Believe: significant profitability improvement and solid organic

growth despite currency impacts in H1’24

Significant profitability improvement and

solid organic growth despite currency impacts in H1’24

Paris, France – August 1, 2024

H1 2024 Key Figures1

- Revenues of €474.1 million in H1’24, up +14.1% at current rate

with an organic growth of +12.3% including currency headwinds

embedded in Premium Solutions digital sales.

Adjusted2 organic growth amounted to +15.4% in

H1’24.

- Strong growth in France (+17.9%), Europe excl. France &

Germany (+24.7%) and Americas (+21.8%), and softer growth in

Asia/Oceana/Africa (+3.7%), which was affected by soft ad-supported

revenues and FX (although the long-term tailwinds in Asia remain

compelling). Germany (which continues to be actively managed away

from physical distribution contracts and towards digital

distribution) still penalizing revenue growth, which would have

amounted to +16.4% excluding the country.

- Digital sales grew at a slower pace in Q2’24 on an organic

basis compared with Q1’24, reflecting softer market growth and more

limited market share gains.

- Strong increase in Adjusted EBITDA at €31.3 million, up + 29.3%

versus H1’23 or a margin of 6.6%, up +80bps YoY reflecting focus on

value optimization, control on investments and operating

leverage.

- Increase in advances paid to labels and artists was less

prominent than in H1'23, leading to improved free cash flow dynamic

(negative €19.4 million in H1’24 compared with negative of €32.9

million in H1’23). Net cash at the end of June’24 was

€183.6million.

H1 2024

Highlights

- Completion of the simplified tender offer initiated by Upbeat

Bidco (consortium composed of funds managed by TCV, EQT X and Denis

Ladegaillerie) which now holds 96.02% of the share capital and

94.87% of the voting rights.

- Successful focus on key music genres with a confirmed

leadership in rap music and recent developments in electronic and

dance music, notably with the strategic partnership with

Romanian-based Global Records.

- Continued investment in Asia to expand presence across multiple

local markets and address strategic local music genres in the

region.

- Further build-up of the best offer for self-releasing artists

through the offering of top-notch marketing programs and

self-served publishing services.

2024 Outlook

- Adjusted EBITDA margin was ahead of expectations in H1’24

reflecting controlled investments, successful efficiency plans and

focus on value optimization. The Group will pursue this strategy in

H2’24 and is now expecting an Adjusted EBITDA margin higher than

6.5% (versus c. 6.5% initially anticipated).

- Believe also confirms a slightly positive free cash flow in

FY’24.

- Organic growth was in line with expectations in Q1’24 but did

not accelerate in Q2’24 as rapidly as anticipated. In addition,

Believe is now expecting the positive effect of Q4’23 price

increases at large DSPs to fade away in H2’24, when comparing year

on year revenue growth.

- As a result, Believe reviewed its growth scenario for H2’24 and

retained a conservative approach. Paid streaming increase continues

to be very resilient, but will not be uplifted by significant price

increases in the second half of the year. Ad-funded streaming

growth is assumed to remain stable in H2’24 versus H1’24. While

Believe expects to continue to gain market share in H2’24, it is

unlikely to be able to fully mitigate the effect of the slightly

softer than expected market growth outlook in H2’24 (driven by

weaker ad-funded and no additional DSP price increases). Currency

headwinds embedded in the market are still expected to be down c.

-2% year-over-year. Based on those assumptions, Believe now

expects organic growth of c. +12 (versus c. +18% initially).

Adjusted organic growth for embedded market FX of c. + 14% (versus

c. +20% initially).

Denis Ladegaillerie, Founder and

CEO said: “Despite persistent market

headwinds in some of our key territories, Believe continued to

generate solid profitable growth during the semester. We pursued

our strategic roadmap to build the best artist development company

in the music industry, while finalizing the restructuring of our

capital structure providing us with greater financial flexibility

and partners who can accelerate our profitable growth story.

Believe is in good stead for the next phase of growth and industry

consolidation.”

