Continued global momentum, partially offset by US

performance, delivered all-time high revenue in FY23

AB InBev (Brussel:ABI) (BMV:ANB) (JSE:ANH) (NYSE:BUD):

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240228688664/en/

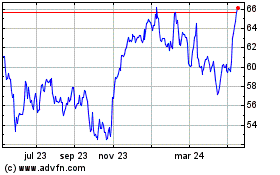

Figure 14. Terms and debt repayment

schedule as of 31 December 2023 (billion USD) (Graphic: Business

Wire)

Regulated and inside information1

“Our business delivered another year of consistent profitable

growth with a revenue increase of 7.8% and EBITDA growth of 7.0%.

Strong free cash flow generation enabled us to progress on our

deleveraging, propose an increased dividend to our shareholders and

execute on a 1 billion USD share buyback. Our results are a

testament to the strength of the beer category, resilience of our

business and people, consistent execution of our replicable growth

drivers and our unwavering commitment to invest for long-term

growth and value creation.” – Michel Doukeris, CEO, AB InBev

Total Revenue

4Q +6.2% | FY + 7.8%

Revenue increased by 6.2% in 4Q23 with revenue per hl growth of

9.3% and by 7.8% in FY23 with revenue per hl growth of 9.9%.

24.6% increase in combined revenues of our global brands,

Budweiser, Stella Artois, Corona and Michelob Ultra, outside of

their respective home markets in 4Q23, and 18.2% in FY23.

Approximately 70% of our revenue through B2B digital

platforms with the monthly active user base of BEES reaching 3.7

million users.

Over 550 million USD of revenue generated by our digital

direct-to-consumer ecosystem.

Total Volume

4Q - 2.6% | FY - 1.7%

In 4Q23, total volumes declined by 2.6% , with own beer volumes

down by 3.6% and non-beer volumes up by 3.0%. In FY23, total

volumes declined by 1.7% with own beer volumes down by 2.3% and

non-beer volumes up by 2.1%.

Normalized EBITDA

4Q + 6.2% | FY +7.0%

In 4Q23, normalized EBITDA increased by 6.2% to 4 877 million

USD with a normalized EBITDA margin contraction of 2 bps to 33.7%.

In FY23, normalized EBITDA increased by 7.0% to 19 976 million USD

and normalized EBITDA margin contracted by 23 bps to 33.6% .

Normalized EBITDA figures of FY23 and FY22 include an impact of 44

million USD and 201 million USD, respectively, from tax credits in

Brazil.

Underlying Profit (million USD)

4Q 1 661 | FY 6 158

Underlying profit (profit attributable to

equity holders of AB InBev excluding non-underlying items and the

impact of hyperinflation) was 1 661 million USD in 4Q23 compared to

1 739 million USD in 4Q22 and was 6 158 million USD in FY23

compared to 6 093 million USD in FY22.

Underlying EPS (USD)

4Q 0.82 | FY 3.05

Underlying EPS was 0.82 USD in 4Q23, a

decrease from 0.86 USD in 4Q22 and was 3.05 USD in FY23, an

increase from 3.03 USD in FY22.

Net Debt to EBITDA

3.38x

Net debt to normalized EBITDA ratio was

3.38x at 31 December 2023, compared to 3.51x at 31 December

2022.

Capital Allocation

Dividend 0.82 EUR

The AB InBev Board proposes a full year

2023 dividend of 0.82 EUR per share, subject to shareholder

approval at the AGM on 24 April 2024. A timeline showing the

ex-dividend, record and payment dates can be found on page 16.

Out of the one billion USD share buyback

program announced on 31 October 2023, 870 million USD was completed

as of 23 February 2024.

The 2023 Full Year Financial Report is available on our website

at www.ab-inbev.com.

1The enclosed information constitutes

inside information as defined in Regulation (EU) No 596/2014 of the

European Parliament and of the Council of 16 April 2014 on market

abuse, and regulated information as defined in the Belgian Royal

Decree of 14 November 2007 regarding the duties of issuers of

financial instruments which have been admitted for trading on a

regulated market. For important disclaimers and notes on the basis

of preparation, please refer to page 17.

Management comments

Creating a future with more cheers

Our business delivered another year of consistent profitable

growth, with an EBITDA increase of 7.0%, in-line with our

medium-term growth ambition and outlook for the year. While our

full growth potential was constrained by the performance of our US

business, we remained true to our purpose and laser focused on the

execution of our strategy.

We made disciplined revenue management and resource allocation

choices, delivering broad-based growth with top- and bottom-line

increases in four of our five operating regions. Our results are a

testament to the strength of the beer category, resilience of our

business and people, consistent execution of our replicable growth

drivers and our unwavering commitment to invest for long-term

growth and value creation.

As with any year, there was success to celebrate and challenges

from which to learn. We are taking the learnings and moving forward

in a stronger position to realize our full growth potential.

Delivering consistent profitable growth

Our top-line increased by 7.8% in FY23, with revenue growth in

more than 85% of our markets, driven by a revenue per hl increase

of 9.9% as a result of pricing actions, ongoing premiumization and

other revenue management initiatives. Volumes declined by 1.7% as

growth in many of our emerging and developing markets was primarily

offset by performance in the US and a soft industry in Europe.

EBITDA increased by 7.0%, with our top-line growth partially

offset by anticipated transactional FX and commodity cost headwinds

and increased sales and marketing investments. Underlying EPS was

3.05 USD, an increase of 0.02 USD per share versus FY22.

Progressing our strategic priorities

- Lead and grow the category We remain focused on the

consistent execution of our five proven and replicable category

expansion levers. In FY23, the beer and beyond beer category

continued to gain share of alcohol by volume globally, led by gains

in South America and China, according to Euromonitor. We focused

our investments behind the megabrands in our portfolio that are

driving the majority of our growth and the global mega platforms

that consumers love and that bring people together. Our portfolio

of brands is unparalleled, with 7 out of the top 10 most valuable

beer brands in the world, according to Kantar BrandZ, and 20 iconic

billion-dollar revenue beer brands. The combination of our iconic

brands with mega platforms such as the Olympics, FIFA World CupTM,

Copa America, NFL, UFC, NBA, Lollapalooza and Tomorrowland has us

uniquely positioned to lead and grow the category. The relevance,

authenticity and effective creativity of our marketing work

continues to be recognized. At the 2023 Cannes Lions International

Festival of Creativity, campaigns and brands from all 5 of our

operating regions were awarded and we were honored to be named as

the Creative Marketer of the Year for the second year in a row.

- Category Participation: In FY23, the percentage of

consumers purchasing our portfolio of brands increased or remained

stable in the majority of our markets, according to our estimates.

Our brand, pack and liquid innovations drove increased

participation with female consumers across key markets in Africa,

Latin America and Europe, and new legal drinking age consumers in

the US and Canada.

- Core Superiority: Our mainstream portfolio delivered

high-single digit revenue growth in FY23 with double-digit growth

in markets such as South Africa, Colombia and Dominican Republic.

Our mainstream brands gained or maintained share of segment in the

majority of our key markets, according to our estimates.

- Occasions Development: Our global no-alcohol beer

portfolio continued to outperform, delivering high-teens revenue

growth in FY23, with our performance driven by Budweiser Zero and

Corona Cero. Our digital direct-to-consumer products enabled us to

develop deep consumer insights and new consumption occasions, such

as Corona Sunset Hours, Brahma Soccer Wednesdays and increased

in-home consumption of returnable glass bottle packs.

- Premiumization: Our above core beer portfolio grew

revenue by low-teens in FY23, with our premium and super premium

brands gaining share of segment in a number of key markets,

including South Africa, Mexico and Brazil, according to our

estimates. Our global megabrands grew revenue by 18.2% outside of

their home markets led by Corona which grew by 22.1%. Budweiser

delivered a revenue increase of 17.1%, with broad-based growth in

more than 25 markets, Stella Artois grew by 18.8% and Michelob

Ultra by 7.5%.

