UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☑ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Under Rule 14a-12

|

AMTECH SYSTEMS, INC. |

(Name of Registrant as Specified in its Charter) |

N/A |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☑ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)Amount Previously Paid:

(2)Form, Schedule or Registration Statement No.:

AMTECH SYSTEMS, INC.

58 SOUTH RIVER DRIVE, SUITE 370

TEMPE, ARIZONA 85288

NOTICE OF 2025 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MARCH 5, 2025

To Our Shareholders:

The 2025 Annual Meeting of Shareholders (the “Annual Meeting”) of AMTECH SYSTEMS, INC., an Arizona corporation (the “Company”), will be held at Amtech Systems, Inc., 58 S. River Drive, 3rd Floor Meeting Room, Tempe, Arizona, on Wednesday, March 5, 2025, at 9:00 a.m., Arizona time, for the following purposes:

1.To elect five (5) directors to serve until the 2026 Annual Meeting of Shareholders and until their successors are duly elected and qualified;

2.To ratify the appointment of KPMG LLP as our independent registered public accountants for the fiscal year ending September 30, 2025;

3.To approve the advisory (non-binding) resolution relating to the named executive officer compensation as disclosed in the accompanying proxy statement;

4.To approve an amendment to the Company's 2022 Equity Incentive Plan; and

5.To transact such other business as may properly come before the meeting or any postponement or adjournment thereof.

The foregoing items of business are more fully described in the proxy statement accompanying this notice. The Company is presently aware of no other business to come before the Annual Meeting.

Important Notice Regarding the Availability of Proxy Materials for the Meeting

The Proxy Statement and annual report to shareholders on Form 10-K for the fiscal year ended September 30, 2024 (the “2024 Annual Report”) are also available at www.proxydocs.com/ASYS. The materials available on this website include this notice, the proxy statement and the 2024 Annual Report.

The Board of Directors has fixed the close of business on January 13, 2025 as the record date (the “Record Date”) for the determination of shareholders who hold the Company’s common stock who are entitled to notice of, and to vote at, the Annual Meeting or any postponement or adjournment thereof. Shareholders are reminded that their shares of the Company’s common stock can be voted at the Annual Meeting only if they are present at the Annual Meeting in person or by valid proxy. A copy of the 2024 Annual Report, which includes our audited financial statements, was mailed with this notice and Proxy Statement on or about January 31, 2025 to all shareholders of record on the Record Date.

Management of the Company cordially invites you to attend the Annual Meeting. Your attention is directed to the attached Proxy Statement for a discussion of the foregoing proposals and the reasons why the Board of Directors encourages you to vote FOR the approval of such proposals.

|

By Order of the Board of Directors: |

|

Wade M. Jenke, Secretary |

Tempe, Arizona

January 24, 2025

|

IMPORTANT: IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AND VOTED AT THIS MEETING WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON. PLEASE VOTE YOUR SHARES PROMPTLY BY COMPLETING AND RETURNING YOUR PROXY CARD OR BY VOTING ON THE INTERNET OR BY TELEPHONE. |

AMTECH SYSTEMS, INC.

PROXY STATEMENT

2025 ANNUAL MEETING OF SHAREHOLDERS

TABLE OF CONTENTS

AMTECH SYSTEMS, INC.

58 S. RIVER DRIVE, #370

TEMPE, ARIZONA 85288

PROXY STATEMENT

The Board of Directors, or “Board,” of Amtech Systems, Inc., an Arizona corporation (the “Company” or “Amtech”), is soliciting proxies to be used at the 2025 Annual Meeting of Shareholders to be held on Wednesday, March 5, 2025, at 9:00 a.m., Arizona time, and any adjournment or postponement thereof (the “Annual Meeting” or “Meeting”). A copy of the Notice of the Meeting accompanies this Proxy Statement. This Proxy Statement and the accompanying form of proxy will be mailed to all shareholders entitled to vote at the Annual Meeting beginning January 31, 2025.

Who Can Vote

Shareholders of record as of the close of business on January 13, 2025 (the “Record Date”), may vote at the Annual Meeting and at any adjournment or postponement of the Meeting. On the Record Date, 14,289,066 shares of our common stock, $0.01 par value (“Common Stock”), were issued and outstanding. A complete list of shareholders entitled to vote at the Annual Meeting shall be open to the examination of any shareholder, for any purpose germane to the Annual Meeting, during ordinary business hours for at least ten days prior to the Annual Meeting at our offices at 58 S. River Drive, #370, Tempe, Arizona 85288.

What Constitutes a Quorum

The presence, in person or by proxy, of the holders of a majority of the voting power of the issued and outstanding shares of Common Stock as of the Record Date entitled to vote is necessary to constitute a quorum at the Annual Meeting. Abstentions and broker non-votes are included in the number of shares present at the Meeting for purposes of determining a quorum. A broker “non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner.

How to Attend the Meeting

If you are a shareholder of record, which means you hold your shares in your name, you may attend the meeting. If you own shares in the name of a bank, broker or other holder of record (“street name”), you will need to ask your broker or bank for a copy of the proxy they received from us. You will need to bring the proxy with you to the Annual Meeting, which will be held at Amtech Systems, Inc., 58 S. River Drive, 3rd Floor Meeting Room, Tempe, Arizona, on Wednesday, March 5, 2025, at 9:00 a.m., Arizona time.

How to Vote

If your shares are registered directly in your name, you may vote:

Via the Internet. If you received the Notice or a printed copy of the proxy materials, follow the instructions in the Notice or on the proxy card.

By Telephone. If you received a printed copy of the proxy materials, follow the instructions on the proxy card.

By Mail. If you received a printed copy of the proxy materials, complete, sign, date, and mail your proxy card in the enclosed, postage-prepaid envelope.

In Person at the Annual Meeting. If you choose to vote in person at the Meeting, you must bring a government-issued proof of identification that includes a photo (such as a driver’s license or passport) and either the enclosed proxy card or other verification of your ownership of shares of Common Stock as of the Record Date.

If your shares are held in street name (held for your account by a broker, bank or other nominee):

Your broker, bank or other nominee should give you instructions for voting your shares. You may vote by Internet, telephone or mail as instructed by your broker, bank or other nominee. You may also vote in person if you obtain a legal proxy from your broker, giving you the right to vote your shares at the Meeting and you bring verification of your ownership of shares of Common Stock to the Meeting.

We are not aware of any other matters to be presented at the Annual Meeting, except those described in this Proxy Statement. However, if any other matters not described in this Proxy Statement are properly presented at the Annual Meeting, the proxies will use their own judgment to determine how to vote your shares. If the Annual Meeting is adjourned, your Common Stock may be voted by the proxies on the new Meeting date as well, unless you have revoked your proxy prior to that time.

What are the Voting Rights of Holders of Common Stock

Except as set forth below with respect to the ability to cumulate votes for directors, the holders of Common Stock will be entitled to one vote per share of Common Stock.

What Vote is Required to Approve Each Item

If a quorum is present, the five nominees who receive a plurality of the votes cast at the Annual Meeting will be elected. Broker non-votes and votes that are withheld will have no effect on the results of the vote for the election of directors. If a quorum is present, a majority of votes cast by holders of Common Stock represented and entitled to vote at the Annual Meeting will constitute a ratification of the appointment of KPMG LLP as our independent registered public accountants. In addition, if a quorum is present, a majority of votes cast by holders of Common Stock represented and entitled to vote at the Annual Meeting will constitute approval of the amendment to the 2022 Equity Incentive Plan.

