TABLE OF CONTENTS

PART I

Item 1. Business

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential" or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors" that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our consolidated financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to "common shares" refer to the common shares in our capital stock.

As used in this annual report and unless otherwise indicated, the terms "we", "us", "our", "our Company, "the Company", and "Enertopia" mean Enertopia Corp.

General Overview

Enertopia Corp. was formed on November 24, 2004 under the laws of the State of Nevada and commenced operations on November 24, 2004.

Enertopia is focused on building shareholder value through a combination of our Nevada Lithium claims and intellectual property & patents in the green technology space.

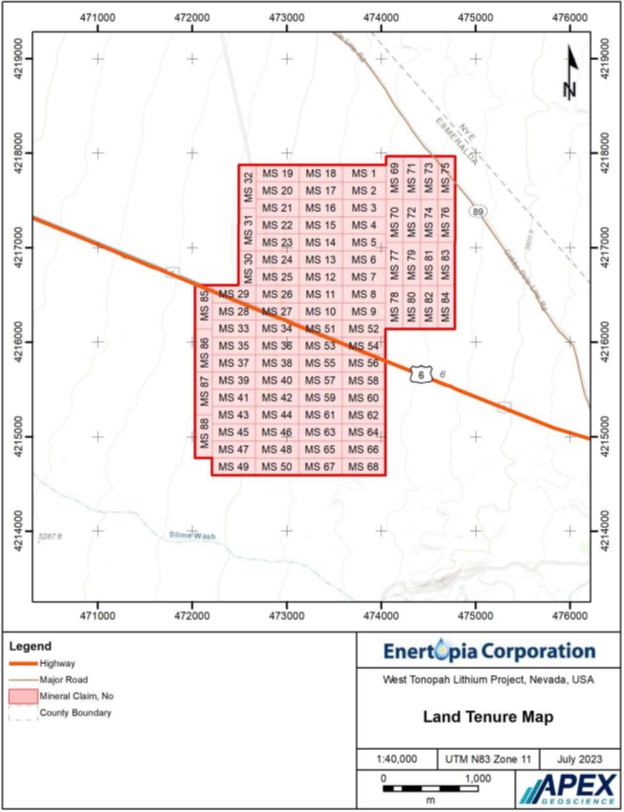

The Company controls 88 unpatented mineral lode claims in Esmeralda County, NV staked covering 1,760 acres of land administrated by the BLM on February 25, 2022. The Company has been focused on using modern technology on extracting lithium and verifying or sourcing other intellectual property in the EV & green technology sectors in developing environmental solutions. In May and August 2023, it announced three non-provisional patents applicable to the above sectors.

The address of our principal executive office is #18 1873 Spall Rd., Kelowna, British Columbia V1Y 4R2. Our telephone number is (250) 870-2219. Our current location provides adequate office space for our purposes at this stage of our development.

Summary of Recent Business

On September 1, 2021 the Company granted 500,000 options to a consultant of the Company for 5yrs at $0.08 per common share.

On December 6, 2021, the Company issued 500,000 stock options to one of the consultants of the Company with an exercise price of $0.07 vested immediately, expiring December 6, 2026.

On December 6, 2021, the Company issued 250,000 stock options to one of the consultants of the Company with an exercise price of $0.07 vested immediately, expiring December 6, 2026.

On December 6, 2021, the Company issued 250,000 stock options to the president of the Company with an exercise price of $0.07 vested immediately, expiring December 6, 2026.

On February 23, 2022, the Company accepted an offer subject to shareholder approval to sell the 160 Acre mineral property in Clayton Valley Nevada to Cypress Development (Nevada) Inc. for $1,100,000 cash with a deposit of $50,000 being paid on signing and the issuance of 3,000,000 common shares of Cypress Development Corp.

On February 25, 2022, the Company issued 1,000,000 shares at $0.04 to one consultant of the Company and $2,500 cash.

On February 25, 2022, the Company received confirmation of staking 1,760 Acres of 88 unpatented lode claims in Esmeralda County, Nevada.

On April 29, 2022, at the Company's SGM shareholders voted 99.12% 45,021,336 in favor, 0.46% 209,236 against and 0.42% 189,752 abstained, for the resolution to sell the 160 acre clayton valley property.

On May 4, 2022, the Company closed the sale of the 160 acre clayton valley property and received the remaining $1,050,000 in cash and the issuance of 3,000,000 shares of Cypress Development Corp on closing, as per the agreement.

On May 23, 2022 the Company announced the filing of Non provisional patent #1, known as the

Enertopia Solar BoosterTM

On May 23, 2022 the Company announced the filing of Non provisional patent #2, known as Enertopia Heat ExtractorTM

On August 15, 2022 the Company announced the filing of Non provisional patent #3, known as Enertopia Rain MakerTM

On August 18, 2022 the Company issued 1,000,000 stock options to two Directors of the Company with an exercise price of $0.06 vested immediately, expiring August 18, 2027.

On August 18, 2022 the Company issued 1,000,000 stock options to Chief Financial Officer of the Company with an exercise price of $0.06 vested immediately, expiring August 18, 2027.

On January 9, 2023, the Company's shares began trading on the Canadian Securities Exchange ("CSE") under the trading symbol ENRT.

On March 22, 2023, the Company held its 2023 annual meeting of stockholders At the Annual Meeting, the Company's stockholders voted on (1) the election of the following individuals to the board of directors: Robert McAllister, Kevin Brown, John Nelson; (2) the ratification of the appointment of Davidson & Company LLP ("Davidson & Company") as the Company's independent registered public accounting firm for the year ending August 31, 2023; (3) approval of the increase in the Company's authorized share capital to 500,000,000 shares of common stock; (4) advisory vote on executive compensation; and (5) approval of the Company's 2023 stock option plan. All proposals were approved.

Chronological Overview of our Business over the Last Five Years

On October 28, 2019, the Company signed an LOI with Eagle Plains Resources Ltd. ("Eagle Plains"). To earn up to 75% interest in the Pine Channel gold project in Saskatchewan, Canada (the "Pine Channel SK Property"). The terms of the LOI included periodic payments cash payments, exploration expenditures, as well as issuance of common shares of the Company. Upon signing the LOI, the Company issued 1,000,000 of its common shares to Eagle Plains, valued at $11,489.

On December 13th 2019 the Company dropped the LOI with Eagle Plains Resources Ltd.

On December 31st 2019 the Company dropped its Canadian Securities Listing (CSE).

On December 31st 2019 the Company accepted the resignation of directors Kristian Ross and Kevin Brown.

On February 11th 2020 the Company signed a 1% Royalty agreement with respect to any future commercial lithium production from the Company's Clayton Valley, Nevada claims in exchange for $200,000. The Company has a right of first refusal to repurchase the royalty upon any proposed sale by the royalty holder to a third party.

