Equifax Canada Champions Financial Inclusion for Newcomers to Canada with the Launch of Global Consumer Credit File

24 Octubre 2024 - 4:50AM

Equifax Canada has launched the Global Consumer Credit File, an

innovative solution designed to empower lenders to make more

confident credit lending decisions for newcomers to Canada. The

solution creates a calibrated credit score using newcomers’ credit

histories from their countries of origin. The platform offers

lenders and newcomers to Canada a seamless and secure means to

access global credit data which is essential in obtaining services

such as housing, credit cards, and mobile phone contracts.

Immigration to Canada continues to

grow, with the country on track to welcome 500,000 new immigrants

annually by 2025. Many of these newcomers will arrive with credit

histories that often go unseen by Canadian financial institutions.

People who are new to Canada often have a thin credit file

(generally defined as having 2 or less credit lines) with little to

no credit history because their credit file from their country of

origin may not carry over to Canada. Without a more robust credit

file, newcomers may face greater challenges in navigating the

Canadian financial economy such as accessing credit cards or

mortgages with favourable rates or renting an apartment. Having a

credit score allows newcomers to Canada to gain access to greater

financial opportunities.

Robust Credit Bureau data from

around the worldThe Global Consumer Credit File allows

newcomers to leverage their global credit profiles when they apply

for the credit necessary to build their financial lives in Canada.

It offers a seamless and secure way of connecting financial data

within Equifax Consumer Credit bureaus worldwide to create a

calibrated score and helping to give financial visibility to

individuals who are new to Canada. With this trusted information,

lenders can make more informed decisions and help to expand credit

access for newcomers based in part upon information gained from

their international credit histories. The Global Consumer Credit

File will launch with credit information from India, with plans to

expand the service for newcomers from Brazil, Argentina, and Chile

over the coming months, and a future roadmap that includes 18

countries total.

“At Equifax Canada, we are committed

to supporting the Canadian financial ecosystem to help provide more

inclusive financial opportunities that move people forward,” said

Sue Hutchison, President and CEO of Equifax Canada. “Newcomers to

Canada bring a wealth of talent and ambition to this country, and

we are proud to play a role in helping them gain access to the

credit they need to thrive. The Global Consumer Credit File allows

us to empower these individuals from day one, helping them

establish their financial roots and contribute to Canada's vibrant

economy.”

Canada’s immigration strategy is a

cornerstone of its economic growth. Equifax Canada is set to

support this growth by providing lenders with access to trusted

global data, expanding credit opportunities, and fostering a more

inclusive financial landscape for all Canadians.

“Financial inclusion is about more

than just credit access,” added Hutchison. “It’s about creating

opportunities for everyone to succeed and contribute to the

economy. Equifax is proud to lead the charge in ensuring that

newcomers have the tools they need to build a strong financial

future here in Canada.”

By reducing barriers to financial

access, the Global Consumer Credit File can help newcomers to

Canada realize their full potential from the moment they arrive,

along with those already in Canada, ensuring that they can thrive

both financially and personally.

About EquifaxAt Equifax (NYSE: EFX), we believe

knowledge drives progress. As a global data, analytics, and

technology company, we play an essential role in the global economy

by helping financial institutions, companies, employers, and

government agencies make critical decisions with greater

confidence. Our unique blend of differentiated data, analytics, and

cloud technology drives insights to power decisions to move people

forward. Headquartered in Atlanta and supported by nearly 15,000

employees worldwide, Equifax operates or has investments in 24

countries in North America, Central and South America, Europe, and

the Asia Pacific region. For more information, visit

Equifax.ca.

Contact:

Andrew FindlaterSELECT Public

Relationsafindlater@selectpr.ca(647) 444-1197

Angie AndichEquifax Canada Media

RelationsMediaRelationsCanada@equifax.com

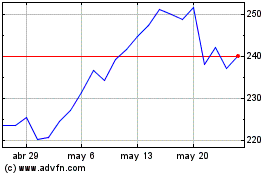

Equifax (NYSE:EFX)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Equifax (NYSE:EFX)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024