Approval of the advisory vote on the compensation of our named executive officers requires the affirmative vote of a majority of the shares of Common Stock present or represented at the Annual Meeting and entitled to vote. Because the vote is advisory, it will not be binding upon the Board. However, the Compensation Committee will take into account the outcome of the vote when considering future executive compensation arrangements.

Revoking Your Proxy or Changing Your Vote

You may revoke your proxy and/or change your vote at any time before the Meeting.

If your shares are registered directly in your name, you must do one of the following:

Via the Internet or by Telephone. Cast your votes again via the Internet or by telephone by following the instructions provided on the proxy card. Only the last Internet or telephone vote will be counted.

By Mail. Sign a new proxy card and submit it as instructed above, or send a notice revoking your proxy to the Secretary so that it is received on or before March 4, 2025.

In Person at the Annual Meeting. Attend the Meeting and vote in person. Presence at the Meeting will not revoke your proxy unless you specifically request that your proxy be revoked.

If your shares are held through a broker or other nominee and you would like to change your voting instructions, please follow the instructions provided by your broker.

How Votes are Counted

Inspectors of election will be appointed for the Annual Meeting. The inspectors of election will determine whether or not a quorum is present and will tabulate votes cast by proxy or in person at the Annual Meeting. If you have returned valid proxy instructions or attend the Annual Meeting in person, your Common Stock will be counted for the purpose of determining whether there is a quorum. Abstentions and broker non-votes will be included in the determination of the number of shares represented for a quorum. Generally, broker non-votes occur when a beneficial owner does not provide instructions to their broker with respect to a matter on which the broker is not permitted to vote without instructions from the beneficial owner. In tabulating the voting result for any particular proposal, shares that constitute broker non-votes are not considered entitled to vote on that proposal. Accordingly, broker non-votes will not affect the outcome of any matter being voted on at the Meeting, assuming that a quorum is obtained.

Costs of this Proxy Solicitation

We will pay the costs of preparing and mailing the Notice of Annual Meeting and Proxy Statement, including the charges and expenses of brokerage firms, banks and others who forward solicitation material to beneficial owners of the Common Stock. We will solicit proxies by mail. Our officers and directors may also solicit proxies personally, or by telephone or facsimile, without additional compensation. We have not retained any outside party to assist in the solicitation of proxies; however, we have retained Broadridge Financial Solutions, Inc. to provide certain administrative services in connection with the proposals in this Proxy Statement, including coordinating the distribution of proxy materials to beneficial owners of Common Stock, contacting shareholders to ensure they have received this Proxy Statement and overseeing the return of proxy cards.

Annual Report

Our Annual Report to Shareholders for the fiscal year ended September 30, 2024 (the “Annual Report”) has been mailed concurrently with the mailing of the Notice of Annual Meeting and Proxy Statement to all shareholders entitled to notice of, and to vote at, the Annual Meeting. The Annual Report is not incorporated into this Proxy Statement and is not considered proxy-soliciting material.

Audit Committee Report

The information contained in the “Audit Committee Report” shall not be deemed “filed” with the Securities and Exchange Commission (the “SEC”) or subject to Regulations 14A or 14C or to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act.

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

(Item No. 1 on the Proxy Card)

Number of Directors to be Elected

Our Board of Directors currently consists of five members. Ms. Lisa D. Gibbs, our former Chief Financial Officer and Director, resigned as our Chief Financial Officer and as a member of the Board effective August 7, 2024. Each director elected will hold office for one year and until his qualified successor is duly elected and qualified. If any director resigns, or otherwise is unable to complete his term in office, our Board may elect another director for the remainder of the resigning director’s term.

Vote Required

The five nominees receiving the highest number of votes cast at the Annual Meeting will be elected. There is cumulative voting in the election of directors. This means that each holder of Common Stock present at the Annual Meeting, either in person or by proxy, will have an aggregate number of votes in the election of directors equal to five (the number of persons nominated for election as directors) multiplied by the number of shares of Common Stock held by such shareholder on the Record Date. The resulting aggregate number of votes may be cast by the shareholder for the election of any single nominee, or the shareholder may distribute such votes among any number or all of the nominees. In order to exercise cumulative voting, the voting shareholder must complete the proxy card and indicate cumulative voting in accordance with the instructions included on the proxy card.

Nominees for Director

Our Board is responsible for supervision of the overall affairs of the Company. Our current Board has nominated the following individuals to serve on the Board for the following year:

Robert M. Averick

Robert C. Daigle

Michael Garnreiter

Asif Y. Jakwani

Michael M. Ludwig

Each of these nominees has agreed to be named in this Proxy Statement and to serve if elected. See below for information regarding each of the nominees.

There are no family relationships among any of the director nominees or executive officers. Each nominee was recommended by a non-employee director.

Our Board recommends a vote FOR the election of the five nominees under Proposal No. 1. The persons appointed by the Board as proxies intend to vote for the election of each of the nominees, for a term to expire at the next annual meeting, unless you indicate otherwise on the proxy or voting instruction card. In that regard, our Board solicits authority to cumulate such votes.

If any nominee should become unavailable for any reason, which we do not anticipate, the proxy will be voted “for” any substitute nominee, or nominees, who may be selected by the Board prior to, or at, the Annual Meeting, or, if no substitute is selected by the Board prior to or at the Annual Meeting, for a motion to reduce the present membership of the Board to the number of nominees available. The information concerning the nominees and their shareholdings has been furnished by them to the Company.

Information Concerning Directors and Executive Officers

The following table sets forth information regarding the executive officers and individuals nominated to serve as directors of the Company as of the date of this filing.

|

|

|

Name |

Age |

Position with the Company |

Robert C. Daigle |

61 |

President, Chief Executive Officer, Chairman of the Board |

Wade M. Jenke |

41 |

Chief Financial Officer, Secretary |

Robert M. Averick |

58 |

Director |

Michael Garnreiter |

72 |

Director |

Asif Y. Jakwani |

56 |

Director |

Michael M. Ludwig |

63 |

Director |

Robert C. Daigle was appointed as Amtech's Chief Executed Officer on August 8, 2023, and has been on the Board since August 12, 2021. Mr. Daigle was appointed Chairman of the Board of Directors effective May 11, 2022. From March 2013 to December 2022, Mr. Daigle served as the Chief Technology Officer of Rogers Corporation (“Rogers”), a publicly-traded global leader in engineered materials, including advanced electronic and elastomeric materials that are used in applications for EV/HEV, automotive safety and radar systems, mobile devices, renewable energy, wireless infrastructure, energy-efficient motor drives, and industrial equipment. Mr. Daigle previously served in a number of other senior executive roles in his 30-year tenure at Rogers. Mr. Daigle holds a B.S in Chemical Engineering and Materials Engineering from the University Connecticut and an M.B.A. from Rensselaer Polytechnic Institute.

Wade M. Jenke was appointed as Amtech's Chief Financial Officer on August 8, 2024. Prior to joining the Company, Mr. Jenke served as Chief Financial Officer of EMS Group, a business unit of ASSA ABLOY Opening Solutions from January 2018 to July 2024. From September 2016 to December 2018, Mr. Jenke served as Vice President of Finance and Director of Accounting at HES Inc. From June 2012 to August 2016, Mr. Jenke served as HES Inc.'s Senior Manager of Finance and Cost Analysis. Mr. Jenke received his B.S. and MBA from Arizona State University.

