Apollo Funds Acquire Majority Stake in The State Group, A Leading Provider of Multi-Trade Services

18 Noviembre 2024 - 3:30PM

Apollo (NYSE: APO) today announced that funds associated with its

Impact and Clean Transition strategies (the “Apollo Funds”) have

acquired a majority stake in The State Group (“TSG” or the

“Company”) from Blue Wolf Capital (“Blue Wolf”). Blue Wolf will

retain a minority stake in the business, alongside existing

management shareholders.

Established in 1961, TSG is a leading provider of electrical,

mechanical, robotics and automation services, with a strong

presence across industrial end markets. TSG executes complex

projects at facilities from newbuild to ongoing maintenance and

retrofit with decades-long customer relationships across key

markets. A substantial portion of the Company’s work enables

customers to optimize, reduce and decarbonize their energy use,

helping a wide range of industrial end markets abate future

emissions. The Company plays an important role in enabling the

energy transition through its expertise in industrial manufacturing

plants as well as power and renewable facilities. TSG’s

capabilities have clear applicability to a number of fast-growing

end markets, including data centers, where the Company supports

critical technology infrastructure by providing electrical

contracting services and other specialized solutions.

“The opportunity to leverage Apollo’s expertise and resources

marks a significant milestone for the next phase of our business’

growth,” said Michael Lampert, CEO of TSG. “The partnership with

Apollo positions us well to enhance our capabilities and meet the

evolving needs of our customers as they scale and optimize their

North American operations.”

“TSG has a proven track record of providing quality and reliable

service to its industrial customers, with a key role to play in

driving energy efficiency and the energy transition,” said

Christine Hommes, Partner at Apollo. “Our organizations have a

shared vision for the continued growth of the business, and we are

excited to partner with Michael and the broader team as they

strengthen and expand their offerings.”

Apollo is a high-growth asset management firm with strategies

dedicated to investing in companies that demonstrate strong

environmental and social impact. Apollo-managed funds have deployed

approximately $40 billioni into energy transition and

sustainability-related investments over the past five years,

supporting companies and projects across clean energy, sustainable

mobility and infrastructure.

Financial terms of the transaction are not disclosed. Moelis

& Company served as financial advisor, and Holland & Knight

LLP and Davies Ward Phillips & Vineberg LLP served as legal

counsel for The State Group. Latham & Watkins LLP and Blake,

Cassels & Graydon LLP acted as legal advisors to the Apollo

Funds.

---

i As of June 30, 2024. Deployment commensurate with Apollo’s

proprietary Climate and Transition Investment Framework, which

provides guidelines and metrics with respect to the definition of a

climate or transition investment. Reflects (a) for equity

investments: (i) total enterprise value at time of signed

commitment for initial equity commitments; (ii) additional capital

contributions from Apollo funds and co-invest vehicles for

follow-on equity investments; and (iii) contractual commitments of

Apollo funds and co-invest vehicles at the time of initial

commitment for preferred equity investments; (b) for debt

investments: (i) total facility size for Apollo originated debt,

warehouse facilities, or fund financings; (ii) purchase price on

the settlement date for private non-traded debt; (iii) increases in

maximum exposure on a period-over-period basis for publicly-traded

debt; (iv) total capital organized on the settlement date for

syndicated debt; and (v) contractual commitments of Apollo funds

and co-invest vehicles as of the closing date for real estate debt;

(c) for SPACs, the total sponsor equity and capital organized as of

the respective announcement dates; (d) for platform acquisitions,

the purchase price on the signed commitment date; and (e) for

platform originations, the gross origination value on the

origination date.

About Apollo

Apollo is a high-growth, global alternative asset manager. In

our asset management business, we seek to provide our clients

excess return at every point along the risk-reward spectrum from

investment grade to private equity with a focus on three investing

strategies: yield, hybrid, and equity. For more than three decades,

our investing expertise across our fully integrated platform has

served the financial return needs of our clients and provided

businesses with innovative capital solutions for growth. Through

Athene, our retirement services business, we specialize in helping

clients achieve financial security by providing a suite of

retirement savings products and acting as a solutions provider to

institutions. Our patient, creative, and knowledgeable approach to

investing aligns our clients, businesses we invest in, our

employees, and the communities we impact, to expand opportunity and

achieve positive outcomes. As of September 30, 2024, Apollo had

approximately $733 billion of assets under management. To learn

more, please visit www.apollo.com.

About The State Group

The State Group is one of North America’s leading multi-trade

industrial and specialty services contractor, providing electrical,

mechanical, millwrighting, robotics and automation services to

diverse industries. Headquartered in Franklin, TN, The State Group

has offices across Canada and the United States and has built

long-term relationships with Fortune 100 companies, property

managers and original equipment suppliers who look to The State

Group to complete complex building, manufacturing and engineering

projects while staying on schedule and within budget.

Apollo Contacts

Noah GunnGlobal Head of Investor RelationsApollo Global

Management, Inc.(212) 822-0540IR@apollo.com

Joanna RoseGlobal Head of Corporate CommunicationsApollo Global

Management, Inc.(212) 822-0491Communications@apollo.com

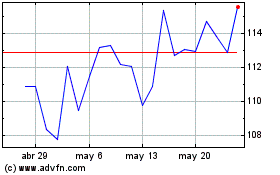

Apollo Global Management (NYSE:APO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Apollo Global Management (NYSE:APO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024