Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) ("Cenovus") and

Headwater Exploration Inc. (TSX: HWX) ("Headwater" or the

"Company") have closed the previously announced bought deal

secondary offering (the "Offering") of common shares of Headwater

(the "Common Shares"). The Offering was completed on a bought deal

basis, pursuant to an underwriting agreement dated effective

September 27, 2021 among the Company, Cenovus, Cenovus Marten Hills

Partnership, a wholly-owned subsidiary of Cenovus (the "Selling

Shareholder"), and a syndicate of underwriters led by Peters &

Co. Limited and BMO Nesbitt Burns Inc. and including CIBC World

Markets Inc., RBC Dominion Securities Inc., Scotia Capital Inc.,

and TD Securities Inc. (collectively, the "Underwriters").

Pursuant to the Offering, Cenovus, through the

Selling Shareholder, sold a total of 50,000,000 Common Shares

(collectively, the "Offered Shares"), including 5,000,000 Common

Shares sold pursuant to the exercise in full of an over-allotment

option granted to the Underwriters. The Offered Shares were sold at

a price of $4.55 per Offered Share for total gross proceeds to the

Selling Shareholder of $227,500,000. The Company has not and will

not receive any of the proceeds of the Offering. In connection with

the Offering, the Underwriters received a cash commission equal to

4% of the gross proceeds from the sale of the Offered Shares.

The Selling Shareholder and the Company entered

into an investor agreement dated December 2, 2020 (the "Investor

Agreement") in connection with the issuance of Common Shares and

Common Share purchase warrants (the "Warrants") to the Selling

Shareholder. As a result of the completion of the Offering, the

Investor Agreement automatically terminated in accordance with its

terms. The Investor Agreement provided the Selling Shareholder with

certain contractual rights related to, among other things, the

nomination of directors of the Company. In connection with the

termination of the Investor Agreement, Sarah Walters, who was a

nominee of the Selling Shareholder on the Board of Directors (the

"Board") of the Company, resigned as a director of the Company

effective upon completion of the Offering. Kam Sandhar, who was

also nominated to the Board by the Selling Shareholder pursuant to

the Investor Agreement, is expected to remain on the Board

following the Offering notwithstanding the termination of the

Investor Agreement.

Cenovus sold the Common Shares as part of its

plan to reduce its net debt levels towards its $10 billion interim

target and accelerate shareholder returns. The Common Shares and

Warrants were originally issued to the Selling Shareholder as

partial consideration for the acquisition by Headwater of the

Selling Shareholder's assets in the Marten Hills area of Alberta.

Through its active development plan and early success, Headwater

has accelerated the value generated from the Marten Hills asset and

continues to progress its exploration program. The Offering expands

Headwater’s free-trading float and is expected to provide new and

existing shareholders with enhanced trading liquidity.

The Common Shares were offered by way of a short

form prospectus filed by the Company in all provinces of Canada,

excluding Quebec. Offered Shares were sold on a private placement

basis in the United States to "qualified institutional buyers"

pursuant to Rule 144A of the Securities Act of 1933 (as amended,

the "U.S. Securities Act"). No securities regulatory authority has

either approved or disapproved of the contents of this news

release.

The Common Shares have not been, nor will they

be, registered under the U.S. Securities Act, and may not be

offered or sold in the United States or to, or for the account or

benefit of, U.S. persons absent registration or an applicable

exemption from the registration requirements. This press release

shall not constitute an offer to sell or the solicitation of an

offer to buy nor shall there be any sale of the securities in any

state in which such offer, solicitation or sale would be

unlawful.

Additional Early Warning

Disclosure

This additional disclosure is provided pursuant

to National Instrument 62-103—The Early Warning System and Related

Take-Over Bid and Insider Reporting Issues, which also requires a

report to be filed by Cenovus with the regulatory authorities in

each jurisdiction in which the Company is a reporting issuer

containing information with respect to the foregoing matters (the

"Early Warning Report").

Prior to the Offering, the Selling Shareholder

held 50,000,000 Common Shares, representing approximately 24.7% of

the issued and outstanding Common Shares on an undiluted basis and

approximately 26.8% of the issued and outstanding Common Shares on

a fully diluted basis after giving effect to all convertible

securities of the Company, including the exercise of the Warrants.

Pursuant to the Offering, the Selling Shareholder disposed of legal

and beneficial ownership of 50,000,000 Common Shares, being 100% of

the Common Shares held by the Selling Shareholder.

Following completion of the Offering, the

Selling Shareholder no longer holds any Common Shares. Cenovus,

through the Selling Shareholder, continues to own 15,000,000

Warrants exercisable at $2.00 per Common Share until December 2,

2023, which have not been exercised. If the Warrants were exercised

in full, Cenovus would indirectly own, through the Selling

Shareholder, an aggregate of 15,000,000 Common Shares, representing

approximately 6.9% of the issued and outstanding Common Shares.

In connection with the Offering, net proceeds of

approximately $218.4 million were paid to, and received by, the

Selling Shareholder, representing the gross proceeds of the

Offering less the fees paid to the Underwriters by the Selling

Shareholder. The Selling Shareholder may from time to time,

depending on market and other conditions, exercise the Warrants,

acquire or dispose of additional Common Shares through market

transactions, public offerings, private agreement or otherwise.

