Ocugen, Inc. (Ocugen or the Company) (NASDAQ: OCGN), a

biotechnology company focused on discovering, developing, and

commercializing novel gene and cell therapies, biologics, and

vaccines, today reported second quarter 2024 financial results

along with a business update.

“The first half of 2024 has been marked with significant

accomplishments for our modifier gene therapy platform—including

dosing patients in the OCU400 Phase 3 clinical trial for retinitis

pigmentosa (RP) and progressing into Phase 2 of the OCU410 ArMaDa

clinical trial for the treatment of geographic atrophy (GA),” said

Dr. Shankar Musunuri, Chairman, CEO, and Co-founder of Ocugen.

“These meaningful milestones bring us closer to providing a

potential one-time therapy for life for patients living with RP

(300,000 in the U.S. and Europe) and GA (2-3 million in the U.S.

and Europe) who desperately need effective treatment options.

Thanks to our Ocugen team for their tireless efforts to keep these

and all our clinical trials on track.”

The OCU400 Phase 3 trial has a sample size of 150 participants:

one arm has 75 participants with RHO gene mutations, and

the other arm has 75 participants with mutations in any of several

other genes associated with RP. The Luminance Dependent Navigation

Assessment (LDNA) is the primary endpoint for the study. In this

assessment, a participant navigates an obstacle course that

constitutes a more sensitive and specific measurement of visual

function than the mobility measurement used in previous Phase 3

clinical trials. The Phase 3 liMeliGhT trial will focus on the

proportion of responders, in treated and untreated groups, who

achieve an improvement of at least 2 Lux (light) levels from

baseline in the study eyes. More than 60% of the intent-to-treat

patients from the Phase 1/2 clinical trial, including patients with

the RHO mutation, meet the responder criteria established for Phase

3. The Phase 3 mobility test responder rate for the only

FDA-approved product to treat one mutation in RP was 52%. The Phase

3 trial is powered greater than 95% assuming a 50% responder

rate.

Recently, the FDA approved the OCU400 expanded access program

(EAP) for the treatment of adult patients, aged 18 and older, with

RP. This is the first ever gene therapy candidate to treat patients

with RP, regardless of mutation, approved for an EAP and the EAP

further supports the gene-agnostic mechanism of action for this

novel modifier gene therapy.

Novel modifier gene therapy has the potential to address

multiple inherited retinal diseases as well as multifactorial

causes of blindness that affect millions of patients, like dry

age-related macular degeneration (dAMD). OCU410 and OCU410ST aim to

treat geographic atrophy secondary to dAMD and Stargardt disease,

respectively. These modifier gene therapies leverage a nuclear

hormone receptor gene called RORA (RAR-related orphan receptor A)

as a potential one-time therapy for life with a single sub-retinal

injection.

OCU410 is specifically designed to address multiple pathways

implicated in the pathogenesis of dAMD and offers a distinct

advantage over current treatment options that target only one

pathway—the complement system—and require frequent intravitreal

injections (about 6-12 doses per year), accompanied by various

safety concerns, such as roughly 12% of patients progressing to wet

AMD. OCU410 has the potential to regulate all four pathways related

to disease progression—lipid metabolism, inflammation, oxidative

stress, and the complement system—with a one-time sub-retinal

injection.

OCU410ST has received an Orphan Drug Designation from the FDA

for the treatment of Stargardt disease, which has no approved

treatment and affects approximately 100,000 people in the U.S. and

Europe combined. The third cohort of the clinical trial is

currently receiving the high dose. OCU410ST has the potential to be

the first one-time gene therapy for Stargardt disease.

Ocugen continues to pursue strategic partnerships that will

drive long-term strategy, and most importantly, will help patients

access these novel modifier gene therapies globally. During the

2024 BIO International Convention, Ocugen engaged with potential

partners and pharmaceutical executives to explore opportunities for

the Company’s dynamic pipeline.

“Ocugen’s inclusion in the Russell Index in June further

bolsters the value of our pipeline and recognizes the Company’s

robust growth strategy,” said Dr. Musunuri. “This ranking supports

our efforts to enable long-term shareholder value, garner

significant visibility for Ocugen within the investment community,

and broaden our shareholder base. I look forward to the second half

of 2024 as we continue to solidify Ocugen’s position as a

biotechnology leader.”

Subsequent to June 30, 2024, the Company closed a public

offering of common stock with net proceeds of $32.6

million—extending its expected cash runway into the third quarter

of 2025. The offering was led by a large premier mutual fund, along

with participation from leading life sciences investors.

Ophthalmic Gene Therapies—First-in-Class

OCU400 – Ocugen is actively dosing subjects in

the OCU400 Phase 3 liMeliGhT trial for the treatment of RP. With

dosing of the Phase 3 trial underway, OCU400 remains on track for

the 2026 BLA and MAA approval targets.

OCU410 – In July 2024, Ocugen announced the

completion of dosing in the third cohort of the OCU410 Phase 1/2

ArMaDa clinical trial for the treatment of GA. To date, nine

patients with GA have been dosed in the Phase 1/2 clinical trial

(with low, medium, and high doses). Phase 2 of the clinical trial

has been initiated and will assess the safety and efficacy of

OCU410 in a larger group of patients who will be randomized into

either of two treatment groups (medium or high dose) or a control

group.

