Coach, Inc. (NYSE: COH), a leading marketer of modern classic

American accessories, today announced a 49% increase in earnings

per diluted share for its fourth fiscal quarter ended July 2, 2005.

This substantial increase in earnings from the prior year's fourth

quarter reflected 24% growth in net sales combined with significant

operating margin improvement. For the full fiscal year, net sales

rose 29% and net income increased 48% versus the prior fiscal year.

The prior year's fourth fiscal quarter included an additional week

and therefore, on a 13-week to 13-week basis, sales rose 31% and

earnings per share rose 58%. Similarly, on a 52-week to 52-week

basis, sales rose 31% for the fiscal year, while earnings per share

rose 49%. In addition, on July 1, 2005 the company completed the

purchase of Sumitomo's 50% interest in Coach Japan, Inc. for

approximately $225 million plus undistributed profits and paid-in

capital of about $75 million. During the fourth quarter, net sales

were $419 million, 24% higher than generated in the prior year's

fourth quarter. Net income rose 49% to $98 million, or $0.25 per

diluted share, compared with $66 million, or $0.17 per share in the

prior year. This was ahead of the analysts' consensus estimate of

$0.24 for the quarter. For the fiscal year 2005, net sales were

$1.7 billion, up 29% from the $1.3 billion recorded in fiscal year

2004. Net income rose to $389 million, up 48% from the $262 million

earned in the prior year. Diluted earnings per share rose 47% to

$1.00, versus $0.68 a year ago, and ahead of analysts' estimates of

$0.98. Earnings per share numbers have been adjusted for the

two-for-one split, which was effected on April 4, 2005. Lew

Frankfort, Chairman and Chief Executive Officer of Coach, Inc.,

said, "Once again, I'm delighted with our fiscal fourth quarter and

full year performance. This quarter's results demonstrated a

continuation of the broad based strength we have seen throughout

the year, as our market share continued to expand across all

channels and geographies. Similarly, fiscal 2005 was another

remarkable year for our company, as we posted excellent financial

metrics throughout our businesses. Our performance reflects the

sustainability of our growth strategies and the distinctiveness of

our accessible luxury proposition, which continues to be embraced

by our loyal consumer base in North America and internationally."

In the fourth quarter, gross margin increased by 90 basis points on

a year-over-year basis from 76.7% to 77.6%, while gross margin for

the year expanded from 74.9% to 76.6%, a 170 basis point increase.

This annual improvement was driven by channel mix, product mix and

sourcing cost initiatives. As expected, SG&A expenses as a

percentage of net sales were level with prior year in the fourth

quarter, at 43.8%. For the full year, SG&A expenses as a

percentage of net sales declined to 40.3% from 41.3% a year ago.

The operating margin in the quarter reached 33.8%, compared with

32.9% in the year-ago fourth quarter. For the full year the

company's operating margin rose to 36.4% from the 33.6% margin

achieved in fiscal year 2004, a 280 basis point improvement. Coach

also noted that the buyout of its joint venture partner in Coach

Japan at fiscal year end allowed the company to capture a foreign

tax benefit for the year. This benefit was recorded in the fourth

quarter and brought the full year to the lower effective

appropriate annual rate. The company also noted that this benefit,

associated with the tax structure in Japan for income earned and

reinvested in-country, will be ongoing. At the end of the fiscal

year the company had cash and marketable securities of $505

million, as compared with $564 million a year ago. It should be

noted that the 2005 fiscal year end cash balance reflects the

buyout of Sumitomo's interest in Coach Japan and the repurchase of

$265 million of Coach stock during the fiscal year. Fourth fiscal

quarter and full year sales grew in each of Coach's primary

channels of distribution as follows: -- Direct to consumer sales,

which consist primarily of sales at Coach stores, rose 26% to $245

million during the fourth quarter from $195 million posted for the

fourth quarter of the prior year. These exceptional results were

driven by both same store sales increases and distribution growth.

Comparable store sales rose 22.0%, with retail stores up 13.6%, and

factory stores up 34.7%. For the full year, direct to consumer

sales rose 29% to $935 million from $726 million generated in

fiscal 2004. Overall, comparable store sales for the fiscal year

increased 18.2%, with retail stores up 14.1% and factory stores up

23.9%. -- Indirect sales increased 21% to $174 million in the

fourth quarter from the $144 million reported for the prior year.

