Mama’s Creations, Inc. (NASDAQ: MAMA), a leading national marketer

and manufacturer of fresh deli prepared foods, has reported its

financial results for the third quarter ended October 31, 2024.

Financial Summary:

| |

|

Three Months

Ended October 31, |

| $ in millions |

|

2024 |

|

|

2023 |

|

|

% Change |

|

| Revenues |

|

$ |

31.5 |

|

|

$ |

28.7 |

|

|

|

10.0 |

% |

| Gross

Profit |

|

$ |

7.1 |

|

|

$ |

8.6 |

|

|

|

(17.6 |

%) |

| Operating

Expenses |

|

$ |

6.6 |

|

|

$ |

5.9 |

|

|

|

10.5 |

% |

| Net

Income |

|

$ |

0.4 |

|

|

$ |

2.0 |

|

|

|

(79.6 |

%) |

| Earnings per Share (Diluted) |

|

$ |

0.01 |

|

|

$ |

0.05 |

|

|

|

(80.0 |

%) |

| Adj.

EBITDA (non-GAAP) |

|

$ |

1.7 |

|

|

$ |

3.5 |

|

|

|

(49.6 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Third Quarter Fiscal 2025 & Subsequent Operational

Highlights:

-

Following completion of strategic CapEx projects in September 2024,

the company achieved a sequential step change in the preliminary

unaudited gross margin profile in November 2024, which indicates a

full reversal of the ~400 basis points of construction headwinds

with significant room for further improvement.

-

Completed build-out of industry-leading senior management team with

the appointments of veteran CPG and Retail executive Chris Darling

as Chief Commercial Officer and end-to-end supply chain leader

Moore (Skip) Tappan to the role of Chief Operating Officer.

-

Participated and exhibited at leading industry trade shows,

including the 2024 UNFI Holiday & Winter Show and 2024 National

Association of Convenience Stores (NACS) Show.

-

Invited to present at leading investor conferences nationally,

including the Raymond James Small Cap Summit, 15th Annual

Craig-Hallum Alpha Select Conference, and 13th Annual ROTH Deer

Valley Event.

-

Cash and cash equivalents as of October 31, 2024 were $9.3 million,

as compared to $11.0 million as of January 31, 2024. The change in

cash and cash equivalents was primarily driven by $5.0 million in

capital investments and $2.5 million of debt paydown during the

quarter, largely offset by working capital improvements as third

quarter cash flow from operations increased 23.7%

year-over-year.

Management Commentary

“We delivered a robust 10% revenue growth to

$31.5 million in the quarter, while concurrently completing CapEx

investments to double our grilled chicken throughput, adding

world-class senior leadership, and positioning Mama’s Creations to

fully realize its growth potential,” said Adam L. Michaels,

Chairman and CEO of Mama’s Creations. “While our East Rutherford

facility is already achieving our long-term gross margin target

north of 30%, the tail end of construction-related disruptions in

August and September at our Farmingdale facility drove a 400 basis

point impact to our third quarter gross margins, further pressured

by chicken prices. These construction challenges are now firmly

behind us, as our preliminary unaudited November gross margin

profile saw a step change improvement, indicative of a full

reversal of the construction headwinds with significant room for

further improvement.

“As part of our continued focus on our 4 Cs –

Cost, Controls, Culture and Catapult – during the third quarter we

focused on implementing automation and operational efficiency

improvements across the organization. This included the

aforementioned CapEx investments that were completed in September,

improvements in chicken trimming capabilities as well as labor cost

savings through a new lower-overtime staffing model that will be

fully implemented in December, and additional procurement

efficiencies and recent upgrades to our existing grills that will

drive meaningful improvements in throughput. When taken together,

we expect to see a materially stronger go-forward margin profile

more in-line with historical norms.

“To lead us forward and emerge as a dominant

player in the prepared foods space, we also completed the build-out

of our industry-leading executive team during the quarter. Chris

Darling, our new Chief Commercial Officer, brings over 20 years of

experience in executive leadership from a storied career in the

deli – where he led world class commercial organizations at

industry-leading firms such as Boar’s Head, HEB, Ahold and

Albertsons. Most importantly, Chris knows how to build a national

brand, particularly in the prepared meal solutions space. Chris

joins Skip Tappan, our Chief Operating Officer, an end-to-end

supply chain leader, bringing over 30 years of experience with

Gordon Food Service, Walmart, Campbell’s and Procter & Gamble.

