false

0001623925

0001623925

2024-10-30

2024-10-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

October 30, 2024

ANTERO

MIDSTREAM CORPORATION

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-38075 |

|

61-1748605 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification Number) |

1615

Wynkoop Street

Denver,

Colorado 80202

(Address of Principal Executive Offices) (Zip

Code)

Registrant’s Telephone Number, Including

Area Code (303) 357-7310

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which

registered |

| Common

Stock, par value $0.01 Per Share |

|

AM |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 |

Results of Operations and Financial Condition |

On October 30,

2024, Antero Midstream Corporation issued a press release, a copy of which is attached hereto as Exhibit 99.1 and incorporated by

reference herein, announcing its financial and operational results for the quarter ended September 30, 2024.

The information

in this Current Report, including Exhibit 99.1, is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to liabilities of that section, and is not incorporated by reference into any filing under the Securities Act of

1933, as amended, or the Exchange Act unless specifically identified therein as being incorporated therein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ANTERO MIDSTREAM CORPORATION |

| |

|

| |

By: |

/s/ Brendan E. Krueger |

| |

|

Brendan E. Krueger |

| |

|

Chief Financial Officer, Vice President –Finance and

Treasurer |

| |

|

|

| Dated: October 30, 2024 |

|

Exhibit 99.1

Antero Midstream Announces Third Quarter 2024

Results and New Appointment to the Board of Directors

Denver,

Colorado, October 30, 2024—Antero Midstream Corporation (NYSE: AM) (“Antero Midstream” or the “Company”)

today announced its third quarter 2024 financial and operating results. The relevant unaudited condensed consolidated financial statements

are included in Antero Midstream’s Quarterly Report on Form 10-Q for the three months ended September 30, 2024. Additionally,

the Company announced that Jeffrey Muñoz has been appointed to its Board of Directors (the “Board”), effective October 29,

2024.

Third Quarter 2024 Highlights:

| · | Net Income was $100 million, or $0.21 per diluted share, a 5% per share increase compared to the prior

year quarter |

| · | Adjusted Net Income was $113 million, or $0.23 per diluted share, in line with the prior year quarter

(non-GAAP measure) |

| · | Adjusted EBITDA was $256 million, a 2% increase compared to the prior year quarter (non-GAAP measure) |

| · | Free Cash Flow after dividends was $40 million, a 32% increase compared to the prior year quarter (non-GAAP

measure) |

| · | Maintained Leverage of 3.1x as of September 30, 2024 (non-GAAP measure) |

| · | Announced the addition of Jeffrey Muñoz to the Board of Directors |

Paul Rady, Chairman and CEO said, “We are

pleased to announce that Jeffrey Muñoz has been appointed to the Board of Directors. Mr. Muñoz has over 30 years of

experience in the energy industry with legal and accounting expertise and will be a valuable addition to the Board.”

Mr. Rady further added, “During the

third quarter, Antero Midstream generated $40 million of Free Cash Flow after dividends, which was an increase of 32% from last year.

This represents the ninth consecutive quarter of generating Free Cash Flow after dividends and brings the year-to-date total to almost

$160 million.”

Brendan Krueger, CFO of Antero Midstream, said

“Consistent with our absolute debt and leverage reduction targets, Antero Midstream continued to pay down debt during the third

quarter. Following the acceleration of capital into the third quarter due to favorable weather conditions, we expect a significant decline

in capital in the fourth quarter. This reduction in capital is expected to result in increased Free Cash Flow, positioning us well to

achieve our 3.0x leverage target during the quarter.”

For

a discussion of the non-GAAP financial measures, including Adjusted EBITDA, Adjusted Net Income, Leverage, Free Cash Flow after

dividends, and Net Debt see “Non-GAAP Financial Measures.”

Third Quarter 2024 Financial Results

Low

pressure gathering volumes for the third quarter of 2024 averaged 3,277 MMcf/d, a 1% decrease compared to the prior year quarter.

Compression volumes for the third quarter of 2024 averaged 3,269 MMcf/d, in line with the prior year quarter. High pressure gathering

volumes averaged 3,046 MMcf/d, a 4% increase compared to the prior year quarter. Fresh water delivery volumes averaged 71 MBbl/d during

the quarter, a 33% decrease compared to the third quarter of 2023. The reduction in fresh water delivery volumes was driven by the reduction

in completion crews operating for Antero Resources from two completion crews in the third quarter of 2023 to one completion crew in the

third quarter of 2024.

