Bank of Georgia Group PLC BOG issues US$ 100,000,000 11.125% AT 1 Notes (6992T)

22 Marzo 2019 - 1:30AM

UK Regulatory

TIDMBGEO

RNS Number : 6992T

Bank of Georgia Group PLC

22 March 2019

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO, OR TO

ANY PERSON LOCATED OR RESIDENT IN, ANY JURISDICTION WHERE IT IS

UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE THIS ANNOUNCEMENT (THE

"ANNOUNCEMENT"). IN PARTICULAR, NOT FOR RELEASE, PUBLICATION OR

DISTRIBUTION IN OR INTO, OR TO ANY PERSON LOCATED OR RESIDENT IN,

THE UNITED STATES, ITS TERRITORIES AND POSSESSIONS, ANY STATE OF

THE UNITED STATES OR THE DISTRICT OF COLUMBIA (THE "UNITED STATES")

OR TO ANY U.S. PERSON (AS DEFINED IN REGULATION S UNDER THE U.S.

SECURITIES ACT OF 1933, AS AMENDED). THE SECURITIES REFERRED TO IN

THIS ANNOUNCEMENT ARE NOT INTENDED TO BE SOLD AND SHOULD NOT BE

SOLD TO RETAIL CLIENTS IN THE EUROPEAN ECONOMIC AREA ("EEA"), AS

DEFINED IN THE RULES SET OUT IN THE MARKETS IN FINANCIAL

INSTRUMENTS DIRECTIVE 2014/65/EU ("MiFID II"), AS AMENDED OR

REPLACED FROM TIME TO TIME. THE SECURITIES IN THIS ANNOUNCEMENT ARE

NOT INTENDED TO BE OFFERED OR SOLD AND SHOULD NOT BE OFFERED OR

SOLD TO ANY NATURAL PERSON FOR THE PURPOSES OF APPLICABLE BANKING

REGULATIONS IN GEORGIA.

London, 22 March 2019

JSC Bank of Georgia announces issuance of U.S.$ 100,000,000

11.125% Additional Tier 1 Capital Notes

On Thursday, March 21, Bank of Georgia Group PLC's subsidiary,

JSC Bank of Georgia (the "Bank") successfully priced an inaugural

U.S.$ 100 million offering of 11.125% Additional Tier 1 Capital

Perpetual Subordinated Notes callable after 5.25 years and on every

subsequent interest payment date, subject to prior consent of the

National Bank of Georgia (the "Notes"). The Notes are being issued

in accordance with Regulation S and sold at an issue price of

100.00%. J.P. Morgan and UBS Investment Bank are acting as Joint

Bookrunners for the Notes, and Galt & Taggart is acting as a

Co-Manager. Latham & Watkins LLP and Baker & McKenzie LLP

are acting as legal advisors to the Joint Bookrunners and the Bank,

respectively. The Notes are expected to be listed on the Irish

Stock Exchange and to be rated B- (Fitch). On closing, the issuance

is expected to be the first international offering of Additional

Tier 1 Capital Notes from Georgia and the South Caucasus

region.

Archil Gachechiladze, Chief Executive Officer of Bank of Georgia

commented: "I am delighted that Bank of Georgia has issued the

first ever Additional Tier 1 Capital Notes from Georgia and the

South Caucasus region. Basel III regulations recently introduced in

Georgia enable this type of capital optimisation and this US Dollar

issue provides the Bank with an opportunity to diversify our

capital structure from a foreign currency perspective and provide a

natural hedge against dollarisation in the economy. Subject to

final regulatory approval, we expect this issuance to add

approximately 230 basis points to the Bank's Tier 1 capital ratio.

To reduce the carry-cost of this new issuance, we intend to repay a

portion of existing Tier 2 capital instruments upon receipt of a

consent of the National Bank of Georgia."

Disclaimer

In the European Economic Area, with respect to any Member State

that has implemented Directive 2003/71/EC and Directive 2010/73/EU

(together with any applicable implementing measures in any Member

State, the "Prospectus Directive"), this Announcement is only

addressed to and is only directed at qualified investors

("Qualified Investors") in that Member State within the meaning of

Artcile2(1)(e) of the Prospectus Directive.