With this world-class leadership team now in place, we are better

positioned to fully optimize operations, execute on our Catapult

growth plan and identify, acquire and integrate future M&A

opportunities.

“The fundamentals of our operations are

incredibly strong, and with these growing pains behind us –

supplemented by our investments in CapEx, senior leadership, and

marketing – have enabled our team to sell with confidence and

fulfill pent-up demand as we enter the new year. Ultimately, I

believe this will support a return to the high end of our

historical margin profile. Combined with a reversal of recent

commodity highs and strong November results, we believe we are well

positioned for profitable growth in the months and years ahead,”

concluded Michaels.

Third Quarter Fiscal 2025 Financial Results

Revenue for the third quarter of fiscal 2025

increased 10.0% to $31.5 million, as compared to $28.7 million in

the same year-ago quarter. The increase was largely attributable to

successful pricing actions, as well as volume gains driven by

increased demand, successful trade promotions, same-customer cross

selling of new items and new customer door expansion.

Gross profit totaled $7.1 million, or 22.6% of

total revenues, in the third quarter of fiscal 2025, as compared to

$8.6 million, or 30.1% of total revenues, in the same year-ago

quarter. The difference in gross margin was primarily attributable

to significant commodity cost increases from historical averages as

well as a non-recurring impact from construction surrounding the

now completed installation of strategic CapEx projects at the

Company’s Farmingdale facility, which management estimates

negatively impacted corporate gross margins by approximately 400

basis points. Subsequent to the end of the third quarter,

preliminary unaudited gross margins in the month of November saw a

step change improvement, indicative of a full reversal of the

construction headwinds.

Operating expenses were $6.6 million in the

third quarter of fiscal 2025, as compared to $5.9 million in the

same year-ago quarter. As a percentage of sales, operating expenses

were 20.8%, as compared to 20.7% in the same year-ago quarter.

Operating expenses as a percentage of sales were relatively flat,

driven by a 90 basis point year-over-year improvement in freight

efficiency, offset by a 75% year-over-year increase in marketing

spend – an area of historical underinvestment – to help drive

repeatable and profitable growth.

Net income for the third quarter of fiscal 2025

totaled $0.4 million, or $0.01 per diluted share, as compared to

net income of $2.0 million, or $0.05 per diluted share, in the same

year-ago quarter. Third quarter net income totaled 1.3% of revenue,

as compared to 7.0% in the same year-ago quarter.

Adjusted EBITDA, a non-GAAP measure, totaled

$1.7 million for the third quarter of fiscal 2025, as compared to

$3.5 million in the same year-ago quarter.

Cash and cash equivalents as of October 31, 2024

totaled $9.3 million, as compared to $11.0 million as of January

31, 2024. The change in cash and cash equivalents was primarily

driven by $5.0 million in capital investments and $2.5 million of

debt paydown year-to-date, partially offset by working capital

improvements as third quarter cash flow from operations increased

23.7% year-over-year. As of October 31, 2024, total debt stood at

$6.3 million.

Conference Call

Management will host an investor conference call

at 4:30 p.m. Eastern time today, Monday, December 16, 2024, to

discuss the Company’s third quarter fiscal 2025 financial results,

provide a corporate update, and conclude with Q&A from

telephone participants. To participate, please use the following

information:

Q3 FY2025 Earnings Conference CallDate: Monday,

December 16, 2024 Time: 4:30 p.m. Eastern time U.S. Dial-in:

1-877-451-6152International Dial-in: 1-201-389-0879Conference ID:

13749939Webcast: MAMA Q3 FY2025 Earnings Conference Call

Please join at least five minutes before the start of the call

to ensure timely participation.

A playback of the call will be available through

Thursday, January 16, 2024. To listen, please call 1-844-512-2921

within the United States and Canada or 1-412-317-6671 when calling

internationally, using replay pin number 13749939. A webcast replay

will also be available using the webcast link above.

About Mama’s Creations, Inc.