For the year, indirect sales rose 30% to $775 million, up from $595

million recorded for fiscal 2004. Results for both the quarter and

fiscal year reflected strong gains in all indirect businesses,

including Coach Japan, U.S. department stores and International

wholesale. For the fourth quarter Coach Japan sales rose 20% in

constant currency, while for the full year, sales increased 30%. On

a comparable 13- and 52-week basis, yen sales in Japan rose 28% and

32%, in the quarter and for the year, respectively. As expected,

comparable location sales in Japan rose at a mid-single-digit rate

for the quarter and for the year. Mr. Frankfort added, "The

strength of our fourth quarter results was reflected in all of our

businesses. Our successful fresh and fun offerings drove our

performance as we continued to improve productivity through monthly

product flow and innovation. Introductions this spring included

Vintage Signature Tie Dye and Straw Boxy Totes. Optic Signature was

offered for the first time in sophisticated Soho silhouettes in new

colors. We also introduced an expanded shoulder tote group and a

fresh interpretation of the ever popular Signature Patchwork.

Lastly, Hamptons Weekend, in its third successful year, was updated

and expanded with new colors and silhouettes, including Signature

Scribble." "In addition, our surging factory store business

reflects a combination of a strengthened merchandising offering,

Coach's unique positioning and the overall vitality of the premier

centers in this channel." "In Japan, we were particularly pleased

with the outstanding sales and market share growth in FY05, which

we achieved despite a lackluster environment. Our rapidly expanding

sales in Japan truly reflect the success of our distribution

strategy - notably the acceleration of flagship openings, along

with the expansion of highly productive shop-in-shops." During the

fourth quarter of fiscal 2005, the company opened seven Coach

retail stores and two factory stores, while closing one factory

location, bringing the total to 193 retail stores and 82 factory

stores at July 2, 2005. This was a net increase of 19 Coach retail

stores from the 174 in operation a year ago. Also during the

quarter, the Ala Moana retail store in Hawaii was expanded,

bringing the total number of completed retail store expansions this

year to seven. Coach Japan opened two new locations, and closed

two, bringing the total to 106 at fiscal year end. This was a net

increase of four locations from the 102 at year-end 2004. In

addition, we expanded two locations during the fourth quarter,

bringing the year end total to 14 expansions in Japan. "While

fiscal 2006 has just begun, our momentum continued through July.

We're confident that our proven growth strategies built upon our

strong business and brand equities, will continue to deliver

excellent returns in the seasons ahead and over our planning

horizon," Mr. Frankfort concluded. The company introduced its first

fiscal quarter outlook with sales targeted to be at $440-$445

million, an increase of at least 28%, and earnings per share

projected to be at least $0.24, a gain of at least 40%. This

compares to the consensus earnings estimate of $0.23 for first

quarter. In addition, Coach raised guidance for fiscal 2006 and now

estimates sales of nearly $2.1 billion for the year, an increase of

about 22%. Operating income is expected to rise at least 25% to an

operating margin of over 37%. Earnings per share are forecasted to

rise to at least $1.24, ahead of the analysts' consensus of $1.21

for the year. This guidance excludes the earnings impact from the

implementation of accounting for share-based payments (Statement of

Financial Accounting Standards No. 123R), which is currently

required in the first quarter of fiscal year 2006. Coach will host

a conference call to review these results at 8:30 a.m. (EDT) today,

August 2, 2005. Interested parties may listen to the webcast by

accessing www.coach.com/investors on the Internet or dialing into

1-888-405-2080 and asking for the Coach earnings call led by Andrea

Shaw Resnick, VP of Investor Relations. A telephone replay will be

available starting at 12:00 noon today, for a period of five

business days. The number to call is 1-866-352-7723. A webcast

replay of the earnings conference call will also be available for

five business days on the Coach website. Coach, with headquarters

in New York, is a leading American marketer of fine accessories and

gifts for women and men, including handbags, women's and men's

small leathergoods, business cases, weekend and travel accessories,

footwear, watches, outerwear, sunwear, and related accessories.

