Cameco Pleased as Federal Court of Appeal Unanimously Upholds Tax Court Decision

26 Junio 2020 - 6:11PM

Cameco (TSX: CCO; NYSE: CCJ) announced today that

the Federal Court of Appeal (Court of Appeal) has upheld the

September 26, 2018 decision of the Tax Court of Canada (Tax Court).

The 2018 decision, which had been appealed by Canada Revenue Agency

(CRA), was unequivocally in Cameco’s favour in its dispute of

reassessments issued by CRA for the 2003, 2005 and 2006 tax years.

“We are very pleased that the Court of Appeal has unanimously

upheld the Tax Court’s clear and decisive ruling in our favour,”

said Cameco president and CEO Tim Gitzel. “Four judges have now

found that Cameco complied with both the letter and intent of the

law. We followed the rules, yet this 12-year dispute has caused

significant uncertainty for our company and our stakeholders at a

time when we have been navigating through some of the most

challenging global market and economic conditions we have ever

faced.”

The September 2018 ruling from the Tax Court found that Cameco’s

marketing and trading structure involving foreign subsidiaries, as

well as the related transfer pricing methodology used for certain

intercompany uranium sales and purchasing agreements, are in full

compliance with Canadian laws for the tax years in question. CRA

appealed this decision to the Court of Appeal on October 26,

2018.

On April 30, 2019, a subsequent decision by the Tax Court

resulted in Cameco being awarded $10.25 million in legal fees and

up to $17.9 million in disbursements for costs incurred as a result

of its dispute with CRA. CRA requested that this cost award be

overturned if its appeal of the September 2018 decision was

successful.

The Court of Appeal’s ruling upholds both the Tax Court’s

original decision on reassessments for the 2003, 2005 and 2006 tax

years and its corresponding decision on the cost award. Cameco will

also be receiving an additional nominal cost award related to the

Court of Appeal hearing.

Under the current rules, CRA has until September 25, 2020 to

seek leave to appeal the decision of the Court of Appeal to the

Supreme Court of Canada. However, proposed legislation related to

COVID-19 pandemic measures is presently under consideration that

would extend the deadline to November 12, 2020. If the Supreme

Court agrees to hear the appeal, Cameco estimates that a further

two years would be required from the date of the Court of Appeal’s

ruling to receive a decision.

If an appeal to the Supreme Court is not sought or granted, then

the dispute over the 2003, 2005 and 2006 tax years is resolved in

Cameco’s favour. Cameco would expect to receive a refund of $5.5

million plus interest for instalments the company paid on previous

reassessments issued by CRA for the 2003, 2005 and 2006 tax years,

as well as the costs awarded by the Tax Court and Court of

Appeal.

The Court of Appeal ruling is not legally binding on the

subsequent tax years in dispute (2007 through 2013), but we believe

it should apply in principle to these tax years and any other tax

years yet to be reassessed.

“Cameco has consistently worked hard to be a good corporate

citizen,” Gitzel said. “We have invested billions of dollars in

Canada, contributed considerably to the well-being of our

communities, and been recognized as one of Canada’s leading

partners, employers and supporters of Indigenous people. Even as we

have managed our way through the incredible challenges posed by the

COVID-19 pandemic, Cameco has not laid off any of our employees and

has not benefitted from any of the related funding governments have

made available to businesses.”

The Government of Canada continues to hold $303 million in cash

and $482 million in letters of credit that Cameco has been required

to pay as instalments on the reassessments issued by CRA for all

tax years in dispute (2003 through 2013), tying up a sizeable

amount of the company’s financial capacity. With both court

decisions in its favour, Cameco will be asking the government to

return these instalments to the company, even if leave to appeal is

requested by CRA.

“Cameco’s position has prevailed at every stage of the legal

process,” Gitzel said. “If CRA feels the laws aren’t written the

way they want, then it’s clear they need to approach the government

to change the laws moving forward, not continue to pursue the same

arguments over and over again before different courts and expect a

different outcome.

“We therefore hope CRA accepts the Court of Appeal’s decision

and applies it to subsequent tax years so that we can finally move

on from this dispute and focus on managing our business for the

benefit of all our stakeholders.”

The Court of Appeal’s written decision is expected to be

received next week and will be posted alongside the Tax Court’s

September 2018 decision on Cameco’s website at www.cameco.com.

Profile

Cameco is one of the largest global providers of the uranium

fuel needed to energize a clean-air world. Our competitive

position is based on our controlling ownership of the world’s

largest high-grade reserves and low-cost operations. Utilities

around the world rely on our nuclear fuel products to generate

power in safe, reliable, carbon-free nuclear reactors. Our shares

trade on the Toronto and New York stock exchanges. Our head office

is in Saskatoon, Saskatchewan.

Caution Regarding Forward-Looking Information and

Statements

This news release includes statements and information about our

expectations for the future, which we refer to as forward-looking

information. Forward-looking information is based on our current

views, which can change significantly, and actual results and

events may be significantly different from what we currently

expect. Examples of forward-looking information in this news

release include our estimate regarding the time it would take to

receive a decision of the Supreme Court if CRA seeks leave to

appeal the decision and the Supreme Court agrees to hear the

appeal; our expectation of receiving a refund of $5.5 million plus

interest for instalments paid on previous reassessments, as well as

the costs awarded by the Tax Court and the Court of Appeal; our

belief the Court of Appeal’s ruling should apply in principle to

other years; and our intention to seek the return of funds held by

the Government of Canada as instalments on reassessments even if

the CRA seeks leave to appeal. Material risks that could lead to

different results include the possibility that it will take longer

to receive a decision if the Supreme Court agrees to hear an

appeal; the risk that we will not receive the full amount, or any

portion, of our expected refund of $5.5 million plus interest for

instalments paid and the costs awarded by the Tax Court and the

Court of Appeal; the possibility of a materially different outcome

in disputes for other years; and the risk that we will be unable to

recover funds held by the Government of Canada if CRA seeks leave

to appeal. In presenting this forward-looking information, we have

made assumptions which may prove incorrect about the time it would

take to receive a decision if the Supreme Court agrees to hear an

appeal; our ability to obtain refunds of past instalment payments

and cost awards; and our ability to recover funds if CRA seeks

leave to appeal. Forward-looking information is designed to help

you understand management’s current views of our near-term and

longer-term prospects, and it may not be appropriate for other

purposes. We will not necessarily update this information unless we

are required to by securities laws.

Investor inquiries:Rachelle

Girard306-956-6403rachelle_girard@cameco.com

Media inquiries:Jeff

Hryhoriw306-385-5221jeff_hryhoriw@cameco.com

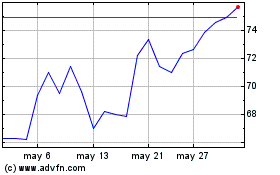

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024