| PROSPECTUS |

Filed Pursuant to Rule 424(b)(4) |

Registration No. 333-272741

Altamira Therapeutics Ltd.

875,000 Common Shares

11,111,112 Common Warrants to Purchase Up to

11,111,112 Common Shares

10,236,112 Pre-Funded Warrants to Purchase Up

to 10,236,112 Common Shares

722,222 Placement Agent Warrants to Purchase

Up to 722,222 Common Shares

21,347,224 Common Shares Underlying the Common

Warrants and Pre-Funded Warrants

722,222 Common Shares Underlying the Placement

Agent Warrants

We are offering on a “reasonable best efforts”

basis 875,000 of our common shares, par value CHF 0.20 per share, together with warrants to purchase up to 11,111,112 common shares, or

the common warrants. Each of our common shares, or a pre-funded warrant in lieu thereof, is being sold together with a common warrant

to purchase one of our common shares. The common shares and common warrants are immediately separable and will be issued separately in

this offering, but must be purchased together in this offering. The public offering price for each common share and accompanying common

warrant is $0.45. Each common warrant will have an exercise price per share of CHF 0.40 (equal to approximately $0.45 as of the date of

this prospectus) and will be immediately exercisable. The common warrants will expire on the fifth year anniversary of the original issuance

date. This prospectus also relates to the offering of the common shares issuable upon exercise of the common warrants.

We are also offering pre-funded warrants to purchase

up to 10,236,112 of our common shares to certain purchasers whose purchase of common shares in this offering would otherwise result in

the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the

purchaser, 9.99%) of our outstanding common shares immediately following the consummation of this offering. The public offering price

of each pre-funded warrant and accompanying common warrant is $0.43889, and the exercise price of each pre-funded warrant will be CHF

0.01 per common share (equal to approximately $0.011 as of the date of this prospectus). The pre-funded warrants will be immediately exercisable

and may be exercised at any time until all of the pre-funded warrants are exercised in full. The pre-funded warrants and common warrants

are immediately separable and will be issued separately in this offering, but must be purchased together in this offering. This prospectus

also relates to the offering of the common shares issuable upon exercise of the pre-funded warrants.

We have engaged H.C. Wainwright & Co., LLC,

or the placement agent, to act as our exclusive placement agent in connection with this offering. The placement agent has agreed to use

its reasonable best efforts to arrange for the sale of the securities offered by this prospectus. The placement agent is not purchasing

or selling any of the securities we are offering and the placement agent is not required to arrange the purchase or sale of any specific

number of securities or dollar amount. We have agreed to pay to the placement agent the placement agent fees set forth in the table below,

which assumes that we sell all of the securities offered by this prospectus. Additionally, we have also agreed to issue to the placement

agent (or its designees) warrants (the “placement agent warrants”) to purchase a number of common shares equal to 6.5% of

the common shares sold in this offering (including the common shares issuable upon the exercise of the pre-funded warrants), at an exercise

price of CHF 0.50 per share, which represents 125% of the public offering price per share and accompanying common warrant, and which such

placement agent warrants are being registered pursuant to this prospectus. The placement agent warrants will be exercisable upon issuance

and will expire five years from the commencement of sales under this offering. This prospectus also relates to the common shares issuable

upon exercise of the placement agent warrants.

There is no arrangement for funds to be received

in escrow, trust or similar arrangement. There is no minimum offering requirement as a condition of closing of this offering. We will

bear all costs associated with the offering. See “Plan of Distribution” on page 27 of this prospectus for more information

regarding these arrangements.

This offering will terminate on the second

trading day after the date of this prospectus, unless we decide to terminate the offering (which we may do at any time in our discretion)

prior to that date. We will have one closing for all the securities purchased in this offering. The combined public offering price per

common share (or pre-funded warrant) and accompanying common warrant will be fixed for the duration of this offering.

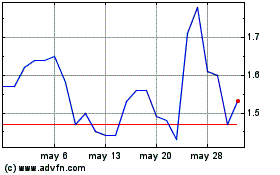

Currently, our common shares are traded on Nasdaq

under the symbol “CYTO”. The closing price of our common shares on Nasdaq on July 3, 2023 was $0.59 per common share.

There is no established public trading market

for the pre-funded warrants and the common warrants and we do not expect a market to develop. Without an active trading market, the liquidity

of the pre-funded warrants and the common warrants will be limited. In addition, we do not intend to list the pre-funded warrants or the

common warrants on Nasdaq, any other national securities exchange or any other trading system.

We are a “foreign private issuer”

as defined under the federal securities laws and, as such, are subject to reduced public company reporting requirements. See “Prospectus

Summary – Implications of Being a Foreign Private Issuer.”

Investing in our securities involves a high

degree of risk. See “Risk Factors” beginning on page 6 and in the documents incorporated by reference into this prospectus

for a discussion of risks that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

Consent under the Exchange Control Act 1972

(and its related regulations) from the Bermuda Monetary Authority for the issue and transfer of our common shares to and between residents

and non-residents of Bermuda for exchange control purposes has been obtained for so long as our common shares remain listed on an “appointed

stock exchange,” which includes the Nasdaq Capital Market. In granting such consent, neither the Bermuda Monetary Authority nor

the Registrar of Companies in Bermuda accepts any responsibility for our financial soundness or the correctness of any of the statements

made or opinions expressed herein.

| | |

Per

Common

Share and

Accompanying

Common

Warrant | | |

Per Pre-funded Warrant and

Accompanying

Common

Warrant | | |

Total(3) | |

| Public offering price | |

$ | 0.45000 | | |

$ | 0.43889 | | |

$ | 4,886,266 | |

| Placement agent fees (1) | |

$ | 0.03375 | | |

$ | 0.03375 | | |

$ | 375,000 | |

| Proceeds to us (before expenses)(2) | |

$ | 0.41625 | | |

$ | 0.40514 | | |

$ | 4,511,266 | |

| (1) | We have also agreed to reimburse the placement agent for

certain of its offering related expenses, including a management fee up to 1.0% of the gross proceeds raised in the offering, reimbursement

for non-accountable expenses in an amount of up to $20,000, legal fees and expenses in the amount of up to $100,000 and for its clearing

expenses in the amount of $15,950. We have also agreed to issue to the placement agent (or its designees) warrants to purchase a number

of common shares equal to 6.5% of the common shares sold in this offering (including the common shares issuable upon the exercise of

the pre-funded warrants), at an exercise price of CHF 0.50 per share, which represents 125% of the public offering price per share and

accompanying common warrant. For a description of the compensation to be received by the placement agent, see “Plan of Distribution”

for more information. |

| (2) |

We estimate the total expenses of this offering payable by us, excluding the placement agent fee, will be approximately $600,000. |

| |

|

| (3) |

Reflects the issuance and sale of 875,000 common shares, common warrants to purchase up to 11,111,112 common shares, and pre-funded warrants to purchase up to 10,236,112 common shares. |

The placement agent expects to deliver the common

shares and any pre-funded warrants and common warrants to the purchasers on or about July 10, 2023, subject to satisfaction of customary

closing conditions.

H.C.

Wainwright & Co.

The date of this prospectus is July 5, 2023.

TABLE OF CONTENTS

This prospectus is part of a registration statement

on Form F-1 that we filed with the U.S. Securities and Exchange Commission. You should read this prospectus and the information and documents

incorporated herein by reference carefully. Such documents contain important information you should consider when making your investment

decision. See “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference”

in this prospectus.

