FALSE000105635800010563582024-11-122024-11-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 12, 2024

MANNATECH, INCORPORATED

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | | | | | | | |

| Texas | 000-24657 | 75-2508900 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | |

| | 1410 Lakeside Parkway, Suite 200 | |

| | Flower Mound, | Texas | 75028 | |

| | (Address of Principal Executive Offices, including Zip Code) | |

| |

| Registrant’s Telephone Number, including Area Code: | (972) | 471-7400 |

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, | par value $0.0001 per share | MTEX | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | |

Emerging Growth Company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On November 12, 2024, Mannatech, Incorporated issued a press release announcing financial and operating results for the third quarter ended September 30, 2024. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | |

| Exhibit Number | Description |

| Press Release, dated November 12, 2024, titled Mannatech Reports Financial Results for Third Quarter 2024 |

*Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

November 12, 2024

| | | | | |

| MANNATECH, INCORPORATED |

| By: | /s/ Landen Fredrick |

| Landen Fredrick |

| Chief Executive Officer |

Mannatech Reports Financial Results for Third Quarter 2024

(Flower Mound, Texas) November 12, 2024 - Mannatech, Incorporated (NASDAQ: MTEX), ("Mannatech" or "Company"), global health and wellness company committed to transforming lives to make a better world, today announced financial results for its third quarter of 2024.

Third Quarter Highlights

•Net sales for the quarter ended September 30, 2024 were $31.7 million, as compared to $32.6 million for the same period in 2023, a decrease of $0.9 million, or 2.5%. On a Constant dollar basis (see Non-GAAP Measures, below) our net sales decreased $0.4 million, or 1.2%, and unfavorable foreign exchange caused a $0.5 million decrease in GAAP net sales as compared to the same period in 2023. The decline in revenues was principally due to slowing demand in Asia due to weakened economic conditions, relative to the prior year.

•Gross profit as a percentage of net sales decreased to 74.5% for the three months ended September 30, 2024, as compared to 79.6% for the same period in 2023, some of the increase in costs were related to increased freight costs related to back ordered items and running sales promotions on products thereby reducing our gross profit margin.

•Commission expenses for the three months ended September 30, 2024 decreased by 2.0%, or $0.2 million, to $12.2 million, as compared to $12.4 million for the same period in 2023. Commissions are earned from sales. Commission expenses in dollar terms decreased during the three months ended September 30, 2024 primarily due to a decline in our sales. For the three months ended September 30, 2024, commissions as a percentage of net sales increased to 38.3% from 38.2% for the same period in 2023. The increase in commissions as a percentage of sales was due to sales promotions during the period.

•For the three months ended September 30, 2024, selling and administrative expenses decreased by $2.8 million, or 21.8%, to $9.8 million, as compared to $12.6 million for the same period in 2023. The decrease in selling and administrative expenses was the result of a $0.9 million reduction in payroll costs, a $0.6 million decrease in marketing costs, a $0.6 million decrease to bad debt, a $0.3 million decrease in professional and consulting fees, a $0.2 million decrease in office expenses, $0.1 million decrease in depreciation expense and a $0.1 million decrease in travel and entertainment costs. Selling and administrative expenses, as a percentage of net sales, for the three months ended September 30, 2024 decreased to 31.0% from 38.6% for the same period in 2023.

•Income from operations was $0.9 million for the three months ended September 30, 2024 as compared to $0.2 million in the same period last year. The increase in operating income in 2024, was primarily a result of decreases in the company’s selling and administrative expenses as described in the previous paragraph.

•Income tax benefit was $0.4 million for the three months ended September 30, 2024 as compared to income tax expense of $0.5 million in the same period last year.

•Net loss was $0.3 million for the three months ended September 30, 2024, or $0.17 per diluted share, as compared to net income of $18,000, or $0.01 per diluted share for the three months ended September 30, 2023.