Gross

processing volumes from the processing and fractionation joint venture with MPLX, LP (the “Joint Venture”) averaged 1,620

MMcf/d for the third quarter of 2024, in line with the prior year quarter. Joint Venture processing capacity was 100% utilized during

the quarter based on nameplate processing capacity of 1.6 Bcf/d. Gross Joint Venture fractionation volumes averaged 40 MBbl/d, in line

with the prior year quarter. Joint Venture fractionation capacity was 100% utilized during the quarter based on nameplate fractionation

capacity of 40 MBbl/d.

| |

|

Three Months Ended

September 30, |

|

|

% |

|

| Average Daily Volumes: |

|

2023 |

|

|

2024 |

|

|

Change |

|

| Low Pressure Gathering (MMcf/d) |

|

|

3,323 |

|

|

|

3,277 |

|

|

|

(1 |

)% |

| Compression (MMcf/d) |

|

|

3,271 |

|

|

|

3,269 |

|

|

|

— |

|

| High Pressure Gathering (MMcf/d) |

|

|

2,935 |

|

|

|

3,046 |

|

|

|

4 |

% |

| Fresh Water Delivery (MBbl/d) |

|

|

106 |

|

|

|

71 |

|

|

|

(33 |

)% |

| Gross Joint Venture Processing (MMcf/d) |

|

|

1,616 |

|

|

|

1,620 |

|

|

|

— |

|

| Gross Joint Venture Fractionation (MBbl/d) |

|

|

40 |

|

|

|

40 |

|

|

|

— |

|

For

the three months ended September 30, 2024, revenues were $270 million, comprised of $226 million from the Gathering and Processing

segment and $44 million from the Water Handling segment, net of $18 million of amortization of customer relationships. Water Handling

revenues include $25 million from wastewater handling and high rate water transfer services.

Direct

operating expenses for the Gathering and Processing and Water Handling segments were $25 million and $27 million, respectively,

for a total of $52 million. Water Handling operating expenses include $22 million from wastewater handling and high rate water transfer

services. General and administrative expenses excluding equity-based compensation were $11 million during the third quarter of 2024. Total

operating expenses during the third quarter of 2024 included $12 million of equity-based compensation expense and $33 million of depreciation

expense.

Net

Income was $100 million, or $0.21 per diluted share, a 5% per share increase compared to the prior year quarter. Net Income adjusted

for amortization of customer relationships, impairment of property and equipment, loss on early extinguishment of debt, and loss (gain)

on asset sale, net of tax effects of reconciling items, or Adjusted Net Income, was $113 million. Adjusted Net Income was $0.23 per diluted

share, in line with the prior year quarter.

The following table reconciles Net Income to Adjusted

Net Income (in thousands):

| | |

Three Months Ended

September 30, | |

| | |

2023 | | |

2024 | |

| Net Income | |

$ | 97,820 | | |

| 99,740 | |

| Amortization of customer relationships | |

| 17,668 | | |

| 17,668 | |

| Impairment of property and equipment | |

| — | | |

| 332 | |

| Loss on early extinguishment of debt | |

| — | | |

| 341 | |

| Loss (gain) on asset sale | |

| 467 | | |

| (473 | ) |

| Tax effect of reconciling items(1) | |

| (4,663 | ) | |

| (4,601 | ) |

| Adjusted Net Income | |

$ | 111,292 | | |

| 113,007 | |

| (1) | The statutory tax rates for the three months ended September 30, 2023 and 2024 were 25.7% and 25.8%, respectively. |

Adjusted

EBITDA was $256 million, a 2% increase compared to the prior year quarter. Interest expense was $52 million, a 6% decrease compared

to the prior year quarter, driven primarily by lower outstanding average total debt. Capital expenditures were $56 million. Free Cash

Flow before dividends was $148 million, a 7% increase compared to the prior year quarter. Free Cash Flow after dividends was $40 million,

a 32% increase compared to the prior year quarter.

The following table reconciles Net Income to Adjusted EBITDA and Free

Cash Flow before and after dividends (in thousands):

| | |

Three Months Ended

September 30, | |

| | |

2023 | | |

2024 | |

| Net Income | |

$ | 97,820 | | |

| 99,740 | |

| Interest expense, net | |

| 55,233 | | |

| 51,812 | |

| Income tax expense | |

| 36,657 | | |

| 38,202 | |

| Depreciation expense | |

| 30,745 | | |

| 32,534 | |

| Amortization of customer relationships | |

| 17,668 | | |

| 17,668 | |

| Loss (gain) on asset sale | |

| 467 | | |

| (473 | ) |

| Accretion of asset retirement obligations | |

| 45 | | |

| 49 | |

| Impairment of property and equipment | |

| — | | |

| 332 | |

| Loss on early extinguishment of debt | |

| — | | |

| 341 | |

| Equity-based compensation | |

| 8,349 | | |

| 11,945 | |

| Equity in earnings of unconsolidated affiliates | |

| (27,397 | ) | |

| (27,668 | ) |

| Distributions from unconsolidated affiliates | |

| 31,330 | | |

| 31,981 | |

| Adjusted EBITDA | |

$ | 250,917 | | |

| 256,463 | |

| Interest expense, net | |

| (55,233 | ) | |

| (51,812 | ) |

| Capital expenditures (accrual-based) | |

| (57,271 | ) | |

| (56,265 | ) |

| Free Cash Flow before dividends | |

$ | 138,413 | | |

| 148,386 | |

| Dividends declared (accrual-based) | |

| (107,936 | ) | |

| (108,298 | ) |

| Free Cash Flow after dividends | |

$ | 30,477 | | |

| 40,088 | |

The following table reconciles net cash provided

by operating activities to Free Cash Flow before and after dividends (in thousands):

