| SECURITIES AND EXCHANGE COMMISSION |

|

| Washington, D.C. 20549 |

|

| |

|

|

SCHEDULE 13D

(Amendment No. 4)* |

| |

| Under the Securities Exchange Act of 1934 |

| |

|

Southwest Airlines

Co. |

| (Name of Issuer) |

| |

|

Common Stock, par

value $1.00 per share |

| (Title of Class of Securities) |

| |

|

844741108 |

| (CUSIP Number) |

| |

|

Elliott Investment Management

L.P.

360 S. Rosemary Ave, 18th Floor

West Palm Beach, FL 33401

with a copy to:

Eleazer Klein, Esq.

Adriana Schwartz, Esq.

Schulte Roth & Zabel LLP

919 Third Avenue

New York, New York 10022

(212) 756-2000 |

| (Name, Address and Telephone Number of Person |

| Authorized to Receive Notices and Communications) |

| |

|

October 14, 2024 |

| (Date of Event Which Requires Filing of This Statement) |

| |

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

Rule 13d-1(f) or Rule 13d-1(g), check the following box. ¨

(Page 1 of 14 Pages)

______________________________

* The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange

Act of 1934 (the “Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to

all other provisions of the Act (however, see the Notes).

| CUSIP No. 844741108 | Schedule 13D/A | Page 2 of 14 Pages |

| 1 |

NAME OF REPORTING PERSON

Elliott Investment Management L.P. |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

61,116,500 |

| 8 |

SHARED VOTING POWER

-0- |

| 9 |

SOLE DISPOSITIVE POWER

61,116,500 |

| 10 |

SHARED DISPOSITIVE POWER

-0- |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

61,116,500 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

(11)

10.2% |

| 14 |

TYPE OF REPORTING PERSON

PN, IA |

| |

|

|

|

|

| CUSIP No. 844741108 | Schedule 13D/A | Page 3 of 14 Pages |

| 1 |

NAME OF REPORTING PERSON

Michael Cawley |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Ireland |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

19,765 |

| 8 |

SHARED VOTING POWER

-0- |

| 9 |

SOLE DISPOSITIVE POWER

19,765 |

| 10 |

SHARED DISPOSITIVE POWER

-0- |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

19,765 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

(11) (see Item 5)

Less than 0.1% |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

| CUSIP No. 844741108 | Schedule 13D/A | Page 4 of 14 Pages |

| 1 |

NAME OF REPORTING PERSON

David Cush |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

10,000 |

| 8 |

SHARED VOTING POWER

-0- |

| 9 |

SOLE DISPOSITIVE POWER

10,000 |

| 10 |

SHARED DISPOSITIVE POWER

-0- |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

10,000 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

(11) (see Item 5)

Less than 0.1% |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

| CUSIP No. 844741108 | Schedule 13D/A | Page 5 of 14 Pages |

| 1 |

NAME OF REPORTING PERSON

Sarah Feinberg |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

3,068 (1) |

| 8 |

SHARED VOTING POWER

-0- |

| 9 |

SOLE DISPOSITIVE POWER

3,068 (1) |

| 10 |

SHARED DISPOSITIVE POWER

-0- |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

3,068 (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

(11) (see Item 5)

Less than 0.1% |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

(1) Includes 268 shares of Common Stock directly held

by domestic partner.

| CUSIP No. 844741108 | Schedule 13D/A | Page 6 of 14 Pages |

| 1 |

NAME OF REPORTING PERSON

Joshua Gotbaum |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

19,162 |

| 8 |

SHARED VOTING POWER

-0- |

| 9 |

SOLE DISPOSITIVE POWER

19,162 |

| 10 |

SHARED DISPOSITIVE POWER

-0- |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

19,162 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

(11) (see Item 5)

