Revenue from continuing operations increased

5.9% to $152.5 million, driven by 5.5% volume growth

Loss from continuing operations of $5.7

million, compared to earnings of $2.4 million in the prior

year

Adjusted EBITDA from continuing operations

increased 8.1% to $19.1 million

Maintains Q4 outlook for continuing

operations and provides 2024 outlook

SunOpta Inc. (“SunOpta” or the “Company”) (Nasdaq:STKL)

(TSX:SOY), a U.S.-based global pioneer fueling the future of

sustainable, plant-based foods and beverages, today announced

financial results for the third quarter ended September 30,

2023.

All amounts are expressed in U.S. dollars and results are

reported in accordance with U.S. GAAP, except where specifically

noted.

Third Quarter 2023 highlights:

- Revenues of $152.5 million increased 5.9% compared to $144.0

million in the year earlier period, driven by 5.5% volume

growth.

- Gross profit margin was 13.3% on a reported basis. Excluding

start-up costs, gross margin was 16.4%, down 140 basis points from

17.8% mainly due to the 150 basis point increase in depreciation

related to new production equipment.

- Loss from continuing operations was $5.7 million compared to

earnings of $2.4 million in the prior year period.

- Adjusted earnings¹ from continuing operations attributable to

common shareholders was $0.5 million or $0.00 per diluted common

share, compared to adjusted earnings of $2.4 million or $0.02 per

diluted common share in the prior year period.

- Adjusted EBITDA¹ from continuing operations of $19.1 million,

or 12.5% of revenues, compared to $17.7 million and 12.3% of

revenues in the prior year period.

“We delivered strong volume-driven revenue growth in the third

quarter from protein shakes, oat milk and snacks,” said Joe Ennen,

SunOpta Chief Executive Officer. “In addition, the divestiture of

our frozen fruit operations subsequent to the end of the quarter

was a major strategic milestone that significantly optimizes our

product portfolio for growth and profitability along with helping

to reduce debt and strengthen our balance sheet, which creates

opportunities for capital allocation beneficial to shareholders,

including the potential adoption of a share repurchase program. Key

growth initiatives continue to advance including market share gains

with existing customers, new customers and total addressable market

expansion. We are also in the process of replacing our existing

asset-based lending arrangement, supplemented with third-party

extended payable facilities and finance leases, with a term loan

and revolver structure with limited finance leases, which we expect

will be in place by the end of the year. With our strong

foundation, leverageable platform and expanding capacity, we are

confident in our direction and believe that we remain well

positioned to deliver significant long-term sustainable growth and

value for shareholders.”

Third Quarter 2023 Results

Revenues from continuing operations increased 5.9% to $152.5

million for the third quarter of 2023. The increase was driven by a

favorable volume/mix which was up 5.5% and pricing which was up

0.4%. Volume/mix reflected volume growth from oat milks and

creamers, 330-milliliter protein shakes and teas, as well as

increased sales volumes for fruit snacks, partially offset by lower

external sales of plant-based ingredients, due to increased

internal demand for oat base and softer demand for almond

beverages.

Gross profit was $20.3 million for the third quarter, compared

to $25.1 million in the prior year period. As a percentage of

revenues, gross profit margin was 13.3% compared to 17.4% in the

third quarter of 2022, a decrease of 410 basis points, as reported.

Excluding the impact of start-up costs related to the new plant in

Midlothian, Texas, and new extrusion line at the fruit snacks

facility in Omak, Washington, adjusted gross margin was 16.4% in

the third quarter of 2023, compared to 17.8% in the third quarter

of 2022. The 140-basis point decline in adjusted gross margin

reflected the impact of incremental depreciation of new production

equipment for capital expansion projects and higher manufacturing

costs partially offset by a positive mix shift in plant-based

ingredients with increased internal use.

Operating income¹ was $1.5 million, or 1.0% of revenue in the

third quarter of 2023, compared to operating income of $6.6

million, or 4.6% of revenues in the third quarter of 2022. The

decrease in operating income was driven by lower gross profit,

higher business development and employee severance costs in

conjunction with the divestiture of Frozen Fruit and related

consolidation of continuing operations, partially offset by lower

employee incentive compensation accruals and variable stock-based

compensation expenses.

Loss from continuing operations for the quarter ended September

30, 2023 was $5.7 million, compared with earnings of $2.4 million

for the quarter ended October 1, 2022. Diluted loss per share from

continuing operations attributable to common shareholders (after

dividends and accretion on preferred stock) was $0.05 for the

quarter ended September 30, 2023, compared with a diluted earnings

per share of $0.01 for the quarter ended October 1, 2022.