You should rely only on the information contained

in or incorporated by reference into this prospectus. We have not authorized anyone to provide you with information different from, or

in addition to, that contained in or incorporated by reference into this prospectus. This prospectus is an offer to sell only the securities

offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in or incorporated

by reference into this prospectus is current only as of their respective dates or on the date or dates that are specified in those documents.

Our business, financial condition, results of operations and prospects may have changed since those dates.

We are not offering to sell or seeking offers

to purchase these securities in any jurisdiction where the offer or sale is not permitted. We have not done anything that would permit

this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than

in the United States. Persons outside the jurisdiction of the United States who come into possession of this prospectus are required to

inform themselves about and to observe any restrictions relating to this offering and the distribution of this prospectus applicable to

that jurisdiction.

Unless otherwise indicated or the context otherwise

requires, all references in this prospectus to “Altamira Therapeutics Ltd.”, or “Altamira”, the “Company,”

“we,” “our,” “ours,” “us” or similar terms refer to (i) Auris Medical Holding Ltd., a

Bermuda company, or Auris Medical (Bermuda), the successor issuer to Auris Medical Holding AG (“Auris Medical (Switzerland)”)

under Rule 12g-3(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), after the effective time of Redomestication

(as defined herein), and (ii) to Altamira Therapeutics Ltd. after adoption of the new company name by resolution of Special General Meeting

of Shareholders held on July 21, 2021. The trademarks, trade names and service marks appearing in this prospectus are property of their

respective owners.

On May 1, 2019, the Company effected a one-for-twenty

reverse share split (the “2019 Reverse Share Split”) of the Company’s issued and outstanding common shares. On October

25, 2022, the Company effected a one-for-twenty reverse share split (the “2022 Reverse Share Split”) of the Company’s

issued and outstanding common shares. The historical financial statements included or incorporated by reference in this prospectus have

been adjusted retrospectively for the 2019 Reverse Share Split and 2022 Reverse Share Split. Unless indicated or the context otherwise

requires, all per share amounts and numbers of common shares in this prospectus have been retrospectively adjusted for the 2019 Reverse

Share Split and 2022 Reverse Share Split.

The terms “dollar,” “USD”

or “$” refer to U.S. dollars and the term “Swiss Franc” and “CHF” refer to the legal currency of Switzerland.

On June 30, 2023, the exchange rate as reported by the U.S. Federal Reserve Bank was CHF 0.8947 to USD 1.00.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains statements that constitute

forward-looking statements, including statements concerning our industry, our operations, our anticipated financial performance and financial

condition, and our business plans and growth strategy and product development efforts. These statements constitute forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended, (the “Securities Act”) and Section 21E of the

Exchange Act. The words “may,” “might,” “will,” “should,” “estimate,” “project,”

“plan,” “anticipate,” “expect,” “intend,” “outlook,” “believe”

and other similar expressions are intended to identify forward-looking statements. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of their dates. These forward-looking statements are based on estimates and assumptions

by our management that, although we believe to be reasonable, are inherently uncertain and subject to a number of risks and uncertainties.

Forward-looking statements appear in a number

of places in this prospectus and include, but are not limited to, statements regarding our intent, belief or current expectations. Forward-looking

statements are based on our management’s beliefs and assumptions and on information currently available to our management. Such

statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking

statements due to various factors, including, but not limited to:

| ● | our

operation as a drug development-stage company with limited operating history and a history of operating losses; |

| ● | our

ability to continue as a going concern, about which there is currently substantial doubt due to our recurring losses and negative cash

flows from operations, our expectation to generate losses from operations for the foreseeable future and our cash position; |

| ● | our

ability to remediate our current material weaknesses in our internal controls over financial reporting; |

| ● | our

ability to timely and successfully reposition our Company around RNA therapeutics and to divest or partner our business in neurotology,

rhinology and allergology; |

| ● | the

COVID-19 pandemic, which continues to evolve, and which could significantly disrupt our preclinical studies and clinical trials, and

therefore our receipt of necessary regulatory approvals; |

| ● | our

need for substantial additional funding to continue the development of our product candidates before we can expect to become profitable

from sales of our products and the possibility that we may be unable to raise additional capital when needed; |

| ● | the

timing, scope, terms and conditions of a potential divestiture or partnering of the Company’s traditional business as well as the

cash such transaction(s) may generate; |

| ● | the

market acceptance and resulting sales from Bentrio® in international markets; |

| ● | our

dependence on the success of OligoPhoreTM, SemaPhoreTM, AM-401 and AM-411, which are still in preclinical development,

and may eventually prove to be unsuccessful; |

| ● | the

chance that we may become exposed to costly and damaging liability claims resulting from the testing of our product candidates in the

clinic or in the commercial stage; |

| ● | the

chance our clinical trials may not be completed on schedule, or at all, as a result of factors such as delayed enrollment or the identification

of adverse effects; |

| ● | uncertainty

surrounding whether any of our product candidates will receive regulatory approval or clearance, which is necessary before they can be

commercialized; |

| ● | if

our product candidates obtain regulatory approval or clearance, our product candidates being subject to expensive, ongoing obligations

and continued regulatory overview; |

| ● | enacted

and future legislation may increase the difficulty and cost for us to obtain marketing approval and commercialization; |

| ● | our

ability to obtain certification of Bentrio® as a Class II medical device under the European Medical Device Regulation and to obtain

regulatory approval for prophylactic or therapeutic claims related to viral infections |

| ● | dependence

on governmental authorities and health insurers establishing adequate reimbursement levels and pricing policies; |

| ● | our

products may not gain market acceptance, in which case we may not be able to generate product revenues; |

| ● | our

reliance on our current strategic relationship with Washington University, or Nuance Pharma and the potential success or failure of strategic

relationships, joint ventures or mergers and acquisitions transactions; |

| ● | our

reliance on third parties to conduct our nonclinical and clinical trials and on third-party, single-source suppliers to supply or produce

our product candidates; |

| ● | our

ability to obtain, maintain and protect our intellectual property rights and operate our business without infringing or otherwise violating

the intellectual property rights of others; |

| ● | our

ability to regain compliance with the continuing listing requirements of Nasdaq and remain listed on Nasdaq; |

| ● | the

chance that certain intangible assets related to our product candidates will be impaired; and |

| ● | other

risk factors discussed under “Risk Factors” beginning on page 6 of this prospectus and in the documents incorporated by

reference herein. |

Our actual results or performance could differ

materially from those expressed in, or implied by, any forward-looking statements relating to those matters. Accordingly, no assurances

can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what

impact they will have on our results of operations, cash flows or financial condition. Except as required by law, we are under no obligation,

and expressly disclaim any obligation, to update, alter or otherwise revise any forward-looking statement, whether written or oral, that

may be made from time to time, whether as a result of new information, future events or otherwise.

