Unifiedpost shows continued double-digit growth in first semester

of 2022

Consistent growth of revenue and customer

base demonstrates momentum for digital business

Regulated Information

La Hulpe, Belgium – August 12, 2022,

7:00 a.m. CET – Unifiedpost Group’s (Euronext: UPG) (Unifiedpost,

the Group or the Company) revenue in the first half year of 2022

increased by 13.6% y/y to €91.7 million. This substantial increase

was mainly driven by the double-digit underlying growth in

recurring digital revenue (+21.7%), which is at the core of the

business of the Company. Unifiedpost expects further double-digit

growth due to the accelerated adoption of e-invoicing throughout

Europe.

Highlights

- Group revenue grew by 13.6% y/y to €91.7 million for H1

2022

- Recurring digital processing revenue up by 21.7% y/y in H1

2022

- Including project and license business, total digital

processing revenue grew +17.7% y/y in H1 2022

- Strong growth of customer base with 14.9% in H1 compared to end

2021

- Reaching cash flow break-even point by H2 2023 is the

predominant priority for the Company

- Promising new business opportunity for the Group with

government portals

Commenting on the business update, Hans

Leybaert, CEO and founder stated: “We show a solid organic growth,

in line with budget, in the first half of 2022. Unifiedpost’s

business remains strongly dependent on local e-invoicing

regulations. We have monitored a positive evolution in the market

in the sense that even more European countries have committed

themselves to making e-invoicing mandatory in the near future. Some

committed countries postponed the implementation in the short term

but are still on the road towards obliging regulatory e-invoicing.

Consequently, potential growth is currently concentrated in the

countries where we see that due to regulatory tailwinds, companies

tend to implement e-invoicing rather sooner. Looking forward to the

coming quarters, we have a well-stocked pipeline of some large

license deals. To pave the way for our long-term business

development, we are currently also building several important

partnerships. Next to that, our focus is on becoming cashflow

break-even.”

Key financial figures

| (EUR million) |

H1 2022 |

H1 2021 |

Change (%) |

| Digital

processing revenue |

59.3 |

50.4 |

+17.7%21,8%-24,4%6,9%13,6% |

|

Recurring |

55.9 |

45.9 |

+21.7%-24,4% |

|

Project & licenses |

3.4 |

4.5 |

-24.3%6,9% |

| Postage &

parcel optimisation revenue |

32.4 |

30.3 |

+6.9% |

| Group

revenue |

91.7 |

80.7 |

+13.6% |

Key business KPI’s

| (#) |

End H1 2022 |

End 2021 |

Change (%) |

| Customers |

910,845 |

792,594 |

+14.9% |

|

Direct paying customers |

430,524 |

368,277 |

+16.9% |

|

Indirect paying customers (third

party) |

480,321 |

424,317 |

+13.2% |

| Companies in business network |

1,745,401 |

1,504,895 |

+16.0% |

| Banqup

customers

|

68,645 |

35,408 |

+93.9% |

|

Organic growth (new

subscriptions) |

10,726 |

4,855 |

+120.9% |

|

Migrated |

22,511 |

- |

- |

| Banqup customers

Belgium

(Billtobox)

|

35,382 |

28,864 |

+22.6% |

| Banqup customers

France

(JeFacture)

|

3,591 |

2,072 |

+73.3% |

Recurring digital processing revenue

grew significantly by 21.7% in H1 2022

Consolidated Group revenue in first semester of

2022 increased by 13.6% to €91.7 million, mainly driven by organic

growth from digital processing revenue1. This core business of

Unifiedpost contributed €59.3 million, an increase of 17.7% y/y, of

which 13.7% was organic. Recurring digital

revenue, i.e., digital platform revenue excluding the

project and license business, showed a strong growth rate of

21.7% y/y. The project and license business, which

is non-recurring, contributed €3.4 million. Postage & parcel

optimisation revenue showed a sound growth rate of 6.9% y/y.