Loss from discontinued operations was $140.1 million (diluted

loss per share of $1.21) for the quarter ended September 30, 2023,

compared with $14.3 million (diluted loss per share of $0.13) for

the quarter ended October 1, 2022. The increase in the loss from

discontinued operations reflected the estimated pre-tax loss on the

divestiture of Frozen Fruit of $118.8 million recognized in the

third quarter of 2023, compared with a pre-tax loss on the

divestiture of Sunflower of $23.2 million recorded in the third

quarter of 2022. In addition, the increase in the loss from

discontinued operations reflected a period-over-period decrease in

the gross profit of Frozen Fruit prior to the divestiture due to

lower sales and production volumes as a result of softer retail

consumption trends and lost foodservice distribution, together with

inventory reserves recognized in connection with the

divestiture.

Adjusted earnings¹ in the third quarter of 2023 was $0.5 million

or $0.00 per diluted common share, compared to adjusted earnings of

$2.4 million or $0.02 per diluted common share in the third quarter

of 2022.

Adjusted EBITDA¹ from continuing operations was $19.1 million or

12.5% of revenue in the third quarter of 2023, compared to $17.7

million or 12.3% of revenue in the third quarter of 2022.

Please refer to the discussion and table below under “Non-GAAP

Measures”.

Balance Sheet and Cash Flow

As of September 30, 2023, SunOpta had total assets of $746.7

million (including $142.1 million of assets held-for-sale related

to the divestiture of Frozen Fruit) and total debt of $314.8

million compared to total assets of $855.9 million and total debt

of $308.5 million at year end fiscal 2022. During the third quarter

of 2023, cash used in operating activities of continuing operations

was $25.9 million compared to cash provided of $9.3 million during

the third quarter of 2022. The increase in cash used mainly

reflected the impact of start-up costs related to our Midlothian,

Texas, facility, and higher cash interest expense on borrowings to

finance capital expenditures, together with increases in working

capital mainly due to the timing of accounts receivable and

payables. Investing activities of continuing operations consumed

$4.7 million of cash during the third quarter of 2023 versus $37.3

million in the prior year. The year-over-year decrease reflected

the completion of certain major capital projects, including the

construction of our new plant-based beverage facility in

Midlothian, Texas.

Divestiture of Frozen Fruit

On October 12, 2023, the Company entered into an Asset Purchase

Agreement with Natures Touch Mexico, S. de R.L. de C.V. and

Nature’s Touch Frozen Fruits, LLC to sell certain assets and

liabilities of Frozen Fruit for an aggregate purchase price of

approximately $141 million, subject to closing working capital

adjustments. The transaction closed on October 12, 2023 (the

“Closing Date”). The transaction represents the Company’s exit from

the processing, packaging and selling of individually quick frozen

fruit for retail, foodservice and industrial applications. Frozen

Fruit was previously identified as a reporting unit within the

Company’s former Fruit-Based Foods and Beverages operating and

reportable segment.

At the Closing Date, the estimated aggregate purchase price was

comprised of cash consideration of $95.3 million; a short-term note

receivable of $10.5 million; secured seller promissory notes due in

three years with a stated principal amount of $20.0 million in the

aggregate; and the assumption by the purchasers of $15.7 million of

accounts payable and accrued liabilities of Frozen Fruit. At the

Closing Date, $20.5 million of the cash consideration was used to

make required repayments of certain bank loans and other

liabilities of Frozen Fruit not assumed by the purchasers. The

Company utilized the remaining cash consideration of $74.8 million

to repay a portion of the outstanding borrowings under its

revolving credit facilities.

2023 Outlook2

For fiscal 2023, the Company maintains its outlook, adjusting

for the divestiture of Frozen Fruit:

($ millions)

Previous 2023 Consolidated

Outlook

2023 Frozen

Fruit Outlook

2023 Continuing Operations

Outlook

Revenue

$

880 - 900

$

266 - 270

$

614 - 630

Adj. EBITDA

$

87 - 91

$

12 – 14

$

75 – 77

Revenue growth

(6%) – (4%)

4% - 7%

Adj. EBITDA growth

4% - 9%

18% - 21%

2024 Outlook2

For fiscal 2024, the Company expects strong revenue growth,

driven by volume and strong adjusted EBITDA growth:

($ millions)

2024 Outlook

Growth*

Revenue

$

670 – 700

8% - 13%

Adj. EBITDA

$

87 - 92

14% - 21%

*Expected growth based on the midpoint of the range of the 2023

outlook

Conference Call

SunOpta plans to host a conference call at 5:30 P.M. Eastern

time on Wednesday, November 8, 2023, to discuss the third quarter

financial results. After opening remarks, there will be a

question-and-answer period. Investors interested in listening the

live webcast can access a link on SunOpta's website at

www.sunopta.com under the “Investor Relations” section or directly

here. A replay of the webcast will be archived and can be accessed

for approximately 90 days on the Company's website. This call may

be accessed with the toll free dial-in number dial (888) 440-4182

or International dial-in number (646) 960-0653 using Conference ID:

8338433.

