Cameco (TSX: CCO; NYSE: CCJ) today reported its consolidated

financial and operating results for the second quarter ended June

30, 2020 in accordance with International Financial Reporting

Standards (IFRS).

“The coronavirus (COVID-19) pandemic has had a significant

impact on people and the economy around the world.” said Tim

Gitzel, Cameco’s president and CEO. “Cameco too has felt the impact

with the proactive shutdown of our operations resulting in an

additional $37 million in care and maintenance costs and an

increased reliance on the spot market for uranium supply, which are

reflected in our results. However, we continue to do our part to

keep people safe and help rebuild the economy. We believe that the

pro-active actions we have taken to slow the spread of the COVID-19

virus are prudent and reflect our values – placing priority on the

health and safety of our employees, their families and their

communities.

“We expect our business to be resilient. Our customers continue

to need uranium fuel to power the carbon-free nuclear electricity

that will be part of the critical infrastructure needed to ensure

hospitals, care facilities and other essential services are

available during this pandemic. However, the COVID-19 pandemic has

disrupted global uranium production adding to the supply

curtailments that have already occurred in the industry due to the

lack of production economics. The industry is reliant on supply

that has become highly concentrated both geographically and

geologically. With the ongoing uncertainty about supply during the

pandemic and trade policy issues, we think the risks to supply are

greater than the risk to demand.

“Therefore, we think our plan to restart Cigar Lake at the

beginning of September is prudent. While health and safety are the

primary considerations for the timing of our Cigar Lake mine

restart decision, there were also commercial considerations,

including market-related factors and the impact on our cost

structure. We will not be able to make up the lost production and

are therefore targeting our share of 2020 production to be up to

5.3 million pounds in total. With the uncertainty remaining about

our ability to restart and continue operating the Cigar Lake mine,

the delays and deferrals of project work and therefore the

resulting production rate in 2020 and 2021, we believe the current

plan represents an appropriate balance of the commercial

considerations affecting our decision.

“We have the tools we need to deal with the current uncertain

environment. We are well positioned to self-manage risk. We have

$878 million in cash and short-term investments on our balance

sheet and a $1 billion undrawn credit facility, which we do not

anticipate we will need to draw on this year. And, we believe our

risks have been significantly reduced with the Federal Court of

Appeal’s unanimous decision in our favour in our tax case with the

Canada Revenue Agency (CRA) for the tax years 2003, 2005 and 2006.

Based on our belief that the principles in the decision apply to

all tax years subsequent to 2006, we expect to recover the $303

million in cash paid and $482 million in letters of credit secured

with the CRA in relation to this dispute.

“We remain resolved in our strategy to build long-term value. We

continue to expect that security of supply will be a priority for

our customers and a rising price environment will provide us with

the opportunity to add value with our tier-one assets.

“Embedded in all our decisions is a commitment to addressing the

environmental, social and governance risks and opportunities that

we believe will make our business sustainable over the long term.

In these uncertain times, perhaps more than ever, it will be

critical that we continue to work together to build on the strong

foundation we have already established.”

- Net loss of $53 million; adjusted net loss of $65

million: Results are driven by normal quarterly variations

in contract deliveries and our continued execution on all strategic

fronts. This quarter was also impacted by increasing uranium

prices, increased purchase activity and additional care and

maintenance costs of $37 million resulting from proactive decisions

to suspend production at the Cigar Lake mine, Blind River refinery

and Port Hope UF6 conversion plant in response to the COVID-19

pandemic. Adjusted net earnings is a non-IFRS measure, see

below.

- Expect higher average unit cost of sales due to impacts

of the COVID-19 pandemic: Given the production

interruptions at the Cigar Lake mine and at the Inkai operations,

we expect an increase in our required spot market purchasing in

2020 to meet our delivery commitments and to maintain our desired

inventory levels. Combined with the additional care and maintenance

costs associated with the temporary closure of the Cigar Lake mine

we expect the average unit cost of sales in our uranium segment to

be higher than disclosed in our 2019 annual MD&A. However, the

exact magnitude of the increase is uncertain and will be dependent

on our ability to achieve the 5.3 million-pound (our share)

production target at Cigar Lake and on the volume of purchases

made. See Outlook for 2020 in our second quarter MD&A for more

information.

