Swiss Franc Slides As Swiss Retail Sales Unexpectedly Fall

02 Abril 2024 - 12:55AM

RTTF2

The Swiss franc weakened against other major currencies in the

European session on Tuesday, after data showed that Switzerland's

retail sales decreased unexpectedly in February after recovering in

the previous month.

Data from the Federal Statistical Office showed that the retail

sales adjusted for sales days and holidays fell a working-day

adjusted 0.2 percent year-on-year in February, reversing a 0.3

percent rise in January. Meanwhile, economists had expected a 0.4

percent increase.

On a monthly basis, retail sales dropped a seasonally adjusted

0.4 percent in February versus a 0.7 percent increase a month

ago.

In nominal terms, retail sales fell 0.4 percent annually and

declined 0.2 percent monthly in February.

Also, the European stocks traded slightly higher as strong U.S.

manufacturing data helped lift mining and energy stocks.

Investors shrugged off the results of a survey showing that

Eurozone factory downturn deepened again in March.

Inflation fell in six economically important German states in

March, preliminary data showed ahead of key German inflation

figures due alter in the day.

Elsewhere, British manufacturers reported their first overall

growth in activity in 20 months in March on the back of recovering

demand in their home market.

The Swiss franc was trading slightly lower against its major

rivals in the Asian session today.

In the European trading now, the Swiss franc fell to a 5-month

low of 0.9090 against the U.S. dollar and a 6-day low of 166.81

against the yen, from early highs of 0.9050 and 167.62,

respectively. If the franc extends its downtrend, it is likely to

find support around 0.92 against the greenback and 165.00 against

the yen.

Against the euro and the pound, the franc slipped to 5-day lows

of 0.9757 and 1.1418 from early highs of 0.9716 and 1.1355,

respectively. The franc may test support near 0.98 against the euro

and 1.15 against the pound.

Looking ahead, Destatis is set to release Germany's flash

inflation figures for March at 8:00 am ET. Economists forecast

consumer price inflation to ease to 2.2 percent from 2.5 percent in

February.

In the New York session, U.S. factory orders for February is

slated for release.

At 10:10 am ET, Federal Reserve Board Governor Michelle Bowman

will speak virtually on "Bank Mergers and Acquisitions, and De Novo

Bank Formation: Implications for the Future of the Banking System"

before the Workshop on the Future of Banking hosted by the Federal

Reserve Bank of Kansas City, in Washington D.C., U.S.

At 12:00 pm ET, Federal Reserve Bank of New York President John

Williams will moderate a discussion with Jeremy Siegel, professor

of finance at the Wharton School of the University of Pennsylvania,

before the Economic Club of New York, in New York, U.S.

Five minutes later, Federal Reserve Bank of Cleveland President

Loretta Mester speaks on the economic outlook before the Cleveland

Association for Business Economics and Team NEO Luncheon, in

Cleveland, U.S.

At 1:30 pm ET, Federal Reserve Bank of San Francisco President

Mary Daly will participate in hybrid fireside chat in partnership

with the Henderson Chamber of Commerce, Latin Chamber of Commerce

Nevada, and Vegas Chamber of Commerce, in Las Vegas, in U.S.

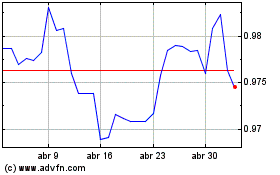

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Mar 2024 a Abr 2024

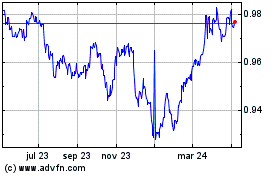

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Abr 2023 a Abr 2024