Less than 0.1% |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

| CUSIP No. 844741108 | Schedule 13D/A | Page 7 of 14 Pages |

| 1 |

NAME OF REPORTING PERSON

Robert Milton |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

1,953 |

| 8 |

SHARED VOTING POWER

-0- |

| 9 |

SOLE DISPOSITIVE POWER

1,953 |

| 10 |

SHARED DISPOSITIVE POWER

-0- |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

1,953 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

(11) (see Item 5)

Less than 0.1% |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

| CUSIP No. 844741108 | Schedule 13D/A | Page 8 of 14 Pages |

| 1 |

NAME OF REPORTING PERSON

Gregg Saretsky |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

4,000 |

| 8 |

SHARED VOTING POWER

-0- |

| 9 |

SOLE DISPOSITIVE POWER

4,000 |

| 10 |

SHARED DISPOSITIVE POWER

-0- |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

4,000 |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

(11) (see Item 5)

Less than 0.1% |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

| CUSIP No. 844741108 | Schedule 13D/A | Page 9 of 14 Pages |

| 1 |

NAME OF REPORTING PERSON

Patricia Watson |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒

(b) ¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

PF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

5,243 (1) |

| 8 |

SHARED VOTING POWER

-0- |

| 9 |

SOLE DISPOSITIVE POWER

5,243 (1) |

| 10 |

SHARED DISPOSITIVE POWER

-0- |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

5,243 (1) |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

(11) (see Item 5)

Less than 0.1% |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

(1) Includes 1,279 shares of Common Stock directly

held by spouse.

| CUSIP No. 844741108 | Schedule 13D/A | Page 10 of 14 Pages |

| The following constitutes Amendment No. 4 to the Schedule 13D (“Amendment No. 4”). This Amendment No. 4 amends the Schedule 13D as specifically set forth herein. |

| |

| Item 2. |

IDENTITY AND BACKGROUND |

| |

| Items 2(a)-(c) and (f) of the Schedule 13D are hereby amended and restated to read as follows: |

| |

| (a)-(c) This statement is being filed by (i) Elliott Investment Management L.P., a Delaware limited partnership (“EIM”), the investment manager of Elliott Associates, L.P., a Delaware limited partnership (“Elliott”) and Elliott International, L.P., a Cayman Islands limited partnership (“Elliott International”, and together with Elliott, the “Elliott Funds”), with respect to the shares of Common Stock held by the Elliott Funds and/or their respective subsidiaries; (ii) Michael Cawley (“Mr. Cawley”); (iii) David Cush (“Mr. Cush”); (iv) Sarah Feinberg (“Ms. Feinberg”); (v) Joshua Gotbaum (“Mr. Gotbaum”); (vi) Robert Milton (“Mr. Milton”); (vii) Gregg Saretsky (“Mr. Saretsky”) and (viii) Patricia Watson (“Ms. Watson” and, together with Ms. Feinberg and Messrs. Cawley, Cush, Gotbaum Milton and Saretsky, the “Nomineee Reporting Persons” and each, a “Nominee Reporting Person”)). |

| |

| Each of the foregoing is referred to as a “Reporting Person” and collectively as the “Reporting Persons.” Each of the Reporting Persons is party to that certain Joint Filing Agreement attached as Exhibit 99.3. Accordingly, the Reporting Persons are hereby filing a joint Schedule 13D. |

| |

| Elliott Investment Management GP LLC, a Delaware limited liability company (“EIM GP”), is the sole general partner of EIM. Paul E. Singer (“Mr. Singer”) is the sole managing member of EIM GP. |

| |

| EIM |

| |

| The business address of EIM is 360 S. Rosemary Ave, 18th Floor, West Palm Beach, FL 33401. |

| |

| The principal business of EIM is to act as investment manager for the Elliott Funds. |

| |

| The name, business address, and present principal occupation or employment of the general partner of EIM is as follows: |

| |

|

|

| NAME |

ADDRESS |

OCCUPATION |

| |

|

|

| Elliott Investment Management GP LLC |

360 S. Rosemary Ave, 18th Floor,

West Palm Beach, FL 33401 |

General partner of EIM |

| |

| EIM GP |

| |

| The business address of EIM GP is 360 S. Rosemary Ave, 18th Floor, West Palm Beach, FL 33401. |

