Current Report Filing (8-k)

17 Marzo 2021 - 6:35AM

Edgar (US Regulatory)

0000037996False00000379962021-03-162021-03-160000037996f:FPRBMember2021-03-162021-03-160000037996f:FPRCMember2021-03-162021-03-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report: March 16, 2021

(Date of earliest event reported)

FORD MOTOR COMPANY

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1-3950

|

|

38-0549190

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

One American Road

|

|

|

|

Dearborn,

|

Michigan

|

|

48126

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code 313-322-3000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $.01 per share

|

|

F

|

|

New York Stock Exchange

|

|

6.200% Notes due June 1, 2059

|

|

FPRB

|

|

New York Stock Exchange

|

|

6.000% Notes due December 1, 2059

|

|

FPRC

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On March 16, 2021, Ford Motor Company (“Ford” or “Company”) entered into the Seventeenth Amendment (the “Seventeenth Amendment”) to its Credit Agreement dated as of December 15, 2006, as amended and restated as of November 24, 2009, as amended and restated as of April 30, 2014, and as further amended and restated as of April 30, 2015 (as amended, supplemented, or otherwise modified from time to time prior to March 16, 2021, the “Existing Credit Agreement”) among Ford, the subsidiary borrowers from time to time party thereto, the several lenders from time to time party thereto, JPMorgan Chase Bank, N.A., as administrative agent, and the other agents party thereto. The Seventeenth Amendment is attached hereto as Exhibit 10.1 and is incorporated by reference herein.

Also on March 16, 2021, Ford entered into the Second Amendment (the “Supplemental Second Amendment”) to its Revolving Credit Agreement dated as of April 23, 2019 (as amended, supplemented, or otherwise modified from time to time prior to March 16, 2021, the “Existing Supplemental Revolving Credit Agreement”) among Ford, the several lenders from time to time party thereto, and JPMorgan Chase Bank, N.A., as administrative agent. The Supplemental Second Amendment is attached hereto as Exhibit 10.2 and is incorporated by reference herein.

The Seventeenth Amendment and the Supplemental Second Amendment amend the Existing Credit Agreement and the Existing Supplemental Revolving Credit Agreement, respectively, to facilitate the offering of the Notes (as defined below), including to permit the Company to settle in cash any conversion, redemption, or other prepayment of the Notes.

Item 8.01. Other Events.

On March 17, 2021, the Company issued a press release announcing the pricing of the offering of $2.0 billion aggregate principal amount (plus an additional $300 million to be subject to an over-allotment option) of convertible senior notes due 2026 (the “Notes”) in a private placement offering to persons reasonably believed to be qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”). A copy of the press release is filed as Exhibit 99 hereto and is incorporated by reference herein.

This Current Report on Form 8-K is neither an offer to sell nor a solicitation of an offer to buy any security (including without limitation the Notes and the shares of the Company’s common stock issuable upon conversion of the Notes) and shall not constitute an offer, solicitation, or sale in any jurisdiction in which such offer, solicitation, or sale would be unlawful.

Item 9.01. Financial Statements and Exhibits.

EXHIBITS*

|

|

|

|

|

|

|

|

|

|

|

Designation

|

Description

|

Method of Filing

|

|

|

|

|

|

|

Seventeenth Amendment dated March 16, 2021 to the

|

Filed with this Report

|

|

|

Credit Agreement dated as of December 15, 2006,

|

|

|

|

as amended and restated as of November 24, 2009,

|

|

|

|

as amended and restated as of April 30, 2014,

|

|

|

|

as amended and restated as of April 30, 2015,

|

|

|

|

and as further amended

|

|

|

|

|

|

|

|

Second Amendment dated March 16, 2021 to the

|

Filed with this Report

|

|

|

Revolving Credit Agreement dated April 23, 2019

|

|

|

|

|

|

|

|

News release announcing the pricing of the Notes

|

Filed with this Report

|

|

|

offering, dated March 17, 2021

|

|

|

|

|

|

|

Exhibit 104

|

Cover Page Interactive Data File

|

**

|

|

|

(formatted in Inline XBRL)

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

FORD MOTOR COMPANY

|

|

|

|

(Registrant)

|

|

|

|

|

|

Date: March 17, 2021

|

By:

|

/s/ Corey M. MacGillivray

|

|

|

|

Corey M. MacGillivray

|

|

|

|

Assistant Secretary

|

|

|

|

|

|

|

|

|

|

|

|

*

|

|

Any reference in the attached exhibit(s) to our corporate website(s) and/or other social media sites or platforms, and the contents thereof, is provided for convenience only; such websites or platforms and the contents thereof are not incorporated by reference into this Report nor deemed filed with the Securities and Exchange Commission.

|

|

**

|

|

Submitted electronically with this Report in accordance with the provisions of Regulation S-T.

|

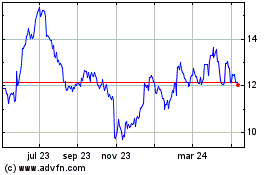

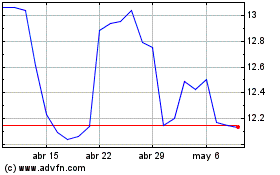

Ford Motor (NYSE:F)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Ford Motor (NYSE:F)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024