- Planned Cigar Lake restart: Providing it is

safe to do so, we plan to restart the Cigar Lake mine at the

beginning of September. If we are able to restart and maintain

continued operations, we are targeting our share of production for

2020 to be up to 5.3 million pounds in total. The restart will be

dependent on our ability to establish safe and stable operating

protocols among other factors, including availability of the

necessary workforce and how the COVID-19 pandemic is affecting

northern Saskatchewan.

- Fuel services division benefiting from conversion

market transition: With the restart of the Blind River

refinery and Port Hope UF6 conversion plant in May, and despite a

slight decrease in expected production due to the temporary

COVID-19 pandemic-related suspension, weaker performance in our

uranium segment is being partially offset by the strong performance

of our fuel services division.

- Strong balance sheet: As of June 30, 2020, we

had $878 million in cash and short-term investments and $1.0

billion in long-term debt with maturities in 2022, 2024 and 2042.

In addition, we have a $1 billion undrawn credit facility. We

expect our cash balances and operating cash flows to meet our

capital requirements during 2020, therefore, we do not anticipate

drawing on our credit facility this year.

- Federal Court of Appeal upheld Tax Court

decision: On June 26, 2020, the Federal Court of Appeal

decided unanimously in our favour in our dispute with CRA. The

decision upholds the September 26, 2018 decision of the Tax Court

of Canada, which was unequivocally in our favour for the 2003,

2005, and 2006 tax years and it sustains the corresponding decision

on the cost award. As a result, we expect to receive refunds

totaling $5.5 million plus interest for the three tax years and

$10.25 million for legal fees incurred plus an amount for

disbursements of up to $17.9 million. Timing of any payments is

uncertain. We believe the principles in the decision apply to all

subsequent tax years. See Transfer pricing dispute in our second

quarter MD&A for more information.

- Spot prices holding, and long-term fundamentals remain

strong: Low uranium prices, government-driven trade

policies and the COVID-19 pandemic are having an effect on the

security of supply in our industry. In addition to the supply

curtailments that have occurred in the industry for many years, we

have seen a number of unplanned supply disruptions since March,

including our suspension at the Cigar Lake mine and the reduction

in operational activities across all mines in Kazakhstan. The

duration and extent of these disruptions are still unknown.

Following the announcements, the uranium spot price initially

increased by more than 35%. Recently prices have held at a level

that is averaging close to $10 (US) per pound higher than spot

prices in 2019. As noted recently by the International Atomic

Energy Agency, while electricity demand in the near-term has

declined, the proportion of nuclear power has increased relative to

fossil fuel sources which demonstrates the resilience of the clean,

carbon-free, base-load electricity generation that nuclear power

provides.

|

Consolidated financial results |

|

|

|

|

|

|

|

|

|

|

|

|

THREE MONTHS |

|

SIX MONTHS |

|

| CONSOLIDATED

HIGHLIGHTS |

ENDED JUNE 30 |

|

ENDED JUNE 30 |

|

| ($

MILLIONS EXCEPT WHERE INDICATED) |

2020 |

2019 |

CHANGE |

2020 |

2019 |

CHANGE |

|

Revenue |

525 |

388 |

35% |

871 |

685 |

27% |

| Gross

profit (loss) |

(14) |

42 |

>(100%) |

21 |

59 |

(64)% |

| Net

losses attributable to equity holders |

(53) |

(23) |

>(100%) |

(72) |

(41) |

(76)% |

|

|

$ per

common share (basic) |

(0.13) |

(0.06) |

>(100%) |

(0.18) |

(0.10) |

(80)% |

|

|

$ per

common share (diluted) |

(0.13) |

(0.06) |

>(100%) |

(0.18) |

(0.10) |

(80)% |

|

Adjusted net losses (non-IFRS, see below) |

(65) |

(18) |

>(100%) |

(36) |

(51) |

29% |

|

|

$ per

common share (adjusted and diluted) |

(0.16) |

(0.04) |

>(100%) |

(0.09) |

(0.13) |

31% |

| Cash

provided by (used in) operations (after working capital

changes) |

(316) |

(59) |

>(100%) |

(134) |

21 |

>(100%) |

The financial information presented for the three months

and six months ended June 30, 2019 and June 30, 2020 is

unaudited.