OCU410ST – Currently dosing the high dose of

OCU410ST in the dose-escalation phase of the study.

Regenerative Cell Therapies—First-in-class

NeoCart® – Ocugen intends to initiate the

Phase 3 trial contingent on the availability of adequate

funding.Vaccines Portfolio—First-in-class

Inhaled Mucosal Vaccine Platform – NIAID plans

to submit an IND to initiate the OCU500 (COVID-19) Phase 1 clinical

trial this year. Ocugen is continuing discussions with relevant

government agencies as well as strategic partners regarding funding

for the development of the OCU510 and OCU520 platforms.

Ophthalmic Biologic Product

OCU200 – Ocugen continues to work with the FDA

to lift the clinical hold.

Second Quarter 2024 Financial Results

- Received $32.6 million net cash from

underwritten public offering of common stock that closed on August

2, 2024.

- The Company’s cash, cash

equivalents, and restricted cash totaled $16.0 million as of

June 30, 2024, compared to $39.5 million as of

December 31, 2023. The Company had 257.4 million shares of

common stock outstanding as of June 30, 2024.

- Total operating expenses for the

three months ended June 30, 2024 were $16.6 million and

included research and development expenses of $8.9 million and

general and administrative expenses of $7.7 million. This

compares to total operating expenses for the three months ended

June 30, 2023 of $24.0 million that included research and

development expenses of $14.5 million and general and

administrative expenses of $9.5 million.

- Ocugen reported a $0.04 net loss per

common share for the three months ended June 30, 2024 compared

to a $0.10 net loss per common share for the three months ended

June 30, 2023.

Conference Call and Webcast Details

Ocugen has scheduled a conference call and webcast for 8:30 a.m.

ET today to discuss the financial results and recent business

highlights. Ocugen’s senior management team will host the call,

which will be open to all listeners. There also will be a

question-and-answer session following the prepared remarks.

Attendees are invited to participate on the call or webcast:

Dial-in Numbers: (800) 715-9871 for U.S. callers and (646)

307-1963 for international callersConference ID: 7453742Webcast:

Available on the events section of the

Ocugen investor siteA replay of the call and archived webcast

will be available for approximately 45 days following the event on

the Ocugen investor site.

About Ocugen, Inc.Ocugen, Inc. is a

biotechnology company focused on discovering, developing, and

commercializing novel gene and cell therapies, biologics, and

vaccines that improve health and offer hope for patients across the

globe. We are making an impact on patients’ lives through

courageous innovation—forging new scientific paths that harness our

unique intellectual and human capital. Our breakthrough modifier

gene therapy platform has the potential to treat multiple retinal

diseases with a single product, and we are advancing research in

infectious diseases to support public health and orthopedic

diseases to address unmet medical needs. Discover more

at www.ocugen.com and follow us

on X and LinkedIn.

Cautionary Note on Forward-Looking

StatementsThis press release contains forward-looking

statements within the meaning of The Private Securities Litigation

Reform Act of 1995, including, but not limited to, strategy,

business plans and objectives for Ocugen’s clinical programs, plans

and timelines for the preclinical and clinical development of

Ocugen’s product candidates, including the therapeutic potential,

clinical benefits and safety thereof, expectations regarding

timing, success and data announcements of current ongoing

preclinical and clinical trials, the ability to initiate new

clinical programs; Ocugen’s financial condition and expected cash

runway into the third quarter of 2025, statements regarding

qualitative assessments of available data, potential benefits,

expectations for ongoing clinical trials, anticipated regulatory

filings and anticipated development timelines, which are subject to

risks and uncertainties. We may, in some cases, use terms such as

“predicts,” “believes,” “potential,” “proposed,” “continue,”

“estimates,” “anticipates,” “expects,” “plans,” “intends,” “may,”

“could,” “might,” “will,” “should,” or other words that convey

uncertainty of future events or outcomes to identify these

forward-looking statements. Such statements are subject to numerous

important factors, risks, and uncertainties that may cause actual

events or results to differ materially from our current

expectations, including, but not limited to, the risks that

preliminary, interim and top-line clinical trial results may not be

indicative of, and may differ from, final clinical data; that

unfavorable new clinical trial data may emerge in ongoing clinical

trials or through further analyses of existing clinical trial data;

that earlier non-clinical and clinical data and testing of may not

be predictive of the results or success of later clinical trials;

and that that clinical trial data are subject to differing

interpretations and assessments, including by regulatory

authorities. These and other risks and uncertainties are more fully

described in our annual and periodic filings with the Securities

and Exchange Commission (SEC), including the risk factors described

in the section entitled “Risk Factors” in the quarterly and annual

reports that we file with the SEC. Any forward-looking statements

that we make in this press release speak only as of the date of

this press release. Except as required by law, we assume no

obligation to update forward-looking statements contained in this

press release whether as a result of new information, future

events, or otherwise, after the date of this press release.

