TIDMATC

RNS Number : 9181N

All Things Considered Group PLC

28 September 2023

28 September 2023

All Things Considered Group Plc

("ATC", the "Company" or the "Group")

Interim Results for the six months ended 30 June 2023

Transformative period bolstering platform for growth

All Things Considered Group Plc (AQSE: ATC), the independent

music company housing artist representation and music industry

services, is pleased to announce its unaudited interim results for

the six months ended 30 June 2023 ("H1 2023").

Financial highlights

-- Underlying Group revenue increased 40% to GBP3.39m (H1 2022: GBP2.42m)*

-- The Group's Artist Representation segment (comprising ATC

Management,ATC Live and other representation activities) saw

revenue increase 39% to GBP2.72m (H1 2022: GBP1.96m)

-- 84% revenue growth in ATC Management to GBP1.78m,

demonstrating early returns of investment made in prior financial

year

-- 14% revenue growth for ATC Live to GBP0.74m in traditionally

quieter H1 period for live music activities

-- 42% increase in underlying Services divisional revenue* to GBP0.66m (H1 2022: GBP0.47m)

-- 10% improvement in underlying loss before tax** to GBP0.70m

(H1 2022: Loss before tax of GBP0.78m), in line with seasonal

variation in industry

-- Net cash after short term debt GBP0.89m at 30 June 2023 (30

June 2022: net cash of GBP3.0m including GBP1.6m relating to

Driift)

Operational highlights

-- Artist Representation:

o Continued strength in artist representation businesses, ATC

Management and ATC Live, with more than 70 and 450 clients

respectively

o Recently opened New York office, in its second year of

operation, driving new business with key new signings including

Lianne La Havas and Kelsey Lu

o ATC Live deepened trading arrangements with the Arrival

Artists partnership in North America providing artists with global

representation and strengthening its position as one of the world's

leading independent live agencies (now ranked 8(th) largest agency

globally)

-- Services:

o Solid underlying performance driven by US business

o The Group's minority interest in Driift remains well-funded

with segment seeing impact of resumption of live touring.

Substantially improved livestreaming platform product resulted in

livestream show with legendary band, Blur.

Post period end, current trading and outlook

-- Successful placing in July 2023 raising GBP4.18m to fund 60%

acquisition of Sandbag Limited and provide capital to support

organic and acquisitive growth

-- Significant majority acquisition of a full-service

merchandise company, Sandbag Limited ("Sandbag"), completed on 19

July 2023 bringing 200 clients and real strength to the Group's

fully-integrated services offering that can engage with musical

talent across all available income streams. Initial benefits of

revenue and profitability synergies to be realised in the second

half of 2023.

-- Good visibility on medium term performance pipeline,

seasonally weighted to the second half of the year for the ATC Live

business

-- Higher than expected losses anticipated for minority interest in Livestreaming business

-- Strengthened balance sheet following successful placing.

Group cash at the end of August, before short term debt, after net

proceeds from the fundraise and after GBP2.4m initial consideration

paid for Sandbag was GBP2.6m, excluding cash balances of

Sandbag.

Adam Driscoll, Chief Executive Officer of ATC Group plc,

commented: "We are pleased to report on a busy period of

operational and strategic progress for the Group as we execute our

vision of building a full-service music business. This is

underpinned by the continued strength of our established businesses

which continue to drive underlying Group growth.

"A significant achievement was the recent majority acquisition

of merchandise partner, Sandbag, adding scale and complementary

services to the Group as we execute our strategy of broadening and

deepening our engagement across artists' commercial interests. As

we scale, we see the advantages of this strategy bearing fruit as

we generate greater industry insight and proprietary data to

leverage across the Group's multiple service lines.

"We enter the second half with good pipeline visibility, a

strong financial position and the initial revenue and profit

synergies from the Sandbag acquisition still to be realised. This

leaves us in a strong position to take advantage of the near-term

evolution of the music industry."

* Excluding the one-off Services revenue in H1 2022 of

GBP1.74m

**Excluding the one-off profit of GBP0.825m on Services revenue

in H1 2022 of GBP1.74m and share of losses of Driift

This Announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 as retained as part of UK

law by virtue of the European Union (Withdrawal) Act 2018 as

amended. Upon the publication of this Announcement, this inside

information is now considered to be in the public domain. The

person responsible for arranging for the release of this

announcement on behalf of the Company is Adam Driscoll, CEO.

-S-

For more information, please contact:

For more information, please contact:

ATC Group Via Alma PR

Adam Driscoll, CEO

Rameses Villanueva, CFO

Panmure Gordon (UK) Limited +44 (0)207 886 2500

AQSE Corporate Adviser and Broker

James Sinclair-Ford / Mark Rogers /

Freddie Wooding

Hugh Rich / Rauf Munir

Alma PR +44(0)20 3405 0205

Financial PR

Hilary Buchanan / Justine James / Robyn

Fisher

Notes to Editors

ATC Group is an independent music company housing talent

management, live booking, music industry services and livestreaming

within the same group.

The Group is headquartered in London, with offices in Los

Angeles, New York and Copenhagen. ATC Group Plc is led by an

experienced management team who have operated across multiple music

industry sectors.

The Group has an established, long-standing client base which,

together with innovative new offerings, gives the Directors

confidence that the company is well positioned to capitalise on the

opportunities emerging from a disrupted music industry.