Robert M. Averick has been a Director since January 2016. Mr. Averick has over 20 years of experience as a small-capitalization, value-driven public equity portfolio manager. His previous work experience includes positions of increasing responsibility within structured finance, strategic planning and consulting. Mr. Averick received an undergraduate degree in Economics from The University of Virginia and a Masters in Business Administration in Finance from The University of Pennsylvania, The Wharton School of Business. Mr. Averick has worked as a portfolio manager at Kokino LLC since 2012. Mr. Averick and certain entities to which his employer provides investment management services currently own in excess of 19% of Amtech’s outstanding shares. He previously served on our Board during 2005 and 2006. Mr. Averick also serves on the board of directors of Gulf Island Fabrication, Inc., a publicly-traded fabricator of complex steel structures, modules and marine vessels and is a member of its compensation committee and corporate governance and nominating committee. Additionally, Mr. Averick currently serves as Chairman of PhoneX Holdings, Inc., an OTC bulletin-board company, and he previously served as a director of Key Technology, Inc. until its sale in 2018. Mr. Averick serves as Chairman of our Compensation Committee and as a member of our Audit and Nominating and Governance Committees. Mr. Averick’s experience in finance and strategy planning allows him to provide valuable advice to the Board of Directors and the Committees on which he serves.

Michael Garnreiter has been a Director since February 2007 and was appointed Lead Independent Director in May 2020. He is the Chairman of our Audit Committee and serves as a member of our Compensation and Nominating and Governance Committees. Mr. Garnreiter is our designated financial expert on the Audit Committee. Mr. Garnreiter, for the past three years, has served as Interim Chief Financial Officer for LeVecke Corporation, a privately-held, California-based distilled spirits bottling company. He retired from that role in early 2023. Also, he retired in December 2015 as Vice President of Finance and Treasurer of Shamrock Foods, a privately-held manufacturer and distributor of foods and food-related products. From January 2010 until August 2012, Mr. Garnreiter was a managing director of Fenix Financial Forensics, a Phoenix-based litigation and financial consulting firm. From August 2006 until January 2010, he was a managing member of Rising Sun Restaurant Group LLC, and, from December 2008 until

December 2009, he was president of New Era Restaurants, LLC, both of which are privately-held restaurant operating companies. From 2002 to 2006, Mr. Garnreiter was CFO of Main Street Restaurant Group, a publicly-traded restaurant operating company, and from 1976 to 2002, he was a senior audit partner of Arthur Andersen LLP. Mr. Garnreiter serves on the boards of directors of Axon Enterprise, Inc. (as Chairman), a publicly-traded manufacturer of non-lethal protection devices, Knight-Swift Transportation Holdings Inc., a publicly-traded nationwide truckload transportation company, and Banner Health, a multi-state health care delivery system. He graduated from California State University Long Beach with a Bachelor of Science in Accounting and Business Administration. Mr. Garnreiter is a Certified Public Accountant in the State of Arizona and Certified Fraud Examiner. Mr. Garnreiter’s financial background and expertise allows him to provide valuable advice to the Board of Directors.

Asif Y. Jakwani has been a Director since January 2025. Mr. Jakwani was appointed to Amtech’s board on January 23, 2025. He served as Senior Vice President and General Manager of On Semiconductor Corporation (“Onsemi”) from February 2020 until March of 2024. Onsemi is a publicly-traded semiconductor company that specializes in delivering industry-leading intelligent power and intelligent sensing solutions that help customers solve challenging problems and greatly improve the safety, sustainability and power efficiency of end products in the automotive and industrial markets. As the general manager of the Advance Power Division (APD), Mr. Jakwani was responsible of all power discrete and modules for Onsemi including SiC, approximately 40% of Onsemi’s revenue in 2023. Under his leadership, Onsemi attained number 2 market share position in SiC in 2023, growing 4x from 2022. During his seventeen career at Onsemi, Mr. Jakwani held various positions with increasing responsibilities. Prior to joining Onsemi in 2007, Mr. Jakwani held marketing and design engineering roles with Tyco Electronics Power Systems and Current Technology, Inc, a subsidiary of Danaher Corporation. He graduated from Lamar University with a Bachelor of Science Degree in Electrical Engineering, the University of Texas at Austin with a Master of Science Degree in Electrical Engineering, and the University of Texas at Dallas with an MBA. Mr. Jakwani’s technical background and expertise allows him to provide valuable advice to the Board of Directors.

Michael M. Ludwig has been a Director since January 2023. He served as Senior Vice President, Chief Financial Officer and Treasurer of Rogers Corporation ("Rogers") from September 2018 until May 2021. Rogers is a publicly-traded global leader in engineered materials, including advanced electronic and elastomeric materials that are used in applications for EV/HEV, automotive safety and radar systems, mobile devices, renewable energy, wireless infrastructure, energy-efficient motor drives, and industrial equipment. From May 2011 to March 2018, Mr. Ludwig served as Senior Vice President and Chief Financial Officer of FormFactor, Inc., a publicly-traded global leader in the design and manufacturing of advanced probe cards, analytical probes, probe stations, metrology systems, thermal systems and cryogenic systems sold to semiconductor and scientific institutions. Prior to May 2011, Mr. Ludwig held various senior financial management positions at FormFactor, Elo TouchSystems, Inc. and Beckman Coulter. Mr. Ludwig began his career in public accounting at Arthur Young. He graduated from California State Polytechnic University, Pomona with a Bachelor of Science in Business Administration and Accounting. Mr. Ludwig serves as Chairman of our Nominating and Governance Committee and as a member of our Audit and Compensation Committees. Mr. Ludwig's financial background and expertise allows him to provide valuable advice to the Board of Directors and the Committees on which he serves.

Board Diversity

The below Board Diversity Matrix provides the diversity statistics for our Board.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Board Diversity Matrix (As of January 12, 2025) |

|

Total Number of Directors |

5 |

|

|

Female |

|

|

Male |

|

|

Non-Binary |

|

|

Did Not Disclose Gender |

|

Part I: Gender Identity |

|

Directors |

|

— |

|

|

|

5 |

|

|

|

— |

|

|

|

— |

|

Part II: Demographic Background |

|

African American or Black White |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Alaskan Native or Native American |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Asian |

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

Indian or South Asian |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Hispanic or Latinx |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Native Hawaiian or Pacific Islander |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

White |

|

— |

|

|

|

4 |

|

|

|

— |

|

|

|

— |

|

Two or More Races or Ethnicities |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

LGBTQ+ |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Did Not Disclose Demographic Background |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Information About Board and Committee Meetings

Information concerning our Board and the three committees maintained by our Board is set forth below. Pursuant to Nasdaq and SEC rules, during fiscal 2024 the majority of our directors were not employees of the Company and were “independent” within the meaning of the Nasdaq Listing Rules and SEC standards. Importantly, all members of the Audit, Compensation, and Nominating and Governance Committees are independent. Currently, our independent directors are Robert M. Averick, Michael Garnreiter and Michael M. Ludwig. Additionally, each member of the Audit Committee is financially literate, and one of the Audit Committee members, Michael Garnreiter, has financial management expertise as required by Nasdaq’s rules and meets the SEC’s definition of an “audit committee financial expert.”

