UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2025.

Commission File Number 001-31722

New Gold Inc.

Suite 3320 - 181 Bay Street

Toronto, Ontario M5J 2T3

Canada

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form

40-F ☒

DOCUMENTS FILED AS PART OF THIS FORM 6-K

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

NEW GOLD INC. |

| |

|

|

| |

By: |

/s/ Sean Keating |

|

| Date: January 9, 2025 |

|

Sean Keating |

| |

|

Vice President, General Counsel and Corporate Secretary |

Exhibit 99.1

NEW GOLD DELIVERS HIGHEST PRODUCTION QUARTER

OF 2024

Upcoming Catalysts to Showcase Significant Near-Term

Free Cash Flow Generation

TORONTO, Jan. 9, 2025 /CNW/ - New Gold Inc. ("New

Gold" or the "Company") (TSX: NGD) (NYSE American: NGD) reports fourth quarter and full year operational results for

the Company as of December 31, 2024.

The Company is providing notice that it will release

its operational outlook, technical report summaries for Rainy River and New Afton, and updated Mineral Reserve and Mineral Resource Statement

for the Company as of December 31, 2024 after market close on Wednesday, February 12, 2025. A conference call and webcast will be hosted

on Thursday, February 13, 2025 at 1:00 pm Eastern Time.

The Company is also providing notice that it will

release its fourth quarter and full year 2024 financial results after market close on Wednesday, February 19, 2025. The Company will host

its fourth quarter and full year 2024 earnings conference call and webcast on Thursday, February 20, 2025 at 8:30 am Eastern Time.

Highest Production Quarter of the Year Highlighted

by New Afton Beating Gold Production Guidance, Partially Offsetting Rainy River Underperformance

"The fourth quarter was our highest production

quarter of the year. This was during a quarter that saw New Gold deliver on key growth milestones including commercial production at New

Afton's C-Zone and first ore from Rainy River underground, both ahead of schedule," stated Patrick Godin, President & CEO. "New

Afton delivered a standout quarter for gold production, beating the top end of its gold production guidance range. Rainy River experienced

operational challenges in December impacting processing capabilities, leading to a slight miss on updated consolidated gold production

guidance for the year."

"The Company continues to advance initiatives

to shape its future. We will release two updated technical reports later this quarter, one for Rainy River and one for New Afton, to illustrate

our ability to increase our production, decrease our costs, and maximize our free cash flow generation in the years to come," added

Mr. Godin.

- Fourth quarter consolidated production was 80,438 ounces of gold

and 14.5 million pounds of copper, representing the highest gold and copper production quarter of 2024, resulting in a 2% and 20% increase

over the prior-year period, and 3% and 15% increase over the third quarter of 2024, respectively.

- New Afton fourth quarter production was 19,652 ounces of gold

and 14.5 million pounds of copper, an increase of 19% gold production and 15% copper production over the third quarter. The B3 cave performed

as planned, and C-Zone ore production is ramping up as planned following commercial production and crusher commissioning early in the

fourth quarter. Gold production beat the top end of the original 2024 guidance, with copper production achieving the midpoint.

- Rainy River fourth quarter production was 60,786 ounces of gold.

Fourth quarter operations were adversely impacted by unexpected mechanical down-time on the crushing and conveying system in December,

leading to lower than expected throughput. As a result, fourth quarter production, specifically December production, was below plan, leading

to gold production slightly below the updated 2024 guidance range.

- 2024 consolidated gold production of 298,303 ounces of gold was

slightly below the updated consolidated guidance range of 300,000 to 310,000 ounces, while 54.0 million pounds of copper achieved the

midpoint of initial copper production guidance range outlined at the start of 2024. Consolidated all-in sustaining costs3 are

expected to be at the low end of the guidance range of $1,240 to $1,340 per gold ounce sold on a by-product basis.