The Group's key divisions, grouped under three segments,

are:

Artist representation

-- ATC Management (Europe and USA) - artist management and development

-- ATC Live - live event booking agency for artists

Services

-- Sandbag - a market leading merchandising and 'Direct to Consumer' business

-- ATC Media- providing consultancy and development services

-- Your Army USA - marketing and promotions agency specialising in dance and electronic music

-- Familiar Music - synchronisation agency placing music in

films, TV, advertisements and other media

-- ATC Experience - developing live theatrical events and digital experiences with artists

Livestreamed events

-- Minority interest in Driift - a global livestreaming business

For more information see: www.atcgroupplc.com

CEO Review

Overview

The six-month period to 30 June 2023 marked a period of

significant activity for the Group, culminating in the announcement

on 29 June 2023 of the successful placing of new shares to raise

GBP4.18 million (the "Fundraise") with the net proceeds being used

primarily to acquire a 60% holding in Sandbag, a full-service

merchandise business. The remaining net proceeds of around GBP1.4

million strengthen the Company's balance sheet and provide capital

for the Group's further expansion into live events and

experiences.

We were delighted by the substantial support from a number of

our key existing shareholders and equally pleased to be able to

welcome new shareholders to the register who share the Directors'

optimism about the Group's prospects. We continue to have engaging

and constructive conversations with our shareholders as we explore

the exciting array of opportunities that lie ahead, and we would

like to thank shareholders for their continued support.

The acquisition of Sandbag, which completed shortly after the

period end on 19 July 2023, marks a substantial development for the

Group's Services division. It brings real strength to the strategy

of building a business that can engage with musical talent across

all available revenue streams and provide a fully-integrated

service empowering creators and artists to build optimal commercial

structures to generate increased revenues.

Notwithstanding this significant corporate and operational

activity, we are pleased with the continued growth of the Group's

substantial Artist Representation segment, consisting of ATC

Management and ATC Live. The division has continued to go from

strength to strength, with ATC Management and ATC Live representing

more than 70 clients and 450 clients respectively. The clients -

being the artists - are the real source of all revenue generation

in the industry. With the acquisition of Sandbag, delivering

another roster of more than 200 clients, such as Radiohead, ABBA

Voyage, Incubus, Charli XCX and Glastonbury Festival , amongst

others, w e continue to deliver on a 'direct to consumer'

opportunity for fan engagement that will, we believe, become a key

economic driver of the Group's business in the future.

As noted above, the Fundraise has also given us additional

capital to continue the development of our live and events

businesses. We can see a huge opportunity to move more directly

into the ownership of stakes in festivals, theatrical experiences

and other ticketed performance businesses. We have the advantage

bestowed via our ATC Live and our ATC Management businesses of data

that gives us a deeper understanding of the market: who is selling

tickets, where they are selling them and at what price points -

using that market intelligence to inform the data-driven

development of our live and events businesses is a competitive

advantage that comes from our unique position as a comprehensive

talent services provider. We continue to assess various

opportunities in this space which show the potential to enhance the

growth strategy of the Group.

Market - Music industry in transition

The music industry is undergoing rapid transformation brought

about by technology innovation, empowered artist expectations and

changing consumer behaviours, disrupting traditional business

models in a multi-billion dollar industry. The Directors believe

the Group's diversified business model and established track record

means it is well positioned to build on future organic and

acquisitional growth opportunities in an evolving and fragmented

music industry.

Performance Review

The formation and investment into the Group's business platform,

providing a comprehensive range of talent services, is guided by

the Group's strategy to build a fully-integrated services business

covering the spectrum of artists' needs. This enables the Group to

align more closely with artists' commercial ambitions, capture a

greater share of music industry revenue streams, and enables a

virtuous circle of industry insight and proprietary data across

service lines, creating substantial competitive differentiation. In

our core areas of business, the first half of 2023 has demonstrated

solid progress.

Artist Representation

In the key areas of Artist Representation we have seen revenue

increase by 39% from GBP1.96 million in 2022 to GBP2.72 million in

2023 including new artist signings including Lianne La Havas,

Kelsey Lu, The Murder Capital, Cate Le Bon, Yellow Days, Ty Segall,

and Katie Malco.

ATC Management

The ATC Management business achieved double digit revenue growth

of 84% to GBP1.78 million in 2023 (2022: GBP0.97 million). As noted

in the 2022 annual report, the second half of 2022 was marked by

the addition of a number of new managers and artists joining our

roster. The first half of 2023 saw the benefits of that growth as

those artists and managers began to deliver new revenues to the

Group. We are pleased to report that the roster has continued to

strengthen in the first half of 2023, with the New York office,

which is only in its second year of operation, bringing in new

business and both the US and European businesses attracting new

clients.

ATC Live

ATC Live continued to see growth in live music activities, as

evidenced by the 14% uplift in revenue from GBP0.65 million in 2022

to GBP0.74 million in H1 2023. Traditionally the first half of the

year is a quieter period for ATC Live, with a substantial ramp up

of revenues being seen during the summer festival season and second

half touring activity. We are encouraged by the pipeline we see for

this business for the rest of 2023 and into 2024. The pattern of

ATC Live's activity is such that it is often booking its artists

into events that will take place in 12 to 18 months' time, giving

us good visibility on its medium term performance prospects.

ATC Live continues to deepen its trading arrangements with North

American agency, Arrival Artists which was launched in October 2020

in order to offer artists the option of global representation via

that partnership. This has strengthened ATC Live's position as one

of the world's leading independent live agencies - it is ranked the

8(th) largest agency globally by Rostr.

Services

In our Services division, we saw underlying revenue growth in H1

of 42% to GBP0.66m which was driven primarily by some excellent

results from our US based music promotions business, Your Army

America. In H1 2022 our Services division delivered one specific

project which generated substantial revenue of GBP1.74m for the

Group (further details are included within the CFO Review section).

We did not have any 'one off' projects of this size in H1 2023. We

continue to assess opportunities where we can generate consultancy

fees of this nature but expect the pattern of any such non-core

income to be irregular.

Notwithstanding that, the acquisition of a majority stake in

Sandbag is a transformative moment for our Services division.

Sandbag's most recently audited full year accounts to 31 March 2022

showed revenues of over GBP30m and a pre-tax profit of over GBP1m.