¹ See discussion of non-GAAP measures

2 The Company has included certain forward-looking statements

about the future financial performance that include non-GAAP

financial measures, including Adjusted EBITDA. These non–GAAP

financial measures are derived by excluding certain amounts,

expenses or income, from the corresponding financial measures

determined in accordance with GAAP. The determination of the

amounts that are excluded from these non-GAAP financial measures is

a matter of management judgment and depends upon, among other

factors, the nature of the underlying expense or income amounts

recognized in a given period. We are unable to present a

quantitative reconciliation of the aforementioned forward-looking

non-GAAP financial measures to their most directly comparable

forward-looking GAAP financial measures because management cannot

reliably predict all of the necessary components of such GAAP

measures. Historically, management has excluded the following items

from certain of these non-GAAP measures, and such items may also be

excluded in future periods and could be significant amounts.

- Expenses related to the acquisition or divestiture of a

business, including business development costs, impairment of

assets, integration costs, severance, retention costs and

transaction costs;

- Start-up costs of new facilities and equipment;

- Charges associated with restructuring and cost saving

initiatives, including but not limited to asset impairments,

accelerated depreciation, severance costs and lease abandonment

charges;

- Asset impairment charges and facility closure costs;

- Legal settlements or awards; and

- The tax effect of the above items.

About SunOpta Inc.

SunOpta (Nasdaq:STKL) (TSX:SOY) is a U.S.-based, global pioneer

fueling the future of sustainable, plant-based food and beverages.

Founded nearly 50 years ago, SunOpta manufactures natural, organic

and specialty products sold through retail and foodservice

channels. SunOpta operates as a manufacturer for leading natural

and private label brands, and also proudly produces its own brands,

including SOWN ®, Dream®, and West LifeTM. For more information,

visit www.sunopta.com, LinkedIn and Twitter.

Forward-Looking Statements

Certain statements included in this press release may be

considered "forward-looking statements" within the meaning of the

United States Private Securities Litigation Reform Act of 1995 and

applicable Canadian securities legislation, which are based on

information available to us on the date of this release. These

forward-looking statements include, but are not limited to, the

potential adoption of a share repurchase program, replacement of

our existing asset-based lending arrangement by the end of the

year, our belief that we are well positioned to deliver significant

long-term sustainable growth and value for shareholders, our

expectation for strong revenue growth for fiscal 2024 and our

anticipated Revenue, Adjusted EBITDA , Revenue growth and Adjusted

EBITDA growth for fiscal 2023 and our anticipated Revenue and

Adjusted EBITDA for fiscal 2024. Generally, forward-looking

statements do not relate strictly to historical or current facts

and are typically accompanied by words such as “potential”,

“expect”, “believe”, “anticipate”, “estimates”, “can”, “will”,

“target”, "should", "would", "plans", “continue”, "becoming",

"intend", "confident", "may", "project", "intention", "might",

"predict", “budget”, “forecast” or other similar terms and phrases

intended to identify these forward-looking statements.

Forward-looking statements are based on information available to

the Company on the date of this release and are based on estimates

and assumptions made by the Company in light of its experience and

its perception of historical trends, current conditions and

expected future developments including, but not limited to, the

Company’s actual financial results; our exit from, and use of

proceeds from the divestiture of the assets and liabilities of,

Frozen Fruit, uninterrupted operations and service levels to our

customers; current customer demand for the Company’s products;

general economic conditions; continued consumer interest in health

and wellness; the Company’s ability to maintain product pricing

levels; planned facility and operational expansions, closures and

divestitures; cost rationalization and product development

initiatives; alternative potential uses for the Company’s capital

resources; portfolio optimization and productivity efforts; the

sustainability of the Company’s sales pipeline; the Company’s

expectations regarding commodity pricing, margins and hedging

results; procurement and logistics savings; freight lane cost

reductions; yield and throughput enhancements; the cost of the

frozen fruit recall; labor cost reductions; and the terms of our

insurance policies. Whether actual timing and results will agree

with expectations and predictions of the Company is subject to many

risks and uncertainties including, but not limited to, potential

loss of suppliers and customers as well as the possibility of

supply chain, logistics and other disruptions; unexpected issues or

delays with the Company’s structural improvements and automation

investments; failure or inability to implement portfolio changes,

process improvements, go-to-market improvements and process

sustainability strategies in a timely manner; changes in the level

of capital investment; local and global political and economic

conditions; consumer spending patterns and changes in market

trends; decreases in customer demand; delayed or unsuccessful

product development efforts; potential product recalls; potential

additional costs associated with the frozen fruit recall; working

capital management; availability and pricing of raw materials and

supplies; potential covenant breaches under the Company’s credit

facilities; and other risks described from time to time under "Risk

Factors" in the Company's Annual Report on Form 10-K and its

Quarterly Reports on Form 10-Q (available at www.sec.gov).

Consequently, all forward-looking statements made herein are

qualified by these cautionary statements and there can be no

assurance that the actual results or developments anticipated by

the Company will be realized. The Company undertakes no obligation

to publicly correct or update the forward-looking statements in

this document, in other documents, or on its website to reflect

future events or circumstances, except as may be required under

applicable securities laws.