| | |

Three Months Ended

September 30, | |

| | |

2023 | | |

2024 | |

| Net cash provided by operating activities | |

$ | 202,437 | | |

| 184,936 | |

| Amortization of deferred financing costs | |

| (1,506 | ) | |

| (1,571 | ) |

| Settlement of asset retirement obligations | |

| 174 | | |

| 99 | |

| Changes in working capital | |

| (5,421 | ) | |

| 21,187 | |

| Capital expenditures (accrual-based) | |

| (57,271 | ) | |

| (56,265 | ) |

| Free Cash Flow before dividends | |

$ | 138,413 | | |

| 148,386 | |

| Dividends declared (accrual-based) | |

| (107,936 | ) | |

| (108,298 | ) |

| Free Cash Flow after dividends | |

$ | 30,477 | | |

| 40,088 | |

Third Quarter 2024 Operating Update

During

the third quarter of 2024, Antero Midstream connected 23 wells to its gathering system and serviced 9 wells with its fresh water

delivery system.

Capital Investments

Capital

expenditures were $56 million during the third quarter of 2024. The Company invested $49 million in gathering and compression,

$6 million in water infrastructure, and $1 million in the Stonewall Joint Venture for an expansion to improve connectivity to the Mountain

Valley Pipeline. The increase in capital expenditures during the quarter was driven by favorable weather conditions and the acceleration

of capital into the third quarter. As a result, Antero Midstream expects a sequential decline in capital expenditures during the fourth

quarter to remain in line with its annual 2024 capital budget guidance of $150 to $170 million.

2024 Guidance Update

Antero Midstream is adjusting its 2024 net income,

adjusted net income, and interest expense guidance. The changes are driven primarily by increased interest expense as a result of higher

interest rates and other non-cash items related to the refinancing of senior notes and credit facility in 2024. All other guidance ranges

remain unchanged.

| | |

Twelve Months Ended

December 31, 2024 | | |

Change vs.

Prior

Guidance | |

| | |

Low | | |

High | | |

(At midpoint) | |

| Net Income | |

$ | 400 | | |

$ | 420 | | |

$ | (25 | ) |

| Adjusted Net Income | |

| 465 | | |

| 485 | | |

| (15 | ) |

| Interest Expense | |

| 200 | | |

| 210 | | |

| 10 | |

Appointment of Jeffrey Muñoz to the Board of Directors

Antero Midstream appointed Jeffrey Muñoz

to its Board as a Class II Director. He is an independent director under the director independence standards set forth in the rules and

regulations of the Securities and Exchange Commission and the applicable listing standards of the New York Stock Exchange. Mr. Muñoz

has over 30 years of experience in the energy industry with a legal and accounting background, having spent ten years as a partner with

Latham and Watkins LLP where he served as a member of the firm’s diversity committee. Prior to that he spent 20 years with Vinson

and Elkins, LLP, the last 11 years there as a partner. Mr. Muñoz spent several years at Arthur Andersen LLP in the oil and

gas audit division and received his Juris Doctorate from Stanford University and Bachelor of Business Administration from the University

of Texas. He will serve on the Audit, Nominating and Governance, and ESG committees. The appointment increases the size of the Board to

ten directors, eight of whom are independent directors.

Conference Call

A

conference call is scheduled on Thursday, October 31, 2024 at 10:00 am MT to discuss the financial and operational results. A brief

Q&A session for security analysts will immediately follow the discussion of the results. To participate in the call, dial in at 877-407-9126

(U.S.), or 201-493-6751 (International) and reference “Antero Midstream.” A telephone replay of the call will be available

until Thursday, November 7, 2024 at 10:00 am MT at 877-660-6853 (U.S.) or 201-612-7415 (International) using the conference ID: 13743806.

To access the live webcast and view the related earnings conference call presentation, visit Antero Midstream's website at www.anteromidstream.com.

The webcast will be archived for replay until Thursday, November 7, 2024 at 10:00 am MT.

Presentation

An updated presentation will be posted to the

Company's website before the conference call. The presentation can be found at www.anteromidstream.com on the homepage. Information on

the Company's website does not constitute a portion of, and is not incorporated by reference into this press release.