The Early Warning Report with additional

information in respect of the foregoing matters will be filed and

made available on the System for Electronic Document Analysis and

Retrieval (SEDAR) at sedar.com under Headwater's issuer profile. A

copy of such report may also be obtained by contacting the

secretary of Headwater, on behalf of Cenovus and the Selling

Shareholder, at telephone number (587) 391-3680.

Cenovus's head office is located at 225 – 6th

Avenue S.W., Calgary, AB T2P 0M5. Headwater's head office is

located at Suite 1200, 500 - 4th Avenue S.W., Calgary, Alberta T2P

2V6.

Advisory

Basis of PresentationCenovus

reports financial results in Canadian dollars and presents

production volumes on a net to Cenovus before royalties basis,

unless otherwise stated. Cenovus prepares its financial statements

in accordance with International Financial Reporting Standards

(IFRS).

Forward-looking InformationThis

news release contains certain forward-looking statements and

forward-looking information (collectively referred to as

"forward-looking information") within the meaning of applicable

securities legislation, including the United States Private

Securities Litigation Reform Act of 1995, about Cenovus’s and

Headwater’s current expectations, estimates and projections about

the future, based on certain assumptions made by Cenovus and

Headwater in light of their respective experience and perception of

historical trends. Although Cenovus and Headwater believe that the

expectations represented by such forward-looking information are

reasonable, there can be no assurance that such expectations will

prove to be correct. Readers are cautioned not to place undue

reliance on forward-looking information as actual results may

differ materially from those expressed or implied. Neither Cenovus

nor Headwater undertake any obligation to update or revise any

forward-looking information except as required by law.

This forward-looking information is identified

by words such as "achieve", "commitment", "continue", "expect",

"may", "position" and "will", or similar expressions and includes

suggestions of future outcomes, and in respect of Cenovus includes

statements about the use of net proceeds from the Offering to

reduce net debt levels and accelerate returns to its shareholders;

and the potential exercise of the Warrants or other acquisitions or

dispositions of Common Shares. In respect of Headwater, the

forward-looking information includes statements about: the intent

to continue to progress its exploration program; the composition of

the Board upon completion of the Offering; and that the Offering

will expand Headwater’s free-trading float and is expected to

provide new and existing shareholders with enhanced trading

liquidity.

Developing forward-looking information involves

reliance on a number of assumptions and consideration of certain

risks and uncertainties, some of which are specific to Cenovus or

Headwater and others that apply to the industry generally.

Additional information about risks, assumptions,

uncertainties and other factors that could cause Cenovus's actual

results to differ materially from those expressed or implied by its

forward-looking statements is contained under "Risk Management and

Risk Factors" in Cenovus's Annual Management’s Discussion and

Analysis (MD&A) or Form 40-F for the year ended December 31,

2020 and in the updates in the "Risk Management and Risk Factors"

section of Cenovus’s MD&A for the period ended June 30, 2021.

Additional information about risks, assumptions, uncertainties and

other factors that could cause Headwater's actual results to differ

materially from those expressed or implied by its forward-looking

statements is contained under "Risk Factors" in its annual

information form for the year ended December 31, 2020, which is

available on SEDAR at sedar.com.

Cenovus Energy Inc.

Cenovus Energy Inc. is an integrated energy

company with oil and natural gas production operations in Canada

and the Asia Pacific region, and upgrading, refining and marketing

operations in Canada and the United States. The company is focused

on managing its assets in a safe, innovative and cost-efficient

manner, integrating environmental, social and governance

considerations into its business plans. Cenovus common shares and

warrants are listed on the Toronto and New York stock exchanges,

and the company’s preferred shares are listed on the Toronto Stock

Exchange. For more information, visit cenovus.com.

Find Cenovus on Facebook, Twitter, LinkedIn,

YouTube and Instagram.

Headwater Exploration Inc.

Headwater Exploration Inc. is a Canadian

publicly traded resource company engaged in the exploration for and

development and production of petroleum and natural gas in Canada.

Headwater currently has high quality oil production, reserves, and

lands in the prolific Clearwater play in the Marten Hills area of

Alberta as well as low decline natural gas production and reserves

in the McCully Field near Sussex, New Brunswick. Headwater is

focused on providing superior corporate level returns by focusing

on sustainability, asset quality and balance sheet strength.

Headwater common shares are listed on the Toronto Stock Exchange.

For more information, visit headwaterexp.com.

Cenovus contacts:

|

Investors |

Media |

|

Investor Relations general line403-766-7711 |

Media Relations general line403-766-7751 |

Headwater contacts:

|

Neil Roszell, P. Eng.Chair and Chief Executive

Officer |

Jason Jaskela, P. Eng.President and Chief

Operating Officer |

|

Ali Horvath, CPA, CAVice President, Finance and

Chief Financial Officerinfo@headwaterexp.com403-391-3680 |

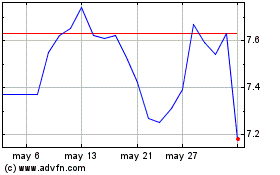

Headwater Exploration (TSX:HWX)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Headwater Exploration (TSX:HWX)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024