•As of September 30, 2024, the company's cash and cash equivalents increased 57.2%, or $4.4 million, to $12.2 million from $7.7 million as of December 31, 2023. Operations provided $2.5 million cash for the nine months ended September 30, 2024 compared to a use of $1.0 million cash for the same period in 2023. Acquisition of property and equipment decreased for the nine months ended September 30, 2024, to $0.4 million as compared to $0.5 million for the same period in 2023. Financing activities provided $2.9 million of cash during the nine months ended September 30, 2024. This increase consisted of $3.6 million in gross loan proceeds and use of $0.7 million for the repayment of finance lease obligations and other long-term liabilities. For the nine months ended September 30, 2023, $1.6 million was used related to payments for dividends of $0.7 million, repurchase of common stock of $0.2 million and $0.7 million for the repayment of lease obligations and other long-term liabilities. Additionally, foreign exchange effects decreased the Company's cash position by $0.6 million in the nine months ended September 30, 2024, as compared to a $2.3 million effect in the same period in 2023.

•The approximate number of new and continuing independent associate and preferred customer positions held by individuals in Mannatech’s network and associated with purchases of its packs or products as of September 30, 2024 was approximately 136,000, as compared to 146,000 in the same period of 2023. Recruiting new associates and preferred customers decreased 28.1% in the third quarter of 2024 as compared to the third quarter of 2023.

Landen Fredrick, President and CEO, noted that "although the third quarter of 2024 provided our highest revenue quarter in 2024, we continued to battle demand weakness in the third quarter across our global operations, with the most

significant impact in the Asia/Pacific region due to ongoing economic challenges. Despite anticipating continued economic difficulties for the rest of 2024, we are committed to increasing our revenue by growing our team of sales associates and expanding our base of preferred customers, all while keeping costs under strict cost controls."

Non-GAAP Financial Measures

In addition to results presented in accordance with GAAP, this press release and related tables include certain non-GAAP financial measures, including a presentation of Constant dollar measures. The company discloses operating results that have been adjusted to exclude the impact of changes due to the translation of foreign currencies into U.S. dollars, including changes in: Net Sales, Gross Profit, and Income from Operations.

The company believes that these non-GAAP financial measures provide useful information to investors because they are an indicator of the strength and performance of ongoing business operations. The constant currency figures are financial measures used by management to provide investors with an additional perspective on trends. Although management believes the non-GAAP financial measures enhance investors’ understanding of their business and performance, these non-GAAP financial measures should not be considered an exclusive alternative to accompanying GAAP financial measures. Please see the accompanying table entitled "Non-GAAP Financial Measures" for a reconciliation of these non-GAAP financial measures.

Safe Harbor statement

This release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements generally can be identified by use of phrases or terminology such as “may,” “will,” “should,” "hope," “could,” “would,” “expects,” “plans,” “intends,” “anticipates,” “believes,” “estimates,” “approximates,” “predicts,” “projects,” “potential,” and “continues” or other similar words or the negative of such terminology. Similarly, descriptions of Mannatech’s objectives, strategies, plans, goals or targets contained herein are also considered forward-looking statements. Mannatech believes this release should be read in conjunction with all of its filings with the United States Securities and Exchange Commission and cautions its readers that these forward-looking statements are subject to certain events, risks, uncertainties, and other factors. Some of these factors include, among others, Mannatech’s inability to attract and retain associates and members, increases in competition, litigation, regulatory changes, and its planned growth into new international markets. Although Mannatech believes that the expectations, statements, and assumptions reflected in these forward-looking statements are reasonable, it cautions readers to always consider all of the risk factors and any other cautionary statements carefully in evaluating each forward-looking statement in this release, as well as those set forth in its latest Annual Report on Form 10-K, and other filings filed with the United States Securities and Exchange Commission, including its current reports on Form 8-K. All of the forward-looking statements contained herein speak only as of the date of this release.

^ Mannatech operates in China under a cross-border e-commerce platform that is separate from its network marketing model.

Individuals interested in Mannatech's products or in exploring its business opportunity can learn more at Mannatech.com.

Contact Information:

Erin K. Barta

General Counsel and Corporate Secretary

214-724-3378

ir@mannatech.com

www.mannatech.com

MANNATECH, INCORPORATED AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS - (UNAUDITED)