H1 2024 KEY FIGURES

| in

€million |

H1 2023 |

H1 2024 |

Change

YoY |

Organic change |

| Group Revenues |

415.4 |

474.1 |

+ 14.1% |

+ 12.3% |

|

Premium Solutions |

388.5 |

440.9 |

+ 13.5% |

+ 11.7% |

|

Automated Solutions |

26.9 |

33.2 |

+ 23.4% |

+ 20.5% |

| Adjusted EBITDA pre-Central

Platform |

61.7 |

73.4 |

+18.9% |

|

| in % of

revenues |

14.9% |

15.5% |

60bps |

|

|

Premium Solutions |

57.2 |

65.2 |

+14.0% |

|

|

Automated Solutions |

4.5 |

8.2 |

+81.8% |

|

| Central Platform |

(37.5) |

(42.1) |

+12.2% |

|

| Group's Adjusted

EBITDA |

24.2 |

31.3 |

+29.3% |

|

|

in % of revenues |

5.8% |

6.6% |

80bps |

|

| Operating income / loss (EBIT) |

1.0 |

(7.0) |

|

|

| Net cash from operating activities |

(27.2) |

(13.1) |

|

|

| Free cash flow |

(32.9) |

(19.4) |

|

|

| Net cash and cash

equivalents |

210.2 |

183.6 |

|

|

H1 2024 HIGHLIGHTS

The simplified public tender offer initiated by

Upbeat Bidco, the consortium formed by funds managed by TCV, EQT X

and Denis Ladegaillerie was completed on June 21. At the time of

this release, the consortium holds 96.02% of the share capital.

With a free float just below 4% and ongoing coverage cessation, the

Group has decided to review its financial communication agenda.

Going forward, Believe will publish interim and full year results,

and no longer release quarterly revenues.

Adjusted organic revenue growth of

+15.4% in H1’24, a solid performance despite growth not

accelerating as expected at the end of the semester

After a solid start to the year, revenue growth

did not accelerate at the end of H1’24 as previously anticipated.

The market growth was softer in Q2’24 than in Q1’24 and remained

penalized by negative embedded market FX notwithstanding a slight

improvement during the quarter.

Paid streaming trends were solid and still

enhanced by price increases by several large digital platforms in

Q4’23. Ad-funded streaming monetization remained weak, notably in

Asia. The expected recovery at the end of Q2’24 did not happen,

leading the Group to a more cautious view on ad-funded streaming

for the rest of the year.

In H1'24, revenues grew by +14.1% to reach

€474.1 million, reflecting an organic growth of +12.3%, a positive

perimeter effect related to the Sentric acquisition in March’23

(€10 million in revenue recorded in Q1’24 or 2.4% to revenue growth

in H1’24) and a negative forex impact (-0.6%). Revenue remained

affected by embedded currency headwinds in H1’24 as the Group

anticipated (-3.1%), but the negative effect decelerated in Q2

versus Q1. Adjusted organic growth reached +15.4%.

A solid performance of the roster in a

wider variety of genres

Believe further grew its revenues in H1’24 reflecting a solid

performance of the existing roster of artists and labels. Over the

course of H1’24, the Group remained at the forefront of audience

development, fostering digital monetization in an ever-growing

number of digital music genres.

Believe once again confirmed its leadership in

France in new releases and its success in sustainably developing

artists in H1’24 as illustrated by the recently released SNEP data.

Believe ranked #1 on Streaming Top Albums and Top Singles, for the

1st time. Its market share is particularly high on local acts, with

40% of local top singles and 30% on local top albums (physical +

digital). In addition, Believe had 5 best-selling artists in the

Top 10 in H1’24, proving its unique capacity to develop multiple

artists in several genres at the very top of the market.

With the Group’s support, several French rap

artists reached new heights in Q2’24, including KeBlack, Heuss

l’Enfoiré, Uzi or Carbonne among others. Believe also saw

equivalent success in Brazil with G.A. and Grego, two local hip hop

/ trap artists. The Group also succeeded in developing several Pop

artists in Europe and Asia and helped them become top charting

artists, including among others the UK band Sea Girls, the

Australian band Royal Otis, Harvi, NIrvair Pannu and Fahean

Abdullah in India as well as several Indonesian artists with the

launch of the new imprint dedicated to the Java Pop music genre.

Believe also supported the development of Sevdaliza, an

Iranian-Dutch electro artist which has been upsell from TuneCore to

Premium Solutions, whose recent Ride or Die part 2 track

entered the Spotify Daily Top 50 in 19 countries, of

which 11 in top 10 position and whose track Alibi

generated more than 67 million streams in two weeks.

