Form 8-K - Current report

13 Septiembre 2023 - 4:15PM

Edgar (US Regulatory)

false 0001830033 0001830033 2023-09-13 2023-09-13 0001830033 pct:CommonStockParValue0.001PerShareMember 2023-09-13 2023-09-13 0001830033 pct:WarrantsEachExercisableForOneShareOfCommonStock0.001ParValuePerShareAtAnExercisePriceOf11.50PerShareMember 2023-09-13 2023-09-13 0001830033 pct:UnitsEachConsistingOfOneShareOfCommonStock0.001ParValuePerShareAndThreeQuartersOfOneWarrantMember 2023-09-13 2023-09-13

United States

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 Or 15(d)

of the Securities Exchange Act Of 1934

Date of report (Date of earliest event reported): September 13, 2023

PureCycle Technologies, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Delaware |

|

001-40234 |

|

86-2293091 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

|

|

|

|

|

|

| 5950 Hazeltine National Drive, |

|

|

|

Suite 300, |

|

Orlando |

|

|

| Florida |

|

32822 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (877) 648-3565

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

PCT |

|

The Nasdaq Stock Market LLC |

| Warrants, each exercisable for one share of common stock, $0.001 par value per share, at an exercise price of $11.50 per share |

|

PCTTW |

|

The Nasdaq Stock Market LLC |

| Units, each consisting of one share of common stock, $0.001 par value per share, and three quarters of one warrant |

|

PCTTU |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On October 7, 2020, the Southern Ohio Port Authority (“SOPA”) issued certain revenue bonds (the “Revenue Bonds”) pursuant to an Indenture of Trust dated as of October 1, 2020 (as amended, restated, supplemented or otherwise modified from time to time, the “Indenture”), between SOPA and UMB Bank, N.A., as trustee (“Trustee”), and loaned the proceeds from their sale to PureCycle: Ohio LLC (“PCO”), an Ohio limited liability company and indirect wholly-owned subsidiary of PureCycle Technologies, Inc. (the “Company”), pursuant to a loan agreement dated as of October 1, 2020, between SOPA and PCO (as amended, restated, supplemented or otherwise modified from time to time, the “Loan Agreement”), to be used to, among other things, acquire, construct and equip the Company’s first commercial-scale recycling facility in Lawrence County, Ohio (the “Ironton Facility”).

On March 15, 2023, SOPA, PCO, PureCycle Technologies LLC, PCTO Holdco LLC (the pledgor under an Equity Pledge and Security Agreement (as defined in the Indenture), pursuant to which the pledgor pledged certain interests to secure obligations of PCO under various Financing Documents (as defined in the Indenture) relating to the Revenue Bonds) and the Trustee entered into a Limited Waiver and First Supplemental Indenture (the “Limited Waiver”), supplementing the Indenture and amending the Loan Agreement and the amended and restated Guaranty (as defined in the Indenture), to which the majority holders of the Series 2020A Bonds (the “Majority Holders”) consented and pursuant to which, based on conditions stated therein, the Majority Holders acknowledged and agreed to the existence of a Specified Event of Default (as defined below) under the Indenture and the Loan Agreement.

Under the terms of the Loan Agreement, PCO was required to cause the Ironton Facility to be completed by December 1, 2022. The Ironton Facility was not completed by that date due to a variety of challenges resulting from, among other things, the COVID-19 outbreak, the ongoing military conflict between Russia and Ukraine, and certain U.S. weather-related events (the “Specified Event of Default”).

Subject to the conditions set forth in the Limited Waiver, the Specified Event of Default was waived in exchange for PCO’s agreement to meet certain milestones toward completing the Ironton Facility, including, but not limited to, a requirement that PCO shall have produced 4.45 million pounds of pellets from Project feedstock in a single month by September 30, 2023 (the “September Milestone”).

On August 7, 2023, the Ironton Facility experienced a full plant power outage resulting from a severe weather impact to a third party power supplier. Operations resumed but, on September 3, 2023, the Ironton Facility experienced a seal system failure in a key operation that resulted in a loss of barrier fluid pressure surrounding the seal. The seal failure required the Ironton Facility to halt operations to assess any damage and the root cause of the seal failure.

On September 7, 2023, following removal and evaluation of the mechanical component and evaluation of the issue by two different third parties, PCO and the Company concluded that the seal failure was the result of the August 7, 2023 full plant power outage caused by a failure of a third party power supply utility. PCO undertook immediate steps to initiate the repair. PCO installed a spare seal and initiated restart procedures at the Ironton Facility on September 11, 2023. PCO and the Company are unable to eliminate the risk that the restart will be unsuccessful, or whether other failures resulting from the August 7, 2023 power outage may be discovered in the future.

