A Botched Heist: A Look At The Sloppy $8.5M Hack On Platypus Protocol

17 Febrero 2023 - 5:18PM

NEWSBTC

Avalanche-based Platypus Protocol, an AMM that was less than two

weeks into launching it’s new stablecoin USP, suffered an $8.5M

flash loan attack on Thursday. There’s plenty to talk about

recently about stablecoins, but this story isn’t about regulation –

but rather about community-issued enforcement and collaboration to

rectify actions from the hack. In less than 24 hours, community

collaboration has allowed Platypus to recover almost a third of the

funds – and the hacker has sleuths hot on his tail. Moving At A

Platypus’ Pace? Not So Fast On the cusp of robust SEC and

stablecoin discussion, including drama surrounding Paxos-issued

BUSD and the SEC’s new suit against Do Kwon and Terraform Labs

(creators of the Terra stablecoin UST), there’s more stablecoin

madness this week that is unrelated to regulation. Platypus Finance

has operated in the Avalanche ecosystem for some time now as an

established AMM operating a liquidity pool, and recently launched a

stablecoin, USP, pegged to the US dollar. On Thursday, a hacker who

routinely identifies as ‘retlqw’ used a flash loan to take

advantage of Platypus’ code. They sought to deploy a single

contract to exploit Platypus, but the work has generally been seen

as sloppy and a result of ‘poor coding’ rather than ‘good

exploiting.’ The hacker took a flash loan from Aave for 44M USDC,

deposited it to the Platypus pool for liquidity pool tokens. The

exploiter deposited those liquidity pool tokens into a staking

contract, allowing them to borrow a massive amount of USP tokens.

This is all standard procedure, up until now: the hacker than took

advantage of a ’emergencyWithdraw’ function, which manipulated the

code to allow the hacker to swap back the liquidity pool tokens,

returning the flash loan from Aave, and still maintain the USP

token. The hacker swapped USP tokens for as much as they could at

that moment – roughly $8.5M worth of stablecoins. Platypus Finance

(PTP) native token has seen substantial volatility through up's and

down's lately. | Source: PTP-USDT on TradingView.com Related

Reading: FIL Price Surges 25.8% Following Smart Contract

Development on Filecoin Hot Pursuit The Platypus team consulted

with Avalanche’s internal team at Ava Labs, as well as industry

professionals like BlockSec. Within a few hours, four lines of

corrected code had been implemented to rectify the issue. Within

the same day, crypto’s signature sleuth ZachXBT issued a tweet

identifying the hacker and expressing interest in negotiating a

bounty before reporting them to law enforcement: Hi @retlqw since

you deactivated your account after I messaged you. I've traced

addresses back to your account from the @Platypusdefi exploit and I

am in touch with their team and exchanges. We’d like to negotiate

returning of the funds before we engage with law enforcement.

pic.twitter.com/oJdAc9IIkD — ZachXBT (@zachxbt) February 17, 2023

In less than 48 hours, Platypus has already recovered 2.4M USDC and

it appears that many of the other funds are frozen courtesy of

coordinated work with Platypus’ team. This hack serves as another

stark reminder that code is often far from perfect in early stages

of development. The stablecoin sagas continue. Related Reading:

Blur Token Airdrop Spikes Ethereum Gas Prices And Burn

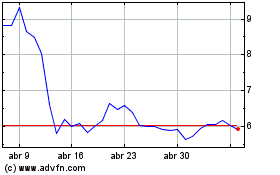

Filecoin (COIN:FILUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Filecoin (COIN:FILUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024