Building strong market position in

digital friendly music genres: further progress in electronic and

dance music with the acquisition of Global Records

Since 2023, the Group is expanding its position in electronic and

dance music with the launch of two global dance/electronic music

labels, b.electronic and All Night Long. This increased Believe’s

commercial appeal in those music genres and enabled the Group to

develop both labels and artists digitally. Aligned with its

blueprint strategy to first grow organically then implement

partnerships with entrepreneurial labels to accelerate growth,

Believe signed a strategic partnership with Global Records, Central

and Eastern Europe’s top independent dance music company, and

committed to take a 25% stake in its capital.

The objective is to accelerate Global Records’

growth by bringing together Believe’s successful track record of

developing digital-friendly music genres across multiple

territories and unrivaled capacity to scale and grow local

businesses, and Global Records’ powerful full-service model and

A&R capacities in dance music. Global Records is a music first

company that has built a solid reputation as a hitmaker in dance

music. In 2023 only, it cumulated over 6 billion streams across all

platforms and over 20 billion streams for its global catalogue.

Pursuing investment in Asia to

strengthen its regional footprint and foster future growth

opportunities despite softer market conditions experienced across

the region outside China and Japan

Believe pursued its investment in Greater China and reinforced the

local top management to prepare for the next phase of growth. Now

the world’s fifth music market, Greater China recorded the fastest

rates of revenue growth in 2023, with a relatively low penetration

of paid music subscribers. Looking ahead, the streaming market in

China is expected to grow by more than 120% by 2030 (according to

Midia estimates), boosting the rise of digital-friendly music

genres like hip-hop and the emergence of top-charting artists. The

local top management is responsible for defining and leading the

most adapted revenue growth strategies, growing the roster of local

artists and labels and further building up relationships with local

digital services.

Believe also launched Krumulo, a new imprint in

Indonesia dedicated to Java Pop, one of the most popular local

genres with the objective to be the top-of-mind artist services

brand for Java Pop artists. The imprint will provide an adaptive,

personalized and comprehensive marketing and promotion strategy

across various touchpoints and help them to expand their reach to

nation-wide engagement.

Further building up the best offer for

self-releasing artists

As of June’24, self-releasing artists on TuneCore earned more than

$4 billion since the company’s founding in 2006, with $1 billion

paid out since December’22. The automated platform was aided by the

deals with DSPs negotiated by Believe, the expansion of publishing

activities since Sentric’s acquisition (March’23) and the launch of

the TuneCore Accelerator marketing program in December’23. The new

marketing program helped artists get their music in front of more

listeners and enabled TuneCore to be once again recognized as one

of Fast Company’s most innovative companies. TuneCore maintained

its focus on building the most complete suite of products to

support the development of self-releasing artists. Under this

objective, the TuneCore Mastering tool, which is designed to help

artists improve the sound quality of their recordings before

release, was added at the end of Q2’24.

H1’24 FINANCIALS

Premium Solutions and Automated

Solutions both driving revenue growth in H1’24

Digital Music Sales3 (DMS) amounted to €636.9million in

H1’24, up +9.0% year-over-year, with Premium Solutions again

recording a double-digit growth and a solid performance in

Automated Solutions.

In H1’24, Premium Solutions, revenues amounted

to €440.9 million, up c. +13.5% at current rate, mostly reflecting

an organic growth of +11.7% and a positive perimeter effect of

+2.3% related to the acquisition of Sentric (completed in

March’23). Adjusted organic growth was +15.1% in H1’24. Addressable

markets were softer in Q2’24 versus Q1’24, resulting in lower

organic growth for Believe, but this was mitigated by an

improvement in the estimated embedded market FX effect (-2.7% in

Q2’24 versus -4.0% in Q1’24).

Paid streaming trends remained solid throughout

the semester, while ad-funded streaming activities remained subdued

notably in Asia and did not recover at the end of Q2’24 as

initially anticipated by the Group. Believe continued gaining

market share in H1’24, but they were more limited in Q2’24 compared

with previous quarters.

Automated Solutions revenues amounted to €33.2

million up by +23.4% in H1’24, reflecting +18.2% in Q1’24 and

+28.0% in Q2’24. Digital sales showed improvement throughout the

semester and recorded a solid growth acceleration in Q2’24.