On September 13, 2023, PCO provided Notice of a Force Majeure Event pursuant to Section 2.4(b)(vi)(C)(VI) of the Loan Agreement, and intends to engage with the Trustee regarding required adjustments to the September Milestone.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

PURECYCLE TECHNOLOGIES, INC. |

|

|

|

|

| Date: September 13, 2023 |

|

|

|

By: |

|

/s/ Lawrence Somma |

|

|

|

|

|

|

Lawrence Somma |

|

|

|

|

|

|

Chief Financial Officer |

Ironton Operations Update September

13, 2023 Exhibit 99.1

Forward-Looking Statements Certain

statements in this Presentation contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), including statements about the force majeure declaration at PureCycle Technologies, Inc.’s (“PCT”) first commercial-scale recycling facility in Lawrence County, Ohio (the “Ironton

Facility”), the status of the force majeure and the anticipated duration of the force majeure, and the financial condition, results of operations, earnings outlook and prospects of PureCycle Technologies, Inc. (“PCT”).

Forward-looking statements generally relate to future events or PCT’s future financial or operating performance and may refer to projections and forecasts. Forward-looking statements are typically identified by words such as

“plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,”

“could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such

words or expressions), but the absence of these words does not mean that a statement is not forward-looking. The forward-looking statements are based on the current expectations of the management of PCT and are inherently subject to

uncertainties and changes in circumstances and their potential effects and speak only as of the date of this presentation. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements

involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are

not limited to, those factors described in the section of PCT’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 entitled “Risk Factors,” those discussed and identified in other public filings made with the

U.S. Securities and Exchange Commission (the “SEC”) by PCT and the following: PCT’s ability to obtain funding for its operations and future growth and to continue as a going concern; PCT's ability to meet, and to continue to

meet, applicable regulatory requirements for the use of PCT's UPR resin in food grade applications (including in the United States, Europe, Asia and other international locations); PCT's ability to comply on an ongoing basis with the numerous

regulatory requirements applicable to the UPR resin and PCT's facilities (including in the United States, Europe, Asia and future international locations); expectations and changes regarding PCT's strategies and future financial

performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses

of cash, capital expenditures, and PCT's ability to invest in growth initiatives; the ability of the Ironton Facility to be appropriately certified by Leidos Engineering, LLC, following certain performance and other tests, and commence full-scale

commercial operations in a timely and cost-effective manner; PCT's ability to complete the necessary funding with respect to, and complete the construction of, (i) its first U.S. multi-line facility, located in Augusta, Georgia (the

“Augusta Facility”); (ii) its first commercial-scale European plant located in Antwerp, Belgium and (iii) its first commercial-scale Asian plant located in Ulsan, South Korea, in a timely and cost-effective manner; PCT's ability to

sort and process polypropylene plastic waste at its plastic waste prep ("Feed PreP") facilities; PCT's ability to maintain exclusivity under the Procter & Gamble Company license; the implementation, market acceptance and success of PCT's

business model and growth strategy; the success or profitability of PCT's offtake arrangements; the ability to source feedstock with a high polypropylene content at a reasonable cost; PCT's future capital requirements and sources and

uses of cash; developments and projections relating to PCT's competitors and industry; the outcome of any legal or regulatory proceedings to which PCT is, or may become a party, including the securities class action case; geopolitical

risk and changes in applicable laws or regulations; the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors, including rising interest rates, availability of capital, economic cycles, and other

macro-economic impacts; turnover or increases in employees and employee-related costs; changes in the prices and availability of labor (including labor shortages), transportation and materials, including significant inflation, supply chain

conditions and its related impact on energy and raw materials, and PCT's ability to obtain them in a timely and cost-effective manner; any business disruptions due to political or economic instability, pandemics, armed hostilities (including the

ongoing conflict between Russia and Ukraine); the potential impact of climate change on PCT, including physical and transition risks, higher regulatory and compliance costs, reputational risks, and availability of capital on attractive terms;

operational risk; and PCT's ability to meet, and to continue to meet, the requirements imposed upon it and its subsidiaries by the funding for its operations, including the funding for the Ironton Facility. The forward-looking statements in

this Presentation represent PCT’s views as of the date of this Presentation. Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of PCT prove incorrect, actual results may vary

in material respects from those projected in these forward-looking statements. All subsequent written and oral forward-looking statements or other matters attributable to PCT or any person acting on their behalf are expressly qualified in

their entirety by the cautionary statements contained or referred to in this Presentation. Except to the extent required by applicable law or regulation, PCT undertakes no obligation to update these forward-looking statements to reflect events or

circumstances after the date of this Presentation or to reflect the occurrence of unanticipated events.