| |

| The principal business of EIM GP is serving as a general partner of EIM. |

| |

| The name, business address, and present principal occupation or employment of the managing member of EIM GP is as follows: |

| |

| NAME |

ADDRESS |

OCCUPATION |

| |

|

|

| Paul E. Singer |

360 S. Rosemary Ave, 18th Floor, West Palm Beach, FL 33401 |

Sole managing member of EIM GP |

| |

|

|

|

|

|

| CUSIP No. 844741108 | Schedule 13D/A | Page 11 of 14 Pages |

| MR. SINGER |

| |

| Mr. Singer’s business address is 360 S. Rosemary Ave, 18th Floor, West Palm Beach, FL 33401. |

| |

| Mr. Singer’s principal occupation is to serve as the sole managing member of EIM GP. |

| |

| MR. CAWLEY |

| |

| Mr. Cawley’s address is Creeslough House, Upper Kindlestown, Delgany, Co. Wicklow, Ireland A63T0X6. |

| |

| Mr. Cawley formerly served as the Deputy Chief Executive Officer, Chief Operation Officer and Chief Financial Officer of Ryanair Holdings plc. |

| |

| MR. CUSH |

| |

| Mr. Cush’s address is 100 Commons Road, Suite 7, Box 325, Dripping Springs, TX 78620. |

| |

| Mr. Cush formerly served as the Chief Executive Officer of Virgin America. |

| |

| MS. FEINBERG |

| |

| Ms. Feinberg’s address is 438 East 12th Street, Apt. 5D, New York, NY 10009. |

| |

| Ms. Feinberg formerly served as the Transportation Regulator and Administrator of the Federal Railroad Administration. |

| |

| MR. GOTBAUM |

| |

| Mr. Gotbaum’s address is 4139 Parkglen Court NW, Washington, DC 20007. |

| |

| Mr. Gotbaum’s principal occupation is to serve as an advisor to companies and labor groups and he formerly served as the Chapter 11 Trustee of Hawaiian Airlines. |

| |

| MR. MILTON |

| |

| Mr. Milton’s address is c/o RAM787, LLC, 1317 Edgewater Dr., #722, Orlando, FL 32804. |

| |

| Mr. Milton formerly served as the Chief Executive Officer of Air Canada and ACE Aviation Holdings Inc. and as the Chairman of United Airlines, Inc. |

| |

| MR. SARETSKY |

| |

| Mr. Saretsky’s address is 2925 165th Avenue SE, Bellevue, WA 98008. |

| |

| Mr. Saretsky formerly served as the Chief Executive Officer of WestJet Airlines. |

| |

| MS. WATSON |

| |

| Ms. Watson’s address is 3201 Dallas Parkway, Frisco, TX 75034. |

| |

| Ms. Watson’s principal occupation is Chief Information and Technology Officer of NCR Atleos Corporation. |

| CUSIP No. 844741108 | Schedule 13D/A | Page 12 of 14 Pages |

| (f) See Items 2(a)-(c) above. Mses. Feinberg and Watson and Messrs. Cush, Gotbaum, Milton, Saretsky and Singer are citizens of the United States of America. Mr. Cawley is a citizen of Ireland. |

| Item 4. |

PURPOSE OF TRANSACTION |

| |

| Item 4 of the Schedule 13D is hereby amended and supplemented to add the following: |

| |

| On

October 14, 2024, the Elliott Funds, together with EIM, submitted a request to the Secretary of the Issuer (the “Special

Meeting Request”) to call a special meeting of shareholders (the “Special Meeting”) for the purposes

of (i) repealing each provision of, or amendment to, the Fourth Amended and Restated Bylaws of the Issuer (the “Bylaws”)

adopted by the Board without the approval of the shareholders of the Issuer after February 2, 2024 and up to and including the date

of the Special Meeting (the “Bylaw Restoration Proposal”), (ii) removing each of Douglas H. Brooks, Eduardo F.