Non-GAAP Financial Measures and Definitions

Antero Midstream uses certain non-GAAP financial

measures. Antero Midstream defines Adjusted Net Income as Net Income plus amortization of customer relationships, impairment of property

and equipment, loss on early extinguishment of debt, and loss (gain) on asset sale, net of tax effect of reconciling items. Antero Midstream

uses Adjusted Net Income to assess the operating performance of its assets. Antero Midstream defines Adjusted EBITDA as Net Income plus

net interest expense, income tax expense, depreciation expense, amortization of customer relationships, loss (gain) on asset sale, accretion

of asset retirement obligations, impairment of property and equipment, loss on early extinguishment of debt, loss on settlement of asset

retirement obligations, and equity-based compensation expense, excluding equity in earnings of unconsolidated affiliates, plus distributions

from unconsolidated affiliates.

Antero Midstream uses Adjusted EBITDA to assess:

| · | the financial performance of Antero Midstream’s assets, without regard to financing methods, capital

structure or historical cost basis; |

| · | its operating performance and return on capital as compared to other publicly traded companies in the

midstream energy sector, without regard to financing or capital structure; and |

| · | the viability of acquisitions and other capital expenditure projects. |

Antero Midstream defines Free Cash Flow before

dividends as Adjusted EBITDA less net interest expense and accrual-based capital expenditures. Capital expenditures include additions

to gathering systems and facilities, additions to water handling systems, and investments in unconsolidated affiliates. Capital expenditures

exclude acquisitions. Free Cash Flow after dividends is defined as Free Cash Flow before dividends less accrual-based dividends declared

for the quarter. Antero Midstream uses Free Cash Flow before and after dividends as a performance metric to compare the cash generating

performance of Antero Midstream from period to period.

Adjusted EBITDA, Adjusted Net Income, and Free

Cash Flow before and after dividends are non-GAAP financial measures. The GAAP measure most directly comparable to these measures is Net

Income. Such non-GAAP financial measures should not be considered as alternatives to the GAAP measures of Net Income and cash flows provided

by (used in) operating activities. The presentations of such measures are not made in accordance with GAAP and have important limitations

as analytical tools because they include some, but not all, items that affect Net Income and cash flows provided by operating activities.

You should not consider any or all such measures in isolation or as a substitute for analyses of results as reported under GAAP. Antero

Midstream’s definitions of such measures may not be comparable to similarly titled measures of other companies.

The following table reconciles cash paid for capital expenditures and

accrued capital expenditures during the period (in thousands):

| | |

Three Months Ended

September 30, | |

| | |

2023 | | |

2024 | |

| Capital expenditures (as reported on a cash basis) | |

$ | 45,286 | | |

| 56,428 | |

| Change in accrued capital costs | |

| 11,985 | | |

| (163 | ) |

| Capital expenditures (accrual basis) | |

$ | 57,271 | | |

| 56,265 | |

Antero Midstream defines Net Debt as consolidated

total debt, excluding unamortized debt premiums and debt issuance costs, less cash and cash equivalents. Antero Midstream views Net Debt

as an important indicator in evaluating Antero Midstream’s financial leverage. Antero Midstream defines leverage as Net Debt divided

by Adjusted EBITDA for the last twelve months. The GAAP measure most directly comparable to Net Debt is total debt, excluding unamortized

debt premiums and debt issuance costs.

The following table reconciles consolidated total

debt to consolidated net debt, excluding debt premiums and issuance costs, (“Net Debt”) as used in this release (in thousands):

| | |

September 30, 2024 | |

| Bank credit facility | |

$ | 539,900 | |

| 5.75% senior notes due 2027 | |

| 650,000 | |

| 5.75% senior notes due 2028 | |

| 650,000 | |

| 5.375% senior notes due 2029 | |

| 750,000 | |

| 6.625% senior notes due 2032 | |

| 600,000 | |

| Consolidated total debt | |

$ | 3,189,900 | |

| Less: Cash and cash equivalents | |

| — | |

| Consolidated net debt | |

$ | 3,189,900 | |

The following table reconciles Net Income to Adjusted EBITDA for the

last twelve months as used in this release (in thousands):

| | |

Twelve Months Ended

September 30, 2024 | |

| Net Income | |

$ | 390,150 | |

| Interest expense, net | |

| 209,306 | |

| Income tax expense | |

| 133,991 | |

| Depreciation expense | |

| 142,090 | |

| Amortization of customer relationships | |

| 70,672 | |

| Accretion of asset retirement obligations | |

| 184 | |

| Impairment of property and equipment | |

| 478 | |

| Equity-based compensation | |

| 41,302 | |

| Equity in earnings of unconsolidated affiliates | |

| (110,426 | ) |

| Distributions from unconsolidated affiliates | |

| 137,846 | |

| Loss on early extinguishment of debt | |

| 14,091 | |

| Loss on settlement of asset retirement obligations | |

| 185 | |

| Loss on asset sale | |

| 900 | |

| Adjusted EBITDA | |

$ | 1,030,769 | |

Antero Midstream Corporation is a Delaware corporation that owns,

operates and develops midstream gathering, compression, processing and fractionation assets located in the Appalachian Basin, as well

as integrated water assets that primarily service Antero Resources Corporation’s (NYSE: AR) (“Antero Resources”) properties.