On February 25th 2020 the Company signed Mark Snyder to a one year Technology Advisory Board. Monthly contract rate of $1,000 per month and the issuance of 2,000,000 stock options valid for two years at a strike price of $0.02 per share.

On April 2, 2020 the Company announced its maiden 43-101 Lithium resource report. The project this report referenced was sold on May 5, 2022 for $1,050,000 in cash and 3,000,000 shares of Cypress Development Corp (renamed to Century Lithium).

On October 30th, 2020 the Company signed a 1% Royalty agreement with respect to any future commercial lithium production from the Company's Clayton Valley, Nevada claims in exchange for $250,000. The Company has a right of first refusal to repurchase the royalty upon any proposed sale by the royalty holder to a third party.

On February 25, 2022, the Company had 88 unpatented mineral lode claims in Esmeralda County, NV staked covering 1,760 acres of land administrated by the BLM.

During May of 2022, the Company began filing two provisional patents in the Clean Technology segment of our business with 2 more filings occurring during May and August of 2022 for a total of four filings.

Our Current Business

Enertopia is engaged in the business of Lithium exploration at their Nevada claims, along with performing research and development and holding intellectual property & non provisional pending patents in the green technology space.

Mineral Property

West Tonopah Lithium

On February 25, 2022, the Company had 88 unpatented mineral lode claims in Esmeralda County, NV staked covering 1,818 acres of land administrated by the BLM. The property is in good standing until September 3, 2024. Estimated respective yearly holding fees to the BLM $14,520 and $1,068 to Esmeralda County NV.

| Enertopia Claim name |

State or Federal Agency |

Claim number from |

Claim number to |

| MS 1-88 |

BLM |

NV 105296951 |

NV 105297038 |

| MS 1-88 |

Esmeralda County, NV |

230856 |

230943 |

Company completed its maiden drill program in June 2022, second phase drill program April 2023 and has a pending 43-101 Technical Resource report pending publication. Further information can be found at www.enertopia.com.

CLEAN TECHNOLOGY

The company continues to test off-the-shelf technology under the potential for lower capex scenarios in lithium extraction.

NON PROVISIONAL PATENTS

On May 23, 2022 the Company announced the filing of Non provisional patent #1, known as the Enertopia Solar BoosterTM. The Enertopia Solar Booster captures heat from the solar panels, increasing PV output enhancing production and increasing the lifetime of the PV panels.

On May 23, 2022 the Company announced the filing of Non provisional patent #2, known as Enertopia Heat ExtractorTM Heat Extractor Technology can be used behind the PV panels or in a glazed format on their own to create liquid temperatures to 200 degrees F.

On August 15, 2022 the Company announced the filing of Non provisional patent #3, known as Enertopia RainmakerTM By cooling the backside of the PV panels below the dew point the atmospheric moisture condenses on the back side of the panel and drips as rain into the tray collecting the water.

On November 4, 2021, the Company announced the provisional patent filing known as Energy Management System, this was subsequently filed as a non-provisional patent on November 2, 2022, and is undergoing USPTO review.

Summary

The continuation of our business is dependent upon obtaining further financing, a successful program of development, and, finally, achieving a profitable level of operations. The issuance of additional equity securities by us could result in a significant dilution in the equity interests of our current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

There are no assurances that we will be able to obtain further funds required for our continued operations. As noted herein, we are pursuing various financing alternatives to meet our immediate and long-term financial requirements. There can be no assurance that additional financing will be available to us when needed or, if available, that it can be obtained on commercially reasonable terms. If we are not able to obtain the additional financing on a timely basis, we will be unable to conduct our operations as planned, and we will not be able to meet our other obligations as they become due. In such event, we will be forced to scale down or perhaps even cease our operations. There is significant uncertainty as to whether we can obtain additional financing.

Employees

We primarily used the services of sub-contractors and consultants for our intended business operations. Our technical consultant is Mr. McAllister, our president, CEO and a director.

On November 30, 2007, Mr. McAllister was appointed as our President and on April 14, 2008 he was appointed as a director. On July 31, 2017, Mr. McAllister was appointed interim CFO. Mr. McAllister voluntarily suspended and terminated accrual of these consulting fees commencing on December 1, 2019 and continuing until such time as the Company's financial condition permits a resumption of such cost. On May 1, 2022, the Company entered into a consulting agreement with President of the Company for $9,500 per month plus goods and services tax ("GST") on a continuing basis. On August 16th Mr. McAllister resigned from the interim CFO position.

The Company has a consulting agreement with the CFO of the Company Mr. Allan Spissinger for corporate administration and consulting services for $7,500 per quarter plus goods and services tax ("GST") on a continuing basis.

We do not expect any material changes in the number of employees over the next 12-month period. We do and will continue to outsource contract employment as needed.

Research and Development

We have incurred $965,361 in research and development expenditures over the last two fiscal years.

Item 1A. Risk Factors

Our business operations are subject to a number of risks and uncertainties, including, but not limited to those set forth below:

Risks Associated with Our Business

Our company has no operating history and an evolving business model. Which raises doubt about our ability to achieve profitability or obtain financing.

Our Company has no operating history. Moreover, our business model is still evolving, subject to change, and will rely on the cooperation and participation of our joint venture partners. Our Company's ability to continue as a going concern is dependent upon our ability to obtain adequate financing and to reach profitable levels of operations has and we no proven history of performance, earnings or success. There can be no assurance that we will achieve profitability or obtain future financing.

Uncertain demand for mineral resources sector may cause our business plan to be unprofitable.

Demand for mineral resources is based on the world economy and new technologies. Current lithium demand exceeds available supply due to the rapid increase in lithium batteries in portable electronics and the growing electric vehicle markets. There can be no assurance that current supply and demand factors will remain the same or that projected supply and demand factors will actually come to pass from 3rd party projections that are currently believed to be true and accurate. There can be no assurance that new disruptive technologies will replace lithium as a significant component in battery storage over time.

Conflicts of interest between our company and our directors and officers may result in a loss of business opportunity.

Our directors and officers are not obligated to commit their full time and attention to our business and, accordingly, they may encounter a conflict of interest in allocating their time between our future operations and those of other businesses. In the course of their other business activities, they may become aware of investment and business opportunities which may be appropriate for presentation to us as well as other entities to which they owe a fiduciary duty. As a result, they may have conflicts of interest in determining to which entity a particular business opportunity should be presented. They may also in the future become affiliated with entities, engaged in business activities similar to those we intend to conduct.