- Beyond Beer: In FY23, our Beyond Beer business

contributed approximately 1.5 billion USD of revenue and grew by

mid-single digits, as growth globally was partially offset by the

performance of malt-based seltzer in the US. Growth was primarily

driven by Brutal Fruit and Flying Fish in Africa, our spirits based

ready-to-drink portfolio in the US and Beats in Brazil, all of

which grew revenue by double-digits.

- Digitize and monetize our ecosystem The digital

transformation of our route to consumer is a fundamental evolution

in how we do business and serve our customers. Our digital

platforms are enabling us to increase the distribution of our

brands, reduce our cost to serve and improve our relationship with

customers and consumers. It is a key competitive advantage, and we

continue to explore new ways to monetize our digital and physical

assets to create additional profitable revenue streams.

- Digitizing our relationships with our more than six million

customers globally: As of 31 December 2023, BEES was live in 26

markets, with approximately 70% of our 4Q23 revenues captured

through B2B digital platforms. In FY23, BEES reached 3.7 million

monthly active users and captured 39.8 billion USD in gross

merchandise value (GMV), growth of 27% versus FY22. BEES

Marketplace was live in 15 markets with 67% of BEES customers also

Marketplace buyers. Marketplace captured approximately 1.5 billion

USD in GMV from sales of third-party products this year, growth of

52% versus FY22.

- Leading the way in DTC solutions: Our omnichannel

direct-to-consumer (DTC) ecosystem of digital and physical products

generated revenue of approximately 1.5 billion USD this year. Our

DTC megabrands, Zé Delivery, TaDa and PerfectDraft are available in

21 markets, fulfilled over 69 million e-commerce orders and

generated revenue of more than 550 million USD in FY23, growth of

15% versus FY22.

- Unlocking value from our ecosystem: We continue to

explore opportunities to generate scalable incremental revenue

streams for our business through EverGrain, our upcycled barley

ingredients company, and Biobrew, our precision fermentation

venture.

- Optimize our business

- Maximizing value creation: Our objective to maximize

long-term value creation is driven by our focus on three areas:

optimized resource allocation, robust risk management and an

efficient capital structure. Our culture of everyday financial

discipline enables us to optimize resource allocation and invest

for growth. In FY23, we invested 11.6 billion USD in capex and

sales and marketing while delivering free cash flow of

approximately 8.8 billion USD, a 0.3 billion USD increase versus

FY22. We continued to deleverage, reducing gross debt by 1.8

billion USD to reach 78.1 billion USD, resulting in a net debt to

EBITDA ratio of 3.38x as of 31 December 2023. Our robust risk

management was recognized earlier this year with a credit rating

upgrade from Baa1 to A3 by Moody’s and from BBB+ to A- by S&P.

As a result, we have additional flexibility in our capital

allocation choices. The AB InBev Board of Directors has proposed a

full year dividend of 0.82 EUR per share, a 9% increase versus

FY22. In addition, as of 23rd February 2024 we have completed

nearly 90% of our 1 billion USD share buyback program announced on

31 October 2023.

- Advancing our sustainability priorities: In FY23, we

continued to make progress towards our ambitious 2025

Sustainability Goals. We contracted the equivalent of 100% of our

global purchased electricity volume from renewable sources with

73.6% operational. Since 2017, we reduced our absolute GHG

emissions across Scopes 1 and 2 by 44% and GHG emissions intensity

across Scopes 1, 2 and 3 by 24.2%. In Sustainable Agriculture, 95%

of our direct farmers met our criteria for skilled, 92% for

connected and 86% for financially empowered. In Water Stewardship,

we are investing in restoration and conservation efforts across

100% of our sites in high stress areas, with 56% of sites in scope

for our 2025 goal already seeing measurable improvement in

watershed health. For Circular Packaging, 77.5% of our products

were in packaging that was returnable or made from majority

recycled content. We are also progressing on our ambition to

achieve net zero by 2040, with 36 lighthouse projects implemented

worldwide in 2023. In recognition of our leadership in corporate

transparency and performance on climate change and water security,

we were awarded a double A score by CDP. We are committed to Smart

Drinking and improving moderation habits all over the world. Since

2016, we have invested 900 million USD in social norms marketing

and are on track to deliver our 1 billion USD goal by 2025. We have

also undertaken the largest voluntary guidance labeling initiative,

with 100% of our labels now featuring Smart Drinking icons and

moderation actionable messages in 26 markets. Please refer to our

Sustainability Statements in our 2023 annual report here for

further details.

Looking forward

As we reflect on 2023, while our full potential was constrained,

the fundamental strengths of our business drove another year of

consistent profitable growth. Beer is a large, profitable and

growing category, gaining share of alcohol globally and with

significant headroom for premiumization. Our diversified footprint,

global scale and unparalleled ecosystem uniquely position us to

lead and grow the category. We have replicable growth drivers such

as our portfolio of megabrands that consumers love, digital

products that unlock value and a category expansion model that

drives organic growth. Our business generates superior

profitability and cash generation, and our dynamic capital

allocation framework provides us flexibility to maximize value

creation. The resilience, relentless commitment and deep ownership

culture of our people is truly unwavering, and we thank all our

colleagues globally for their hard work and dedication.

Looking ahead to 2024, our purpose as a company remains as

relevant as ever. Guided by our strategy and our focus on customer

and consumer centricity, we are energized about the opportunities

ahead to activate the category through our megabrands and

platforms. We believe in the potential of the beer category, the

fundamentals of our company and our people, and our ability to

generate superior long-term value and create a future with more

cheers.

2024 Outlook

(i) Overall Performance: We expect our

EBITDA to grow in line with our medium-term outlook of between

4-8%1. The outlook for FY24 reflects our current assessment of

inflation and other macroeconomic conditions.

(ii) Net Finance Costs: Net pension

interest expenses and accretion expenses are expected to be in the

range of 220 to 250 million USD per quarter, depending on currency

and interest rate fluctuations. We expect the average gross debt

coupon in FY24 to be approximately 4%.

(iii) Effective Tax Rates (ETR): We

expect the normalized ETR in FY24 to be in the range of 27% to 29%.

The ETR outlook does not consider the impact of potential future

changes in legislation.

(iv) Net Capital Expenditure: We

expect net capital expenditure of between 4.0 and 4.5 billion USD

in FY24.

1Please refer to the FY24 presentation

update on organic growth on page 16

Figure 1. Consolidated performance

(million USD)

4Q22

4Q23

Organic

growth

Total Volumes (thousand hls)

148 775

144 706

-2.6%

AB InBev own beer

128 502

123 764

-3.6%

Non-beer volumes

19 421

19 998

3.0%

Third party products

853

944

13.1%

Revenue

14 668

14 473

6.2%

Gross profit

8 007

7 794

5.3%

Gross margin

54.6%

53.9%

-49 bps

Normalized EBITDA

4 947

4 877

6.2%

Normalized EBITDA margin

33.7%

33.7%

-2 bps

Normalized EBIT

3 608

3 491

6.9%

Normalized EBIT margin

24.6%

24.1%

16 bps

Profit attributable to equity holders of

AB InBev

2 844

1 891

Underlying profit attributable to

equity holders of AB InBev

1 739

1 661

Earnings per share (USD)

1.41

0.94

Underlying earnings per share

(USD)

0.86

0.82

FY22

FY23

Organic

growth

Total Volumes (thousand hls)

595 133

584 728

-1.7%

AB InBev own beer

517 990

505 899

-2.3%

Non-beer volumes

73 241

74 810

2.1%

Third party products

3 903

4 019

4.7%

Revenue

57 786

59 380

7.8%

Gross profit

31 481

31 984

6.7%

Gross margin

54.5%

53.9%

-53 bps

Normalized EBITDA

19 843

19 976

7.0%

Normalized EBITDA margin

34.3%

33.6%

-23 bps

Normalized EBIT

14 768

14 590

6.4%

Normalized EBIT margin

25.6%

24.6%

-31 bps

Profit attributable to equity holders of

AB InBev

5 969

5 341

Underlying profit attributable to

equity holders of AB InBev

6 093

6 158

Earnings per share (USD)

