Thunder Bridge Capital Partners Ⅳ, Inc. (“THCP” or “Thunder

Bridge”), a special purpose acquisition company (“SPAC”) publicly

listed on the Nasdaq Global Market (“Nasdaq”), is working closely

with Coincheck Group B.V. (“CCG” or “Coincheck Group”), a

consolidated subsidiary of Monex Group, Inc. (headquarters: Tokyo,

Japan; Representative Executive Officer and CEO: Oki Matsumoto),

which will be a holding company of Coincheck, Inc. (“Coincheck”),

to complete the previously announced merger which will result in

CCG becoming a publicly listed company on Nasdaq (the “CCG De-SPAC

Transaction”) pursuant to the Business Combination Agreement, dated

March 22, 2022, among THCP and CCG and certain of its affiliates

(as amended from time to time, the “Business Combination

Agreement”).

In response to the U.S. Securities and Exchange Commission’s

(“SEC”) prolonged registration review process, THCP filed a proxy

statement on May 31, 2023 in connection with a special meeting of

stockholders of THCP that will be held on June 21, 2023 (the “THCP

Stockholders Meeting”), which includes, among other things, a

proposal to amend its amended and restated certificate of

incorporation to extend the date by which THCP must consummate a

de-SPAC transaction from July 2, 2023 to July 2, 2024 (the

“Extension Proposal”).

In light of the above, the parties have agreed to amend the

Business Combination Agreement to extend the deadline for

completing the CCG De-SPAC Transaction for one year, subject to

stockholder approval of the Extension Proposal at the THCP

Stockholders Meeting.

Gary Simanson, President & Chief Executive Officer of THCP,

said, “As the process for our proposed business combination with

Coincheck Group has progressed, it has also enabled us to build a

strong working relationship with Oki Matsumoto and his team. Their

commitment to professionalism, doing things the right way, and

prudently managing the short-term, while also building and managing

for the long-term, are the traits and characteristics that were

clearly evident when we first evaluated the opportunity to combine

our companies. How Oki and his team have conducted themselves the

past 16 months strongly re-affirms our view and findings from when

we initially conducted due diligence last year that they are an

excellent business partner.

“Given the stable fundamental business performance of Coincheck

over the past year, in what has been a most uncertain and unstable

time for the industry overall, Oki and his team’s steady hand

throughout this period says it all, and speaks well of the future

of the combined company and the opportunities that lie before us.

Oki and I have frequently said during this time, that as a

registered virtual currency exchange in Japan, Coincheck is well

positioned to take advantage of the current disruptions in the

industry and we believe the opportunities for a transparent,

regulated, public company, are even more compelling today than when

we first envisioned the proposed business combination.

“We remain committed to completing the proposed business

combination and are truly grateful to Oki and his team for their

equal commitment to seeing the proposed transaction through and

then, with our combined resources, going on to build an even

greater global company.”

“After more than a year of working with Gary Simanson and his

team at Thunder Bridge, Coincheck Group remains committed to

completing the business combination with Thunder Bridge and to

gaining access to the U.S. capital markets,” said Oki Matsumoto,

Chairman and Chief Executive Officer of Monex Group, Inc. “The

rationale for the proposed business combination and listing of

Coincheck Group, as a holding company of a registered virtual

crypto currency exchange in Japan, on the Nasdaq Global Market is

more compelling than ever. By extending the deadline of the

business combination for an additional twelve months, we are making

a clear statement that we are committed to pursuing this strategic

transaction. We look forward to working with Gary Simanson and his

team to successfully consummate the proposed business combination

and to having Coincheck Group become a publicly traded company on

the Nasdaq Global Market.

“The listing of CCG on Nasdaq through the CCG De-SPAC

Transaction will enable us to gain exposure to international

investors and to utilize Nasdaq-listed shares as effective currency

for recruiting talent and making global acquisitions, thereby

further expanding its crypto asset business. We intend to continue

our efforts toward completing the CCG De-SPAC Transaction in

accordance with the Business Combination Agreement.”

ADDITIONAL INFORMATION AND WHERE TO FIND IT

For additional information on the CCG De-SPAC Transaction, see

THCP’s Current Report on Form 8-K filed with the SEC on March 22,

2022. In connection with the proposed business combination, the

parties intend to file relevant materials with the SEC, including a

registration statement on Form F-4 to be filed by CCG with the SEC,

which will include a proxy statement/prospectus of THCP, and will

file other documents regarding the proposed business combination

with the SEC. THCP’s stockholders and other interested persons are

advised to read, when available, the preliminary proxy

statement/prospectus and the amendments thereto and the definitive

proxy statement and documents incorporated by reference therein

filed in connection with the proposed business combination, as

these materials will contain important information about CCG,

Coincheck, THCP and the proposed business combination. Promptly

after the Form F-4 is declared effective by the SEC, THCP will mail

the definitive proxy statement/prospectus and a proxy card to each

stockholder entitled to vote at the meeting relating to the

approval of the proposed business combination and other proposals

set forth in the proxy statement/prospectus. Before making any

voting or investment decision, investors and stockholders of THCP

are urged to carefully read the entire registration statement and

proxy statement/prospectus, when they become available, and any

other relevant documents filed with the SEC, as well as any

amendments or supplements to these documents, because they will

contain important information about the proposed business

combination. The documents filed by THCP with the SEC may be

obtained free of charge at the SEC’s website at www.sec.gov, or by

directing a request to Thunder Bridge Capital Partners IV, Inc.,

9912 Georgetown Pike, Suite D203, Great Falls, Virginia 22066,

Attention: Secretary, (202) 431-0507.