Certain

Definitions

| “December 2022 Loans” |

|

means , collectively, two separate loan agreements, as amended, entered into by the Company and, in each case, a private investor, dated December 28, 2022, pursuant to which the private investors agreed to loan to the Company CHF 250,000 and CHF 100,000, respectively, which loans bear interest at the rate of 5% per annum and mature on July 31, 2023. |

| |

|

|

| “February 2022 Loan” |

|

means the convertible loan

agreement, as amended, entered into by the Company with FiveT Investment Management Ltd. (“FiveT IM”), dated February 4,

2022, pursuant to which FiveT IM loaned to the Company CHF 5,000,000, which loan bore interest at the rate of 10% per annum and

had an initial maturity date of May 31, 2023. In April 2023, FiveT IM converted the entire loan into an aggregate of 4,341,012

common shares at an average conversion price of $1.4475 per share. As a result, the loan is no longer outstanding and has been

terminated. |

| |

|

|

| “May 2023 Loan” |

|

means the convertible

loan agreement entered into by the Company with FiveT IM, dated May 1, 2023, pursuant to which FiveT IM loaned to the Company CHF

2,500,000, which loan bears interest at the rate of 10% per annum and matures on March 4, 2025, convertible at a rate of CHF 1.42

per common share. |

| |

|

|

| “September 2022 Loan” |

|

means the loan agreement,

as amended, entered into among FiveT IM, Dominik Lysek and Thomas Meyer, the Company’s CEO (collectively, the “September

2022 Lenders”), and the Company, dated September 9, 2022, which loan has a principal amount of CHF 600,000, bears interest at

the rate of 5% per annum and matures on July 31, 2023, convertible at a rate of CHF 1.12 per common share. |

| |

|

|

| “Short-Term Loan” |

|

means the short-term loan

of CHF 100,000 received by the Company on December 8, 2022, which loan had an initial maturity date of March 31, 2023, bore interest

at the rate of 5% per annum and was repaid on March 8, 2023. |

PROSPECTUS

SUMMARY

This summary highlights information contained

elsewhere in this prospectus. This summary may not contain all the information that may be important to you, and we urge you to read this

entire prospectus carefully, including in particular the section entitled “Risk Factors,” in this prospectus, “Item

3. Key Information—D. Risk factors”, Item 4, “Information on the Company”; Item 5, “Operating and Financial

Review and Prospects”; Item 6,”Directors, Senior Management and Employees”; Item 7, Major Shareholders and Related Party

Transactions”; Item 8, “Financial Information” in our Annual Report on Form 20-F for the year ended December 31, 2022,

the other sections of the documents incorporated by reference in this prospectus and the financial statements and the related notes incorporated

by reference in this prospectus, before deciding to invest in our securities.

Overview

We are a clinical- and commercial-stage biopharmaceutical

company developing therapeutics that address important unmet medical needs. We are currently active in two areas: the development of RNA

delivery technology for extrahepatic therapeutic targets (OligoPhore™ / SemaPhore™ platforms; AM-401 for the treatment of

KRAS driven cancer, AM-411 for the treatment of rheumatoid arthritis; preclinical), and nasal sprays for protection against airborne allergens,

and where approved, viruses (Bentrio®; commercial) or the treatment of vertigo (AM-125; Phase 2). We have announced our intention

to reposition the Company around RNA delivery technology while exploring strategic options to either divest our non-RNA traditional businesses

or partner them with one or several other companies. In particular, we have announced that we are seeking to divest or partner our legacy

assets, including Bentrio® for North America, Europe and other key markets and our inner ear therapeutics assets.

Recent Developments

Top-Line Data from

Bentrio® Clinical Trial in Seasonal Allergic Rhinitis

On May 24, 2023, we announced

positive and statistically significant top-line results from the randomized controlled NASAR clinical trial evaluating our Bentrio®

nasal spray in patients with seasonal allergic rhinitis (SAR). Bentrio® nasal spray is formulated as a drug-free and preservative-free

gel emulsion designed to help protect against airborne allergens such as pollen or house dust mites. The NASAR trial enrolled 100

SAR patients in Australia who were randomized at a 1:1 ratio to receive either Bentrio® or saline nasal spray for two

weeks via self-administration three times per day, or as needed. For eligibility, patients had to have a baseline reflective Total Nasal

Symptom Score (rTNSS) of at least 5 points out of 12, referring to the worst level of nasal congestion, sneezing, nasal itching, and rhinorrhea

(runny nose) within the past 24 hours averaged over a one-week treatment-free run-in period. The primary efficacy endpoint was defined

as the difference in the average rTNSS over the subsequent 2-week treatment period between Bentrio® and saline nasal spray, the current

standard of care in drug-free SAR management. The change in mean rTNSS over two weeks is generally accepted as a primary efficacy endpoint

for SAR trials and is also recommended by the Food and Drug Administration (FDA).

The rTNSS decreased in

the Bentrio® group from 6.9 points in the pre-treatment period to an average of 5.0 points over the 14-day treatment period (i.e.

-1.9 points), while the saline spray group showed a decrease from 6.9 to 6.2 points (i.e. -0.8 points). The reduction in nasal symptoms

conferred by Bentrio® was thus 2.5 times larger than with saline nasal spray. The difference in rTNSS reduction of 1.1 points in favor

of Bentrio® was statistically significant in the ANCOVA model (LSmeans; p = 0.012; 95% confidence interval -2.0 to -0.3), and the

study thus met the primary efficacy endpoint. The treatment effect shown with Bentrio® was well above the minimal clinically important

difference of 0.28 points. 63.3% of Bentrio®-treated study participants rated treatment efficacy as either good or very good vs. 29.2%

of saline-treated participants. Among the latter, 45.8% reported efficacy as poor vs. only 8.2% in the Bentrio® group. 73.5% of Bentrio®-treated

study participants rated tolerability of the treatment as either good or very good vs. 85.5% of saline-treated participants. Among the

latter, 10.4% reported tolerability as poor vs. only 6.1% in the Bentrio® group.

Loans

On March 8, 2023, the

Company repaid the outstanding principal amount under the Short-Term Loan.

From April 13, 2023 to

April 17, 2023, FiveT IM converted the entire principal amount outstanding under the February 2022 Loan into an aggregate of 4,341,012

common shares at an average conversion price of $1.4475 per share. As a result, the February 2022 Loan is no longer outstanding and has

been terminated.

On May 1, 2023, the

Company entered into the May 2023 Loan with FiveT IM, pursuant to which FiveT IM loaned the Company CHF 2,500,000. The May 2023 Loan

bears interest at the rate of 10% per annum and matures on March 4, 2025, convertible at a rate of CHF 1.42 per common share.

Nasdaq Continued

Listing Deficiencies

On May 25, 2023,

the Company received written notification from the Listing Qualifications Department of Nasdaq indicating that based on the Company’s

shareholders’ equity of $(9.0) million for the period ended December 31, 2022, the Company is no longer in compliance with the

minimum shareholders’ equity requirement of $2.5 million as set forth in Nasdaq Listing Rule 5550(b)(1) for continued listing on

Nasdaq. This Nasdaq notification does not result in the immediate delisting of the Company’s common shares, and the shares will

continue to trade uninterrupted.

The Company has until

July 10, 2023 to submit a plan to regain compliance with the minimum shareholders’ equity requirement, and if the Company’s

plan is accepted, Nasdaq can grant an extension of up to 180 calendar days from the date of the written notification, i.e. up to November

25, 2023, to evidence compliance. In case the plan is not accepted by Nasdaq, the Company may appeal the decision to a Hearings Panel.

In addition, on June

26, 2023 the Company received a letter from the Listings Qualifications Department of Nasdaq notifying the Company that the minimum bid

price per share for its common shares was below $1.00 for a period of 30 consecutive business days and that the Company did not meet

the minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Deficiency”). This Nasdaq notification

does not result in the immediate delisting of the Company’s common shares, and the shares will continue to trade uninterrupted.