Having completed the acquisition on 19 July 2023, we expect to see

the benefits of both that revenue and profitability flow through in

the second half of the year. The integration of Sandbag's

management team into the Group has been seamless and we anticipate

that synergies will be realised in the short term with cross

selling opportunities across a broader client base.

Minority Interest - Livestreaming

Driift, which since 1 October 2022 has been an associated

company, continues to provide end-to-end livestreaming capability -

across show development, production, ticketing, streaming and

distribution. However, the market for livestreaming sales has

certainly been affected by the resumption of live activity

following the post-Covid reopening. Industry forecasts still point

towards this being a multi-billion dollar sector over the coming

years, but the journey towards that destination is currently slower

than anticipated.

Driift is one of the leading brands in the field and is well

positioned to benefit from the industry's anticipated growth in

this sector - it remains well funded. Driift has substantially

improved its livestreaming platform product over recent months and

a recent livestream show with legendary band, Blur, saw fantastic

metrics in terms of satisfaction with the consumer experience of

using the platform and the quality of the show delivery. This has

led to enquiries from non-music event hosts looking to use Driift's

platform as a white labelled tool to deliver and monetise their own

events - a new area of business which is being explored. Alongside

this, Driift has continued to deliver livestreaming events for

well-regarded artists and is exploring the commercial potential to

produce and promote live events with globally recognised performers

outside of the music sector. We hold a minority stake of 32.5% in

Driift but remain active in helping the company achieve its goals

in a more challenging environment.

Current Trading and FY23 outlook

The Group's divisional businesses in Artist Representation and

Services have performed in line with management expectations in the

first half of 2023 and we expect that to continue for the full

year. At a Group level, this has been offset by Driift's

performance which has been behind the budget set for it by its

board for 2023, and we therefore expect our share of its losses to

be higher than originally forecast for that division. Our recent

fundraising and the acquisition of a majority stake in Sandbag has

given added impetus across all Group businesses. We are well

capitalised to pursue our clear growth opportunities, with this

being especially true in the live events space.

At this point of the year, we also have visibility on many of

our artists' activity for 2024. Tours are already booked and many

others are in advanced planning stages. Highlights include sell out

tours from PJ Harvey, The Hives and Black Country, New Road. PJ

Harvey's forthcoming tour sold out three times faster than her

previous tour, with her performing two nights in various key

European venues and The Hives' UK/EU and US tour sold out in

minutes and sees the band playing to their biggest audiences in Los

Angeles in 20 years. We are expecting to see healthy levels of

activity throughout next year which will positively impact all

areas of Group business.

In summary, we continue to expect our comprehensive service

offering to continue not only its organic growth, but expansion

through the launch of new initiatives and acquisition

opportunities. We believe that we remain well placed to move into

areas where the Group can create, capture and manage more

intellectual property in partnership with its clients. We have,

with the addition of Sandbag, improved our asset base and this is

enabling us to deliver on our plan to grow a substantial group

which can take advantage of the near-term evolution of music

industry models.

At 30 June 2023, the Group retains a sufficiently healthy net

cash position (after current debt) of GBP 0.89 million which has

been further improved following the fundraise and acquisition of

Sandbag after the period end.

Adam Driscoll

28 September 2023

CFO Review

Overview

The Group's underlying revenue for the first half of 2023

(excluding the one-off Services revenue earned in H1 2022 of

GBP1.74 million) saw a 40% improvement to GBP3.39 million (2022:

GBP2.42 million).

Losses from continuing operations were expected during the first

half of the year due to the commercial cyclical rhythm of the

industry, with the second half of the year traditionally seeing

much more activity as festivals and live tours are delivered.

Excluding the Group share of losses of Driift in 2023 and the

one-off Services revenue in 2022, the Group's loss before tax in H1

2023 amounted to GBP0.70 million (2022: loss before tax GBP 0.78

million) which is an improvement of 10%. ATC retains a positive net

cash position as at 30 June 2023 (after current debt but excluding

long-term debt) of GBP0.89 million. Long-term debt of GBP1.1

million is owed to a related party and is payable over the period

to 2030.

The Group is well positioned to continue its growth momentum in

the remaining half of 2023 and 2024 with the Fundraise which was

completed in July 2023 further improving the Group's net cash

position.

Revenue

Excluding the one-off Services revenue in H1 2022 of GBP1.74

million, the Group's consolidated revenue was up 40% to GBP3.39

million (2022: GBP2.42 million).

The segmental analysis is shown below:

Six months Six months

ended June ended June

2023 2022

Continuing operations: GBP GBP

Artist Representation 2,722,400 1,956,928

Services 664,086 467,781

-------------- -------------

Sub-total 3,386,486 2,424,709

Services - One off* - 1,743,633

Total revenue from continuing

operations 3,386,486 4,168,342

Discontinued operations:

-------------- -------------

Livestreamed events** - -

-------------- -------------

3,386,486 4,168,342

============== =============

* The Services division earned significant one-off

revenue of approximately $ 2.3 million ( GBP1.74million)

in March 2022 from its consulting services in facilitating

of the private acquisition of streaming platform,

Napster. The division earned gross profit of $1.15m

(GBP0.825m) from this transaction.

** Revenue of Drift group for the six-months ending

30 June 2022 amounted to GBP 1.85 million but for

presentation and comparability purposes and in accordance

with IFRS5, Driift results are presented as a one

line item under Discontinued operations. Following

the transaction with Deezer SA which completed on

30 September 2022, the Group's ownership of Driift

reduced from 52% to 32.5% and, from 1 October 2022,

the enlarged Driift group is treated as an associated

undertaking in the Group's accounts.