Operational Highlights

| Consolidated1 |

Q4 2024 |

FY 2024 |

2024 Updated Guidance |

| Gold production (ounces) |

80,438 |

298,303 |

300,000 – 310,000 |

| Gold sold (ounces) |

77,281 |

296,846 |

- |

| Copper production (Mlbs) |

14.5 |

54.0 |

50 - 60 |

| Copper sold (Mlbs) |

13.6 |

50.0 |

- |

| New Afton Mine1 |

Q4 2024 |

FY 2024 |

2024 Original Guidance |

| Gold production (ounces) |

19,652 |

72,609 |

60,000 – 70,000 |

| Gold sold (ounces) |

18,442 |

68,170 |

- |

| Copper production (Mlbs) |

14.5 |

54.0 |

50 - 60 |

| Copper sold (Mlbs) |

13.6 |

50.0 |

- |

| |

|

|

|

|

|

|

| Rainy River Mine1 |

Q4 2024 |

FY 2024 |

2024 Updated Guidance |

| Gold production (ounces) |

60,786 |

225,694 |

230,000 - 240,000 |

| Gold sold (ounces) |

58,839 |

228,676 |

- |

Operating Key Performance Indicators

| New Afton Mine |

Q4 2024 |

Q4 2023 |

FY 2024 |

FY 2023 |

| New Afton Mine Only |

|

|

|

|

| Tonnes mined per day (ore and waste) |

11,890 |

9,933 |

10,616 |

9,771 |

| Tonnes milled per calendar day |

13,189 |

8,181 |

11,439 |

8,289 |

| Gold grade milled (g/t) |

0.58 |

0.73 |

0.61 |

0.72 |

| Gold recovery (%) |

85 |

90 |

87 |

90 |

| Copper grade milled (%) |

0.62 |

0.79 |

0.65 |

0.77 |

| Copper recovery (%) |

87 |

91 |

89 |

91 |

| Gold production (ounces) |

19,310 |

15,942 |

71,551 |

62,637 |

| Copper production (Mlbs) |

14.5 |

12.0 |

54.0 |

47.4 |

| Ore Purchase Agreements2 |

|

|

|

|

| Gold production (ounces) |

342 |

553 |

1,058 |

4,796 |

| Rainy River Mine |

Q4 2024 |

Q4 2023 |

FY 2024 |

FY 2023 |

| Open Pit Only |

|

|

|

|

| Tonnes mined per day (ore and waste) |

75,644 |

109,895 |

91,895 |

119,948 |

| Ore tonnes mined per day |

21,774 |

29,377 |

20,092 |

34,007 |

| Operating waste tonnes per day |

53,870 |

47,838 |

53,443 |

53,537 |

| Capitalized waste tonnes per day |

- |

32,681 |

18,361 |

32,404 |

| Total waste tonnes per day |

53,870 |

80,519 |

71,803 |

85,942 |

| Strip ratio (waste:ore) |

2.47 |

2.74 |

3.57 |

2.53 |

| Underground Only |

|

|

|

|

| Ore tonnes mined per day |

1,068 |

859 |

834 |

857 |

| Waste tonnes mined per day |

1,506 |

653 |

1,251 |

506 |

| Lateral development (metres) |

1,602 |

659 |

5,235 |

3,030 |

| Open Pit and Underground |

|

|

|

|

| Tonnes milled per calendar day |

22,656 |

25,046 |

24,563 |

24,012 |

| Gold grade milled (g/t) |

0.97 |

0.94 |

0.85 |

0.99 |

| Gold recovery (%) |

93 |

90 |

92 |

91 |

Operational Outlook and Life-of-Mine Technical

Session Webcast

The Company will release its operational outlook,

technical report summaries for Rainy River and New Afton, and updated Mineral Reserve and Mineral Resource Statement for the Company as

of December 31, 2024 after market close on Wednesday, February 12, 2025. A conference call and webcast will be hosted on Thursday, February

13, 2025 at 1:00 pm Eastern Time.

- Participants may listen to the webcast by registering on our website

at www.newgold.com or via the following link https://app.webinar.net/LpXO3lgJWEK

- Participants may also listen to the conference call by calling

North American toll free 1-888-699-1199, or 1-416-945-7677 outside of the U.S. and Canada, passcode 52116

- To join the conference call without operator assistance, you may

register and enter your phone number at https://emportal.ink/3V9yGSb to receive an instant automated call back.

- A recorded playback of the conference call will be available until

March 13, 2025 by calling North American toll free 1-888-660-6345, or 1-289-819-1450 outside of the U.S. and Canada, passcode 52116. An

archived webcast will also be available at www.newgold.com

Fourth Quarter and Full Year 2024 Conference Call

and Webcast

The Company will release its fourth quarter and full

year 2024 financial results after market close on Wednesday, February 19, 2025. A conference call and webcast will be hosted on Thursday,

February 20, 2025 at 8:30 am Eastern Time.

- Participants may listen to the webcast by registering on our website

at www.newgold.com or via the following link https://app.webinar.net/nvDNqb8B0py

- Participants may also listen to the conference call by calling

North American toll free 1-888-699-1199, or 1-416-945-7677 outside of the U.S. and Canada, passcode 58557

- To join the conference call without operator assistance, you may

register and enter your phone number at https://emportal.ink/4fR2dsv to receive an instant automated call back.