This

release includes "forward-looking statements.” Such forward-looking statements are subject to a number of risks and uncertainties,

many of which are not under Antero Midstream’s control. All statements, except for statements of historical fact, made in this release

regarding activities, events or developments Antero Midstream expects, believes or anticipates will or may occur in the future, such as

statements regarding our strategy, future operations, financial position, estimated revenues and losses, projected costs,

prospects, plans and objectives of management, NGL and oil prices, impacts of geopolitical and world health events, Antero Midstream’s

ability to execute its share repurchase program, Antero Midstream’s ability to realize the benefits of the Marcellus bolt-on acquisition,

including the anticipated capital avoidance and synergies, Antero Midstream’s ability to execute its business plan and return capital

to its stockholders, information regarding Antero Midstream’s return of capital policy, information regarding long-term financial

and operating outlooks for Antero Midstream and Antero Resources, information regarding Antero Resources’ expected future growth

and its ability to meet its drilling and development plan and the participation level of Antero Resources’ drilling partner, the

impact on demand for Antero Midstream’s services as a result of incremental production by Antero Resources, and expectations regarding

the amount and timing of litigation awards are forward-looking statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934. All forward-looking statements speak only as of the date of this

release. Although Antero Midstream believes that the plans, intentions and expectations reflected in or suggested by the forward-looking

statements are reasonable, there is no assurance that these plans, intentions or expectations will be achieved. Therefore, actual outcomes

and results could materially differ from what is expressed, implied or forecast in such statements. Except as required by law, Antero

Midstream expressly disclaims any obligation to and does not intend to publicly update or revise any forward-looking statements.

Antero Midstream cautions you that these forward-looking

statements are subject to all of the risks and uncertainties incident to our business, most of which are difficult to predict and many

of which are beyond Antero Midstream’s control. These risks include, but are not limited to, commodity price volatility, inflation,

supply chain or other disruptions, environmental risks, Antero Resources’ drilling and completion and other operating risks, regulatory

changes or changes in law, the uncertainty inherent in projecting Antero Resources’ future rates of production, cash flows and access

to capital, the timing of development expenditures, impacts of world health events, cybersecurity risks, the state of markets for and

availability of verified quality carbon offsets and the other risks described under the heading "Item 1A. Risk Factors" in Antero

Midstream's Annual Report on Form 10-K for the year ended December 31, 2023 and Quarterly Report on Form 10-Q for the three

months ended September 30, 2024.

For more information, contact Justin Agnew,

Vice President – Finance and Investor Relations of Antero Midstream, at (303) 357-7269 or jagnew@anteroresources.com.

ANTERO MIDSTREAM CORPORATION

Condensed Consolidated Balance Sheets

(In thousands, except per share amounts)

| | |

| | |

(Unaudited) | |

| | |

December 31, | | |

September 30, | |

| | |

2023 | | |

2024 | |

| Assets |

|

|

|

|

|

|

|

|

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 66 | | |

| — | |

| Accounts receivable–Antero Resources | |

| 88,610 | | |

| 98,037 | |

| Accounts receivable–third party | |

| 952 | | |

| 536 | |

| Other current assets | |

| 1,500 | | |

| 1,303 | |

| Total current assets | |

| 91,128 | | |

| 99,876 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 3,793,523 | | |

| 3,892,154 | |

| Investments in unconsolidated affiliates | |

| 626,650 | | |

| 609,427 | |

| Customer relationships | |

| 1,215,431 | | |

| 1,162,427 | |

| Other assets, net | |

| 10,886 | | |

| 13,567 | |

| Total assets | |

$ | 5,737,618 | | |

| 5,777,451 | |

| | |

| | | |

| | |

| Liabilities and Stockholders' Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable–Antero Resources | |

$ | 4,457 | | |

| 5,317 | |

| Accounts payable–third party | |

| 10,499 | | |

| 9,718 | |

| Accrued liabilities | |

| 80,630 | | |

| 75,565 | |

| Other current liabilities | |

| 831 | | |

| 920 | |

| Total current liabilities | |

| 96,417 | | |

| 91,520 | |

| Long-term liabilities: | |

| | | |

| | |

| Long-term debt | |

| 3,213,216 | | |

| 3,171,664 | |

| Deferred income tax liability, net | |

| 265,879 | | |

| 369,004 | |

| Other | |

| 10,375 | | |

| 15,362 | |

| Total liabilities | |

| 3,585,887 | | |

| 3,647,550 | |

| | |

| | | |

| | |

| Stockholders' equity: | |

| | | |

| | |

| Preferred stock, $0.01 par value: 100,000 authorized as of December 31, 2023 and September 30, 2024 | |