The Company has a

compliance period of 180 calendar days (the “Compliance Period”), i.e. up to December 26, 2023, to regain compliance with

Nasdaq’s minimum bid price requirement. If at any time during the Compliance Period, the closing bid price per share of the Company’s

common shares is at least $1.00 for a minimum of 10 consecutive business days, Nasdaq will provide the Company a written confirmation

of compliance and the matter will be closed.

In the event the

Company does not regain compliance by the end of the Compliance Period, the Company may be eligible for an additional 180 days. To qualify,

the Company will be required to meet the continued listing requirement for market value of publicly held shares and all other initial

listing standards for The Nasdaq Capital Market, with the exception of the bid price requirement, and will need to provide written notice

of its intention to remediate the deficiency during the second compliance period, by effecting a reverse share split, if necessary.

Investigational New

Drug (IND) Clearance by the FDA for AM-125 in Acute Vestibular Syndrome

On June 14, 2023, the

FDA completed its safety review of the Company’s IND application for AM-125 (betahistine nasal spray) in acute vestibular syndrome

(AVS). The FDA concluded that the proposed Phase 2 clinical trial with AM-125 in the treatment of posterior canal benign paroxysmal positional

vertigo (BPPV), the most common type of vertigo, may proceed. The FDA’s conclusion of the safety review opens the way for the clinical

evaluation of AM-125 in the United States. An earlier Phase 2 clinical trial conducted in Europe demonstrated that a four-week treatment

course with AM-125 in AVS patients, following surgical removal of a tumor behind the inner ear, was well tolerated and helped to accelerate

vestibular compensation enabling patients to regain balance and recover faster. The new Phase 2 trial is designed to demonstrate AM-125’s

tolerability and clinical utility also in BPPV.

Reverse Share

Split

In order to remediate

the Bid Price Deficiency, in the event of the Company’s common share market price continues to not meet the $1.00 minimum bid price

requirement, the Company intends to effect a reverse share split on or prior to July 31, 2023, at a ratio and at a time to be determined

by the Company’s board of directors, taking into account the market price of the common shares at such time.

Implications of Being a Foreign Private Issuer

We currently report under the Exchange Act as

a non-U.S. company with foreign private issuer, or FPI, status. Although we no longer qualify as an emerging growth company, as long as

we qualify as a foreign private issuer under the Exchange Act we will continue to be exempt from certain provisions of the Exchange Act

that are applicable to U.S. domestic public companies, including:

| ● | the

sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under

the Exchange Act; |

| ● | the

sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability

for insiders who profit from trades made in a short period of time; and |

| ● | the

rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other

specified information, or current reports on Form 8-K, upon the occurrence of specified significant events. |

Corporate Information

We are an exempted company incorporated under

the laws of Bermuda. We began our current operations in 2003. On April 22, 2014, we changed our name from Auris Medical AG to Auris Medical

Holding AG and transferred our operational business to our newly incorporated subsidiary Auris Medical AG, which is now our main operating

subsidiary. On March 13, 2018, we effected a corporate reorganization through a merger into a newly formed holding company for the purpose

of effecting the equivalent of a 10-1 “reverse share split.” Following shareholder approval at an extraordinary general meeting

of shareholders held on March 8, 2019 and upon the issuance of a certificate of continuance by the Registrar of Companies in Bermuda on

March 18, 2019, the Company discontinued as a Swiss company and, pursuant to Article 163 of the Swiss Federal Act on Private International

Law and pursuant to Section 132C of the Companies Act 1981 of Bermuda (the “Companies Act”), continued existence under the

Companies Act as a Bermuda company with the name “Auris Medical Holding Ltd.” (the “Redomestication”). Following

shareholders’ approval at a special general meeting of shareholders held on July 21, 2021 we changed our name to Altamira Therapeutics

Ltd. Our registered office is located at Clarendon House, 2 Church Street, Hamilton HM11, Bermuda, telephone number +1 (441) 295 5950.

We maintain a website at www.altamiratherapeutics.com

where general information about us is available. Investors can obtain copies of our filings with the Securities and Exchange Commission

(the “SEC” or the “Commission”), from this site free of charge, as well as from the SEC website at www.sec.gov.

We are not incorporating the contents of our website into this prospectus.

THE

OFFERING

This summary highlights information presented

in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all the information you should consider

before investing in our securities. You should carefully read this entire prospectus before investing in our securities including “Risk

Factors,” section in this prospectus and under similar captions in the documents incorporated by reference into this prospectus

and our consolidated financial statements contained in our Annual Report on Form 20-F for the year ended December 31, 2022 and incorporated

by reference to this prospectus.

| Common shares offered by us in this offering: |

|

875,000 common shares. |

| |

|

|

| Common warrants offered by us in this offering: |

|

Common warrants to purchase up to 11,111,112 common shares. Each of our common shares, or a pre-funded warrant in lieu thereof, is being sold together with a common warrant to purchase one of our common shares. The common shares or pre-funded warrants, respectively, and common warrants are immediately separable and will be issued separately in this offering, but must initially be purchased together in this offering. Each common warrant has an exercise price of CHF 0.40 (equal to approximately $0.45 as of the date of this prospectus) per common share and is immediately exercisable and will expire five years from the date of the issuance. See “Description of Securities We Are Offering”. This prospectus also relates to the offering of the common shares issuable upon exercise of the common warrants. |

| |

|

|

| Pre-funded warrants offered by us in this offering: |

|

We are also offering pre-funded warrants to purchase up to 10,236,112 common shares to each purchaser whose purchase of common shares in this offering would otherwise result in the purchaser, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common shares immediately following the consummation of this offering. The purchase price of each pre-funded warrant and accompanying common warrant is $0.43889, and the exercise price of each pre-funded warrant will be CHF 0.01 per share (equal to approximately $0.011 as of the date of this prospectus). The pre-funded warrants will be exercisable immediately and may be exercised at any time until all of the pre-funded warrants are exercised in full. See “Description of Securities We Are Offering” for additional information. This prospectus also relates to the offering of the common shares issuable upon exercise of the pre-funded warrants. |

| |

|

|

| Placement agent warrants offered by us in this offering: |

|

We have agreed to issue to the placement agent (or its designees) the placement agent warrants to purchase up to 722,222 common shares (representing 6.5% of the aggregate number of common shares sold in this offering, including shares underlying any pre-funded warrants), at an exercise price equal to CHF 0.50 (representing 125% of the public offering price per common share and accompanying common warrant to be sold in this offering). The placement agent warrants will be exercisable upon issuance and will expire five years from the commencement of sales under this offering. This prospectus also relates to the offering of the common shares issuable upon exercise of the placement agent warrants. |

| |

|

|

| Term of the offering: |

|

This offering will terminate on the second trading day after the date of this prospectus, unless we decide to terminate the offering (which we may do at any time in our discretion) prior to that date. |

| Common shares outstanding prior to this offering: |

|

7,954,004 common shares. |

| |

|

|

| Common shares outstanding after this offering(1): |

|

8,829,004 common shares, assuming none of the common warrants or pre-funded warrants issued in this offering were exercised. Assuming all of the pre-funded warrants were immediately exercised, there would be 19,065,116 common shares outstanding after this offering. |

| Use of Proceeds: |

|

We currently

intend to use the net proceeds from this offering for research and development, working capital and general corporate purposes, which

may include the repayment of certain indebtedness. See “Use of Proceeds” in this prospectus. |

| |

|

|

| Nasdaq Capital Market symbol: |

|

Our common shares are listed on Nasdaq under the symbol “CYTO.” There is no established public trading market for the common warrants or pre-funded warrants, and we do not expect such a market to develop. We do not intend to list the common warrants or pre-funded warrants on any securities exchange or other trading market. Without an active trading market, the liquidity of the pre-funded warrants and the common warrants will be extremely limited. |

| |

|

|

| Risk Factors: |

|

An investment in our securities involves a high degree of risk. Please refer to “Risk Factors” in this prospectus and under “Item 3. Key Information—D. Risk factors” in our Annual Report on Form 20-F for the year ended December 31, 2022, incorporated by reference herein, and other information included or incorporated by reference in this prospectus for a discussion of factors you should carefully consider before investing in our securities. |