Coach is sold worldwide through Coach stores, select department

stores and specialty stores, through the Coach catalog in the U.S.

by calling 1-800-223-8647 and through Coach's website at

www.coach.com. Coach's shares are traded on The New York Stock

Exchange under the symbol COH. This press release contains

forward-looking statements based on management's current

expectations. These statements can be identified by the use of

forward-looking terminology such as "may," "will," "should,"

"expect," "intend," "estimate," "are positioned to," "continue,"

"project," "guidance," "forecast," "anticipated," or comparable

terms. Future results may differ materially from management's

current expectations, based upon risks and uncertainties such as

expected economic trends, the ability to anticipate consumer

preferences, the ability to control costs, etc. Please refer to

Coach's latest Annual Report on Form 10-K for a complete list of

risk factors. -0- *T COACH, INC. ----------- CONDENSED CONSOLIDATED

STATEMENTS OF INCOME -------------------------------------------

For the Quarters and Twelve Months Ended July 2, 2005 and July 3,

2004

----------------------------------------------------------------------

(in thousands, except per share data)

------------------------------------- QUARTER ENDED (1) TWELVE

MONTHS ENDED (1) ----------------------- -----------------------

July 2, July 3, July 2, July 3, 2005 2004 2005 2004 -----------

----------- ----------- ----------- (unaudited) Net sales $ 418,660

$ 338,145 $1,710,423 $1,321,106 Cost of sales 93,704 78,632 399,652

331,024 ---------- ---------- ---------- ---------- Gross profit

324,956 259,513 1,310,771 990,082 Selling, general and

administrative expenses 183,547 148,246 688,961 545,617 ----------

---------- ---------- ---------- Operating income 141,409 111,267

621,810 444,465 Interest income, net 4,836 1,553 15,760 3,192

---------- ---------- ---------- ---------- Income before income

taxes and minority interest 146,245 112,820 637,570 447,657 Income

taxes 48,573 42,299 235,277 167,866 Minority interest, net of tax

107 4,851 13,641 18,043 ---------- ---------- ---------- ----------

Net income $ 97,565 $ 65,670 $ 388,652 $ 261,748 ==========

========== ========== ========== Net income per share Basic $ 0.26

$ 0.17 $ 1.03 $ 0.70 ========== ========== ========== ==========

Diluted $ 0.25 $ 0.17 $ 1.00 $ 0.68 ========== ==========

========== ========== Shares used in computing net income per share

Basic 377,632 377,035 378,670 372,120 ========== ==========

========== ========== Diluted 389,130 389,411 390,191 385,558

========== ========== ========== ========== (1) Includes 53rd week

in fiscal year 2004 COACH, INC. ----------- CONDENSED CONSOLIDATED

BALANCE SHEETS ------------------------------------- At July 2,

2005 and July 3, 2004 -------------------------------- (in

thousands) -------------- July 2, July 3, 2005 2004 ----------

---------- ASSETS Cash, cash equivalents and short term investments

$ 383,051 $ 434,443 Receivables 64,190 55,724 Inventories 184,419

161,913 Other current assets 80,096 53,536 ---------- ----------

Total current assets 711,756 705,616 Property and equipment, net

207,204 164,291 Long term investments 122,065 130,000 Other

noncurrent assets 306,379 44,518 ---------- ---------- Total assets

$1,347,404 $1,044,425 ========== ========== LIABILITIES AND

STOCKHOLDERS' EQUITY Accounts payable $ 64,985 $ 44,771 Accrued

liabilities 190,749 116,368 Subsidiary credit facilities 12,292

1,699 Current portion of long-term debt 150 115 ----------

---------- Total current liabilities 268,176 162,953 Long-term debt

3,270 3,420 Other liabilities 43,182 55,568 Minority interest, net

of tax - 40,198 Stockholders' equity 1,032,776 782,286 ----------

---------- Total liabilities and stockholders' equity $1,347,404

$1,044,425 ========== ========== *T

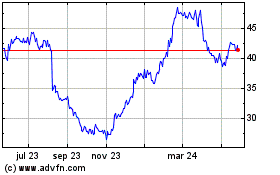

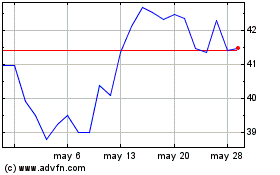

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

Tapestry (NYSE:TPR)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024