In general, officers and directors of a corporation are required to present business opportunities to a corporation if:

| • |

the corporation could financially undertake the opportunity; |

| • |

the opportunity is within the corporation's line of business; and |

| • |

it would be unfair to the corporation and its stockholders not to bring the opportunity to the attention of the corporation. |

We plan to adopt a code of ethics that obligates our directors, officers and employees to disclose potential conflicts of interest and prohibits those persons from engaging in such transactions without our consent. Despite our intentions, conflicts of interest may nevertheless arise which may deprive our company of a business opportunity, which may impede the successful development of our business and negatively impact the value of an investment in our company.

The speculative nature of our business plan may result in the loss of your investment.

Our operations are in the start-up or early stage only and are unproven. We may not be successful in implementing our business plan to become profitable. There may be less demand for our services than we anticipate. There is no assurance that our business will succeed, and you may lose your entire investment.

Changing consumer preferences may cause our planned products to be unsuccessful in the marketplace.

The decision of a potential client to undergo an environmental audit or review may be based on ethical or commercial reasons. In some instances, or with certain businesses, there may be no assurance that an environmental review will result in any cost savings or increased revenues. As such, unless the ethical consideration is also a material factor, there may be no incentive for such businesses to undertake an environmental review. Changes in consumer and commercial preferences, or trends, toward or away from environmental issues may impact on businesses" decisions to undergo environmental reviews.

General economic factors may negatively impact the market for our planned products.

The willingness of businesses to spend time and money on energy efficiency may be dependent upon general economic conditions; and any material downturn may reduce the likelihood of businesses incurring costs toward what some businesses may consider a discretionary expense item.

A wide range of economic and logistical factors may negatively impact our operating results.

Our operating results will be affected by a wide variety of factors that could materially affect revenues and profitability, including the timing and cancellation of customer orders and projects, competitive pressures on pricing, availability of personnel, and market acceptance of our services. As a result, we may experience material fluctuations in future operating results on a quarterly and annual basis which could materially affect our business, financial condition and operating results.

Changes in environmental regulations may have an impact on our operations

We believe that we currently comply with existing environmental laws and regulations affecting our proposed operations. While there are no currently known proposed changes in these laws or regulations, significant changes have affected the industry in the past and additional changes may occur in the future. The company is subject to the Bureau of Land Management ("BLM"), State and potentially other government agencies with respect to its lithium brine business.

Our operations may be subject to environmental laws, regulations and rules promulgated from time to time by government. In addition, certain types of operations require the submission and approval of environmental impact assessments. Environmental legislation is evolving in a manner that means stricter standards and enforcement. Fines and penalties for non-compliance are more stringent. Environmental assessments of proposed projects carry a heightened degree of responsibility for companies, directors, officers and employees. The cost of compliance with changes in governmental regulations has potential to reduce the profitability of operations. We intend to comply with all environmental regulations in the United States and Canada.

If we fail to effectively and efficiently advertise, the growth of our business may be compromised.

The future growth and profitability of our business will be dependent in part on the effectiveness and efficiency of our advertising and promotional expenditures, including our ability to (i) create greater awareness of our products, (ii) determine the appropriate creative message and media mix for future advertising expenditures, and (iii) effectively manage advertising and promotional costs in order to maintain acceptable operating margins. There can be no assurance that we will experience benefits from advertising and promotional expenditures in the future. In addition, no assurance can be given that our planned advertising and promotional expenditures will result in increased revenues, will generate levels of service and name awareness or that we will be able to manage such advertising and promotional expenditures on a cost-effective basis.

Our success is dependent on our unproven ability to attract qualified personnel.

We depend on our ability to attract, retain and motivate our management team, consultants and advisors. There is strong competition for qualified technical and management personnel in the business sector, and it is expected that such competition will increase. Our planned growth will place increased demands on our existing resources and will likely require the addition of technical personnel and the development of additional expertise by existing personnel. There can be no assurance that our compensation packages will be sufficient to ensure the continued availability of qualified personnel who are necessary for the development of our business.

We have a limited operating history with losses, and we expect the losses to continue, which raises concerns about our ability to continue as a going concern.

We have generated minimal revenues since our inception and will, in all likelihood, continue to incur operating expenses with minimal revenues until we are able to successfully develop our business. Our business plan will require us to incur further expenses. We may not be able to ever become profitable. These circumstances raise concerns about our ability to continue as a going concern. We have a limited operating history and must be considered in the start-up stage.

There is an explanatory paragraph to their audit opinion issued in connection with the consolidated financial statements for the year ended August 31, 2023 with respect to their doubt about our ability to continue as a going concern. As discussed in Note 2 to our consolidated financial statements for the year ended August 31, 2023, we have incurred cumulative losses of $14,526,485 that raises substantial doubt about its ability to continue as a going concern. Our management has been able, thus far, to finance the operations through equity financing and cash on hand. There is no assurance that our company will be able to continue to finance our company on this basis.

Without additional financing to develop our business plan, our business may fail.

Because we have generated only minimal revenue from our business and cannot anticipate when we will be able to generate meaningful revenue from our business, we will need to raise additional funds to conduct and grow our business. We do not currently have sufficient financial resources to completely fund the development of our business plan. We anticipate that we will need to raise further financing. We do not currently have any arrangements for financing and we can provide no assurance to investors that we will be able to find such financing if required. The most likely source of future funds presently available to us is through the sale of equity capital. Any sale of share capital will result in dilution to existing security-holders.

We may not be able to obtain all of the licenses necessary to operate our business, which would cause our business to fail.

Our operations require licenses and permits from various governmental authorities related to the establishment of our planned facilities, to the production, storage and distribution of our products, and to the disposal of waste. We believe that we will be able to obtain all necessary licenses and permits under applicable laws and regulations for our operations and believe we will be able to comply in all material respects with the terms of such licenses and permits. However, such licenses and permits are subject to change in various circumstances. There can be no guarantee that we will be able to obtain or maintain all necessary licenses and permits.

If we are unable to recruit or retain qualified personnel, it could have a material adverse effect on our operating results and stock price.

Our success depends in large part on the continued services of our executive officers and third party relationships. We currently do not have key person insurance on these individuals. The loss of these people, especially without advance notice, could have a material adverse impact on our results of operations and our stock price. It is also very important that we be able to attract and retain highly skilled personnel, including technical personnel, to accommodate our exploration plans and to replace personnel who leave. Competition for qualified personnel can be intense, and there are a limited number of people with the requisite knowledge and experience. Under these conditions, we could be unable to recruit, train, and retain employees. If we cannot attract and retain qualified personnel, it could have a material adverse impact on our operating results and stock price.

If we fail to effectively manage our growth our future business results could be harmed and our managerial and operational resources may be strained.

