UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Under Section 12(b) or (g) of The Securities

Exchange Act of 1934

INNOVARO,

INC.

(Exact name of registrant in its charter)

| Delaware |

|

93-2109296 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

Suite 389, 74 East Glenwood Avenue

Smyrna, Delaware |

|

19977 |

| (Address of principal executive office) |

|

(Zip Code) |

| Registrant’s telephone number, including area code: (908) 462-2267 |

| Securities to be registered under Section 12(b) of the Act: |

NONE |

| |

|

| Securities to be registered under Section 12(g) of the Act: |

common stock, par value $0.00001 |

| |

(Title of class) |

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in

Rule 12b-2 of the Exchange Act.

| Large accelerated filer □ |

Accelerated filer □ |

| Non-accelerated filer ⌧ |

Smaller reporting company ⌧ |

| |

Emerging growth company ⌧ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

INFORMATION REQUIRED IN REGISTRATION STATEMENT

Item 1. Description of Business.

Introduction.

We were incorporated in 1999 in Delaware under the name of Utek Corporation

as a business development corporation and we acquired by merger a Florida corporation of the same name. We changed our name to Innovaro,

Inc. in 2010. We filed reports with the SEC through 2014. Our last annual report on Form 10-K disclosed our business as being focused

on delivering innovation solutions to our clients through a combination of software and associated services as well as information for

strategic decision making. We offered a comprehensive set of software to ensure the success of any innovation project, regardless of the

size or intent. Our unique combination of our LaunchPad software (an integrated innovation environment) and our trends and foresight services

provided any business with the innovation support they need to drive success. Current management believes we have been

dormant most of the time subsequent to 2014.. The only available business history subsequent to 2014 is summarized in the 2022 annual

information statement published by current management at OTCMarkets.com which includes a statement that we were “previously

engaged in software service”. The disclosure states further that “the company

does not have operations at this time but plans to acquire an operating company via reverse merger”. However, we understand

it is the plan of our two controlling stockholders, one of whom is our director and chief executive officer, to privately sell their shares

to a person or persons yet to be identified who they expect will use us to acquire an operating business or start a business. The

address of our principal executive offices is Suite 389, 74 East Glenwood Avenue, Smyrna, Delaware and

our phone number is (908) 462-2267. We do not have a website.

We are a shell company

We are a shell company. We have no assets. We are not engaged in any

business, do not have any operations and are not generating any revenues.

Item 1A. Risk Factors

A purchase of our shares will involve a high degree of risk.

We have no business, no operations and no history of either on which

to base a decision to investment in our commons stock. You will be entirely dependent on the experience and judgment of our management

to determine what business or industry in which we may engage. You have no assurance the management who will make decisions regarding

the business or industry in which we engage will be our current management.

Our management, whether current or future, may have a conflict

of interest when deciding what business to acquire.

Our current or future management making the decision regarding acquisition

of a business may have a conflict of interest in the event that decision involves a company in which management has an ownership interest.

You can expect your percentage of ownership to be diluted in

the event we raise capital to start a business or purchase a business for cash or stock.

In the event we decide to start a business or purchase a business,

we will need to issue more stock to either sell for cash to fund operations, whether we start or acquire a business. It is likely that

we may also issue stock to make an acquisition if that is the course we take to obtain a business. You have no assurance we will be able

to either sell stock or use stock to make an acquisition.

You will not be able to evaluate the management that operates

a business we start or acquire.

It is probable that current management will not be management that

operates a business we start or we acquire. Current management is likely to be replaced by management who have experience in operating

the type of business we start or acquire; however, you have no assurance that future management will have the any such experience.

You will not have any vote on the type of business we start or

acquire.

Our current management will have the sole right to decide what business

we start or acquire. Stockholders, especially minority stockholders, will not have any right to vote and are not likely to be able influence

what business we start or acquire. You will be entirely dependent on current management to make the decisions regarding our business.

You are unable to determine the merits or risks of the business

we may start or acquire, or even the industry in which we may ultimately operate.

You have no current basis to evaluate the possible merits or risks

of the business we may start, the business we may acquire or the even the particular industry in which we may ultimately operate. The

business we may start, the business we may acquire or the industry in which we ultimately operate may be characterized by a high level

of risk. Although our management will endeavor to evaluate the merits or risks of the business we may start, the business we

may acquire or the even the particular industry in which we may ultimately operate., you have no assurance that our board of directors

will properly ascertain or assess all of the significant risk factors.

Our long-term success will likely be dependent upon a yet to

be identified management team which may be difficult to fully evaluate.

In the event we start or acquire a business, the success of our operations

will be dependent upon management which we cannot now identify and numerous other factors beyond our control. Although

it is possible that our current management will remain associated with the business we start or acquire a business, it is likely that

the management team will change and, in the event we acquire a business, it is likely the management team of that business will remain

in place given that they will have greater knowledge, experience and expertise compared to our current management. We expect to be dependent

upon a yet to be identified management team for our long-term success. As a result, you will not be able to evaluate the management

team that we will likely be dependent upon for our long-term success. Although we intend to scrutinize management of a prospective

business to be acquired as closely as possible in connection with evaluating the desirability of acquiring it, you have no assurance that

our assessment of the business of its management team will prove to be correct. These individuals may be unfamiliar with the

requirements of operating a public company and the securities laws, which could increase the time and resources they must expend in becoming

familiar with the complex disclosure and financial reporting requirements imposed on U.S. public companies. This could be expensive

and time-consuming and could lead to various regulatory issues that may adversely affect our future operations.

We may acquire a financially unstable company or an entity in

the early stage of development or growth, which is subject to greater risks compared to an acquisition of a more established company with

a proven record of earnings and growth.

We do not have financial resources that would make us attractive to

persons controlling an existing business that is financially stable, which places us at a disadvantage of other publicly traded companies

with whom we will complete to acquire an existing business operation, especially a business that is established with successful operations

and an established record of sales or earnings. Accordingly, businesses that would have an interest in being acquired by us

will likely be financially unstable or early stage or emerging growth company, which would limit our prospects to businesses impacted

by numerous risks inherent in the business and operations of such a company that we would not be subject to if we were to acquire a company

with a more established company with a proven record of earnings and growth.

We do not have resources to conduct market research or to identify

better industry or business opportunities.

We have not conducted nor do we have resources to conduct market research

concerning better industries or better business opportunities. Our management has not identified any specific industry or existing

business. You have no assurance that we will be able to effectively identify either an industry or a business an any industry that is

a sound business opportunity. Decisions as to which business opportunity to participate in will be unilaterally made by our

management, which may, in many instances, act without the consent, vote or approval of our stockholders.

We may acquire a business on terms that are not favorable to

us and to our existing stockholders.

We do not have the resources, financial and otherwise, to negotiate

terms for acquisition of a business that would be deemed to be favorable to us and to our stockholders. Any such transaction is likely

to be deemed to be more favorable to the owners of any business we acquire, particularly in the number of or shares the owners are willing

to receive in exchange for their ownership. This is especially true with respect to the number of our shares our currently controlling

stockholders retain as compared to shares we are obligated to newly issue. Our currently controlling stockholders will be incentivized

to retain as many shares as possible and obligate us to issue new shares, which will reduce or dilute your percentage of ownership following

any acquisition of an existing business.

Our acquisition of an existing business can be expected to benefit

our controlling stockholders.

In achieving the acquisition of an existing business, you may expect

our controlling stockholders to sell for cash all or a significant part of their shares to the persons who own the acquired business.

Our management who are our controlling stockholders may be incentivized to acquire a business which results in the highest price for their

stock rather than the best available business opportunity for us.