NET EARNINGS

The following table shows what contributed to the change in net

earnings and adjusted net earnings (non-IFRS measure, see below) in

the second quarter and first six months of 2020, compared to the

same period in 2019.

| CHANGES IN EARNINGS |

THREE MONTHS |

SIX MONTHS |

| ($ MILLIONS) |

ENDED JUNE 30 |

ENDED JUNE 30 |

|

|

IFRS |

ADJUSTED |

IFRS |

ADJUSTED |

|

Net losses – 2019 |

(23) |

(18) |

(41) |

(51) |

| Change in gross profit by segment |

|

|

|

|

| (We

calculate gross profit by deducting from revenue the cost of

products and services sold, and depreciation and amortization

(D&A)) |

|

Uranium |

Higher sales

volume |

9 |

9 |

7 |

7 |

| |

Lower realized prices ($US) |

(1) |

(1) |

(6) |

(6) |

| |

Foreign exchange impact on realized prices |

18 |

18 |

15 |

15 |

| |

Higher costs |

(83) |

(83) |

(65) |

(65) |

| |

Change – uranium |

(57) |

(57) |

(49) |

(49) |

| Fuel services |

Higher sales volume |

- |

- |

1 |

1 |

| |

Higher realized prices ($Cdn) |

11 |

11 |

19 |

19 |

| |

Higher costs |

(7) |

(7) |

(6) |

(6) |

| |

Change – fuel services |

4 |

4 |

14 |

14 |

| Higher administration expenditures |

(6) |

(6) |

(4) |

(4) |

| Lower exploration expenditures |

1 |

1 |

2 |

2 |

| Change in reclamation provisions |

1 |

- |

9 |

- |

| Lower earnings from equity-accounted investee |

(11) |

(11) |

(10) |

(10) |

| Change in gains or losses on derivatives |

24 |

- |

(61) |

8 |

| Change in foreign exchange gains or losses |

(5) |

(5) |

45 |

45 |

| Change in income tax recovery or expense |

16 |

24 |

10 |

(4) |

| Other |

3 |

3 |

13 |

13 |

|

Net losses – 2020 |

(53) |

(65) |

(72) |

(36) |

Adjusted net earnings (non-IFRS measure)

Adjusted net earnings is a measure that does not have a

standardized meaning or a consistent basis of calculation under

IFRS (non-IFRS measure). We use this measure as a meaningful way to

compare our financial performance from period to period. We believe

that, in addition to conventional measures prepared in accordance

with IFRS, certain investors use this information to evaluate our

performance. Adjusted net earnings is our net earnings attributable

to equity holders, adjusted to reflect the underlying financial

performance for the reporting period. The adjusted earnings measure

reflects the matching of the net benefits of our hedging program

with the inflows of foreign currencies in the applicable reporting

period, and has also been adjusted for reclamation provisions for

our Rabbit Lake and US operations, which had been impaired, and

income taxes on adjustments.

Adjusted net earnings is non-standard supplemental information

and should not be considered in isolation or as a substitute for

financial information prepared according to accounting standards.

Other companies may calculate this measure differently, so you may

not be able to make a direct comparison to similar measures

presented by other companies.

The following table reconciles adjusted net earnings with net

earnings for the second quarter and first six months of 2020 and

compares it to the same periods in 2019.

| |

|

THREE MONTHS |

SIX MONTHS |

|

|

|

ENDED JUNE 30 |

ENDED JUNE 30 |

| ($

MILLIONS) |

2020 |

2019 |

2020 |

2019 |

|

Net losses attributable to equity holders |

(53) |

(23) |

(72) |

(41) |

|

Adjustments |

|

|

|

|

|

|

Adjustments on derivatives |

(41) |

(17) |

29 |

(40) |

| |

Reclamation provision

adjustments |

23 |

24 |

17 |

26 |

|

|

Income

taxes on adjustments |

6 |

(2) |

(10) |

4 |

|

Adjusted net losses |

(65) |

(18) |

(36) |

(51) |

Every quarter we are required to update the reclamation

provisions for all operations based on new cash flow estimates,

discount and inflation rates. This normally results in an

adjustment to an asset retirement obligation asset in addition to

the provision balance. When the assets of an operation have been

written off due to an impairment, as is the case with our Rabbit

Lake and US ISR operations, the adjustment is recorded directly to

the statement of earnings as “other operating expense (income)”.

See note 7 of our interim financial statements for more

information. This amount has been excluded from our adjusted net

earnings measure.