Artist representation

During the period, the revenue of our Artist Representation

segment increased by 39% from GBP1.96 million in 2022 to GBP2.72

million in 2023 attributed mainly to the following:

-- ATC Management achieved double digit revenue growth of 84% to

GBP1.78 million in 2023 (2022: GBP0.97 million). During the second

half of 2022, ATC Management strengthened its roster of new

managers and artists which resulted in the revenue growth for the

division commencing in the first half of 2023.

-- ATC Live continued to see growth as evidenced by the 14%

growth in revenue from GBP0.65 million in 2022 to GBP0.74 million

in 2023.

-- Other activities GBP0.20m (2022: GBP0.34m)

The Group continues to streamline and expand its Artist

representation businesses and expects to reap long-term benefits

from this process.

Services

Excluding the one-off Services revenue in H1 2022 of GBP1.74

million, the Group has seen an increase in Services revenue of 42%

to GBP0.66 million (2022: GBP0.47 million) due mainly to strong

performance of in Your Army America in their provision of DJ

promotion services both in the club and radio divisions in the

United States.

As detailed in the CEO report, the Group acquired a 60% holding

in Sandbag on 19 July 2023. This acquisition marks a substantial

addition to the Group's client base, grows the direct-to-customer

services division and provides greater capacity in the 'direct to

fan' model which is increasingly being embraced by artists. The

acquisition is expected to enable ATC to keep more of the 'value

chain' within the Group and build an 'end to end' artist commerce

business. The acquisition adds substantial turnover to the Group

and we expect Sandbag to remain profitable.

The Group is continuously exploring consultancy arrangements,

building strategic partnerships with other players in the industry

and creating and offering new artist related services as part of

its growth strategy for this division.

Livestreamed events

As discussed above, Driift is now an associated undertaking as

of 1 October 2022 and the Group's share of its results are included

in the line 'Share of results of associates and joint ventures'.

The Group's share of Driift's loss for H1 amounted to GBP435,660

(H1 2022 loss GBP290,994) and the board of Driift are in the

process of restructuring its business model, organisation, cost

structure and processes to better position the company as a

commercially sustainable enterprise.

Profit /(loss) before tax

The cyclical nature of the industry means that losses from

continuing operations are expected during the first half of the

year because this is the slower season in the industry. Excluding

the Group share of losses of Driift in 2023 and the one-off

Services revenue in 2022, the Group's loss before tax in H1 2023

amounted to GBP0.70 million (2022: loss before tax GBP0.78 million)

which is an improvement of 10%. The segmental analysis is shown

below:

Six months Six months

ended June ended June

2023 2022

Continuing operations: GBP GBP

Artist representation (326,134) (228,303)

Services (112,668) (166,619)

Central costs (261,099) (383,698)

Loss before share in net loss

of Driift and one-off Services

net profit (699,901) (778,620)

Livestreamed events* (435,660) -

Services - One off ** - 825,205

Total loss from continuing

operations (1,135,561) 46,585

Discontinued operations

Livestreamed events*** - (225,570)

------------ ------------

Profit/(loss) before tax (1,135,561) (178,985)

============ ============

* Driift as an associate (32.5% of result)

** Profit before tax of GBP0.825 from the one-off

Services revenue in H1 2022.

*** Driift results are presented as a one line item

in June 2022 comparatives for comparability purposes

and in accordance with IFRS5.

Net cash /(debt) position

The Group's net cash after short-term debt as at 30 June 2023 is

GBP0.89 million (2022: net cash of GBP3.0 million). It is important

to highlight that in 2022, the net cash included cash of the Driift

group of GBP1.6 million. The cash balances of the Driift group were

deconsolidated with effect from 1 October 2022.

Financing costs of GBP35,000 (2022: GBP77,000) were comprised

mainly of interest expenses on loans.

At 30 June At 30 June

2023 2022*

GBP GBP

Cash and cash equivalents 5,917,167 8,398,106

Less funds held on behalf

of clients (4,694,870) (4,905,279)

------------- ------------

Own funds 1,222,297 3,492,827

Short-term:

Borrowings (209,188) (334,443)

Right of use lease liabilities (124,443) (142,041)

------------- ------------

Net cash after current debt 888,666 3,016,343

------------- ------------

Long -term:

Borrowings (1,097,664) (1,324,199)

Right of use liabilities (52,515) (176,957)

-------------

(1,150,179) (1,501,156)

------------- ------------

Net cash after long term

debt (261,513) 1,515,187

------------- ------------

* At 30 June 2022, net cash included the cash in

Driift group of GBP1.6 million. Driift was deconsolidated

effective 1 October 2022 as the Group's ownership

reduced from 52% to 32.5%.

Overall, the Group's net cash position after long-term debt is

net debt of GBP0.26 million (2022: net cash of GBP1.5 million but

this includes cash in Driift group of GBP1.6 million). It should be

noted that the long-term debt is owed to a related party and the

annual loan repayment is GBP 50,000 .

As disclosed in Note 8 of these interim accounts, on 19 July

2023, the Group raised GBP4.18 million in aggregate before expenses

and the Fundraise was deployed primarily to acquire a 60% holding

in Sandbag, a full-service merchandise company for an initial

consideration of GBP2.42 million. The revenue and profit before tax

for Sandbag group, as disclosed in the statutory accounts for the

year ended 31 March 2022, were GBP31.7 million and GBP1.21 million,

respectively.

The remaining balance of c.GBP1.4 million in net proceeds from

the Fundraise will provide capital for future potential accretive

opportunities identified across ATC's Live and Experience divisions

and provide additional liquidity to fund the Group's working

capital requirements.

Earnings (Loss) Per Share

Basic and diluted earnings per share from all activities was a

loss of 12.31 pence per share (2022: loss of 1.05 pence per

share).

Basic and diluted earnings per share from continuing activities

was a loss of 12.31 pence per share (2022: profit of 1.30 pence per

share).