Our management will devote a portion of their time to other businesses

which may cause conflicts of interest in the determination as to how much time to devote to our affairs. This conflict of interest

could have a negative impact us.

Our officers and sole director engage in other businesses and are not

required to devote their full time or any specific number of hours to our affairs, which could create a conflict of interest when allocating

time between our affairs and their other commitments. We do not have and do not expect to have any full-time employees until

we start or acquire a business, either of which you have no assurance. Our officers’ and director’s other business

affairs require them to devote substantial amounts of time to such affairs, which limits their ability to devote time to our affairs and

could be expected to have a negative impact on our ability to start or acquire a business. We cannot assure you that these

conflicts will be resolved in our favor.

There is currently no active trading market for our common stock.

The public market for our shares is limited. See Item 9 “Market

Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters” for price and volume information.

Item 2. Financial Information.

Plan of Operations

We have no assets and no operations. We have $2,500 in liabilities

and have incurred operating expenses of $1,250 and $14,632 in 2023 and 2022, respectively and $204,129 in the first six months of 2024,

of which $197,139 was executive compensation and a consulting fee paid it our shares of common stock. We do not have a plan of operations.

Mr. Bland, our director and chief executive officer has voluntarily funded operating expenses; provided, that you have no assurance he

will continue to do so.

Item 3. Properties.

We rent on a month to month basis an office in an office suite operation

at $15.00 per month.

Item 4. Security Ownership of Certain Beneficial Owners and Management.

Our principal stockholders are set forth in the

following table. These principal stockholders include:

| |

· |

each of our directors and executive officers, |

| |

· |

our directors and executive officers as a group, and |

| |

· |

others who we know own more than five percent of our issued and outstanding common stock. |

We believe each of these persons has sole voting and investment power

over the shares they own, unless otherwise noted. The address of our directors and executive officers is our address.

| | |

| |

Number

of Shares | | |

Percentage | |

| Kenneth D. Bland (1) | |

Common Stock | |

| 990,692,535 | | |

| 49.684% | |

| | |

Special 2022 Series A Preferred (2) | |

| 1 | | |

| 100.00% | |

| Jonathan Gruchy | |

none | |

| none | | |

| 0.00% | |

| Jackson L. Morris | |

none | |

| none | | |

| 0.00% | |

| All Directors and Officers as a Group (3 persons) | |

Common Stock | |

| 990,692,535 | | |

| 49.684% | |

| | |

Special 2022 Series A Preferred (2) | |

| 1 | | |

| 100.00% | |

| A.I. International Corporate Holdings, Ltd. (3) | |

Common Stock | |

| 985,692,535 | | |

| 49.284% | |

| Address – Sable Trust Road Town, Tortola, British Virgin Islands | |

| |

| | | |

| | |

| (1) |

Mr. Bland’s shares are registered in the name of Rhyans Crawford LLC |

| (2) |

The one share of Special 2022 Series A Preferred is entitled to cast sixty

percent of all votes eligible to be cast on all matters submitted to the stockholders for approval and converts into 30,000,000

common shares. |

| (3) |

A.I. International Corporate Holdings, Ltd. is entirely owned by Ezzat Jallad |

Item 5. Directors and Executive Officers.

The following table sets forth information about

our directors and our executive officers at the date of this prospectus:

| Name |

Age |

Position |

|

Director Since |

| Kenneth D. Bland |

61 |

Director and Chief Executive Officer |

|

April 20, 2024 |

| Jonathan Gruchy |

35 |

Chief Financial Officer |

|

N/A |

| Jackson L. Morris |

80 |

Corporation Secretary |

|

N/A |

Our stockholders elect our directors. Our directors

serve terms of one year and are generally elected at each annual stockholders meeting; provided, that there is no assurance we will hold

a stockholders’ meeting annually. Each director will remain in office until his successor is elected. We do not have independent

directors using the definition of independence contained in the NASDAQ listing rules. Our executive officers are elected by the board

of directors and their terms of office are at the discretion of the board of directors, subject to terms and conditions of their respective

employment agreements, if any. We have the authority under Florida law and our bylaws to indemnify our directors and officers against

certain liabilities. We have been informed by the U.S. Securities and Exchange Commission that indemnification against violations of federal

securities law is against public policy and therefore unenforceable.

Management Biographies

Kenneth D. Bland is our sole director and

Chief Executive Officer on a part time basis. He expects to devote _10 % of his time to our business and affairs. Mr. Bland is devoting

all of his working time and attention to our business and affairs. Mr. Bland has been engaged in the development of a live video streaming

application and platform for mobile devices during the past five years. Mr. Bland has held senior executive positions in management, finance,

sales and marketing at telecommunications companies including, Phone Two Communications, Broadwing Communications and AT&T. He attended

Rutgers University.

Jonathan Gruchy is our Chief Financial Officer

on a part time basis. He expects to devote 5 % of his time to our business and affairs. Mr. Gruchy has served in accounting and management

roles in a variety of industries for the last eight years. He earned a B.S. in Accounting from the University at Buffalo (date) and is

a certified public accountant in New York. Mr. Gruchy started his career at CitiGroup as a Financial Analyst in 2012. He then moved into

a Controller role with a heavy industrial manufacturer which he has served for over five years. He currently serves a variety of clients

offering services in accounting, management, and taxation. Jon has been running his firm Gruchy, CPA since 2017.

Jackson L. Morris fills the statutory position

of corporation secretary as a courtesy and incidental to his services as our independent corporate and securities counsel. Mr. Morris

has practiced law beginning 1971 and been engaged in the private practice of law since 1975, maintaining his own practice in the Tampa

Bay area since 1993. Mr. Morris focuses his practice on corporate and securities law. Mr. Morris earned a B.A. degree in economics from

Emory University in 1966, a J.D. degree from Emory University Law School in 1969 and a L.L.M. degree in Federal Taxation from Georgetown

Law School in 1974.

Item 6. Executive Compensation.

Except as set forth in the table below, we have

not compensated our executive officers in the last three years.

| | |

Year | |

Stock Awards | | |

Total | |

| Kenneth D. Bland, Chief Executive Officer | |

2024 | |

$ | 98,569 | (1) | |

$ | 98,569 | |

(1) 985,692,535 shares valued at $0.0001

Item 7. Certain Relationships and Related Transactions and Director

Independence.

Related Party Transactions.

We have not engaged in any related party transactions.

Family Relationships.

There is no family relationship among our directors and officers

Corporate Governance and Director Independence.

The Company has not:

| |

· |

established its own definition for determining whether its directors and nominees for directors are “independent” nor has it adopted any other standard of independence employed by any national securities exchange or inter-dealer quotation system, though our current director would not be deemed to be “independent” under any applicable definition given that he is an officer of the Company; nor |

| |

|

|

| |

· |

established any committees of the board of directors. |

In view of our current business and the composition of our management,

our board of directors does not believe we require a corporate governance committee at this time.

Item 8. Legal Proceedings.

We are not a party to, nor is our management aware of any pending,

legal proceedings.

Item 9. Market Price of and Dividends on the Registrant’s

Common Equity and Related Stockholder Matters.

Market Information

As of the date of this Registration Statement, there are 524 record

holders of our common stock.