As we proceed with our business plan, we expect to experience significant and rapid growth in the scope and complexity of our business. We will need to add staff to market our services, manage operations, handle sales and marketing efforts and perform finance and accounting functions. We will be required to hire a broad range of additional personnel in order to successfully advance our operations. This growth is likely to place a strain on our management and operational resources. The failure to develop and implement effective systems, or to hire and retain sufficient personnel for the performance of all of the functions necessary to effectively service and manage our potential business, or the failure to manage growth effectively, could have a materially adverse effect on our business and financial condition.

Risks Associated with the Shares of Our Company

Because we do not intend to pay any dividends on our shares, investors seeking dividend income or liquidity should not purchase our shares.

We have not declared or paid any dividends on our shares since inception, and do not anticipate paying any such dividends for the foreseeable future. We presently do not anticipate that we will pay dividends on any of our common stock in the foreseeable future. If payment of dividends does occur at some point in the future, it would be contingent upon our revenues and earnings, if any, capital requirements, and general financial condition. The payment of any common stock dividends will be within the discretion of our Board of Directors. We presently intend to retain all earnings to implement our business plan; accordingly, we do not anticipate the declaration of any dividends for common stock in the foreseeable future.

Investors seeking dividend income or liquidity should not invest in our shares.

Because we can issue additional shares, purchasers of our shares may incur immediate dilution and may experience further dilution.

We are authorized to issue up to 500,000,000 shares. The board of directors of our company has the authority to cause us to issue additional shares, and to determine the rights, preferences and privileges of such shares, without consent of any of our stockholders. Consequently, our stockholders may experience more dilution in their ownership of our company in the future.

Other Risks

Trading on the OCTQB and CSE may be volatile and sporadic, which could depress the market price of our common stock and make it difficult for our stockholders to resell their shares.

Our common stock is quoted on the OTCQB electronic quotation service operated by OTC Markets Group Inc. and on the CSE (Canadian Stock Exchange) a recognized Stock Exchange. Trading in stock quoted on the OTCQB is often thin and characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects. This volatility could depress the market price of our common stock for reasons unrelated to operating performance. Moreover, the OTCQB is not a stock exchange, and trading of securities on the OTCQB is often more sporadic than the trading of securities listed on a quotation system like Nasdaq or a stock exchange like Amex. Accordingly, shareholders may have difficulty reselling shares.

Our stock is a penny stock. Trading of our stock may be restricted by the Securities and Exchange Commission's penny stock regulations which may limit a stockholder's ability to buy and sell our stock.

Our stock is a penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which generally defines "penny stock" to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and "accredited investors". The term "accredited investor" refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the Securities and Exchange Commission which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

The Financial Industry Regulatory Authority, or FINRA, has adopted sales practice requirements which may also limit a stockholder's ability to buy and sell our stock.

In addition to the "penny stock" rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

We believe that our operations comply, in all material respects, with all applicable environmental regulations.

Our operating partners maintain insurance coverage customary to the industry; however, we are not fully insured against all possible environmental risks.

Any change to government regulation/administrative practices may have a negative impact on our ability to operate and our profitability.

The laws, regulations, policies or current administrative practices of any government body, organization or regulatory agency in the United States, Canada, or any other jurisdiction, may be changed, applied or interpreted in a manner which will fundamentally alter the ability of our company to carry on our business.

The actions, policies or regulations, or changes thereto, of any government body or regulatory agency, or other special interest groups, may have a detrimental effect on us. Any or all of these situations may have a negative impact on our ability to operate and/or our profitably.

Because we can issue additional shares, purchasers of our shares may incur immediate dilution and may experience further dilution.

We are authorized to issue up to 500,000,000 shares. The board of directors of our company has the authority to cause us to issue additional shares, and to determine the rights, preferences and privileges of such shares, without consent of any of our stockholders. Consequently, our stockholders may experience more dilution in their ownership of our company in the future.

Our by-laws contain provisions indemnifying our officers and directors against all costs, charges and expenses incurred by them.

Our by-laws contain provisions with respect to the indemnification of our officers and directors against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, actually and reasonably incurred by him, including an amount paid to settle an action or satisfy a judgment in a civil, criminal or administrative action or proceeding to which he is made a party by reason of his being or having been one of our directors or officers.

Investors' interests in our company will be diluted and investors may suffer dilution in their net book value per share if we issue additional shares or raise funds through the sale of equity securities.

Our constating documents authorize the issuance of 500,000,000 shares of common stock with a par value of $0.001. In the event that we are required to issue any additional shares or enter into private placements to raise financing through the sale of equity securities, investors" interests in our company will be diluted and investors may suffer dilution in their net book value per share depending on the price at which such securities are sold. If we issue any such additional shares, such issuances also will cause a reduction in the proportionate ownership and voting power of all other shareholders. Further, any such issuance may result in a change in our control.

Our by-laws do not contain anti-takeover provisions, which could result in a change of our management and directors if there is a take-over of our company.

We do not currently have a shareholder rights plan or any anti-takeover provisions in our By-laws. Without any anti-takeover provisions, there is no deterrent for a take-over of our company, which may result in a change in our management and directors.

As a result of a majority of our directors and officers are residents of other countries other than the United States, investors may find it difficult to enforce, within the United States, any judgments obtained against our company or our directors and officers.

Our only office space is located Kelowna, British Columbia, Canada and we do not currently maintain a permanent place of business within the United States. In addition, a majority of our directors and officers are nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons" assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against our company or our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

Trends, risks and uncertainties.

We have sought to identify what we believe to be the most significant risks to our business, but we cannot predict whether, or to what extent, any of such risks may be realized nor can we guarantee that we have identified all possible risks that might arise such as a black swan event. An absolute worst case scenario with sufficient potential impact to risk the future of the company as an independent business operating in its chosen markets. Significant reputational impact as a result of a major issue resulting in multiple fatalities, possibly compounded by apparently negligent management behavior; extreme adverse press coverage and viral social media linking the Company name to consumer brands, leads to a catastrophic share price fall, very significant loss of consumer confidence and inability to retain and recruit quality people. Investors should carefully consider all of such risk factors before making an investment decision with respect to our common shares.

Item 1B. Unresolved Staff Comments

As a "smaller reporting company", we are not required to provide the information required by this Item.

Item 2. Properties

Executive Offices

The address of our executive office is #18 1873 Spall Rd., Kelowna, British Columbia V1Y 4R2. Our main telephone number is (250) 870-2219. Our current location provides adequate office space for our purposes at this stage of our development.