- A recorded playback of the conference call will be available until

March 20, 2025 by calling North American toll free 1-888-660-6345, or 1-289-819-1450 outside of the U.S. and Canada, passcode 58557. An

archived webcast will also be available at www.newgold.com

About New Gold

New Gold is a Canadian-focused intermediate mining Company with a portfolio of two core producing assets in Canada, the Rainy River

gold mine and the New Afton copper-gold mine. New Gold's vision is to build a leading diversified intermediate gold company based in Canada

that is committed to the environment and social responsibility. For further information on the Company, visit www.newgold.com.

Endnotes

| 1. | Production is shown on a total contained basis while sales

are shown on a net payable basis, including final product inventory and smelter payable adjustments, where applicable. |

| 2. | Key performance indicator data is inclusive of gold ounces

from ore purchase agreements for New Afton. The New Afton Mine purchases small amounts of ore from local operations, subject to certain

grade and other criteria. These ounces represented approximately 2% of total gold ounces produced at New Afton during the quarter, using

New Afton's excess mill capacity. All other ounces are mined and produced at New Afton. |

| 3. | "All-in sustaining costs (AISC) per gold ounce sold"

is a non-GAAP financial performance measure that is used in this news release. This measure does not have any standardized meaning under

IFRS and therefore may not be comparable to similar measures presented by other issuers. For more information about this measure, and

why it is used by the Company, see the "Non-GAAP Financial Performance Measures" section of this news release. New Gold will

provide applicable historical information and reconciliation to the most directly comparable GAAP measure in its fourth quarter and full

year 2024 financial results to be released on February 19, 2025 |

Non-GAAP Financial Performance Measures

"All-in sustaining costs per gold ounce sold" ("AISC") is a non-GAAP financial performance measure that does not

have any standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. New Gold

calculates "all-in sustaining costs per gold ounce sold" based on guidance announced by the World Gold Council ("WGC")

in September 2013. The WGC is a non-profit association of the world's leading gold mining companies established in 1987 to promote the

use of gold to industry, consumers and investors. The WGC is not a regulatory body and does not have the authority to develop accounting

standards or disclosure requirements. The WGC has worked with its member companies to develop a measure that expands on IFRS measures

to provide visibility into the economics of a gold mining company. Current IFRS measures used in the gold industry, such as operating

expenses, do not capture all of the expenditures incurred to discover, develop and sustain gold production. New Gold believes that "all-in

sustaining costs per gold ounce sold" provides further transparency into costs associated with producing gold and will assist analysts,

investors, and other stakeholders of the Company in assessing its operating performance, its ability to generate free cash flow from current

operations and its overall value. In addition, the Human Resources and Compensation Committee of the Board of Directors uses "all-in

sustaining costs", together with other measures, in its Company scorecard to set incentive compensation goals and assess performance.

"All-in sustaining costs per gold ounce sold"

is intended to provide additional information only and does not have any standardized meaning under IFRS and may not be comparable to

similar measures presented by other mining companies. It should not be considered in isolation or as a substitute for measures of performance

prepared in accordance with IFRS. The measure is not necessarily indicative of cash flow from operations under IFRS or operating costs

presented under IFRS.

New Gold defines all-in sustaining costs per gold

ounce sold as the sum of cash costs, net capital expenditures that are sustaining in nature, corporate general and administrative costs,

sustaining leases, capitalized and expensed exploration costs that are sustaining in nature, and environmental reclamation costs, all

divided by the total gold ounces sold to arrive at a per ounce figure. To determine sustaining capital expenditures, New Gold uses cash

flow related to mining interests from its unaudited condensed interim consolidated statement of cash flows and deducts any expenditures

that are non-sustaining (growth). Capital expenditures to develop new operations or capital expenditures related to major projects at

existing operations where these projects will materially benefit the operation are classified as growth and are excluded. The definition

of sustaining versus non-sustaining is similarly applied to capitalized and expensed exploration costs. Exploration costs to develop new

operations or that relate to major projects at existing operations where these projects are expected to materially benefit the operation

are classified as non-sustaining and are excluded.

Costs excluded from all-in sustaining costs per gold

ounce sold are non-sustaining capital expenditures, non-sustaining lease payments and exploration costs, financing costs, tax expense,

and transaction costs associated with mergers, acquisitions and divestitures, and any items that are deducted for the purposes of adjusted

earnings.

