$6 Million ETH Sale: Ethereum Foundation Joins Whale Liquidation Frenzy

09 Octubre 2024 - 9:00AM

NEWSBTC

The Ethereum Foundation was at the center of attention recently

concerning a liquidation plan it has set in place to sell parts of

its Ether balance. Related Reading: Analyst Foresees 90% Cardano

Price Drop in Next 6 Months According to the on-chain tracker

Lookonchain, a wallet linked to the foundation moved 2,500 ETH,

valued around $6 million, to the exchange Bitstamp on October 8,

2024. This is part of an increasing trend in which large holders,

colloquially known as “whales,” are selling their holdings in the

face of this volatile market environment. A whale deposited 11,456

$ETH($27.8M) to #Binance in the past 40

minutes!https://t.co/0L5r2u9wF9 pic.twitter.com/gNZI3pKAEx —

Lookonchain (@lookonchain) October 8, 2024 Significant Transactions

Uncovered Lookonchain claims this is not the only transaction this

foundation has lately done. ETH sold overall in 2024 is as high as

3,766, which brought $10.46 million. The organization sold 950 ETH

in September, equal to $2.27 million. They sell them often, roughly

every 11 days. The transaction averages about 151 ETH in size. The

foundation still retains a significant sum: 271,274 ETH, or about

$655 million. Market Reactions And Jitters The crypto community has

a reason to worry over the continuous selling of Ethereum. Much of

the investors have severely feared that this huge liquidation might

lead to downward pressure on ETH prices. During the last 14 days,

the price of Ethereum went down by around 8%. This has led some

analysts to speculate that these selling events are contributing

factors behind the bearish market of ETH. Community commentators

are divided between interest and concern regarding the history of

the wallet by the foundation, how it affects the market dynamics,

Lookonchain has disclosed. Related Reading: Cardano Surges In

Strength—Now 10x More Powerful, Analyst Says Future Financial

Planning Such sales, according to Aya Miyaguchi, an executive

director of the Ethereum Foundation, are part of a deliberate

financial strategy – working to pay for operational costs and cover

the costs of ongoing projects. The entire annual budget is

estimated to be around $100 million, with some of these costs –

such as salaries and grants – requiring fiat currency. Thus,

turning part of the ETH reserve into stablecoins like DAI has

become routine. With the Ethereum Foundation still working through

its financial situation in a volatile market, only time will tell

how these continued sales will affect both the price of ETH and the

robustness of the Ethereum ecosystem. With quite a bit of resources

still locked up by the foundation, individuals are paying close

attention to look for changes or constructive/violent reactions in

the market. Featured image from ETF Stream, chart from TradingView

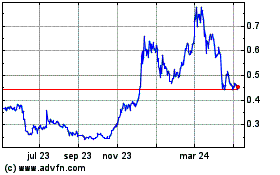

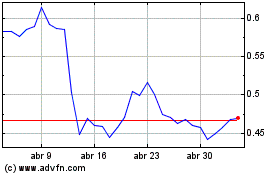

Cardano (COIN:ADAUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Cardano (COIN:ADAUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024