Conrado, William H. Cunningham, Thomas W. Gilligan, David P. Hess, Gary C. Kelly, Elaine Mendoza and Jill A. Soltau from the Board

as well as any other person or persons elected or appointed to the Board without shareholder approval after September 26, 2024 and

up to and including the date of the Special Meeting (other than any Nominee set forth below), effective immediately (the “Removal

Proposal”), and (iii) electing each of Michael Cawley, David Cush, Sarah Feinberg, Joshua Gotbaum, David Grissen, Robert

Milton, Gregg Saretsky and Patricia Watson (the “Nominees”) to the Board (the “Director Election Proposal”).

Attached to the Special Meeting Request was a notice from Elliott to the Issuer of its intention to present the Bylaw Restoration

Proposal, the Removal Proposal, and the Director Election Proposal at the Special Meeting. Also on October 14, 2024, EIM issued a

press release announcing the submission of the Special Meeting Request. A copy of the press release which is attached hereto as Exhibit

99.8 and is incorporated by reference herein. |

| |

| In addition, effective as of October 14, 2024, EIM waived Sections 2(b)

and 5 of each of the Candidate Agreements with Nancy Killefer and Mr. Sundaram previously disclosed in Item 4 of the Schedule 13D.

Accordingly, Mr. Sundaram is no longer a Reporting Person on this Schedule 13D, and he may no longer be deemed to be part of a “group”

with EIM and the Nominee Reporting Persons. |

| Item 5. |

INTEREST IN SECURITIES OF THE ISSUER |

| |

| Items 5(a)-(c) of the Schedule 13D are hereby amended and restated to read as follows: |

| |

| (a) See rows (11) and (13) of the cover page to this Schedule 13D for the aggregate number of shares of Common Stock and percentage of shares of Common Stock beneficially owned by each Reporting Person. The aggregate percentage of shares of Common Stock reported beneficially owned by each Reporting Person is based upon 599,157,019 shares of Common Stock outstanding as of July 25, 2024, as disclosed in the Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2024, filed by the Issuer with the Securities and Exchange Commission on July 29, 2024. |

| |

| By

virtue of the Candidate Agreements with each of the Nominee Reporting Persons, EIM and the Nominee Reporting Persons may be deemed

to have formed a “group” within the meaning of Section 13(d)(3) of the Exchange Act and the “group” may be

deemed to beneficially own an aggregate of 61,179,691 shares of Common Stock, representing approximately 10.2% of the outstanding

shares of Common Stock. Each Reporting Person expressly disclaims beneficial ownership of the shares of Common Stock beneficially

owned by the other Reporting Persons. |

| |

| (b) See rows (7) through (10) of the cover page to this Schedule 13D for the shares of Common Stock as to which each Reporting Person has the sole or shared power to vote or direct the vote and sole or shared power to dispose or to direct the disposition. |

| |

| (c) No transactions in the shares of Common Stock have been effected by the

Reporting Persons since the filing of Amendment No. 3. |

| CUSIP No. 844741108 | Schedule 13D/A | Page 13 of 14 Pages |

| Item 6. |

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER |

| |

| Item

6 of the Schedule 13D is hereby amended and supplemented to add the following: |

| |

| Item 4 of Amendment No. 4 is incorporated herein by reference. |

| Item 7. |

EXHIBITS |

| |

| Item 7 of the Schedule 13D is hereby amended and supplemented to add the following: |

| |

| Exhibit 99.8: |

Press Release, dated October 14, 2024. |

| CUSIP No. 844741108 | Schedule 13D/A | Page 14 of 14 Pages |

SIGNATURES

After reasonable inquiry

and to the best of its knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete

and correct.

