-50% reduction in

greenhouse gas intensity of upstream operations; a 70-80% reduction

in corporate-wide methane intensity; and a 60-70% reduction in

corporate-wide flaring intensity.

With advancements in technology and the support of clear and

consistent government policies, ExxonMobil aims to achieve net-zero

Scope 1 and 2 greenhouse gas emissions from its operated assets by

2050. To learn more, visit exxonmobil.com and ExxonMobil’s

Advancing Climate Solutions.

Follow us on LinkedIn.

Cautionary Statement

FORWARD-LOOKING STATEMENTS. Statements of future events,

conditions, expectations, plans, performance, earnings power,

opportunities, potential addressable markets, ambitions, or results

in this release are forward-looking statements. Similarly,

discussions of future projects or markets for carbon capture,

transportation, and storage, biofuels, hydrogen, ammonia, lithium,

direct air capture, and other low carbon business plans to reduce

emissions and emission intensity of ExxonMobil, its affiliates, or

third parties are dependent on future market factors, such as

continued technological progress, stable policy support, and timely

rule-making and permitting, and represent forward-looking

statements. Actual future results, including financial and

operating performance; potential earnings, cash flow, surplus cash,

dividends, share repurchases, or shareholder returns; total cash

capital expenditures and mix, including allocations of capital to

low carbon investments; realization and maintenance of structural

cost reductions and efficiency gains, including the ability to

offset inflationary pressures; plans to reduce future emissions and

emissions intensity; ambitions to reach Scope 1 and Scope 2 net

zero from operated assets by 2050, to reach Scope 1 and 2 net zero

in heritage Upstream Permian Basin unconventional operated assets

by 2030 and Pioneer Permian assets by 2035, to eliminate routine

flaring in-line with World Bank Zero Routine Flaring, to reach

near-zero methane emissions from operated assets and other methane

initiatives, to meet ExxonMobil’s emission reduction plans and

goals, divestment and start-up plans, and associated project plans

as well as technology advances, including in the timing and outcome

of projects to capture and store CO2, produce hydrogen and ammonia,

produce biofuels, produce lithium, create new advanced carbon

materials, and use plastic waste as feedstock for advanced

recycling; maintenance and turnaround activity; drilling and

improvement programs; price and margin recovery; planned Pioneer or

Denbury integration benefits; resource recoveries and production

rates; and product sales levels and mix could differ materially due

to a number of factors. These include global or regional changes in

oil, gas, petrochemicals, or feedstock prices, differentials,

seasonal fluctuations, or other market or economic conditions

affecting the oil, gas, and petrochemical industries and the demand

for our products; new or changing government policies for lower

carbon and new market investment opportunities, or policies

limiting the attractiveness of investments such as European taxes

on energy and unequal support for different methods of carbon

capture; consumer preferences including willingness and ability to

pay for reduced emissions products; variable impacts of trading

activities; the outcome of competitive bidding and project awards;

regulatory actions targeting public companies in the oil and gas

industry; the development or changes in local, national, or

international laws, regulations, and policies affecting our

business including with respect to the environment, taxes, and

trade sanctions; adoption of regulatory rules consistent with

written laws; the ability to realize efficiencies within and across

our business lines and to maintain current cost reductions as

efficiencies without impairing our competitive positioning;

decisions to invest in future reserves; reservoir performance,

including variability and timing factors applicable to

unconventional projects and the success of new unconventional

technologies; the level, outcome, and timing of exploration and

development projects and decisions to invest in future resources;

timely completion of construction projects; war, civil unrest,

attacks against the company or industry, and other political or

security disturbances; expropriations, seizures, and capacity,

insurance, or shipping limitations by foreign governments or

international embargoes; changes in market strategy by national oil

companies; opportunities for and regulatory approval of investments

or divestments; the outcome of other energy companies’ research

efforts and the ability to bring new technology to commercial scale

on a cost-competitive basis; the development and competitiveness of

alternative energy and emission reduction technologies; unforeseen

technical or operating difficulties, including the need for

unplanned maintenance; and other factors discussed here and in Item

1A. Risk Factors of our Form 10-K and under the heading “Factors

Affecting Future Results” available under the “Earnings” tab

through the “Investors” page of our website at www.exxonmobil.com.

All forward-looking statements are based on management’s knowledge

and reasonable expectations at the time of this release and we

assume no duty to update these statements as of any future date.

Neither future distribution of this material nor the continued

availability of this material in archive form on our website should

be deemed to constitute an update or re-affirmation of these

figures as of any future date. Any future update of these figures

will be provided only through a public disclosure indicating that

fact.