Our common stock trades in the OTC Pink Market. Trading in our common

stock cannot be deemed to be “active”, in view of the limited number of transactions and volume. Brokers cannot publish quotes

for our shares and can receive unsolicited offers only

| Quarter Ended |

|

High |

|

Low |

|

Volume |

| March 31, 2022 |

|

$0.0001 |

|

$0.0001 |

|

0 |

| June 30, 2022 |

|

$0.0001 |

|

$0.0001 |

|

0 |

| September 30, 2022 |

|

$0.0001 |

|

$0.0001 |

|

0 |

| December 31, 2022 |

|

$0.0061 |

|

$0.0024 |

|

50,000 |

| March 31, 2023 |

|

$0.0225 |

|

$0.0225 |

|

0 |

| June 30, 2023 |

|

$0.016 |

|

$0.016 |

|

0 |

| September 30, 2023 |

|

$0.0144 |

|

$0.0144 |

|

50,000 |

| December 31, 2023 |

|

$0.0143 |

|

$0.0143 |

|

7,000 |

| March 31, 2024 |

|

$0.0175 |

|

$0.015 |

|

107,217 |

| June 30, 2024 |

|

$0.013 |

|

$0.013 |

|

0 |

Dividends

We have not paid any dividends on our common stock to date and do not

presently intend to pay cash dividends. It is the expectation of our management that future earnings if any, will be retained

for use in our business operations. The payment of any dividends in the future will be within the discretion of our board of directors.

Item 10. Recent Sales of Unregistered Securities.

The sales of securities we have made during the last three fiscal years

and the current fiscal year through June 30 without registration under the Securities Act of 1933 is set forth in the following table.

| Name | |

Date | |

Number | | |

Consideration | |

Relationship |

| Rhyans Crawford LLC (1) | |

| |

| | | |

| |

Executive Officer |

| Special 2022 Series A Preferred | |

April 5, 2024 | |

| 1 | | |

Compensation | |

|

| Common Stock | |

July 25, 2024 | |

| 985,692,535 | | |

Compensation | |

|

| A.I. International Corporate Holdings, Ltd. (2) | |

July 26, 2024 | |

| 985,692,535 | | |

Consulting Fee | |

Consultant |

| (1) |

Entirely owned by Kenneth D. Bland, our sole director and Chief Executive Officer. |

| (2) |

Entirely owned by Ezzat Jallad. |

Item 11. Description of Securities.

The following description of our common stock is qualified in its entirety

by reference to our Articles of Incorporation, as amended, and Delaware corporation law. We are authorized to issue 2,000,000,000 shares

of common stock, $0.00001 par value per share. At the date of this registration statement, we have 1,994,000,000 shares of common stock

issued and outstanding, of which 1,976,572,093 shares are deemed to be “restricted” and subject to Rule 144 with respect to

resale. Holders of our common stock:

| |

· |

have one vote per share on election of each director and other matters submitted to a vote of stockholders; |

| |

· |

have equal rights with all holders of issued and outstanding common stock to receive dividends from funds legally available therefore, if any, when, as and if declared from time to time by the board of directors; |

| |

·

| are entitled to share equally with all holders of issued and outstanding common stock in all of our assets remaining after payment of liabilities, upon liquidation, dissolution or winding up of our affairs; |

| |

· |

do not have preemptive, subscription or conversion rights; and |

| |

· |

do not have cumulative voting rights. |

Preferred stock

We are authorized to issue 10,000,000 share of preferred stock of which

one share is designated as Special 2022 Series A Preferred, which has been issued to Mr. Bland. Mr. Bland has approved termination of

the designation and cancellation of the one. We have filed Articles for termination of the one share with Delaware.

Item 12. Indemnification of Directors and Officers.

Subchapter IV, §145, of the Delaware corporation law grants us

broad powers to indemnify our officers, directors, employees and agents who was or is a party or is threatened to be made a party to any

threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action

by or in the right of the corporation) by reason of the fact that the person is or was a director, officer, employee or agent of the corporation,

or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership,

joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement

actually and reasonably incurred by the person in connection with such action, suit or proceeding if the person acted in good faith and

in a manner the person reasonably believed to be in or not opposed to the best interests of the corporation, and, with respect to any

criminal action or proceeding, had no reasonable cause to believe the person’s conduct was unlawful.

Any indemnification (unless ordered by a court) shall be made by the

corporation only as authorized in the specific case upon a determination that indemnification of the present or former director, officer,

employee or agent is proper in the circumstances because the person has met the applicable standard of conduct. Such determination shall

be made, with respect to a person who is a director or officer of the corporation at the time of such determination:

(1) By a majority vote of the directors who are not parties to such

action, suit or proceeding, even though less than a quorum; or

(2) By a committee of such directors designated by majority vote of

such directors, even though less than a quorum; or

(3) If there are no such directors, or if such directors so direct,

by independent legal counsel in a written opinion; or

(4) By the stockholders.

We may pay expenses (including attorneys’ fees) incurred by an

officer or director of the corporation in defending any civil, criminal, administrative or investigative action, suit or proceeding in

advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of such director or

officer to repay such amount if it shall ultimately be determined that such person is not entitled to be indemnified by the corporation

as authorized in this section. Such expenses (including attorneys’ fees) incurred by former directors and officers or other employees

and agents of the corporation or by persons serving at the request of the corporation as directors, officers, employees or agents of another

corporation, partnership, joint venture, trust or other enterprise may be so paid upon such terms and conditions, if any, as the corporation

deems appropriate.

We have the power to purchase and maintain insurance on behalf of any

indemnified person.

Item 13. Financial Statements and Supplementary Data

INNOVARO, INC.

INDEX TO FINANCIAL STATEMENTS

Report of an Independent Registered Public Accounting

Firm

To the shareholders and the board of directors

of Innovaro, Inc

Opinion on the Financial Statements

We have audited the accompanying balance sheets of

Innovaro Inc (the “Company”) as of December 31, 2023, and 2022, the related statements of operations, changes in shareholders’

equity and cash flows, for each of the two years in the period ended December 31, 2023, and 2022, and the related notes collectively referred

to as the “financial statements. In our opinion, the financial statements present fairly, in all material respects, the financial

position of the Company as of December 31, 2023, and 2022, and the results of its operations and its cash flows for the year ended December

31, 2023, and 2022, in conformity with U.S. generally accepted accounting principles.

Going Concern

The accompanying financial statements have been prepared

assuming the company will continue as a going concern as disclosed in Note to the financial statement, the Company incurred a net loss

of $14,632 for the year ended December 31, 2023, and an accumulated deficit of $87,803,324 at December 31, 2023. The continuation of the

Company as a going concern through December 31, 2023, is dependent upon improving the profitability and the continuing financial support

from its stockholders. Management believes the existing shareholders or external financing will provide additional cash to meet the Company’s

obligations as they become due. These factors raise substantial doubt about the company’s ability to continue as a going concern.

These financial statements do not include any adjustments that might result from the outcome of the uncertainty.

Basis for Opinion

These financial statements are the responsibility

of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our

audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”)

and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable

rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audits in accordance with the standards

of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements

are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material

misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures

included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included

evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation

of the financial statements. We believe that our audits provide a reasonable basis for our opinion. The company is not required to have,

nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain

an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of

the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Critical Audit Matters

Critical audit matters are matters arising from the

current period audit of the financial statements that were communicated or required to be communicated to the audit committee and that:

(1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective,

or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the financial statements, taken

as a whole and we are not, by communicating the critical audit matters, providing separate opinions on the critical audit matter or on

the accounts or disclosures to which they relate. There are no critical audit matters to be communicated.

OLAYINKA OYEBOLA & CO.

(Chartered Accountants)-PCAOB ID 5968

We have served as the Company’s auditor since

February 2024.

March 22nd, 2024.

Lagos Nigeria

INNOVARO, INC.