| | | |

| | |

| Series A non-voting perpetual preferred stock; 12 designated and 10 issued and outstanding as of December 31, 2023 and September 30, 2024 | |

| — | | |

| — | |

| Common stock, $0.01 par value; 2,000,000 authorized; 479,713 and 481,295 issued and outstanding as of December 31, 2023 and September 30, 2024, respectively | |

| 4,797 | | |

| 4,813 | |

| Additional paid-in capital | |

| 2,046,487 | | |

| 2,025,348 | |

| Retained earnings | |

| 100,447 | | |

| 99,740 | |

| Total stockholders' equity | |

| 2,151,731 | | |

| 2,129,901 | |

| Total liabilities and stockholders' equity | |

$ | 5,737,618 | | |

| 5,777,451 | |

ANTERO MIDSTREAM CORPORATION

Condensed Consolidated Statements of Operations

and Comprehensive Income (Unaudited)

(In thousands, except per share amounts)

| | |

Three Months Ended September 30, | |

| | |

2023 | | |

2024 | |

| Revenue: | |

| | |

| |

| Gathering and compression–Antero Resources | |

$ | 214,992 | | |

| 234,847 | |

| Water handling–Antero Resources | |

| 66,132 | | |

| 52,294 | |

| Water handling–third party | |

| 383 | | |

| 397 | |

| Amortization of customer relationships | |

| (17,668 | ) | |

| (17,668 | ) |

| Total revenue | |

| 263,839 | | |

| 269,870 | |

| Operating expenses: | |

| | | |

| | |

| Direct operating | |

| 51,914 | | |

| 51,724 | |

| General and administrative (including $8,349 and $11,945 of equity-based compensation in 2023 and 2024, respectively) | |

| 17,633 | | |

| 22,872 | |

| Facility idling | |

| 722 | | |

| 405 | |

| Depreciation | |

| 30,745 | | |

| 32,534 | |

| Impairment of property and equipment | |

| — | | |

| 332 | |

| Accretion of asset retirement obligations | |

| 45 | | |

| 49 | |

| Loss (gain) on asset sale | |

| 467 | | |

| (473 | ) |

| Total operating expenses | |

| 101,526 | | |

| 107,443 | |

| Operating income | |

| 162,313 | | |

| 162,427 | |

| Other income (expense): | |

| | | |

| | |

| Interest expense, net | |

| (55,233 | ) | |

| (51,812 | ) |

| Equity in earnings of unconsolidated affiliates | |

| 27,397 | | |

| 27,668 | |

| Loss on early extinguishment of debt | |

| — | | |

| (341 | ) |

| Total other expense | |

| (27,836 | ) | |

| (24,485 | ) |

| Income before income taxes | |

| 134,477 | | |

| 137,942 | |

| Income tax expense | |

| (36,657 | ) | |

| (38,202 | ) |

| Net income and comprehensive income | |

$ | 97,820 | | |

| 99,740 | |

| | |

| | | |

| | |

| Net income per common share–basic | |

$ | 0.20 | | |

| 0.21 | |

| Net income per common share–diluted | |

$ | 0.20 | | |

| 0.21 | |

| | |

| | | |

| | |

| Weighted average common shares outstanding: | |

| | | |

| | |

| Basic | |

| 479,676 | | |

| 481,288 | |

| Diluted | |

| 482,840 | | |

| 485,532 | |

ANTERO MIDSTREAM CORPORATION

Selected Operating Data (Unaudited)