Supplemental Information

See the Supplemental Information below through the end of this

press release for additional important information required by

Regulation G for non-GAAP measures, measures that the company

considers useful to investors, and definitions of terms used in

herein, including cash capex; cash opex excluding energy and

production taxes; earnings and cash flow ex. identified items and

working capital / other adjusted to 2024 $65/bbl real Brent and

10-year average Energy, Chemical, and Specialty Products margins;

operating costs; shareholder distributions; and structural cost

savings. Supplemental Information also includes information on the

assumptions used in these materials, including assumptions on

future crude oil prices and product margins used to develop

outlooks regarding future potential outcomes of current management

plans.

IMPORTANT INFORMATION AND ASSUMPTIONS REGARDING CERTAIN

FORWARD-LOOKING STATEMENTS. For all price point comparisons, unless

otherwise indicated, we assume $65/bbl Brent crude prices, $3/mmbtu

Henry Hub gas prices, and $6.5/mmbtu TTF gas prices. Unless

otherwise specified, crude prices are Brent prices. These are used

for clear comparison purposes and are not necessarily

representative of management’s internal price assumptions. Crude

and natural gas prices for future years are adjusted for inflation

(assumption of 2.5%) from 2024. Operating costs and capex are also

inflated consistent with plans done on a country-by-country basis.

Energy, Chemical, and Specialty Product margins reflect annual

historical averages for the 10-year period from 2010-2019 unless

otherwise stated. Lower emissions returns are calculated based on

current and potential future government policies based on

ExxonMobil projections as of the date of this presentation. These

prices are not intended to reflect management’s forecasts for

future prices or the prices we use for internal planning purposes.

Unless otherwise indicated, asset sales and proceeds and Corporate

and Financing expenses are aligned with our internal planning.

Corporate and Financing expenses reflect estimated potential debt

levels under various disclosed scenarios. All references to

production rates, project capacity, resource size, and acreage are

on a net basis, unless otherwise noted. All references to tons

refer to metric tons, unless otherwise noted.

ExxonMobil has business relationships with thousands of

customers, suppliers, governments, and others. For convenience and

simplicity, words such as venture, joint venture, partnership,

co-venturer, operated by others, and partner are used to indicate

business and other relationships involving common activities and

interests, and those words may not indicate precise legal

relationships.

Competitor data and ExxonMobil data used for comparisons to

competitor data are sourced from publicly available information and

FactSet and are done so consistently for each company in the

comparison. Future competitor data and future ExxonMobil data used

for comparison to future competitor data, unless otherwise noted,

are sourced from FactSet and have not been independently verified

by ExxonMobil or any third party. We note that certain competitors

report financial information under accounting standards other than

U.S. GAAP (i.e., IFRS).

Our capital allocation plans do not extend beyond 2030.

Statements about our businesses that reference periods beyond 2030

are made on a basis consistent with ExxonMobil’s Global Outlook,

which is publicly available on our website.

Frequently Used Terms and Non-GAAP Measures

Advantaged assets (Advantaged growth projects). When used

in reference to our Upstream business, includes Permian (heritage

Permian and Pioneer), Guyana, and LNG.

Advantaged projects. Capital projects and programs of

work that contribute to Energy, Chemical, and/or Specialty Products

segments that drive integration of segments/businesses, increase

yield of higher value products, or deliver higher than average

returns.

Capital and exploration expenditures (Capital expenditures,

Capex). Represents the combined total of additions at cost to

property, plant and equipment, and exploration expenses on a

before-tax basis from the Consolidated Statement of Income.

ExxonMobil’s Capex includes its share of similar costs for equity

companies. Capex excludes assets acquired in nonmonetary exchanges,

the value of ExxonMobil shares used to acquire assets, and

depreciation on the cost of exploration support equipment and

facilities recorded to property, plant and equipment when acquired.

While ExxonMobil’s management is responsible for all investments

and elements of net income, particular focus is placed on managing

the controllable aspects of this group of expenditures.

Cash capital expenditures (Cash Capex) (Non-GAAP). Sum of

Additions to property, plant and equipment; Additional investments

and advances; and Other investing activities including collection

of advances; reduced by Inflows from noncontrolling interests for

major projects, each from the Consolidated Statement of Cash Flows.

Prior to fourth quarter 2024, Inflows from noncontrolling interests

for major projects was included within Changes in noncontrolling

interests on the Consolidated Statement of Cash Flows. This measure

is useful for investors to understand the current period cash

impact of investments in the business.

Cash operating expenses (cash opex) excluding energy and

production taxes (non-GAAP). Subset of total operating costs

that are stewarded internally to support management’s oversight of

spending over time. This measure is useful for investors to

understand our efforts to optimize cash through disciplined expense

management for items within management’s control.