Executive Summary The Ironton Facility

was negatively impacted by a severe thunderstorm which knocked out the power to southern Ohio and Ironton for an extended period of time Given the negative impact on the Ironton Facility from the power outage, PureCycle is declaring force

majeure as a result of the incident Force Majeure was declared given uncertainties of PureCycle's ability to achieve one or more remaining milestones We expect to have the plant restored and back online as soon as reasonably

possible but this will be done methodically with a focus on safety and improving reliability

Force Majeure Timeline Event timeline

On 7-August, the Ironton Facility experienced a full power outage for approximately 2 hours; the Ironton Facility initially recovered the next day without any identifiable significant issues. On 25-August, the mechanical component appeared to

fail. The Ironton Facility was cycled down, evaluated, and then returned to service within 4 days. The mechanical component recovered without any obvious indication of ongoing problems. On 3-September, that same mechanical

component failed completely. Two separate field repairs were attempted, but the component was deemed irreparable on 5-September. The mechanical component was replaced with a spare on 9-September and the Ironton Facility is currently

in the process of restarting. Force Majeure Notice Following the 3-September event, two separate 3rd parties independently evaluated the component and determined that the failure was attributable to the 7-August full power failure

of an outside supplier due to severe storms. Due to the extended outage which delayed plant production, the Company currently does not expect to meet the 30-September milestone in its Ohio bond agreements requiring one month's production

of 4.45MM lbs. of ultra-pure recycled resin. The Company intends to engage with bondholders but, in an abundance of caution, filed a Notice of Force Majeure with the Trustee on 13-September.

Ironton Facility Operations Update Now

that the Ironton Facility mechanical component has been replaced, PureCycle is working methodically to reestablish operations. Most recent final product quality (9/1) is on specification and has been certified by the onsite laboratory; we have

achieved significant product quality improvements since June 2023. The Ironton Facility expects to ship the first commercial customer orders soon.

Ironton is making solid progress

Equipment issues; Normal startup activity. Mechanical in nature, not core tech; flange leaks, seal leaks, & screen leaks. Root Cause Failure Analysis (RCFA) have been performed on each failure with good reliability improvements implemented each

time. Product quality improvements; Took several weeks longer to sweep the construction debris from the system to make on specification product quality. Current product quality is on spec which indicates all critical construction debris has been

removed from system. Operations learning curve; PureCycle Ironton’s Operational Team is growing into a 24/7 operation, but at times it means slowing down to ensure the development of the right experience. This complements our intent

to safely, reliably, and methodically operate the Ironton facility.

v3.23.2

Document and Entity Information

|

Sep. 13, 2023 |

| Document And Entity Information [Line Items] |

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001830033

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 13, 2023

|

| Entity Registrant Name |

PureCycle Technologies, Inc.

|

| Entity Incorporation State Country Code |

DE

|

| Entity File Number |

001-40234

|

| Entity Tax Identification Number |

86-2293091

|

| Entity Address, Address Line One |

5950 Hazeltine National Drive

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Orlando

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32822

|

| City Area Code |

(877)

|

| Local Phone Number |

648-3565

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre Commencement Tender Offer |

false

|

| Pre Commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock Par Value 0.001 Per Share [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

PCT

|

| Security Exchange Name |

NASDAQ

|

| Warrants Each Exercisable For One Share Of Common Stock 0.001 Par Value Per Share At An Exercise Price Of 11.50 Per Share [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Warrants, each exercisable for one share of common stock, $0.001 par value per share, at an exercise price of $11.50 per share

|

| Trading Symbol |

PCTTW

|

| Security Exchange Name |

NASDAQ

|

| Units Each Consisting Of One Share Of Common Stock 0.001 Par Value Per Share And Three Quarters Of One Warrant [Member] |

|

| Document And Entity Information [Line Items] |

|

| Security 12b Title |

Units, each consisting of one share of common stock, $0.001 par value per share, and three quarters of one warrant

|

| Trading Symbol |

PCTTU

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pct_CommonStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pct_WarrantsEachExercisableForOneShareOfCommonStock0.001ParValuePerShareAtAnExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pct_UnitsEachConsistingOfOneShareOfCommonStock0.001ParValuePerShareAndThreeQuartersOfOneWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

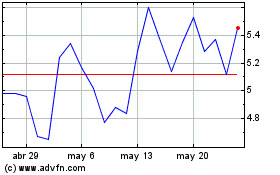

PureCycle Technologies (NASDAQ:PCT)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

PureCycle Technologies (NASDAQ:PCT)

Gráfica de Acción Histórica

De May 2023 a May 2024