FREYR Battery (NYSE: FREY) (“FREYR” or the “Company”) has

announced that the Company has entered into an agreement to acquire

the U.S. solar manufacturing assets of Trina Solar Co Ltd. (SHA:

688599) (“Trina Solar”). The transaction is subject to certain

customary conditions precedent, including receipt of certain

third-party consents, completion of the preferred stock issuance to

Encompass Capital Advisors LLC and internal reorganization to be

completed by Trina Solar and is expected to close around year end

2024.

Highlights

- The transaction is expected to close year end 2024 and

creates a leading integrated U.S.-owned and operated solar

technology company with a pathway for value enhancing

growth

- FREYR is acquiring 5 GW, 1.35 million square foot solar

module manufacturing facility in Wilmer, Texas that started

production on November 1, 2024

- Trina Solar is a global leader in solar and renewable energy

industry with an established U.S. commercial presence, global

supply chains, advantaged technology, and a strong track record of

manufacturing and project execution for U.S. customers

- FREYR is developing a new 5GW, U.S. solar cell manufacturing

facility; site selection underway and targeting start of production

in H2 2026

- FREYR provides 2025 EBITDA guidance of $75 - $125 million.

FREYR expects to exit 2025 at full-year run rate EBITDA of $175 -

$225 million

- Total consideration to Trina Solar of $340 million,

comprised of $100 million of cash, $50 million repayment of an

intercompany loan, $150 million loan note, 9.9% of FREYR

outstanding common stock, and a convertible loan note that would

convert into an additional 11.5% of FREYR outstanding common stock

after certain conditions are satisfied

- Simultaneously, FREYR has secured a $100 million commitment

for the issuance of preferred stock issuance to Encompass Capital

Advisors LLC and $14.8 million through a private placement of FREYR

common stock

- Daniel Barcelo, FREYR’s Chairman of the Board of Directors

(the “Board”), assumes role of Chief Executive Officer of FREYR

with immediate effect and Evan Calio will remain Chief Financial

Officer. Subject to closing of the transaction, Mingxing Lin will

be appointed Chief Strategy Officer and Dave Gustafson will be

appointed Chief Operating Officer; while Peter del Vecchio will be

joining as Interim Chief Legal Officer with immediate

effect

- Co-founder Tom Einar Jensen appointed CEO of FREYR Europe

and will oversee value optimization of European assets

- New CEO Daniel Barcelo to remain Chairman of the Board of

Directors; W. Richard Anderson appointed to FREYR’s Board; Incoming

Chief Strategy Officer Mingxing Lin has been selected as a Board

nominee subject to closing of the transaction; Tom Einar Jensen to

step down from the Board

Under the terms of the agreement, FREYR will acquire Trina

Solar’s 5 GW solar module manufacturing facility in Wilmer, Texas,

which started production on November 1, 2024. The facility is

expected to ramp up to full production in 2025 with 30% of

estimated production volumes backed by firm offtake contracts with

U.S. customers.

Upon closing of the transaction, FREYR will execute a

multi-phase strategic plan to establish a vertically integrated

U.S. solar manufacturing footprint. The next phase of the plan will

be to construct a 5GW solar cell manufacturing facility in the U.S.

Site selection is underway and FREYR is targeting a start of

construction in 2Q 2025 with anticipated first solar cell

production in 2H 2026. The creation of a U.S.-owned and operated

company that can provide a turnkey solar technology solution is

expected to solve a bottleneck for developers, create up to 1,800

direct jobs, satisfy local content requirements for U.S. solar

projects, and competitively differentiate FREYR.

“We are pleased to announce this transformative transaction,

which will immediately position the Company as one of the leading

solar manufacturing companies in the U.S. We are proud to be

partnered with Trina Solar, a global manufacturing and solar

technology leader.” commented Daniel Barcelo, FREYR’s newly

appointed Chief Executive Officer. “Domestic manufacturing capacity

for solar and batteries is essential for energy transition and job

creation. The U.S. was once the global leader in solar, and it can

be again.”