Our Board of Directors held eight (8) meetings during fiscal year 2024. None of our current directors who were directors during 2024 attended less than 75% of the aggregate of Board meetings and relevant committee meetings held during the year. Our Board has the authority under our Amended and Restated Bylaws, as amended, to increase or decrease the size of our Board and to fill vacancies, and the directors chosen to fill such vacancies will hold office until our next annual meeting or until their successors are elected and qualified. We do not have a formal policy with respect to members of the Board attending our annual meetings. All of our Board members attended the 2024 annual meeting.

The Audit Committee, the Compensation Committee, and the Nominating and Governance Committee are the standing committees of our Board of Directors. The members of these committees as of January 13, 2025, are as follows:

Audit – Michael Garnreiter (Chairman), Robert M. Averick and Michael M. Ludwig

Compensation – Robert M. Averick (Chairman), Michael Garnreiter and Michael M. Ludwig

Nominating and Governance – Michael M. Ludwig (Chairman), Robert M. Averick and Michael Garnreiter

The Audit Committee held nine (9) meetings during fiscal year 2024. The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities with respect to the independent auditors and members of financial management, and our financial affairs, including financial statements and audits, the adequacy and effectiveness of the internal accounting controls and systems, compliance with legal and regulatory requirements, and the retention

and termination of the independent registered public accounting firm. The Audit Committee has a written charter, which was updated in 2022, a copy of which is available on our website at www.amtechsystems.com.

The Audit Committee is composed of outside directors who are not officers or employees of the Company or its subsidiaries. In the opinion of our Board, and as “independent” is defined under Nasdaq Listing Rules and SEC standards, these directors are independent of management and free of any relationship that would interfere with their exercise of independent judgment as members of this committee. Additionally, each member of the Audit Committee is financially literate, and one of the Audit Committee members, Mr. Michael Garnreiter, has financial management expertise as required by Nasdaq’s rules and meets the SEC’s definition of an “audit committee financial expert.”

The Compensation Committee held two (2) meetings during fiscal year 2024. The Compensation Committee makes recommendations concerning officer compensation, benefit programs and retirement plans. Each member of the Compensation Committee is an “independent director” as defined in the Nasdaq Listing Rules and SEC standards. The Compensation Committee has a written charter, which was updated in 2022, a copy of which is available on our website at www.amtechsystems.com.

The Nominating and Governance Committee held two (2) meetings during fiscal year 2024. The Nominating and Governance Committee identifies and approves individuals qualified to serve as members of our Board and also evaluates the Board’s performance. In evaluating a prospective nominee, the Nominating and Governance Committee takes several factors into consideration, including such individual’s integrity, business skills, experience and judgment. The evaluation of director nominees by the Nominating and Governance Committee also takes into account the diversity of prospective Board members’ background, factoring in gender, race, ethnicity, differences in professional background, education, skills, and experience, and other individual qualities and attributes that contribute to the total mix of viewpoints and experience. The Nominating and Governance Committee also reviews whether a prospective nominee will meet our independence standards and any other director or committee membership requirements imposed by law, regulation or stock exchange rules. The Nominating and Governance Committee will consider, but is not required to approve, director nominations made by our shareholders, provided a written recommendation is received by us no later than the date shareholder proposals must be submitted for consideration prior to such annual meeting and all other applicable requirements have been satisfied. The Nominating and Governance Committee also develops and recommends corporate governance guidelines to the Board and provides oversight with respect to ethical conduct. Each member of the Nominating and Governance Committee is an “independent director” as defined in the Nasdaq Listing Rules and SEC standards. The Nominating and Governance Committee has a written charter, which was updated in 2022, a copy of which is available on our website at www.amtechsystems.com.

Board Leadership Structure

Mr. Robert C. Daigle currently serves as the Chairman of our Board of Directors (“Chairman”) and Chief Executive Officer ("CEO"). Our Corporate Governance Guidelines (discussed below) provide, among other things, that it is a best practice that the offices of Chairman and CEO be maintained as separate roles. In the absence of a separation of such roles, the Board will appoint a lead director who will have the duties and responsibilities as determined by the Board. Following Mr. Daigle’s appointment as our Chief Executive Officer, Mr. Garnreiter was appointed as the Company’s lead independent director.

Executive Leadership Change – In 2024, the Board of Directors selected Mr. Jenke to serve as the Company's Chief Financial Officer upon Ms. Lisa Gibbs' resignation.

Addition of New Director – In December 2024, the Board of Directors, after an extensive search, agreed to appoint Mr. Jakwani to the Board effective January 23, 2025. Mr. Jakwani fills the vacancy created by the resignation of Ms. Gibbs from the Board and as the Company’s Chief Financial Officer.

Board’s Role in Risk Oversight

Our Board of Directors is actively engaged in the oversight of risks that could affect the Company, with key aspects of such oversight being conducted through the committees of the Board. The Audit Committee focuses on

financial risks, primarily those that could arise from our accounting and financial reporting processes, and also oversees compliance-related legal and regulatory exposure. The Nominating and Governance Committee focuses on the management of risks associated with corporate governance matters, including board organization, membership and structure; management development; and appropriate approval and oversight mechanisms. The Compensation Committee focuses on the management of risks arising from our compensation policies and programs and, in particular, our executive compensation programs and policies.

While the committees of our Board are focused on the above specific areas of risk, the full Board of Directors retains responsibility for the general oversight of risk. Committee chairs are expected to, and do, provide periodic reports to the full Board regarding the risk considerations within each committee’s area of expertise. Periodic reports are provided to the Board or the appropriate committee by the executive management team on areas of material risk, including operational, financial, legal, regulatory and strategic risks. In addition, the general management and operating leadership of each of our divisions and subsidiaries review, with the full Board, their individual assessment of business risks and their approach to manage those risks. The Board relies upon these reports, and its discussions relating to such reports, to enable it to understand our strategies for the identification, management and mitigation of risks. This structure enables the Board and its committees to coordinate its risk oversight role. The Board’s approach to risk oversight does not directly affect the leadership structure of our Board of Directors, as described above.

DIRECTOR COMPENSATION

The following table shows the annual retainers paid to our non-employee directors in fiscal 2024 for their service on the Board and as a Chairperson of applicable Board committees:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Board |

|

|

Audit |

|

|

Compensation |

|

|

Nominating and Governance |

|

Non-Employee Chairperson |

$ |

75,000 |

|

|

$ |

15,000 |

|

|

$ |

7,500 |

|

|

$ |

7,500 |

|

Non-Employee Member |

$ |

40,000 |

|

|

|

|

|

|

|

|

|

|

The 2024 Board retainers in the table above are paid, pro-rata, on a quarterly basis. We reimburse all of our directors for reasonable expenses incurred to attend our Board of Directors and committee meetings.

Beginning in 2023, our Chairman and our other non-employee directors will receive $75,000 and $40,000, respectively, in Restricted Stock Units ("RSUs") upon each re-election to the Board at our annual meeting of shareholders or at such other time as may be determined by the Board. These RSUs will vest on the one-year anniversary of the grant date. Mr. Daigle, who became our Chief Executive Officer effective August 8, 2023, will not receive such RSU grants while serving as an employee of the Company.

The following table shows the total dollar value of all fees earned and paid in cash to all individuals who were directors in fiscal 2024 and the grant date fair value of stock option awards to directors made in fiscal 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

Fees Earned or

Paid in Cash (1) |

|

|

Stock

Awards (2) (3) |

|

|

Total |

|

Robert C. Daigle |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

Lisa D. Gibbs (4) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

Robert M. Averick |

|

$ |

47,500 |

|

|

$ |

40,001 |

|

|

$ |

87,501 |

|

Michael Garnreiter |

|

$ |

55,000 |

|

|

$ |

40,001 |

|

|

$ |

95,001 |

|

Michael M. Ludwig |

|

$ |

47,500 |

|

|

$ |

40,001 |

|

|

$ |

87,501 |

|

____________________

(1)Directors who are employees of the Company receive no additional compensation for serving as directors.