Mama’s Creations, Inc. (NASDAQ: MAMA) is a

leading marketer and manufacturer of fresh deli prepared foods,

found in over 8,000 grocery, mass, club and convenience stores

nationally. The Company’s broad product portfolio, born from

MamaMancini’s rich history in Italian foods, now consists of a

variety of high quality, fresh, clean and easy to prepare foods to

address the needs of both our consumers and retailers. Our vision

is to become a one-stop-shop deli solutions platform, leveraging

vertical integration and a diverse family of brands to offer a wide

array of prepared foods to meet the changing demands of the modern

consumer. For more information, please visit

https://mamascreations.com.

Use of Non-GAAP Financial

Measures

This press release includes the following

non-GAAP measure – Adjusted EBITDA, which is not a measure of

financial performance under GAAP and should not be considered as an

alternative to net income as a measure of financial performance.

Adjusted EBITDA represents net income (loss) before interest,

taxes, depreciation and amortization adjusted for stock-based

compensation and one-time costs associated with a legal settlement.

The company believes this non-GAAP measure, when considered

together with the corresponding GAAP measures, provides useful

information to investors and management regarding financial and

business trends relating to the company’s results of operations.

However, this non-GAAP measure has significant limitations in that

it does not reflect all the costs and other items associated with

the operation of the company’s business as determined in accordance

with GAAP. In addition, the company’s non-GAAP measures may be

calculated differently and are therefore not comparable to similar

measures by other companies. Therefore, investors should consider

non-GAAP measures in addition to, and not as a substitute for, or

superior to, measures of financial performance in accordance with

GAAP. A reconciliation of Adjusted EBITDA to net income, its

corresponding GAAP measure, is shown below.

GAAP NET INCOME TO ADJUSTED EBITDA

RECONCILIATION(Unaudited)(in

thousands)

| |

|

THREE MONTHS

ENDED |

|

| |

|

|

31-Oct-24 |

|

|

| |

|

|

2024 |

|

|

|

2023 |

|

|

Net Income |

|

$ |

410 |

|

|

$ |

2,009 |

|

|

Depreciation |

|

|

451 |

|

|

|

255 |

|

|

Amortization |

|

|

388 |

|

|

|

388 |

|

|

Taxes |

|

|

128 |

|

|

|

568 |

|

|

Interest, net |

|

|

83 |

|

|

|

124 |

|

|

Share Based Compensation |

|

|

280 |

|

|

|

110 |

|

|

Adjusted EBITDA (Non-GAAP) |

|

$ |

1,740 |

|

|

$ |

3,454 |

|

|

|

|

|

|

|

|

|

|

|

Forward-Looking Statements

This press release may contain forward-looking

statements within the meaning of Section 27 A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934.

Forward-looking statements include information about management’s

view of the Company’s future expectations, plans and prospects,

including future business opportunities or strategies and are

generally preceded by words such as “may,” “believe,” “future,”

“plan” or “planned,” “will” or “should,” “expect,” “anticipates,”

“eventually” or “projected.” You are cautioned that such statements

are subject to a multitude of known and unknown risks and

uncertainties that could cause future circumstances, events, or

results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors , including the impacts

of public health emergencies, such as the COVID-19 pandemic, on our

business, financial condition and results of operations, and our

inability to mitigate such impacts; the adequacy of our liquidity

to pursue our business objectives; reliance on a limited number of

customers; loss or retirement of key executives, including prior to

identifying a successor; adverse economic conditions or intense

competition; pricing pressures in the market and lack of control

over the pricing of raw materials and freight; entry of new

competitors and products; adverse federal, state and local

government regulation (including, but not limited to, the Food and

Drug Administration); liability related to the consumption of our

products ability to secure placement of our products in key retail

locations; wage and price inflation; maintenance of quality

control; and issues related to the enforcement of our intellectual

property rights, and other risks identified in the Company’s 10-K

for the fiscal year ended January 31, 2024 and other filings made

by the Company with the Securities and Exchange Commission.

Investor Relations Contact:Lucas A.