DATE: October 15, 2024

| Elliott Investment Management L.P. |

|

| |

|

| /s/ Elliot Greenberg |

|

| Name: Elliot Greenberg |

|

| Title: Vice President |

|

| |

|

| |

|

| /s/ Elliot Greenberg |

|

| As attorney-in-fact for Michael Cawley, David Cush, Sarah Feinberg, Joshua Gotbaum, Robert Milton, Gregg Saretsky and Patricia Watson |

|

Media Contact:

Casey Friedman

Elliott Investment Management L.P.

(212) 478-1780

cfriedman@elliottmgmt.com

Elliott Calls for Special Meeting of Shareholders

in Order to Bring Urgently Needed Change to Southwest

Submits Proposals to Elect Eight Independent Best-in-Class

Nominees and Remove Eight Current Directors

Calls on Southwest to Confirm Meeting Date Promptly

Without Unnecessary Delay

Shareholders Should Take Action As Soon As Possible

to Ensure They Are Able to Vote Their Shares

WEST PALM BEACH, FLA. (October 14, 2024) –

Elliott Investment Management L.P. (“Elliott”), which manages funds that together have an investment representing an approximately

11% economic interest in Southwest Airlines Co. (NYSE:

LUV) (the “Company” or “Southwest”), today announced it has delivered a request to call a Special Meeting of Shareholders

(“the Special Meeting,” or “the Meeting”) for December 10, 2024 and will be filing an accompanying preliminary

proxy statement with the U.S. Securities and Exchange Commission.

Elliott released the following statement on behalf

of Partner John Pike and Portfolio Manager Bobby Xu:

“Today, after exhaustive attempts

to persuade Southwest to implement the necessary governance changes, we are formally calling a Special Meeting to give shareholders the

opportunity to elect a completely independent, best-in-class slate of director nominees. Absent a thorough reconstitution of its Board,

the story of Southwest will remain one of empty promises and unfulfilled potential. The nominees we have put forward today are uniquely

qualified to hold the Company’s executive leadership accountable and ensure that the Company delivers improved results.

We are taking this step today because

the need for improved oversight at Southwest has never been more urgent. Following Elliott’s public push for changes,

Southwest has responded with a series of long-overdue strategic and corporate-governance initiatives, promising that better

performance will follow. However, Southwest’s shareholders have heard these sorts of promises before, and what they need

today, at the outset of this attempted turnaround, is an experienced, highly qualified Board to oversee the changes and ensure

successful execution. Southwest’s shareholders cannot afford to see – yet again – today’s new initiatives

turn into tomorrow’s broken promises.

We strongly urge all Southwest shareholders

– particularly those who engage in share lending or authorize their brokers to engage in share lending – to work with their

banks and brokers as soon as possible to confirm that they will be able to vote all their Southwest shares. We also call on Southwest

to confirm the date of the Meeting for December 10, 2024, and to publicly announce a reasonable corresponding record date promptly, without

any gamesmanship or defensive maneuvers.

It is time for shareholders’ voices

to be heard, so that Southwest can finally deliver on its full potential for customers, employees and shareholders alike. Electing a world-class

slate of exceptional director candidates is the essential first step to making this happen.”

Elliott has submitted a proposal to elect the following

eight director candidates to Southwest’s Board:

| · | Michael Cawley, the former

deputy CEO, COO and CFO of Ryanair |

| · | David Cush, the former

CEO of Virgin America |

| · | Sarah Feinberg, a former

senior official at the Department of Transportation and former head of the Federal Railroad Administration |

| · | Hon. Josh Gotbaum, a

longtime advisor to companies and labor groups and the former chapter 11 trustee of Hawaiian Airlines |

| · | Dave Grissen, the former

Group President of Marriott International |

| · | Robert Milton, the former

CEO of Air Canada and ACE Aviation Holdings and the former Chairman of United Airlines |

| · | Gregg Saretsky, the former

CEO of WestJet |

| · | Patty Watson, the current

EVP and Chief Information & Technology Officer at NCR Atleos and a longtime technology executive |

Elliott has also submitted a proposal for the removal

of eight current Southwest directors: Douglas Brooks, Eduardo Conrado, William Cunningham, Thomas Gilligan, David Hess, Gary Kelly, Elaine

Mendoza and Jill Soltau.