Group-wide recurring revenue remains high at 96.3% of total Group

revenue for the first half of 2022.

Customer base grew substantially by

14.9% in H1 2022

In H1 2022 Unifiedpost grew its customer

base to 910,845 customers (+14.9%

compared to FY 2021). The consolidated business

network expanded to over 1.75 million

companies, representing an estimated share of 6% of SME

businesses in Europe.

The total number of Banqup

customers grew to 68,645 (+93.9%

compared end YE 2021). The customer growth includes migration

effects, mainly from legacy platforms in the Baltics. Adjusting for

such migrated users, the number of Banqup users increased by 10,726

in the first six months of 2022, supported by a very pleasing

organic growth in markets like France, Serbia and in the

Benelux.

In the French market, Unifiedpost sees the

number of JeFacture customers increasing steadily.

Management expects exponential customer growth rates when the

deadline for mandatory B2B e-invoicing is nearing.

Overall average revenue per user (ARPU) in

digital processing business amounts to €23 for Q2 2022. This

reflects some decline compared to Q1 (€24.5). This decrease is as

expected by the management. It is important to emphasize that this

effect results from the significantly higher contribution from

Unifiedpost’s SME business in terms of new customers, which have a

significantly lower ARPU. This leads to a structural dilution of

the overall ARPU figure, in line with expectations based on the

Company’s strategy.

Platform scalability and new ecosystems

show promising results

Unifiedpost Group continued to successfully

launch its Banqup platform in 2022. Given the

accelerated adoption of e-invoicing throughout Europe, the growth

of the platform is expected to continue based on the implementation

of regulation on country level2. Unifiedpost has been speeding up

the roll-out of its payment services by further connecting major

European banks to the platform. Today the Company has 686 banking

connections (PSD2) in 19 countries. As of today, the payment

functionality is live in 8 countries and is expected to reach 14 by

year end 2022.

Impact of macro-economic and

geopolitical situation

Unifiedpost has not been directly

impacted by the Russian aggression against Ukraine. The

Group has no business in Ukraine, nor in Russia. It also has no

development centres in these countries. All countries where the

Group is active are however experiencing levels of inflation that

have not been observed in decades.

Market

The world has changed. The uncertain

geo-political environment and the supply chain disruptions are

persisting. This creates a challenging business context impacting

businesses worldwide with international sanctions against Russia,

rising energy prices, unprecedented inflation and increasing

interest rates. As businesses seek in these circumstances for cost

efficiency measures, the need for digital solutions like

e-invoicing is more relevant than ever. Governments are largely

impacted today by an increasing deficit and debt. To reduce their

deficit, governments are accelerating the fight against VAT fraud

by declaring e-invoicing mandatory. Within the EU the program ‘VAT

in Digital Age’ is a new legislative package to adapt the way

value-added tax shall be reported and collected. This should lead

to a significant boost for the (B2B) e-invoicing once the laws are

in force. The boost is expected in the period

2023-2028. The year 2022 is for most of the countries a

preparation year. Countries who had already released a timetable

for making B2B e-invoicing mandatory are experiencing some

execution delays. This is the case in Poland and France.

Additionally, market trends show that the increased adoption of

B2B-invoicing is closely linked to the deadline of mandatory

e-invoicing. The growth in markets is back end loaded. With the

increasing legislation on mandatory e-invoicing there is an

increasing demand from governments for e-invoice

portals. Governments aim to offer a basic free e-invoicing portal

to businesses.

Management guidance

Unifiedpost’s organic growth has been supported

by a growing number of SME and corporate customers, and an

increasing usage of the platform. The growth is steady

double-digit. A further acceleration is linked to the deadlines of

governments making e-invoicing mandatory. These ground-breaking

movements are challenging for governments.