Compound annual growth rate (CAGR). Represents the

consistent rate at which an investment or business result would

have grown had the investment or business result compounded at the

same rate each year.

Distributions to shareholders (shareholder

distributions). The Corporation distributes cash to

shareholders in the form of both dividends and share purchases.

Shares are acquired to reduce shares outstanding and to offset

shares or units settled in shares issued in conjunction with

company benefit plans and programs. For the purposes of calculating

distributions to shareholders, the Corporation includes only the

cost of those shares acquired to reduce shares outstanding.

Divestments. Refers to asset sales; results include

associated cash proceeds and production impacts, as applicable, and

are consistent with our internal planning.

Earnings (loss) excluding Identified Items (Earnings ex.

Ident. Items) (non-GAAP). Earnings (loss) excluding

individually significant non-operational events with, typically, an

absolute corporate total earnings impact of at least $250 million

in a given quarter. The earnings (loss) impact of an Identified

Item for an individual segment may be less than $250 million when

the item impacts several periods or several segments. Earnings

(loss) excluding Identified Items does include non-operational

earnings events or impacts that are generally below the $250

million threshold utilized for Identified Items. When the effect of

these events is significant in aggregate, it is indicated in

analysis of period results as part of quarterly earnings press

release and teleconference materials. Management uses these figures

to improve comparability of the underlying business across multiple

periods by isolating and removing significant non-operational

events from business results. The Corporation believes this view

provides investors increased transparency into business results and

trends and provides investors with a view of the business as seen

through the eyes of management. Earnings (loss) excluding

Identified Items is not meant to be viewed in isolation or as a

substitute for net income (loss) attributable to ExxonMobil as

prepared in accordance with U.S. GAAP.

Heritage Permian. Permian basin assets excluding assets

acquired as part of the acquisition of Pioneer Natural Resources

that closed in May 2024.

High-value products. Includes performance products and

lower-emissions fuels.

Industry-leading results (industry-leading returns,

industry-leading financial performance, industry-leading

shareholder value). Includes our leadership in metrics such as

earnings, cash flow, dividends paid, share buybacks, and total

shareholder return versus the IOCs. Similar terms, such as

industry-leading performance or industry-leading shareholder value,

refer to our leadership versus the IOCs in metrics such as

production or individual terms such as return on capital employed

and total shareholder return as applicable in the context

presented.

IOCs. Unless stated otherwise, IOCs include each of BP,

Chevron, Shell, and TotalEnergies.

Lower-emission fuels. Fuels with lower life cycle

emissions than conventional transportation fuels for gasoline,

diesel, and jet transport.

Operating costs (Opex) (non-GAAP). Operating costs are

the costs during the period to produce, manufacture, and otherwise

prepare the company’s products for sale – including energy,

staffing, and maintenance costs. They exclude the cost of raw

materials, taxes, and interest expense and are on a before-tax

basis. While ExxonMobil’s management is responsible for all revenue

and expense elements of net income, operating costs, as defined

above, represent the expenses most directly under management’s

control, and therefore are useful for investors and ExxonMobil

management in evaluating management’s performance.

Performance products (performance chemicals, performance

lubricants). Refers to products that provide differentiated

performance for multiple applications through enhanced properties

versus commodity alternatives and bring significant additional

value to customers and end-users.

Project. The term “project” as used in this presentation

can refer to a variety of different activities and does not

necessarily have the same meaning as in any government payment

transparency reports. Projects or plans may not reflect investment

decisions made by the company. Individual opportunities may advance

based on a number of factors, including availability of supportive

policy, technology for cost-effective abatement, and alignment with

our partners and other stakeholders. The company may refer to these

opportunities as projects in external disclosures at various stages

throughout their progression.

Reinvestment rate. Cash capex as a percentage of cash

flow from operations excluding identified items and working capital

/ other.

Returns, rate of return, investment returns, project returns,

IRR. Unless referring specifically to ROCE or external data,

references to returns, rate of return, IRR, and similar terms mean

future discounted cash flow returns on future capital investments

based on current company estimates. Investment returns exclude

prior exploration and acquisition costs.