2023 2022

GBP GBP

Loss attributable to owners of parent

company (1,090,875) (100,825)

Basic and diluted number of shares

in issue 9,584,020 9,584,020

Earnings per share pence pence

Basic and diluted earnings/(loss)

per share (11.38) (1.05)

Basic and diluted earnings/(loss)

per share (Continuing activities) (11.38) 1.30

Basic and diluted earnings/(loss)

per share (Discontinued activities) - (2.35)

Going Concern

The accounts have been prepared on a going concern basis. The

Directors have a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable

future, based on projections for at least twelve months from the

date of approval of the interim accounts.

Rameses Villanueva

CFO

28 September 2023

Consolidated statement of comprehensive income

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

(Unaudited) (Unaudited) ( Audited

)

Notes GBP GBP GBP

Revenue 2 3,386,486 4,168,342 9,446,031

Cost of sales 2 (958,178) (1,491,095) (3,084,378)

-------------- ------------ -------------

Gross profit 2,428,308 2,677,247 6,361,653

Other operating income 3 97,729 81,074 192,937

Administrative expenses (3,209,014) (2,646,790) (5,962,123)

-------------- ------------ -------------

Operating profit/(loss) 2 (682,977) 111,531 592,467

Share of results of associates

and joint ventures 4 (423,486) 18,908 (165,729)

Finance income 5,752 234 3,000

Finance costs (34,850) (77,461) (127,924)

Profit/(loss) before taxation (1,135,561) 53,212 301,814

Income tax expense - (6,627) (77,931)

-------------- ------------ -------------

Profit/(loss) for the period

from continuing operations (1,135,561) 46,585 223,883

Discontinued operations 5 - (225,570) 2,220,177

-------------- ------------ -------------

Profit/(loss) for the period (1,135,561) (178,985) 2,444,060

Other comprehensive income:

Items that will not be reclassified

to profit and loss:

Revaluation gain/(loss) on

unlisted investments 18,241 53,638 (42,283)

Currency translation differences

and others 11,322 53,813 (13,001)

-------------- ------------ -------------

Total other comprehensive

income 29,563 107,451 (55,284)

============== ============ =============

Total comprehensive income

for the period (1,105,998) (71,534) 2,388,776

============== ============ =============

Profit/(loss) for the period

attributable to:

- Owners of the parent company (1,090,875) (100,825) 2,596,921

- Non-controlling interests (44,686) (78,160) (152,861)

-------------- ------------ -------------

(1,135,561) (178,985) 2,444,060

============== ============ =============

Total comprehensive income

for the period is attributable

to:

- Owners of the parent company (1,061,312) 6,626 2,541,637

- Non-controlling interests (44,686) (78,160) (152,861)

-------------- ------------ -------------

(1,105,998) (71,534) 2,388,776

============== ============ =============

Earnings/(loss) per share Total Total Total

Pence Pence Pence

Basic and diluted (pence) 6 (11.38) (1.87) 27.10

============== ============ =============

Consolidated statement of financial position

As at 30 As at 30 As at 31

June June December

( Unaudited (Unaudited) (Audited)

)

Notes 2023 2022 2022

GBP GBP GBP

Non-current assets

Goodwill 1,167,420 1,135,403 1,111,400

Property, plant and

equipment 252,051 367,268 303,504

Investments 2,244,441 187,336 2,670,497

------------ ------------ ------------

3,663,912 1,690,007 4,085,401

Current assets

Trade and other receivables 1,983,476 2,569,897 2,669,395

Cash and cash equivalents 7 5,917,167 8,398,106 3,917,270

------------ ------------ ------------

7,900,643 10,968,003 6,586,665

Total assets 11,564,555 12,658,010 10,672,066

============ ============ ============

EQUITY

Called up share capital 95,840 95,840 95,840

Share premium account 3,983,970 3,983,970 3,983,970

Merger reserve 2,883,611 2,883,611 2,883,611

Currency translation

reserve 12,773 44,063 1,451

Retained earnings (3,720,296) (4,933,832) (2,727,652)

------------ ------------ ------------

Equity attributable

to the shareholders

of the parent company 3,255,898 2,073,652 4,237,220

------------ ------------ ------------

Non-controlling interests (3,813) 117,667 17,190

------------ ------------ ------------

Total equity 3,252,085 2,191,319 4,254,410

------------ ------------

LIABILITIES

Non-current liabilities

Borrowings 1,097,664 1,324,199 1,214,057

Other creditors 56,460 59,058 59,438

Right of use lease

liabilities 52,515 176,957 104,444

------------ ------------ ------------

1,206,639 1,560,214 1,377,939

Current liabilities

Trade and other payables 6,772,200 8,429,994 4,686,735

Borrowings 209,188 334,443 209,188

Right of use lease

liabilities 124,443 142,040 143,794

------------ ------------ ------------

7,105,831 8,906,477 5,039,717

Total liabilities 8,312,470 10,466,691 6,417,656

------------ ------------ ------------

Total equity and

liabilities 11,564,555 12,658,010 10,672,066

============ ============ ============

Consolidated statement of changes in equity - June 2023

Share Share Merger Currency Retained Total Non-controlling Total

capital premium reserve translation earnings interests

account reserve

GBP GBP GBP GBP GBP GBP GBP GBP

Balance at 1

January 2023 95,840 3,983,970 2,883,611 1,451 (2,727,652) 4,237,220 17,190 4,254,410

-------- ---------- ---------- ------------ ------------ ------------ ---------------- ------------

Loss for the

period - - - - (1,090,875) (1,090,875) (44,686) (1,135,561)

Other

comprehensive

income:

Revaluation gain

on unlisted

investments - - - - 18,241 18,241 - 18,241

Currency

translation

differences

on overseas

subsidiaries - - - 11,322 - 11,322 - 11,322

Total

comprehensive

income

for the year 11,322 (1,072,634) (1,061,312) (44,686) (1,105,998)