2.97

2.65

Underlying earnings per share

(USD)

3.03

3.05

Figure 2. Volumes (thousand

hls)

4Q22

Scope

Organic

4Q23

Organic growth

growth

Total

Own beer

North America

23 451

- 149

-3 563

19 738

-15.3%

-16.2%

Middle Americas

38 286

-

348

38 635

0.9%

0.9%

South America

46 860

-

- 157

46 704

-0.3%

-2.0%

EMEA

24 094

50

- 180

23 964

-0.7%

-1.0%

Asia Pacific

15 903

-

- 438

15 465

-2.8%

-2.9%

Global Export and Holding Companies

181

-52

71

200

55.0%

54.8%

AB InBev Worldwide

148 775

- 151

-3 919

144 706

-2.6%

-3.6%

FY22

Scope

Organic

FY23

Organic growth

growth

Total

Own beer

North America

102 674

-118

-12 417

90 140

-12.1%

-12.6%

Middle Americas

147 624

-

1 106

148 730

0.7%

0.1%

South America

164 319

-

-1 859

162 460

-1.1%

-2.0%

EMEA

90 780

204

- 771

90 213

-0.8%

-1.1%

Asia Pacific

88 898

-

3 828

92 726

4.3%

4.2%

Global Export and Holding Companies

838

-236

-143

459

-23.7%

-26.4%

AB InBev Worldwide

595 133

- 151

-10 255

584 728

-1.7%

-2.3%

Key Market Performances

United States: Revenue declined by 9.5% impacted by volume

performance

- Operating performance:

- 4Q23: Revenue declined by 17.3% with sales-to-retailers

(STRs) down by 12.1%, primarily due to the volume decline of Bud

Light. Sales-to-wholesalers (STWs) declined by 16.1% as shipments

lagged stronger depletions in December. Revenue per hl decreased by

1.4% due to negative mix and cycling the October price increase in

4Q22. EBITDA declined by 34.2%, with approximately two thirds of

this decrease attributable to market share performance and the

remainder from productivity loss, increased sales and marketing

investments and support measures for our wholesaler partners.

- FY23: Revenue declined by 9.5% with revenue per hl

growth of 3.7%. STWs declined by 12.7% and STRs were down by 11.9%.

EBITDA decreased by 23.4%.

- Commercial highlights: The beer industry remained

resilient in FY23, with volumes improving sequentially throughout

the year and with beer gaining share of total alcohol by value in

the off-premise, according to Circana. Our beer market share has

seen continued gradual improvement since May through the end of

December. While our mainstream beer revenues declined this year,

our above core beer megabrands continued to grow. In Beyond Beer,

our spirits-based ready-to-drink portfolio delivered strong

double-digit volume growth, outperforming the industry. To support

our long-term strategy, we continue to invest in our megabrands,

wholesaler support measures and key mega platforms including the

NFL, MLB, PGA and the NBA as well as new partnerships with the UFC,

Copa America and Team USA for the Olympic and Paralympic

Games.

Mexico: High-single digit top- and bottom-line growth with

margin expansion

- Operating performance:

- 4Q23: Revenue was flat with low-single digit revenue per

hl growth driven by revenue management initiatives in an

environment of moderating inflation. Volumes declined by low-single

digits, underperforming the industry, primarily impacted by adverse

weather in the Acapulco region. EBITDA grew by mid-single digits

with margin expansion of over 150bps.

- FY23: Revenue and revenue per hl grew by high-single

digits with volumes declining slightly, in-line with the industry.

EBITDA grew by high-single digits with margin expansion of

approximately 60bps.

- Commercial highlights: Our performance this year was

driven by consistent execution across all three pillars of our

strategy. Our above core portfolio continued to outperform in FY23,

delivering low-single digit volume growth, while our core brands

remained healthy, increasing revenues by high-single digits. We

continued to progress our digital initiatives with our digital DTC

platform, TaDa, operating in over 60 major cities with more than 90

000 monthly active users. We continue to explore and scale value

added services through the BEES platform, such as Vendo, which

enabled more than 650 000 transactions for digital utilities

payments and mobile data purchases in FY23, and BEES

Marketplace.

Colombia: Record high volumes delivered double-digit top-line

and high-single digit bottom-line growth

- Operating performance:

- 4Q23: Revenue grew by low-teens with mid-single digit

volume and high-single digit revenue per hl growth, driven by

revenue management initiatives. EBITDA grew by mid-single digits as

top-line growth was partially offset by anticipated transactional

FX and commodity cost headwinds.

- FY23: Revenue grew by low-teens with revenue per hl

growth of high-single digits. Volumes grew low-single digits.

EBITDA grew by high-single digits.

- Commercial highlights: Driven by the consistent

execution of our category expansion levers, the beer category

continues to grow, gaining 70bps share of total alcohol this year

and with our volumes reaching a new record high. Our core portfolio

led our performance in FY23, delivering low-teens revenue growth

with a particularly strong performance from Poker which grew

volumes by high-single digits.

Brazil: High-single digit top-line and double-digit

bottom-line growth with margin expansion of 462bps

- Operating performance:

- 4Q23: Revenue grew by 5.8% with revenue per hl growth of

5.0% driven by revenue management initiatives. Total volumes grew

by 0.8%, with beer volumes declining by 1.1% as we cycled FIFA

World CupTM activations in 4Q22. Non-beer volumes increased by

5.3%. EBITDA increased by 26.3% with margin expansion of

537bps.

- FY23: Revenue increased by 8.7% with revenue per hl

growth of 8.5%. Total volumes grew by 0.2% with beer volumes down

by 1.0%, slightly underperforming the industry according to our

estimates, and non-beer volumes up by 3.6%. EBITDA increased by

28.0% with margin expansion of 462bps.

- Commercial highlights: Our performance this year was led

by our premium and super premium brands, which delivered volume

growth in the mid-twenties and gained share of the premium beer

segment, according to our estimates. Our core beer portfolio

remained healthy, increasing revenues by high-single digits.

Non-beer performance was led by our low- and no-sugar portfolio,

which grew volumes by over 25%. BEES Marketplace continued to

expand, reaching over 835 000 customers, a 17% increase versus

4Q22, and grew GMV by over 35% in FY23. Our digital DTC platform,

Zé Delivery, reached 5.7 million monthly active users in 4Q23, a

19% increase versus 4Q22, and increased GMV by 8% in FY23.

Europe: High-single digit top- and low-single digit

bottom-line growth

- Operating performance:

- 4Q23: Revenue grew by mid-single digits with high-single

digit revenue per hl growth, driven by pricing actions and

continued premiumization. Volumes declined by low-single digits,

outperforming a soft industry in the majority of our key markets

according to our estimates. EBITDA declined by approximately 10%,

as top-line growth was offset by anticipated commodity cost

headwinds.

- FY23: Revenue increased by high-single digits, driven by

low-teens revenue per hl growth. Volumes declined by mid-single

digits, driven by a soft industry. EBITDA increased by low-single

digits.

- Commercial highlights: We continued to premiumize our

portfolio this year with our premium and super premium brands

delivering high-single digit revenue growth, led by Corona, Leffe

and Stella Artois. Through the consistent execution of our strategy

and investment in our brands, we gained or maintained market share

in the majority of our key markets in FY23, according to our

estimates. Our digital transformation in Europe is progressing,

with BEES now live in the UK, Germany, Belgium, the Netherlands,

and the Canary Islands.

South Africa: Record high volumes delivered double digit top-

and high-single digit bottom-line growth

- Operating performance:

- 4Q23: Revenue grew by high-teens, with revenue per hl

growth of mid-teens, driven by pricing actions and continued

premiumization. Our volumes increased by low-single digits,

outperforming the industry according to our estimates. EBITDA grew

by mid-twenties.