Non-digital sales were significantly up compared with last year,

driven by the integration of Sentric self-served activities and a

positive one-off in publishing activities (TuneCore was already

providing publishing services before the acquisition). Automated

Solutions growth was also supported by its new marketing advanced

program (TuneCore Accelerator program), which is boosting its

performance notably on Spotify.

Strong growth in France, the Americas

and Europe excluding France and Germany

| in

€ million |

H1 2023 |

H1 2024 |

Change YoY |

| Europe excl.

France and Germany |

121.9 |

152.0 |

+ 24.7% |

| Americas |

60.6 |

73.9 |

+ 21.8% |

| France |

66.5 |

78.4 |

+ 17.9% |

| Asia / Oceania

/ Africa |

112.2 |

116.3 |

+ 3.7% |

| Germany |

54.1 |

53.5 |

- 1.2% |

|

Total |

415.4 |

474.1 |

+ 14.1% |

Sentric revenues are now split by region thanks

to greater integration in the Group’s systems, while they were

previously accounted for in Europe excl. France and Germany. This

was completed in Q2’24 and most of revenues were reallocated to the

US.

Revenue growth amounted to +24.7% in

Europe (excluding France and Germany) and

represented 32.1% of total revenues in H1’24. Believe recorded

strong growth across Eastern Europe and in Spain, while the

activity remained solid in Italy. Revenues in Turkey significantly

increased throughout the semester. The performance in the UK was

penalized by the reallocation of Sentric revenues to the US which

was done in Q2’24 and therefore hampered the comparison basis with

Q2’23 as all Sentric revenues were then allocated in this market.

Americas grew by

+21.8% and represented 15.6% of Group revenues in H1’24. The

performance in Q2’24 was uplifted by the reallocation of Sentric

revenues to the US. The level of activity was strong in Mexico,

while Brazil recorded a slowdown in its revenue growth. TuneCore

achieved a solid level of revenues thanks to its powerhouse

marketing program TuneCore Accelerator, while also recording strong

growth of its publishing activities, which included a positive

one-off related to the acquisition of Sentric.

In France, revenues

increased by +17.9% in H1’24 and represented 16.5 % of Group

revenues. Digital revenues continued recording double-digit growth

throughout the semester, but the growth rate stalled momentarily

down in April. The Group confirmed its leadership for local acts in

France notably in the rap music genre. Non-digital sales were also

very dynamic, driven by live and branding activities. Given the

market position and the size of Artist Services, non-digital

revenues h ave become significant as Believe offers a complete

range of services to the top local artists that it serves.

In H1’24, revenue growth reached +3.7%

in Asia Pacific and Africa, which

represented 24.5% of Group revenues. After a slow start to the year

(as a result of weaker ad-funded streaming market), the Group

returned to revenue growth in Q2’24. The level of activity in

Greater China and Japan, where the Group is currently building up

its position was strong throughout the semester. Revenues were up

slightly in India and down in several Southeast Asian markets, as

the two regions are more dependent on ad-funded streaming. In

addition, Believe’s market position in several Southeast Asian

markets mitigated its capacity to generate additional market share

gains.

In Germany, revenues

were down -1.2% in H1’24 and represented 11.3% of Group revenues.

After declining in Q1’24, revenues stabilized in Q2’24. Digital

sales were slightly up in Q1’24 and further progressed in Q2’24,

confirming their positive trajectory thanks to the strong

positioning on local acts and the ongoing diversification of music

genres in the roster. Non-digital sales continued to decline

throughout the semester on the back of Believe’s proactive decision

to accelerate its exit from contracts that were too heavily reliant

on physical sales and merchandising, which should reset the

business to a stronger base for future growth and margins.

Strong increase in Adjusted EBITDA

margin illustrating control on investments and operating

leverage

Believe adapted its investment pace to the

growth level and focused on further optimizing value, improving

efficiency and deploying automation in H1’24. The Group continued

investing in local teams to fuel its future revenue growth. Hence

Believe reduced its pace of investment in local teams in H1’24,

while launching its Be Odyssey program, which aims at

further optimizing technological capabilities of the Central

Platform and required increased spending dedicated to Tech and

Product.