BALANCE SHEETS

| | |

December 31,

2023 | | |

December 31,

2022 | |

| ASSETS | |

| | |

| |

| | |

| | |

| |

| CURRENT ASSETS: | |

| | |

| |

| Cash | |

$ |

– | | |

$ |

– | |

| | |

| | |

| |

| TOTAL ASSETS | |

$ |

– | | |

$ |

– | |

| | |

| | |

| |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| | |

| | | |

| | |

| Accrued liabilities | |

$ | 2,500 | | |

$ | 1,250 | |

| Total Current Liabilities | |

| 2,500 | | |

| 1,250 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENCIES | |

| | | |

| | |

| | |

| | | |

| | |

| STOCKHOLDERS’ DEFICIT: | |

| | | |

| | |

| Preferred stock, 10,000,000 shares authorized, $0.01 par value: 0 issued and outstanding, respectively | |

| – | | |

| – | |

| Series A Preferred stock, 1 shares authorized, $1,500 par value: 1 share issued and

outstanding, respectively | |

| 1,500 | | |

| 1,500 | |

| Common stock, 50,000,000 shares authorized, $0.01 par value: 22,614,930 and 17,614,930 issued and outstanding, respectively | |

| 226,149 | | |

| 176,149 | |

| Additional paid-in capital | |

| 87,573,175 | | |

| 87,609,793 | |

| Accumulated deficit | |

| (87,803,324 | ) | |

| (87,788,692 | ) |

| Total Stockholders’ Deficit | |

| (2,500 | ) | |

| (1,250 | ) |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ DEFICIT | |

$ | – | | |

$ | – | |

The accompanying notes are an integral part of

these financial statements.

INNOVARO, INC.

STATEMENTS OF OPERATIONS

| | |

For the Years Ended

December 31, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| Revenue | |

$ | – | | |

$ | – | |

| | |

| | | |

| | |

| Expenses: | |

| | | |

| | |

| General and administrative | |

| 14,632 | | |

| 1,250 | |

| Total operating expenses | |

| 14,632 | | |

| 1,250 | |

| Loss from operations | |

| (14,632 | ) | |

| (1,250 | ) |

| | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | |

| | |

| | | |

| | |

| Total other expense | |

| – | | |

| – | |

| | |

| | | |

| | |

| Net loss before income taxes | |

| (14,632 | ) | |

| (1,250 | ) |

| Provision for income tax | |

| – | | |

| – | |

| Net Loss | |

$ | (14,632 | ) | |

$ | (1,250 | ) |

| | |

| | | |

| | |

| Loss per share – basic and diluted | |

$ | (0.00 | ) | |

$ | (0.00 | ) |

| | |

| | | |

| | |

| Weighted average shares outstanding – basic and diluted | |

| 22,614,930 | | |

| 17,614,900 | |

The accompanying notes are an integral part of

these financial statements.

INNOVARO, INC.

STATEMENT OF CHANGES IN STOCKHOLDERS’ DEFICIT

FOR THE YEARS ENDED DECEMBER 31, 2023, AND

2022

| | |

Series A Preferred Stock | | |

Common Stock | | |

Additional | | |

Accumulated | | |

Total Stockholder’ | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Paid-in Capital | | |

Deficit | | |

Deficit | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance, December 31, 2021 | |

| – | | |

$ | – | | |

| 17,614,930 | | |

$ | 176,149 | | |

$ | 87,609,793 | | |

$ | (87,787,442 | ) | |

$ | (1,500 | ) |

| Series A shares issued | |

| 1 | | |

| 1,500 | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 1,500 | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (1,250 | ) | |

| (1,250 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, December 31, 2022 | |

| 1 | | |

| 1,500 | | |

| 17,614,930 | | |

| 176,149 | | |

| 87,609,793 | | |

| (87,788,692 | ) | |

| (1,250 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance, December 31, 2022 | |

| 1 | | |

| 1,500 | | |

| 17,614,930 | | |

| 176,149 | | |

| 87,609,793 | | |

| (87,788,692 | ) | |

| (1,250 | ) |

| Common stock issued | |

| – | | |

| – | | |

| 5,000,000 | | |

| 50,000 | | |

| (36,618 | ) | |

| – | | |

| 13,382 | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| (14,632 | ) | |

| (14,632 | ) |

| Balance, December 31, 2023 | |

| 1 | | |

$ | 1,500 | | |

| 22,614,930 | | |

$ | 226,149 | | |

$ | 87,573,175 | | |

$ | (87,803,324 | ) | |

$ | (2,500 | ) |

The accompanying notes are an integral part of

these financial statements.

INNOVARO, INC.

STATEMENTS OF CASH FLOWS

| | |

For the Years Ended

December 31, | |

| | |

2023 | | |

2022 | |

| Cash Flows from Operating Activities: | |

| | | |

| | |

| Net loss | |

$ | (14,632 | ) | |

$ | (1,250 | ) |

| Adjustments to reconcile net loss to net cash used by operating activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

| 1,250, | | |

| 1,250 | |

| Accrued interest – related party | |

| – | | |

| – | |

| Accrued interest | |

| – | | |

| – | |

| Net cash used in operating activities | |

| (13,382 | ) | |

| – | |

| | |

| | | |

| | |

| Cash Flows from Investing Activities: | |

| – | | |

| – | |

| | |

| | | |

| | |

| Cash Flows from Financing Activities: | |

| | | |

| | |

| Additional paid in capital | |

| 13,382 | | |

| – | |

| Proceeds from related parties | |

| – | | |

| – | |

| Net cash provided by financing activities | |

| 13,382 | | |

| – | |

| | |

| | | |

| | |

| Net Change in Cash | |

| – | | |

| – | |

| Cash beginning of year | |

| – | | |

| – | |

| Cash end of year | |

$ | – | | |

$ | – | |

| | |

| | | |

| | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | |

| | | |

| | |

| Cash paid during the period for: | |

| | | |

| | |

| Interest | |

$ | – | | |

$ | – | |

| Income taxes | |

$ | – | | |

$ | – | |

The accompanying notes are an integral part of

these financial statements.

INNOVARO, INC.

Notes to Audited Financial Statements

December 31, 2023

NOTE 1 — ORGANIZATION AND OPERATIONS

Innovaro, Inc. (the “Company,” “we,”

“us” or “our”), a Delaware corporation, has a fiscal year end of December 31 and is listed on the OTC Pink Markets

under the trading symbol INNI. The Company had abandoned its business and failed to take steps to dissolve, liquidate and distribute its

assets. It had also failed to meet the required reporting requirements with the Delaware Secretary of State, hold an annual meeting of

stockholders and pay its annual franchise tax from 2017 to 2022 which resulted in its Delaware charter being revoked. The Company also

failed to provide adequate current public information as defined in Rule 144, promulgated under the Securities Act of 1933, and was thus

subject to revocation by the Securities and Exchange Commission pursuant to Section 12(k) of the Exchange Act.

On November 18th , 2022, David Duarte, was appointed

as Sole Officer and Director of the Corporation by Asa Lanum, the former remaining Sole Officer and Director. Mr. Duarte was not able

to recover any of the Company’s accounting records from previous management but was able to get the shareholder information hence

the Company’s outstanding common shares were reflected in the equity section of the accompanying unaudited financial statements

for the Twelve months ended December 30, 2023, and 2022.

The company was incorporated in the State of Delaware

on July 13th, 1999, as UTEK Corp. The issuer changed its name to Innovaro, Inc. on July 8th, 2010.

On November 18th, 2022, David Duarte, was appointed

as Sole Officer and Director of the Corporation by Asa Lanum, the former remaining Sole Officer and Director.

On November 28th, 2022, the Company filed a “Renewal

for Void” with the Secretary State of the State of Delaware, which reinstated the Company’s charter and appointed a new Registered

Agent in Delaware.

The company remained non-operating for the 2023 fiscal

year and is currently engaged in evaluating and assessing new business opportunities.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

Basis of Presentation

The Company’s financial statements have been

prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Use of Estimates

The preparation of financial statements in conformity

with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and

expenses during the reporting periods. Actual results could differ from those estimates.

Stock-based Compensation.

In June 2018, the FASB issued ASU 2018-07, Compensation

– Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting. ASU 2018-07 allows companies to

account for non-employee awards in the same manner as employee awards. The guidance is effective for fiscal years beginning after December

15, 2018, and interim periods within those annual periods.

Related Party Transactions

Under ASC 850 “Related Party Transactions”

an entity or person is considered to be a “related party” if it has control, significant influence or is a key member of management

personnel or affiliate. A transaction is considered to be a related party transaction when there is a transfer of resources or obligations

between related parties. The Company, in accordance with ASC 850 presents disclosures about related party transactions and outstanding

balances with related parties.

Derivative Financial Instruments

The Company evaluates its convertible notes to determine

if such instruments have derivatives or contain features that qualify as embedded derivatives. For derivative financial instruments that

are accounted for as liabilities, the derivative instrument is initially recorded at its fair value and is then re-valued at each reporting

date, with changes in the fair value reported in the statements of operations. For stock-based derivative financial instruments, the Company

uses a weighted-average Black-Scholes-Merton option pricing model to value the derivative instruments at inception and on subsequent valuation

dates. The classification of derivative instruments, including whether such instruments should be recorded as liabilities or as equity,

is evaluated at the end of each reporting period.

Fair Value of Financial Instruments

The Company follows paragraph 825-10-50-10 of the

FASB Accounting Standards Codification for disclosures about fair value of its financial instruments and paragraph 820-10-35-37 of the

FASB Accounting Standards Codification (“Paragraph 820-10-35-37”) to measure the fair value of its financial instruments.

Paragraph 820-10-35-37 establishes a framework for measuring fair value in accounting principles generally accepted in the United States

of America under U.S. GAAP and expands disclosures about fair value measurements. To increase consistency and comparability in fair value

measurements and related disclosures, Paragraph 820-10-35-37 establishes a fair value hierarchy which prioritizes the inputs to valuation

techniques used to measure fair value into three broad levels. The fair value hierarchy gives the highest priority to quoted prices

(unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The three levels of

fair value hierarchy defined by Paragraph 820-10-35-37 are described below:

| Level 1: |

Quoted market prices available in active markets for identical assets or liabilities as of the reporting date. |

| |

|

| Level 2: |

Pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date. |

| |

|

| Level 3: |

Pricing inputs that are generally unobservable inputs and not corroborated by market data. |

The carrying amount of the Company’s financial

assets and liabilities, such as cash, prepaid expenses and accrued expenses approximate their fair value because of the short maturity

of those instruments. The Company’s notes payable approximate the fair value of such instruments as the notes bear interest

rates that are consistent with current market rates.

Basic and Diluted Income (Loss) Per Share

The Company computes income (loss) per share in accordance

with FASB ASC 260. Basic earnings (loss) per share is computed using the weighted-average number of common shares outstanding during the

period. Diluted earnings (loss) per share is computed using the weighted-average number of common shares and the dilutive effect of contingent

shares outstanding during the period. As of December 31, 2023.

Income Taxes

Income taxes are provided for the tax effects of

the transactions reported in the financial statements and consist of taxes currently due plus deferred taxes related primarily to

tax net operating loss carryforwards. The deferred tax assets and liabilities represent the future tax return consequences of these differences,

which will either be taxable or deductible when assets and liabilities are recovered or settled, as well as operating loss carryforwards.

Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those

temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates

is recognized in income in the period that includes the enactment date. A valuation allowance is established against deferred tax assets

when in the judgment of management, it is more likely than not that such deferred tax assets will not become available. Because the judgment

about the level of future taxable income is dependent to a great extent on matters that may, at least in part, be beyond the Company’s

control, it is at least reasonably possible that management’s judgment about the need for a valuation allowance for deferred taxes

could change in the near term.

Tax benefits are recognized only for tax positions

that are more likely than not to be sustained upon examination by tax authorities. The amount recognized is measured as the largest amount

of benefit that is greater than 50 percent likely to be realized upon settlement. A liability for “unrecognized tax benefits”

is recorded for any tax benefits claimed in the Company’s tax returns that do not meet these recognition and measurement standards.

As of December 31, 2023 and 2022, no liability for unrecognized tax benefits was required to be reported.

Recently Issued Accounting Pronouncements

The Company has implemented all new applicable accounting

pronouncements that are in effect. These pronouncements did not have any material impact on the financial statements unless otherwise

disclosed, and the Company does not believe that there are any other new accounting pronouncements that have been issued that might have

a material impact on its financial position or results of operations.

NOTE 3 – GOING CONCERN

The Company’s financial statements have been

prepared assuming that the Company will continue as a going concern, which contemplates continuity of operations, realization of assets,

and liquidation of liabilities in the normal course of business.

As of December 31, 2023, the Company has no source

of revenue and has an accumulated deficit of approximately $87,803,324 and requires additional funds to support its operations and to

achieve its business development goals, the attainment of which are not assured.

These factors and uncertainties raise substantial

doubt about the Company’s ability to continue as a going concern. The financial statements do not include any adjustments relating

to the recoverability and classification of recorded assets, or the amounts and classification of liabilities that might incur in the

event the Company cannot continue in existence. Management intends to seek additional capital from new equity securities offerings, debt

financing and debt restructuring to provide funds needed to increase liquidity, fund internal growth and fully implement its business

plan. However, management can give no assurance that these funds will be available in adequate amounts, or if available, on terms that

would be satisfactory to the Company.

The timing and amount of the Company’s capital

requirements will depend on a number of factors, including maintaining its status as a public company and supporting shareholder and investor

relations.

NOTE 4 – SUBSEQUENT EVENTS

The Company follows the guidance in Section 855-10-50

of the FASB Accounting Standards Codification for the disclosure of subsequent events. The Company will evaluate subsequent events through

the date when the financial statements were issued.

Item 14. Changes in and Disagreements with Accountants.

We do not have and have not had any disagreements with our independent

accountants on any matter of accounting principles, practices or financial statement disclosure.

Item 15. Financial Statements and Exhibits.

Financial Statements – see Item 13, above.

Exhibits –

SIGNATURES

Pursuant to the requirements of Section 12 of the Securities Exchange

Act of 1934, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly

authorized.

| |

INNOVARO, INC. |

| |

|

|

| Date: August 13th, 2024 |

By: |

/s/ Kenneth D. Bland |

| |

Kenneth D. Bland |

| |

President |

Exhibit 3.1

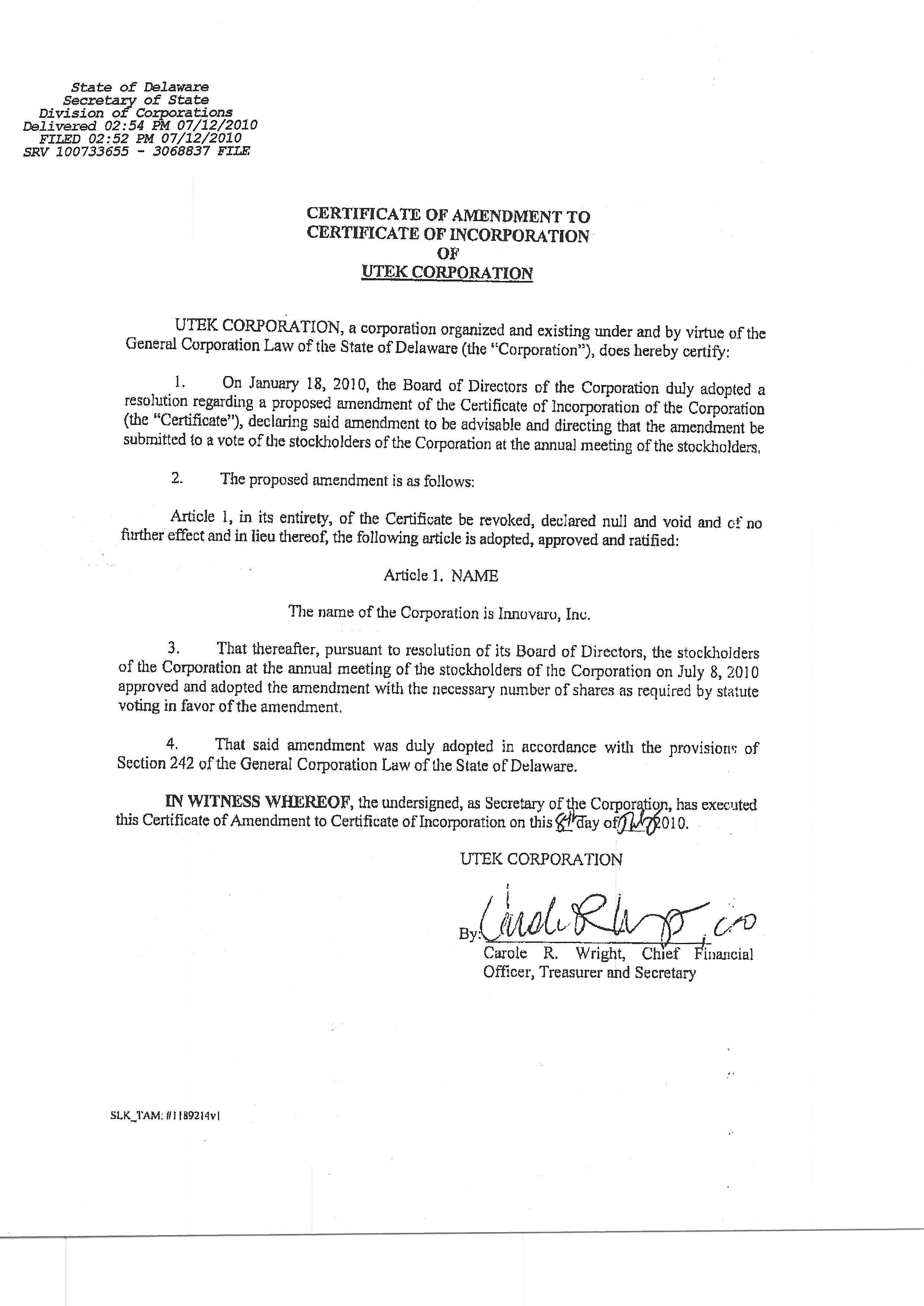

State of .Delaware Secretary of State Division of Corporations .Delivered 02:54 PM 07/12/2010 FILED 02:52 PM 07/12/2010 SRV 100733655 - 3068837 FILE CERTIFICATE OF AMENDMENT TO CERTIFICATE OF INCORPORATION OF UTEK CORPORATION UTEK CORPORATION, a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the "Corporation"), does hereby certify: 1. On January 18 , 2010 , the Board of Directors of the Corporation duly adopted a resolution regarding a proposed wnendment of the Certificate of Incorporation of the Corporation (the "Certificate"), declaring said amendment to be advisable and directing that the amendment be submitted to a vote of the stockholders of the Corporation at the annual meeting of the stockholders, 2. The proposed amendment is as follows: Article 1, in its entirety, of the Certificate be revoked, declared null and void and cf no further effect and in lieu thereof, the following article is adopted, approved and ratified: Article 1. NAME 111e name of thi:: Corporation is Innovaru, Inc. 3. That thereafter, pursuant to resolution of its Board of Directors, the stockholders of the Corporation at the annual meeting of the stockholders of the Corporation on July 8 , 2010 approved and adopted the amendment with the necessary number of shares as requ i red by statute voting in favor of the amendment . 4. That said amendment was duly adopted in accordance with the provision •: of Section 242 of the General Corporation Law of the State of Dt!laware . IN WITNESS WHEREOF, 1he undersigned, as Secretary oftjle COfJ?3f • has exec 1 .1ted thls Certificate of Amendment to Certificate of Incorporation on this 'cay of[)J!!IJ - 010. UTEK CORPORATION ! ! 0 i, · aLMoli c/ 0 Cai - ole R. Wright,cluefinancial Officer, Treasurer and Secretary SLK_TAM: Ill 189214vl

CERTIFICATE OF AMENDMENT OF CERTIFICATE OF INCORPORA TlON OF UTEK CORPORATION UTEK Corporation (the "Corporation''), a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware {the "DGCL "), does hereby certify as follows: FIRST: That the Board of Directors of said corporation, at a meeting duly convened and held, adopted the following resolution and directed that said resolution be submtted to stockholders of the Corporation entitled to vote in respect thereof for their approval: RESOLVED, that the Certificate of Incorporation be amended by changing the article thereof numbered "ARTlCLE 4" so that, as amended, said article shall be and read as follows: ARTICLE 4. SHARES The total authorized stock of this corporation shall consist of 29,000,000 shares of common stock having a par value of $0.0 l per share (the "Common Stock') and 1,000,000 shares of preferred stock having a par value of $0 . 0 I per share (the "Preferred Stock") . Each share of Common Stock shall entitle the holder to (I) one vote on all matters submitted to a vote of the shareholders, (ii) to receive dividends when and if declared by the Board of Directors from funds legally available therefore according to the number of shares held, and (iii) upon liquidation, dissolution or winding up of the Corporation, to share ratably in any assets available for distribution to shareholders and payment of all obligations of the Corporation and after provision has been made with respect to each class of stock, if any, having preference over the Common Stock. The shares of Preferred Stock may be issued in one or more series, and each series shall be so designated to distinguish the shares thereof from the shares of all other series. Authority is hereby expressly granted to the Board of Directors to fix by resolution or resolution, before the issuance of any shares of a particular series, the number ;ind any of the designations and the powers, preferences and rights, and the qualifications, limitations or restrictions which are pennjtted by Delaware General Corporation Law in respect of any series of Preferred Stock of the corporation. SECOND: The Corporation's original Certificate of Incorporation was filed with the Secretary of State of the State of Delaware on July 13. 1999. THIRD: The foregoing amendment has been duly adopted by the Board of Directors and stockholders in accordance with the provisions of Section 242 of the DGCL. IN WITNESS WHEREOF, UTEK Corporation has caused this Certificate . of Amendment to the Certificate of Jncorporation to be signed by its Chairman and Chief Executive Officer thi 0 day of June, 2007. Clifford M. Gross, Ph.D. Chainnan and Chief Executive Officer WO 7498&1.I State of Delaware Secreta.ey of State Division of Corporations Delivered 06:08 PM 07/12/2007 FILED 05: 54 PM 07/12/2007 SRV 070809331 - 3068837 FILE

Exhibit 3.2

AMENDED AND RESTATED BY-LAWS

OF

UTEK CORPORATION

(As amended and restated by the Board of Directors on

February 26, 2009)

ARTICLE I

OFFICES

1. The location of the registered office of the Corporation in the State of Delaware is

Corporation Trust Center, 1209 Orange Street, in the City of Wilmington, County of New Castle, and the name of its registered agent at such address is Corporation Trust Company.

2. The Corporation shall in addition to its registered office in the State of Delaware establish and maintain an office or offices at such place or

places as the Board of Directors may from time to time find necessary or desirable.

ARTICLE II

CORPORATE SEAL

The corporate seal of

the Corporation shall have inscribed thereon the name of the Corporation and may be in such form as the Board of Directors may determine. Such seal may be used by causing it or a facsimile thereof to be impressed, affixed or otherwise reproduced.

ARTICLE III

MEETINGS

OF STOCKHOLDERS

1. All meetings of the stockholders shall be held at the registered office of the Corporation in the State of Delaware

or at such other place as shall be determined from time to time by the Board of Directors.

2. The annual meeting of stockholders shall be

held on such day and at such time as may be determined from time to time by resolution of the Board of Directors, when they shall elect by plurality vote, a Board of Directors to hold office until the annual meeting of stockholders held next after

their election and their successors are respectively elected and qualified or until their earlier resignation or removal. Any other proper business may be transacted at the annual meeting.

3. The holders of a majority of the stock issued and outstanding and entitled to vote thereat, present in person or represented by proxy, shall constitute a quorum at all meetings of the stockholders for the

transaction of business, except as otherwise expressly provided by statute, by the Certificate of Incorporation or by these By-laws.

If, however, such majority shall not be present or represented at any meeting of the stockholders, the stockholders entitled to vote

thereat, present in person or by proxy, shall have power to adjourn the meeting from time to time, without notice other than

announcement at the meeting (except as otherwise provided by statute). At such adjourned meeting at which the requisite amount of

voting stock shall be represented any business may be transacted which might have been transacted at the meeting as originally

notified.

4. At all meetings of the stockholders each stockholder having the right to vote shall be entitled to vote in person, or by proxy appointed by an

instrument in writing subscribed by such stockholder and bearing a date not more than three years prior to said meeting, unless such instrument provides for a longer period.

5. At each meeting of the stockholders each stockholder shall have one vote for each share of capital stock having voting power, registered in his name

on the books of the Corporation at the record date fixed in accordance with these By-laws, or otherwise determined, with respect to such meeting. Except as otherwise expressly provided by statute, by the Certificate of Incorporation or by these

By-laws, all matters coming before any meeting of the stockholders shall be decided by the vote of a majority of the number of shares of stock present in person or represented by proxy at such meeting and entitled to vote thereat, a quorum being

present.

6. Notice of each meeting of the stockholders shall be mailed to each stockholder entitled to vote thereat not less than 10 nor

more than 60 days before the date of the meeting. Such notice shall state the place, date and hour of the meeting and, in the case of a special meeting, the purposes for which the meeting is called.

7. Special meetings of the stockholders, for any purpose or purposes, unless otherwise prescribed by statute, may be called by the President or by the

Board of Directors, and shall be called by the Secretary at the request in writing of stockholders owning a majority of the amount of the entire capital stock of the Corporation issued and outstanding and entitled to vote. Such request by

stockholders shall state the purpose or purposes of the proposed meeting.

8. Business transacted at each special meeting shall be confined

to the purpose or purposes stated in the notice of such meeting.

9. The order of business at each meeting of stockholders shall be

determined by the presiding officer.

ARTICLE IV

DIRECTORS

1. The business and affairs of the Corporation shall be managed under the direction of a

Board of Directors, which may exercise all such powers and authority for and on behalf of the Corporation as shall be permitted by law, the Certificate of Incorporation or these By-laws. Each of the directors shall hold office until the next annual

meeting of stockholders and until his successor has been elected and qualified or until his earlier resignation or removal.

2.

The Board of Directors may hold their meetings within or outside of the State of Delaware, at such place or places as it may from time

to time determine.

3. The number of directors comprising the Board of Directors shall be such number as may be from time to

time fixed by resolution of the Board of Directors. In case of any increase, the Board shall have power to elect each additional director to hold office until the next annual meeting of stockholders and until his successor is elected and qualified

or his earlier resignation or removal. Any decrease in the number of directors shall take effect at the time of such action by the Board only to the extent that vacancies then exist; to the extent that such decrease exceeds the number of such

vacancies, the decrease shall not become effective, except as further vacancies may thereafter occur, until the time of and in connection with the election of directors at the next succeeding annual meeting of the stockholders.

4. If the office of any director becomes vacant, by reason of death, resignation, disqualification or otherwise, a majority of the directors then in

office, although less than a quorum, may fill the vacancy by electing a successor who shall hold office until the next annual meeting of stockholders and until his successor is elected and qualified or his earlier resignation or removal.

5. Any director may resign at any time by giving written notice of his resignation to the Board of Directors. Any such resignation shall take effect

upon receipt thereof by the Board, or at such later date as may be specified therein. Any such notice to the Board shall be addressed to it in care of the Secretary.

ARTICLE V

COMMITTEES OF DIRECTORS

1. The Board may designate an Executive Committee and one or more other committees, each such committee to consist of one or more directors of the

Corporation. The Executive Committee shall have and may exercise all the powers and authority of the Board in the management of the business and affairs of the Corporation (except as otherwise expressly limited by statute), including the power and

authority to declare dividends and to authorize the issuance of stock, and may authorize the seal of the corporation to be affixed to all papers which may require it. Each such committee shall have such of the powers and authority of the Board as

may be provided from time to time in resolutions adopted by a majority of the whole Board.

2. The requirements with respect to the manner

in which the Executive Committee and each such other committee shall hold meetings and take actions shall be set forth in the resolutions of the Board of Directors designating the Executive Committee or such other committee.

ARTICLE VI

COMPENSATION OF

DIRECTORS

The

directors shall receive such compensation for their services as may be authorized by resolution of the Board of Directors, which

compensation may include an annual fee and a fixed sum for expense of attendance at regular or special meetings of the Board or any

committee thereof. Nothing herein contained shall be construed to preclude any director from serving the Corporation in any other

capacity and receiving compensation therefor.

ARTICLE VII

MEETINGS OF DIRECTORS; ACTION WITHOUT A MEETING

1. Regular meetings of the Board of Directors may be held without notice

at such time and place, either within or without the State of Delaware, as may be determined from time to time by resolution of the Board.

2. Special meetings of the Board of Directors shall be held whenever called by the President of the Corporation or the Board of Directors on at least 24 hours’ notice to each director. Except as may be otherwise specifically provided

by statute, by the Certificate of Incorporation or by these By-laws, the purpose or purposes of any such special meeting need not be stated in such notice, although the time and place of the meeting shall be stated.

3. At all meetings of the Board of Directors, the presence in person of a majority of the total number of directors shall be necessary and sufficient to

constitute a quorum for the transaction of business, and, except as otherwise provided by statute, by the Certificate of Incorporation or by these Bylaws, if a quorum shall be present the act of a majority of the directors present shall be the act

of the Board.

4. Any action required or permitted to be taken at any meeting of the Board of Directors or of any committee thereof may be

taken without a meeting if all the members of the Board or such committee, as the case may be, consent thereto in writing and the writing or writings are filed with the minutes of proceedings of the Board of committee. Any director may participate

in a meeting of the Board, or any committee designated by the Board, by means of a conference telephone or similar communications equipment by means of which all persons participating in the meeting can hear each other, and participation in a

meeting pursuant to this sentence shall constitute presence in person at such meeting.

ARTICLE VIII

OFFICERS

1. The officers of the

Corporation shall be chosen by the Board of Directors and shall be a President, one or more Vice Presidents, a Secretary and a Treasurer. The Board may also choose one or more Assistant Secretaries and Assistant Treasurers, and such other officers

as it shall deem necessary. Any number of offices may be held by the same person.

2.

The salaries of all officers of the Corporation shall be fixed by the Board of Directors, or in such manner as the Board may prescribe.

3. The officers of the Corporation shall hold office until their successors are elected and qualified, or

until their earlier resignation or removal. Any officer may be at any time removed from office by the Board of Directors, with or without cause. If the office of any officer becomes vacant for any reason, the vacancy may be filled by the Board of

Directors.

4. Any officer may resign at any time by giving written notice of his resignation to the Board of Directors. Any such

resignation shall take effect upon receipt thereof by the Board or at such later date as may be specified therein. Any such notice to the Board shall be addressed to it in care of the Secretary.

ARTICLE IX

CHIEF EXECUTIVE OFFICER

Subject to the supervision and direction of the Board of Directors, the Chief Executive Officer shall be responsible for managing the

affairs of the Corporation. He shall have supervision and direction of all of the other officers of the Corporation and shall have the powers and duties usually and customarily associated with the office of the President. He shall preside at

meetings of the stockholders and of the Board of Directors.

ARTICLE X

PRESIDENT

The President shall have such powers and duties as may be delegated

to him by the Chief Executive Officer. In the event that the Board of Directors does not appoint a Chief Executive Officer, the President shall perform the duties and shall have the powers of the Chief Executive Officer.

ARTICLE XI

SECRETARY AND ASSISTANT

SECRETARY

1. The Secretary shall attend all meetings of the Board of Directors and of the stockholders, and shall record the minutes

of all proceedings in a book to be kept for that purpose. He shall perform like duties for the committees of the Board when required.

2.

The Secretary shall give, or cause to be given, notice of meetings of the stockholders, of the Board of Directors and of the committees

of the Board. He shall keep in safe custody the seal of the Corporation, and when authorized by the Chief Executive Officer, President,

an Executive Vice President or a Vice President, shall affix the same to any instrument requiring it, and when so affixed it shall be

attested by his signature or by the signature of an Assistant Secretary. He shall have such other powers and duties as may be delegated

to him by the Chief Executive Officer or by the President. The Assistant Secretary shall, in case of the absence of the Secretary,

perform the duties and exercise the powers of the Secretary, and shall have such other powers and duties as may be delegated to them

by the Chief Executive Officer or by the President.

ARTICLE XII

TREASURER AND ASSISTANT TREASURER

1. The Treasurer shall have the custody of the corporate funds and securities, and shall deposit or cause to be deposited under his direction all moneys

and other valuable effects in the name and to the credit of the Corporation in such depositories as may be designated by the Board of Directors or pursuant to authority granted by it. He shall render to the Chief Executive Officer and to the

President and the Board whenever they may require it an account of all his transactions as Treasurer and of the financial condition of the Corporation. He shall have such other powers and duties as may be delegated to him by the Chief Executive

Officer or by the President.

2. The Assistant Treasurer shall, in case of the absence of the Treasurer, perform the duties and exercise

the powers of the Treasurer, and shall have such other powers and duties as may be delegated to them by the Chief Executive Officer or by the President.

ARTICLE XIII

CERTIFICATES OF STOCK

The certificates of stock of the Corporation shall be numbered and shall be entered in the books of the Corporation as they are issued. They shall

exhibit the holder’s name and number of shares and shall be signed by the Chief Executive Officer, President or an Executive Vice President or Vice President, and by the Treasurer or an Assistant Treasurer, or the Secretary or an Assistant

Secretary.

ARTICLE XIV

CHECKS

All checks, drafts and other orders for the payment of money and all promissory notes and other evidences of

indebtedness of the Corporation shall be signed by such officer or officers or such other person as may be designated by the Board of Directors or pursuant to authority granted by it.

ARTICLE XV

FISCAL YEAR

The fiscal year

of the Corporation shall be as determined from time to time by resolution duly adopted by the Board of Directors.

ARTICLE XVI

NOTICES AND WAIVERS

1. Whenever by statute, by the Certificate of Incorporation or by these By-laws

it is provided that notice shall be given to any director or stockholder, such provision shall not be construed to require personal notice, but such notice may be given in writing, by mail, by depositing the same in the United States mail, postage

prepaid, directed to such stockholder or director at his address as it appears on the records of the Corporation, and such notice shall be deemed to be given at the time when the same shall be thus deposited. Notice of regular or special meetings of

the Board of Directors may also be given to any director by telephone or by telex, telegraph or cable, and in the latter event the notice shall be deemed to be given at the time such notice, addressed to such director at the address hereinabove

provided, is transmitted by telex (with confirmed answerback), or delivered to and accepted by an authorized telegraph or cable office.

2.

Whenever by statute, by the Certificate of Incorporation or by these By-laws a notice is required to be given, a written waiver thereof, signed by the person entitled to notice, whether before or after the time stated therein, shall be deemed

equivalent to notice. Attendance of any stockholder or director at any meeting thereof shall constitute a waiver of notice of such meeting by such stockholder or director, as the case may be, except as otherwise provided by statute.

ARTICLE XVII

INDEMNIFICATION

All

persons who the Corporation is empowered to indemnify pursuant to the provisions of Section 145 of the General Corporation Law of

the State of Delaware (or any similar provision or provisions of applicable law at the time in effect) shall be indemnified by the Corporation

to the full extent permitted thereby. The foregoing right of indemnification shall not be deemed to be exclusive of any other such rights

to which those seeking indemnification from the Corporation may be entitled, including, but not limited to, any rights of indemnification

to which they may be entitled pursuant to any agreement, insurance policy, other by-law or charter provision, vote of stockholders or

directors, or otherwise. No repeal or amendment of this Article XVIII shall adversely affect any rights of any person pursuant to this

Article XVIII which existed at the time of such repeal or amendment with respect to acts or omissions occurring prior to such repeal

or amendment.

ARTICLE XVIII

ALTERATION OF BY-LAWS

The By-laws of the Corporation may be altered, amended or repealed, and new

By-laws may be adopted, by the stockholders or by the Board of Directors.

Exhibit 10.1

ADVISORY AGREEMENT THIS ADVISORY AGREEMENT (this "Agreement") is made as of April Pt, 2024, by and among Innovaro, Inc., a limited liability company incorporated under the laws of Delaware with address at 624 Tyvola Rd Suite l 03 # 186 Charlotte, NC 28217 (the "Company"); Kenneth Bland & Ezzat Jallad collectively (the "Advisors"). WHEREAS, the Company requires expertise in the areas of Re - organization, Audit, SEC Filing requirements, among others WHEREAS, the Advisors have the expertise to assist and implement such requirements and have agreed to provide to the Company. NOW, THEREFORE, in consideration of the services contained herein the parties agree as follows: 1. Appointment of Advisors The Company hereby appoints the Advisors, and the Advisors agree to implement the required actions 2. Company Obligations (a) The Company shall cooperate with the Advisor and provide necessary documents and information as requested by the Advisors; (b) The Company shall make the payment of the advisory fee as stipulated in the Agreement without delay. 4. Company Information In connection with the Advisors performance of its duties hereunder, the Company shall (i) provide the Advisors on a timely basis, all information reasonably requested by the Advisors, and (ii) make its officers and professionals available to the Advisors and such third parties as the Advisors shall designate (such as the Auditors & Attorneys) , as agreed to in advance by the Company, at reasonable times and upon reasonable notice . 5. Confidential Information The Advisors acknowledges that, in the course of performing its duties hereunder, it may obtain information relating to the Company, which the Company has marked as confidential ("Confidential Information") . The Advisors shall hold at all times , both during the term of this Agreement and at all times thereafter, such Confidential Information in the strictest confidence, and shall not use such Confidential Information for any purpose, other than as may be reasonably necessary for the performance of its duties purs 1 uant to this Agreement, without the Company's