- FY23: Revenue grew by mid-teens with low-teens revenue

per hl growth and a mid-single digit increase in volume. EBITDA

grew by high-single digits, as top-line growth was partially offset

by anticipated transactional FX and commodity cost headwinds.

- Commercial highlights: Driven by focused commercial

investment and the consistent execution of our strategy, the

momentum of our business continued in FY23. Our portfolio delivered

all-time high volumes, with increased Brand Power of our beer and

beyond beer portfolios driving market share gains of both beer and

total alcohol according to our estimates. Our core beer portfolio

continued to outperform, and our global brands grew volumes by more

than 30%, driven by Corona and Stella Artois. In Beyond Beer, our

portfolio grew volumes by high-single digits led by Flying Fish and

Brutal Fruit.

China: Double digit top- and bottom-line growth with margin

expansion of 125bps

- Operating performance:

- 4Q23: Revenue grew by 11.2% with revenue per hl

increasing by 14.7%, driven by continued premiumization and

supported by a favorable comparable in 4Q22. Total volumes declined

by 3.1%, driven by a softer mainstream industry, however our

premium and super-premium volumes grew by double-digits. EBITDA

increased by 31.6%.

- FY23: Revenue grew by 12.3% with a revenue per hl

increase of 7.6% and volume growth of 4.3%, outperforming the

industry according to our estimates. EBITDA grew by 16.3% with

margin expansion of 125bps.

- Commercial highlights: We continue to invest behind our

commercial strategy, focused on premiumization, channel and

geographic expansion, and digital transformation. In FY23, our

premium and super premium portfolio continued to outperform,

delivering double-digit revenue growth and driving overall market

share expansion, according to our estimates. The roll out and

adoption of the BEES platform continued, with BEES now present in

approximately 260 cities and with 70% of our revenue generated

through digital channels in December.

Highlights from our other markets

- Canada: Revenue declined by mid-single digits this

quarter with revenue per hl growth of mid-single digits. In FY23,

revenue was flat with revenue per hl growth of high-single digits,

driven by revenue management initiatives and the continued

outperformance of our above core beer portfolio. Volumes declined

by high-single digits in 4Q23 and by mid-single digits in FY23,

underperforming a soft industry.

- Peru: Revenue and revenue per hl increased by mid-single

digits this quarter with volumes declining by low-single digits. In

FY23, our portfolio gained share of total alcohol with revenue

growth of high-single digits and revenue per hl increasing by

approximately 10%, driven primarily by revenue management

initiatives. Volumes declined by low-single digits, outperforming a

soft industry.

- Ecuador: Revenue declined by low-single digits this

quarter driven by a volume decline of mid-single digits as the

industry was impacted by four fewer trading days due to election

related dry laws. In FY23, our portfolio gained share of total

alcohol with revenue increasing by mid-single digits led by our

above core beer brands, which delivered a high-single digit revenue

increase. Beer volumes were flattish.

- Argentina: Volumes declined by mid-single digits in 4Q23

and high-single digits in FY23, as overall consumer demand was

impacted by inflationary pressures. Revenue increased by over 100%

on an organic basis in both the quarter and full year, driven by

revenue management initiatives in a highly inflationary

environment. Reported USD revenues declined in FY23, driven

primarily by the hyperinflation accounting treatment of the

currency devaluation in December 2023. Refer to the note on page 14

for further details.

- Africa excluding South Africa: In Nigeria, revenue grew

by over 30% this quarter driven by pricing actions and other

revenue management initiatives. Beer volumes declined by

high-single digits, driven by a soft industry which was impacted by

the continued challenging operating environment. In FY23, revenue

increased by high-teens with a beer volume decline of low-teens. In

our other markets, we grew revenue in aggregate by high-single

digits in 4Q23 and by low-teens in FY23, driven by Tanzania,

Botswana and Zambia.

- South Korea: Total revenue increased by low-single

digits in 4Q23 with mid-single digit volume decline and high-single

digit revenue per hl growth, driven by revenue management

initiatives. In FY23, revenue decreased by low-single digits with

flattish revenue per hl and a low-single digit volume decline,

underperforming the industry.

Consolidated Income

Statement

Figure 3. Consolidated income statement

(million USD)

4Q22

4Q23

Organic

growth

Revenue

14 668

14 473

6.2%

Cost of sales

-6 661

-6 679

-7.4%

Gross profit

8 007

7 794

5.3%

SG&A

-4 592

-4 537

-4.3%

Other operating income/(expenses)

193

234

11.4%

Normalized profit from operations

(normalized EBIT)

3 608

3 491

6.9%

Non-underlying items above EBIT (incl.

impairment losses)

19

-165

Net finance income/(cost)

-1 221

-1 290

Non-underlying net finance

income/(cost)

798

550

Share of results of associates

89

95

Non-underlying share of results of

associates

-

-35

Income tax expense

5

-376

Profit

3 298

2 270

Profit attributable to non-controlling

interest

454

379

Profit attributable to equity holders of

AB InBev

2 844

1 891

Normalized EBITDA

4 947

4 877

6.2%

Underlying profit attributable to

equity holders of AB InBev

1 739

1 661

FY22

FY23

Organic

growth

Revenue

57 786

59 380

7.8%

Cost of sales

-26 305

-27 396

-9.0%

Gross profit

31 481

31 984

6.7%

SG&A

-17 555

-18 172

-7.4%

Other operating income/(expenses)

841

778

19.8%

Normalized profit from operations

(normalized EBIT)

14 768

14 590

6.4%

Non-underlying items above EBIT (incl.

impairment losses)

-251

-624

Net finance income/(cost)

-4 978

-5 033

Non-underlying net finance

income/(cost)

829

-69

Share of results of associates

299

295

Non-underlying share of results of

associates

-1 143

- 35

Income tax expense

-1 928

-2 234

Profit

7 597

6 891

Profit attributable to non-controlling

interest

1 628

1 550

Profit attributable to equity holders of

AB InBev

5 969

5 341

Normalized EBITDA

19 843

19 976

7.0%

Underlying profit attributable to

equity holders of AB InBev

6 093

6 158

We are reporting our Argentinean operation applying

hyperinflation accounting under IAS 29, following the

categorization of Argentina as a country with a three-year

cumulative inflation rate greater than 100%, since 2018. Inflation

in Argentina has accelerated, resulting in a more significant

impact on the organic revenue growth of AB InBev than historically.

For illustrative purposes, fully excluding the Argentinean

operation, the 4Q23 organic revenue increase for AB InBev would be

0.5% versus the 6.2% reported. For FY23, revenue growth for AB

InBev would be 3.8% versus the 7.8% reported.

Consolidated other operating income/(expenses) in FY23 increased

by 19.8% primarily driven by higher government grants. In FY23,

Ambev recognized 44 million USD income in other operating income

related to tax credits (FY22: 201 million USD). The year-over-year

change is presented as a scope change and does not affect the

presented organic growth rates.

Non-underlying items above EBIT & Non-underlying share of

results of associates

Figure 4. Non-underlying items above

EBIT & Non-underlying share of results of associates (million

USD)

4Q22

4Q23

FY22

FY23

COVID-19 costs

-2

-

-18

-

Restructuring

-47

-64

-110

-142

Business and asset disposal (incl.

impairment losses)

72

-23

-71

-385

Claims and legal costs

-

-66

-

-85

AB InBev Efes related costs

-3

-12

-51

-12

Acquisition costs / Business

combinations

-1

-

-1

-

Non-underlying items in EBIT

19

-165

-251

-624

Non-underlying share of results of

associates

-

- 35

-1 143

- 35

EBIT excludes negative non-underlying items of 165 million USD

in 4Q23 and 624 million USD in FY23. Business and asset disposal

(including impairment losses) for FY23 includes a loss of

approximately 300 million USD recognized upon disposal of a

portfolio of eight beer and beverage brands and associated assets

in the US to Tilray Brands, Inc in 3Q23.