(in thousands, except share and per share information)

| | | | | | | | | | | |

| ASSETS | September 30, 2024 (unaudited) | | December 31, 2023 |

| Cash and cash equivalents | $ | 12,150 | | | $ | 7,731 | |

| Restricted cash | 939 | | | 938 | |

| Accounts receivable, net of allowance of $932 and $1,278 | 22 | | | 91 | |

| Income tax receivable | 414 | | | 465 | |

| Inventories, net | 11,660 | | | 14,535 | |

| Prepaid expenses and other current assets | 2,291 | | | 1,774 | |

| Deferred commissions | 1,224 | | | 2,130 | |

| Total current assets | 28,700 | | | 27,664 | |

| Property and equipment, net | 3,118 | | | 4,147 | |

| Operating lease right-of-use assets | 2,532 | | | 3,315 | |

| | | |

| Other assets | 3,674 | | | 3,751 | |

| Deferred tax assets, net | 1,913 | | | 1,611 | |

| Long-term restricted cash | 635 | | | 718 | |

| Total assets | $ | 40,572 | | | $ | 41,206 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| Commissions and incentives payable | $ | 8,203 | | | $ | 8,175 | |

| Accrued expenses | 4,803 | | | 5,118 | |

| Deferred revenue | 3,018 | | | 4,786 | |

| Accounts payable | 3,580 | | | 4,010 | |

| Taxes payable | 1,361 | | | 1,521 | |

| Current notes payable | 208 | | | 240 | |

| Current portion of finance lease liabilities | 271 | | | 269 | |

| Deferred tax liabilities, net | — | | | — | |

| Total current liabilities | 22,952 | | | 25,780 | |

| Long-term notes payable | 3,600 | | | — | |

| Operating lease liabilities, excluding current portion | 1,787 | | | 2,582 | |

| Other long-term liabilities | 1,483 | | | 1,404 | |

| Finance lease liabilities, excluding current portion | 751 | | | 956 | |

| Total liabilities | 30,573 | | | 30,722 | |

| | | |

| | | |

| | | |

| Shareholders’ equity: | | | |

| Preferred stock, $0.01 par value, 1,000,000 shares authorized, no shares issued or outstanding | — | | | — | |

Common stock, $0.0001 par value, 99,000,000 shares authorized, 2,742,857 shares issued and 1,884,814 shares outstanding as of September 30, 2024 and 2,742,857 shares issued and 1,860,154 shares outstanding as of December 31, 2023 | — | | | — | |

| Additional paid-in capital | 33,005 | | | 33,309 | |

| Accumulated deficit | (1,073) | | | (1,301) | |

| Accumulated other comprehensive loss | (1,997) | | | (1,015) | |

Treasury stock, at average cost, 858,043 shares as of September 30, 2024 and 882,703 shares as of December 31, 2023 | (19,936) | | | (20,509) | |

| Total shareholders’ equity | 9,999 | | | 10,484 | |

| Total liabilities and shareholders’ equity | $ | 40,572 | | | $ | 41,206 | |

MANNATECH, INCORPORATED AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS - (UNAUDITED)

(in thousands, except per share information)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | $ | 31,725 | | | $ | 32,553 | | | $ | 88,858 | | | $ | 99,261 | |

| Cost of sales | 8,105 | | | 6,625 | | | 20,763 | | | 21,042 | |

| Gross profit | 23,620 | | | 25,928 | | | 68,095 | | | 78,219 | |

| Operating expenses: | | | | | | | |

| Commissions and incentives | 12,893 | | | 13,178 | | | 36,237 | | | 40,200 | |

| Selling and administrative expenses | 9,840 | | | 12,578 | | | 31,293 | | | 38,088 | |

| | | | | | | |

| | | | | | | |

| Total operating expenses | 22,733 | | | 25,756 | | | 67,530 | | | 78,288 | |

| Income (loss) from operations | 887 | | | 172 | | | 565 | | | (69) | |

| Interest expense, net | (109) | | | (17) | | | (196) | | | (3) | |

| Other (expense) income, net | (1,495) | | | 320 | | | 495 | | | 803 | |

| (Loss) income before income taxes | (717) | | | 475 | | | 864 | | | 731 | |

| Income tax benefit (expense) | 389 | | | (457) | | | (636) | | | (1,214) | |

| Net (loss) income | $ | (328) | | | $ | 18 | | | $ | 228 | | | $ | (483) | |

| (Loss) income per common share: | | | | | | | |

| Basic | $ | (0.17) | | | $ | 0.01 | | | $ | 0.12 | | | $ | (0.26) | |

| Diluted | $ | (0.17) | | | $ | 0.01 | | | $ | 0.12 | | | $ | (0.26) | |

| Weighted-average common shares outstanding: | | | | | | | |

| Basic | 1,885 | | | 1,863 | | | 1,885 | | | 1,868 | |

| Diluted | 1,885 | | | 1,863 | | | 1,885 | | | 1,868 | |

Net sales by region for the three and nine months ended September 30, 2024 and 2023 were as follows (in millions, except percentages):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| Region | | 2024 | | 2023 | | 2024 | | 2023 |