(2)Amounts represent the aggregate grant date fair value of RSU awards granted calculated in accordance with FASB ASC Topic 718. For a description of the calculation of the grant date fair value, refer to Note 13 of the consolidated financial statements included in our Annual Report on Form 10-K for fiscal 2024.

(3)As of September 30, 2024, Messrs. Averick, Garnreiter and Ludwig each held 8,299 unvested RSU awards scheduled to vest on March 6, 2025. All other awards held were fully vested.

(4)Ms. Gibbs resigned from the Board and her position as Chief Financial Officer effective August 7, 2024.

EXECUTIVE COMPENSATION

Compensation Philosophy

Our Compensation Committee is charged with the evaluation of the compensation of our executive officers and to assure that they are compensated effectively in a manner consistent with our compensation strategy and resources, competitive practice, and the requirements of the appropriate regulatory bodies.

Our Compensation Committee establishes our general compensation policies and specific compensation for each of our executive officers and administers our stock incentive program. In addition, our Compensation Committee is responsible for developing, administering and interpreting the compensation program for our named executive officers and other key employees. Our Compensation Committee may delegate some or all of its responsibilities to one or more subcommittees whenever necessary to comply with any statutory or regulatory requirements or if otherwise deemed appropriate by our Compensation Committee. Our Compensation Committee has the authority to retain consultants and other advisors to assist with its duties and has sole authority to approve the fees and other retention terms of such consultants and advisors.

Our compensation philosophy has the following basic objectives: align the interests of our executives and shareholders by rewarding executives when shareholder value increases and motivate our executives to manage our business to meet our short-term and long-term corporate goals and business objectives, and reward them for meeting these objectives. We use a mix of short-term compensation in the form of base salaries and cash incentive bonuses and long-term compensation in the form of equity incentive compensation to provide a total compensation structure that is designed to encourage our executives to achieve these objectives. Our performance, including, but not limited to, return on equity, return on invested capital, earnings, revenue growth, cash flow, and continuous improvement initiatives, is a significant part of our evaluation and compensation levels.

In December 2024, the Compensation Committee changed the metrics to be used in the cash incentive bonus program for fiscal 2025 from a return-on-invested-capital (“ROIC”) metric to an EBITDA based metric. The Board of Directors will establish an EBITDAS threshold for fiscal 2025 (and each year thereafter). Targets will be based on an employee’s level within the Company. Employees working in sales generally participate in a commission plan, and certain other personnel, such as marketing directors, participate in both the commission plan and the bonus plan on a hybrid basis. The Company’s Chief Executive Officer is not eligible to participate in the bonus program. As with the ROIC metric, the EBITDA based metric will be used to incentivize participants for profitability and balance sheet management. The equity incentive plan is designed to include defined goals and objectives, the achievement of which may result in the issuance of stock options or restricted stock units to executives.

2024 Base Salary and Benefits

The compensation of our named executive officers is determined and approved by our Compensation Committee.

On August 8, 2023, the Board approved the appointment of Robert C. Daigle to succeed Michael Whang as President and Chief Executive Officer of the Company. Mr. Daigle and the Company entered into an Employment Agreement, which is described further below. Pursuant to his Employment Agreement, Mr. Daigle serves as President and Chief Executive Officer of the Company for a period of three (3) years (the “Term”). Pursuant to his employment agreement, Mr. Daigle (i) will receive an annual base salary of $450,000, (ii) is eligible to participate in the Company’s annual executive bonus program, (iii) was granted an option to purchase 150,000 shares of common stock of the Company (the “Option Grant”) issued under the Company’s 2022 Equity Incentive Plan (the “Equity Incentive Plan”), and (iv) on the Effective Date (as defined in the Employment Agreement) and on each one-year anniversary thereafter, will be granted restricted stock units with an aggregate fair market value equal to $500,000 as of the grant date (the “RSU Grant”). The Option Grant vests ratably on each of the annual anniversaries over the Term, subject to Mr. Daigle’s continued service with the Company; provided, however, that 50,000 shares of such Option Grant vested immediately upon grant. The RSU Grants will vest in full on the one-year anniversary of the grant date, subject to Mr. Daigle’s continued service with the Company. Mr. Daigle also receives medical and other benefits consistent with the Company’s standard policies and is eligible to participate in other Company plans. Depending on the circumstances of termination, Mr. Daigle may be entitled to receive post-termination compensation from the Company.

Mr. Jenke entered into an offer letter with the Company, effective August 8, 2024, in connection with his appointment as Chief Financial Officer of the Company. Under the terms of the offer letter, Mr. Jenke (i) will receive an annual base salary of $280,000, (ii) is eligible to receive a target annual performance-based incentive bonus of $140,000 upon the achievement of established individual and company operational goals paid in 60% cash and 40% restricted stock, and (iii) will receive 30,000 stock options. Such options will vest in three equal increments on the 1-year, 2-year and 3-year anniversary dates of the grants and have a 10-year life.

2024 Incentive Plans and Discretionary Bonuses

In the fiscal year ended 2024, incentive bonuses were not earned under the 2024 incentive bonus program. Ms. Gibbs submitted her resignation as Chief Financial Officer and Board member, effective as of the close of business on August 7, 2024. In connection with Ms. Gibbs’ departure, the Company agreed to pay Ms. Gibbs a bonus, $150,000 of which was payable following the filing of the Company’s 10-Q for the quarterly period ended June 30, 2024 and $30,000 was payable following the Company’s filing of its Form 10-K for the fiscal year ended September 30, 2024.

2024 Long-Term Equity Incentive Awards

Our Compensation Committee is responsible for determining and approving equity incentive awards. As of September 30, 2024, we have generally granted equity awards to our named executive officers in the form of stock options and restricted stock units. Vesting of the stock options and restricted stock units is tied to continuous service with us and serves as an additional retention measure. We do not have a standardized policy for granting annual equity awards to our named executive officers. Our executives generally are awarded an initial grant upon commencement of employment or upon significant promotion. Additional grants may occur periodically in order to incentivize, reward and retain executives as the Compensation Committee determines appropriate, taking into consideration the executive’s aggregate equity holdings. We are thoughtful in the use of our equity pool and resulting dilution to our stockholders; our named executive officers are not guaranteed an equity award grant each year. We currently grant equity awards pursuant to our 2022 Equity Incentive Plan.

On February 29, 2024, the Compensation Committee granted Mr. Daigle an out-of-the-money option to purchase 400,000 shares of common stock of the Company at $6.00 per share. The award vests in equal installments on the first through third six-month anniversaries of the February 29, 2024 grant date. The award expires after a term of five years. On August 6, 2024, the Compensation Committee approved an amendment to Mr. Daigle’s stock option award agreement to permit Mr. Daigle to exercise vested options following his termination of service for the remaining term of such option grants, subject to certain exceptions set forth in such amendment.

As stated above, upon Mr. Jenke's appointment as Chief Financial Officer, he received an option to purchase 30,000 shares of common stock. Such options will vest in three equal increments on the 1-year, 2-year and 3-year anniversary dates of the grants and have a 10-year life.