West Tonopah Lithium Exploration Project

Property Introduction

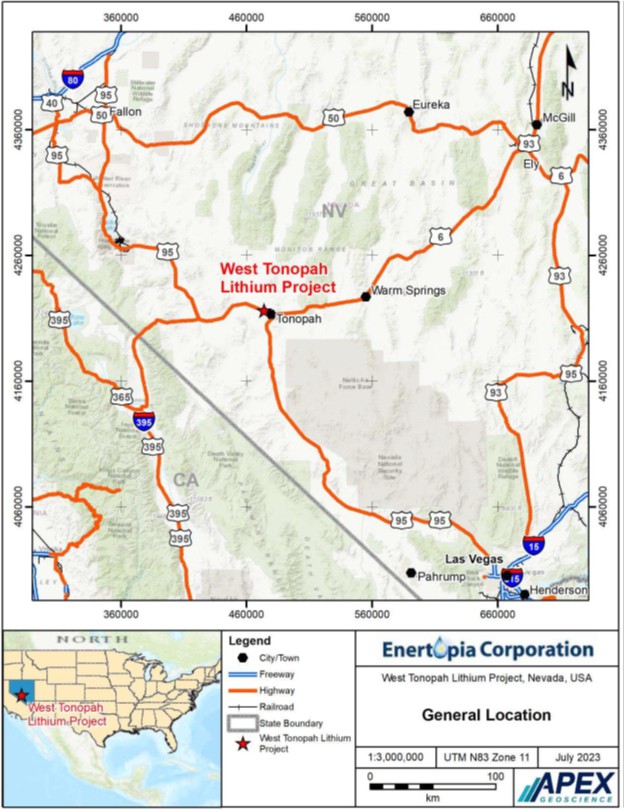

The West Tonopah Lithium Project consists of 88 unpatented Lode Mining Claims that are 100% owned by Enertopia and encompass a contiguous land position of approximately 1,818 acers. The claims were acquired directly from the United States Department of the Interior, Bureau of Land Management.

The lithium-claystone project occurs within the Big Smoky Valley basin of Esmeralda County, NV, approximately 4 miles (6.4 km) west of the Unincorporated Town of Tonopah. The Property can be accessed via the United States Highway Route 6, a well-maintained paved highway that divides the property into southern and northern portions. Additional road access within the property is via a paved two-lane road that extends north from US 6 and numerous trails located throughout the property.

Enertopia has obtained surface authorization rights in the form of a Notice of Intent through the Bureau of Land Management Tonopah Field Office. There are no royalties applicable to the West Tonopah Lode Claims. If mineral extraction were to occur in the future on these claims, the State of Nevada would impose taxes.

Enertopia is exploring the Miocene-aged Siebert Formation sedimentary and volcaniclastic rocks in the Big Smoky Valley basin for their lithium-claystone potential. During 2021-2023, Enertopia conducted 1) 2021 prospecting and a winkie drill program, and 2) 2022 and 2023 sonic drill programs that collectively drilled 22 holes to a total depth of 4,913.0 feet (1,497.5 m). The Enertopia exploration program results demonstrate the Siebert Formation is enriched in lithium and that portions of the West Tonopah Lithium Project have a lithium inventory with reasonable prospects of eventual economic extraction. It is the Qualified Person's opinion that the exploration work conducted by Enertopia at the West Tonopah Lithium Project is reasonable and within the standard practices for the evaluation of lithium-claystone deposit type projects.

12

Property Location Fig 1

13

Claims Location Fig 2

14

Geological Setting

Tectonic extension, which began around 17 Ma, formed the Basin and Range Province physiography that is defined by alternating mountain ranges (horsts) and elongated valleys (grabens) attributed to crustal extension and faulting along the western margin of North America. Valleys and low-lying grabens in the Basin and Range Province are filled with sedimentary rocks eroded from nearby mountains, or accumulated evaporite deposits from playa lakes formed within the topographical lows. The Big Smoky Valley represents a drainage divide landform within the Tonopah Basin.

The Miocene Siebert Formation (17-13 Ma) was derived from volcaniclastic fluvial and lacustrine deposits that include mudstone, siltstone, sandstone, and conglomerate with intercalated pyroclastic flows and tuff. The mineralisation belongs to the lithium-claystone deposit type. The Siebert Formation, and particularly the mudstone dominant horizons, at the Western Tonopah Lithium Project are enriched in lithium. Of 754 sonic drill core samples logged and analyzed by Enertopia, the minimum and maximum lithium values range from below the minimum limit of detection (20 ppm Li) to 1,520 ppm Li with an average value of 583.1 ppm Li.

Mineral Resource Estimations

The mineral resource estimation work was conducted in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum definition standards and best practice guidelines, National Instrument 43-101 Standards of Disclosure for Mineral Projects, and in accordance with the requirements of S-K 1300.

The lithium-claystone resources defined in the technical report are constrained 1) stratigraphically to the Siebert Formation sedimentary and pyroclastic rock strata, and 2) are spatially split into the west and east resource areas divided by a Qualified Person-interpreted north-south trending fault.

Critical steps in the determination of the lithium-claystone resource model and estimations included:

- Definition of the geology and geometry of the Siebert Formation sedimentary and pyroclastic rocks in the west and east resource areas utilizing a 10 m resolution Digital Elevation Model, and geological information from 5 winkie drillholes and 22 sonic drillholes.

- Lithium grade estimation of the Siebert Formation blocks utilizing 766 lithium assays including 12 and 754 assays from the winkie and Sonic drill programs, respectively. To ensure lithium metal grades were not overestimated, composites were capped to specified maximum values of 1,250 ppm and 670 ppm in the west and east resource areas.

- Based on the drillhole spacing and detail within the 3D geological model, a block model with a block size of 66 x 66 x 10 feet (or 20 m by 20 m in the horizontal directions and 3 m in the vertical direction was generated).

- The Ordinary Kriging (OK) technique was used to estimate the lithium at each parent block within the Siebert Formation wireframe. A two-pass method was employed that used two different search ellipses.

- The West Tonopah Lithium Project is a project of merit in that there is a concentration or occurrence of lithium-claystone in such form, grade or quality and quantity that there are reasonable prospects for eventual economic extraction. A conceptual pit shell based on theoretical, but reasonable, parameters (such as a lithium recovery of 80%) demonstrated that blocks contained within the conceptual pit satisfy the test of reasonable prospects for eventual economic extraction.

- A nominal density of 1.70 g/cm3 was applied to convert the Siebert Formation block volumes to tonnage based on analogous Tonopah- and Siebert Formation-based mineral resource studies.

15

In consideration of Canadian Institute of Mining, Metallurgy, and Petroleum definition standards and S-K 1300, the west resource area is classified as indicated and inferred mineral resources and the east resource area is classified as an inferred mineral resource (Tables 1,2,3 below). Based on a cutoff of 400 ppm Li and on blocks contained within the conceptual pit shell, the West Tonopah Lithium Project's mineral resource estimations are summarized as follows:

- The west resource area has an indicated lithium-claystone resource estimate of 44,000 short tons (40,000 metric tonnes) of elemental Li (Table 1). The global (total) lithium carbonate equivalent (LCE) for the west indicated resource area, which is calculated by multiplying elemental lithium by a factor of 5.323, is 233,000 short tons (212,000 metric tonnes) LCE.

