- Following the non-adoption of certain financial delegations

at the Annual General Meeting of November 28, 2024:

- Cash runway significantly reduced

- Redemption of the ORANE held by IRIS due, rendering

redemption of the IPF Partners bonds also due in the absence of a

new General Meeting authorizing the issue of new shares to redeem

the ORANE

- Without the renewal of the authorization by the General

Meeting and subject to an agreement with its creditors, the Company

may not be able to meet the redemption requests of IRIS and IPF

Partners

- Suspension by the Company until further notice of the

drawdown of new ORANE tranches under the equity-linked

financing facility put in place with IRIS

- Downward revision of corporate officers’

compensation

- Upcoming Combined General Meeting to be held on February 11,

2025, to adopt new financial delegations to maintain the cash

runway to end-2025 and avoid the immediate redemption of the ORANE

and the IPF Partners bonds

Regulatory News:

POXEL SA (Euronext : POXEL - FR0012432516), a clinical stage

biopharmaceutical company developing innovative treatments for

chronic serious diseases with metabolic pathophysiology, including

metabolic dysfunction-associated steatohepatitis (MASH) and rare

metabolic disorders, today announces its half-year financial

results for the period ended June 30, 2024 and provides an update

on its financial situation and outlook, in particular following the

non-adoption of certain financial resolutions by the Annual General

Meeting on November 28, 2024.

First Half 2024 Financial Statements (IFRS Standards)

Income statement1

EUR (in thousands)

H1 2024

6 months

H1 2023

6 months

Revenue

1,162

955

Cost of sales

(1,146)

(955)

Gross margin

16

-

Net research and development expenses*

(521)

(2,424)

Depreciation and amortization of

intangible assets

-

(16,572)

General and administrative expenses

(3,205)

(4,278)

Operating income (loss)

(3,710)

(23,274)

Financial income (expenses)

(3,548)

(2,968)

Income tax

-

-

Net income (loss)

(7,258)

(26,243)

*Net of R&D tax credit.

As already announced on September 9, 2024, Poxel reported

revenue of EUR 1.162 million in the first half of 2024, as compared

to EUR 955 thousand for the same period in 2023, mainly

corresponding to the JPY 199 million (EUR 1,162 thousand2) of

royalty revenue from Sumitomo Pharma, which represents 8% of

TWYMEEG net sales in Japan.

Cost of sales amounted to EUR 1.1 million as of June 30, 2024,

corresponding to the 8% royalties on net sales of Imeglimin in

Japan due to Merck Serono, as part of the Merck Serono license

agreement.

R&D expenses totaled EUR 0.5 million for the first half of

2024, as compared to EUR 2.4 million for the same period in 2023.

R&D expenditures are net of the R&D Tax Credit (CIR) that

represented income of EUR 0.1 million for the first half of 2024,

as compared to EUR 0.3 million for the same period in 2023.

General and administrative expenses came to EUR 3.2 million for

the first half of 2024, as compared to EUR 4.3 million for the

corresponding period in 2023, reflecting in particular the savings

plan undertaken by the Company.

The financial loss amounted to EUR 3.5 million for the first

half of 2024, as compared to EUR 3.0 million for the first half of

2023. This was mainly due to the interests attached to the Company

indebtedness.

The net loss for the financial period ending June 30, 2024, came

to EUR 7.3 million, as compared to EUR 26.2 million for the same

period in 2023.

The Company will publish its half-yearly financial report in the

next few days. This report will include the statutory auditors'

limited review reports on the consolidated financial statements for

the six months ended June 30, 2024.

Significant reduction in cash runway in the absence of full

residual drawdown of the equity-linked financing facility

As announced on September 30, 2024, following the non-dilutive

financing agreement with OrbiMed, the Company extended its cash

runway to the end of 2025, assuming the inclusion of the full

residual drawdown of the equity-linked financing facility put in

place with IRIS3, the latter assuming that the Company has the

necessary financial delegations at the time of drawdown and

conversion of the ORANE.

The non-adoption of most of the financial delegations at the

Annual General Meeting on November 28, 2024, and, in particular,

the one relating to the issue of new shares in redemption of ORANE,

which was intended to replace a similar delegation due to expire on

December 20, 2024, entails, in accordance with the agreements

entered into with IRIS and IPF Partners respectively, the

redemption of the ORANE held by IRIS, the latter also results in

the redemption of the IPF Partners bonds, unless a new

Extraordinary General Meeting, convened no later than 63 days from

the date of notification of the Company's failure to deliver new

shares, adopts a resolution renewing the delegation necessary for

the continued redemption of the ORANE in shares.

Despite the recent restructuring of the Company's debt made

possible in particular by the monetization transaction with

OrbiMed, which extended Poxel's cash runway to the end of 2025, the

non-adoption of most financial delegations, and in particular that

relating to the issue of new shares in redemption of ORANE, but

also including more usual delegations for biotechnology companies

willing to raise capital, places the Company, as well as its

shareholders, in an unprecedented, uncertain and potentially very

negative situation for the pursuit of its activities.