Retained earnings

movements

due to increased

investment

by NCI - - - - 79,990 79,990 - 79,990

Other movements in

non-controlling

interests - - - - - - 23,683 23,683

-------- ---------- ---------- ------------ ------------ ------------ ---------------- ------------

At 30 June 2023 95,840 3,983,970 2,883,611 12,773 (3,720,296) 3,255,898 (3,813) 3,252,085

======== ========== ========== ============ ============ ============ ================ ============

Consolidated statement of changes in equity - June 2022

Share Share Merger Currency Retained Total Non-controlling Total

capital premium reserve translation earnings interests

account reserve

Balance at 1

January 2022 95,840 3,983,970 2,883,611 (9,750) (4,898,864) 2,054,807 197,649 2,252,456

-------- ---------- ---------- ------------ ------------ ---------- ---------------- ----------

Loss for the

period - - - - (100,825) (100,825) (78,160) (178,985)

Other

comprehensive

income:

Currency

translation

differences

on overseas

subsidiaries

and

others - - - 53,813 53,638 107,451 107,451

-------- ---------- ---------- ------------ ------------ ---------- ---------------- ----------

Total

comprehensive

income

for the period 53,813 (47,187) 6,626 (79,160) (71,534)

Other movements 12,219 12,219 (1,822) 10,397

At 31 June 2022 95,840 3,983,970 2,883,611 44,063 (4,933,832) 2,073,652 117,667 2,191,319

======== ========== ========== ============ ============ ========== ================ ==========

Consolidated statement of changes in equity - December 2022

Share Share Merger Currency Retained Total Non-controlling Total

capital premium reserve translation earnings interests

account reserve

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January

2022 95,840 3,983,970 2,883,611 (9,750) (4,898,864) 2,054,807 197,649 2,252,456

--------- ------------ ------------ ------------ -------------- ------------ ---------------- ------------

Profit for the

year - - - - 2,596,921 2,596,921 (152,861) 2,444,060

Other

comprehensive

income:

Revaluation loss

on unlisted

investments - - - - (42,283) (42,283) - (42,283)

Currency

translation

differences

on overseas

subsidiaries

and

others - - - 10,941 (23,942) (13,001) - (13,001)

--------- ------------ ------------ ------------ -------------- ------------ ---------------- ------------

Total

comprehensive

income

for the year - - - 10,941 2,530,696 2,541,637 (152,861) 2,388,776

Disposal of

controlling

interest - - - 260 (361,098) (360,838) (21,687) (382,525)

Other movements - - - - 1,614 1,614 (5,911) (4,297)

At 31 December

2022 95,840 3,983,970 2,883,611 1,451 (2,727,652) 4,237,220 17,190 4,254,410

========= ============ ============ ============ ============== ============ ================ ============

Consolidated statement of cash flows

Six months Six months Year

ended

ended ended 31 December

30 June 30 June

2023 2022 2022

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Cash flows from operating activities

Loss for the period after tax (1,135,561) (178,985) (67,919)

Adjustments for:

Taxation charged - 6,626 77,931

Finance costs 34,850 77,592 128,055

Finance income (5,752) (234) (3,000)

Loss on disposal of property, plant

and equipment - - 6,927

Depreciation of property, plant and

equipment 65,725 65,247 133,378

Share of results of associates and

joint ventures 423,486 (18,908) 165,729

Movements in working capital:

Increase in trade and other receivables 693,449 45,988 (444,986)

Increase in trade and other payables 2,112,749 2,999,364 582,008

------------ ------------ ------------

Cash generated/(absorbed by) from

operations 2,188,946 2,996,690 578,123

Interest paid (34,850) (77,365) (128,055)

Tax paid - (57,471) -

------------ ------------ ------------

Net cash inflow/ (outflow) from

operating activities 2,154,096 2,861,854 450,068

------------ ------------ ------------

Investing activities

Purchase of property, plant and equipment (15,755) (32,083) (50,235)

Disposal of controlling interest

in Driift - cash disposed of - - (1,340,058)

Investment in unlisted shares - 97,806 -

Net amount (invested in)/withdrawn

from associates and joint ventures 11,724 - (158,825)

Interest received 5,752 7 3,000

------------ ------------ ------------

Net cash (absorbed by)/generated

from investing activities 1,721 65,730 (1,546,118)

------------ ------------ ------------

Financing activities

Proceeds from non-controlling interest - -

investment (ATC Experience) 100,000

Repayment of borrowings (116,392) (171,733) (377,809)

Payment of lease liabilities (71,281) (69,527) (140,287)

------------ ------------ ------------

Net cash (absorbed by)/ generated

from financing activities (87,673) (241,260) (518,096)

------------ ------------ ------------

Net increase/(decrease) in cash

and cash equivalents 2,068,144 2,686,324 (1,614,146)

Cash and cash equivalents at beginning

of period 3,917,270 5,532,272 5,532,272

Effect of foreign exchange rates (68,247) 179,510 (856)

------------ ------------ ------------

Cash and cash equivalents at end

of period 5,917,167 8,398,106 3,917,270

============ ============ ============

Notes to the Interim Financial Statements

1. Basis of preparation

The results for the six months ended 30 June 2023 and 30 June

2022 are unaudited. This interim report, which has neither been

audited nor reviewed by independent auditors, was approved by the

board of Directors on 27 September 2023.

The consolidated Group financial statements represent the

consolidated results of All Things Considered Group plc and its

subsidiaries. The consolidated interim financial information has

been prepared in accordance with International Financial Reporting

Standards, International Accounting Standards and Interpretations

(collectively IFRSs), as adopted by the United Kingdom.

The accounting policies applied by the Group are the same as

those applied by the Group in its financial statements for the year

ended 31 December 2022. The independent auditors' report was

unqualified, did not draw attention to any matters by way of

emphasis, and did not contain a statement under 498(2) or 498(3) of

the Companies Act 2006.

