ScS Group PLC Trading Update (0105C)

16 Junio 2021 - 1:00AM

UK Regulatory

TIDMSCS

RNS Number : 0105C

ScS Group PLC

16 June 2021

For Immediate Release 16 June 2021

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 which is part of UK law

by virtue of the European Union (Withdrawal) Act 2018

ScS Group plc

("ScS", or the "Group")

Trading Update

Current trading very strong and the Board now expects FY21 to be

ahead of market expectations

Outlook for FY22 substantially better than current market

forecasts

Resumption of dividends with interim dividend declared today

ScS, one of the UK's largest retailers of upholstered furniture

and floorings, today issues the following trading update for the 46

weeks ended 12 June 2021.

Order intake

As previously reported, the Group experienced strong order

intake growth over the first 21 weeks of the financial year despite

the impact of further temporary regional and national store

closures across the UK as a result of COVID-19. Increased

restrictions across the UK meant our stores were closed from late

December onwards, with our Scottish stores opening on 5 April,

followed by our English and Welsh stores on 12 April.

Period Weeks Like-for-like order Like-for-like order

intake vs prior year intake vs 2019

26 July to 19 December 1 to 21 12.4% 6.6%

--------- ---------------------- --------------------

20 December to 23 January 22 to 26 (65.2%) (65.9%)

--------- ---------------------- --------------------

26 July 2020 to 23 January 2021 1 to 26 (9.1%) (13.1%)

--------- ---------------------- --------------------

24 January to 3 April 21 27 to 36 (82.9%) (86.2%)

--------- ---------------------- --------------------

4 April 2021 to 12 June 2021 37 to 46 370.8%* 79.0%

--------- ---------------------- --------------------

26 July 2020 to 12 June 2021 1 to 46 10.6% (9.5%)

--------- ---------------------- --------------------

*stores were closed for the majority of this period in the prior

year

The Board is delighted to report that, following the reopening

of our stores, performance has been very encouraging. T he Board

expects full year performance for FY21 to be ahead of market

expectations.

The launch of the new website, coupled with a number of

initiatives completed in the year, has seen the Group's online

sales channel continue to make good progress, with a year to date

increase in order intake of 95.3% when compared with the same

period in the prior year (+165.0% on a two year basis).

As at 12 June 2021, the Group's order book was GBP116.6m

(including VAT), GBP39.0m larger than at the same point in the

prior year.

Liquidity

The Group has maintained a robust balance sheet, with cash at 12

June 2021 of GBP101.3m and no debt. Further liquidity is available

through the three year GBP20.0m CLBILS revolving credit facility

(RCF) granted on 25 August 2020.

Furlough

Given the encouraging trading performance, and in line with the

intention outlined in our half year results announcement, the Board

confirms that the Group has repaid the GBP3.0m Coronavirus Job

Retention Scheme (CJRS) grants previously claimed in relation to

the current financial year.

Dividend

The strength of the Group's balance sheet, coupled with the

robust trading experienced since our stores opened in April, has

provided the Board with the confidence to recommence dividends,

starting with an interim dividend of 3.0p per share which is being

declared with this update. The dividend will be paid on 24 July

2021 to shareholders on the register on 9 July 2021. The

ex-dividend date is 8 July 2021.

Outlook

The Board is encouraged by the Group's strong trading

performance since reopening. Whilst some uncertainty persists

relating to the end to all Covid restrictions, the Board believes

the Group is well positioned to maximise opportunities for growth.

The Group has a robust balance sheet and the re-introduction of

dividends today reflects the Board's confidence in the business

going forward. As such, and given the strength of the current order

book, the Board's outlook for FY22 is substantially better than

current market forecasts.

David Knight's handover to the new CEO Steve Carson has

progressed as planned and Steve has now assumed responsibility for

the day to day running of the business, with David remaining

available to support as and when required.

Next scheduled update

The Group will provide a trading update for the 53 weeks ending

31 July 2021 on Thursday 5 August, ahead of publishing its

preliminary results for the year on Tuesday 5 October 2021.

Enquiries:

ScS Group PLC c/o Buchanan +44 (0)20

Steve Carson, Chief Executive Officer 7466 5000

Chris Muir, Chief Financial Officer

Buchanan Tel: +44 (0)20 7466

Richard Oldworth 5000

Tilly Abraham scs@buchanan.uk.com

Charlotte Slater

Shore Capital Tel: +44 (0)207 408

Patrick Castle 4050

James Thomas

Sarah Mather

Notes to Editors

ScS is one of the UK's largest retailers of upholstered

furniture and floorings, promoting itself as the "Sofa Carpet

Specialist", seeking to offer value and choice through a wide range

of upholstered furniture and flooring products. The Group's product

range is designed to appeal to a broad customer base with a

mid-market priced offering and is currently traded from 100

stores.

The Group's upholstered furniture business specialises primarily

in fabric and leather sofas and chairs. ScS sells a range of

branded products which are not sold under registered trademarks and

a range of branded products which are sold under registered

trademarks owned by ScS (such as Endurance, Inspire and SiSi

Italia). The Group also offers a range of third-party brands (which

include La-Z-Boy and G Plan). The Group's flooring business

includes carpets, as well as laminate and vinyl flooring.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGPURAQUPGGQA

(END) Dow Jones Newswires

June 16, 2021 02:00 ET (06:00 GMT)

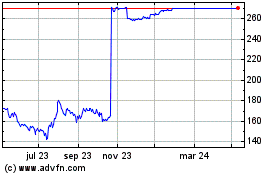

Scs (LSE:SCS)

Gráfica de Acción Histórica

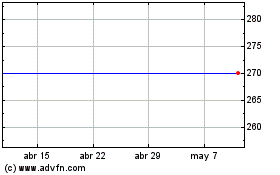

De Mar 2024 a Abr 2024

Scs (LSE:SCS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024