Timing of Equity Incentive Award Grants

Equity grants made to the named executive officers must be approved by the Compensation Committee. During fiscal 2024, equity awards to employees generally were granted on March 15, 2024, which is around the time of the Company's annual shareholder meeting. As part of the Company’s annual performance and compensation review process, the Compensation Committee approves stock option awards to our named executive officers in the second fiscal quarter of the following fiscal, long after the Company's fiscal year end. The Compensation Committee does not grant equity awards in anticipation of the release of material nonpublic information and the Company does not time the release of material nonpublic information based on equity award grant dates.

In accordance with Item 402(x) of Regulation S-K, we are providing information regarding our procedures related to the grant of stock options close in time to the release of material non-public information. Although we do not have a formal policy that requires us to award equity or equity-based compensation on specific dates, our Compensation Committee and Board have adopted a policy with respect to the grant of stock options and other equity incentive awards that generally prohibits the grant of stock options or other equity awards to executive officers during closed quarterly trading windows (as determined in accordance with our insider trading policy). Our insider trading policy also prohibits directors, officers and employees from trading in our common stock while in possession of or on

the basis of material non-public information about us. Neither our Board nor our Compensation Committee takes material non-public information into account when determining the timing of equity awards, nor do we time the disclosure of material non-public information for the purpose of impacting the value of executive compensation. We generally issue equity awards to our executive officers on a limited and infrequent basis, and not in accordance with any fixed schedule. During fiscal 2024, there were no equity awards to any named executive officers within four business days preceding or one business day after the filing of any report of Forms 10-K, 10-Q, or 8-K that discloses material nonpublic information.

2025 Compensation Programs

There are no additional changes planned for the 2025 compensation programs.

SUMMARY COMPENSATION TABLE

The following table sets forth all of the compensation awarded to, earned by or paid to our named executive officers during our fiscal years ended September 30, 2024 and 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Principal Position |

|

Year |

|

Salary ($) |

|

|

Bonus

($)

(1) |

|

|

Option

Awards

($)

(2) |

|

|

Stock

Awards

($)

(2) |

|

|

All Other

Compen-

sation ($) |

|

|

|

Total ($) |

|

Robert C. Daigle* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chief Executive Officer, |

|

2024 |

|

|

450,000 |

|

|

|

— |

|

|

|

945,960 |

|

|

|

— |

|

|

|

15,339 |

|

(3) |

|

|

1,411,299 |

|

President and Chairman of the Board |

|

2023 |

|

|

50,192 |

|

|

|

— |

|

|

|

712,800 |

|

|

|

500,004 |

|

|

|

458 |

|

(4) |

|

|

1,263,454 |

|

Wade M. Jenke** |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vice President, Chief Financial Officer |

|

2024 |

|

|

32,308 |

|

|

|

— |

|

|

|

87,897 |

|

|

|

— |

|

|

|

750 |

|

(5) |

|

|

120,955 |

|

Lisa D. Gibbs*** |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Former Vice President, |

|

2024 |

|

|

246,883 |

|

|

|

150,000 |

|

|

|

77,748 |

|

|

|

— |

|

|

|

14,860 |

|

(6) |

|

|

489,491 |

|

Chief Financial Officer and Director |

|

2023 |

|

|

260,000 |

|

|

|

— |

|

|

|

48,107 |

|

|

|

— |

|

|

|

10,000 |

|

(7) |

|

|

318,107 |

|

____________________

* Mr. Robert C. Daigle was appointed Chief Executive Officer effective August 8, 2023.

**Mr. Wade M. Jenke was appointed Chief Financial Officer effective August 8, 2024.

***Ms. Lisa D. Gibbs resigned as Chief Financial Officer effective August 7, 2024.

(1)The Compensation Committee awarded Ms. Gibbs a cash bonus of $150,000 in recognition of her efforts to effect the sale of the Company's headquarters, which was completed in the second quarter of 2024.

(2)Amounts represent the aggregate grant date fair value calculated in accordance with FASB ASC Topic 718. For a description of the assumptions made when calculating such grant date fair value, refer to Note 13 of the consolidated financial statements included in our Annual Report on Form 10-K for fiscal 2024.

(3)Amount represents a Company match of $11,839 under the 401(k) plan, a discretionary contribution to Mr. Daigle's health savings account and a discretionary contribution to his lifestyle spending account.

(4)Amount represents a discretionary contribution to Mr. Daigle's health savings account and to his lifestyle spending account.

(5)Amount represents a discretionary contribution to Mr. Jenke's health reimbursement account and to his lifestyle spending account.

(6)Amount represents a Company match of $13,860 under the 401(k) plan and a discretionary contribution to Ms. Gibbs' lifestyle spending account.

(7)Amount represents a Company match under the 401(k) plan and a discretionary contribution to Ms. Gibbs' lifestyle spending account.

In addition to the above compensation, our named executive officers are reimbursed for reasonable out-of-pocket business expenses and receive customary benefits generally available to all of our employees, including reimbursement of mobile phone expenses, the cost of continuing professional education courses and related benefits. There were no bonuses paid to our named executive officers in the fiscal years presented.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

The following table sets forth information regarding grants of plan-based option awards held by our named executive officers as of September 30, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Option Awards |

|

Name |

|

Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable |

|

|

Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable |

|

|

|

Options

Exercise

Price ($) |

|

|

Option

Expiration

Date |

|

Robert C. Daigle |

|

|

6,000 |

|

|

|

— |

|

|

|

$ |

9.99 |

|

|

8/12/2031 |

|

|

|

|

6,000 |

|

|

|

— |

|

|

|

$ |

10.22 |

|

|

3/2/2032 |

|

|

|

|

100,001 |

|

|

|

49,999 |

|

(1) |

|

$ |

9.00 |

|

|

8/14/2033 |

|

|

|

|

133,334 |

|

|

|

266,666 |

|

(2) |

|

$ |

6.00 |

|

|

3/1/2029 |

|

Wade M. Jenke |

|

|

— |

|

|

|

30,000 |

|

(3) |

|

$ |

5.37 |

|

|

8/8/2034 |

|

Lisa D. Gibbs(4) |

|

|

10,000 |

|

|

|

— |

|

|

|

$ |

4.85 |

|

|

11/9/2024 |

|

|

|

|

10,000 |

|

|

|

— |

|

|

|

$ |

7.40 |

|

|

11/9/2024 |

|

|

|

|

7,500 |

|

|

|

— |

|

|

|

$ |

5.52 |

|

|

11/9/2024 |

|

|

|

|

10,000 |

|

|

|

— |

|

|

|

$ |

4.77 |

|

|

11/9/2024 |

|

|

|

|

15,000 |

|

|

|

— |

|

|

|

$ |

5.67 |

|

|

11/9/2024 |

|

|

|

|

6,667 |

|

|

|

— |

|

|

|

$ |

15.43 |

|

|

11/9/2024 |

|

(1)Unvested option awards will vest in equal installments on the first through second anniversaries of the August 14, 2023 grant date.

(2)Unvested option awards will vest in equal installments on the first through third six-month anniversaries of the February 29, 2024 grant date.

(3)Unvested option awards will vest in equal installments on the first through third anniversaries of the August 8, 2024 grant date.

(4)Ms. Lisa D. Gibbs resigned as Chief Financial Officer effective August 7, 2024. Upon her resignation, unvested awards granted under the Company's various equity plans were forfeit; vested awards remained outstanding for 90 days from the date of resignation.

