Cameco (TSX: CCO; NYSE: CCJ) today announced the closing of its

previously announced bought deal offering of 34,057,250 common

shares of Cameco, including the exercise in full of the

underwriters’ option to purchase additional common shares, at a

price of $21.95 per share, for gross proceeds to us of

approximately $747.6 million (the “Offering”).

We intend to use the aggregate proceeds from the Offering, after

payment of fees and expenses, to partially fund our share of the

acquisition of Westinghouse Electric Company, one of the world’s

leading nuclear services businesses, through a strategic

partnership with Brookfield Renewable Partners (“Brookfield

Renewable”), together with Brookfield Renewable’s institutional

partners (the “Acquisition”).

CIBC Capital Markets and Goldman Sachs & Co. LLC acted as

joint bookrunners for the Offering.

We offered and sold the common shares in the U.S. pursuant to

our effective shelf registration statement on Form F-10 (File No.

333-267625) (the “U.S. Registration Statement”) filed with the U.S.

Securities and Exchange Commission (the “SEC”), and in Canada

pursuant to our short form base shelf prospectus (the “Base Shelf

Prospectus”), in each case, filed on September 26, 2022. A

prospectus supplement relating to and describing the terms of the

Offering was filed with the SEC and with the securities regulatory

authorities in each of the provinces and territories of Canada as

part of the U.S. Registration Statement and the Base Shelf

Prospectus, respectively. The documents filed in connection with

the Offering contain important detailed information about the

Company and the Offering. Prospective investors should read these

filings, and the documents incorporated by reference therein,

before making an investment decision.

Copies of the Base Shelf Prospectus and the prospectus

supplement are available free of charge on SEDAR at www.sedar.com,

and copies of the U.S. Registration Statement and the prospectus

supplement are available free of charge on EDGAR on the SEC website

at www.sec.gov. Alternatively, copies may be obtained from: CIBC

Capital Markets, 161 Bay Street, 5th Floor, Toronto, ON M5J 2S8 or

by telephone at 1-416-956-6378 or by email at

mailbox.canadianprospectus@cibc.com; or from Goldman Sachs &

Co. LLC, Attention: Prospectus Department, 200 West Street, New

York, NY 10282, or by telephone: 1-866-471-2526, or by facsimile:

212-902-9316 or by emailing Prospectus-ny@ny.email.gs.com or

Goldman Sachs Canada Inc., TD North Tower, 77 King Street West

Suite 3400, Toronto, ON M5K 1B7.

No securities regulatory authority has either approved

or disapproved the contents of this press release. This press

release does not constitute an offer to sell or the solicitation of

an offer to buy any securities of Cameco, nor shall there be any

sale of the securities in any province, territory, state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such province, territory, state or

jurisdiction.

Caution about forward-looking information

Certain information in this news release, including statements

regarding the Acquisition, including the anticipated use of the net

proceeds of the Offering to fund the Acquisition and the timing and

completion of the Acquisition, constitutes forward-looking

information within the meaning of applicable securities laws in

Canada and the United States, including the United States Private

Securities Litigation Reform Act of 1995. In some cases, but not

necessarily in all cases, forward-looking information can be

identified by the use of forward-looking terminology such as

“plans”, “targets”, “expects” or “does not expect”, “is expected”,

“should”, “an opportunity exists”, “is positioned”, “estimates”,

“intends”, “assumes”, “anticipates” or “does not anticipate” or

“believes”, or variations of such words and phrases or state that

certain actions, events or results “may”, “could”, “would”,

“might”, “will” or “will be taken”, “occur” or “be achieved”. In

addition, any statements that refer to expectations, projections or

other characterizations of future events or circumstances contain

forward-looking information. Statements containing forward-looking

information are not historical facts but instead represent

management’s expectations, estimates and projections regarding

future events.

Forward-looking information is necessarily based on a number of

opinions, assumptions and estimates that, while considered

reasonable by the Company as of the date of this press release, are

subject to known and unknown risks, uncertainties, assumptions and

other factors that may cause the actual results, level of activity,

performance or achievements to be materially different from those

expressed or implied by such forward-looking information, including

but not limited to the failure to satisfy the closing conditions to

the completion of the Acquisition and the factors described in

greater detail in the “Risk Factors” section of the Company’s

current annual information form, prospectus supplement dated

October 12, 2022 and in the Company’s other materials filed with

the Canadian securities regulatory authorities and the SEC from

time to time, available at www.sedar.com and www.sec.gov,

respectively. These factors are not intended to represent a

complete list of the factors that could affect the Company;

however, these factors should be considered carefully. There can be

no assurance that such estimates and assumptions will prove to be

correct. The forward-looking statements contained in this press

release are made as of the date of this press release, and the

Company expressly disclaims any obligation to update or alter

statements containing any forward-looking information, or the

factors or assumptions underlying them, whether as a result of new

information, future events or otherwise, except as required by

law.

Profile

Cameco is one of the largest global providers of the uranium

fuel needed to energize a clean-air world. Our competitive position

is based on our controlling ownership of the world’s largest

high-grade reserves and low-cost operations. Utilities around the

world rely on our nuclear fuel products to generate safe, reliable,

carbon-free nuclear power. Our shares trade on the Toronto and New

York stock exchanges. Our head office is in Saskatoon,

Saskatchewan.

As used in this news release, the terms we, us, our, the Company

and Cameco mean Cameco Corporation and its subsidiaries unless

otherwise indicated.

Investor inquiries:

Rachelle Girard306-956-6403rachelle_girard@cameco.com

Media inquiries:

Veronica Baker306-385-5541veronica_baker@cameco.com

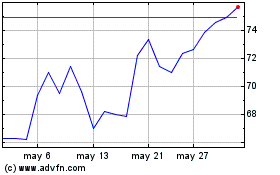

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Cameco (TSX:CCO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024