The historical financial statements included or

incorporated by reference in this prospectus have been adjusted retrospectively for the 2019 Reverse Share Split and 2022 Reverse Share

Split. Unless indicated or the context otherwise requires, all per share amounts and numbers of common shares in this prospectus have

been retrospectively adjusted for the 2019 Reverse Share Split and 2022 Reverse Share Split.

(1) The number of our common shares issued

and outstanding after this offering is based on 7,954,004 common shares issued and outstanding as of June 30, 2023 and excludes:

| |

● |

518,312

common shares issuable upon the exercise of options issued pursuant to the Company’s equity incentive plan, outstanding as

of June 30, 2023 at a weighted average exercise price of $6.64 per common share; |

| |

● |

1,724,658

common shares issuable upon exercise of warrants outstanding as of June 30, 2023 at a weighted average exercise price of $4.93 per

common share; |

| ● | 1,760,564

common shares issuable upon the conversion of the May 2023 Loan, at a conversion price of CHF 1.42 per common share; and |

| ● | 535,715 common shares issuable upon the conversion of the September

2022 Loan, at a conversion price of CHF 1.12 per common share. |

Unless expressly indicated or the context requires

otherwise, all information in this prospectus assumes (i) no exercise of the common warrants offered hereby, and (ii) no exercise of the

warrants to be issued to the placement agent or its designees in connection with this offering.

RISK

FACTORS

Any investment in our securities involves a

high degree of risk. You should carefully consider the risks described below and in “Item 3. Key Information—D. Risk factors”

in our Annual Report on Form 20-F for the year ended December 31, 2022, incorporated by reference herein, and all of the information included

or incorporated by reference in this prospectus before deciding whether to purchase our securities. The risks and uncertainties described

below are not the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us or that we currently

deem immaterial may also impair our business operations. If any of the events or circumstances described in the following risk factors

actually occur, our business, financial condition and results of operations would suffer. In that event, the price of our common shares

could decline, and you may lose all or part of your investment. The risks discussed below also include forward-looking statements and

our actual results may differ substantially from those discussed in these forward-looking statements. See “Cautionary Statement

Regarding Forward-Looking Statements.”

Risks Related to this Offering and Our Securities

We need to raise capital in this offering

to support our operations, and there is substantial doubt about our ability to continue as a going concern. If we are unable to raise

capital when needed, we could be forced to delay, reduce or eliminate our product development programs or commercialization efforts.

We have incurred substantial losses since our

inception. Net losses and negative cash flows have had, and will continue to have, an adverse effect on our shareholders’ equity

and working capital. We incurred net losses (defined as net loss attributable to owners of the Company) of CHF 26.5 million, CHF 17.1

million and CHF 8.2 million for the years ended December 31, 2022, 2021 and 2020, respectively. As of December 31, 2022, we had an accumulated

deficit of CHF 201.4 million. We expect our research and development expenses to remain significant as we advance or initiate the pre-clinical

and clinical development of AM-401, AM-411 or any other product candidate.

We expect our total additional cash need in 2023

to be in the range of CHF 15 to 17 million, prior to the receipt of any proceeds from this offering. Our assumptions may prove to be wrong,

and we may have to use our capital resources sooner than we currently expect. To the extent that we will be unable to generate sufficient

cash proceeds from the planned divestiture or partnering of our legacy assets or other partnering activities, we will need substantial

additional financing to meet these funding requirements. These factors raise substantial doubt about the Company’s ability to continue

as a going concern. The financial statements incorporated by reference in this prospectus have been prepared on a going concern basis,

which contemplates the continuity of normal activities and realization of assets and settlement of liabilities in the normal course of

business. The financial statements do not include any adjustments that might result from the outcome of this uncertainty. The lack of

a going concern assessment may negatively affect the valuation of the Company’s investments in its subsidiaries and result in a

revaluation of these holdings. The board of directors will need to consider the interests of our creditors and take appropriate action

to restructure the business if it appears that we are insolvent or likely to become insolvent. Our future funding requirements will depend

on many factors, including but not limited to:

| ● | the

amount of our investments in raising market awareness of and growing market penetration for Bentrio®; |

| ● | the

success of our distributors in commercializing Bentrio® in their territories and our ability to access additional geographies through

further distributors; |

| ● | the

scope, rate of progress, results and cost of our clinical trials, nonclinical testing, and other related activities; |

| ● | the

cost of manufacturing clinical supplies, and establishing commercial supplies, of our product candidates and any products that we may

develop; |

| ● | the

number and characteristics of product candidates that we pursue; |

| ● | the

cost, timing, and outcomes of regulatory approvals; |

| ● | the

cost and timing of establishing sales, marketing, and distribution capabilities; and |

| ● | the

terms and timing of any collaborative, licensing, and other arrangements that we may establish, including any required milestone and

royalty payments thereunder. |

We expect that we will require additional funding

to continue our roll out of Bentrio® and our ongoing clinical development activities and seek to obtain regulatory approval for, and

commercialize, our product candidates. If we receive regulatory approval or clearance for any of our product candidates, and if we choose

to not grant any licenses to partners, we expect to incur significant commercialization expenses related to product manufacturing, sales,

marketing and distribution, depending on where we choose to commercialize. We also expect to continue to incur additional costs associated

with operating as a public company. Additional funds may not be available on a timely basis, on favorable terms, or at all, and such funds,

if raised, may not be sufficient to enable us to continue to implement our long-term business strategy. If we are not able to raise capital

when needed, we could be forced to delay, reduce or eliminate our product development programs or commercialization efforts, which could

materially harm our business, prospects, financial condition and operating results. This could then result in bankruptcy, or the liquidation

of the Company.

This is a best efforts offering, no minimum

amount of securities is required to be sold, and we may not raise the amount of capital we believe is required for our business plans,

including our near-term business plans.

The placement agent has agreed to use its reasonable

best efforts to solicit offers to purchase the securities in this offering. The placement agent has no obligation to buy any of the securities

from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. There is no required minimum

number of securities that must be sold as a condition to completion of this offering. Because there is no minimum offering amount required

as a condition to the closing of this offering, the actual offering amount, placement agent fees and proceeds to us are not presently

determinable and may be substantially less than the maximum amounts set forth herein. We may sell fewer than all of the securities offered

hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund

in the event that we do not sell an amount of securities sufficient to support our continued operations, including our near-term continued

operations. Thus, we may not raise the amount of capital we believe is required for our operations in the short-term and may need to raise

additional funds to complete such short-term operations. Such additional fundraises may not be available or available on terms acceptable

to us.