Non-underlying share of results of associates of FY22 includes

the non-cash impairment of 1 143 million USD the company recorded

on its investment in AB InBev Efes in 1Q22.

Net finance income/(cost)

Figure 5. Net finance income/(cost)

(million USD)

4Q22

4Q23

FY22

FY23

Net interest expense

-785

-712

-3 294

-3 131

Net interest on net defined benefit

liabilities

-18

-26

-73

-90

Accretion expense

-231

-228

-782

-808

Net interest income on Brazilian tax

credits

22

61

168

168

Other financial results

-208

-385

-997

-1 172

Net finance income/(cost)

-1 221

-1 290

-4 978

-5 033

Other financial results were negatively impacted by 125 million

USD in 4Q23 versus 4Q22 and by 269 million USD in FY23 versus FY22,

due to a decrease in hyperinflation monetary adjustments resulting

from the devaluation of the Argentinean Peso in December 2023.

Non-underlying net finance income/(cost)

Figure 6. Non-underlying net finance

income/(cost) (million USD)

4Q22

4Q23

FY22

FY23

Mark-to-market

454

294

606

-325

Gain/(loss) on bond redemption and

other

344

256

223

256

Non-underlying net finance

income/(cost)

798

550

829

-69

Non-underlying net finance cost in FY23 includes mark-to-market

losses on derivative instruments entered into to hedge our

shared-based payment programs and shares issued in relation to the

combination with Grupo Modelo and SAB.

The number of shares covered by the hedging of our share-based

payment program, the deferred share instrument and the restricted

shares are shown in figure 7, together with the opening and closing

share prices.

Figure 7. Non-underlying equity

derivative instruments

4Q22

4Q23

FY22

FY23

Share price at the start of the period

(Euro)

46.75

52.51

53.17

56.27

Share price at the end of the period

(Euro)

56.27

58.42

56.27

58.42

Number of equity derivative instruments at

the end of the period (millions)

100.5

100.5

100.5

100.5

Income tax expense

Figure 8. Income tax expense (million

USD)

4Q22

4Q23

FY22

FY23

Income tax expense

-5

376

1 928

2 234

Effective tax rate

-0.2%

14.5%

18.6%

25.2%

Normalized effective tax rate

12.2%

16.7%

23.8%

24.3%

The increase in normalized ETR in 4Q23 compared to 4Q22 and the

increase in FY23 compared to FY22 is driven mainly by country

mix.

Figure 9. Underlying Profit

attributable to equity holders of AB InBev (million USD)

4Q22

4Q23

FY22

FY23

Profit attributable to equity holders

of AB InBev

2 844

1 891

5 969

5 341

Net impact of non-underlying items on

profit

-1 127

-360

153

614

Hyperinflation impacts in underlying

profit

22

130

- 30

203

Underlying profit attributable to

equity holders of AB InBev

1 739

1 661

6 093

6 158

Underlying profit attributable to equity holders in 4Q22 and

FY22 were positively impacted by 13 million USD and 186 million USD

respectively, and in 4Q23 and FY23 by 55 million USD and 122

million USD respectively, after tax and non-controlling interest

related to tax credits in Brazil.

Basic and underlying EPS

Figure 10. Earnings per share

(USD)

4Q22

4Q23

FY22

FY23

Basic EPS

1.41

0.94

2.97

2.65

Net impact of non-underlying items on

profit

-0.57

-0.18

0.07

0.31

Hyperinflation impacts in EPS

0.01

0.06

-0.02

0.10

Underlying EPS

0.86

0.82

3.03

3.05

Weighted average number of ordinary and

restricted shares (million)

2 013

2 016

2 013

2 016

Figure 11. Key components - Underlying

EPS in USD

4Q22

4Q23

FY22

FY23

Normalized EBIT before

hyperinflation

1.83

1.86

7.41

7.42

Hyperinflation impacts in normalized

EBIT

-0.04

-0.13

-0.07

-0.18

Normalized EBIT

1.79

1.73

7.34

7.24

Net finance cost

-0.61

-0.64

-2.47

-2.50

Income tax expense

-0.14

-0.18

-1.16

-1.15

Associates & non-controlling

interest

-0.19

-0.15

-0.67

-0.64

Hyperinflation impacts in EPS

0.01

0.06

-0.02

0.10

Underlying EPS

0.86

0.82

3.03

3.05

Weighted average number of ordinary and

restricted shares (million)

2 013

2 016

2 013

2 016

Reconciliation between normalized EBITDA and profit

attributable to equity holders

Figure 12. Reconciliation of normalized

EBITDA to profit attributable to equity holders of AB InBev

(million USD)

4Q22

4Q23

FY22

FY23

Profit attributable to equity holders

of AB InBev

2 844

1 891

5 969

5 341

Non-controlling interests

454

379

1 628

1 550

Profit

3 298

2 270

7 597

6 891

Income tax expense

-5

376

1 928

2 234

Share of result of associates

-89

-95

-299

-295

Non-underlying share of results of

associates

-

35

1 143

35

Net finance (income)/cost

1 221

1 290

4 978

5 033

Non-underlying net finance

(income)/cost

-798

-550

-829

69

Non-underlying items above EBIT (incl.

impairment losses)

-19

165

251

624

Normalized EBIT

3 608

3 491

14 768

14 590

Depreciation, amortization and

impairment

1 338

1 386

5 074

5 385

Normalized EBITDA

4 947

4 877

19 843

19 976

Normalized EBITDA and normalized EBIT are measures utilized by

AB InBev to demonstrate the company’s underlying performance.

Normalized EBITDA is calculated excluding the following effects

from profit attributable to equity holders of AB InBev: (i)

non-controlling interest; (ii) income tax expense; (iii) share of

results of associates; (iv) non-underlying share of results of

associates; (v) net finance income or cost; (vi) non-underlying net

finance income or cost; (vii) non-underlying items above EBIT; and

(viii) depreciation, amortization and impairment.

Normalized EBITDA and normalized EBIT are not accounting

measures under IFRS accounting and should not be considered as an

alternative to profit attributable to equity holders as a measure

of operational performance, or an alternative to cash flow as a

measure of liquidity. Normalized EBITDA and normalized EBIT do not

have a standard calculation method and AB InBev’s definition of

normalized EBITDA and normalized EBIT may not be comparable to that

of other companies.

Argentinean Peso devaluation

In December 2023, the Argentinean Peso underwent a significant

devaluation with the USDARS exchange rate closing at 809 on 31

December 2023 compared to 350 on 30 September 2023. IFRS (IAS 29)

require us to restate the year-to-date results for the change in

the general purchasing power of the local currency, using official

indices before converting the local amounts at the closing rate of

the period (i.e. FY23 and FY22 results at the closing rate on 31

December 2023 and 2022, respectively). The December 2023

devaluation negatively impacted our revenue and Normalized EBITDA

as reported in 4Q23 and FY23. The impact of hyperinflation

accounting in 4Q22 and 4Q23, as well as FY22 and FY23 were as

follows:

Impact of hyperinflation (million

USD)

Revenue

4Q22

4Q23

FY22

FY23

Indexing (1)

161

156

483

561

Currency(2)

-268

-855

-578

-1 279

Total impact

-107

-699

-95

-717

Normalized EBITDA

4Q22

4Q23

FY22

FY23

Indexing (1)

41

83

150

211

Currency(2)

-107

-356

-209

-525

Total impact

-66

-274

-59

-314

USDARS average rate

128

294

USDARS closing rate

177

809

(1)

Indexation calculated at closing

rate

(2)

Currency impact from

hyperinflation calculated as the difference between converting the

Argentinean peso (ARS) reported amounts at the closing exchange

rate compared to the average exchange rate of each period

Financial position

Figure 13. Cash Flow Statement (million

USD)

FY22

FY23

Operating activities

Profit of the period

7 597

6 891

Interest, taxes and non-cash items

included in profit

12 344

14 181

Cash flow from operating activities

before changes in working capital and use of provisions

19 941

21 072

Change in working capital

- 346

-1 541

Pension contributions and use of

provisions

- 351

- 419

Interest and taxes (paid)/received

-6 104

-5 975

Dividends received

158

127

Cash flow from/(used in) operating

activities

13 298

13 265

Investing activities

Net capex

-4 838

-4 482

Sale/(acquisition) of subsidiaries, net of

cash disposed/ acquired of

- 70

9

Net proceeds from sale/(acquisition) of

other assets

288

119

Cash flow from/(used in) investing

activities

-4 620

-4 354

Financing activities

Net (repayments of) / proceeds from

borrowings

-7 174

-2 896

Dividends paid

-2 442

-3 013

Share buyback

-

- 362

Payment of lease liabilities

- 610

- 780

Derivative financial instruments

61

- 841

Other financing cash flows

- 455

- 704

Cash flow from/(used in) financing

activities

-10 620

-8 596

.