To provide additional information to investors, the

Company has also calculated all-in sustaining costs per gold ounce sold on a co-product basis for New Afton, which removes the impact

of other metal sales that are produced as a by-product of gold production and apportions the all-in sustaining costs to each metal produced

on a percentage of revenue basis, and subsequently divides the amount by the total gold ounces, or pounds of copper sold, as the

case may be, to arrive at per ounce or per pound figures. By including cash costs as a component of all-in sustaining costs, the measure

deducts by-product revenue from gross cash costs.

Cautionary Note Regarding Forward-Looking Statements

Certain information contained in this news release, including any information relating to New Gold's future financial or operating

performance are "forward-looking". All statements in this news release, other than statements of historical fact, which address

events, results, outcomes or developments that New Gold expects to occur are "forward-looking statements". Forward-looking statements

are statements that are not historical facts and are generally, but not always, identified by the use of forward-looking terminology such

as "plans", "expects", "is expected", "budget", "scheduled", "targeted", "estimates",

"forecasts", "intends", "anticipates", "projects", "potential", "believes"

or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would",

"should", "might" or "will be taken", "occur" or "be achieved" or the negative connotation

of such terms. Forward-looking statements in this news release include, among others, statements with respect to: successfully generating

significant near-term free cash flow; intended timing for and release of upcoming public disclosure; successfully increasing production,

decreasing costs and maximizing free cash flow generation in the years to come; and expectations that consolidated AISC will be at the

low end of the guidance range.

All forward-looking statements in this news release

are based on the opinions and estimates of management that, while considered reasonable as at the date of this news release in light of

management's experience and perception of current conditions and expected developments, are inherently subject to important risk factors

and uncertainties, many of which are beyond New Gold's ability to control or predict. Certain material assumptions regarding such forward-looking

statements are discussed in this news release, New Gold's latest annual management's discussion and analysis ("MD&A"), its

most recent annual information form and technical reports on the Rainy River Mine and New Afton Mine filed on SEDAR+ at www.sedarplus.ca

and on EDGAR at www.sec.gov. In addition to, and subject to, such assumptions discussed in more detail elsewhere, the forward-looking

statements in this news release are also subject to the following assumptions: (1) there being no significant disruptions affecting New

Gold's operations, including material disruptions to the Company's supply chain, workforce or otherwise; (2) political and legal developments

in jurisdictions where New Gold operates, or may in the future operate, being consistent with New Gold's current expectations; (3) the

accuracy of New Gold's current Mineral Reserve and Mineral Resource estimates and the grade of gold, copper and silver expected to be

mined; (4) the exchange rate between the Canadian dollar and U.S. dollar, and commodity prices being approximately consistent with current

levels and expectations for the purposes of guidance and otherwise; (5) prices for diesel, natural gas, fuel oil, electricity and

other key supplies being approximately consistent with current levels; (6) equipment, labour and material costs increasing on a basis

consistent with New Gold's current expectations; (7) arrangements with First Nations and other Indigenous groups in respect of the Rainy

River Mine and New Afton Mine being consistent with New Gold's current expectations; (8) all required permits, licenses and authorizations

being obtained from the relevant governments and other relevant stakeholders within the expected timelines and the absence of material

negative comments or obstacles during any applicable regulatory processes; and (9) the results of the life of mine plans for the Rainy

River Mine and the New Afton Mine described herein being realized.

Forward-looking statements are necessarily based on

estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors that may cause actual

results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking

statements. Such factors include, without limitation: price volatility in the spot and forward markets for metals and other commodities;

discrepancies between actual and estimated production, between actual and estimated costs, between actual and estimated Mineral Reserves

and Mineral Resources and between actual and estimated metallurgical recoveries; equipment malfunction, failure or unavailability; accidents;

risks related to early production at the Rainy River Mine, including failure of equipment, machinery, the process circuit or other processes

to perform as designed or intended; the speculative nature of mineral exploration and development, including the risks of obtaining and

maintaining the validity and enforceability of the necessary licenses and permits and complying with the permitting requirements of each

jurisdiction in which New Gold operates, including, but not limited to: uncertainties and unanticipated delays associated with obtaining

and maintaining necessary licenses, permits and authorizations and complying with permitting requirements; changes in project parameters

as plans continue to be refined; changing costs, timelines and development schedules as it relates to construction; the Company not being

able to complete its construction projects at the Rainy River Mine or the New Afton Mine on the anticipated timeline or at all; volatility

in the market price of the Company's securities; changes in national and local government legislation in the countries in which New Gold

does or may in the future carry on business; compliance with public company disclosure obligations; controls, regulations and political

or economic developments in the countries in which New Gold does or may in the future carry on business; the Company's dependence on the

