PricingDirect and Aumni Partner to Deliver Independent Valuations for Private Equity Securities

10 Diciembre 2024 - 6:00AM

Business Wire

PricingDirect, Inc. (“PricingDirect”) and Aumni, Inc. (“Aumni”),

both wholly owned subsidiaries of JPMorgan Chase & Co., are

pleased to announce a strategic partnership aimed at providing

investors with independent valuations of private equity securities.

This collaboration leverages the strengths of both entities to

offer a comprehensive solution that enhances transparency and

efficiency in the valuation process, helping investors navigate the

complexities of private equity investments.

By combining PricingDirect's expertise in evaluated pricing and

Aumni's private market expertise and advanced data analytics

capabilities, the partnership offers investors the ability to

receive valuations that are both reliable and aligned with industry

standards.

“In the past few years, we’ve witnessed a significant increase

in allocations to alternative assets. With over two decades of

valuation experience in public markets, we are delighted to deliver

solutions for private equity valuations to managers and

allocators,” said Neil Hyman, CEO of PricingDirect. “With the

powerful combination of PricingDirect’s valuation expertise and

Aumni’s leading private market data structuring capabilities and

insights, we can bring streamlined and tech-enabled capabilities to

private markets participants,” Hyman added.

The partnership is designed to assist investors in complying

with the Financial Accounting Standards Board's ASC 820 and in

meeting the requirements of the U.S. Securities and Exchange

Commission's Rule 2a-5, which governs the fair valuation of fund

investments. A key component of this partnership is the integration

of Aumni's market leading private investment structuring

capabilities and Market Insights product. By utilizing this

innovative tool, PricingDirect is able to deliver more informed and

precise valuations, ensuring fair value calculations incorporate

trends in private market valuations.

"We are excited to join forces with PricingDirect to deliver a

solution that addresses the critical need for independent

valuations in the venture capital and private equity space," said

Alex Woodgate, Head of Corporate Development and Data Solutions at

Aumni.

The partnership underscores J.P. Morgan's commitment to being

the leading bank for the Innovation Economy. The firm is uniquely

positioned to serve the global innovation ecosystem, from venture

capital firms and their general partners to startups and

high-growth companies. With dedicated teams focused on industries

such as technology, fintech, life sciences, and climate tech, J.P.

Morgan delivers deep industry expertise and comprehensive solutions

across its Commercial & Investment Bank and Private Bank. By

leveraging its robust network of investors and partners, J.P.

Morgan supports companies from inception through IPO and beyond,

reinforcing its role as a steadfast supporter of the Innovation

Economy.

About PricingDirect,

Inc.

PricingDirect is a wholly-owned subsidiary of JPMorganChase that

provides evaluated pricing and analytics for nearly 3MM fixed

income cash and derivative instruments across all global markets

and more than a dozen snapshots every day. PricingDirect services

approximately 3,000 clients globally across a broad spectrum of

financial services related companies including asset managers,

mutual fund complexes and custodians, banks, broker dealers, hedge

funds, insurance companies, and many others. PricingDirect is the

pricing agent for the J.P. Morgan family of fixed income indices.

PricingDirect has offices in New York, London, Hong Kong and

Singapore.

For more information, please visit:

https://www.pricing-direct.com/

About Aumni, Inc.

Aumni, a J.P. Morgan company, is a leading provider of venture

capital data and portfolio solutions. Venture firms, limited

partners, fund administrators, and law firms use Aumni’s features

to collect, structure, monitor, analyze, report on, and manage

portfolio company documents and data – allowing clients to track

KPI performance, summarize LPA terms, conduct scenario modeling,

analyze market insights for benchmarking, and more. Aumni was

founded in 2018 and acquired by J.P. Morgan in 2023. For more

information, please visit: www.aumni.fund

About J.P. Morgan’s Commercial &

Investment Bank

J.P. Morgan’s Commercial & Investment Bank is a global

leader in banking, payments, markets and securities services.

Start-ups, companies, governments and institutions entrust us with

their business in more than 100 countries worldwide. With $35.8

trillion of assets under custody and $966 billion in deposits, the

Commercial & Investment Bank provides strategic advice, raises

capital, manages risk, offers payment solutions, safeguards assets

and extends liquidity in global markets. Further information about

J.P. Morgan is available at www.jpmorgan.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241210000816/en/

Media: Patrick Burton +44 20 7134 9041

patrick.o.burton@jpmorgan.com Gurpreet Kaur +1 212 270 8894

gurpreet.x3.kaur@jpmorgan.com

For more information about Aumni, please email:

contact@aumni.fund For more information about PricingDirect, please

email: PD_Sales@jpmorgan.com

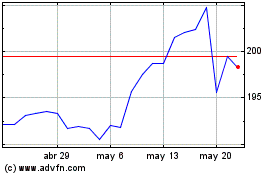

JP Morgan Chase (NYSE:JPM)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

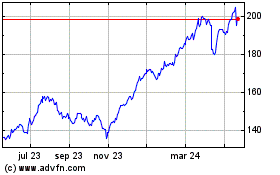

JP Morgan Chase (NYSE:JPM)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024