Adjusted EBITDA pre-Central Platform

costs4 grew by +18.9% in H1’24 to reach €73.4

million (versus €61.7 million in H1’23). Believe pursued its

investment strategy in H1’24 to support its profitable growth plan.

The Group deployed additional sourcing and servicing capabilities

in Premium Solutions, while further rolling out its new marketing

program TuneCore Accelerator and accelerating the development of

self-served publishing activities. The Group was however focused on

controlling its investment in local teams in H1’24. As a result,

the Adjusted EBITDA margin pre-Central Platform further progressed

and reached 15.5% in H1’24, an increase of 60bps compared with

H1’23 (14.9%). This margin included growth investments in both

segments including Sentric, which represented 3.1% of total

revenues in H1’24.

Central Platform costs (€42.1

million in H1’24 versus €37.5 million in H1’23) increased by +12.2%

year-over-year and remained stable over revenue versus last year

(8.9% in H1’24 compared with 9.0% in H1’23). Believe continued

implementing efficiency plans to optimize its investments in the

Central Platform and also launched in H1’24 its Be Odyssey

program to prepare for the next phase of growth and scale increase.

As a result, Tech & Product costs significantly increased in

H1’24. Sales & Marketing costs progressed more in line with

revenue growth, while General & Administrative spending

declined for the first year since the IPO. Notwithstanding the

increase in Tech & Product, Central Platform costs remained

stable as a percentage of revenue.

As for previous years, some Central Platform

investments are capitalized under IFRS accounting principles. In

H1’24, total investment (P&L and capitalized costs) in the

Central Platform amounted to €48.9 million. Total investment went

up +8.0% year-over-year and represented 10.3% of total Group

revenues compared with 10.9% in H1’23, or a decrease of 60bps.

The Group’s Adjusted EBITDA

grew by +29.3% year-over-year to reach €31.3 million compared with

€24.2 million in H1’23. Adjusted EBITDA margin stood at 6.6% in

H1’24 compared with 5.8% in H1’23 thanks to the Adjusted EBITDA

margin increase at the segment level and better operating leverage

achieved in Central Platform. The Group therefore is progressing in

delivering operating leverage and approaching the high-end of the

mid-term objective level (Group adjusted EBITDA margin of 5% to 7%

by 2025).

Operating income (EBIT) reflecting

higher D&A versus last year and costs related to the Offer

process

Depreciation & Amortization amounted to €24.8 million in H1’24,

up +17.2% compared with H1’23 (€21.2 million), reflecting the

resumption of the external growth strategy since Q1’23 as it is the

first driver of the past D&A increases reported by the Group.

The Group recorded €7.3 million in other operating expenses largely

driven by costs related to the offer initiated by the consortium.

This was a steep change compared with last year as the Group

recorded a positive other income of €2.0 million in H1’23. As a

result, EBIT was negative €7.0 million.

Free cash flow reflecting commercial

dynamism. Solid cash level at the end of June’24

Working capital variation was negative by €34.3 million, reflecting

higher artist and label advances that grew by €25.5 million

compared with the end of December’23. In H1’24, the Group had the

opportunity to further deepen its relationships with its existing

roster and to attract additional Tier1 labels. Signing activity

was, however, hampered by the offer process and the associated

unsolicited approach the Group faced. As anticipated by the Group,

there were some renewals of large Tier1 labels on better and longer

terms in H1’24, but this trend was not confirmed in H2’24.

Free cash flow was negative by €19.4 million in

H1’24 reflecting negative working capital variation. Capex amounted

to €15.3 million and represented 3.2% of Group revenue, compared

with €18.4 million or 4.4% of Group revenue in H1’23, and were

mostly capitalized costs.

Cash on the balance sheet amounted to €183.6

million at the end of June’24 compared with €210.2 million at the

end of June’23 and €214.2 million at the end of December’23, mostly

higher artist and label advances and capex compared with last

year.

The Group will continue to manage its cash and

to allocate between advances and acquisitions, seeking

opportunities with greater return and better contribution to the

profitable growth strategy that Believe is pursuing.

FY 2024 OUTLOOK

In FY’24, the Group will continue to drive a

profitable growth trajectory towards its long-term profitability

objective of 15% Adjusted EBITDA margin.