New business opportunities have emerged for

Unifiedpost: government portals. A basic version of the Unifiedpost

platform is a perfect solution for government e-invoice portals and

gateways to VAT-compliance validation. Unifiedpost has sold

platform licenses to governments in the past. Today, with the

regulatory tailwinds becoming stronger and stronger, more business

can be generated. With the transitional year 2022 for the B2B

e-invoicing market the Group will generate substantial additional

revenue from this business in Q3/Q4 with

license deals. The pipeline for license sale is

well stocked. These deals, if timely materialised in 2022, will

support the organic growth of 25%.

Due to the changed business conditions, the

Company has decided to make the target to become cashflow

break-even its predominant priority. The target is to be

cashflow break-even by the second semester of

2023. All costs and investments will further be aligned to

B2B e-invoice market developments and market growth. The costs of

the Group are meanwhile impacted directly and indirectly by

inflation. To counter that impact the Group plans to increase sales

prices.

Investors

& Media webcast

Management will host

a live video webcast for analysts, investors and media today at

10:00 a.m. CET.

A recording will be available shortly

after the event. To attend, please register at

https://onlinexperiences.com/Launch/QReg/ShowUUID=AE36E23B-6237-4AB5-B993-341BE192ADC3

A full replay be

available after the webcast at:

https://www.unifiedpost.com/en/investor-relations

Financial Calendar 2022

- 16 September 2022 Publication H1 2022 Financial Results

- 10 November 2022

Publication Q3 2022 Business Update

Investor Relations & Media

Sarah Heuninck+32 491 15 05

09sarah.heuninck@unifiedpost.com

About Unifiedpost Group

Unifiedpost is a leading cloud-based platform for SME business

services built on “Documents”, “Identity” and “Payments”.

Unifiedpost operates and develops a 100% cloud-based platform for

administrative and financial services that allows real-time and

seamless connections between Unifiedpost’s customers, their

suppliers, their customers, and other parties along the financial

value chain. With its one-stop-shop solutions, Unifiedpost’s

mission is to make administrative and financial processes simple

and smart for its customers. Since its founding in 2001,

Unifiedpost has grown significantly, expanding to offices in 32

countries, with more than 500 million documents processed in 2021,

reaching over 1,600,000 SMEs and more than 2,500 Corporates across

its platform today.

Noteworthy facts and figures:

- Established in 2001, with a proven track record

- 2021 turnover € 171 million

- 1400+ employees

- Diverse portfolio of clients across a wide variety of

industries (banking, leasing, utilities, media, telecommunications,

travel, social security service providers, public organisations,

etc.) ranging from large internationals to SMEs

- Unifiedpost Payments, a fully owned subsidiary, is recognised

as a payment institution by the National Bank of Belgium

- Certified Swift partner

- International M&A track record

- Listed on the regulated market of Euronext Brussels, symbol:

UPG

(*) Warning about future statements: The statements contained

herein may contain forecasts, future expectations, opinions and

other future-oriented statements concerning the expected further

performance of Unifiedpost Group on the markets in which it is

active. Such future-oriented statements are based on the

current insights and assumptions of management concerning future

events. They naturally include known and unknown risks,

uncertainties and other factors, which seem justified at the time

that the statements are made but may possibly turn out to be

inaccurate. The actual results, performance or events may

differ essentially from the results, performance or events which

are expressed or implied in such future-oriented statements.

Except where required by the applicable legislation, Unifiedpost

Group shall assume no obligation to update, elucidate or improve

future-oriented statements in this press release in the light of

new information, future events or other elements and shall not be

held liable on that account. The reader is warned not to rely

unduly on future-oriented statements.

1 As from Q2 2022, organic growth includes revenue from all

acquired entities.

2 An international roadmap and details on tax compliance can be

found on

https://www.unifiedpost.com/en/crossnet/tax-compliance.

- Logo

-

20220812_UnifiedpostGroup_PressRelease_H12022_BusinessUpdate_ENG

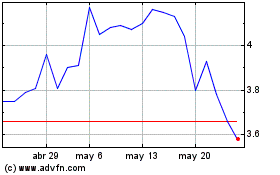

Unifiedpost Group SANV (EU:UPG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Unifiedpost Group SANV (EU:UPG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025