SunOpta Inc.

Consolidated Statements of Operations

For the quarters and three quarters ended

September 30, 2023 and October 1, 2022

(Unaudited)

(All dollar amounts expressed in thousands

of U.S. dollars, except per share amounts)

Quarter ended

Three quarters ended

September 30, 2023

October 1, 2022

September 30, 2023

October 1, 2022

$

$

$

$

Revenues

152,541

144,023

448,673

431,605

Cost of goods sold

132,273

118,891

385,697

355,691

Gross profit

20,268

25,132

62,976

75,914

Selling, general and administrative

expenses

18,377

17,866

58,403

58,864

Intangible asset amortization

446

446

1,338

1,338

Other expense (income), net

-

451

(20

)

1,408

Foreign exchange loss (gain)

(37

)

(223

)

44

(208

)

Operating income

1,482

6,592

3,211

14,512

Interest expense, net

7,162

3,901

19,391

8,844

Earnings (loss) from continuing

operations before income taxes

(5,680

)

2,691

(16,180

)

5,668

Income tax expense

-

332

3,978

1,360

Earnings (loss) from continuing

operations

(5,680

)

2,359

(20,158

)

4,308

Loss from discontinued operations

(140,143

)

(14,293

)

(143,126

)

(10,203

)

Net loss

(145,823

)

(11,934

)

(163,284

)

(5,895

)

Dividends and accretion on preferred

stock

(426

)

(764

)

(1,552

)

(2,279

)

Loss attributable to common

shareholders

(146,249

)

(12,698

)

(164,836

)

(8,174

)

Basic earnings (loss) per share

Earnings (loss) from continuing

operations

(0.05

)

0.01

(0.19

)

0.02

Loss from discontinued operations

(1.21

)

(0.13

)

(1.26

)

(0.09

)

Loss attributable to common

shareholders(1)

(1.26

)

(0.12

)

(1.45

)

(0.08

)

Diluted earnings (loss) per

share

Earnings (loss) from continuing

operations

(0.05

)

0.01

(0.19

)

0.02

Loss from discontinued operations

(1.21

)

(0.13

)

(1.26

)

(0.09

)

Loss attributable to common

shareholders(1)

(1.26

)

(0.12

)

(1.45

)

(0.08

)

Weighted-average common shares

outstanding (000s)

Basic

115,616

107,752

113,700

107,566

Diluted

115,616

109,239

113,700

108,731

(1) The sum of individual per share

amounts may not add due to rounding.

SunOpta Inc.

Consolidated Balance Sheets

As at September 30, 2023 and December 31,

2022

(Unaudited)

(All dollar amounts expressed in thousands

of U.S. dollars)

September 30, 2023

December 31, 2022

$

$

ASSETS

Current assets

Cash and cash equivalents

348

679

Restricted cash

3,196

-

Accounts receivable

60,634

59,545

Inventories

84,332

74,439

Prepaid expenses and other current

assets

20,011

15,535

Income taxes recoverable

3,384

4,040

Current assets held for sale

142,070

148,119

Total current assets

313,975

302,357

Property, plant and equipment, net

316,500

292,306

Operating lease right-of-use assets

84,653

78,761

Intangible assets, net

22,307

23,646

Goodwill

3,998

3,998

Deferred income taxes

696

3,712

Other assets

4,522

5,184

Non-current assets held for sale

-

145,888

Total assets

746,651

855,852

LIABILITIES

Current liabilities

Accounts payable and accrued

liabilities

89,993

95,879

Notes payable

44,446

-

Income taxes payable

521

957

Current portion of long-term debt

46,695

38,491

Current portion of operating lease

liabilities

13,488

12,499

Current liabilities held for sale

18,878

13,207

Total current liabilities

214,021

161,033

Long-term debt

268,093

269,993

Operating lease liabilities

80,842

74,329

Deferred income taxes

325

-

Non-current liabilities held for sale

-

3,228

Total liabilities

563,281

508,583

Series B-1 preferred stock

14,385

28,062

SHAREHOLDERS' EQUITY

Common shares

462,630

440,348

Additional paid-in capital

25,516

33,184

Accumulated deficit

(320,524

)

(155,688

)

Accumulated other comprehensive income

1,363

1,363

Total shareholders' equity

168,985

319,207

Total liabilities and shareholders'

equity

746,651

855,852

SunOpta Inc.