Our management will have broad discretion

in the use of the net proceeds from this offering and may invest or spend the proceeds in ways with which you do not agree and in ways

that may not yield a return.

Our management will have broad discretion in the

application of the net proceeds from this offering, including for any of the purposes described in the section titled “Use of

Proceeds,” and you will not have the opportunity as part of your investment decision to assess whether the net proceeds are

being used appropriately. Because of the number and variability of factors that will determine our use of the net proceeds from this offering,

their ultimate use may vary from their currently intended use. The failure by our management to apply these funds effectively could harm

our business. Pending their use, we may invest the net proceeds from this offering in investment-grade, interest-bearing securities. These

investments may not yield a favorable return to our securityholders.

If you purchase common shares in this offering,

you will suffer immediate dilution of your investment.

You will incur immediate and substantial dilution

as a result of this offering. Because the combined price per common share and accompanying common warrant being offered is higher than

our net tangible book value per common share, you will experience dilution to the extent of the difference between the effective offering

price per common share and accompanying common warrant you pay in this offering and our net tangible book value per common share immediately

after this offering. Our pro forma net tangible book value (deficit) as of December 31, 2022, was approximately $(1.1) million, or $(0.14)

per common share. Net tangible book value per common share is equal to our total tangible assets minus total liabilities, all divided

by the number of common shares outstanding. See the section titled “Dilution” for a more detailed discussion of the

dilution you will incur if you purchase common shares in this offering.

If you purchase our securities in this offering,

you may experience future dilution as a result of future equity offerings or other equity issuances.

In order to raise additional capital, we believe

that we will offer and issue additional common shares or other securities convertible into or exchangeable for common shares in the future.

We cannot assure you that we will be able to sell common shares or other securities in any other offering at a price per common share

that is equal to or greater than the effective price per common share paid by investors in this offering, and investors purchasing other

securities in the future could have rights superior to existing shareholders. The price per common share at which we sell additional common

shares or other securities convertible into or exchangeable for common shares in future transactions may be higher or lower than the effective

price per common share in this offering.

In addition, we have a significant number of warrants,

options and convertible debt outstanding. To the extent that outstanding options, warrants or convertible debt have been or may be exercised

or converted or other common shares are issued, you may experience further dilution. Further, we may choose to raise additional capital

due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans,

which may lead to further dilution.

Purchasers who purchase our securities in

this offering pursuant to a securities purchase agreement may have rights not available to purchasers that purchase without the benefit

of a securities purchase agreement.

In addition to rights and remedies available

to all purchasers in this offering under federal securities and state law, the purchasers that enter into a securities purchase agreement

will also be able to bring claims of breach of contract against us. The ability to pursue a claim for breach of contract provides those

investors with the means to enforce the covenants uniquely available to them under the securities purchase agreement including: (i) timely

delivery of shares; (ii) agreement to not enter into variable rate financings for one year from closing, subject to certain exceptions;

(iii) agreement to not enter into any financings for 60 days from closing; and (iv) indemnification for breach of contract.

There is no public market for the common

warrants or pre-funded warrants to purchase common shares being offered by us in this offering.

There is no established public trading market

for the common warrants or pre-funded warrants to purchase common shares that are being offered as part of this offering, and we do not

expect a market to develop. In addition, we do not intend to apply to list the common warrants or pre-funded warrants on any national

securities exchange or other nationally recognized trading system, including Nasdaq. Without an active market, the liquidity of the common

warrants and pre-funded warrants will be limited.

The common warrants and pre-funded warrants

are speculative in nature.

The common warrants and pre-funded warrants offered

hereby do not confer any rights of common share ownership on their holders, such as voting rights or the right to receive dividends, but

rather merely represent the right to acquire common shares at a fixed price. Specifically, commencing on the date of issuance, and subject

to the availability of sufficient authorized common shares, holders of the common warrants may acquire the common shares issuable upon

exercise of such warrants at an exercise price of CHF 0.40 per common share (equal to approximately $0.45 as of the date of this prospectus),

and holders of the pre-funded warrants may acquire the common shares issuable upon exercise of such warrants at an exercise price of CHF

0.01 per common share. Moreover, following this offering, the market value of the common warrants and pre-funded warrants is uncertain

and there can be no assurance that the market value of the common warrants or pre-funded warrants will equal or exceed their respective

public offering prices. There can be no assurance that the market price of the common shares will ever equal or exceed the exercise price

of the common warrants or pre-funded warrants, and consequently, whether it will ever be profitable for holders of common warrants to

exercise the common warrants or for holders of the pre-funded warrants to exercise the pre-funded warrants.

Holders of the pre-funded warrants and the

common warrants offered hereby will have no rights as common shareholders with respect to the common shares underlying the warrants until

such holders exercise their warrants and acquire our common shares, except as otherwise provided in the pre-funded warrants and the common

warrants.

Until holders of the common warrants and the pre-funded warrants

acquire common shares upon exercise thereof, such holders will have no rights with respect to the common shares underlying such warrants.

Upon exercise of the common warrants and the pre-funded warrants, the holders will be entitled to exercise the rights of common shareholders

only as to matters for which the record date occurs after the exercise date.

Our common shares may be involuntarily delisted

from trading on Nasdaq if we fail to comply with the continued listing requirements. A delisting of our common shares is likely to reduce

the liquidity of our common shares and may inhibit or preclude our ability to raise additional financing.

We are required to comply with certain Nasdaq

continued listing requirements, including a series of financial tests relating to shareholder equity, market value of listed securities

and number of market makers and shareholders. If we fail to maintain compliance with any of those requirements, our common shares could

be delisted from Nasdaq.

On May 25, 2023,

we received written notification from the Listing Qualifications Department of Nasdaq indicating that based on our shareholders’

equity of $(9.0) million for the period ended December 31, 2022, we are no longer in compliance with the minimum shareholders’

equity requirement of $2.5 million as set forth in Nasdaq Listing Rule 5550(b)(1) for continued listing on Nasdaq. This Nasdaq notification

does not result in the immediate delisting of our common shares, and the shares will continue to trade uninterrupted.

We have until July 10, 2023 to submit a plan

to regain compliance with the minimum shareholders’ equity requirement, and if our plan is accepted, Nasdaq can grant an extension

of up to 180 calendar days from the date of the written notification, i.e. up to November 25, 2023, to evidence compliance. In case the

plan is not accepted by Nasdaq, we may appeal the decision to a Hearings Panel.

In addition, on June

26, 2023 the Company received a letter from the Listings Qualifications Department of Nasdaq notifying the Company that the minimum bid

price per share for its common shares was below $1.00 for a period of 30 consecutive business days and that the Company did not meet

the minimum bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2). This Nasdaq notification does not result in the immediate

delisting of the Company’s common shares, and the shares will continue to trade uninterrupted.

The Company has a

compliance period of 180 calendar days (the “Compliance Period”), i.e. up to December 26, 2023, to regain compliance with

Nasdaq’s minimum bid price requirement. If at any time during the Compliance Period, the closing bid price per share of the Company’s

common shares is at least $1.00 for a minimum of 10 consecutive business days, Nasdaq will provide the Company a written confirmation

of compliance and the matter will be closed.

In the event the Company does not regain compliance

by the end of the Compliance Period, the Company may be eligible for an additional 180 days. To qualify, the Company will be required

to meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for The Nasdaq

Capital Market, with the exception of the bid price requirement, and will need to provide written notice of its intention to remediate

the deficiency during the second compliance period, by effecting a reverse share split, if necessary.