The securities referred to herein have not been and will not be

registered under the US Securities Act of 1933, as amended (the

"Securities Act"), or with any securities regulatory authority of

any state or other jurisdiction of the United States, and may not

be offered or sold in the United States or to US persons (as such

term is defined in Regulation S under the Securities Act) except

pursuant to an exemption from, or in a transaction not subject to,

the registration requirements of the US Securities Act. The issuer

of the securities has not registered, and does not intend to

register, any portion of the offering in the United States, and

does not intend to conduct a public offering of the securities in

the United States.

This Announcement is not intended to, and shall not, constitute

or contain an offer to sell or solicitation of an offer to purchase

the securities referred to herein by any person in any jurisdiction

where it is unlawful to make an offer or solicitation. The

distribution of the Announcement and the offer or sale of the

securities referred to herein in certain jurisdictions is

restricted by law. This Announcement may not be used for or in

connection with, and does not constitute, any offer to, or

solicitation by, anyone in any jurisdiction or under any

circumstance in which such offer or solicitation is not authorised

or is unlawful.

In the United Kingdom ("UK"), this Announcement is being

distributed only to, and is directed only at, Qualified Investors

(i) who have professional experience in matters relating to

investments falling within Article 19(5) of the Financial Services

and Markets Act 2000 (Financial Promotion) Order 2005, as amended

(the "Order") and Qualified Investors falling within Article 49 of

the Order, and (ii) to whom it may otherwise be lawfully

communicated (all such persons together being referred to as

"relevant persons"). Any investment or investment activity to which

this Announcement relates is available only to relevant persons and

will be engaged in only with relevant persons. Any person who is

not a relevant person should not act or rely on this Announcement

or any of its contents.

This Announcement is not intended to be a public offer or

advertisement of securities in Georgia, and is not intended to be

an offer, or an invitation to make offers, to purchase, sell,

exchange or transfer any securities in Georgia, and must not be

made otherwise publicly available in Georgia. Any failure to comply

with this restriction may constitute a violation of Georgia

securities law.

Name of authorised official of issuer responsible for making

notification: Natia Kalandarishvili, Head of Investor Relations and

Funding

About Bank of Georgia Group PLC

Bank of Georgia Group PLC ("Bank of Georgia Group" or the

"Group" - LSE: BGEO LN) is a UK incorporated holding company, which

comprises: a) retail banking and payment services, b) corporate

investment banking and wealth management operations and c) banking

operations in Belarus ("BNB"). JSC Bank of Georgia ("Bank of

Georgia", "BOG" or the "Bank"), the leading universal bank in

Georgia, is the core entity of the Group. The Group targets to

benefit from superior growth of the Georgian economy through both

its retail banking and corporate investment banking services and

aims to deliver on its strategy, which is based on at least 20%

ROAE and 15%-20% growth of its loan book.

JSC Bank of Georgia has, as of

the date hereof, the following

credit ratings:

Fitch Ratings 'BB-/B'

Moody's 'Ba3/NP' (FC) &

'Ba2/NP' (LC)

For further information, please visit www.bankofgeorgiagroup.com

or contact:

Archil Gachechiladze Michael Oliver David Tsiklauri Natia Kalandarishvili

Group CEO Adviser to the Group CFO Head of Investor

CEO Relations

+995 322 444 444

+995 322 444 144 +44 203 178 4034 +995 322 444 108 (9282)

agachechiladze@bog.ge moliver@bgeo.com dtsiklauri@bog.ge ir@bog.ge

This news report is presented for general informational purposes

only and should not be construed as an offer to sell or the

solicitation of an offer to buy any securities

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCLIFLDVTIFFIA

(END) Dow Jones Newswires

March 22, 2019 03:30 ET (07:30 GMT)

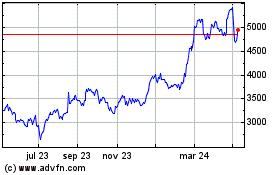

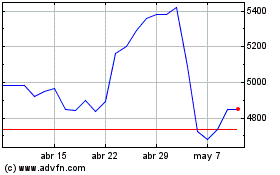

Bank Of Georgia (LSE:BGEO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Bank Of Georgia (LSE:BGEO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024