- The west resource area has an inferred lithium-claystone resource estimate of 87,000 short tons (79,000 metric tonnes) of elemental Li (Table 2). This translates to 463,000 short tons (420,000 metric tonnes) LCE.

- The east resource area has a lithium-claystone inferred resource estimate of 5,000 short tons (5,000 metric tonnes) of elemental Li (Table 2). This translates to 27,000 short tons (25,000 metric tonnes) LCE.

Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no guarantee that all or any part of the mineral resource will be converted into a mineral reserve. The estimate of mineral resources may be materially affected by geology, environment, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. It is reasonably expected that most inferred mineral resources could be upgraded to indicated mineral resources with continued exploration.

Table 1 West Tonopah Lithium Project west resource area indicated lithium-claystone resource estimate. The indicated mineral resource is reported for the Siebert Formation as a total (global) volume and tonnage using a lower cutoff of 400 ppm Li (bold font highlighted in grey).

West Resource Area Indicated Mineral Resource Estimate

| Li Cutoff(ppm) |

Rock Mass |

|

Contained Metal |

|

Average Li Grade(ppm) |

| Metric tonnes(t) |

Short tons(st) |

Metric tonnes(t) |

|

Short tons(st) |

| Li |

LCE |

Li |

LCE |

| 300 |

80,428,000 |

88,657,000 |

|

45,000 |

240,000 |

|

50,000 |

265,000 |

|

561 |

| 400 |

65,322,000 |

72,005,000 |

|

40,000 |

212,000 |

|

44,000 |

233,000 |

|

609 |

| 500 |

46,476,000 |

51,231,000 |

|

31,000 |

166,000 |

|

34,000 |

184,000 |

|

673 |

| 600 |

30,221,000 |

33,313,000 |

|

22,000 |

119,000 |

|

25,000 |

131,000 |

|

739 |

| 800 |

7,646,000 |

8,428,000 |

|

7,000 |

35,000 |

|

7,000 |

39,000 |

|

859 |

| 1000 |

264,000 |

291,000 |

|

- |

1,000 |

|

- |

2,000 |

|

1061 |

Note 1: Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Note 2: The weights are reported in United States short tons (2,000 lbs or 907.2 kg) and metric tonnes (1,000 kg or 2,204.6 lbs). The tonnage numbers are rounded to the nearest 1,000 unit, and therefore, may not add up.

Note 3: The density used to convert volume to tonnage is 1.70 g/cm3 for the Siebert Formation and the overburden/pediment.

Note 4: The mineral resource is contained within a conceptual pit shell in which blocks meet the test of reasonable prospects for eventual economic extraction. The estimation assumes a lithium recovery factor of 80%.

Note 5: To describe the resource in terms of the industry standard, a conversion factor of 5.323 is used to convert elemental Li to Li2CO3, or Lithium Carbonate Equivalent (LCE).

16

Table 2 West Tonopah Lithium Project west and east resource areas inferred lithium-claystone resource estimate. The inferred mineral resources are reported for the Siebert Formation as a total (global) volume and tonnage using a lower cutoff of 400 ppm Li (bold font highlighted in grey).

A) West Resource Area Inferred Mineral Resource Estimate

| Li Cutoff(ppm) |

Rock Mass |

|

Contained Metal |

|

Average Li Grade

(ppm) |

Metric tonnes

(t) |

Short tons

(st) |

Metric tonnes

(t) |

|

Short tons

(st) |

| Li |

LCE |

Li |

LCE |

| 300 |

119,801,000 |

132,058,000 |

|

83,000 |

440,000 |

|

91,000 |

485,000 |

|

690 |

| 400 |

109,366,000 |

120,556,000 |

|

79,000 |

420,000 |

|

87,000 |

463,000 |

|

722 |

| 500 |

95,516,000 |

105,288,000 |

|

73,000 |

387,000 |

|

80,000 |

427,000 |

|

762 |

| 600 |

80,725,000 |

88,985,000 |

|

65,000 |

344,000 |

|

71,000 |

379,000 |

|

801 |

| 800 |

37,191,000 |

40,996,000 |

|

34,000 |

178,000 |

|

37,000 |

197,000 |

|

902 |

| 1000 |

4,153,000 |

4,578,000 |

|

4,000 |

24,000 |

|

5,000 |

26,000 |

|

1063 |

B) East Resource Area Inferred Mineral Resource Estimate

| Li Cutoff(ppm) |

Rock Mass |

|

Contained Metal |

|

Average Li Grade

(ppm) |

Metric tonnes

(t) |

Short tons

(st) |

Metric tonnes

(t) |

|

Short tons

(st) |

| Li |

LCE |

Li |

LCE |

| 300 |

18,119,000 |

19,972,000 |

|

8,000 |

41,000 |

|

8,000 |

45,000 |

|

425 |

| 400 |

9,314,000 |

10,267,000 |

|

5,000 |

25,000 |

|

5,000 |

27,000 |

|

499 |

| 500 |

3,503,000 |

3,862,000 |

|

2,000 |

11,000 |

|

2,000 |

12,000 |

|

578 |

| 600 |

967,000 |

1,066,000 |

|

1,000 |

3,000 |

|

1,000 |

4,000 |

|

650 |

| 800 |

- |

- |

|

- |

- |

|

- |

- |

|

|

| 1000 |

- |

- |

|

- |

- |

|

- |

- |

|

|

Note 1: Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Note 2: The weights are reported in United States short tons (2,000 lbs or 907.2 kg) and metric tonnes (1,000 kg or 2,204.6 lbs). The tonnage numbers are rounded to the nearest 1,000 unit, and therefore, may not add up.

Note 3: The density used to convert volume to tonnage is 1.70 g/cm3 for the Siebert Formation and the overburden/pediment.

Note 4: The mineral resource is contained within a conceptual pit shell in which blocks meet the test of reasonable prospects for eventual economic extraction. The estimation assumes a lithium recovery factor of 80%.

Note 5: To describe the resource in terms of the industry standard, a conversion factor of 5.323 is used to convert elemental Li to Li2CO3, or Lithium Carbonate Equivalent (LCE).

Collectively, the West Tonopah Lithium Project is predicted to contain 1) an indicated mineral resource in the west resource area of 44,000 short tons (40,000 metric tonnes) of elemental lithium, and 2) combined inferred mineral resources in the west and east resource areas of 92,000 short tons (84,000 metric tonnes) of elemental lithium. The west and east mineral resource areas are overlain by 71.9 and 11.0 million short tons (65.2 and 10.0 million metric tonnes) of overburden-pediment waste material, respectively.