Net increase/(decrease) in cash and

cash equivalents

-1 942

315

FY23 recorded an increase in cash and cash equivalents of 315

million USD compared to a decrease of 1 942 million USD in FY22,

with the following movements:

- Our cash flow from operating activities reached 13 265

million USD in FY23 compared to 13 298 million USD in FY22. The

decrease was driven by changes in working capital for FY23 compared

to FY22 as a result of (i) higher trade and other receivables due

partially to increased sales in December 2023 versus December 2022

and extended credit terms to our wholesalers in the US, and (ii) a

decrease in trade and other payables due to lower inventory

purchases and net capex, and US volume performance.

- Our cash outflow from investing activities was 4 354

million USD in FY23 compared to a cash outflow of 4 620 million USD

in FY22. The decrease in the cash outflow from investing activities

was mainly due to lower net capital expenditures in FY23 compared

to FY22. Out of the total FY23 capital expenditures, approximately

40% was used to improve the company’s production facilities while

44% was used for logistics and commercial investments and 16% was

used for improving administrative capabilities and for the purchase

of hardware and software.

- Our cash outflow from financing activities amounted to 8

596 million USD in FY23, as compared to a cash outflow of 10 620

million USD in FY22. The decrease is primarily driven by lower debt

redemption in FY23 compared to FY22.

Our net debt decreased to 67.6 billion USD as of 31 December

2023 from 69.7 billion USD as of 31 December 2022.

Our net debt to normalized EBITDA ratio was 3.38x as of 31

December 2023. Our optimal capital structure is a net debt to

normalized EBITDA ratio of around 2x.

We continue to proactively manage our debt portfolio. After

redemptions in December 2023 of 3 billion USD, 98% of our bond

portfolio holds a fixed-interest rate, 41% is denominated in

currencies other than USD and maturities are well-distributed

across the next several years.

In addition to a very comfortable debt maturity profile and

strong cash flow generation, as of 31 December 2023, we had total

liquidity of 20.5 billion USD, which consisted of 10.1 billion USD

available under committed long-term credit facilities and 10.4

billion USD of cash, cash equivalents and short-term investments in

debt securities less bank overdrafts.

2024 presentation update

For FY24, the definition of organic revenue growth has been

amended to cap the price growth in Argentina to a maximum of 2% per

month. Corresponding adjustments will be made to all income

statement related items in the organic growth calculations.

Proposed full year 2023 dividend

The AB InBev Board proposes a full year 2023 dividend of 0.82

EUR per share, subject to shareholder approval at the AGM on 24

April 2024. In line with the Company’s financial discipline and

deleveraging objectives, the recommended dividend balances the

Company’s capital allocation priorities and dividend policy while

returning cash to shareholders. A timeline showing the ex-dividend,

record and payment dates can be found below:

Dividend Timeline

Ex-dividend date

Record Date

Payment date

Euronext

3 May 2024

6 May 2024

7 May 2024

MEXBOL

3 May 2024

6 May 2024

7 May 2024

JSE

2 May 2024

6 May 2024

7 May 2024

NYSE (ADR program)

3 May 2024

6 May 2024

7 June 2024

Restricted Shares

3 May 2024

6 May 2024

7 May 2024

Notes

To facilitate the understanding of AB InBev’s underlying

performance, the analyses of growth, including all comments in this

press release, unless otherwise indicated, are based on organic

growth and normalized numbers. In other words, financials are

analyzed eliminating the impact of changes in currencies on

translation of foreign operations, and scope changes. Scope changes

represent the impact of acquisitions and divestitures, the start or

termination of activities or the transfer of activities between

segments, curtailment gains and losses and year over year changes

in accounting estimates and other assumptions that management does

not consider as part of the underlying performance of the business.

The organic growth of our global brands, Budweiser, Stella Artois,

Corona and Michelob Ultra, excludes exports to Australia for which

a perpetual license was granted to a third party upon disposal of

the Australia operations in 2020. All references per hectoliter

(per hl) exclude US non-beer activities. Whenever presented in this

document, all performance measures (EBITDA, EBIT, profit, tax rate,

EPS) are presented on a “normalized” basis, which means they are

presented before non-underlying items. Non-underlying items are

either income or expenses which do not occur regularly as part of

the normal activities of the Company. They are presented separately

because they are important for the understanding of the underlying

sustainable performance of the Company due to their size or nature.

Normalized measures are additional measures used by management and

should not replace the measures determined in accordance with IFRS

as an indicator of the Company’s performance. As from 1 January

2023, mark-to-market gains/(losses) on derivatives related to the

hedging of our share-based payment programs are reported in the

non-underlying net finance income/(cost). The 2022 presentation was

amended to conform to the 2023 presentation. We are reporting the

results from Argentina applying hyperinflation accounting since

3Q18. The IFRS rules (IAS 29) require us to restate the

year-to-date results for the change in the general purchasing power

of the local currency, using official indices before converting the

local amounts at the closing rate of the period. These impacts are

excluded from organic calculations. In FY23, we reported a negative

impact on the profit attributable to equity holders of AB InBev of

203 million USD. The impact in FY23 Basic EPS was -0.10 USD. Values

in the figures and annexes may not add up, due to rounding. 4Q23

and FY23 EPS is based upon a weighted average of 2 016 million

shares compared to a weighted average of 2 013 million shares for

4Q22 and FY22.

Legal disclaimer

This release contains “forward-looking statements”. These

statements are based on the current expectations and views of

future events and developments of the management of AB InBev and

are naturally subject to uncertainty and changes in circumstances.

The forward-looking statements contained in this release include

statements other than historical facts and include statements

typically containing words such as “will”, “may”, “should”,

“believe”, “intends”, “expects”, “anticipates”, “targets”,

“estimates”, “likely”, “foresees” and words of similar import. All

statements other than statements of historical facts are

forward-looking statements. You should not place undue reliance on

these forward-looking statements, which reflect the current views

of the management of AB InBev, are subject to numerous risks and

uncertainties about AB InBev and are dependent on many factors,

some of which are outside of AB InBev’s control. There are

important factors, risks and uncertainties that could cause actual

outcomes and results to be materially different, including, but not

limited to the risks and uncertainties relating to AB InBev that

are described under Item 3.D of AB InBev’s Annual Report on Form

20-F filed with the SEC on 17 March 2023. Many of these risks and

uncertainties are, and will be, exacerbated by any further

worsening of the global business and economic environment,

including as a result of the ongoing conflict in Russia and Ukraine

and in the Middle East, including the conflict in the Red Sea.

Other unknown or unpredictable factors could cause actual results

to differ materially from those in the forward-looking statements.

