Revenue from continuing operations increased

18% to $182.8 million, driven by volume growth

Earnings from continuing operations of $3.8

million compared to a loss of $2.8 million in the prior

year

Adjusted EBITDA from continuing operations

of $22.6 million, an increase of 21%

Raising 2024 outlook

SunOpta Inc. (“SunOpta” or the “Company”) (Nasdaq:STKL)

(TSX:SOY), an innovative and sustainable manufacturer fueling the

future of food, today announced financial results for the first

quarter ended March 30, 2024.

All amounts are expressed in U.S. dollars and results are

reported in accordance with U.S. GAAP, except where specifically

noted.

First Quarter 2024 highlights:

- Revenues of $182.8 million increased 18.0% compared to $155.0

million in the year earlier period, driven by 23.5% volume growth

partially offset by a 5% price reduction for pass-through commodity

pricing

- Gross profit of $31.7 million increased 31.8% compared to $24.1

million in the prior year period

- Operating income of $10.2 million compared to $0.5 million in

the prior year period

- Earnings from continuing operations were $3.8 million compared

to a loss of $2.8 million in the prior year period

- Adjusted EBITDA from continuing operations1 increased 20.8% to

$22.6 million, or 12.3% of revenues, compared to $18.7 million and

12.0% of revenues in the prior year period.

“SunOpta’s first quarter performance was defined by excellent

revenue growth across our portfolio of products, customers, and

channels, which continue to see healthy, broad-based demand,” said

Brian Kocher, Chief Executive Officer of SunOpta. “We are

encouraged by the progress of our capacity investments and our

operational improvement initiatives, which are supporting

significant volume growth, driving our revenue trajectory and

enabling us to improve gross margin. Based on the strength of first

quarter results, the relentless pursuit of operational excellence,

our robust pipeline of opportunities and confidence in our business

momentum, we are increasing our 2024 outlook.”

First Quarter 2024 Results

Revenues increased 18.0% to $182.8 million for the first quarter

of 2024. The increase was driven by a favorable volume/mix impact

of 23.5%, partially offset by a price reduction of 5.0% due to pass

through of commodity prices, together with a 0.6% revenue reduction

related to our exit from the smoothie bowls category in March 2024.

Volume/mix reflected volume growth for oat milks and creamers,

protein shakes, broths, teas, and fruit snacks, partially offset by

softer demand for other varieties of plant-based milks.

Gross profit increased by $7.6 million to $31.7 million for the

first quarter, compared to $24.1 million in the prior year period.

As a percentage of revenue, gross profit margin was 17.4% compared

to 15.5% in the first quarter of 2023. Adjusted gross margin1 was

17.5% compared to 19.3% in the first quarter of 2023. The 180-basis

point decrease in adjusted gross margin reflected the impact of

incremental depreciation of new production equipment for capital

expansion projects, together with higher inventory reserves,

partially offset by plant production volumes that drove favorable

plant utilization.

Operating income was $10.2 million, or 5.6% of revenue in the

first quarter of 2024, compared to operating income of $0.5

million, or 0.3% of revenue in the first quarter of 2023. The

increase in operating income was primarily driven by higher gross

profit.

Earnings from continuing operations were $3.8 million for the

first quarter of 2024 compared with a loss of $2.8 million in the

prior year period. Diluted earnings per share from continuing

operations attributable to common shareholders (after dividends and

accretion on preferred stock) was $0.03 for the first quarter

compared with a diluted loss per share of $0.03 in the prior year

period.

Loss from discontinued operations was $1.4 million or $0.01 per

diluted share in the first quarter of 2024 versus earnings of $4.2

million or $0.04 per diluted share in the year earlier period.

Adjusted earnings from continuing operations1 were $1.9 million

or $0.02 per diluted share in the first quarter of 2024 compared to

adjusted earnings from continuing operations of $1.8 million or

$0.02 per diluted share in the first quarter of 2023.

Adjusted EBITDA from continuing operations1 was $22.6 million or

12.3% of revenue in the first quarter of 2024 compared to $18.7

million and 12.0% of revenue in the first quarter of 2023.

Please refer to the discussion and table below under “Non-GAAP

Measures”.

Balance Sheet and Cash Flow

As of March 30, 2024, SunOpta had total assets of $671.8 million

and total debt of $258.8 million compared to total assets of $669.4

million and total debt of $263.2 million at year end fiscal 2023.

During the first quarter of 2024, cash provided by operating

activities of continuing operations was $7.4 million compared to

$6.7 million during the first quarter of 2023. The increase in cash

provided mainly reflected the increase in operating income,

partially offset with increases in working capital mainly due to an

increase in inventory supporting increased demand. Investing

activities of continuing operations consumed $4.2 million of cash

during the first quarter of 2024 down from $25.4 million in the

prior year, reflecting the completion of certain major capital

projects, including the construction of our new plant-based

beverage facility in Midlothian, Texas and $3.3 million in proceeds

from the sale of smoothie bowls.

2024 Outlook2

For fiscal 2024, the Company is raising its outlook and

continues to expect strong growth in revenue and Adjusted EBITDA

from continuing operations:

($ millions)

Prior Outlook

Revised Outlook

Revenue

$670 – $700

$685 - $715

Adj. EBITDA from continuing operations

$87 - $92

$88 - $92

Revenue growth

6% - 11%

9% - 13%

Adj. EBITDA from continuing operations

growth

11% - 17%

12% - 17%

Conference Call

SunOpta plans to host a conference call at 5:30 P.M. Eastern

time on Wednesday, May 8, 2024, to discuss the first quarter

financial results. After prepared remarks, there will be a question

and answer period. Investors interested in listening to the live

webcast can access a link on SunOpta’s website at www.sunopta.com

under the “Investor Relations” section or directly here. A replay

of the webcast will be archived and can be accessed for

approximately 90 days on the Company’s website.

This call may be accessed with the toll free dial-in number

(888) 440-4182 or international dial-in number (646) 960-0653 using

Conference ID: 8338433.

1 See discussion of non-GAAP measures

2 The Company has included certain forward-looking statements

about the future financial performance, including adjusted EBITDA

from continuing operations, which is a non-GAAP financial measure.

Adjusted EBITDA from continuing operations is derived by excluding

certain amounts, expenses or income, from earnings from continuing

operations determined in accordance with U.S. GAAP. The

determination of these excluded amounts is a matter of management

judgment and depends upon, among other factors, the nature of the

underlying expense or income amounts recognized in a given period.

We are unable to present a quantitative reconciliation of the

aforementioned forward-looking non-GAAP financial measure of

adjusted EBITDA from continuing operations to the most directly

comparable forward-looking GAAP financial measure because

management cannot reliably predict all of the necessary components

of earnings from continuing operations. Historically, management

has excluded the following items in the determination of certain

non-GAAP measures, including adjusted EBITDA from continuing

operations, and such items may also be excluded in future periods

and could be significant amounts.

- Expenses related to the acquisition or divestiture of a

business, including business development costs, impairment of

assets, integration costs, severance, retention costs and

transaction costs;

- Start-up costs of new facilities and equipment;

- Charges associated with restructuring and cost saving

initiatives, including but not limited to asset impairments,

accelerated depreciation, severance costs and lease abandonment

charges;

- Asset impairment charges and facility closure costs;

- Legal settlements or awards; and

- The tax effect of the above items.

About SunOpta Inc.

SunOpta (Nasdaq:STKL) (TSX:SOY) is an innovative and sustainable

manufacturer fueling the future of food. With roots tracing back

over 50 years, SunOpta drives growth for today’s leading brands by

serving as a trusted innovation partner and value-added

manufacturer, crafting organic, plant-based beverages, fruit

snacks, nutritional beverages, broths and tea products sold through

retail, club, foodservice and e-commerce channels. Alongside the

company’s commitment to top brands, retailers and coffee shops,

SunOpta also proudly produces its own brands, including Sown®,

Dream®, and West LifeTM. For more information, visit

www.sunopta.com and LinkedIn.

Forward-Looking Statements

Certain statements included in this press release may be

considered "forward-looking statements" within the meaning of the

United States Private Securities Litigation Reform Act of 1995 and

applicable Canadian securities legislation, which are based on

information available to us on the date of this release. These

forward-looking statements include, but are not limited to, our

expectation for strong growth in revenue, Adjusted EBITDA from

continuing operations, and our revised revenue growth and Adjusted

EBITDA from continuing operations growth for fiscal 2024.

Generally, forward-looking statements do not relate strictly to

historical or current facts and are typically accompanied by words

such as “expect”, “potential”, “believe”, “anticipate”,

“estimates”, “can”, “will”, “target”, "should", "would", "plans",

“continue”, "becoming", "intend", "confident", "may", "project",

"intention", "might", "predict", “budget”, “forecast” or other

similar terms and phrases intended to identify these

forward-looking statements. Forward-looking statements are based on

information available to the Company on the date of this release

and are based on estimates and assumptions made by the Company in

light of its experience and its perception of historical trends,

current conditions and expected future developments including, but

not limited to, the Company’s actual financial results; our exit

from, and use of proceeds from the divestiture of the assets and

liabilities of, Frozen Fruit, uninterrupted operations and service

levels to our customers; current customer demand for the Company’s

products; general economic conditions; continued consumer interest

in health and wellness; the Company’s ability to maintain product

pricing levels; planned facility and operational expansions,

closures and divestitures; cost rationalization and product

development initiatives; alternative potential uses for the

Company’s capital resources; portfolio optimization and

productivity efforts; the sustainability of the Company’s sales

pipeline; the Company’s expectations regarding commodity pricing,

margins and hedging results; procurement and logistics savings;

freight lane cost reductions; yield and throughput enhancements;

labor cost reductions; and the terms of our insurance policies.

Whether actual timing and results will agree with expectations and

predictions of the Company is subject to many risks and

uncertainties including, but not limited to, potential loss of

suppliers and customers as well as the possibility of supply chain,

logistics and other disruptions; unexpected issues or delays with

the Company’s structural improvements and automation investments;

failure or inability to implement portfolio changes, process

improvements, go-to-market improvements and process sustainability

strategies in a timely manner; changes in the level of capital

investment; local and global political and economic conditions;

consumer spending patterns and changes in market trends; decreases

in customer demand; delayed or unsuccessful product development

efforts; potential product recalls; potential additional costs

associated with the frozen fruit recall; working capital

management; availability and pricing of raw materials and supplies;

potential covenant breaches under the Company’s credit facilities;

and other risks described from time to time under "Risk Factors" in

the Company's Annual Report on Form 10-K and its Quarterly Reports

on Form 10-Q (available at www.sec.gov). Consequently, all

forward-looking statements made herein are qualified by these

cautionary statements and there can be no assurance that the actual

results or developments anticipated by the Company will be

realized. The Company undertakes no obligation to publicly correct

or update the forward-looking statements in this document, in other

documents, or on its website to reflect future events or

circumstances, except as may be required under applicable

securities laws.

SunOpta Inc.

Consolidated Statements of Operations

For the quarters ended March 30, 2024 and

April 1, 2023

(Unaudited)

(All dollar amounts expressed in thousands

of U.S. dollars, except per share amounts)

Quarter ended

March 30, 2024

April 1, 2023

$

$

Revenues

182,848

154,969

Cost of goods sold

151,101

130,890

Gross profit

31,747

24,079

Selling, general and administrative

expenses

22,988

23,069

Intangible asset amortization

446

446

Other expense (income), net

(1,800

)

42

Foreign exchange gain

(51

)

(11

)

Operating income

10,164

533

Interest expense, net

6,050

5,664

Earnings (loss) from continuing

operations before income taxes

4,114

(5,131

)

Income tax expense (benefit)

277

(2,304

)

Earnings (loss) from continuing

operations

3,837

(2,827

)

Earnings (loss) from discontinued

operations

(1,417

)

4,204

Net earnings

2,420

1,377

Dividends and accretion on preferred

stock

(433

)

(704

)

Earnings attributable to common

shareholders

1,987

673

Basic and diluted earnings (loss) per

share

Earnings (loss) from continuing

operations

0.03

(0.03

)

Earnings (loss) from discontinued

operations

(0.01

)

0.04

Earnings attributable to common

shareholders

0.02

0.01

Weighted-average common shares

outstanding (000s)

Basic

116,033

110,014

Diluted

117,558

110,014

SunOpta Inc.

Consolidated Balance Sheets

As at March 30, 2024 and December 30,

2023

(Unaudited)

(All dollar amounts expressed in thousands

of U.S. dollars)

March 30, 2024

December 30, 2023

$

$

ASSETS

Current assets

Cash and cash equivalents

1,487

306

Accounts receivable

67,823

64,862

Inventories

92,000

83,215

Prepaid expenses and other current

assets

20,435

25,235

Income taxes recoverable

4,070

4,717

Current assets held for sale

2,542

5,910

Total current assets

188,357

184,245

Restricted cash

9,066

8,448

Property, plant and equipment, net

317,084

319,898

Operating lease right-of-use assets

106,667

105,919

Intangible assets, net

21,415

21,861

Goodwill

3,998

3,998

Other assets

25,174

25,055

Total assets

671,761

669,424

LIABILITIES

Current liabilities

Accounts payable and accrued

liabilities

95,900

96,650

Notes payable

16,648

17,596

Current portion of long-term debt

24,882

24,346

Current portion of operating lease

liabilities

16,403

15,808

Total current liabilities

153,833

154,400

Long-term debt

233,874

238,883

Operating lease liabilities

100,500

100,102

Deferred income taxes

378

505

Total liabilities

488,585

493,890

Series B-1 preferred stock

14,637

14,509

SHAREHOLDERS' EQUITY

Common shares

464,817

464,169

Additional paid-in capital

32,413

27,534

Accumulated deficit

(330,700

)

(332,687

)

Accumulated other comprehensive income

2,009

2,009

Total shareholders' equity

168,539

161,025

Total liabilities and shareholders'

equity

671,761

669,424

SunOpta Inc.

Consolidated Statements of Cash Flows

For the quarters ended March 30, 2024 and

April 1, 2023

(Unaudited)

(Expressed in thousands of U.S.

dollars)

Quarter ended

March 30, 2024

April 1, 2023

$

$

CASH PROVIDED BY (USED IN)

Operating activities

Net earnings

2,420

1,377

Earnings (loss) from discontinued

operations

(1,417

)

4,204

Earnings (loss) from continuing

operations

3,837

(2,827

)

Items not affecting cash:

Depreciation and amortization

8,576

7,050

Amortization of debt issuance costs

229

407

Deferred income taxes

-

(4,850

)

Stock-based compensation

5,299

3,892

Gain on sale of smoothie bowls product

line

(1,800

)

-

Other

(97

)

603

Changes in operating assets and

liabilities, net of divestitures

(8,642

)

2,389

Net cash provided by operating activities

of continuing operations

7,402

6,664

Net cash used in operating activities of

discontinued operations

(2,133

)

(2,797

)

Net cash provided by operating

activities

5,269

3,867

Investing activities

Additions to property, plant and

equipment

(7,548

)

(25,395

)

Proceeds received from sale of smoothie

bowls product line

3,336

-

Net cash used in investing activities of

continuing operations

(4,212

)

(25,395

)

Net cash provided by (used in) investing

activities of discontinued operations

6,300

(62

)

Net cash provided by (used in) investing

activities

2,088

(25,457

)

Financing activities

Increase in borrowings under revolving

credit facilities

250

5,573

Repayment of long-term debt

(4,782

)

(9,899

)

Borrowings of long-term debt

-

18,693

Proceeds from notes payable

33,424

10,662

Repayment of notes payable

(34,373

)

(5,433

)

Proceeds from the exercise of stock

options and employee share purchases

314

289

Payment of withholding taxes on

stock-based awards

(86

)

(249

)

Payment of cash dividends on preferred

stock

(305

)

(818

)

Payment of share issuance costs

-

(87

)

Net cash provided by (used in) financing

activities of continuing operations

(5,558

)

18,731

Net cash provided by financing activities

of discontinued operations

-

3,090

Net cash provided by (used in) financing

activities

(5,558

)

21,821

Increase in cash, cash equivalents and

restricted cash in the period

1,799

231

Cash, cash equivalents and restricted

cash, beginning of the period

8,754

679

Cash, cash equivalents and restricted

cash, end of the period

10,553

910

Non-GAAP Financial Measures

Adjusted Gross Margin

The Company uses a measure of adjusted gross margin to evaluate

the underlying profitability of its revenue-generating activities

within each reporting period. This non-GAAP measure excludes

non-capitalizable start-up costs included in cost of goods sold

that are incurred in connection with capital expansion projects.

Additionally, the Company’s measure of adjusted gross margin may

exclude other unusual items that are identified and evaluated on an

individual basis, which due to their nature or size, the Company

would not expect to occur as part of its normal business on a

regular basis. The Company believes that disclosing this non-GAAP

measure provides investors with a meaningful, consistent comparison

of its profitability measure for the periods presented. However,

the non-GAAP measure of adjusted gross margin should not be

considered in isolation or as a substitute for gross margin

calculated based on gross profit determined in accordance with U.S.

GAAP.

The following table presents a reconciliation of adjusted gross

margin from reported gross margin calculated in accordance with

U.S. GAAP.

For the quarter ended

March 30, 2024

April 1, 2023

Reported gross margin

17.4%

15.5%

Start-up costs(a)

0.2%

3.7%

Adjusted gross margin

17.5%

19.3%

Note: percentages may not add due to

rounding.

(a)

Represents incremental direct costs

incurred in connection with plant expansion projects and new

product introductions before the project or product reaches normal

production levels, including costs for the hiring and training of

additional personnel, fees for outside services, travel costs, and

plant- and production-related expenses. For the first quarter of

2024, start-up costs related to the ramp-up of production on a

third line at our plant-based beverage facility in Midlothian,

Texas, together with an expansion of our ingredient extraction

operations at our Modesto, California, facility. For the first

quarter of 2023, start-up costs included in cost of goods sold

mainly related to the ramp-up of production on the first two lines

at our Midlothian, Texas, facility.

Adjusted Earnings from Continuing

Operations and Adjusted EBITDA from Continuing

Operations

In addition to reporting financial results in accordance with

U.S. GAAP, the Company provides additional information about its

operating results regarding adjusted earnings from continuing

operations and adjusted earnings before interest, taxes,

depreciation and amortization (“Adjusted EBITDA”) from continuing

operations, which are not measures in accordance with U.S. GAAP.

The Company believes that adjusted earnings from continuing

operations and Adjusted EBITDA from continuing operations assist

investors in comparing performance across reporting periods on a

consistent basis by excluding items that management believes are

not indicative of its operating performance. These non-GAAP

measures are presented solely to allow investors to more fully

assess the Company’s results of operations and should not be

considered in isolation of, or as substitutes for, an analysis of

the Company’s results as reported under U.S. GAAP.

The following are tabular presentations of adjusted earnings

from continuing operations and Adjusted EBITDA from continuing

operations, including a reconciliation from earnings (loss) from

continuing operations, which the Company believes to be the most

directly comparable U.S. GAAP financial measure.

March 30, 2024

April 1, 2023

Per Share

Per Share

For the quarter ended

$

$

$

$

Earnings (loss) from continuing

operations

3,837

(2,827

)

Dividends and accretion on preferred

stock

(433

)

(704

)

Earnings (loss) from continuing operations

attributable to common

shareholders

3,404

0.03

(3,531

)

(0.03

)

Adjusted for:

Gain on sale of smoothie bowls product

line(a)

(1,800

)

-

Start-up costs(b)

327

6,425

Business development costs(c)

-

731

Other

-

42

Net income tax on adjusting items(d)

-

(1,873

)

Adjusted earnings from continuing

operations

1,931

0.02

1,794

0.02

March 30, 2024

April 1, 2023

For the quarter ended

$

$

Earnings (loss) from continuing

operations

3,837

(2,827

)

Income tax expense (benefit)

277

(2,304

)

Interest expense, net

6,050

5,664

Depreciation and amortization

8,576

7,050

Stock-based compensation

5,299

3,892

Adjusted for:

Gain on sale of smoothie bowls product

line(a)

(1,800

)

-

Start-up costs(b)

327

6,425

Business development costs(c)

-

731

Other

-

42

Adjusted EBITDA from continuing

operations

22,566

18,673

(a)

Reflects the pre-tax gain on sale of the

smoothie bowls product line, which is recorded in other income.

(b)

For the first quarter of 2024, start-up

costs related to the ramp-up of production on a third line at our

plant-based beverage facility in Midlothian, Texas, together with

an expansion of our ingredient extraction operations at our

Modesto, California, facility, and are recorded in cost of goods

sold. For the first quarter of 2023, start-up costs mainly related

to the ramp-up of production on the first two lines at our

Midlothian, Texas, facility, and are recorded in cost of goods sold

($5.8 million) and SG&A expenses ($0.6 million).

(c)

Represents third-party costs associated

with business development activities, which are inclusive of costs

related to the evaluation, execution, and integration of external

acquisitions and divestitures, internal expansion projects, and

other strategic initiatives. For the first quarter of 2023,

business development costs related to the divestiture of our frozen

fruit business, which was completed in October 2023. These costs

are recorded in SG&A expenses.

(d)

Reflects the tax effect of the adjustments

to earnings calculated based on the statutory tax rates applicable

in the tax jurisdiction of the underlying adjustment, net of

deferred tax valuation allowances.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240508006860/en/

Investor Relations: Reed Anderson ICR 646-277-1260

investors@sunopta.com

Media Relations: Claudine Galloway SunOpta 952-295-9579

press.inquiries@sunopta.com

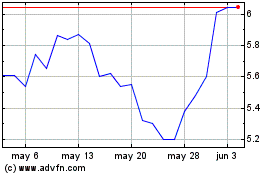

SunOpta (NASDAQ:STKL)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

SunOpta (NASDAQ:STKL)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024