Selected segmented highlights

| |

|

|

THREE MONTHS |

|

SIX MONTHS |

|

|

|

|

|

ENDED JUNE 30 |

|

ENDED JUNE 30 |

|

|

HIGHLIGHTS |

2020 |

2019 |

CHANGE |

2020 |

2019 |

CHANGE |

|

Uranium |

Production volume (million lbs) |

- |

2.5 |

(100)% |

2.1 |

5.0 |

(58)% |

| |

Sales

volume (million lbs) |

9.2 |

6.6 |

39% |

15.2 |

11.5 |

32% |

|

|

Average realized price |

($US/lb) |

32.99 |

33.07 |

- |

32.36 |

32.64 |

(1)% |

| |

|

($Cdn/lb) |

46.13 |

44.31 |

4% |

44.28 |

43.67 |

1% |

| |

Revenue

($ millions) |

426 |

293 |

45% |

674 |

500 |

35% |

|

|

Gross

profit (loss) ($ millions) |

(34) |

23 |

(248)% |

(29) |

20 |

(245)% |

| Fuel

services |

Production volume (million kgU) |

2.7 |

3.9 |

(31)% |

6.4 |

7.7 |

(17)% |

| |

Sales

volume (million kgU) |

3.2 |

3.2 |

- |

6.3 |

6.2 |

2% |

| |

Average

realized price |

($Cdn/kgU) |

28.95 |

25.37 |

14% |

29.43 |

26.29 |

12% |

| |

Revenue

($ millions) |

92 |

80 |

15% |

186 |

163 |

14% |

|

|

Gross

profit ($ millions) |

24 |

19 |

26% |

53 |

40 |

33% |

Board of directors’ update

Cameco’s board of directors has appointed Leontine Atkins as a

board member effective August 1, 2020. Atkins currently serves as a

director on the boards of Seven Generations Energy and Points

International, a leading global loyalty ecommerce platform. She

served as a Partner at KPMG Canada from 2006 until early 2019 and

was previously a Partner at KPMG Netherlands. Atkins holds a

Bachelor of Business Administration in Finance from Acadia

University and a Master of Business Administration from Dalhousie

University. She has also obtained her CPA, CA designation as well

as the ICD.D designation from the Institute of Corporate Directors.

Atkins will serve on Cameco’s reserves oversight and nominating,

corporate governance and risk committees upon her appointment as a

director.

Management's discussion and analysis and financial

statements

The second quarter MD&A and unaudited condensed consolidated

interim financial statements provide a detailed explanation of our

operating results for the three and six months ended June 30, 2020,

as compared to the same periods last year. This news release should

be read in conjunction with these documents, as well as our audited

consolidated financial statements and notes for the year ended

December 31, 2019, first quarter and annual MD&A, and our most

recent annual information form, all of which are available on our

website at cameco.com, on SEDAR at sedar.com, and on EDGAR at

sec.gov/edgar.shtml.

Qualified persons

The technical and scientific information discussed in this

document for our material property Cigar Lake was approved by the

following individual who is a qualified person for the purposes of

NI 43-101:

- Lloyd Rowson, general manager, Cigar Lake, Cameco

Caution about forward-looking information

This news release includes statements and information about our

expectations for the future, which we refer to as forward-looking

information. Forward-looking information is based on our current

views, which can change significantly, and actual results and

events may be significantly different from what we currently

expect.

Examples of forward-looking information in this news release

include: our expectation that we are well positioned financially

with solid balance sheet supported by planned restart at Cigar

Lake; our expectations regarding our business resiliency, ability

to self-manage risk, and not drawing on our credit facility,

including to fund 2020 capital requirements; our expectation that

we will continue to provide the uranium fuel required to power

nuclear electricity to ensure essential services are available

during this pandemic; our belief that our risks have been

significantly reduced with the Federal Court of Appeal decision and

that the principles in the decision apply to subsequent tax years;

expected recovery of $785 million paid or secured to date with CRA

and $10.25 million in legal fees and an amount for disbursements;

our plan to restart Cigar Lake and targeted share of 2020

production; expectations for 2020 spot market purchases, unit cost

of sales, and cash balances; our view that the fuel services

division is benefiting from the conversion market transition; our

views on the uranium market, including spot prices, long term

fundamentals, supply, demand and opportunities to add value; and

expected dates for future announcements of financial results.

Material risks that could lead to different results include:

that we may be required to draw on our credit facility to manage

disruptions to our business caused by the COVID-19 pandemic and to

fund 2020 capital requirements; that we may be unable to

successfully manage the current uncertain environment resulting

from the COVID-19 pandemic and its related operational, safety,

marketing or financial risks successfully, including the risk of

significant disruption to our operations, workforce, required

supplies or services, and ability to produce, transport and deliver

uranium; that our business may not be as resilient in recovering

from the disruptions caused by the COVID-19 pandemic as we expect;

that our Cigar Lake restart and production plans are delayed or do

not succeed for any reason; that our views on the uranium market,

providing uranium fuel required to power nuclear electricity during

the COVID-19 pandemic, or our risks prove to be inaccurate; we are

unsuccessful in an appeal of the Federal Court of Appeal’s decision

and this ultimately gives rise to material tax liabilities and

payment obligations that would have a material adverse effect on

us; the possibility of materially different outcomes in disputes

with CRA for subsequent tax years; the risk we may for any reason

be unable to obtain a full refund of amounts we have paid or

secured, or the full payment of cost awards; unexpected changes in

uranium supply, demand, contracting, and prices; a major accident

at a nuclear power plant; changes in government regulations or

policies; the risk of litigation or arbitration claims or appeals

against us that have an adverse outcome; the risk our strategies

may change, be unsuccessful or have unanticipated consequences; the

risk our estimates and forecasts prove to be incorrect; and the

risk that we may be delayed in announcing future financial

results.

In presenting this forward-looking information, we have made

material assumptions which may prove incorrect, including

assumptions regarding our ability to successfully manage the

current uncertain environment resulting from the COVID-19 pandemic

and its related operational, safety, marketing and financial risks

successfully; the ability of our business to recover from the

disruptions caused by the COVID-19 pandemic; the ability to manage

disruptions to our business caused by the COVID-19 pandemic without

drawing on our credit facility; the principles in the Federal Court

of Appeal decision should apply to all subsequent tax years; our

ability to obtain refunds of the amounts we have previously paid or

secured and payment of cost awards; assumptions regarding our

ability to resume and maintain production at Cigar Lake and the

McClean Lake mill’s ability to restart and mill Cigar Lake ore; our

assumptions about uranium supply, demand, contracting and prices;

the market conditions and other factors upon which we have based

our future plans and forecasts; the absence of any adverse

government regulations, policies or decisions; the successful

outcome of any litigation or arbitration claims or appeals against

us; and our ability to announce future financial results when

expected.

Forward-looking information is designed to help you understand

management’s current views of our near-term and longer-term

prospects, and it may not be appropriate for other purposes. We

will not necessarily update this information unless we are required

to by securities laws.

Conference call

We invite you to join our second quarter conference call on

Wednesday, July 29, 2020, at 8:00 a.m. Eastern.

The call will be open to all investors and the media. To join

the call, please dial 1-800-319-4610 (Canada and US) or

1-604-638-5340. An operator will put your call through. The slides

and a webcast of the conference call will be available from a link

at cameco.com. See the link on our home page on the day of the

call.

A recorded version of the proceedings will be available:

- on our website, cameco.com, shortly after the call

- on post view until midnight, Eastern, August 29, 2020, by

calling 1-800-319-6413 (Canada and US) or 1-604-638-9010 (Passcode

4735)

2020 quarterly report release dates

We plan to announce our 2020 third quarter consolidated

financial and operating results before markets open on November 6,

2020.

The 2021 date for the announcement of our fourth quarter

and 2020 consolidated financial and operating results will be

provided in our 2020 third quarter MD&A. Announcement dates are

subject to change.

Profile

Cameco is one of the largest global providers of the uranium

fuel needed to energize a clean-air world. Our competitive position

is based on our controlling ownership of the world’s largest

high-grade reserves and low-cost operations. Utilities around the

world rely on our nuclear fuel products to generate power in safe,

reliable, carbon-free nuclear reactors. Our shares trade on the

Toronto and New York stock exchanges. Our head office is in

Saskatoon, Saskatchewan.

As used in this news release, the terms we, us, our, the Company

and Cameco mean Cameco Corporation and its subsidiaries unless

otherwise indicated.

Investor inquiries: Rachelle Girard

306-956-6403rachelle_girard@cameco.com

Media inquiries: Jeff Hryhoriw

306-385-5221jeff_hryhoriw@cameco.com

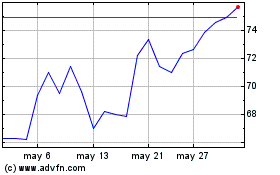

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024