In particular, the non-adoption of the delegation allowing the

issue of shares in redemption of ORANE held by IRIS for a total

amount, to date, of EUR 4.3 million or that may still be issued in

the event of the draw down of additional ORANE from IRIS (i.e. EUR

3.2 million) under the equity-linked financing program signed by

Poxel with IRIS in August 2022 and renewed in March 2023,

significantly affects the Company's cash flow forecasts and its

ability to continue as a going concern.

In this context, and based on the cash position as of September

30, 2024, amounted to EUR 13.1 million and taking into account the

following financial items affecting the Company's financial

situation:

(i) partial repayments of the PGE loans

according to the new schedule agreed upon as part of the Company's

debt restructuring with its creditors; (ii) advisory fees incurred

in the framework of the transaction concluded with OrbiMed; and

(iii) the anticipated business plan including strict control of

operating expenses,

the Company now expects to be able to finance its operations and

capital expenditures only until the end of the 1st quarter of 2025,

at which point it would no longer be able to meet its expenses if

the current situation is not resolved.

Significant additional financial risk

In the event of non-fulfilment by the Company of its obligation

to deliver shares following a request for conversion of ORANE by

IRIS resulting from an absence of financial authorization, IRIS may

request, in accordance with the terms of the contract of issuance,

the early redemption of all outstanding ORANE, i.e. EUR 4.3 million

to date, unless the Company holds an Extraordinary General Meeting

within 63 days of notification by IRIS of the failure to deliver

shares and obtains the approval of the resolution to remedy the

situation.

The failure by such an Extraordinary General Meeting to adopt a

new authorization to redeem ORANE in shares would result in the

ORANE becoming immediately redeemable.

In the event of non-adoption of this authorization, and in the

absence of an agreement with IRIS and IPF Partners respectively,

the latter would also have the right under the terms of the

agreements relating to its bonds to impose its immediate redemption

for an amount of EUR 17.1 million4 to date (including EUR 13

million in principal and EUR 4.1 million in exit fees).

In this case, the Company would not have the cash required to

meet its anticipated redemption obligations, which would

significantly compromise its ability to continue as a going concern

and the continuation of its activities.

Convening of a new General Meeting aimed at adopting new

financial delegations and resolutions relating to the compensation

policy for corporate officers

As stated in the press release of November 29, 20245 announcing

the results of the Annual General Meeting of November 28, 2024, the

Board of Directors noted that certain financial delegations as well

as policies on the compensation of corporate officers had not been

adopted.

Acknowledging the questions asked by the Company's shareholders

prior to and during the Annual General Meeting, in particular

concerning the continuation of the financing program underway with

IRIS and the compensation policy for corporate officers, and also,

the non-adoption of the aforementioned resolutions (including the

very usual delegations for any biotech company having recourse to

the issue of equity securities or securities giving access to

capital for its financing), the Board of Directors has decided to

suspend until further notice its drawings under the equity-linked

financing facility put in place with IRIS.

The Board of Directors also decided to revise downwards the

compensation policy for the Company's corporate officers. A new

compensation policy will therefore be submitted to the next General

Meeting.

As the Company's ability to comply with the going concern

principle depends in particular on its ability to raise capital to

finance its activities and to honor its commitments to its current

financial creditors, the Board of Directors has thus decided to

resubmit for shareholder approval new resolutions, firstly on

financial matters and secondly on the compensation policy for its

corporate officers at a Combined General Meeting to be held on

February 11, 2025.

This Combined General Meeting will enable Poxel shareholders to

assume their responsibilities with regard to their Company's

financial situation, its going concern and their interests as

shareholders.

In preparation for the forthcoming General Meeting, the

convening of which will be announced in a press release, and to

review the available options to explore financing and operational

continuity options, the Company has also engaged discussions with

its current creditors.

Context of the preparation of the consolidated financial

statements as of June 30, 2024

In light of the above-described factors, the Company believes

that its ability to continue as a going concern is tied to the

outcome of the shareholders’ vote on the resolutions that will be

submitted at the General Meeting scheduled on February 11,

2025.

The Board of Directors of December 6, 2024, approved the

Company's condensed interim consolidated financial statements ended

June 30, 2024, in compliance with the going concern principle,

assuming that shareholders will cast a positive vote at the

Extraordinary General Meeting to be held on February 11, 2025,

which could extend its cash runway until the end of 2025.

At the meeting of the Board of Directors on December 6, 2024,

the Statutory Auditors indicated that their report would include an

inability to reach a conclusion on the condensed interim

consolidated financial statements at June 30, 2024, due to the

uncertainties surrounding going concern arising from the

non-adoption of the financial resolutions by the Annual General

Meeting on November 28, 2024, and the uncertainty associated with

the adoption of new resolutions at the next General Meeting

scheduled for February 11, 2025.

