Binance Coin Price Prediction: Will Correction Trend Push BNB Under $200?

09 Septiembre 2023 - 6:02AM

NEWSBTC

Binance Coin (BNB) has experienced a notable setback, retracing

from its overhead resistance for the third time in just two months.

This downward trajectory has formed a falling wedge pattern, a

technical indicator characterized by declining peaks and troughs

confined within two converging trend lines. As of the latest data

from CoinGecko, BNB is currently trading at $214.94, with a 24-hour

decline of 0.9% and a modest seven-day gain of 0.6%. On August 31,

the BNB price dipped below the critical $220 local support level,

signaling the possibility of further bearish movement. Related

Reading: Shiba Inu Tallies 77% Accumulation By Major Investors –

Good For SHIB Price? However, amidst the prevailing market

uncertainty, BNB’s price has turned sideways, leaving both buyers

and sellers in a state of indecision. BNB weekly price action.

Source: Coingecko The falling wedge pattern, often referred to as

an ending diagonal pattern, can be seen as a potential signal of

exhaustion within a prevailing bearish phase, hinting at a

potential trend reversal. If the recent breach below $220 fails to

sustain, it could open the door for buyers to challenge the

overhead resistance. Binance Coin Potential For Turnaround Price

analysis suggests that a successful breakout from this falling

wedge pattern would signify a bullish turnaround for BNB. This

could potentially propel the coin’s price to target levels of $234,

and if momentum continues to favor buyers, it may even reach

heights of $247 or even $263. In a parallel development,

PancakeSwap (CAKE) has achieved a significant milestone in the

cryptocurrency ecosystem. According to a post by glebk.eth,

PancakeSwap’s monthly revenue has surpassed that of BNB Chain over

the last 30 days. .@PancakeSwap surpassed @BNBCHAIN in terms of

monthly revenue Data source: @tokenterminal $CAKE $BNB #BNB

#BNBChain pic.twitter.com/Vp1bHg8o6N — glebk.eth (@glebk_eth)

September 7, 2023 PancakeSwap operates on BNB Chain due to its

lower transaction costs, which allow users to swap tokens with

significantly reduced fees compared to Ethereum (ETH). Token

Terminal data reveals that, as of September 6, PancakeSwap

generated fees totaling $96,237, indicating a substantial increase

in user transactions compared to the previous day. In contrast, BNB

Chain’s 30-day revenue stood at $931,700 on September 7.

PancakeSwap’s revenue during the same period, however, exceeded

expectations, reaching $970,800. BNB market cap currently at $33

billion on the weekend chart: TradingView.com Implications For The

Crypto Market These developments in the crypto market highlight the

ongoing battle between various blockchain platforms and

decentralized exchanges. BNB’s struggle with overhead resistance

underscores the challenges faced by cryptocurrencies in maintaining

upward momentum amid market volatility. Related Reading: XLM Surges

With 10% Rally – Can The Recovery Hold Its Ground? As the crypto

landscape continues to evolve, investors and enthusiasts will

closely monitor these trends to assess the potential impact on the

broader market and the long-term viability of different blockchain

ecosystems. (This site’s content should not be construed as

investment advice. Investing involves risk. When you invest, your

capital is subject to risk). Featured image from Fortune

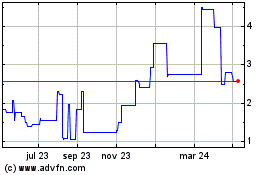

PancakeSwap Token (COIN:CAKEUSD)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

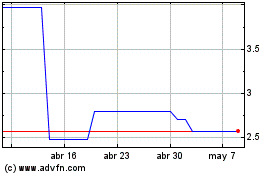

PancakeSwap Token (COIN:CAKEUSD)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024