ZimmermanManaging DirectorMZ Group – MZ North America(949)

259-4987MAMA@mzgroup.us www.mzgroup.us

Mama’s Creations,

Inc.Condensed Consolidated Balance

Sheets(In thousands, except share and per share

data)

| |

|

October 31, 2024 |

|

|

January 31, 2024 |

|

| |

|

|

(Unaudited) |

|

|

|

|

|

| Assets: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current

Assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

9,319 |

|

|

$ |

11,022 |

|

| Accounts

receivable, net |

|

|

8,567 |

|

|

|

7,859 |

|

| Inventories,

net |

|

|

3,190 |

|

|

|

3,310 |

|

| Prepaid

expenses and other current assets |

|

|

929 |

|

|

|

1,375 |

|

| Total

Current Assets |

|

|

22,005 |

|

|

|

23,566 |

|

| |

|

|

|

|

|

|

|

|

| Property,

plant, and equipment, net |

|

|

9,849 |

|

|

|

4,436 |

|

| Intangible

assets, net |

|

|

3,822 |

|

|

|

4,979 |

|

| Goodwill |

|

|

8,633 |

|

|

|

8,633 |

|

| Operating

lease right of use assets, net |

|

|

3,080 |

|

|

|

2,889 |

|

| Deferred tax

asset |

|

|

413 |

|

|

|

503 |

|

| Deposits |

|

|

95 |

|

|

|

95 |

|

| Total

Assets |

|

$ |

47,897 |

|

|

$ |

45,101 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Liabilities: |

|

|

|

|

|

|

|

|

| Current

Liabilities: |

|

|

|

|

|

|

|

|

| Accounts

payable and accrued expenses |

|

$ |

13,845 |

|

|

$ |

12,425 |

|

| Term loan,

net of unamortized debt discount of $25 and $38, respectively |

|

|

1,527 |

|

|

|

1,514 |

|

| Operating

lease liabilities |

|

|

844 |

|

|

|

434 |

|

| Finance

leases payable |

|

|

369 |

|

|

|

367 |

|

| Promissory

notes – related parties |

|

|

2,250 |

|

|

|

1,950 |

|

| Total

Current Liabilities |

|

|

18,835 |

|

|

|

16,690 |

|

| |

|

|

|

|

|

|

|

|

| Line of credit |

|

|

— |

|

|

|

— |

|

| Term loan –

net of current |

|

|

1,730 |

|

|

|

3,003 |

|

| Operating

lease liabilities – net of current |

|

|

2,309 |

|

|

|

2,515 |

|

| Finance

leases payable – net of current |

|

|

1,275 |

|

|

|

1,062 |

|

| Promissory

note – related party, net of current |

|

|

750 |

|

|

|

2,250 |

|

| Total

long-term liabilities |

|

|

6,064 |

|

|

|

8,830 |

|

| |

|

|

|

|

|

|

|

|

| Total

Liabilities |

|

|

24,899 |

|

|

|

25,520 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies (Notes 9 and 10) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ Equity: |

|

|

|

|

|

|

|

|

| Series A

Preferred stock, $0.00001 par value; 120,000 shares authorized;

23,400 issued, 0 shares outstanding |

|

|

- |

|

|

|

- |

|

| Series B

Preferred stock, $0.00001 par value; 200,000 shares authorized; 0

and 0 issued or outstanding |

|

|

- |

|

|

|

- |

|

| Preferred

stock, $0.00001 par value; 19,680,000 shares authorized; 0 shares

issued or outstanding |

|

|

- |

|

|

|

- |

|

| Common stock, $0.00001 par value; 250,000,000 shares

authorized; 37,815,955 and 37,488,239 shares issued as of October

31 and January 31, 2024, respectively, 37,585,955 and

37,258,239 shares outstanding as of October 31 and January 31,

2024, respectively |

|

|

- |

|

|

|

- |

|

| Additional

paid-in capital |

|

|

24,584 |

|

|

|

23,278 |

|

| Accumulated

deficit |

|

|

(1,436 |

) |

|

|

(3,547 |

) |

| Less:

Treasury stock, 230,000 shares at cost |

|

|

(150 |

) |

|

|

(150 |

) |

| Total

Stockholders’ Equity |

|

|

22,998 |

|

|

|

19,581 |

|

| Total

Liabilities and Stockholders’ Equity |

|

$ |

47,897 |

|

|

$ |

45,101 |

|

Mama’s Creations,

Inc.Condensed Consolidated Statements of

Operations(Unaudited)(in

thousands, except per share data)

| |

|

For the Three Months

EndedOctober 31, |

|

|

For the Nine Months EndedOctober

31, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

31,523 |

|

|

$ |

28,648 |

|

|

$ |

89,743 |

|

|

$ |

76,559 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs of sales |

|

|

24,410 |

|

|

|

20,013 |

|

|

|

68,288 |

|

|

|

54,047 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

profit |

|

|

7,113 |

|

|

|

8,635 |

|

|

|

21,455 |

|

|

|

22,512 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

155 |

|

|

|

124 |

|

|

|

352 |

|

|

|

290 |

|

|

Selling, general and administrative expenses |

|

|

6,395 |

|

|

|

5,804 |

|

|

|

18,155 |

|

|

|

15,297 |

|

|

Total operating expenses |

|

|

6,550 |

|

|

|

5,928 |

|

|

|

18,507 |

|

|

|

15,587 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income

from operations |

|

|

563 |

|

|

|

2,707 |

|

|

|

2,948 |

|

|

|

6,925 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other

income (expenses) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(120 |

) |

|

|

(124 |

) |

|

|

(369 |

) |

|

|

(483 |

) |

|

Interest income |

|

|

37 |

|

|

|

— |

|

|

|

192 |

|

|

|

— |

|

|

Amortization of debt discount |

|

|

(3 |

) |

|

|

(6 |

) |

|

|

(13 |

) |

|

|

(17 |

) |

|

Other income |

|

|

61 |

|

|

|

— |

|

|

|

61 |

|

|

|

27 |

|

|

Total other expenses |

|

|

(25 |

) |

|

|

(130 |

) |

|

|

(129 |

) |

|

|

(473 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income before income tax provision and income from equity method

investment |

|

|

538 |

|

|

|

2,577 |

|

|

|

2,819 |

|

|

|

6,452 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from

equity method investment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

223 |

|

| Income tax

expense |

|

|

(128 |

) |

|

|

(568 |

) |

|

|

(708 |

) |

|

|

(1,522 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income |

|

$ |

410 |

|

|

$ |

2,009 |

|

|

$ |

2,111 |

|

|

$ |

5,153 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less: series

B preferred dividends |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(49 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

available to common stockholders |

|

$ |

410 |

|

|

$ |

2,009 |

|

|

$ |

2,111 |

|

|

$ |

5,104 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

– basic |

|

$ |

0.01 |

|

|

$ |

0.05 |

|

|

$ |

0.06 |

|

|

$ |

0.14 |

|

|

– diluted |

|

$ |

0.01 |

|

|

$ |

0.05 |

|

|

$ |

0.05 |

|

|

$ |

0.14 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

– basic |

|

|

37,373 |

|

|

|

37,121 |

|

|

|

37,522 |

|

|

|

36,642 |

|

|

– diluted |

|

|

39,293 |

|

|

|

37,646 |

|

|

|

39,410 |

|

|

|

37,088 |

|

Mama’s Creations,

Inc.Condensed Consolidated Statements of Cash

Flows(Unaudited)(in

thousands)

| |

|

For the Nine Months Ended October 31, |

|

| |

|

2024 |

|

|

2023 |

|

| CASH

FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

2,111 |

|

|

$ |

5,153 |

|

| Adjustments

to reconcile net income to net cash provided by operating

activities: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

1,057 |

|

|

|

767 |

|

|

Amortization of debt discount |

|

|

13 |

|

|

|

17 |

|

|

Amortization of right of use assets |

|

|

(167 |

) |

|

|

221 |

|

|

Amortization of intangibles |

|

|

1,156 |

|

|

|

692 |

|

|

Stock-based compensation |

|

|

801 |

|

|

|

220 |

|

|

Allowance for obsolete inventory |

|

|

- |

|

|

|

78 |

|

|

Change in deferred tax asset |

|

|

90 |

|

|

|

299 |

|

|

Income from equity method investment |

|

|

- |

|

|

|

(223 |

) |

| Changes in

operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Allowance for credit losses |