Indeed, if the resolutions presented to this General Meeting

were not adopted and no new agreements were reached between the

Company and its creditors, the Company would not have the cash

resources to meet its early repayment obligations, which would

significantly compromise its ability to continue as a going

concern.

Next Financial Press Release:

- Fourth Quarter 2024 Cash and Revenue update, on February

19, 2025

About Poxel SA

Poxel is a clinical stage biopharmaceutical company

developing innovative treatments for chronic serious diseases

with metabolic pathophysiology, including metabolic

dysfunction-associated steatohepatitis (MASH) and rare

disorders. For the treatment of MASH, PXL065

(deuterium-stabilized R-pioglitazone) met its primary endpoint in a

streamlined Phase 2 trial (DESTINY-1). In rare diseases,

development of PXL770, a first-in-class direct adenosine

monophosphate-activated protein kinase (AMPK) activator, is focused

on the treatment of adrenoleukodystrophy (ALD) and autosomal

dominant polycystic kidney disease (ADPKD). TWYMEEG®

(Imeglimin), Poxel’s first-in-class product that targets

mitochondrial dysfunction, is now marketed for the treatment of

type 2 diabetes in Japan by Sumitomo Pharma and Poxel expects to

receive royalties and sales-based payments. Poxel has a strategic

partnership with Sumitomo Pharma for Imeglimin in Japan. Listed on

Euronext Paris, Poxel is headquartered in Lyon, France, and has

subsidiaries in Boston, MA, and Tokyo, Japan.

For more information, please visit: www.poxelpharma.com

All statements other than statements of historical fact included

in this press release about future events are subject to (i) change

without notice and (ii) factors beyond the Company’s control. These

statements may include, without limitation, any statements preceded

by, followed by or including words such as “target,” “believe,”

“expect,” “aim,” “intend,” “may,” “anticipate,” “estimate,” “plan,”

“project,” “will,” “can have,” “likely,” “should,” “would,” “could”

and other words and terms of similar meaning or the negative

thereof. Forward-looking statements are subject to inherent risks

and uncertainties beyond the Company’s control that could cause the

Company’s actual results or performance to be materially different

from the expected results or performance expressed or implied by

such forward-looking statements. The Company does not endorse or is

not otherwise responsible for the content of external hyperlinks

referred to in this press release.

Glossary

You will find below a list of words and/or expressions that are

used in this press release or in Poxel’s communication, with the

aim to bring clarification and transparency:

- Sumitomo Pharma fiscal year runs April to March. As an

example, Fiscal Year 2024 is April 1, 2024, through March 31,

2025.

- TWYMEEG royalties: As per the Sumitomo Pharma’s

agreement, Poxel is entitled to receive royalties from the sales of

TWYMEEG (Imeglimin) in Japan

- Sumitomo Pharma communicates gross

sales of TWYMEEG, while TWYMEEG royalties are calculated on

net sales.

- Net sales represent the amount of gross sales to which are

deducted potential rebates, allowances, and costs such as prepaid

freight, postage, shipping, customs duties and insurance

charges.

- Poxel is entitled to receive escalating royalties of 8-18% on

TWYMEEG net sales from Sumitomo

Pharma.

- Positive net royalties: as part of the Merck Serono

licensing agreement, Poxel will pay Merck Serono a fixed 8% royalty

based on the net sales of TWYMEEG, independent of the level of

sales. All royalties that Poxel receives from TWYMEEG net sales

above that 8% level are considered as positive net royalties. Net

royalties will therefore be positive for Poxel when TWYMEEG net

sales exceed JPY 5 billion in a fiscal year and royalties reach 10%

and above.

1 The Statutory Auditors' review

procedures have been completed. The Statutory Auditors' report

stating that they are unable to form a conclusion on the condensed

interim consolidated financial statements for the six months ended

June 30, 2024, due to the going concern risk, will be issued in the

next few days.

2 Converted at the exchange rate as of

June 30, 2024

3 Since March 31, 2023, 16 additional

tranches have been drawn down for a total of EUR 8.3 million. An

additional amount of EUR 3.2 million could be drawn down by the

Company depending on liquidity and exposure conditions under the

IRIS contract and subject to the adoption of the Company's

appropriate financial delegations.

4 Not including the residual amount of the

deposit account set up in connection with the monetization of

royalties with OrbiMed, which will be fully dedicated to repayment

of this debt

5 "Poxel Announces Results from November

28, 2024 Annual General Meeting", on November 29, 2024

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241208394664/en/

Investor relations / Media NewCap Nicolas Fossiez,

Aurélie Manavarere / Arthur Rouillé investors@poxelpharma.com +33 1

44 71 94 94

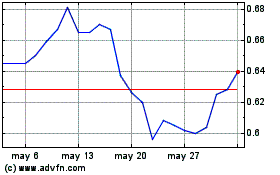

Poxel (EU:POXEL)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Poxel (EU:POXEL)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024