Any shareholders who have questions about what they

need to do to vote their shares should contact Elliott’s proxy solicitor, Okapi Partners, by calling toll-free (877) 629-6357 or

by emailing info@okapipartners.com.

***

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Elliott Investment Management L.P., together with

the other participants named herein (collectively, “Elliott”), intend to file a proxy statement and accompanying proxy card

with the Securities and Exchange Commission (“SEC”) to be used to solicit proxies with respect to the election of Elliott’s

slate of highly qualified director candidates and other proposals that may come before the next shareholder meeting of Southwest Airlines

Co., a Texas corporation (the “Company”), whether an annual or special meeting of shareholders.

THE PARTICIPANTS STRONGLY ADVISE ALL SHAREHOLDERS

OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS, INCLUDING A PROXY CARD, AS THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV.

IN ADDITION, THE PARTICIPANTS WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES

SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the solicitation are anticipated

to be Elliott Investment Management L.P. (“EIM”), Elliott Associates, L.P. (“Elliott Associates”), Elliott International,

L.P. (“Elliott International”), The Liverpool Limited Partnership (“Liverpool”), Elliott Investment Management

GP LLC (“EIM GP”), Paul E. Singer (“Singer”), Michael Cawley, David Cush, Sarah Feinberg, Joshua Gotbaum, David

Grissen, Robert Milton, Gregg Saretsky and Patricia Watson.

As of the date hereof, Elliott has combined economic

exposure in the Company of approximately 11.0% of the shares of its Common Stock, $1.00 par value per share (the “Common Stock”),

outstanding. As of the date hereof, EIM, the investment manager of Elliott Associates and Elliott International (together, the “Elliott

Funds”) with respect to the shares of Common Stock held by the Elliott Funds and/or their respective subsidiaries, beneficially

owns 61,116,500 shares of Common Stock. Additionally, as of the date hereof, the Elliott Funds are party to notional principal amount

derivative agreements in the form of cash settled swaps with respect to an aggregate of 4,808,000 shares of Common Stock (the “Derivative

Agreements”). Elliott Associates, Elliott International and Liverpool are the direct holders of the shares of Common Stock beneficially

owned by EIM, and are party to the Derivative Agreements. Liverpool is a wholly-owned subsidiary of Elliott Associates. EIM GP is the

sole general partner of EIM. Singer is the sole managing member of EIM GP. As of the date hereof, Mr. Cawley holds 19,765 shares of Common

Stock, Mr. Cush holds 10,000 shares of Common Stock, Ms. Feinberg beneficially owns 3,068 shares of Common Stock, including 2,800 shares

of Common Stock held directly and 268 shares of Common Stock held by her domestic partner, Mr. Gotbaum holds 19,162 shares of Common Stock,

Mr. Milton holds 1,953 shares of Common Stock, Mr. Saretsky holds 4,000 shares of Common Stock and Ms. Watson beneficially owns 5,243

shares of Common Stock, including 3,964 shares of Common Stock held directly and 1,279 shares of Common Stock held by her spouse.

About Elliott

Elliott Investment

Management L.P. (together with its affiliates, “Elliott”) manages approximately $69.7 billion of assets as of June

30, 2024. Founded in 1977, it is one of the oldest funds under continuous management. The Elliott funds' investors include pension plans,

sovereign wealth funds, endowments, foundations, funds-of-funds, high net worth individuals and families, and employees of the firm.

####

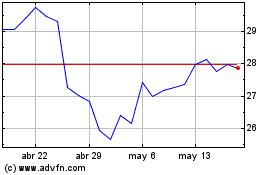

Southwest Airlines (NYSE:LUV)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

Southwest Airlines (NYSE:LUV)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024