The forward-looking statements should be read in conjunction with

the other cautionary statements that are included elsewhere,

including AB InBev’s most recent Form 20-F and other reports

furnished on Form 6-K, and any other documents that AB InBev has

made public. Any forward-looking statements made in this

communication are qualified in their entirety by these cautionary

statements and there can be no assurance that the actual results or

developments anticipated by AB InBev will be realized or, even if

substantially realized, that they will have the expected

consequences to, or effects on, AB InBev or its business or

operations. Except as required by law, AB InBev undertakes no

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. The fourth quarter 2023 (4Q23) and the full year 2023

(FY23) financial data set out in Figure 1 (except for the volume

information), Figures 3 to 5, 6, 8, 9, 12 and 13 of this press

release have been extracted from the group’s audited consolidated

financial statements as of and for the twelve months ended 31

December 2023, which have been audited by our statutory auditors

PwC Réviseurs d’Entreprises SRL / PwC Bedrijfsrevisoren BV in

accordance with the standards of the Public Company Accounting

Oversight Board (United States). Financial data included in Figures

7, 10, 11 and 14 have been extracted from the underlying accounting

records as of and for the twelve months ended 31 December 2023

(except for the volume information). References in this document to

materials on our websites, such as www.ab-inbev.com, are included

as an aid to their location and are not incorporated by reference

into this document.

Conference call and

webcast

Investor Conference call and webcast on Thursday, 29 February

2024: 3.00pm Brussels / 2.00pm London / 9.00am New York

Registration details: Webcast (listen-only mode): AB

InBev 4Q23 Results Webcast

To join by phone, please use one of the following two phone

numbers: Toll-Free: 877-407-8029 Toll: 201-689-8029

About Anheuser-Busch InBev (AB InBev)

Anheuser-Busch InBev (AB InBev) is a publicly traded company

(Euronext: ABI) based in Leuven, Belgium, with secondary listings

on the Mexico (MEXBOL: ANB) and South Africa (JSE: ANH) stock

exchanges and with American Depositary Receipts on the New York

Stock Exchange (NYSE: BUD). As a company, we dream big to create a

future with more cheers. We are always looking to serve up new ways

to meet life’s moments, move our industry forward and make a

meaningful impact in the world. We are committed to building great

brands that stand the test of time and to brewing the best beers

using the finest ingredients. Our diverse portfolio of well over

500 beer brands includes global brands Budweiser®, Corona®, Stella

Artois® and Michelob Ultra®; multi-country brands Beck’s®,

Hoegaarden® and Leffe®; and local champions such as Aguila®,

Antarctica®, Bud Light®, Brahma®, Cass®, Castle®, Castle Lite®,

Cristal®, Harbin®, Jupiler®, Modelo Especial®, Quilmes®, Victoria®,

Sedrin®, and Skol®. Our brewing heritage dates back more than 600

years, spanning continents and generations. From our European roots

at the Den Hoorn brewery in Leuven, Belgium. To the pioneering

spirit of the Anheuser & Co brewery in St. Louis, US. To the

creation of the Castle Brewery in South Africa during the

Johannesburg gold rush. To Bohemia, the first brewery in Brazil.

Geographically diversified with a balanced exposure to developed

and developing markets, we leverage the collective strengths of

approximately 155,000 colleagues based in nearly 50 countries

worldwide. For 2023, AB InBev’s reported revenue was 59.4 billion

USD (excluding JVs and associates).

Annex 1: Segment reporting

(4Q)

AB InBev Worldwide

4Q22

Scope

Currency

Translation

Hyperinflation

restatement

Organic

Growth

4Q23

Organic

Growth

Total volumes (thousand hls)

148 775

-151

-

-

-3 919

144 706

-2.6%

of which AB InBev own beer

128 502

-127

-

-

-4 610

123 764

-3.6%

Revenue

14 668

-67

-2 239

1 199

912

14 473

6.2%

Cost of sales

-6 661

22

914

-464

- 491

-6 679

-7.4%

Gross profit

8 007

-44

-1 325

736

421

7 794

5.3%

SG&A

-4 592

13

594

-358

-195

-4 537

-4.3%

Other operating income/(expenses)

193

48

-24

-4

22

234

11.4%

Normalized EBIT

3 608

17

-755

373

248

3 491

6.9%

Normalized EBITDA

4 947

22

-914

518

304

4 877

6.2%

Normalized EBITDA margin

33.7%

33.7%

-2 bps

North America

4Q22

Scope

Currency

Translation

Hyperinflation

restatement

Organic

Growth

4Q23

Organic

Growth

Total volumes (thousand hls)

23 451

-149

-

-

-3 563

19 738

-15.3%

Revenue

3 931

-37

2

-

- 613

3 283

-15.7%

Cost of sales

-1 566

21

-

-

103

-1 442

6.6%

Gross profit

2 366

-16

1

-

- 510

1 841

-21.7%

SG&A

-1 166

12

-

-

56

-1 098

4.9%

Other operating income/(expenses)

11

-

-

-

7

18

-

Normalized EBIT

1 211

-4

1

-

-448

761

-37.1%

Normalized EBITDA

1 397

-5

1

-

-436

957

-31.3%

Normalized EBITDA margin

35.5%

29.2%

-660 bps

Middle Americas

4Q22

Scope

Currency

Translation

Hyperinflation

restatement

Organic

Growth

4Q23

Organic

Growth

Total volumes (thousand hls)

38 286

-

-

-

348

38 635

0.9%

Revenue

3 913

-17

335

-

206

4 437

5.3%

Cost of sales

-1 521

-7

-128

-

- 76

-1 731

-5.0%

Gross profit

2 392

-23

208

-

130

2 706

5.5%

SG&A

-879

12

-78

-

10

- 934

1.2%

Other operating income/(expenses)

-3

6

-

-

25

27

-

Normalized EBIT

1 510

-5

130

-

165

1 799

11.0%

Normalized EBITDA

1 872

-

160

-

138

2 170

7.4%

Normalized EBITDA margin

47.9%

48.9%

95 bps

South America

4Q22

Scope

Currency

Translation

Hyperinflation

restatement

Organic

Growth

4Q23

Organic

Growth

Total volumes (thousand hls)

46 860

-

-

-

- 157

46 704

-0.3%

Revenue

3 380

3

-2 498

1 199

1 001

3 084

29.6%

Cost of sales

-1 661

-1

987

-464

- 312

-1 450

-18.8%

Gross profit

1 718

2

-1 511

736

689

1 635

40.1%

SG&A

-995

-12

673

-358

-197

- 890

-19.6%

Other operating income/(expenses)

97

43

-24

-4

7

119

6.7%

Normalized EBIT

820

34

-862

373

499

863

61.5%

Normalized EBITDA

1 050

34

-1 041

518

545

1 106

52.4%

Normalized EBITDA margin

31.1%

35.8%

541 bps

EMEA

4Q22

Scope

Currency

Translation

Hyperinflation

restatement

Organic

Growth

4Q23

Organic

Growth

Total volumes (thousand hls)

24 094

50

-

-

-180

23 964

-0.7%

Revenue

2 070

20

-82

-

244

2 252

11.7%

Cost of sales

-1 101

-10

57

-

-199

-1 253

-17.9%

Gross profit

969

9

-25

-

46

999

4.7%

SG&A

-636

-14

3

-

-8

- 655

-1.2%

Other operating income/(expenses)

60

-1

1

-

-7

53

-11.1%

Normalized EBIT

393

-6

-21

-

31

397

8.0%

Normalized EBITDA

676

-5

-32

-

37

675

5.5%

Normalized EBITDA margin

32.6%

30.0%

-176 bps

Asia Pacific

4Q22

Scope

Currency

Translation

Hyperinflation

restatement

Organic

Growth

4Q23

Organic

Growth

Total volumes (thousand hls)

15 903

-

-

-

-438

15 465

-2.8%

Revenue

1 185

-2

1

-

83

1 267

7.0%

Cost of sales

-624

-

2

-

-16

- 637

-2.5%

Gross profit

561

-2

3

67

630

12.1%

SG&A

-520

1

7

-

-22

- 533

-4.2%

Other operating income/(expenses)