Transaction details

Under the terms of the transaction agreement at closing, the

total consideration to Trina Solar will consist of $100 million of

cash, $50 million repayment of an intercompany loan, $150 million

loan note, 9.9% of FREYR outstanding common stock, and an $80

million convertible loan note that would convert into an additional

11.5% of FREYR outstanding common stock after certain conditions

are satisfied. FREYR has secured a $100 million commitment for the

issuance of preferred stock to Encompass Capital Advisors LLC and

$14.8 million for a private placement of 7.0% of FREYR outstanding

common stock to Ms. Chunyan Wu, a co-founder and significant

shareholder of Trina Solar. The funds will be used for general

operational and working capital purposes.

Changes to strengthen FREYR’s management team and Board of

Directors

Daniel Barcelo, FREYR’s current Chairman of the Board, has been

appointed Chief Executive Officer. Tom Einar Jensen, FREYR’s

co-founder, will assume the role of CEO of FREYR Europe and will

oversee the optimization and monetization of FREYR’s European

portfolio. Mr. Jensen is stepping down from FREYR’s Board of

Directors to focus on FREYR’s European portfolio. All these changes

are effective immediately.

Joining FREYR upon closing will be Mingxing Lin, who has been

appointed the Company’s Chief Strategy Officer, and Dave Gustafson,

who has been appointed Chief Operating Officer. Mr. Lin and Mr.

Gustafson bring decades of collective experience in multinational

company management and the solar industry. Mr. Lin has been

appointed a nominee to FREYR’s Board of Directors subject to

closing of the transaction.

W. Richard Anderson has been appointed to FREYR’s Board,

effective immediately. Mr. Anderson is currently the Chief

Executive Officer of Coastline Exploration Ltd., and he brings more

than 25 years of leadership experience in the global energy

industry and more than 15 years as a board member of public and

private energy companies to FREYR.

FREYR provides financial and operational guidance

In anticipation of the closing of the transaction and the start

of solar module production at the Wilmer, Texas facility in Q4

2024, FREYR is initiating 2025 EBITDA guidance of $75 - $125

million and expects to exit 2025 at full-year run rate EBIDTA of

$175 - $225 million.

FREYR European assets

FREYR is implementing a value optimization and monetization

initiative in Europe to align with the Company’s strategy to focus

on vertically integrating the U.S. solar business. As CEO of FREYR

Europe, Tom Einar Jensen will oversee the process.

The Company has terminated its SemiSoldTM technology license

with 24M Technologies (“24M”). Pursuant to the termination of the

24M license agreement, FREYR has no remaining financial obligations

to 24M and no longer holds any equity ownership interest in

24M.

Presentation of Transaction Highlights

A presentation will be held today, November 6, 2025, at 8:00 am

EDT to discuss the transaction. The presentation materials will be

available for download at https://ir.freyrbattery.com.

To access the conference call, listeners should contact the

conference call operator at the appropriate number listed below

approximately 10 minutes prior to the start of the call.

Participant conference call dial-in numbers:

Conference ID 1923230 USA / International Toll +1 (646) 307-1963

USA - Toll-Free (800) 715-9871 Canada - Toronto (647) 932-3411

Canada - Toll-Free (800) 715-9871

Transaction advisors

Santander served as financial advisor, Skadden, Arps, Slate,

Meagher & Flom (UK) LLP served as legal advisor, Arnold &

Porter, Ernst & Young, Clean Energy Associates and Rystad

Energy served as advisors to FREYR in support of the transaction.

Dorsey & Whitney LLP served as U.S. legal advisor, CICC served

as financial advisor and Deloitte served as tax advisor to Trina

Solar.

Cautionary Statement Concerning Forward-Looking

Statements

All statements, other than statements of present or historical

fact included in this presentation, including, without limitation,

FREYR Battery, Inc.’s, a Delaware corporation, (“FREYR”) ability to

establish a commercial presence in the U.S. solar market; the

potential benefits of FREYR’s strategic acquisition of Trina Solar

US Holding Inc., a Delaware corporation (“Trina”); the expected

timeline to closing the transaction; FREYR’s ability to secure

financing options for the solar cell manufacturing facility; the

projected start of module production in Q4 2024; the construction

of a solar cell manufacturing facility targeting start of

production in H2 2026; the integration of U.S. solar module and

solar cell capacity; FREYR’s ability to become a top 5 U.S. solar

module producer; any resulting U.S. government incentives for clean

energy technology manufacturing and development; the establishment

of a domestic manufacturing footprint for FREYR’s integrated clean

energy solution business; the creation of 1,500 local jobs; the

integration of U.S. solar and battery energy storage system

manufacturing; the monetization of FREYR’s legacy assets; any

competitive advantages of integration; any potential benefits of

the U.S. Inflation Reduction Act; the technological advantage of

Trina’s modules; and the ability to replicate global supply chains

in the U.S. are forward-looking statements.