| | |

| | |

| | |

Amount of | | |

| |

| | |

Three Months Ended September 30, | | |

Increase | | |

Percentage | |

| | |

2023 | | |

2024 | | |

or Decrease | | |

Change | |

| Operating Data: | |

| | | |

| | | |

| | | |

| | |

| Gathering—low pressure (MMcf) | |

| 305,676 | | |

| 301,468 | | |

| (4,208 | ) | |

| (1 | )% |

| Compression (MMcf) | |

| 300,967 | | |

| 300,790 | | |

| (177 | ) | |

| * | |

| Gathering—high pressure (MMcf) | |

| 269,986 | | |

| 280,189 | | |

| 10,203 | | |

| 4 | % |

| Fresh water delivery (MBbl) | |

| 9,750 | | |

| 6,514 | | |

| (3,236 | ) | |

| (33 | )% |

| Other fluid handling (MBbl) | |

| 4,961 | | |

| 4,751 | | |

| (210 | ) | |

| (4 | )% |

| Wells serviced by fresh water delivery | |

| 15 | | |

| 9 | | |

| (6 | ) | |

| (40 | )% |

| Gathering—low pressure (MMcf/d) | |

| 3,323 | | |

| 3,277 | | |

| (46 | ) | |

| (1 | )% |

| Compression (MMcf/d) | |

| 3,271 | | |

| 3,269 | | |

| (2 | ) | |

| * | |

| Gathering—high pressure (MMcf/d) | |

| 2,935 | | |

| 3,046 | | |

| 111 | | |

| 4 | % |

| Fresh water delivery (MBbl/d) | |

| 106 | | |

| 71 | | |

| (35 | ) | |

| (33 | )% |

| Other fluid handling (MBbl/d) | |

| 54 | | |

| 52 | | |

| (2 | ) | |

| (4 | )% |

| Average Realized Fees(1): | |

| | | |

| | | |

| | | |

| | |

| Average gathering—low pressure fee ($/Mcf) | |

$ | 0.35 | | |

| 0.36 | | |

| 0.01 | | |

| 3 | % |

| Average compression fee ($/Mcf) | |

$ | 0.21 | | |

| 0.21 | | |

| — | | |

| * | |

| Average gathering—high pressure fee ($/Mcf) | |

$ | 0.21 | | |

| 0.23 | | |

| 0.02 | | |

| 10 | % |

| Average fresh water delivery fee ($/Bbl) | |

$ | 4.20 | | |

| 4.31 | | |

| 0.11 | | |

| 3 | % |

| Joint Venture Operating Data: | |

| | | |

| | | |

| | | |

| | |

| Processing—Joint Venture (MMcf) | |

| 148,672 | | |

| 149,039 | | |

| 367 | | |

| * | |

| Fractionation—Joint Venture (MBbl) | |

| 3,680 | | |

| 3,680 | | |

| — | | |

| * | |

| Processing—Joint Venture (MMcf/d) | |

| 1,616 | | |

| 1,620 | | |

| 4 | | |

| * | |

| Fractionation—Joint Venture (MBbl/d) | |

| 40 | | |

| 40 | | |

| — | | |

| * | |

| * | Not meaningful or applicable. |

| (1) | The average realized fees for the three months ended September 30, 2024 include annual CPI-based adjustments of approximately

1.6%. |

ANTERO MIDSTREAM CORPORATION

Condensed Consolidated Results of Segment Operations

(Unaudited)

(In thousands)

| | |

Three Months Ended September 30, 2024 | |

| | |

Gathering and | | |

Water | | |

| | |

Consolidated | |

| | |

Processing | | |

Handling | | |

Unallocated | | |

Total | |

| Revenues: | |

| | |

| | |

| | |

| |

| Revenue–Antero Resources | |

$ | 234,847 | | |

| 52,294 | | |

| — | | |

| 287,141 | |

| Revenue–third-party | |

| — | | |

| 397 | | |

| — | | |

| 397 | |

| Amortization of customer relationships | |

| (9,271 | ) | |

| (8,397 | ) | |

| — | | |

| (17,668 | ) |

| Total revenues | |

| 225,576 | | |

| 44,294 | | |

| — | | |

| 269,870 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Direct operating | |

| 24,516 | | |

| 27,208 | | |

| — | | |

| 51,724 | |

| General and administrative (excluding equity-based compensation) | |

| 7,495 | | |

| 2,203 | | |

| 1,229 | | |

| 10,927 | |

| Equity-based compensation | |

| 9,591 | | |

| 2,105 | | |

| 249 | | |

| 11,945 | |

| Facility idling | |

| — | | |

| 405 | | |

| — | | |

| 405 | |

| Depreciation | |

| 18,632 | | |

| 13,902 | | |

| — | | |

| 32,534 | |

| Impairment of property and equipment | |

| 332 | | |

| — | | |

| — | | |

| 332 | |

| Accretion of asset retirement obligations | |

| — | | |

| 49 | | |

| — | | |

| 49 | |

| Gain on asset sale | |

| — | | |

| (473 | ) | |

| — | | |

| (473 | ) |

| Total operating expenses | |

| 60,566 | | |

| 45,399 | | |

| 1,478 | | |

| 107,443 | |

| Operating income (loss) | |

| 165,010 | | |

| (1,105 | ) | |

| (1,478 | ) | |

| 162,427 | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| — | | |

| — | | |

| (51,812 | ) | |

| (51,812 | ) |

| Equity in earnings of unconsolidated affiliates | |

| 27,668 | | |

| — | | |

| — | | |

| 27,668 | |

| Loss on early extinguishment of debt | |

| — | | |

| — | | |

| (341 | ) | |

| (341 | ) |

| Total other income (expense) | |

| 27,668 | | |

| — | | |

| (52,153 | ) | |

| (24,485 | ) |

| Income (loss) before income taxes | |

| 192,678 | | |

| (1,105 | ) | |

| (53,631 | ) | |

| 137,942 | |

| Income tax expense | |

| — | | |

| — | | |

| (38,202 | ) | |

| (38,202 | ) |

| Net income (loss) and comprehensive income (loss) | |

$ | 192,678 | | |

| (1,105 | ) | |

| (91,833 | ) | |

| 99,740 | |

ANTERO MIDSTREAM CORPORATION

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(In thousands)

