false

0001682149

0001682149

2024-12-23

2024-12-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): December 23, 2024

WISA TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38608 |

|

30-1135279 |

(State or other jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

|

15268 NW Greenbrier Pkwy

Beaverton, OR |

|

97006 |

| (Address of registrant’s principal executive office) |

|

(Zip code) |

(408) 627-4716

(Registrant’s telephone

number, including area code)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.0001 per share |

|

WISA |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange

Act of 1934.

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure |

On December 23, 2024,

WiSATechnologies, Inc. (the “Company”) issued a press release announcing that the Company’s stockholders had approved,

at the Company’s 2024 Annual Meeting of Stockholders, the issuance of 40,000,000 shares of the Company’s common stock, par

value $0.0001 per share (the “Common Stock”), to Data Vault Holdings Inc. (“Data Vault”) as partial consideration

for the purchase of certain intellectual property assets from Data Vault. The shares of Common Stock will be issued to Data Vault on closing

of the transaction, which closing is subject to customary closing conditions.

On December 23, 2024,

the Company issued an updated press release (the “Updated Press Release”) to clarify that the shares of Common Stock to be

issued to Data Vault will be restricted shares that are not available for immediate resale, absent an exemption from registration under

the Securities Act of 1933, as amended (the “Securities Act”). The Company is not under any obligation to register such shares

pursuant to a registration rights agreement or any other registration mechanism. The Updated Press Release is attached hereto as Exhibit

99.1 to this Current Report on Form 8-K and is incorporated into this Item 7.01 by reference.

The information contained

in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference

in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d)

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: December 23, 2024 |

WISA TECHNOLOGIES, INC. |

| |

|

|

| |

By: |

/s/ Brett Moyer |

| |

|

Name: |

Brett Moyer |

| |

|

Title: |

Chief Executive Officer |

Exhibit 99.1

WiSA Technologies’ Stockholders Overwhelmingly

Approve Purchase of Data Vault Holdings’ Assets

-

Fairness opinion valued Data Vault’s assets between $266M and $501M -

- 40 million shares of WiSA restricted common

stock to be issued at closing of the transaction plus a $10 million 3-year Note -

-

Creates licensing and technology company with extensive patent portfolio for sports & entertainment, events & venues, biotech,

education, fintech, real estate, healthcare, and energy

Beaverton, OR (December 23,

2024) WiSA Technologies, Inc. (“WiSA Technologies”) (NASDAQ: WISA), has received stockholder approval to purchase the

Datavault® intellectual property and information technology assets of privately held Data Vault Holdings Inc.® for 40 million

shares of restricted common stock of WiSA Technologies to be issued at closing of the transaction plus a $10 million 3-year Note.

94% of stockholders present or represented by proxy at the meeting voted in favor of the transaction. Closing remains subject to customary

conditions and is expected to be completed on or about December 31, 2024.

Upon closing, WiSA Technologies

will change its name to Datavault Inc. and will become a data technology and licensing company that enables clients and strategic partners

to monetize their Blockchain Data and AI Web 3.0 assets via tokenization, data ownership and digital twins offering two primary solutions:

| · | Data Sciences will license High Performance

Computing (HPC) software applications and Web 3.0 data management serving the biotech research, energy, education, fintech, real estate,

and healthcare industries, among others. |

| · | Acoustic Sciences will license spatial and

multichannel HD sound transmission, including proprietary brands ADIO®, WiSA® and Sumerian®, to customers in sports &

entertainment, events & venues, restaurants, automotive, finance, and other industries. |

“This resounding vote of

approval from our stockholders marks a turning point in the company’s history, as this transaction will transform the company into

a dramatically larger entity with a broad reach in multiple, rapidly growing markets,” said Brett Moyer, CEO of WiSA Technologies.

“I look forward to working closely with Nate as we move forward integrating these assets and growing the business across multiple

vertical markets.”

Nathaniel T. Bradley, CEO and

co-founder of Data Vault Holdings, said, “This is an exciting time, as the transaction is expected to enable increased access to

capital and additional resources to energize our commercial expansion for Data and Acoustic Sciences. Since embarking on this technology

integration with WiSA in early September, we have a made a number of customer and partnering announcements, and we expect to build on

this momentum in 2025.”

The Datavault Platform

Datavault’s

software and encryption enables a comprehensive solution for managing and monetizing data in the Web 3.0 environment. It allows

risk-free licensing of name, image, and likeness (NIL) by securely attaching physical real-world objects to immutable metadata or blockchain

objects, fostering responsible AI with integrity. Datavault's solutions ensure privacy and credential protection. They are completely

customizable and offer AI and ML automation, third-party integration, detailed analytics and data, marketing automation and advertising

monitoring.

The platform creates value through scarcity,

utility, and encrypted data protection and generates revenue through licensing partnerships that provide detailed analytics, sophisticated

HPC modeling, digital ownership, tokenization, and advertising, among other means.

Summary of the Asset Purchase Agreement

| · | Consideration

paid to Data Vault Holdings in exchange for Datavault and ADIO intellectual property and information technology assets by WiSA Technologies. |

o

40 million shares of restricted common stock of WiSA Technologies to be issued at closing of the transaction

o

$10 million in an unsecured promissory note due 3 years from closing, with 10% of the proceeds of any financings used to pay down or pay

off the promissory note in the interim

| · | 3% royalty

on future revenues from Datavault and ADIO product lines |

Closing

is subject to customary closing conditions.