34

-

-1

-

-8

26

-22.7%

Normalized EBIT

76

-1

10

-

38

122

51.3%

Normalized EBITDA

234

-1

6

-

49

288

21.0%

Normalized EBITDA margin

19.8%

22.8%

258 bps

Global Export and Holding

Companies

4Q22

Scope

Currency

Translation

Hyperinflation

restatement

Organic

Growth

4Q23

Organic

Growth

Total volumes (thousand hls)

181

-52

-

-

71

200

55.0%

Revenue

189

-33

3

-

-9

150

-6.0%

Cost of sales

-189

19

-5

-

9

-166

5.0%

Gross profit

-

-15

-1

-

-1

-17

-4.7%

SG&A

-395

13

-11

-

-34

-427

-8.9%

Other operating income/(expenses)

-6

-

-1

-

-2

-8

-

Normalized EBIT

-401

-1

-13

-

-37

-453

-9.2%

Normalized EBITDA

-282

-1

-8

-

-29

-320

-10.2%

Annex 2: Segment reporting

(FY)

AB InBev Worldwide

FY22

Scope

Currency

Translation

Organic

Growth

FY23

Organic

Growth

Total volumes (thousand hls)

595 133

-151

-

-10 255

584 728

-1.7%

of which AB InBev own beer

517 990

- 81

-

-12 010

505 899

-2.3%

Revenue

57 786

-123

-2 744

4 460

59 380

7.8%

Cost of sales

-26 305

45

1 226

-2 362

-27 396

-9.0%

Gross profit

31 481

-78

-1 518

2 099

31 984

6.7%

SG&A

-17 555

-14

696

-1 299

-18 172

-7.4%

Other operating income/(expenses)

841

-146

-43

126

778

19.8%

Normalized EBIT

14 768

-238

-865

925

14 590

6.4%

Normalized EBITDA

19 843

-223

-1 012

1 368

19 976

7.0%

Normalized EBITDA margin

34.3%

33.6%

-23 bps

North America

FY22

Scope

Currency

Translation

Organic

Growth

FY23

Organic

Growth

Total volumes (thousand hls)

102 674

-118

-

-12 417

90 140

-12.1%

Revenue

16 566

-36

-80

-1 378

15 072

-8.3%

Cost of sales

-6 714

19

28

151

-6 517

2.2%

Gross profit

9 851

-17

-52

-1 227

8 554

-12.5%

SG&A

-4 587

-18

30

-43

-4 619

-0.9%

Other operating income/(expenses)

45

-

3

-14

34

-30.3%

Normalized EBIT

5 309

-35

-19

-1 285

3 970

-24.4%

Normalized EBITDA

6 057

-37

-24

-1 269

4 727

-21.1%

Normalized EBITDA margin

36.6%

31.4%

-507 bps

Middle Americas

FY22

Scope

Currency

Translation

Organic

Growth

FY23

Organic

Growth

Total volumes (thousand hls)

147 624

-

-

1 106

148 730

0.7%

Revenue

14 180

-16

875

1309

16 348

9.2%

Cost of sales

-5 540

-13

-320

-507

-6 379

-9.1%

Gross profit

8 639

-29

556

803

9 969

9.3%

SG&A

-3 390

-6

-228

-167

-3 792

-4.9%

Other operating income/(expenses)

-12

14

2

47

51

-

Normalized EBIT

5 238

-21

329

683

6 228

13.1%

Normalized EBITDA

6 564

-7

430

729

7 715

11.1%

Normalized EBITDA margin

46.3%

47.2%

80 bps

South America

FY22

Scope

Currency

Translation

Organic

Growth

FY23

Organic

Growth

Total volumes (thousand hls)

164 319

-

-

-1 859

162 460

-1.1%

Revenue

11 599

4

-2 702

3 139

12 040

27.3%

Cost of sales

-5 976

-1

1 054

-1 062

-5 984

-18.0%

Gross profit

5 623

3

-1 647

2 077

6 056

37.2%

SG&A

-3 458

-28

697

-787

-3 575

-22.8%

Other operating income/(expenses)

473

-153

-38

112

394

40.6%

Normalized EBIT

2 638

-177

-988

1 402

2 875

58.3%

Normalized EBITDA

3 511

-177

-1 137

1 688

3 884

51.9%

Normalized EBITDA margin

30.3%

32.3%

542 bps

EMEA

FY22

Scope

Currency

Translation

Organic

Growth

FY23

Organic

Growth

Total volumes (thousand hls)

90 780

204

-

- 771

90 213

-0.8%

Revenue

8 120

75

-491

885

8 589

10.8%

Cost of sales

-4 167

-40

297

-734

-4 645

-17.5%

Gross profit

3 953

35

-194

150

3 944

3.8%

SG&A

-2 604

-57

105

-58

-2 614

-2.2%

Other operating income/(expenses)

198

-8

-3

12

198

6.2%

Normalized EBIT

1 546

-30

-92

104

1528

6.9%

Normalized EBITDA

2 612

-29

-158

145

2 570

5.6%

Normalized EBITDA margin

32.2%

29.9%

-148 bps

Asia Pacific

FY22

Scope

Currency

Translation

Organic

Growth

FY23

Organic

Growth

Total volumes (thousand hls)

88 898

-

-

3 828

92 726

4.3%

Revenue

6 532

-12

-350

655

6 824

10.0%

Cost of sales

-3 168

-1

170

-274

-3 272

-8.6%

Gross profit

3 364

-13

-180

380

3 551

11.4%

SG&A

-2 067

7

105

-178

-2 133

-8.6%

Other operating income/(expenses)

137

-

-7

-17

113

-12.6%

Normalized EBIT

1 433

-6

-82

186

1 531

13.0%

Normalized EBITDA

2 104

-6

-118

206

2 186

9.8%

Normalized EBITDA margin

32.2%

32.0%

-7 bps

Global Export and Holding

Companies

FY22

Scope

Currency

Translation

Organic

Growth

FY23

Organic

Growth

Total volumes (thousand hls)

838

-236

-

-143

459

-23.7%

Revenue

790

-137

4

-149

508

-22.8%

Cost of sales

-740

80

-3

64

-598

9.8%

Gross profit

50

-57

1

-84

-90

-

SG&A

-1 447

88

-13

-66

-1 439

-4.9%

Other operating income/(expenses)

1

-

-

-14

-13

-

Normalized EBIT

-1 396

32

-12

-165

-1 542

-12.1%

Normalized EBITDA

-1 004

33

-5

-130

-1 106

-13.4%

Annex 3: Consolidated statement of

financial position

Million US dollar

31 December 2023

31 December 2022

ASSETS

Non-current assets

Property, plant and equipment

26 818

26 671

Goodwill

117 043

113 010

Intangible assets

41 286

40 209

Investments in associates

4 872

4 656

Investment securities

178

175

Deferred tax assets

2 935

2 300

Pensions and similar obligations

12

11

Income tax receivables

844

883

Derivatives

44

60

Trade and other receivables

1 941

1 782

Total non-current assets

195 973

189 757

Current assets

Investment securities

67

97

Inventories

5 583

6 612

Income tax receivables

822

813

Derivatives

505

331

Trade and other receivables

6 024

5 330

Cash and cash equivalents

10 332

9 973

Assets classified as held for sale

34

30

Total current assets

23 367

23 186

Total assets

219 340

212 943

EQUITY AND LIABILITIES

Equity

Issued capital

1 736

1 736

Share premium

17 620

17 620

Reserves

20 276

15 218

Retained earnings

42 215

38 823

Equity attributable to equity holders

of AB InBev

81 848

73 398

Non-controlling interests

10 828

10 880

Total equity

92 676

84 278

Non-current liabilities

Interest-bearing loans and borrowings

74 163

78 880