Corebridge Financial Research Finds Retirement Expectations of Women Don’t Always Meet Realities

11 Diciembre 2024 - 8:00AM

Business Wire

Study findings shed light on retirement from

the point of view of those already retired and those still in their

working years, with key insights into surprises, concerns and

helpful actions

New research from Corebridge Financial digs into the financial

realities of retired women compared to what they expected and

provides key learnings for future retirees. The study reveals that

only 19% of retired women are finding retirement to be exactly what

they expected, with 26% going as far to say that retirement is not

at all what they expected. The most common retirement surprise is

cost, with 50% of retired women saying retirement is more expensive

than anticipated, followed by 46% who say they retired earlier than

they expected.

While 51% of retired women describe their current financial

health as good or very good, 63% wish they began saving earlier,

knowing what they know now. Just 27% say they began saving and

investing between the ages of 18-29. Taking that a step further,

42% of retired women say they did not begin prioritizing their

financial and retirement planning until 41 years old or later, and

20% said they still have not started.

“It’s encouraging to see more than half of retired women feeling

good about their current financial situations, but there are

clearly some stark differences between expectations for retirement

and the realities,” said Terri Fiedler, President of Retirement

Services at Corebridge Financial. “Women are both starting

retirement earlier than expected and managing costs that are higher

than anticipated. These dual challenges point to the importance of

creating an action plan early in your working years that can help

you both build your retirement savings and make them last

throughout your retirement.”

Learning from those before you

Less than half (46%) of women in their working years feel like

they are on the right track for retirement. For these women,

learning from the reflections and insights of those already in

retirement can go a long way in helping achieve their own

retirement success.

Behind inflation (52%), non-retired women rank the ability to

retire comfortably (34%) and running out of money in retirement

(30%) as their top financial concerns. These stressors closely

align with those of retired women who rank inflation (57%) and

running out of money in retirement (39%) as their biggest financial

concerns, suggesting the realities of a longer, more expensive

retirement.

Among retired women, the number one financial step they say they

got right in their preparation for retirement is working with a

financial professional, cited by 35% of respondents. Though 38% of

retired women working with a financial professional wish they began

that relationship sooner. Saving early and contributing more to

their employer retirement savings plan rounded out the top three

actions retirees felt helped prepare them for retirement.

“Retired women’s reflections are like messages from the future

and hopefully inspire younger women to take those crucial first and

next steps toward a secure retirement,” Fiedler said. “At the same

time, it’s important for those already in retirement to remember

that it’s never too late to take action no matter where they are in

their financial journey.”

Action steps for retirement savers and retirees

For non-retirees and retirees alike, there can be obstacles to

taking action that address financial concerns. Nearly four in ten

(37%) non-retired women say that addressing their financial

concerns causes them too much stress. Among retired women, 31% say

they are not in a position to address their financial concerns.

Despite these challenges, women appear determined to take

action. Sixty-one percent of women say they are actively working to

address their concerns, including 59% of non-retired women and 65%

of retired women.

Here are some action steps women can take to move their

financial futures forward:

- Envision your retirement: The most popular action step

women in their working years are taking to address their financial

concerns is conducting research to understand their retirement

needs according to the Corebridge survey. This is an important

first step, as creating an accurate picture of the retirement you

envision can help identify what savings and investment strategies

you might need. Looking ahead, non-retired women most commonly

envision their retirement to include spending time with loved ones

(39%), traveling (36%) and picking up new hobbies (33%).

- Start saving now and maximize contributions: With 63% of

retired women saying they wish they had started saving earlier and

31% saying they wish they had contributed more of each paycheck

into their retirement plan, the message is clear: Start

contributing to a workplace retirement plan as early as you can.

Where possible, try to contribute enough to take advantage of

employer matching.

- Create your own lifetime income for retirement: Among

both retired and non-retired female respondents, the combined

category of savings/money market accounts represents the most

widely owned asset. However, the second most widely owned asset

among retired women (33%) is a pension, compared to just 9% of

non-retired women who say they have one. Conversely, 31% of

non-retired women said they have a workplace retirement account,

compared to 16% of retired women. This reversal of ownership

reflects a changing retirement landscape in which the

responsibility to secure a lifetime income stream is increasingly

shifting to individuals. Perhaps not surprisingly, retired women

surveyed were nearly three times as likely to own an annuity

compared to non-retired women at ownership rates of 13% and 5%

respectively.

- Consider working with a financial professional: The

Corebridge survey finds that working with a financial professional

is strongly correlated with better financial health and confidence.

Nearly three in five women who work with a financial professional

(59%) rate their financial health positively, compared to just 33%

who do not. Women who use a financial professional also feel more

confident in their financial capabilities, especially when it comes

to retirement and making investments. Nearly three in five women

who work with a financial professional (57%) have confidence in

their ability to plan for retirement, and 46% are confident in

their ability to make sound investments compared to just 24% and

18% respectively among those who don’t.

Additional insights on the 2024 Women Speak Out on Money Matters

survey can be found at Corebridge Insights & Education.

Methodology

The 2024 Corebridge Financial Women Speak Out on Money Matters

study is based on online survey responses conducted by Morning

Consult on behalf of Corebridge Financial between May 2-8, 2024,

among a national sample of 4,023 adults (2,574 women and 1,439

men).

About Corebridge Financial

Corebridge Financial, Inc. (NYSE: CRBG) makes it possible for

more people to take action in their financial lives. With more than

$410 billion in assets under management and administration as of

September 30, 2024, Corebridge Financial is one of the largest

providers of retirement solutions and insurance products in the

United States. We proudly partner with financial professionals and

institutions to help individuals plan, save for and achieve secure

financial futures. For more information, visit

corebridgefinancial.com and follow us on LinkedIn, YouTube and

Instagram.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241211148932/en/

Işıl Müderrisoğlu (Investors):

investorrelations@corebridgefinancial.com Jay Russo (Media):

jay.russo@corebridgefinancial.com

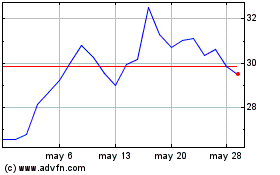

Corebridge Financial (NYSE:CRBG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Corebridge Financial (NYSE:CRBG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025