| | |

| | |

| |

| | |

Nine Months Ended September 30, | |

| | |

2023 | | |

2024 | |

| Cash flows provided by (used in) operating activities: | |

| | | |

| | |

| Net income | |

$ | 271,339 | | |

| 289,703 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation | |

| 101,174 | | |

| 107,205 | |

| Accretion of asset retirement obligations | |

| 133 | | |

| 140 | |

| Impairment of property and equipment | |

| — | | |

| 332 | |

| Deferred income tax expense | |

| 97,422 | | |

| 103,126 | |

| Equity-based compensation | |

| 23,175 | | |

| 32,871 | |

| Equity in earnings of unconsolidated affiliates | |

| (77,825 | ) | |

| (82,795 | ) |

| Distributions from unconsolidated affiliates | |

| 94,900 | | |

| 100,911 | |

| Amortization of customer relationships | |

| 53,004 | | |

| 53,004 | |

| Amortization of deferred financing costs | |

| 4,463 | | |

| 4,721 | |

| Settlement of asset retirement obligations | |

| (869 | ) | |

| (513 | ) |

| Loss on settlement of asset retirement obligations | |

| 620 | | |

| — | |

| Loss on asset sale | |

| 6,036 | | |

| 906 | |

| Loss on early extinguishment of debt | |

| — | | |

| 14,091 | |

| Changes in assets and liabilities: | |

| | | |

| | |

| Accounts receivable–Antero Resources | |

| (6,867 | ) | |

| (9,427 | ) |

| Accounts receivable–third party | |

| 436 | | |

| 883 | |

| Other current assets | |

| (1,307 | ) | |

| 63 | |

| Accounts payable–Antero Resources | |

| (1,766 | ) | |

| 1,143 | |

| Accounts payable–third party | |

| 1,214 | | |

| (1,100 | ) |

| Accrued liabilities | |

| 5,460 | | |

| (3,961 | ) |

| Net cash provided by operating activities | |

| 570,742 | | |

| 611,303 | |

| Cash flows provided by (used in) investing activities: | |

| | | |

| | |

| Additions to gathering systems, facilities and other | |

| (90,175 | ) | |

| (110,514 | ) |

| Additions to water handling systems | |

| (39,850 | ) | |

| (23,493 | ) |

| Investments in unconsolidated affiliates | |

| (262 | ) | |

| (893 | ) |

| Acquisition of gathering systems and facilities | |

| (266 | ) | |

| (69,992 | ) |

| Cash received in asset sales | |

| 1,071 | | |

| 1,158 | |

| Change in other assets | |

| (26 | ) | |

| (1 | ) |

| Change in other liabilities | |

| — | | |

| 659 | |

| Net cash used in investing activities | |

| (129,508 | ) | |

| (203,076 | ) |

| Cash flows provided by (used in) financing activities: | |

| | | |

| | |

| Dividends to common stockholders | |

| (326,871 | ) | |

| (329,252 | ) |

| Dividends to preferred stockholders | |

| (413 | ) | |

| (413 | ) |

| Issuance of Senior Notes | |

| — | | |

| 600,000 | |

| Redemption of Senior Notes | |

| — | | |

| (560,862 | ) |

| Payments of deferred financing costs | |

| — | | |

| (12,738 | ) |

| Borrowings on Credit Facility | |

| 759,300 | | |

| 1,299,500 | |

| Repayments on Credit Facility | |

| (864,900 | ) | |

| (1,389,700 | ) |

| Employee tax withholding for settlement of equity-based compensation awards | |

| (8,350 | ) | |

| (14,828 | ) |

| Net cash used in financing activities | |

| (441,234 | ) | |

| (408,293 | ) |

| Net decrease in cash and cash equivalents | |

| — | | |

| (66 | ) |

| Cash and cash equivalents, beginning of period | |

| — | | |

| 66 | |

| Cash and cash equivalents, end of period | |

$ | — | | |

| — | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash paid during the period for interest | |

$ | 159,019 | | |

| 160,700 | |

| Cash received during the period for income taxes | |

$ | — | | |

| 104 | |

| Increase in accrued capital expenditures and accounts payable for property and equipment | |

$ | 9,171 | | |

| 2,413 | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

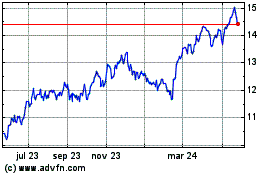

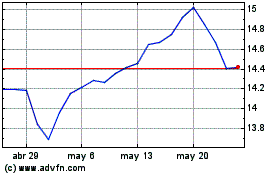

Antero Midstream (NYSE:AM)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Antero Midstream (NYSE:AM)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024