Adjusted EBITDA margin was ahead of expectations

in H1’24, thanks to continued operating leverage (controlled

investments, successful efficiency plans and focus on value

optimization). The Group will pursue this strategy in H2’24 and now

anticipates an Adjusted EBITDA margin of at least 6.5% (versus c.

6.5% initially). Believe will further focus on value optimization

in H2’24. The Group will also continue to adapt the investment

cycle to market growth and to optimize investments in the Central

Platform and increase efficiency through automatization.

Organic growth was in line with expectations in

Q1’24 but did not accelerate in Q2’24 as rapidly as anticipated.

Besides, Believe is now expecting the positive effect of Q4’23

price increases of large DSPs to fade away in H2’24. As a result,

Believe now retains a conservative approach for its growth scenario

for H2’24. Paid streaming increase remains very resilient but will

not be uplifted by significant price increases in H2’24. Ad-funded

streaming growth is assumed stable in H2’24 versus H1’24. This will

not be fully mitigated by the expected additional market share

gains. Currency headwinds embedded in the market are still expected

to be down c. -2% year-over-year. Based on those assumptions,

Believe now expects organic growth of c. +12% (versus c. +18%

initially). Adjusted organic growth for embedded market FX of c. +

14-16% (versus c. +20% initially).

Believe also confirms it will deliver a slightly

positive free cash flow in FY’24. The Group will continue to

allocate cash between advances and acquisitions in the months

ahead. Believe’s reinforced appeal to a greater number of artists

and labels in a wider variety of music genres and the ongoing

industry consolidation provide more attractive opportunities for

the Group, which will therefore allocate more cash to internal and

external investments going forward.

The interim earnings report is available on our investor

website: Financials | Believe

Next earnings release of Believe (Ticker: BLV, ISIN:

FR0014003FE9):

13 March 2025: FY 2024 earnings – Press release to be issued

after market close.

Investor

Relations & Financial Media

Emilie MEGEL

investors@believe.com

Cell: + 33 6 07 09 98

60 |

Press

Relations

Manon JESSUA

manon.jessua@believe.com

Maria DA SILVA

maria.da-silva@agenceproches.com

Cell: +33 7 60 70 23 16 |

Appendix

1. Use of Alternative Performance

Indicators

To supplement our financial information

presented in accordance with IFRS, we use the following non-IFRS

financial measures:

- DMS is the revenue generated from digital store partners

and social media platforms before royalty payment to artists and

labels.

- Organic growth accounts for revenue growth at a

like-for-like perimeter and at constant exchange rate.

- Adjusted EBITDA is calculated based on operating income

(loss) before (i) depreciation, amortization and impairment, (ii)

share-based payments (IFRS 2) including social security

contributions and employer contributions (iii) other operating

income and expense; and (iv) depreciation of assets identified at

the acquisition date net of deferred taxes from the share of net

income (loss) of equity-accounted companies.

- Free cash flow corresponds to net cash flows from operating

activities, after taking into account acquisitions and disposals of

intangible assets and property, plant and equipment, and restated

for (i) costs related to acquisitions, (ii) acquisition costs of a

group of assets, that does not meet the definition of a business

combination and (iii) advances related to distribution contracts

intended specifically for the acquisition of assets (acquisition of

companies, catalogs, etc).

2. Quarterly revenue by division

|

in € million |

Q1 2023 |

Q1 2024 |

Change |

Organic at constant rate |

| Premium solutions |

186.0 |

215.3 |

+ 15.8% |

+ 12.6% |

| Automated solutions |

12.7 |

14.9 |

+ 18.2% |

+ 10.8% |

|

Total revenues |

198.6 |

230.3 |

+ 15.9% |

+ 12.5% |

|

in € million |

Q2 2023 |

Q2 2024 |

Change |

Organic at constant rate |

| Premium solutions |

202.5 |

225.6 |

+ 11.4% |

+ 10.8% |

| Automated solutions |

14.3 |

18.3 |

+ 28.0% |

+ 29.0% |

|

Total revenues |

216.8 |

243.9 |

+ 12.5% |

+ 12.0% |

3. Q2 revenue by geography

|

in € million |

Q2 2023 |

Q2 2024 |

Change YoY |

| Americas |

31.2 |

41.2 |

+ 31.8% |

| France |

34.4 |

39.9 |

+ 15.8% |

| Europe excl.