Structural cost savings (structural cost reductions,

structural cost efficiencies, structural efficiencies, structural

cost improvements). Structural cost savings describe decreases

in cash opex excluding energy and production taxes as a result of

operational efficiencies, workforce reductions, divestment-related

reductions, and other cost-savings measures, that are expected to

be sustainable compared to 2019 levels. Relative to 2019, estimated

cumulative structural cost savings totaled $11.3 billion as of

September 30, 2024. The total change between periods in expenses

will reflect both structural cost savings and other changes in

spend, including market factors, such as inflation and foreign

exchange impacts, as well as changes in activity levels and costs

associated with new operations, mergers and acquisitions, new

business venture development, and early-stage projects. Estimates

of cumulative annual structural savings may be revised depending on

whether cost reductions realized in prior periods are determined to

be sustainable compared to 2019 levels. Structural cost savings are

stewarded internally to support management’s oversight of spending

over time. This measure is useful for investors to understand our

efforts to optimize spending through disciplined expense

management.

Structural earnings improvements (structural improvements,

growing earnings power, improved earnings power). Structural

earnings improvements consist of efforts to improve earnings on a

like-for-like price and margin basis and incorporate improvement

efforts by the corporation such as growing advantaged assets,

improving mix, and reducing structural costs.

Synergies. Synergies refer to pre-tax increases in cash

flow due to factors such as higher resource recovery, lower

development costs, lower operating costs, among others.

Technology investments. Expenditures to fund and support

the activities of the ExxonMobil Technology and Engineering

Company, which includes research, development, engineering, and

information technology. Other technology expenditures are not

included in the definition for this disclosure.

Total shareholder return (TSR). For the purposes of this

disclosure, total shareholder return is as defined by FactSet and

measures the change in value of an investment in common stock over

a specified period of time, assuming dividend reinvestment. For

this purpose, FactSet assumes dividends are reinvested in stock at

market prices on the ex-dividend date. Unless stated otherwise,

total shareholder return is quoted on an annualized basis.

Supplemental Information

Reconciliation of 2019 Earnings and

Cash Flow from Operations

2019 Earnings (Billion USD)

TOTAL

Earnings (U.S. GAAP)

14.3

Asset Management

(3.7)

Impairment

0.0

Tax / Other Items

(1.1)

Earnings ex. Identified Items

9.6

Adjustment to 2024 $65/bbl real Brent and

10-year average Energy, Chemical, and Specialty Product margins

0.6

Earnings, ex. identified items and

adjusted to 2024 $65/bbl real Brent and 10-year average Energy,

Chemical, and Specialty Product margins

10.2

2019 Cash Flow from Operations (Billion

USD)

Earnings, ex. identified items and

adjusted to 2024 $65/bbl real Brent and 10-year average Energy,

Chemical, and Specialty Product margins

10.2

Depreciation, ex. identified items

19.0

Cash flow from operating activities,

ex. Identified items (excluding working capital / other), adjusted

to 2024 $65/bbl real Brent and 10-year average Energy, Chemical,

and Specialty Product margins

29.2

Calculation of Structural Cost Savings

(Billion USD)

2019

2023

YTD’23

YTD’24

Components of operating costs

From ExxonMobil’s Consolidated

statement of income

(U.S. GAAP)

Production and manufacturing expenses

36.8

36.9

27.0

28.8

Selling, general and administrative

expenses

11.4

9.9

7.3

7.4

Depreciation and depletion (includes

impairments)

19.0

20.6

12.9

16.9

Exploration expenses, including dry

holes

1.3

0.8

0.6

0.6

Non-service pension and postretirement

benefit expense

1.2

0.7

0.5

0.1

Subtotal

69.7

68.9

48.3

53.7

ExxonMobil’s share of equity company

expenses (non-GAAP)

9.1

10.5

7.4

7.1

Total adjusted operating costs

(non-GAAP)

78.8

79.4

55.7

60.8

Total adjusted operating costs

(non-GAAP)

78.8

79.4

55.7

60.8

Less:

Depreciation and depletion (includes

impairments)

19.0

20.6

12.9

16.9

Non-service pension and postretirement

benefit expense

1.2

0.7

0.5

0.1

Other adjustments (including equity

company depreciation and depletion)

3.6

3.7

2.3

2.5

Total cash operating expense (cash

opex) (non-GAAP)

55.0

54.4

40.0

41.3

Energy and production taxes (non-GAAP)

11.0

14.9

11.0

10.3

Total cash operating expenses (cash

opex) excluding energy and production taxes (non-GAAP)

44.0

39.5

29.0

31.0

vs. 2019

vs. 2023

Cumulative

Total cash operating expenses (cash

opex) excluding energy and production taxes (non-GAAP)

-4.5

+2.0

Market

+3.6

+0.4

Activity/Other

+1.6

+3.2

Structural cost savings

-9.7

-1.6

-11.3

___________________

1 Increases are versus 2024. Earnings and

cash flow from operations exclude identified items and are adjusted

to 2024 $65/bbl real Brent (assumes annual inflation of 2.5%) and

10-year average Energy, Chemical, and Specialty Product margins,

which refer to the average of annual margins from 2010-2019. Cash

flow from operations also excludes working capital/other.