OPTION EXERCISES AND STOCK VESTED

The following table sets forth information regarding exercises of plan-based option awards held by our named executive officers during the fiscal year ended September 30, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Option Awards |

|

|

Stock Awards |

|

Name |

|

Number of

Shares

Acquired

On Exercise

(#) |

|

|

Value

Realized

On Exercise

($) |

|

|

Number of

Shares

Acquired

On Vesting

(#) (1) |

|

|

Value

Realized

On Vesting

($) (1) |

|

Robert C. Daigle |

|

|

— |

|

|

|

— |

|

|

|

63,410 |

|

|

|

391,271 |

|

Wade M. Jenke |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Lisa D. Gibbs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

(1)During 2024, the stock awards (all RSUs) that vested for Mr. Daigle were net-share settled such that the Company withheld shares with value equivalent to Mr. Daigle’s minimum statutory tax obligation for the applicable income and other employment taxes and remitted cash to the appropriate taxing authorities. The amounts in the table represent the gross number of shares and value realized on vesting. The net number of shares acquired by Mr. Daigle on vesting were 45,335.

PAY VERSUS PERFORMANCE

Pay Versus Performance Table

As required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and Item 402(v) of Regulation S-K, we are providing the following information about the relationship between executive compensation and certain financial performance of our company for each of the last three completed fiscal years. The table below presents information on the compensation of our CEO and our other named executive officers (“NEOs”) in comparison to certain performance metrics for 2024, 2023 and 2022. We are permitted to report as a “smaller reporting company” as defined under the U.S. federal securities laws. Accordingly, we have not included a tabular list of financial performance measures, and the table below does not include a column for a “Company-Selected Measure” as defined in Item 402(v) of Regulation S-K.

The table below summarizes the total compensation, compensation actually paid, and other metrics used to evaluate the Named Executives’ compensation to the Company’s performance.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

|

Summary Compensation Table Total for CEO ($)(a) |

|

|

Summary Compensation Table Total for Former CEO ($)(a) |

|

|

Compensation Actually Paid to CEO ($)(b) |

|

|

Compensation Actually Paid to Former CEO ($)(b) |

|

|

Average Summary Compensation Table Total for Non-CEO NEO ($)(c) |

|

|

Average Compensation Actually Paid to Non-CEO NEO ($)(d) |

|

|

Net Income (Loss) ($)(e) |

|

|

Value of Initial Fixed $100 Investment Based on Total Shareholder return ($)(f) |

|

2024 |

|

|

1,411,299 |

|

|

|

- |

|

|

|

1,471,642 |

|

|

|

- |

|

|

|

305,223 |

|

|

|

437,168 |

|

|

|

(8,486 |

) |

|

|

50.74 |

|

2023 |

|

|

1,263,454 |

|

|

|

485,436 |

|

|

|

1,137,734 |

|

|

|

445,549 |

|

|

|

318,107 |

|

|

|

260,130 |

|

|

|

(12,582 |

) |

|

|

66.67 |

|

2022 |

|

|

- |

|

|

|

781,086 |

|

|

|

- |

|

|

|

671,860 |

|

|

|

578,241 |

|

|

|

422,177 |

|

|

|

17,367 |

|

|

|

74.37 |

|

a)The amounts in these two columns represents the total compensation of our chief executive officer, Mr. Daigle, for the fiscal years ended September 30, 2024 and 2023 and for our former CEO, Mr. Whang, for each of the fiscal years ended September 30, 2023 and 2022, respectively, as reported in the Summary Compensation Table included in the Executive Compensation section of this proxy statement. As noted elsewhere in this proxy statement, Mr. Daigle was appointed principal executive officer of the Company effective August 8, 2023. Mr. Whang served as our principal executive officer for all of fiscal 2022 and until August 8, 2023.

b)The amounts in this column represent the total compensation actually paid to the CEO for the years indicated, adjusting the total compensation from column (a) by the amounts in the “Adjustments” table below.

c)The amounts in this column represents the average total compensation of our Named Executive Officers, excluding the CEO (the “Non-CEO NEO”), Ms. Gibbs for each of the fiscal years ended September 30, 2024, 2023 and 2022 and Mr. Jenke for the fiscal year ended September 30, 2024, as reported in the Summary Compensation Table of the proxy statement filed in the applicable year. As noted elsewhere in this proxy statement, Ms. Gibbs resigned as Chief Financial Officer, effective August 7, 2024, and Mr. Jenke was appointed Chief Financial Officer of the Company effective August 8, 2024.

d)The amounts in this column represent the average total compensation actually paid to the Non-CEO NEO for the years indicated, adjusting the total compensation from column (d) by the amounts in the “Adjustments” table below.

e)The amounts in this column (in thousands) represent the Company’s net income (loss) for the indicated years as reported in the Company’s Annual Report on Form 10-K filed with the SEC.

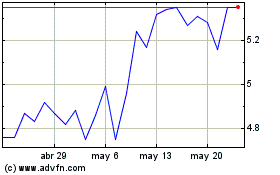

f)The amounts in this column represent the cumulative total shareholder return of a fixed investment of $100 made at the closing price of the Company’s common stock at September 30, 2021 for the measurement period beginning on such date and continuing through and including the end of the applicable fiscal year reflected in the table. Because the covered years are presented in the table in reverse chronological order (from top to bottom), the table should be read from bottom to top for purposes of understanding cumulative returns over time.

The table below represents the amount of compensation actually paid to the PEO and to the Non-PEO NEOs as computed in accordance with Item 402(v) of Regulation S-K. The amounts do not reflect the actual compensation earned or paid during the applicable fiscal year.

|

|

|

|

|

|

|

|

|

|

|

PEO |

|

|

Average Non-PEO NEOs |

|

|

|

2024 |

|

|

2024 |

|

Total from Summary Compensation Table (SCT) |

|

|

1,411,299 |

|

|

|

305,223 |

|

Less the amounts reported under the Stock Awards column in the SCT |

|

|

- |

|

|

|

- |

|

Less the amounts reported under the Option Awards column in the SCT |

|

|

(945,960 |

) |

|

|

82,823 |

|

Plus Year-End Fair Value of Outstanding and Unvested Equity Awards Granted in the Year |

|

|

828,798 |

|

|

|

48,990 |

|

Year over Year Change in Fair Value of Outstanding and Unvested Equity Awards Granted in Prior Years |

|

|

(57,099 |

) |

|

|

- |

|

Plus Fair Value as of Vesting Date of Equity Awards Granted and Vested in the Same Year |

|

|

370,002 |

|

|

|

- |

|

Year over Year Change in Fair Value of Equity Awards Granted in Prior Years which Vested in the Year |

|

|

(135,398 |

) |

|

|

132 |

|

Add dividends paid in fiscal year |

|

|

- |

|

|

|

- |

|

Equals compensation actually paid in fiscal year |

|

|

1,471,642 |

|

|

|

437,168 |

|

Adjustments from Total Compensation to Compensation Actually Paid

The amounts reported in the “Compensation Actually Paid to CEO” and “Compensation Actually Paid to Non-CEO NEOs” columns do not reflect the actual compensation paid to or realized by our CEO or our Non-CEO NEOs during each applicable year. The calculation of compensation actually paid for purposes of this table includes point-in-time fair values of stock awards and these values will fluctuate based on our stock price, various accounting valuation assumptions and projected performance related to our performance awards. See the Summary Compensation Table for certain other compensation of our CEO and our Non-CEO NEOs for each applicable fiscal year and the

Outstanding Equity Awards at September 30, 2024 table for the value realized by each of them upon the vesting of stock awards during our fiscal year ended September 30, 2024.