Upon

closing, Mr. Bradley will become CEO and Mr. Moyer, CFO, and the company will change its name to Datavault Inc.

Nathaniel

(Nate) Bradley

Nathaniel

(Nate) Bradley, CEO and Co-founder of Data Vault Holdings Inc., a highly accomplished inventor with over 70 international and U.S. patents

across diverse fields such as Internet broadcasting, mobile advertising, behavioral healthcare, blockchain, cybersecurity, AI, and data

science. As CEO and co-founder of Data Vault Holdings Inc., which operates Datavault Inc., Adio LLC, True Luck Inc., and Data Donate Technologies,

Mr. Bradley has developed patented technologies that establish Datavault as a leader in Web 3.0 data monetization. He has also lobbied

Congress for a Digital Bill of Rights and founded the Intellectual Property Network Inc., offering IP and IT development services globally.

Previously, Mr. Bradley was the inventor and founder of AudioEye (NASDAQ: AEYE), where he pioneered cloud-based assistive technologies,

earning recognition for his contributions to internet accessibility. His extensive experience includes roles as Chief Technology Officer

for Marathon Patent Group (currently named Marathon Digital Holdings, NASDAQ: MARA) and involvement in significant acquisitions within

the Internet Radio industry.

Legal Advisors

Sullivan & Worcester LLP served as legal

counsel for WiSA Technologies, and Mitchell Silberberg & Knupp LLP served as legal counsel for Data Vault Holdings Inc.

About Data Vault Holdings

Inc.

Data Vault Holdings Inc. is a technology

holding company that provides a proprietary, cloud-based platform for the delivery of blockchain objects. Data Vault Holdings Inc. provides

businesses with the tools to monetize data assets securely over its Information Data Exchange® (IDE). The company is in the process

of finalizing the consolidation of its affiliates Data Donate Technologies, Inc., ADIO LLC, and Datavault Inc. as wholly owned subsidiaries

under one corporate structure. Learn more about Data Vault Holdings Inc. Datavault Inc. and True Luck, Inc. as wholly owned subsidiaries

under one corporate structure. Learn more about Data Vault Holdings Inc. at www.datavaultsite.com.

Cautionary Note Regarding

Forward-Looking Statements

This

press release of WiSA Technologies, Inc. (NASDAQ: WISA) (the “Company”, “us”, “our” or “WiSA”)

contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements, include, among others,

the Company’s and Data Vault Holdings, Inc.’s (“Datavault”) expectations with respect to the proposed asset purchase

(the “Asset Purchase) between them, including statements regarding the benefits of the Asset Purchase, the anticipated timing of

the Asset Purchase, the implied valuation of Datavault, the products offered by Datavault and the markets in which it operates, and the

Company’s and Datavault’s projected future results and market opportunities, as well as information with respect to WiSA’s

future operating results and business strategy. Readers are cautioned not to place undue reliance on these forward-looking statements.

Actual results may differ materially from those indicated by these forward-looking statements as a result of a variety of factors, including,

but not limited to: (i) risks and uncertainties impacting WiSA’s business including, risks related to its current liquidity position

and the need to obtain additional financing to support ongoing operations, WiSA’s ability to continue as a going concern, WiSA’s

ability to maintain the listing of its common stock on Nasdaq, WiSA’s ability to predict the timing of design wins entering production

and the potential future revenue associated with design wins, WiSA’s ability to predict its rate of growth, WiSA’s ability

to predict customer demand for existing and future products and to secure adequate manufacturing capacity, consumer demand conditions

affecting WiSA’s customers’ end markets, WiSA’s ability to hire, retain and motivate employees, the effects of competition

on WiSA’s business, including price competition, technological, regulatory and legal developments, developments in the economy and

financial markets, and potential harm caused by software defects, computer viruses and development delays, (ii) risks related to the Asset

Purchase, including WiSA’s ability to close the Asset Purchase in a timely manner or at all, or on the terms anticipated, whether

due to WiSA’s ability to satisfy the applicable closing conditions and secure stockholder approval from WiSA stockholders or otherwise,

as well as risks related to WiSA’s ability to realize some or all of the anticipated benefits from the Asset Purchase, (iii) any

risks that may adversely affect the business, financial condition and results of operations of Datavault, including but not limited to

cybersecurity risks, the potential for AI design and usage errors, risks related to regulatory compliance and costs, potential harm caused

by data privacy breaches, digital business interruption and geopolitical risks, and (iv) other risks as set forth from time to time in

WiSA’s filings with the U.S. Securities and Exchange Commission. The information in this press release is as of the date hereof

and neither the Company nor Datavault undertakes any obligation to update such information unless required to do so by law. The reader

is cautioned not to place under reliance on forward looking statements. Neither the Company nor Datavault gives any assurance that either

the Company or Datavault will achieve its expectations.

Investors Contact for WiSA Technologies

and Data Vault Holdings:

David Barnard, Alliance Advisors Investor

Relations, 415-433-3777, dbarnard@allianceadvisors.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

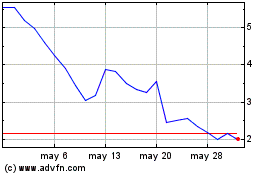

WiSA Technologies (NASDAQ:WISA)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

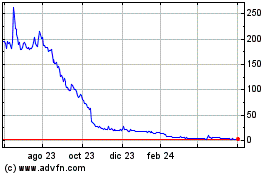

WiSA Technologies (NASDAQ:WISA)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024