Continuing activities and discontinued operations - on 30

September 2022 the Group entered into a transaction with Deezer SA

('Deezer') involving Driift Holdings Limited ('Driift') whereby

Deezer introduced new equity funds of GBP4m and the company

Dreamstage, Inc. into the Driift group. As a result, ATCs interest

in Driift reduced from 52% to 32.5% and from 1 October 2022 Driift

has been accounted for as an associated undertaking.

In accordance with IFRS 5, the results of Driift to 30 September

2022 are shown as discontinued operations and the comparatives

adjusted accordingly. The share of Driift's results from 1 October

2022 are included in continuing activities. All activities for the

six months ended 30 June 2023 are continuing.

2. Segmental analysis - Unaudited six months ended 30 June 2023

Artist Services* Livestreamed Central Total before Eliminations Total

representation events costs eliminations

GBP GBP GBP GBP GBP GBP GBP

Revenue 2,722,400 664,086 - - 3,386,486 - 3,386,486

Cost of sales (895,214) (62,964) - - (958,178) - (958,178)

--------------- ---------- ------------- ---------- ------------- ------------- ------------

Gross profit 1,827,186 601,122 - - 2,428,308 - 2,428,308

Other operating income 277,267 - - 186,905 464,172 (366,443) 97,729

Administrative expenses (2,440,971) (686,482) - (448,004) (3,575,457) 366,443 (3,209,014)

------------- ------------

Operating loss (336,518) (85,360) - (261,099) (682,977) - (682,977)

Share of results of

associates

and joint ventures 39,482 (27,308) (435,660) - (423,486) - (423,486)

Finance income 5,752 - - - 5,752 - 5,752

Finance costs (34,850) - - - (34,850) - (34,850)

Loss before taxation (326,134) (112,668) (435,660) (261,099) (1,135,561) - (1,135,561)

Income tax expense - - - - - - -

--------------- ---------- ------------- ---------- ------------- ------------- ------------

Loss for the period (326,134) (112,668) (435,660) (261,099) (1,135,561) - (1,135,561)

Assets and

liabilities

Total assets 5,620,308 907,986 - 2,788,911 9,317,205 2,247,350 11,564,555

Total liabilities (7,858,224) (306,238) - (117,899) (8,282,360) (30,110) (8,312,470)

--------------- ---------- ------------- ---------- ------------- ------------- ------------

Net

assets/(liabilities) (2,237,916) 601,748 - 2,671,012 1,034,845 2,217,241 3,252,085

=============== ========== ============= ========== ============= ============= ============

2. Segmental analysis - Unaudited six months ended 30 June

2022

Artist Services* Livestreamed Central Total Eliminations Total

representation events costs before

eliminations

GBP GBP GBP GBP GBP GBP GBP

Revenue 1,956,928 2,211,414 - - 4,168,342 - 4,168,342

Cost of sales - (566,735) (924,360) - - (1,491,095) - (1,491,094)

--------------- ---------- ------------- ---------- ------------- ------------- -------------

Gross profit 1,390,193 1,287,054 - - 2,677,247 - 2,677,247

Other operating income 212,001 - - - 212,001 (130,927) 81,074

Administrative expenses (1,803,459) (628,404) - (345,854) (2,777,717) 130,927 (2,646,790)

------------- -------------

Operating (loss)/profit (201,265) 658,650 - (345,854) 111,531 - 111,531

Share of results of

associates

and joint ventures 18,908 - - - 18,908 - 18,908

Finance income 234 - - - 234 - 234

Finance costs (39,553) (64) - (37,844) (77,461) - (77,461)

(Loss)/profit before

taxation (221,676) 658,586 - (383,698) 53,212 - 53,213

Income tax expense (6,627) - (6,627) - (6,627)

--------------- ---------- ------------- ---------- ------------- ------------- -------------

(Loss)/profit for the

period before gain on

disposal of controlling

interest (228,303) 658,586 - (383,698) 46,585 - 46,586

Discontinued

operations:

Discontinued operations - - (225,570) (225,570) - (225,570)

--------------- ---------- ------------- ---------- ------------- ------------- -------------

(Loss)/profit for the

period (228,303) 658,586 (225,570) (383,698) (178,985) - (178,985)

=============== ========== ============= ========== ============= ============= =============

Assets and liabilities

Total assets 6,924,404 1,517,294 2,250,290 3,103,362 13,795,350 (1,137,340) 12,658,010

Total liabilities (8,545,249) (398,343) (1,362,631) (121,198) (10,427,421) (39,270) (10,466,691)

--------------- ---------- ------------- ---------- ------------- ------------- -------------

Net assets/(liabilities) (1,620,845) 1,118,950 887,659 2,982,164 3,367,929 (1,176,609) 2,191,319

=============== ========== ============= ========== ============= ============= =============

2. Segmental analysis - Audited 31 December 2022

Continuing activities Discontinued

operations

Artist Services* Livestreamed Central Total Livestreamed Total before Eliminations Total

representation events costs events eliminations

GBP GBP GBP GBP GBP GBP GBP GBP GBP

Revenue 6,571,428 2,874,603 - - 9,446,031 - 9,446,031 - 9,446,031

Cost of sales - (2,053,180) (1,031,198) - - (3,084,378) - (3,084,378) - (3,084,378)

--------------- ------------ ------------- ------------ ------------ ------------- ------------- ------------- ------------

Gross profit 4,518,248 1,843,405 - - 6,361,653 - 6,361,653 6,361,653

Other operating

income 178,215 14,722 - 366,741 559,678 - 559,678 (366,741) 192,937

Administrative

expenses (4,211,950) (1,354,434) - (762,481) (6,328,864) - (6,328,864) 366,741 (5,962,123)