The table above summarizes the adjustments made to the total compensation as reported in the Summary Compensation Table included in the Executive Compensation section of this proxy statement to determine the total actual compensation paid to the CEO and Non-CEO NEOs for the years indicated as reported in the table above.

EMPLOYMENT AND CHANGE IN CONTROL ARRANGEMENTS

Employment Agreement with Chief Executive Officer

As of August 14, 2023, we entered into an Employment Agreement with Robert Daigle, our President and Chief Executive Officer (the “Original Employment Agreement”). That Employment Agreement was amended by Amendment No. 1, dated effective as of February 29, 2024 (“Amendment No. 1”) and Amendment No. 2, dated effective as of August 6, 2024 (“Amendment No. 2” and, together with Amendment No. 2, the “Employment Agreement”). Below is a summary of the terms and conditions of the Employment Agreement.

Term

The employment agreement has an initial term of three years.

Compensation, including Bonus and Equity Awards

Under the terms of Mr. Daigle’s Original Employment Agreement he (i) is entitled to receive an annual base salary of $450,000, (ii) was eligible to participate in the Company’s annual executive bonus program adopted by our Compensation Committee, (iii) was granted an option to purchase 150,000 shares of common stock of the Company (the “Option Grant”) issued under the 2022 Equity Plan (the “Equity Plan”), and (iv) on the Effective Date and on each one-year anniversary thereafter, be granted restricted stock units with an aggregate fair market value equal to $500,000 as of the grant date (the “RSU Grant”). The Board or a committee of the Board is required to review Executive’s performance on at least an annual basis and may increase, but not decrease, such base salary if, in its sole discretion, any such adjustment is warranted, provided, however, the base salary may be decreased in connection with salary reductions implemented by the Board or a Committee of the Board applicable to all executives of the Company. During his employment with the Company, Mr. Daigle will no longer be compensated for his service as the Company’s Chairman of the Board; provided, however, that any unvested equity awards previously issued to Mr. Daigle during his service as a Board member shall continue to vest based on Mr. Daigle’s continued service as an employee or a member of the Board.

The Option Grant vests ratably over the two (2) year period following the Effective Date, subject to Mr. Daigle’s continued service with the Company; provided, however, that 50,000 shares of such Option Grant vested immediately upon the grant date. The RSU Grant will vest in full on the one-year anniversary of the grant date, subject to Mr. Daigle’s continued service with the Company. Mr. Daigle is entitled to receive such employee benefits as are provided to our other executive officers, including comprehensive health and major medical, dental and life insurance, and short-term and long-term disability. Other benefits provided to Mr. Daigle under the employment agreement include reimbursement for expenses, paid time off, and other executive perquisites as may be made available or deemed appropriate for Mr. Daigle.

Under the terms of Amendment No. 1, Mr. Daigle’s right to the RSU Grant was cancelled and replaced with the grant of an option to purchase 400,000 shares of common stock of the Company at an exercise price of $6.00 per share, which exercise price represented a premium of approximately 25% to the closing price of the Company’s common stock on February 29, 2024, the date of grant. The option has a term of five years, in lieu of the typical ten-year term, and vests in one-third increments commencing on August 8, 2024, February 8, 2025, and August 8, 2025. In consideration of the foregoing, Mr. Daigle agreed to forego his right to participate in the Company’s executive bonus plan.

Under the terms of Amendment No. 2, the Board of Directors, based on the recommendation of the Compensation Committee, approved an amendment to Mr. Daigle’s stock option and award agreement to permit the exercise of vested options following Mr. Daigle’s termination of service with the Company for the term of such option grants, subject to certain exceptions set forth in such amendment.

Change in Control

Notwithstanding anything in the employment agreement or any award agreement to the contrary, if a Change of Control occurs during the Term and irrespective of whether the equity grants are assumed, substituted, exchanged or terminated in connection with the Change of Control, then such equity awards shall become vested as to 100% of the portion of any such award then unvested, effective immediately prior to and contingent upon the consummation of the Change of Control. For purpose of this Agreement, the term “Change of Control” shall have the meaning set forth in the 2022 Equity Plan.

Severance

Mr. Daigle’s employment agreement also provides him with severance in the event his employment is terminated by us without Good Cause (as defined below). In such event, Mr. Daigle is (a) entitled to continue to receive his then current annual base salary, and (b) shall receive payment for any cash bonus earned pursuant to the Company’s executive bonus plan for the calendar year immediately preceding the calendar year in which the termination of employment occurs which is unpaid on the effective date of termination, which shall be paid when paid to other similarly situated executives of the Company.

For purposes of Mr. Daigle’s employment agreement, “Good Cause” means any one or more of the following: (i) Mr. Daigle’s material breach of the employment agreement (continuing for thirty (30) days after receipt of written notice of need to cure, if, in the Company’s determination, such breach is curable); (ii) Mr. Daigle’s intentional nonperformance of lawful instructions of the Board (continuing for thirty (30) days after receipt of written notice of need to cure, if, in the Company’s determination, such breach is curable) of any of Mr. Daigle’s material duties and responsibilities; (iii) Mr. Daigle’s willful dishonesty, fraud, or misconduct with respect to the business or affairs of the Company; (iv) Mr. Daigle’s conviction of, or guilty or nolo contendre plea to a felony crime involving dishonesty or moral turpitude whether or not relating to the Company (not including traffic offenses unless such traffic offense resulted in death); (v) a confirmed positive drug test result for an illegal drug while performing services for the Company; or (vi) a material sanction is imposed on Mr. Daigle by any applicable professional organization or professional governing body.

Non-Compete

Lastly, Mr. Daigle has agreed that during the term of his employment, he will not engage in certain activities in which he would be competing with us or our subsidiaries. He also agrees that for a period of twelve (12) months after the termination of his employment with us, he will not engage in certain activities in which he would be competing with us or our subsidiaries. He also agrees that during the term of his employment and for a period of twenty-four (24) months after the termination of his employment with us, he will not directly or indirectly solicit employees, certain consultants, or independent contractors of the Company. Mr. Daigle also agrees that during the term of his employment and for a period of twenty-four (24) months after the termination of his employment with us, he will not directly or indirectly solicit or engage in business with any of the actual or targeted prospective customers or clients of the Company on behalf of any person or entity in connection with any Competitive Business (as defined in the employment agreement).

Consulting Agreement with Former Chief Financial Officer

Ms. Gibbs voluntarily resigned as the Company’s Chief Financial Officer effective August 7, 2024. Following the effective date of Ms. Gibbs' resignation, she agreed to remain with the Company as a consultant for a period of approximately three months, to assist Mr. Jenke with transition matters. Ms. Gibbs received an agreed-upon hourly rate for the consulting hours incurred. In connection with Ms. Gibbs’ departure, the Company agreed to pay Ms. Gibbs a bonus, $150,000 of was paid following the filing of the Company’s 10-Q for the quarterly period ended June 30, 2024 and $30,000 was paid following the Company’s filing of its Form 10-K for the fiscal year ended September 30, 2024.

Compensation Policies and Practices as Related to Risk Management

The Compensation Committee does not believe our compensation policies and practices create risks that are reasonably likely to have a material adverse effect on the Company. The Compensation Committee has determined

that our executive compensation program does not encourage unnecessary or excessive risk taking as a result of the following factors: