Cogeco Releases Its Results for the Third Quarter of Fiscal 2019

10 Julio 2019 - 5:18PM

Today, Cogeco Inc. (TSX: CGO) ("Cogeco" or the "Corporation")

announced its financial results for the third quarter ended

May 31, 2019, in accordance with International Financial

Reporting Standards ("IFRS").

Following Cogeco Communications' announcement on

February 27, 2019 of the agreement to sell Cogeco Peer 1 Inc., its

Business information and communications technology ("Business ICT")

services subsidiary, the operating and financial results from this

subsidiary for the current and comparable periods are presented as

discontinued operations separate from the Corporation's continuing

operations.

For the third quarter of fiscal 2019:

- Revenue increased by 3.1% (1.3% in constant currency) compared

to the same period of the prior year to reach $617.6 million driven

by growth of 3.6% (1.7% in constant currency) in the Communications

segment, partly offset by a decrease of 4.8% in the Other segment.

Revenue increased in the Communications segment mostly as a result

of organic growth and the acquisition of the south Florida fibre

network previously owned by FiberLight, LLC (the "FiberLight

acquisition") on October 3, 2018 in the American broadband services

operations, partly offset by a decrease of 4.8% in the Other

segment resulting mainly from a soft advertising market and

increased competition in the media activities;

- Adjusted EBITDA increased by 4.5% (2.9% in constant currency)

to reach $289.9 million mostly attributable to the higher adjusted

EBITDA in the Communications segment as a result of increases in

both the American and Canadian broadband services

operations;

- Profit for the period from continuing operations amounted to

$102.6 million of which $33.7 million, or $2.09 per share, was

attributable to owners of the Corporation compared, respectively,

to $76.1 million, $26.9 million, or $1.64 per share, for the same

period of fiscal 2018. The increase resulted mainly from higher

adjusted EBITDA combined with a decrease in financial expense,

partly offset by increases in income taxes and depreciation and

amortization;

- On April 30, 2019, Cogeco Communications completed the sale of

its subsidiary Cogeco Peer 1 Inc., its Business ICT services

subsidiary, to affiliates of Digital Colony for a net cash

consideration of $720 million resulting in a gain on sale of $82.4

million. For the third quarter of fiscal 2019, profit for the

period from discontinued operations amounted to $82.5 million

mainly due to the gain of disposal of a subsidiary compared to a

loss for the period of $5.4 million for the same period of the

prior year;

- Profit for the period amounted to $185.0 million of which $59.9

million, or $3.71 per share, was attributable to owners of the

Corporation compared, respectively, to $70.8 million, $25.2

million, or $1.54 per share, for the same period of fiscal 2018.

The variation is mainly due to a gain of $82.4 million resulting

from the sale of Cogeco Peer 1 combined with higher adjusted EBITDA

in the Communications segment;

- Free cash flow, from continuing operations, increased by 28.3%

to reach $140.4 million. On a constant currency basis, free cash

flow increased by 27.9% as a result of higher adjusted EBITDA

combined with a decrease in financial expense;

- Cash flow from operating activities increased by 55.7% to reach

$267.4 million for the same period of the prior year mainly due to

higher adjusted EBITDA combined with decreases in income taxes

paid, financial expense paid and changes in non-cash operating

activities primarily due to changes in working capital;

- The Corporation released its fiscal 2020 preliminary financial

guidelines. On a constant currency basis, the Corporation expects

fiscal 2020 revenue to grow between 2% and 4%, adjusted EBITDA

between 2.5% and 4.5%, acquisition of property, plant and equipment

should reach between $465 million and $485 million and free cash

flow is expected to grow between 5% and 11%; and

- At its July 10, 2019 meeting, the Board of Directors of

Cogeco declared a quarterly eligible dividend of $0.43 compared to

$0.39 per share in the comparable period of fiscal 2018;

|

(1) |

The indicated terms do not have standardized definitions prescribed

by IFRS and, therefore, may not be comparable to similar measures

presented by other companies. For more details, please consult the

“Non-IFRS financial measures” section of the MD&A. |

“Once again we are very satisfied with our

overall quarterly performance as the results of the third quarter

of fiscal 2019 are in line with expectations,” declared Philippe

Jetté, President and Chief Executive Officer of Cogeco Inc.

“At Cogeco Communications, we reported strong

growth in adjusted EBITDA resulting from our ongoing operational

improvement initiatives at Cogeco Connexion,” stated Mr. Jetté.

“At Atlantic Broadband, we continue to see solid

organic growth,” added Mr. Jetté. “We are seeing the benefits of

our amplified marketing activities with a significant increase in

our primary service units, demonstrating our American broadband

services operations' position as a growth driver for Cogeco

Communications.”

“On April 30 we completed the sale of Cogeco

Peer 1, our Business information and communications technology

operations, to affiliates of Digital Colony. This transaction

resulted in a gain and allows the Corporation to focus on the

growth of our broadband business,” added Mr. Jetté.

"Finally, at our radio subsidiary Cogeco Media,

we are still experiencing the effects of a weak market, however we

are pleased to see that our top stations continue to maintain

strong ratings," concluded Mr. Jetté.

ABOUT COGECO

Cogeco Inc. is a diversified holding corporation

which operates in the communications and media sectors. Its Cogeco

Communications Inc. subsidiary provides residential and business

customers with Internet, video and telephony services through its

two-way broadband fibre networks, operating in Québec and Ontario,

Canada, under the Cogeco Connexion name, and in the United

States under the Atlantic Broadband brand (in 11 states along the

East Coast, from Maine to Florida). Its Cogeco Media subsidiary

owns and operates 23 radio stations with complementary radio

formats and extensive coverage serving a wide range of audiences

mainly across the province of Québec, as well as Cogeco News, a

news agency. Cogeco’s subordinate voting shares are listed on the

Toronto Stock Exchange (TSX: CGO). The subordinate voting shares of

Cogeco Communications Inc. are also listed on the Toronto Stock

Exchange (TSX: CCA).

|

Source: |

Cogeco

Inc. |

| |

Patrice Ouimet |

| |

Senior Vice President and Chief Financial Officer |

| |

Tel.: 514-764-4700 |

| |

|

| Information: |

Media |

| |

Marie-Hélène Labrie |

| |

Senior Vice-President, Public Affairs and Communications |

| |

Tel.: 514-764-4700 |

| |

|

| Analyst Conference Call: |

Thursday, July 11, 2019 at 11:00 a.m. (Eastern

Daylight Time) |

| |

Media representatives may attend as listeners only. |

| |

|

| |

Please use the following dial-in number to have access to the

conference call by dialing five minutes before the start of the

conference: |

| |

|

| |

Canada/United States Access Number:

1-877-291-4570 |

| |

International Access Number: +

1-647-788-4919 |

| |

|

| |

In order to join this conference, participants are only

required to provide the operator with the company name, that is,

Cogeco Inc. or Cogeco Communications Inc. |

| |

|

| |

By Internet at

http://corpo.cogeco.com/cgo/en/investors/investor-relations/ |

| |

|

SHAREHOLDERS’ REPORTThree and

nine-month periods ended May 31, 2019

FINANCIAL HIGHLIGHTS

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended |

Nine months ended |

| |

May 31, 2019 |

May 31, 2018(1) |

|

Change |

|

Change in constant currency(2) |

|

Foreign exchange impact(2) |

May 31, 2019 |

May 31, 2018(1) |

|

Change |

|

Change inconstantcurrency(2) |

|

Foreign exchange impact(2) |

| (in

thousands of dollars, except percentages and per share data) |

$ |

$ |

|

% |

|

% |

|

$ |

$ |

$ |

|

% |

|

% |

|

$ |

|

Operations |

|

|

|

|

|

|

|

|

|

|

|

Revenue |

617,617 |

598,877 |

|

3.1 |

|

1.3 |

|

10,849 |

1,833,552 |

1,669,753 |

|

9.8 |

|

7.7 |

|

35,006 |

| Adjusted EBITDA(3) |

289,935 |

277,397 |

|

4.5 |

|

2.9 |

|

4,514 |

850,999 |

766,168 |

|

11.1 |

|

9.1 |

|

14,811 |

| Integration, restructuring and

acquisition costs(4) |

1,155 |

2,260 |

|

(48.9 |

) |

|

|

12,012 |

18,651 |

|

(35.6 |

) |

|

|

| Profit for the period from

continuing operations |

102,559 |

76,116 |

|

34.7 |

|

|

|

272,972 |

321,610 |

|

(15.1 |

) |

|

|

| Profit (loss) for the period

from discontinued operations |

82,451 |

(5,365 |

) |

— |

|

|

|

73,460 |

(23,329 |

) |

— |

|

|

|

| Profit for the period |

185,010 |

70,751 |

|

— |

|

|

|

346,432 |

298,281 |

|

16.1 |

|

|

|

| Profit for the period

attributable to owners of the Corporation |

59,883 |

25,155 |

|

— |

|

|

|

111,718 |

101,272 |

|

10.3 |

|

|

|

|

Cash flow from continuing operations |

|

|

|

|

|

|

|

|

|

|

| Cash flow from operating

activities |

267,388 |

171,757 |

|

55.7 |

|

|

|

575,172 |

369,698 |

|

55.6 |

|

|

|

| Acquisitions of property,

plant and equipment(5) |

97,169 |

98,950 |

|

(1.8 |

) |

(4.5 |

) |

2,629 |

292,456 |

296,438 |

|

(1.3 |

) |

(4.2 |

) |

8,413 |

| Free

cash flow(3) |

140,393 |

109,446 |

|

28.3 |

|

27.9 |

|

421 |

381,544 |

268,793 |

|

41.9 |

|

41.4 |

|

1,551 |

| Financial

condition(6) |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

|

|

|

448,424 |

86,352 |

|

— |

|

|

|

| Total assets |

|

|

|

|

|

7,064,426 |

7,335,547 |

|

(3.7 |

) |

|

|

| Indebtedness(7) |

|

|

|

|

|

3,578,541 |

3,951,791 |

|

(9.4 |

) |

|

|

| Equity

attributable to owners of the Corporation |

|

|

|

|

|

753,702 |

710,908 |

|

6.0 |

|

|

|

| Per Share

Data(8) |

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

|

|

|

|

|

|

|

|

|

From continuing operations |

2.09 |

1.64 |

|

27.4 |

|

|

|

5.46 |

6.63 |

|

(17.6 |

) |

|

|

|

From discontinued operations |

1.62 |

(0.10 |

) |

— |

|

|

|

1.44 |

(0.45 |

) |

— |

|

|

|

|

From continuing and discontinued operations |

3.71 |

1.54 |

|

— |

|

|

|

6.90 |

6.18 |

|

11.7 |

|

|

|

|

Diluted |

|

|

|

|

|

|

|

|

|

|

|

From continuing operations |

2.07 |

1.63 |

|

27.0 |

|

|

|

5.41 |

6.58 |

|

(17.8 |

) |

|

|

|

From discontinued operations |

1.61 |

(0.10 |

) |

— |

|

|

|

1.43 |

(0.45 |

) |

— |

|

|

|

|

From continuing and discontinued operations |

3.68 |

1.52 |

|

— |

|

|

|

6.84 |

6.13 |

|

11.6 |

|

|

|

| Dividends |

0.43 |

0.39 |

|

10.3 |

|

|

|

1.29 |

1.17 |

|

10.3 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

(1) |

Fiscal 2018 was restated to comply with IFRS 15 and to reflect a

change in accounting policy as well as to reclassify results from

Cogeco Peer 1 as discontinued operations. For further details,

please consult the "Accounting policies" and "Discontinued

operations" sections of the MD&A. |

|

(2) |

Key performance indicators presented on a constant currency basis

are obtained by translating financial results of the current

periods denominated in US dollars at the foreign exchange rates of

the comparable periods of the prior year. For the three and

nine-month periods ended May 31, 2018, the average foreign exchange

rates used for translation were 1.2846 USD/CDN and 1.2664 USD/CDN,

respectively. |

|

(3) |

The indicated terms do not have standardized definitions prescribed

by the International Financial Reporting Standards ("IFRS") and,

therefore, may not be comparable to similar measures presented by

other companies. For more details, please consult the "Non-IFRS

financial measures" section of the MD&A. |

|

(4) |

For the three and nine-month periods ended May 31, 2019,

integration, restructuring and acquisition costs were mostly due to

restructuring costs in the Canadian broadband services operations

and were related to an operational optimization program. In

addition, acquisition costs for the nine-month period ended

May 31, 2019 were related to the acquisition of 10 regional

radio stations on November 26, 2018 by the Corporation's

subsidiary, Cogeco Media. For the three and nine-months periods

ended May 31, 2018, integration, restructuring and acquisition

costs were related to the MetroCast acquisition completed on

January 4, 2018. |

|

(5) |

For the three and nine-months periods ended May 31, 2019,

acquisitions of property, plant and equipment in constant currency

amounted to $94.5 million and $284.0 million, respectively. |

|

(6) |

At May 31, 2019 and August 31, 2018. |

|

(7) |

Indebtedness is defined as the aggregate of bank indebtedness,

balance due on business combinations and principal on long-term

debt. |

|

(8) |

Per multiple and subordinate voting shares. |

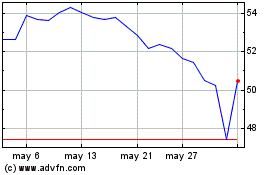

Cogeco (TSX:CGO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Cogeco (TSX:CGO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024