France and Germany |

67.5 |

75.2 |

+ 11.5% |

| Asia / Oceania

/ Africa |

56.2 |

60.0 |

+ 6.8% |

| Germany |

27.5 |

27.6 |

+ 0.1% |

|

Total |

216.8 |

243.9 |

+ 12.5% |

4. Revenue breakdown between digital and non-digital

sales (as reported)

|

|

Q1 2023 |

Q2 2023 |

H1 2023 |

Q1 2024 |

Q2 2024 |

H1 2024 |

| Digital sales |

93% |

90% |

91% |

90% |

89% |

89% |

|

Non-digital sales |

7% |

10% |

9% |

10% |

11% |

11% |

5. Digital and non-digital sales growth (as

reported)

|

|

Q1 2024 |

Q2 2024 |

H1 2024 |

| Digital sales |

+ 12.1% |

+ 11.2% |

+ 11.6% |

|

Non-digital sales |

+ 64.0% |

+ 24.3% |

+ 40.7% |

6. Premium Solutions revenue growth adjusted for

estimated embedded market FX effects

|

|

Q1 2024 |

Q2 2024 |

H1 2024 |

| Digital sales |

+ 17.9% |

+ 13.6% |

+ 15.7% |

|

Non-digital sales |

+ 0.3% |

+ 13.5% |

+ 7.9% |

About Believe

Believe is one of the world’s leading digital music companies.

Believe’s mission is to develop independent artists and labels in

the digital world by providing them the solutions they need to grow

their audience at each stage of their career and development.

Believe’s passionate team of digital music experts around the world

leverages the Group’s global technology platform to advise artists

and labels, distribute and promote their music. Its 2,020 employees

in more than 50 countries aim to support independent artists and

labels with a unique digital expertise, respect, fairness and

transparency. Believe offers its various solutions through a

portfolio of brands including Believe, TuneCore, Nuclear Blast,

Naïve, Groove Attack, AllPoints, Ishtar and Byond. Believe is

listed on compartment B of the regulated market of Euronext Paris

(Ticker: BLV, ISIN: FR0014003FE9).www.believe.com

Forward Looking

statement

This press release contains forward-looking statements

regarding the prospects and growth strategies of Believe and its

subsidiaries (the “Group”). These statements include statements

relating to the Group’s intentions, strategies, growth prospects,

and trends in its results of operations, financial situation and

liquidity. Although such statements are based on data, assumptions

and estimates that the Group considers reasonable, they are subject

to numerous risks and uncertainties and actual results could differ

from those anticipated in such statements due to a variety of

factors, including those discussed in the Group’s filings with the

French Autorité des Marchés Financiers (AMF) which are available on

the website of Believe (www.believe.com). Prospective information

contained in this press release is given only as of the date

hereof. Other than as required by law, the Group expressly

disclaims any obligation to update its forward-looking statements

in light of new information or future developments. Some

of the financial information contained in this press release is not

IFRS (International Financial Reporting Standards) accounting

measures.

1 Alternative performance indicators are

presented, defined and reconciled with IFRS in appendices 1 of this

press release (page 9).

2 Adjusted organic growth aims at

providing a view on Believe’s organic revenue growth after

neutralizing embedded market forex impact: Believe assesses the

forex impact on each digital market served by the Group to estimate

the market forex embedded into its digital revenues collected from

its digital partners. Digital sales embed currency translation

effects as the amounts collected from Subscriptions and Ad-funded

by digital stores are in local currencies and perceived by Believe

mainly in euros.

3. Digital Music Sales or DMS is a non IFRS

measure defined in appendix 1.

4. The Adjusted EBITDA pre-central platform costs

consists in the Adjusted EBITDA of the Automated and Premium

Solutions segments before considering Central Platform costs.

Central Platform costs account for the costs that cannot be

allocated by segment.

- 2024-08-01-Believe-H1 2024 earnings-ENG

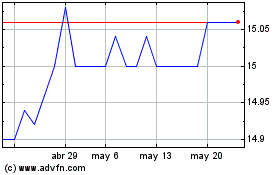

Believe (EU:BLV)

Gráfica de Acción Histórica

De Oct 2024 a Oct 2024

Believe (EU:BLV)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024