2 $3 billion in Pioneer synergies is a

>50% increase vs. prior disclosures and is based on a 10-year

average.

3 $3 billion by 2030 subject to additional

investment by ExxonMobil, final 45V regulations for hydrogen

production credits, and receipt of government permitting for carbon

capture and storage projects.

4 Lower emissions cash capex includes cash

capex attributable to carbon capture and storage, hydrogen,

lithium, biofuels, ProxximaTM, Carbon Materials, and activities to

lower ExxonMobil’s emissions and/or third party (3P) emissions.

Planned spend is from 2025-2030.

5 See below for definition of reinvestment

rate. Cash flow from operations excludes identified items and

working capital/other is adjusted to 2024 $65/bbl real Brent

(assumes annual inflation of 2.5%) and 10-year average Energy,

Chemical, and Specialty Product margins, which refer to the average

of annual margins from 2010-2019.

6 Earnings and cash flow from operations

exclude identified items and are adjusted to 2024 $65/bbl real

Brent (assumes annual inflation of 2.5%) and 10-year average

Energy, Chemical, and Specialty Product margins, which refer to the

average of annual margins from 2010-2019. Cash flow from operations

also excludes working capital/other.

7 Third-party cash flow refers to cash

flow excluding working capital/other and is calculated as earnings

sourced from FactSet plus depreciation sourced from FactSet. 2019

to 2023 figures are actuals. 2024 figures are consensus estimates

as of December 5, 2024. Three- and five-year CAGRs are from 2021 to

2024E and 2019 to 2024E respectively.

8 Calculated as of November 29, 2024.

9 Major investments represents investments

over $500 million that are expected to start up between 2025 and

2030. Includes pre-2025 capex spend on these investments, except

for the Permian work program, which is limited to capex between

2025-2030. Calculations for full-life major investments returns are

based on ExxonMobil internal project plans for investments over

$500 million that are expected to start up between 2025 and 2030

and the Permian work program. Calculations include internal project

plan price assumptions.

10 Surplus cash is calculated assuming

2024 $65 real Brent (assumes annual inflation of 2.5%) and 10-year

average Energy, Chemical, and Specialty Product margins, which

refer to the average of annual margins from 2010-2019. Any

decisions on future dividend levels are at the discretion of the

Board of Directors. This calculation assumes dividends are held

flat relative to 4Q24 levels. The PP&E / I&A factor

includes changes in non-controlling interests. 3Q24 cash balance

excludes a $5 billion minimum cash assumption.

11 Plans based on Scope 1 and Scope 2

emissions from operated assets. Intensity is calculated as

emissions per metric ton of throughput/production. ExxonMobil

reported emissions, reductions, and avoidance performance data are

based on a combination of measured and estimated emissions data

using reasonable efforts and collection methods. Calculations are

based on industry standards and best practices, including guidance

from the American Petroleum Institute (API) and Ipieca. There is

uncertainty associated with the emissions, reductions, and

avoidance performance data due to variation in the processes and

operations, the availability of sufficient data, quality of those

data, and methodology used for measurement and estimation.

Performance data may include rounding. Changes to the performance

data may be reported as part of the Company’s annual publications

as new or updated data and/or emission methodologies become

available. We are working to continuously improve our performance

and methods to detect, measure and address greenhouse gas

emissions. ExxonMobil works with industry, including API and

Ipieca, to improve emission factors and methodologies, including

measurements and estimates. ExxonMobil’s plans regarding expected

GHG emissions reductions by 2030 can be found in our 2024 Advancing

Climate Solutions report.

12 Based on Enverus 2024 Permian Basin

Play Fundamentals article with updated data as of 10/2024 |

Locations normalized to 10,000-foot laterals; Peers include Apache

Corporation, BP, ConocoPhillips, Coterra Energy, Chevron, Devon

Energy, Diamondback Energy, EOG Resources, Matador Resources,

Ovintiv, Occidental, and Permian Resources. PV-10 Breakeven @ 20:1

WTI:HH ($/bbl).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241210516473/en/

ExxonMobil Media Relations (737) 272-1452

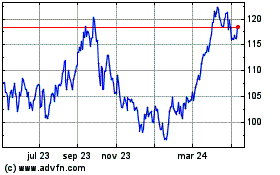

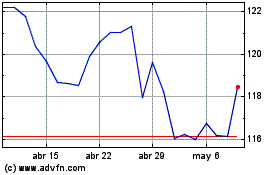

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Exxon Mobil (NYSE:XOM)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024