Further, in 2017, 2019, 2020 and 2022, we failed

to maintain compliance with the minimum bid price requirement. To address non-compliance in 2017, on March 13, 2018, we effected “reverse

share splits” at a ratio of 10-for-1. To address non-compliance in 2019 and 2022, we effected the 2019 Reverse Share Split and the

2022 Reverse Share Split respectively. In 2020, we regained compliance as our share price increased. Additionally, on January 11, 2018,

we received a letter from Nasdaq indicating that we were not in compliance with Nasdaq’s market value of listed securities requirement.

As a result of our registered offering of 897,435 common shares in July 2018, we resolved the non-compliance with the market value of

listed securities requirement by complying with Nasdaq’s minimum equity standard. However, there can be no assurance that we will

be able to successfully maintain compliance with the several Nasdaq continued listing requirements.

If, for any reason, Nasdaq should delist our common

shares from trading on its exchange and we are unable to obtain listing on another national securities exchange or take action to restore

our compliance with Nasdaq’s continued listing requirements, a reduction in some or all of the following may occur, each of which

could have a material adverse effect on our shareholders:

| ● | the

liquidity of our common shares; |

| ● | the

market price of our common shares; |

| ● | our

ability to obtain financing for the continuation of our operations; |

| ● | the

number of institutional and general investors that will consider investing in our common shares; |

| ● | the

number of investors in general that will consider investing in our common shares; |

| ● | the

number of market makers in our common shares; |

| ● | the

availability of information concerning the trading prices and volume of our common shares; and |

| ● | the

number of broker-dealers willing to execute trades in shares of our common shares. |

Moreover, delisting may make unavailable a tax

election that could affect the U.S. federal income tax treatment of holding, and disposing of, our common shares. See “Taxation—Material

U.S. Federal Income Tax Considerations for U.S. Holders” below.

If we are or become classified as a passive

foreign investment company (“PFIC”), our U.S. shareholders and holders of common warrants or pre-funded warrants may suffer

adverse tax consequences as a result.

A non-U.S. corporation, such as our Company, will

be considered a PFIC for any taxable year if either (i) at least 75% of its gross income is passive income or (ii) at least 50% of the

value of its assets (based on an average of the quarterly values of the assets during a taxable year) is attributable to assets that produce

or are held for the production of passive income.

Based upon our current and projected income and

assets, and projections as to the value of our assets, we do not anticipate that we will be a PFIC for the 2023 taxable year or the foreseeable

future. However, no assurance can be given in this regard because the determination of whether we will be or become a PFIC is a factual

determination made annually that will depend, in part, upon the composition of our income and assets, and we have not and will not obtain

an opinion of counsel regarding our classification as a PFIC. Fluctuations in the market price of our common shares may cause us to be

classified as a PFIC in any taxable year because the value of our assets for purposes of the asset test, including the value of our goodwill

and unbooked intangibles, may be determined by reference to the market price of our common shares from time to time (which may be volatile).

If our market capitalization subsequently declines, we may be or become classified as a PFIC for the 2023 taxable year or future taxable

years. Furthermore, the composition of our income and assets may also be affected by how, and how quickly, we use our liquid assets and

any future fundraising activity. Under circumstances where our revenues from activities that produce passive income significantly increases

relative to our revenues from activities that produce non-passive income, or where we determine not to deploy significant amounts of cash

for active purposes, our risk of becoming classified as a PFIC may substantially increase. It is also possible that the Internal Revenue

Service (the “IRS”) may challenge the classification or valuation of our Company’s assets, including its goodwill and

other unbooked intangibles, or the classification of certain amounts received by our Company, which may result in our Company being, or

becoming classified as, a PFIC for the 2023 taxable year or future taxable years. Accordingly, there can be no assurance that we will

not be a PFIC in the current or for any future taxable year and U.S. investors should invest in our common shares, common warrants or

pre-funded warrants only if they are willing to bear the U.S. federal income tax consequences associated with investments in PFICs.

If we were a PFIC for any taxable year during

which a U.S. investor held our common shares, common warrants or pre-funded warrants, certain adverse U.S. federal income tax consequences

could apply to the U.S. Holder. See “Taxation—Material U.S. Federal Income Tax Considerations for U.S. Holders.”

PRESENTATION

OF FINANCIAL AND OTHER INFORMATION

We report under International Financial Reporting

Standards as issued by the International Accounting Standards Board in Swiss Francs. None of the consolidated financial statements were

prepared in accordance with generally accepted accounting principles in the United States.

The terms “dollar,” “USD”

or “$” refer to U.S. dollars, the term, “Swiss Francs” or “CHF” refers to the legal currency of Switzerland

and the terms “€” or “euro” are to the currency introduced at the start of the third stage of European economic

and monetary union pursuant to the treaty establishing the European Community, as amended. Unless otherwise indicated, all references

to currency amounts in this prospectus are in Swiss Francs.

We have made rounding adjustments to some of the

figures included in this prospectus. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation

of the figures that preceded them.

MARKET

AND INDUSTRY DATA

This prospectus contains industry, market and

competitive position data that are based on industry publications and studies conducted by third parties as well as our own internal

estimates and research. These industry publications and third party studies generally state that the information that they contain has

been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information.

USE

OF PROCEEDS

We estimate that the net proceeds from the sale

of the securities offered under this prospectus, after deducting placement agent’s fees and estimated offering expenses payable

by us, will be approximately $4.1 million, assuming no exercise of the common warrants, pre-funded warrants or placement agent warrants

issued in this offering. We intend to use the net proceeds from the sale of the securities for research and development, working capital

and general corporate purposes. We may also use the net proceeds from this offering to (i) repay the September 2022 Loan, which has a

principal amount of CHF 600,000, bears interest at the rate of 5% per annum and matures on July 31, 2023, (ii) repay the December 2022

Loans, which have an aggregate principal amount of CHF 350,000, bear interest at the rate of 5% per annum and mature on July 31, 2023,

and (iii) make monthly tranche payments equal to at least 1/20th of the May 2023 Loan plus accrued interest pro rata. The May 2023 Loan,

which has a principal amount of CHF 2,500,000, bears interest at the rate of 10% per annum, matures on March 4, 2025 and requires, beginning

after July 1, 2023, that we repay a minimum of CHF 125,000 plus pro rata accrued interest each month in either cash (with a 3% premium)

or common shares (valued using a volume weighted average price at the time of repayment). We have used the proceeds of the September 2022

Loan, December 2022 Loans and May 2023 Loan for research and development, working capital and general corporate purposes.

However, because this is a best efforts offering

and there is no minimum offering amount required as a condition to the closing of this offering, the actual offering amount, the placement

agent’s fees and net proceeds to us are not presently determinable and may be substantially less than the maximum amounts set forth

on the cover page of this prospectus.

This expected use of net proceeds from this offering

represents our intentions based upon our current plans and business conditions, which could change in the future as our plans and business

conditions evolve. We cannot currently allocate specific percentages of the net proceeds to us from this offering that we may use for

the purposes specified above. Our management will have broad discretion in the application of the net proceeds from this offering and

could use them for purposes other than those contemplated at the time of this offering. Our shareholders may not agree with the manner

in which our management chooses to allocate and spend the net proceeds. Moreover, our management may use the net proceeds for corporate

purposes that may not result in our being profitable or increase our market value.