|

|

- |

|

|

|

140 |

|

|

Accounts receivable |

|

|

(708 |

) |

|

|

(1,170 |

) |

|

Inventories |

|

|

120 |

|

|

|

986 |

|

|

Prepaid expenses and other current assets |

|

|

(491 |

) |

|

|

(179 |

) |

|

Security deposits |

|

|

- |

|

|

|

(35 |

) |

|

Accounts payable and accrued expenses |

|

|

1,872 |

|

|

|

(1,851 |

) |

|

Operating lease liability |

|

|

180 |

|

|

|

(237 |

) |

| Net Cash

Provided by Operating Activities |

|

|

6,034 |

|

|

|

4,878 |

|

| |

|

|

|

|

|

|

|

|

| CASH

FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Purchase of

fixed assets |

|

|

(5,022 |

) |

|

|

(671 |

) |

| Cash paid

for investment in Chef Inspirational Foods, LLC, net |

|

|

- |

|

|

|

(646 |

) |

| Net Cash

(Used in) Investing Activities |

|

|

(5,022 |

) |

|

|

(1,317 |

) |

| |

|

|

|

|

|

|

|

|

| CASH

FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Repayment of

term loan |

|

|

(1,274 |

) |

|

|

(1,265 |

) |

| Repayment of

line of credit, net |

|

|

- |

|

|

|

(890 |

) |

| Repayment of

related party note |

|

|

(1,200 |

) |

|

|

- |

|

| Repayment of

finance lease obligations |

|

|

(296 |

) |

|

|

(175 |

) |

| Payment of

Series B Preferred dividends |

|

|

- |

|

|

|

(49 |

) |

| Proceeds

from exercise of stock options |

|

|

55 |

|

|

|

65 |

|

| Net Cash

(Used in) Financing Activities |

|

|

(2,715 |

) |

|

|

(2,314 |

) |

| |

|

|

|

|

|

|

|

|

| Net

(Decrease) Increase in Cash |

|

|

(1,703 |

) |

|

|

1,247 |

|

| |

|

|

|

|

|

|

|

|

| Cash and

cash equivalents at beginning of period |

|

|

11,022 |

|

|

|

4,378 |

|

| |

|

|

|

|

|

|

|

|

| Cash and

cash equivalents at end of period |

|

$ |

9,319 |

|

|

$ |

5,625 |

|

| |

|

|

|

|

|

|

|

|

|

SUPPLEMENTARY CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

|

| Cash paid

during the period for: |

|

|

|

|

|

|

|

|

| Income

taxes |

|

$ |

947 |

|

|

$ |

112 |

|

| Interest |

|

$ |

329 |

|

|

$ |

477 |

|

| |

|

|

|

|

|

|

|

|

|

SUPPLEMENTARY DISCLOSURE OF NON-CASH INVESTING AND FINANCING

ACTIVITIES: |

|

|

|

|

|

|

|

|

| Conversion

of series B preferred stock to common stock |

|

$ |

- |

|

|

$ |

- |

|

| Finance

lease asset additions |

|

$ |

511 |

|

|

$ |

1,297 |

|

| Right of use

asset recognized |

|

$ |

873 |

|

|

$ |

- |

|

| Write-off of

right of use asset |

|

$ |

897 |

|

|

$ |

- |

|

| Related

party debt incurred for purchase of Chef Inspirational Foods,

LLC |

|

$ |

- |

|

|

$ |

2,700 |

|

| Settlement

of liability in common stock |

|

$ |

- |

|

|

$ |

50 |

|

| Issuance of

stock for director settlement |

|

$ |

450 |

|

|

$ |

- |

|

| Receipt of

fixed assets for deposits previously paid |

|

$ |

937 |

|

|

$ |

- |

|

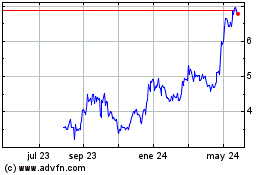

Mamas Creations (NASDAQ:MAMA)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

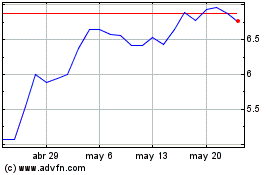

Mamas Creations (NASDAQ:MAMA)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024