Consolidated Statements of Cash Flows

For the quarters and three quarters ended

September 30, 2023 and October 1, 2022

(Unaudited)

(Expressed in thousands of U.S.

dollars)

Quarter ended

Three quarters ended

September 30, 2023

October 1, 2022

September 30, 2023

October 1, 2022

$

$

$

$

CASH PROVIDED BY (USED IN)

Operating activities

Net loss

(145,823

)

(11,934

)

(163,284

)

(5,895

)

Loss from discontinued operations

(140,143

)

(14,293

)

(143,126

)

(10,203

)

Earnings (loss) from continuing

operations

(5,680

)

2,359

(20,158

)

4,308

Items not affecting cash:

Depreciation and amortization

7,983

5,837

22,873

16,828

Amortization of debt issuance costs

298

413

1,093

1,184

Deferred income taxes

282

7,590

4,260

11,237

Stock-based compensation

3,068

4,092

8,989

9,691

Other

(96

)

(74

)

410

1,822

Changes in operating assets and

liabilities, net of divestitures

(31,708

)

(10,878

)

(25,852

)

(21,651

)

Net cash provided by (used in) operating

activities of continuing operations

(25,853

)

9,339

(8,385

)

23,419

Net cash provided by operating activities

of discontinued operations

16,521

10,634

18,798

9,643

Net cash provided by (used in) operating

activities

(9,332

)

19,973

10,413

33,062

Investing activities

Additions to property, plant and

equipment

(4,716

)

(37,371

)

(37,272

)

(98,742

)

Proceeds from sale of property, plant and

equipment

-

90

-

4,182

Net cash used in investing activities of

continuing operations

(4,716

)

(37,281

)

(37,272

)

(94,560

)

Net cash provided by (used in) investing

activities of discontinued operations

(127

)

15,373

(1,085

)

7,750

Net cash used in investing activities

(4,843

)

(21,908

)

(38,357

)

(86,810

)

Financing activities

Increase in borrowings under revolving

credit facilities

16,207

1,761

22,718

19,724

Borrowings of long-term debt

507

33,094

19,840

74,197

Repayment of long-term debt

(10,629

)

(6,172

)

(31,435

)

(13,557

)

Proceeds from notes payable

42,507

-

77,602

-

Repayment of notes payable

(17,788

)

-

(33,156

)

-

Proceeds from the exercise of stock

options and employee share purchases

255

612

831

1,203

Payment of withholding taxes on

stock-based awards

(114

)

(631

)

(9,121

)

(1,602

)

Payment of cash dividends on preferred

stock

(304

)

(609

)

(1,427

)

(1,827

)

Payment of share issuance costs

(68

)

-

(191

)

-

Payment of debt issuance costs

-

(113

)

-

(672

)

Net cash provided by financing activities

of continuing operations

30,573

27,942

45,661

77,466

Net cash used in financing activities of

discontinued operations

(13,835

)

(26,101

)

(14,852

)

(23,486

)

Net cash provided by financing

activities

16,738

1,841

30,809

53,980

Increase (decrease) in cash, cash

equivalents and restricted cash in the period

2,563

(94

)

2,865

232

Cash and cash equivalent, beginning of the

period

981

553

679

227

Cash, cash equivalents and restricted

cash, end of the period

3,544

459

3,544

459

Non-GAAP Measures

In addition to reporting financial results in accordance with

U.S. GAAP, the Company provides additional information about its

operating results regarding adjusted earnings/loss and adjusted

earnings/loss before interest, taxes, depreciation and amortization

(“Adjusted EBITDA”), which are not measures in accordance with U.S.

GAAP. The Company believes that adjusted earnings/loss and adjusted

EBITDA assist investors in comparing performance across reporting

periods on a consistent basis by excluding items that management

believes are not indicative of its operating performance. The

non-GAAP measures of adjusted earnings/loss and adjusted EBITDA

should not be considered in isolation or as a substitute for

performance measures calculated in accordance with U.S. GAAP.

In order to evaluate its results of operations, the Company uses

certain other non-GAAP measures that it believes enhance an

investor’s ability to derive meaningful period-over-period

comparisons and trends from the results of operations. In

particular, the Company excludes specific items from its reported

results that due to their nature or size, it does not expect to

occur as part of its normal business on a regular basis. These

items are identified in the tables below. These non-GAAP measures

are presented solely to allow investors to more fully assess the

Company’s results of operations and should not be considered in

isolation of, or as substitutes for, an analysis of the Company’s

results as reported under U.S. GAAP.

Adjusted Earnings/Loss

When assessing its financial performance, the Company uses an

internal measure that excludes charges and gains that it believes

are not reflective of normal operations. This information is

provided to allow investors to make meaningful comparisons of the

Company’s operating performance between periods and to view the

Company’s business from the same perspective as the Company’s

management. Adjusted earnings/loss and adjusted earnings/loss per

diluted share should not be considered in isolation or as a

substitute for performance measures calculated in accordance with

U.S. GAAP.

The following is a tabular presentation of adjusted

earnings/loss and adjusted earnings/loss per diluted share,

including a reconciliation from net earnings/loss, which the

Company believes to be the most directly comparable U.S. GAAP

financial measure.

