NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION

IN THE UNITED STATES.

Premium Brands Holdings Corporation ("Premium Brands" or the

"Company") (TSX:PBH), a leading producer, marketer and distributor

of branded specialty food products, is pleased to announce it has

entered into an agreement with a syndicate of underwriters

co-led by BMO Capital Markets, CIBC Capital Markets, and Scotiabank

(collectively, the "Underwriters"), pursuant to which the Company

will issue on a "bought-deal" basis, subject to regulatory

approval, $150,000,000 aggregate principal amount of convertible

unsecured subordinated debentures (the "Debentures") at a price of

$1,000 per Debenture (the "Offering"). The Company has also granted

the Underwriters an over-allotment option to purchase up to an

additional $22,500,000 aggregate principal amount of Debentures, on

the same terms, exercisable in whole or in part at any time for a

period of up to 30 days following closing of the Offering, to cover

over-allotments, if any. If the over-allotment option is exercised

in full, the total gross proceeds raised under the Offering will be

$172,500,000.

The Company intends to use the net proceeds of

the Offering to fund the cash portion of the purchase price of the

previously announced acquisition (the “Acquisition”) of Concord

Premium Meats Ltd. (“Concord”). Concord is an Ontario based

manufacturer of branded and customized protein solutions for

retailers and foodservice customers across Canada. The

closing of the Acquisition is subject to approval of the

Competition Bureau and customary closing conditions, and is

expected to close in the second quarter of 2018. There can be

no assurance that the Acquisition will be completed or, if

completed, will be on the terms that are substantially the same as

those previously announced. The balance of the net proceeds

will be used to reduce existing indebtedness, to fund the intended

redemption of the Company’s outstanding 5.00% convertible unsecured

subordinated debentures due April 30, 2020 (the “5.00%

Debentures”), and to fund future acquisitions and capital

projects.

The Debentures will bear interest from the date

of issue at 4.65% per annum, payable semi-annually in arrears on

April 30 and October 31 each year commencing October 31, 2018, and

each will have a maturity date of April 30, 2025 (the "Maturity

Date").

The Debentures will be convertible at the

holder's option at any time prior to the close of business on the

earlier of the Maturity Date and the business day immediately

preceding the date specified by the Company for redemption of the

Debentures into common shares at a conversion price of $182.51 per

common share, being a conversion rate of 5.4792 common shares for

each $1,000 principal amount of Debentures.

Closing of the Offering is expected to occur on

or about April 10, 2018. The Offering is subject to normal

regulatory approvals, including approval of the Toronto Stock

Exchange.

The Debentures will be offered in each of the

provinces and territories of Canada by way of a short form

prospectus, and by way of private placement in the United States to

"qualified institutional buyers" pursuant to Rule 144A or in such a

manner as to not require registration under the United States

Securities Act of 1933, as amended.

In addition to the Offering, the Company also

intends to issue a notice of redemption to holders the 5.00%

Debentures at the earliest possible date.

Premium Brands owns a broad range of leading

specialty food manufacturing and differentiated food distribution

businesses with operations in British Columbia, Alberta,

Saskatchewan, Manitoba, Ontario, Quebec, Nova Scotia, Nevada, Ohio,

Arizona, Minnesota, Mississippi, California and Washington State.

The Company services a diverse base of customers located across

North America and its family of brands and businesses include

Grimm’s, Harvest, McSweeney’s, Piller’s, Freybe, SJ Fine Foods,

Expresco, Belmont Meats, Leadbetter, Skilcor, Hempler’s, Isernio’s,

Fletcher’s U.S., Direct Plus, Audrey’s, SK Food Group, OvenPride,

Bread Garden Go, Hygaard, Quality Fast Foods, Deli Chef, Buddy’s

Kitchen, Raybern’s, Creekside Bakehouse, Stuyver’s Bakestudio,

Island City Baking, Shaw Bakers, Partners Crackers, Conte Foods,

Larosa Foods, Gourmet Chef, Duso’s, Centennial Foodservice, B&C

Food Distributors, Shahir, Wescadia, Harlan Fairbanks, Maximum

Seafood, Ocean Miracle, Hub City Fisheries, Diana’s Seafood,

C&C Packing, Premier Meats and Interprovincial Meat Sales.

Forward-Looking Statements

This press release contains forward looking

statements with respect to the Company, including its business

operations, strategy and financial performance and condition. These

statements generally can be identified by the use of forward

looking words such as "may", "could", "should", "would", "will",

"expect", "intend", "plan", "estimate", "project", "anticipate",

"believe" or "continue", or the negative thereof or similar

variations.

Although management believes that the

expectations reflected in such forward looking statements are

reasonable and represent the Company's internal expectations and

belief as of March 15, 2018, such statements involve unknown risks

and uncertainties beyond the Company's control which may cause its

actual performance and results in future periods to differ

materially from any estimates or projections of future performance

or results expressed or implied by such forward looking

statements.

Factors that could cause actual results to

differ materially from the Company's expectations include, among

other things: (i) changes in the cost of raw materials used in the

production of Premium Brands’ products; (ii) seasonal and/or

weather related fluctuations in Premium Brands’ sales; (iii)

reductions in consumer discretionary spending resulting from

changes in economic conditions and/or general consumer confidence

levels; (iv) changes in the cost of products sourced from third

party manufacturers and sold through Premium Brands’ proprietary

distribution network; (v) changes in Premium Brands’ relationship

with its larger customers; (vi) access to commodity raw materials;

(vii) potential liabilities, losses and expenses resulting from

defects in Premium Brands’ products and/or product recalls; (viii)

changes in consumer food product preferences; (ix) competition from

other food manufacturers and distributors; (x) execution risk

associated with the Company’s growth and business restructuring

initiatives; (xi) risks associated with the Company’s business

acquisition strategies; (xii) changes in the value of the Canadian

dollar relative to the U.S. dollar; (xiii) new government

regulations affecting the Company’s business and operations; (xiv)

the Company’s ability to raise the capital needed to fund its

various growth initiatives; (xv) labour related issues including

potential labour disputes with employees represented by labour

unions and labour shortages; (xvi) the loss of and/or the inability

to attract key personnel; (xvii) fluctuations in the interest rates

associated with the Company’s funded debt; (xviii) failure or

breach of the Company’s information systems; (xix) financial

exposure resulting from credit extended to the Company’s customers;

(xx) the malfunction of critical equipment used in the Company’s

operations; (xxi) livestock health issues; (xxii) international

trade issues; and (xxiii) changes in environmental, health and

safety standards. Details on these risk factors as well as other

factors can be found in the Company's 2015 MD&A, which is filed

electronically through SEDAR and is available online at

www.sedar.com.

Unless otherwise indicated, the forward looking

information in this document is made as of March 15, 2018 and,

except as required by applicable law, will not be publicly updated

or revised. This cautionary statement expressly qualifies the

forward looking information in this press release.

Premium Brands Holdings Corporation George PaleologouPresident

and CEO (604) 656-3100

Premium Brands Holdings Corporation Will KalutyczCFO(604)

656-3100www.premiumbrandsholdings.com

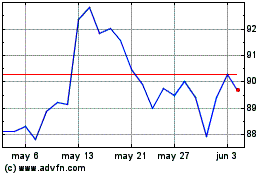

Premium Brands (TSX:PBH)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Premium Brands (TSX:PBH)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024