Rainy River Mine and New Afton Mine; the Company not being able to complete its exploration drilling programs on the anticipated timeline

or at all; inadequate water management and stewardship; tailings storage facilities and structure failures; failing to complete stabilization

projects according to plan; geotechnical instability and conditions; disruptions to the Company's workforce at either the Rainy River

Mine or the New Afton Mine, or both; significant capital requirements and the availability and management of capital resources; additional

funding requirements; diminishing quantities or grades of Mineral Reserves and Mineral Resources; actual results of current exploration

or reclamation activities; uncertainties inherent to mining economic studies including the Technical Reports for the Rainy River Mine

and New Afton Mine; impairment; unexpected delays and costs inherent to consulting and accommodating rights of First Nations and other

Indigenous groups; climate change, environmental risks and hazards and the Company's response thereto; ability to obtain and maintain

sufficient insurance; actual results of current exploration or reclamation activities; fluctuations in the international currency markets

and in the rates of exchange of the currencies of Canada, the United States and, to a lesser extent, Mexico; global economic and financial

conditions and any global or local natural events that may impede the economy or New Gold's ability to carry on business in the normal

course; inflation; compliance with debt obligations and maintaining sufficient liquidity; the responses of the relevant governments to

any disease, epidemic or pandemic outbreak not being sufficient to contain the impact of such outbreak; disruptions to the Company's supply

chain and workforce due to any disease, epidemic or pandemic outbreak; an economic recession or downturn as a result of any disease, epidemic

or pandemic outbreak that materially adversely affects the Company's operations or liquidity position; taxation; fluctuation in treatment

and refining charges; transportation and processing of unrefined products; rising costs or availability of labour, supplies, fuel and

equipment; adequate infrastructure; relationships with communities, governments and other stakeholders; labour disputes; effectiveness

of supply chain due diligence; the uncertainties inherent in current and future legal challenges to which New Gold is or may become a

party; defective title to mineral claims or property or contests over claims to mineral properties; competition; loss of, or inability

to attract, key employees; use of derivative products and hedging transactions; reliance on third-party contractors; counterparty risk

and the performance of third party service providers; investment risks and uncertainty relating to the value of equity investments in

public companies held by the Company from time to time; the adequacy of internal and disclosure controls; conflicts of interest; the lack

of certainty with respect to foreign operations and legal systems, which may not be immune from the influence of political pressure, corruption

or other factors that are inconsistent with the rule of law; the successful acquisitions and integration of business arrangements and

realizing the intended benefits therefrom; and information systems security threats.. In addition, there are risks and hazards associated

with the business of mineral exploration, development and mining, including environmental events and hazards, industrial accidents, unusual

or unexpected formations, pressures, cave-ins, flooding and gold bullion losses (and the risk of inadequate insurance or inability to

obtain insurance to cover these risks) as well as "Risk Factors" included in New Gold's most recent annual information form,

MD&A and other disclosure documents filed on and available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. Forward looking

statements are not guarantees of future performance, and actual results and future events could materially differ from those anticipated

in such statements. All forward-looking statements contained in this news release are qualified by these cautionary statements. New Gold

expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information,

events or otherwise, except in accordance with applicable securities laws.

Technical Information

The scientific and technical information in this news release has been reviewed and approved by Gord Simms, General Manager of the

Rainy River Mine. Mr. Simms is a Professional Engineer and member of the Engineers and Geoscientists British Columbia. Mr. Simms

is a "Qualified Persons" for the purposes of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

View original content to download multimedia:https://www.prnewswire.com/news-releases/new-gold-delivers-highest-production-quarter-of-2024-302347444.html

SOURCE New Gold Inc.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/January2025/09/c3811.html

%CIK: 0000800166

For further information: For further information, please contact:

Ankit Shah, Executive Vice President, Strategy & Business Development, Direct: +1 (416) 324-6027, Email: ankit.shah@newgold.com; Brandon

Throop, Director, Investor Relations, Direct: +1 (647) 264-5027, Email: brandon.throop@newgold.com

CO: New Gold Inc.

CNW 17:00e 09-JAN-25

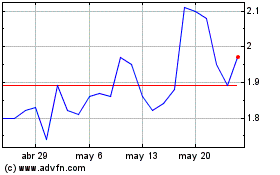

New Gold (AMEX:NGD)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

New Gold (AMEX:NGD)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025