The amounts and timing of our actual expenditures

will depend upon numerous factors, including our clinical development efforts, our operating costs and the other factors described under

“Risk Factors” in this prospectus and under similar captions in the documents incorporated by reference into this

prospectus. Accordingly, our management will have flexibility in applying the net proceeds from this offering. An investor will not have

the opportunity to evaluate the economic, financial or other information on which we base our decisions on how to use the proceeds.

DIVIDEND

POLICY

We have never paid a dividend,

and we do not anticipate paying dividends in the foreseeable future. We intend to retain all available funds and any future earnings to

fund the development and expansion of our business. As a result, investors in our common shares will benefit in the foreseeable future

only if our common shares appreciate in value.

Any future determination

to declare and pay dividends to holders of our common shares will be made at the discretion of our board of directors, which may take

into account several factors, including general economic conditions, our financial condition and results of operations, available cash

and current and anticipated cash needs, capital requirements, contractual, legal, tax and regulatory restrictions, the implications of

the payment of dividends by us to our shareholders and any other factors that our board of directors may deem relevant. In addition, pursuant

to the Companies Act, a company may not declare or pay dividends if there are reasonable grounds for believing that (1) the company is,

or would after the payment be, unable to pay its liabilities as they become due or (2) that the realizable value of its assets would thereby

be less than its liabilities. Under our bye-laws, each of our common shares is entitled to dividends if, as and when dividends are declared

by our board of directors, subject to any preferred dividend right of the holders of any preferred shares.

We are a holding company

with no material direct operations. As a result, we would be dependent on dividends, other payments or loans from our subsidiaries in

order to pay a dividend. Our subsidiaries are subject to legal requirements of their respective jurisdictions of organization that may

restrict their paying dividends or other payments, or making loans, to us.

CAPITALIZATION

The table below sets forth our cash and cash equivalents

and our total capitalization (defined as total debt and shareholders’ equity) as of December 31, 2022:

| |

● |

on a

pro forma basis to give effect to (i) the issuance and sale of an aggregate of 2,082,939 common shares for net proceeds of $4.9

million under the sales agreement with A.G.P./Alliance Global Partners (“A.G.P.”) dated November 30, 2018, as amended

(the “A.G.P. Sales Agreement”) subsequent to December 31, 2022 and through June 30, 2023, (ii) the issuance and sale of

an aggregate of 350,000 common shares for net proceeds of $0.9 million under the purchase agreement with Lincoln Park Capital Fund,

LLC (“LPC”) dated December 5, 2022 (the “2022 LPC Purchase Agreement”) subsequent to December 31, 2022 and

through June 30, 2023, (iii) the issuance of an aggregate of 4,341,012 common shares to FiveT IM upon the conversion in full and

termination of the February 2022 Loan in April 2023, including the accounting effects of accrued interest and amortization under the

effective interest method until the date of conversion, (iv) the borrowing of an aggregate of CHF 2,500,000 principal amount under

the May 2023 Loan and (v) the repayment of the Short-Term Loan in the amount of CHF 100,000 (collectively, the “pro forma

events”); and |

| |

● |

on a pro forma as adjusted basis to give further effect to our issuance and sale of 875,000 common shares, pre-funded warrants to purchase up to 10,236,112 common shares and accompanying common warrants to purchase up to 11,111,112 common shares in this offering, at the public offering price of $0.45 per common share and accompanying common warrant, and $0.44 per pre-funded warrant and accompanying common warrant, after deducting placement agent’s fees and estimated offering expenses payable by us, excluding the proceeds, if any, from the exercise of the common warrants issued in this offering, assuming the immediate full exercise of the pre-funded warrants issued in this offering and assuming no value is attributed to the common warrants being sold in this offering. |

Investors should read this table in conjunction

with our audited consolidated financial statements and related notes as of and for the year ended December 31, 2022 and management’s

discussion and analysis thereon, each as incorporated by reference into this prospectus, as well as “Use of Proceeds” in this

prospectus.

U.S. dollar amounts have been translated into

Swiss Francs at a rate of CHF 0.9241 to USD 1.00, the official exchange rate quoted as of December 30, 2022 by the U.S. Federal Reserve

Bank. Such Swiss Franc amounts are not necessarily indicative of the amounts of Swiss Francs that could actually have been purchased upon

exchange of U.S. dollars on December 30, 2022 and have been provided solely for the convenience of the reader. On June 30, 2023, the exchange

rate as reported by the U.S. Federal Reserve Bank was CHF 0.8947 to USD 1.00.

| | |

As of December 31, 2022 | |

| | |

Actual | | |

Pro Forma | | |

Pro Forma

As Adjusted | |

| | |

(in CHF, except for share amounts) | |

| Cash and cash equivalents | |

| 15,395 | | |

| 7,777,934 | | |

| 11,533,523 | |

| Loans | |

| 5,869,797 | (1) | |

| 3,371,420 | (2) | |

| 3,371,420 | (2) |

| Lease liabilities | |

| 461,485 | | |

| 461,485 | | |

| 461,485 | |

| Shareholders’ equity: | |

| | | |

| | | |

| | |

| Common shares, par value CHF 0.20 per share; 1,180,053 common shares issued and outstanding on an actual basis, 7,954,004 common shares issued and outstanding on a pro forma basis, 19,065,116 common shares issued and outstanding on a pro forma as adjusted basis | |

| 236,011 | | |

| 1,590,801 | | |

| 3,813,024 | |

| Share premium | |

| 192,622,406 | | |

| 202,436,844 | | |

| 203,970,210 | |

| Other reserves | |

| 258,044 | | |

| 258,044 | | |

| 258,044 | |

| Accumulated deficit | |

| (201,431,272 | ) | |

| (201,673,635 | ) | |

| (201,673,635 | ) |

| Total shareholders’ (deficit)/equity attributable to owners of the company | |

| (8,314,811 | ) | |

| 2,612,054 | | |

| 6,367,643 | |

| Total capitalization | |

| (1,983,529 | ) | |

| 6,444,959 | | |

| 10,200,548 | |

| (1) |

Represents the aggregate amounts outstanding

under the February 2022 Loan, September 2022 Loan, Short-Term Loan and December 2022 Loans. |

| (2) | Represents the aggregate amounts outstanding under the September

2022 Loan, December 2022 Loans and May 2023 Loan, after giving effect to the repayment and termination of the February 2022 Loan and

Short-Term Loan subsequent to December 31, 2022. |

The above discussion and table are based on 1,180,053 common shares

outstanding as of December 31, 2022 and excludes:

| |

● |

157,730 of our common shares issuable upon the exercise of options outstanding as of December 31, 2022 at a weighted average exercise price of $19.28 per common share; and |

| |

● |

99,171 common shares issuable upon the exercise of warrants outstanding as of December 31, 2022 at a weighted average exercise price of $57.60 per common share. |

DILUTION

If you invest in our securities, your interest

will be diluted to the extent of the difference between the public offering price you pay in this offering and our pro forma as adjusted

net tangible book value per common share immediately after this offering.

As of December 31, 2022, we had a net tangible

book value (deficit) of $(13.2) million, corresponding to a net tangible book value (deficit) of $(11.20) per common share. Net tangible

book value per share represents the amount of our total assets less our total liabilities, excluding intangible assets and right of use

assets, divided by 1,180,053, the total number of our common shares outstanding as of December 31, 2022.

Our pro forma net tangible book value (deficit)