These forward-looking statements involve significant risks and

uncertainties that could cause the actual results to differ

materially from the expected results. Factors that may cause such

differences include, but are not limited to: (1) the occurrence of

any event, change or other circumstances that could give rise to

the termination of the transaction agreement or could otherwise

cause the transaction to fail to close; (2) the outcome of any

legal proceedings that may be instituted against the Company

following the announcement of the transaction; (3) the inability to

complete the transaction, including due to failure to satisfy

conditions to closing of the transaction; (4) any failure to obtain

lender’s consent with respect to project finance prior to closing;

(5) any material liabilities identified post-signing that may lead

to the termination of the transaction agreement; (6) the risk that

the transaction disrupts current plans and operations as a result

of the announcement and consummation of the transaction; (7) the

ability to recognize the anticipated benefits of the transaction;

(8) costs related to the transaction; (9) changes in applicable

laws or regulations; (10) the possibility that the Company may be

adversely affected by other economic, business, and/or competitive

factors; (11) any material modifications or repeal of the U.S.

Inflation Reduction Act (“IRA”); (12) any enacted legislation that

could limit the ability of companies with a certain percentage of

Chinese ownership to receive tax credits under IRA; (13) any

potential risk that the Chinese equity ownership in the Company may

impact FREYR’s ability to develop a solar cell facility in the

U.S.; (14) any increases to commodity pricing or US tariff and

countervailing duty levels; and (15) potential operational risks

associated with commissioning and ramp-up of production. The

Company cautions that the foregoing list of factors is not

exclusive. Most of these factors are outside FREYR’s control and

are difficult to predict. Additional information about factors that

could materially affect FREYR is set forth under the “Risk Factors”

section in (i) FREYR’s post-effective amendment no. 1 to the

Registration Statement on Form S-3 filed with the Securities and

Exchange Commission (the “SEC”) on January 4, 2024, (ii) FREYR’s

Registration Statement on Form S-4 filed with the SEC on September

8, 2023 and subsequent amendments thereto filed on October 13,

2023, October 19, 2023 and October 31, 2023, and (iii) FREYR’s

annual report on Form 10-K filed with the SEC on February 29, 2024,

and FREYR’s quarterly reports on Form 10-Q filed with the SEC on

May 8 and August 9, 2024, and available on the SEC’s website at

www.sec.gov. Except as otherwise required by applicable law, FREYR

disclaims any duty to update any forward-looking statements, all of

which are expressly qualified by the statements in this section, to

reflect events or circumstances after the date of this

presentation. Should underlying assumptions prove incorrect, actual

results and projections could differ materially from those

expressed in any forward-looking statements.

FREYR intends to use its website as a channel of distribution to

disclose information which may be of interest or material to

investors and to communicate with investors and the public. Such

disclosures will be included on FREYR’s website in the ‘Investor

Relations’ sections. FREYR also intends to use certain social media

channels, including, but not limited to, Twitter and LinkedIn, as

means of communicating with the public and investors about FREYR,

its progress, products and other matters. While not all the

information that FREYR posts to its digital platforms may be deemed

to be of a material nature, some information may be. As a result,

FREYR encourages investors and others interested to review the

information that it posts and to monitor such portions of FREYR’s

website and social media channels on a regular basis, in addition

to following FREYR’s press releases, SEC filings, and public

conference calls and webcasts. The contents of FREYR’s website and

other social media channels shall not be deemed incorporated by

reference in any filing under the Securities Act of 1933, as

amended.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105395960/en/

Investor contact: Jeffrey Spittel Senior Vice President,

Investor Relations and Corporate Development

jeffrey.spittel@freyrbattery.com Tel: (+1) 409 599-5706

Media contact: Amy Jaick Global Head of Communications

amy.jaick@freyrbattery.com Tel: (+1) 973 713-5585

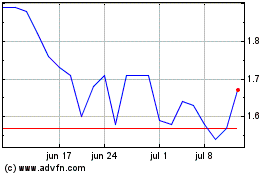

FREYR Battery (NYSE:FREY)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

FREYR Battery (NYSE:FREY)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024