Risks and Uncertainties

The mineral resource model and estimations are based on Enertopia's 2021-2023 exploration work at the West Tonopah Lithium Project. The lithium-claystone resources are subject to change as the project achieves higher levels of confidence in the geological setting, mineralisation, lithium recovery process development, and the implemented cutoff values. The current specific areas of uncertainty with the resource model include the inferred (speculated) fault zone that divides the west and resource areas, detailed stratigraphic modelling of specific Siebert Formation rock units, and the density used to calculate tonnage. The Qualified Person is not aware of any other significant material risks to the mineral resources other than the risks that are inherent to mineral exploration and development in general.

17

With respect to mineral processing, there is no guarantee that the Company can successfully extract lithium from claystone in a commercial capacity. The extraction technology is still at the developmental stage and while the Company has conducted preliminary indicative leach test work, the Qualified Person notes that no optimisation, variability, or reproducibility work has been undertaken at this stage of the study. This work is required prior to any solution impurity purification work. As the technology advances, there is the risk that the scalability of any initial mineral processing bench-scale and/or demonstration pilot test work may not translate to a full-scale commercial operation.

Quality Assurance - Quality Control

The QP assessed Enertopia's QA-QC dataset, which consisted of sample standards and duplicate analyses. Sample blanks were not used. The Company conducted all analytical work at ALS Vancouver and no check labs were commissioned. All QA-QC work was conducted on the Company's drill core samples. The analytical results of the duplicate pairs and standard samples are presented in the text that follows.

As an assessment of data quality and estimate of precision or reproducibility of the analytical results, the average percent relative standard deviation (also known as the % coefficient of variation), or average RSD% is calculated using the formula: RSD% = standard deviation/mean x 100. Average RSD% values below 30% are considered to indicate very good data quality; between 30 and 50%, moderate quality and over 50%, poor quality.

The RSD% of the duplicate pair's ranges from zero to 34.4%. If the single duplicate pair samples with 34.4 RSD% is removed, then the reproducibility improves significantly such that RSD% range is zero to 4%. The QP concludes that most of the duplicate samples exhibit very good data quality. The reason for the single duplicate pair with an RSD% of 34.4% is not known; the QP recommends that these samples are revisited by Enertopia to check sampled IDs and the Company's dataset. It is possible that the sample needs to be re-analyzed. Figure 11.1 shows the precision of the duplicate pairs with an R2 values 0.9747; this would improve to a near 1:1 relationship if the 'outlier' duplicate pair described above was removed from the plot. It is the QPs opinion that the duplicate pair sample analysis shows excellent precision and reproducibility of analytical results.

The QP has reviewed the adequacy of the sample preparation, security, and analytical procedures conducted by Enertopia and found no significant issues or inconsistencies that would cause one to question the validity of the data. A reasonable practical level of sample security from the field to the analytical laboratories is maintained by Enertopia.

The QPs review of the QA-QC results provides the opinion that the data is of reasonable quality, minimal contamination occurred during sample preparation and at the laboratories, and the analytical results are repeatable with good precision and accuracy. The QP is therefore satisfied with the adequacy of the sample preparation, security, and analytical procedures as implemented by Enertopia. The resulting exploration and drill-hole assay databases are reasonable and sufficient for ongoing exploration activities and target generation. The core logging and drill core assay database is of reasonable quality to formulate three-dimensional models, define the geometry of mineralized zones, and for use in mineral resource estimations. It is recommended that Enertopia bolster its QA-QC protocols in the future by considering the addition of Certified Reference Materials, sample blanks, and a secondary check laboratory.

Item 3. Legal Proceedings

We know of no material, existing or pending legal proceedings against us, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our Company.

Item 4. (Removed and Reserved).

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common shares are quoted on the Over-the-Counter Bulletin Board and the OTCQB quotation service and on the CSE under the symbol "ENRT." Our CUSIP number is 29277Q 107.

The following quotations reflect the high and low bids for our common shares based on inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

The high and low bid prices of our common stock on the OTCQB quotation service and Over-the-Counter Bulletin Board for the periods indicated below are as follows:

| Quarter Ended(1) |

High |

Low |

| August 2023 |

$0.031 |

$0.015 |

| May 2023 |

$0.05 |

$0.022 |

| February 2023 |

$0.057 |

$0.02 |

| November 2022 |

$0.05 |

$0.026 |

| |

|

|

| Quarter Ended(1) |

High |

Low |

| August 2022 |

$0.062 |

$0.031 |

| May 2022 |

$0.05 |

$0.034 |

| February 2022 |

$0.05 |

$0.033 |

| November 2021 |

$0.085 |

$0.051 |

(1) The quotations above were obtained from Stockwatch.com, reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

On November 22, 2023, the last closing price for one share of our common stock as reported by the OTC Bulletin Board was $0.0161. This closing price reflects an inter-dealer price, without retail mark-up, mark-down or commission, and may not represent an actual transaction.

The high and low bid prices (given in Canadian Dollars) of our common stock on the Canadian Securities Exchange for the periods indicated below are as follows:

| Quarter Ended(1) |

High |

Low |

| August 2023 |

$0.045 |

$0.010 |

| May 2023 |

$0.08 |

$0.035 |

| February 2023 |

$0.09 |

$0.040 |

| November 2022 |

N/A |

N/A |

| August 2022 |

N/A |

N/A |

| May 2022 |

N/A |

N/A |

| February 2022 |

N/A |

N/A |

| November 2021 |

N/A |

N/A |

(1) The quotations above were obtained from TD Waterhouse Investor Services and/or stockwatch.com, reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions. Before January 9, 2023 the company's shares were not trading on the CSE.

As of September 6, 2023, there were3,448 holders of record of our common stock. As of November 29, 2023, 155,166,088 common shares were issued and outstanding.

Our common shares are issued in registered form. Nevada Agency and Trust Company is the registered agent, 50 West Liberty Street, Suite 880, Reno, Nevada 89501 (Telephone: 775.322.0626; Facsimile: 775.322.5623).

Dividend Policy

We have not paid any cash dividends on our common stock and have no present intention of paying any dividends on the shares of our common stock. Our current policy is to retain earnings, if any, for use in our operations and in the development of our business. Our future dividend policy will be determined from time to time by our board of directors.

Recent Sales of Unregistered Securities

On February 16, 2023 the Company issued 50,000 common shares as a result of the exercise of stock warrants exercised at $0.04 per common share.

Equity Compensation Plan Information

We have no long-term incentive plans other than the stock option plan described below:

2014 Stock Option Plan

On July 15, 2014, the shareholders approved and adopted at the Annual General Meeting the Company's 2014 Stock Option Plan. The purpose of these Plan is to advance the interests of the Corporation, through the grant of Options, by providing an incentive mechanism to foster the interest of eligible persons in the success of the Corporation and its affiliates; encouraging eligible persons to remain with the Corporation or its affiliates; and attracting new Directors, Officers, Employees and Consultants.