Adjusted EBITDA

The Company defines adjusted EBITDA as operating income plus

depreciation, amortization, stock-based compensation, and other

unusual items that affect the comparability of operating

performance as identified above in the determination of adjusted

earnings/loss. The following is a tabular presentation of adjusted

EBITDA, including a reconciliation from net earnings/loss, which

the Company believes to be the most directly comparable U.S. GAAP

financial measure.

Continuing

Discontinued

Operations

Operations

Consolidated

Per Share

Per Share

Per Share

For the quarter ended

$

$

$

$

$

$

September 30, 2023

Net loss

(5,680

)

(140,143

)

(145,823

)

Dividends and accretion on preferred

stock

(426

)

-

(426

)

Loss attributable to common

shareholders

(6,106

)

(0.05

)

(140,143

)

(1.21

)

(146,249

)

(1.26

)

Adjusted for:

Loss on divestiture of discontinued

operations(a)

-

118,795

118,795

Inventory reserves and impairment

charges(b)

-

17,864

17,864

Start-up costs(c)

4,733

-

4,733

Business development costs(d)

928

-

928

Severance costs(e)

897

-

897

Other(f)

-

21

21

Net income tax on adjusting items(g)

-

-

-

Adjusted earnings (loss)

452

0.00

(3,463

)

(0.03

)

(3,011

)

(0.03

)

October 1, 2022

Net earnings (loss)

2,359

(14,293

)

(11,934

)

Dividends and accretion on preferred

stock

(764

)

-

(764

)

Earnings (loss) attributable to common

shareholders

1,595

0.01

(14,293

)

(0.13

)

(12,698

)

(0.12

)

Adjusted for:

Loss on divestiture of discontinued

operations(a)

-

23,227

23,227

Sale of frozen fruit processing

facility(h)

-

(3,460

)

(3,460

)

Start-up costs(c)

608

-

608

Exit from fruit ingredient processing

facility(i)

206

-

206

Business development costs(d)

75

-

75

Other(f)

245

(18

)

227

Net income tax on adjusting items(g)

(299

)

(5,192

)

(5,491

)

Adjusted earnings

2,430

0.02

264

0.00

2,694

0.02

Continuing

Discontinued

Operations

Operations

Consolidated

For the quarter ended

$

$

$

September 30, 2023

Net loss

(5,680

)

(140,143

)

(145,823

)

Income tax benefit

-

(805

)

(805

)

Interest expense, net

7,162

840

8,002

Depreciation and amortization

7,983

2,966

10,949

Stock-based compensation

3,068

-

3,068

Adjusted for:

Loss on divestiture of discontinued

operations(a)

-

118,795

118,795

Inventory reserves and impairment

charges(b)

-

17,864

17,864

Start-up costs(c)

4,733

-

4,733

Business development costs(d)

928

-

928

Severance costs(e)

897

-

897

Other(f)

-

21

21

Adjusted EBITDA

19,091

(462

)

18,629

October 1, 2022

Net earnings (loss)

2,359

(14,293

)

(11,934

)

Income tax expense (benefit)

332

(5,296

)

(4,964

)

Interest expense, net

3,901

441

4,342

Depreciation and amortization

5,837

3,893

9,730

Stock-based compensation

4,092

-

4,092

Adjusted for:

Loss on divestiture of discontinued

operations(a)

-

23,227

23,227

Sale of frozen fruit processing

facility(h)

-

(3,460

)

(3,460

)

Start-up costs(c)

608

-

608

Exit from fruit ingredient processing

facility(i)

206

-

206

Business development costs(d)

75

-

75

Other(f)

245

(18

)

227

Adjusted EBITDA

17,655

4,494

22,149

(a)

Reflects the estimated pre-tax loss on the

divestiture of Frozen Fruit in the third quarter of 2023 and the

pre-tax loss on the divestiture of Sunflower in the third quarter

of 2022, which are recorded in loss from discontinued

operations.

(b)

For the third quarter of 2023, reflects

inventory reserves and impairment charges on equipment and

operating lease right-of-use assets recognized in connection with

the divestiture of Frozen Fruit, which are recorded in loss from

discontinued operations.

(c)

For the third quarter of 2023, start-up

costs included the ramp-up of production at our new plant-based

beverage facility in Midlothian, Texas, and the start-up of a new

extrusion line at our fruit snacks facility in Omak, Washington,

which are recorded in cost of goods sold. For the third quarter of

2022, start-up costs included the hiring and training of new

employees for the Midlothian facility, which are recorded in cost

of goods sold ($0.5 million) and SG&A expenses ($0.1

million).

(d)

Represents third-party costs associated

with business development activities, which are inclusive of costs

related to the evaluation, execution, and integration of external

acquisitions and divestitures, internal expansion projects, and

other strategic initiatives. For the third quarters of 2023 and

2022, business development costs related to the divestiture of

Frozen Fruit and are recorded in SG&A expenses.

(e)

For the third quarter of 2023, reflects

employee severance costs accrued in connection with the

consolidation of our continuing operations following the

divestiture of Frozen Fruit, which are recorded in SG&A

expenses.