| Americas | | $ | 10.6 | | | 33.4 | % | | $ | 10.7 | | | 32.8 | % | | $ | 30.4 | | | 34.2 | % | | $ | 31.8 | | | 32.0 | % |

| Asia/Pacific | | 18.6 | | | 58.7 | % | | 19.6 | | | 60.1 | % | | 51.6 | | | 58.0 | % | | 60.0 | | | 60.4 | % |

| EMEA | | 2.5 | | | 7.9 | % | | 2.3 | | | 7.1 | % | | 6.9 | | | 7.8 | % | | 7.5 | | | 7.6 | % |

| Total sales | | $ | 31.7 | | | 100.0 | % | | $ | 32.6 | | | 100.0 | % | | $ | 88.9 | | | 100.0 | % | | $ | 99.3 | | | 100.0 | % |

Non-GAAP Financial Measures (Sales, Gross Profit and Income from Operations in Constant Dollars)

To supplement its financial results presented in accordance with generally accepted accounting principles in the United States (“GAAP”), Mannatech discloses operating results that have been adjusted to exclude the impact of changes due to the translation of foreign currencies into U.S. dollars, including changes in: Net Sales, Gross Profit, and Income from Operations. It refers to these adjusted financial measures as Constant dollar items, which are non-GAAP financial measures. The company believes these measures provide investors with an additional perspective on trends. To exclude the impact of changes due to the translation of foreign currencies into U.S. dollars, it calculates current year results and prior year results at a constant exchange rate, which is the prior year’s rate. Currency impact is determined as the difference between the actual GAAP results and the recalculated results for the current year at the Constant dollar rates.

The tables below reconcile third quarter 2024 and year-to-date Constant dollar net sales, gross profit and income from operations to GAAP net sales, gross profit and income from operations. (in millions, except percentages):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three-month period ended | September 30, 2024 | | September 30, 2023 | | Constant $ Change |

| GAAP

Measure:

Total $ | Translation Adjustment | Non-GAAP

Measure:

Constant $ | | GAAP

Measure:

Total $ | | Dollar | Percent |

| Net sales | $ | 31.7 | | $ | 0.5 | | $ | 32.2 | | | $ | 32.6 | | | $ | (0.4) | | (1.2) | % |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Gross profit | 23.6 | | 0.4 | | 24.0 | | | 25.9 | | | (1.9) | | (7.3) | % |

| Income from operations | 0.9 | | 0.1 | | 1.0 | | | 0.2 | | | 0.8 | | 400.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine-month period ended | September 30, 2024 | | September 30, 2023 | | Constant $ Change |

| GAAP

Measure:

Total $ | Translation Adjustment | Non-GAAP

Measure:

Constant $ | | GAAP

Measure:

Total $ | | Dollar | Percent |

| Net sales | $ | 88.9 | | $ | 1.9 | | $ | 90.8 | | | $ | 99.3 | | | $ | (8.5) | | (8.6) | % |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Gross profit | 68.1 | | 1.5 | 69.6 | | | 78.2 | | | (8.6) | | (11.0) | % |

| Income (loss) from operations | 0.6 | | $ | 0.5 | | 1.1 | | | (0.1) | | | 1.2 | | (1,200.0) | % |

v3.24.3

Cover

|

Nov. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 12, 2024

|

| Entity Registrant Name |

MANNATECH, INCORPORATED

|

| Entity Address, City or Town |

Flower Mound,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75028

|

| Local Phone Number |

471-7400

|

| City Area Code |

(972)

|

| Entity Incorporation, State or Country Code |

TX

|

| Entity File Number |

000-24657

|

| Entity Tax Identification Number |

75-2508900

|

| Entity Address, Address Line One |

1410 Lakeside Parkway, Suite 200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock,

|

| Trading Symbol |

MTEX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001056358

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

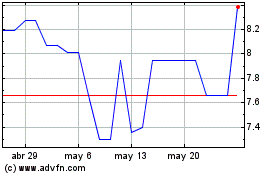

Mannatech (NASDAQ:MTEX)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Mannatech (NASDAQ:MTEX)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024