Contact:Tiffany HamiltonAVP, Head of

CommunicationsTiffany.Hamilton@ocugen.com

(Tables to follow)

|

OCUGEN, INC. |

|

CONSOLIDATED BALANCE SHEETS |

|

(in thousands) |

|

(Unaudited) |

| |

| |

June 30, 2024 |

|

December 31, 2023 |

| Assets |

|

|

|

|

Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

15,697 |

|

|

$ |

39,462 |

|

|

Prepaid expenses and other current assets |

|

2,920 |

|

|

|

3,509 |

|

|

Total current assets |

|

18,617 |

|

|

|

42,971 |

|

|

Property and equipment, net |

|

17,474 |

|

|

|

17,290 |

|

|

Restricted cash |

|

302 |

|

|

|

— |

|

|

Other assets |

|

4,149 |

|

|

|

4,286 |

|

| Total

assets |

$ |

40,542 |

|

|

$ |

64,547 |

|

| Liabilities and

stockholders' equity |

|

|

|

|

Current liabilities |

|

|

|

|

Accounts payable |

$ |

3,391 |

|

|

$ |

3,172 |

|

|

Accrued expenses and other current liabilities |

|

12,814 |

|

|

|

13,343 |

|

|

Operating lease obligations |

|

461 |

|

|

|

574 |

|

|

Current portion of long term debt |

|

1,306 |

|

|

|

— |

|

|

Total current liabilities |

|

17,972 |

|

|

|

17,089 |

|

|

Non-current liabilities |

|

|

|

|

Operating lease obligations, less current portion |

|

3,546 |

|

|

|

3,567 |

|

|

Long term debt, net |

|

1,552 |

|

|

|

2,800 |

|

|

Other non-current liabilities |

|

545 |

|

|

|

527 |

|

| Total non-current

liabilities |

|

5,643 |

|

|

|

6,894 |

|

| Total liabilities |

|

23,615 |

|

|

|

23,983 |

|

| Stockholders' equity |

|

|

|

|

Convertible preferred stock |

|

— |

|

|

|

1 |

|

|

Common stock |

|

2,576 |

|

|

|

2,567 |

|

|

Treasury stock |

|

(48 |

) |

|

|

(48 |

) |

|

Additional paid-in capital |

|

327,742 |

|

|

|

324,191 |

|

|

Accumulated other comprehensive income |

|

28 |

|

|

|

20 |

|

|

Accumulated deficit |

|

(313,371 |

) |

|

|

(286,167 |

) |

| Total stockholders' equity |

|

16,927 |

|

|

|

40,564 |

|

| Total liabilities and

stockholders' equity |

$ |

40,542 |

|

|

$ |

64,547 |

|

|

OCUGEN, INC. |

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(in thousands, except share and per share

amounts) |

|

(Unaudited) |

| |

| |

Three months ended June 30, |

|

Six months ended June 30, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Collaborative arrangement revenue |

$ |

1,141 |

|

|

$ |

485 |

|

|

$ |

2,155 |

|

|

$ |

928 |

|

| Total revenue |

|

1,141 |

|

|

|

485 |

|

|

|

2,155 |

|

|

|

928 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

Research and development |

|

8,902 |

|

|

|

14,574 |

|

|

|

15,728 |

|

|

|

24,746 |

|

|

General and administrative |

|

7,688 |

|

|

|

9,451 |

|

|

|

14,092 |

|

|

|

17,757 |

|

| Total operating expenses |

|

16,590 |

|

|

|

24,025 |

|

|

|

29,820 |

|

|

|

42,503 |

|

| Loss from operations |

|

(15,449 |

) |

|

|

(23,540 |

) |

|

|

(27,665 |

) |

|

|

(41,575 |

) |

| Other income (expense),

net |

|

169 |

|

|

|

475 |

|

|

|

461 |

|

|

|

1,184 |

|

| Net loss |

$ |

(15,280 |

) |

|

$ |

(23,065 |

) |

|

$ |

(27,204 |

) |

|

$ |

(40,391 |

) |

| |

|

|

|

|

|

|

|

| Net loss — basic and

diluted |

|

(15,280 |

) |

|

|

(23,065 |

) |

|

|

(27,204 |

) |

|

|

(40,391 |

) |

| Redeemed Series B convertible

preferred stock |

|

4,988 |

|

|

|

— |

|

|

|

4,988 |

|

|

|

— |

|

| Net loss available to common

shareholders— basic and diluted |

|

(10,292 |

) |

|

|

(23,065 |

) |

|

|

(22,216 |

) |

|

|

(40,391 |

) |

| Shares used in calculating net

loss per common share — basic and diluted |

|

257,353,857 |

|

|

|

238,311,498 |

|

|

|

257,293,247 |

|

|

|

231,952,888 |

|

| Net loss per share available

to common shareholders — basic and diluted |

$ |

(0.04 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.09 |

) |

|

$ |

(0.17 |

) |

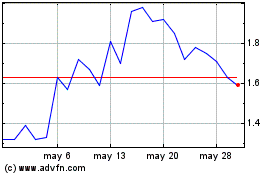

Ocugen (NASDAQ:OCGN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Ocugen (NASDAQ:OCGN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024