(f)

Other includes reserves for legal

settlements and gains and loss on the disposal of assets, which are

recorded in other income/expense and loss from discontinued

operations.

(g)

Reflects the tax effect of the adjustments

to earnings calculated based on the statutory tax rates applicable

in the tax jurisdiction of the underlying adjustment, net of

deferred tax valuation allowances.

(h)

For the third quarter of 2022, reflects

the gain on sale in August 2022 of a previously owned frozen fruit

processing facility, net of exit costs, which is recorded in loss

from discontinued operations.

(i)

For the third quarter of 2022, reflects

exit costs related to a former fruit ingredient processing

facility, which are recorded in other expense.

Continuing

Discontinued

Operations

Operations

Consolidated

Per Share

Per Share

Per Share

For the three quarters ended

$

$

$

$

$

$

September 30, 2023

Net loss

(20,158

)

(143,126

)

(163,284

)

Dividends and accretion on preferred

stock

(1,552

)

-

(1,552

)

Loss attributable to common

shareholders

(21,710

)

(0.19

)

(143,126

)

(1.26

)

(164,836

)

(1.45

)

Adjusted for:

Loss on divestiture of discontinued

operations(a)

-

118,795

118,795

Inventory reserves and impairment

charges(b)

-

17,864

17,864

Start-up costs(c)

17,855

-

17,855

Product recall costs, net of insurance

recoveries(d)

-

2,500

2,500

Business development costs(e)

2,390

-

2,390

Severance costs(f)

897

-

897

Other(g)

(20

)

519

499

Net income tax on adjusting items(h)

-

-

-

Change in valuation allowance for deferred

tax

assets(i)

3,978

-

3,978

Adjusted earnings (loss)

3,390

0.03

(3,448

)

(0.03

)

(58

)

(0.00

)

October 1, 2022

Net earnings (loss)

4,308

(10,203

)

(5,895

)

Dividends and accretion on preferred

stock

(2,279

)

-

(2,279

)

Earnings attributable to common

shareholders

2,029

0.02

(10,203

)

(0.09

)

(8,174

)

(0.08

)

Adjusted for:

Loss on divestiture of discontinued

operations(a)

-

31,468

31,468

Sale of frozen fruit processing

facility(j)

-

(2,544

)

(2,544

)

Start-up costs(c)

1,329

-

1,329

Business development costs(e)

874

-

874

Exit from fruit ingredient processing

facility(k)

577

-

577

Other(g)

831

(64

)

767

Net income tax on adjusting items(h)

(949

)

(16,414

)

(17,363

)

Adjusted earnings

4,691

0.04

2,243

0.02

6,934

0.06

Continuing

Discontinued

Operations

Operations

Consolidated

For the three quarters ended

$

$

$

September 30, 2023

Net loss

(20,158

)

(143,126

)

(163,284

)

Income tax expense (benefit)

3,978

(636

)

3,342

Interest expense, net

19,391

1,392

20,783

Depreciation and amortization

22,873

8,861

31,734

Stock-based compensation

8,989

-

8,989

Adjusted for:

Loss on divestiture of discontinued

operations(a)

-

118,795

118,795

Inventory reserves and impairment

charges(b)

-

17,864

17,864

Start-up costs(c)

17,855

-

17,855

Product recall costs, net of insurance

recoveries(d)

-

2,500

2,500

Business development costs(e)

2,390

-

2,390

Severance costs(f)

897

-

897

Other(g)

(20

)

519

499

Adjusted EBITDA

56,195

6,169

62,364

October 1, 2022

Net earnings (loss)

4,308

(10,203

)

(5,895

)

Income tax expense (benefit)

1,360

(15,978

)

(14,618

)

Interest expense, net

8,844

1,160

10,004

Depreciation and amortization

16,828

11,687

28,515

Stock-based compensation

9,691

-

9,691

Adjusted for:

Loss on divestiture of discontinued

operations(a)

-

31,468

31,468

Sale of frozen fruit processing

facility(j)

-

(2,544

)

(2,544

)

Start-up costs(c)

1,329

-

1,329

Business development costs(e)

874

-

874

Exit from fruit ingredient processing

facility(k)

577

-

577

Other(g)

831

(64

)

767

Adjusted EBITDA

44,642

15,526

60,168

(a)

For the first three quarters of 2023,

reflects the estimated pre-tax loss on the divestiture of Frozen

Fruit which is recorded in loss from discontinued operations. For

the first three quarters of 2022, reflects the pre-tax loss on the

divestiture of Sunflower of $23.2 million, together with a loss of

$8.2 million on the settlement of the purchase price allocation

related to the 2020 divestiture of our global ingredients business,

Tradin Organic, which are recorded in loss from discontinued

operations.

