ECB Cuts Interest Rates By 25 Bps As Lagarde Airs Concern On Eurozone Growth

17 Octubre 2024 - 4:40AM

RTTF2

The European Central Bank cut key interest rates by 25 basis

points, as expected on Thursday, as policymakers assessed that the

disinflation process is on track, and but they are increasingly

concerned over the health of the euro area economy following some

soft data released since the September policy session. The

Governing Council, led by ECB President Christine Lagarde, lowered

the deposit facility rate by a quarter basis point to 3.25 percent

following the rate-setting session held in Ljubljana, the capital

of Slovenia.

"…the decision to lower the deposit facility rate - the rate

through which the Governing Council steers the monetary policy

stance - is based on its updated assessment of the inflation

outlook, the dynamics of underlying inflation and the strength of

monetary policy transmission," the ECB said.

The central bank for the single bloc lowered rates by the same

volume in September and was then widely expected to opt for a cut

only in December.

However, economic data since the September session made

expectations for an imminent reduction stronger. While headline

inflation has slowed much, the core figure has not eased as fast as

the bank would like.

Further, an increasing number of indicators such as those from

the purchasing managers' survey and bank lending data have started

to signal a weakening Eurozone economy, something that the central

bank acknowledged in the policy statement. ECB policymakers have

also started to air doubts over the resilience of the labor

market.

Lagarde also expressed some concern over the recent economic

data as she responded to questions from reporters during the

post-decision press conference. The latest decision to lower rates

was unanimous, she said.

The ECB chief clearly refused to pre-commit an easing in

December, instead stressed on the data-dependency approach.

Answering a question, she said the ECB has not yet completely

"broken the neck of inflation". The bank is still looking at a soft

landing, Lagarde said.

Policymakers will be equipped with the latest set of ECB staff

macroeconomic projections in December.

The ECB left the forward guidance on interest rates unchanged

this time. Policy rates will be kept sufficiently restrictive for

as long as necessary to bring euro area inflation back to the 2

percent target, the ECB said.

"The Governing Council will continue to follow a data-dependent

and meeting-by-meeting approach to determining the appropriate

level and duration of restriction," the bank said.

"The Governing Council is not pre-committing to a particular

rate path," the bank reiterated.

ING economist Carsten Brzeski said the decision to cut rates

only five weeks after the last cut and with only very few pieces of

economic data since then, suggests that the ECB must have become

much more concerned about the eurozone's growth outlook and the

risk of inflation undershooting the target.

The latest rate cut can be seen as a signal that the ECB is now

in a hurry to bring interest rates down to a more neutral level,

the economist added.

Capital Economics economist Jack Allen-Reynolds said the data

released over the next weeks are likely to support 25 basis points

rate cuts at each of the next few meetings, at the very least.

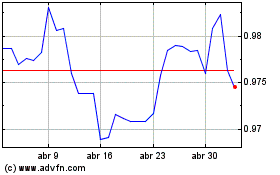

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Oct 2024 a Nov 2024

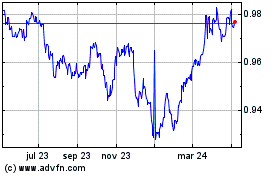

Euro vs CHF (FX:EURCHF)

Gráfica de Divisa

De Nov 2023 a Nov 2024