------------- -------------

Operating profit/(loss) 484,513 503,694 - (395,740) 592,467 - 592,467 - 592,467

Share of results

of associates and

joint ventures 140,708 (15,443) (290,994) - (165,729) - (165,729) - (165,729)

Finance income 3,000 - - - 3,000 - 3,000 - 3,000

Finance costs (86,178) (66) - (41,681) (127,925) - (127,925) - (127,925)

Profit/(Loss)

before taxation 542,043 488,185 (290,994) (437,421) 301,813 - 301,813 - 301,813

Income tax expense - (77,931) - - (77,931) - (77,931) - (77,931)

--------------- ------------ ------------- ------------ ------------ ------------- ------------- ------------- ------------

Profit/(loss)

for the year before

gain on disposal

of controlling

interest 542,043 410,254 (290,994) (437,421) 223,882 - 223,882 - 223,882

Discontinued

operations:

Gain on disposal

of controlling

interest - - - - - 2,220,117 2,220,117 - 2,220,117

--------------- ------------ ------------- ------------ ------------ ------------- ------------- ------------- ------------

Profit/(loss)

for the year 542,043 410,254 (290,994) (437,421) 223,882 2,220,177 2,444,060 - 2,444,060

=============== ============ ============= ============ ============ ============= ============= ============= ============

Assets and

liabilities

Total assets 6,173,734 960,920 2,184,533 3,047,786 12,366,973 - 12,366,973 (1,694,907) 10,672,066

Total liabilities (9,483,839) (331,239) - (115,674) (9,930,752) - (9,930,752) 3,513,096 (6,417,656)

--------------- ------------ ------------- ------------ ------------ ------------- ------------- ------------- ------------

Net assets/(liabilities) (3,310,105) 629,681 2,184,533 2,932,112 2,436,221 - 2,436,221 1,818,189 4,254,410

=============== ============ ============= ============ ============ ============= ============= ============= ============

* Revenue of the Consultancy and Services segment in 2022 includes commission of $2,297,223 received

in March 20222 by ATC Media Inc for the facilitation of the acquisition of Napster Music Inc by Hivemind

and Algorand. ATC Media Inc is also entitled to deferred revenue in the form of a number of Napster crypto

tokens issued as part the merger between Napster Music Inc and Napster Holding Inc, a number that is currently

undetermined. The fair value of the deferred revenue receivable in Napster tokens has been determined

at the year end to be nil.

3. Other operating income

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Government grants received - 77,944 106,946

Sundry income 97,729 3,130 85,991

97,729 81,704 192,937

============ ============ =============

4. Share in results of associates and joint ventures

Six months Six months Year

ended ended ended 31

30 June 30 June December

2023 2022 2022

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Joint ventures:

ATC 4 LLP 35,346 4,791 100,113

ATC 7 LLP 2,173 5,169 6,688

ATC 9 LLP 1,963 8,948 33,907

Associates:

Driift Holdings Limited (435,660) - (290,994)

Company X LLC (27,308) - (15,443)

(423,486) 18,908 (165,729)

============ ============ ==========

5. Discontinued operations - Driift

Six months Six months Year

ended ended ended 31

30 June 30 June December

2023 2022 2022

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Loss for the period after tax - (225,570) (291,802)

Gain on disposal of controlling

interest - - 2,511,979

- (225,570) (2,220,177)

============ ============ ============

6. Earnings/(loss) per share

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2023 2022 2022

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Profit (loss) attributable to owners

of parent company (1,090,875) (100,825) 2,596,921

Basic and diluted number of shares

in issue 9,584,020 9,584,020 9,584,020

Earnings per share pence pence pence

Basic and diluted earnings/(loss)

per share (11.38) (1.05) 27.10

Basic and diluted earnings/(loss)

per share (Continuing activities) (11.38) 1.30 1.58

Basic and diluted earnings/(loss)

per share (Discontinued activities) - (2.35) 25.52

Basic earnings per share is calculated by dividing the

profit/loss after tax attributable to the equity holders of All

Things Considered Group Plc by the weighted numbers of shares in

issue during the year .

7. Cash and cash equivalents

As at 30 As at 30 As at 31

June 2023 June 2022 December

2022

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Own funds 1,222,297 3,492,827 1,744,397

Funds held on behalf of clients 4,694,870 4,905,279 2,172,873

----------- ----------- ---------

5,917,167 8,398,106 3,917,270

=========== =========== =========

8. Events after the reporting date

In July 2023, the Group raised GBP4.18 million in aggregate

before expenses by way of a conditional placing and a subscription

for 4,518,915 new ordinary shares in the Company at the price of

92.5 pence per share . Following admission of the new ordinary

shares to trading, the enlarged share capital of the Company

consisted of 14,102,935 ordinary shares, none of which are held in

treasury.

The net proceeds from the Fundraise were used primarily to

acquire a 60% holding in Sandbag, a full-service merchandise

company, for an initial consideration of GBP2.42 million on 19 July

2023. The Group is in the process of assessing the business

combination accounting requirements under IFRS3and full disclosures

will be made in the annual report for the year ending 31 December

2023. The revenue and profit before tax for Sandbag group, as

disclosed in the statutory accounts for the year ended 31 March

2022 were GBP31,705,490 and GBP1,207,474 respectively.

The net proceeds from the Fundraise will also provide capital

for future accretive opportunities identified across ATC's Live

Events and Experience divisions and provide balance sheet strength

and fund working capital requirements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXDDGDCXSDDGXR

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

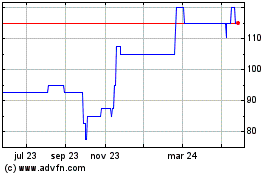

All Things Considered (AQSE:ATC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

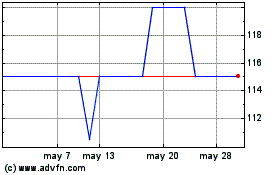

All Things Considered (AQSE:ATC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024