(b)

For the first three quarters of 2023,

reflects inventory reserves and impairment charges on equipment and

operating lease right-of-use assets recognized in connection with

the divestiture of Frozen Fruit, which are recorded in loss from

discontinued operations.

(c)

For the first three quarters of 2023,

start-up costs included the ramp-up of production at our new

plant-based beverage facility in Midlothian, Texas, the start-up of

new extrusion and high-speed packaging lines at our fruit snacks

facility in Omak, Washington, and professional fees related to

productivity initiatives within our manufacturing operations, which

were recorded in cost of goods sold ($16.3 million) and SG&A

expenses ($1.5 million). For the first three quarters of 2022,

start-up costs mainly related to the hiring and training of new

employees for the Midlothian facility, and the integration of the

Dream and West Life brands, which were recorded in cost of goods

sold ($1.2 million) and SG&A expenses ($0.1 million).

(d)

Reflects the self-insured retention amount

under our insurance policies related to the recall of specific

frozen fruit products initiated in the second quarter of 2023,

which is recorded in loss from discontinued operations.

(e)

Represents third-party costs associated

with business development activities, which are inclusive of costs

related to the evaluation, execution, and integration of external

acquisitions and divestitures, internal expansion projects, and

other strategic initiatives. For the first three quarters of 2023,

business development costs related to the divestiture of Frozen

Fruit, and, for the first three quarters of 2022, these costs

related to the divestitures of Frozen Fruit and Sunflower, together

with our inaugural Investor Day held in June 2022. These costs were

recorded in SG&A expenses.

(f)

For the first three quarters of 2023,

reflects employee severance costs accrued in connection with the

consolidation of our continuing operations following the

divestiture of Frozen Fruit, which are recorded in SG&A

expenses.

(g)

Other includes reserves for legal

settlements and gains and loss on the disposal of assets, which are

recorded in other income/expense and loss from discontinued

operations.

(h)

Reflects the tax effect of the preceding

adjustments to earnings calculated based on the statutory tax rates

applicable in the tax jurisdiction of the underlying adjustment,

net of deferred tax valuation allowances. In addition, for the

first three quarters of 2022, reflects $11.0 million of tax

benefits resulting from the settlement of the purchase price

allocation related to the divestiture of Tradin Organic.

(i)

For the first three quarters, reflects an

increase to the valuation allowance for U.S. deferred tax assets

recognized in the second quarter of 2023, based on an assessment of

the future realizability of the related tax benefits.

(j)

For the first three quarters of 2022,

reflects the gain on sale in August 2022 of a previously owned

frozen fruit processing facility, net of exit costs, which is

recorded in loss from discontinued operations.

(k)

For the first three quarters of 2022,

reflects exit costs related to a former fruit ingredient processing

facility, which are recorded in other expense.

Quarterly Adjusted EBITDA from Continuing

Operations

The following table presents quarterly adjusted EBITDA from

continuing operations.

Fiscal 2023

Three quarters

Quarter ended

ended

April 1, 2023

July 1, 2023

September 30, 2023

September 30, 2023

$

$

$

$

Net loss

(1,166

)

(13,312

)

(5,680

)

(20,158

)

Income tax expense (benefit)

(3,965

)

7,943

-

3,978

Interest expense, net

5,664

6,565

7,162

19,391

Depreciation and amortization

7,050

7,840

7,983

22,873

Stock-based compensation

3,892

2,029

3,068

8,989

Adjusted for:

Start-up costs

6,425

6,697

4,733

17,855

Business development costs

731

731

928

2,390

Severance costs

-

-

897

897

Other

42

(62

)

-

(20

)

Adjusted EBITDA

18,673

18,431

19,091

56,195

Fiscal 2022

Quarter ended

Year ended

April 2, 2022

July 2, 2022

October 1, 2022

December 31, 2022

December 31, 2022

$

$

$

$

$

Net earnings

1,055

894

2,359

6,429

10,737

Income tax expense (benefit)

212

816

332

(7,320

)

(5,960

)

Interest expense, net

2,153

2,790

3,901

4,312

13,156

Depreciation and amortization

5,350

5,641

5,837

6,219

23,047

Stock-based compensation

1,629

3,970

4,092

4,139

13,830

Adjusted for:

Start-up costs

440

281

608

4,699

6,028

Business development costs

183

616

75

296

1,170

Exit from fruit ingredient processing

facility

-

371

206

-

577

Other

304

282

245

243

1,074

Adjusted EBITDA

11,326

15,661

17,655

19,017

63,659

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231108998682/en/

Investor Relations: Reed Anderson ICR 646-277-1260

reed.anderson@icrinc.com Media Relations: Konnect Agency

213-988-8344 sunopta@konnectagency.com

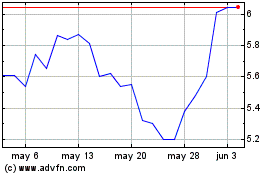

SunOpta (NASDAQ:STKL)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

SunOpta (NASDAQ:STKL)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024