PARTICIPANTS IN THE SOLICITATION

THCP and its directors and executive officers may be deemed

participants in the solicitation of proxies from its stockholders

with respect to the proposed business combination. A list of the

names of those directors and executive officers and a description

of their interests in THCP will be included in the proxy

statement/prospectus for the proposed business combination when

available at www.sec.gov. Information about THCP’s directors and

executive officers and their ownership of THCP common stock is set

forth in THCP prospectus, dated June 29, 2021, as modified or

supplemented by any Form 3 or Form 4 filed with the SEC since the

date of such filing. Other information regarding the interests of

the participants in the proxy solicitation will be included in the

proxy statement/prospectus pertaining to the proposed business

combination when it becomes available. These documents can be

obtained free of charge from the source indicated above.

CCG, Coincheck, THCP and their respective directors and

executive officers may also be deemed to be participants in the

solicitation of proxies from the stockholders of THCP in connection

with the proposed business combination. A list of the names of such

directors and executive officers and information regarding their

interests in the proposed business combination will be included in

the proxy statement/prospectus for the proposed business

combination.

FORWARD-LOOKING STATEMENTS

This communication contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Such statements include, but are not limited to, statements

about future financial and operating results, our plans,

objectives, expectations and intentions with respect to future

operations, products and services; and other statements identified

by words such as “will likely result,” “are expected to,” “will

continue,” “is anticipated,” “estimated,” “believe,” “intend,”

“plan,” “projection,” “outlook” or words of similar meaning. These

forward-looking statements include, but are not limited to,

statements regarding Coincheck’s industry and market sizes, future

opportunities for CCG, Coincheck and THCP, Coincheck’s estimated

future results and the proposed business combination between THCP

and Coincheck, including the implied enterprise value, the expected

transaction and ownership structure and the likelihood, timing and

ability of the parties to successfully consummate the proposed

transaction. Such forward-looking statements are based upon the

current beliefs and expectations of our management and are

inherently subject to significant business, economic and

competitive uncertainties and contingencies, many of which are

difficult to predict and generally beyond our control. Actual

results and the timing of events may differ materially from the

results anticipated in these forward-looking statements.

In addition to factors previously disclosed in THCP’s reports

filed with the SEC and those identified elsewhere in this

communication, the following factors, among others, could cause

actual results and the timing of events to differ materially from

the anticipated results or other expectations expressed in the

forward-looking statements: inability to meet the closing

conditions to the business combination, including the occurrence of

any event, change or other circumstances that could give rise to

the termination of the Business Combination Agreement; the

inability to complete the transactions contemplated by the Business

Combination Agreement due to the failure to obtain approval of

THCP’s stockholders, the failure to achieve the minimum amount of

cash available following any redemptions by THCP stockholders,

redemptions exceeding a maximum threshold or the failure to meet

Nasdaq listing standards in connection with the consummation of the

contemplated transactions; costs related to the transactions

contemplated by the Business Combination Agreement; a delay or

failure to realize the expected benefits from the proposed business

combination; risks related to disruption of management’s time from

ongoing business operations due to the proposed business

combination; changes in the cryptocurrency and digital asset

markets in which Coincheck competes, including with respect to its

competitive landscape, technology evolution or regulatory changes;

changes in domestic and global general economic conditions, risk

that Coincheck may not be able to execute its growth strategies,

including identifying and executing acquisitions; risk that

Coincheck may not be able to develop and maintain effective

internal controls; and other risks and uncertainties indicated in

THCP’s final prospectus, dated June 29, 2021, for its initial

public offering, and the proxy statement/prospectus relating to the

proposed business combination, including those under “Risk Factors”

therein, and in THCP’s other filings with the SEC. CCG, THCP and

Coincheck caution that the foregoing list of factors is not

exclusive.

Actual results, performance or achievements may differ

materially, and potentially adversely, from any projections and

forward-looking statements and the assumptions on which those

forward-looking statements are based. There can be no assurance

that the data contained herein is reflective of future performance

to any degree. You are cautioned not to place undue reliance on

forward-looking statements as a predictor of future performance as

projected financial information and other information are based on

estimates and assumptions that are inherently subject to various

significant risks, uncertainties and other factors, many of which

are beyond our control. All information set forth herein speaks

only as of the date hereof in the case of information about THCP

and Coincheck or the date of such information in the case of

information from persons other than THCP or Coincheck, and we

disclaim any intention or obligation to update any forward looking

statements as a result of developments occurring after the date of

this communication. Forecasts and estimates regarding Coincheck’s

industry and end markets are based on sources we believe to be

reliable, however there can be no assurance these forecasts and

estimates will prove accurate in whole or in part. Annualized, pro

forma, projected and estimated numbers are used for illustrative

purpose only, are not forecasts and may not reflect actual

results.

NO OFFER OR SOLICITATION

This press release shall not constitute a solicitation of a

proxy, consent, or authorization with respect to any securities or

in respect of the proposed business combination. This press release

shall also not constitute an offer to sell or the solicitation of

an offer to buy any securities, nor shall there be any sale of

securities in any states or jurisdictions in which such offer,

solicitation, or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended, or an exemption therefrom.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230531005857/en/

Gary A. Simanson 202.431.0507 gsimanson@thunderbridge.us

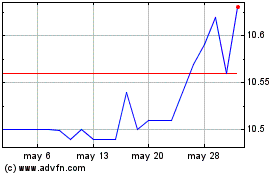

Thunder Bridge Captial P... (NASDAQ:THCP)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Thunder Bridge Captial P... (NASDAQ:THCP)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024