Bitcoin Price Analysis: Ascending Parallel Channel Pattern Points To $57,000 Target

04 Enero 2024 - 6:00PM

NEWSBTC

As anticipation builds around the potential approval or rejection

of spot Bitcoin (BTC) exchange-traded funds (ETFs) by the US

Securities and Exchange Commission (SEC) on January 5, the Bitcoin

price has witnessed a notable 2.7% recovery in the past 24

hours. This development comes amidst growing speculation

about the patterns that could drive the Bitcoin price to reclaim

the highs lost during the bear market in 2022. Notably,

crypto analyst Ali Martinez has identified an ascending parallel

channel as the governing pattern behind the Bitcoin price action

since September 2023. Bitcoin Price Faces Crucial Test At $48,000

According to Ali Martinez’s analysis, Bitcoin prices have exhibited

a consistent pattern known as an ascending parallel channel.

This technical formation suggests that the BTC’s price has been

trading within the confines of a channel characterized by an upper

and lower boundary, as seen in the chart below. BTC could

experience further price movement within the defined boundaries if

the ascending parallel channel pattern holds. The price is

expected to advance toward the upper boundary, which currently

resides around $48,000. However, the Bitcoin price is anticipated

to face resistance at this level and retrace towards the lower

boundary at approximately $34,000. Following the retracement,

a rebound toward the upper boundary, potentially reaching around

$57,000, could be expected. Related Reading: Litecoin Bear Flag

Could Cause 41% Crash To This Level, Analyst Explains The upcoming

decision by the SEC regarding spot Bitcoin ETF applications adds a

layer of significance to Bitcoin’s price movement. The approval of

Bitcoin ETFs has been a subject of great interest within the

cryptocurrency community, as it can enhance liquidity and provide

greater legitimacy to the cryptocurrency market. While the

outcome of the SEC decision remains uncertain, the ascending

parallel channel pattern reveals a compelling technical perspective

that could impact Bitcoin’s price trajectory. Critical Moment For

BTC? Supporting the upside potential of the Bitcoin price in

Martinez’s analysis, crypto analyst Rekt Capital highlights the

importance of BTC’s ability to establish a strong support level at

$43,900. According to Rekt Capital’s analysis, Bitcoin is

exhibiting promising signs as it strives to reclaim the top of the

pattern at $43,900 as a support level. This level holds

importance in determining the cryptocurrency’s ability to sustain

upward momentum. Rekt Capital suggests that a daily candle close

above this resistance is essential for Bitcoin to make another

attempt at moving higher. Related Reading: XRP Price Gears Up For

‘Significant Upswing Soon’: Crypto Analyst The successful

establishment of $43,900 as a support level and a daily candle

close above this resistance would signify a positive development

for Bitcoin’s upside potential. It would indicate a renewed

bullish sentiment and potentially pave the way for further price

appreciation. However, failure to overcome this resistance level

and ending up as an upside wick could hinder Bitcoin’s ability to

sustain upward momentum in the short term. On Wednesday, Bitcoin

trades at $44,000, followed by a news-driven dip toward the $40,800

level. Featured image from Shutterstock, chart from

TradingView.com

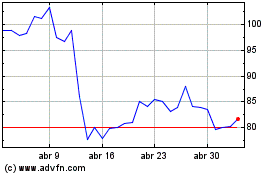

Litecoin (COIN:LTCUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Litecoin (COIN:LTCUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024