This Plan shall be administered by our board. Subject to the provisions of this Plan, our board shall have the authority: to determine the Eligible Persons to whom Options are granted, to grant such Options, and to determine any terms and conditions, limitations and restrictions in respect of any particular Option grant, including but not limited to the nature and duration of the restrictions, if any, to be imposed upon the acquisition, sale or other disposition of shares of common stock acquired upon exercise of the Option, and the nature of the events and the duration of the period, if any, in which any Participant's rights in respect of an Option or shares of common stock acquired upon exercise of an Option may be forfeited; to interpret the terms of this Plan, to make all such determinations and take all such other actions in connection with the implementation, operation and administration of this Plan, and to adopt, amend and rescind such administrative guidelines and other rules and regulations relating to this Plan, as it shall from time to time deem advisable, including without limitation for the purpose of ensuring compliance with Section legislation hereof. Our board's interpretations, determinations, guidelines, rules and regulations shall be conclusive and binding upon our company, Eligible Persons, Participants and all other persons.

The aggregate number of Common Shares that may be reserved, allotted and issued pursuant to Options shall not exceed 17,400,000 shares of common stock, less the aggregate number of shares of common stock then reserved for issuance pursuant to any other share compensation arrangement. For greater certainty, if an Option is surrendered, terminated or expires without being exercised, the Common Shares reserved for issuance pursuant to such Option shall be available for new Options granted under this Plan.

The Board may amend, subject to the approval of any regulatory authority whose approval is required, suspend or terminate this Plan or any portion thereof. No such amendment, suspension or termination shall alter or impair any outstanding unexercised Options or any rights without the consent of such Participant. If this Plan is suspended or terminated, the provisions of this Plan and any administrative guidelines, rules and regulations relating to this Plan shall continue in effect for the duration of such time as any Option remains outstanding.

As at the date of the annual report, there were no stock options exercised except for those disclosed in the regulatory filings and in the notes to the consolidated financial statements.

2023 Stock Option Plan

On March 22, 2023, the shareholders approved and adopted at the Annual General Meeting the Company's 2023 Stock Option Plan. The purpose of these Plan is to advance the interests of the Corporation, through the grant of Options, by providing an incentive mechanism to foster the interest of eligible persons in the success of the Corporation and its affiliates; encouraging eligible persons to remain with the Corporation or its affiliates; and attracting new Directors, Officers, Employees and Consultants.

This Plan shall be administered by our board. Subject to the provisions of this Plan, our board shall have the authority: to determine the Eligible Persons to whom Options are granted, to grant such Options, and to determine any terms and conditions, limitations and restrictions in respect of any particular Option grant, including but not limited to the nature and duration of the restrictions, if any, to be imposed upon the acquisition, sale or other disposition of shares of common stock acquired upon exercise of the Option, and the nature of the events and the duration of the period, if any, in which any Participant's rights in respect of an Option or shares of common stock acquired upon exercise of an Option may be forfeited; to interpret the terms of this Plan, to make all such determinations and take all such other actions in connection with the implementation, operation and administration of this Plan, and to adopt, amend and rescind such administrative guidelines and other rules and regulations relating to this Plan, as it shall from time to time deem advisable, including without limitation for the purpose of ensuring compliance with Section legislation hereof. Our board's interpretations, determinations, guidelines, rules and regulations shall be conclusive and binding upon our company, Eligible Persons, Participants and all other persons.

The aggregate number of Common Shares that may be reserved, allotted and issued pursuant to Options shall not exceed 31,000,000 shares of common stock, less the aggregate number of shares of common stock then reserved for issuance pursuant to any other share compensation arrangement. For greater certainty, if an Option is surrendered, terminated or expires without being exercised, the Common Shares reserved for issuance pursuant to such Option shall be available for new Options granted under this Plan.

The Board may amend, subject to the approval of any regulatory authority whose approval is required, suspend or terminate this Plan or any portion thereof. No such amendment, suspension or termination shall alter or impair any outstanding unexercised Options or any rights without the consent of such Participant. If this Plan is suspended or terminated, the provisions of this Plan and any administrative guidelines, rules and regulations relating to this Plan shall continue in effect for the duration of such time as any Option remains outstanding.

As at the date of the annual report, there were no stock options exercised except for those disclosed in the regulatory filings and in the notes to the consolidated financial statements.

| Equity Compensation Plan Information |

Plan category

Equity compensation plans

approved by Security

holders |

Number of securities

to be issued upon

exercise of

outstanding options,

warrants and rights |

Weighted-average

exercise price of

outstanding options,

warrants and rights |

Number of securities

remaining available

for future issuance

under equity

compensation plans

(excluding securities

reflected in column

(a)) |

| 2014 Stock Option Plan approved by security holders |

9,900,000 |

$0.08 |

3,801,612 |

| 2023 Stock Option Plan approved by security holders |

31,000,000 |

$0.08 |

21,100,000 |

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during our fiscal year ended August 31, 2023.

Item 6. Selected Financial Data

As a "smaller reporting company", we are not required to provide the information required by this Item.

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with our audited consolidated financial statements and the related notes that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to; those discussed below and elsewhere in this annual report, particularly in the section Item 1A entitled Risk Factors of this annual report.

Our audited consolidated financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

Plan of Operation

During the next twelve month period (beginning September 1, 2023), we intend to:

• identify and secure sources of equity and/or debt financing for property payments;

• identify and secure sources of equity and/or debt financing for resource acquisitions;

• identify and secure sources of equity and/or debt financing for continued testing for Lithium technology

• identify and secure sources of equity and/or debt financing for clean technology acquisitions;

We anticipate that we will incur the following operating expenses during this period:

| Estimated Funding Required During the 12 Months beginning September 1, 2023 |

| Expense |

Amount ($) |

| Mineral Costs |

16,000 |

| Bench Tests for Lithium Technology |

60,000 |

| Resource Acquisitions and or Drilling |

60,000 |

| Management Consulting Fees |

180,000 |

| Technology Acquisition and Development |

120,000 |

| Professional fees |

75,000 |

| Rent |

12,000 |

| Other general administrative expenses |

125,000 |

| Total |

$648,000 |

As at the date of this annual report, we do not have sufficient cash on hand to finance our entire potential and estimated $648,000 cash obligation to the proposed spending for the 12 months beginning September 1, 2023. Based on our current cash position of $263,651 we anticipate that we will require approximately $384,349 in additional cash to execute our business plan. In the event that we are unable raise sufficient cash we intend to reduce our planned expenditures to accommodate our means with a view toward prioritizing revenue generating activity and fulfilling our public reporting obligations. As at the date of this registration statement we have no financing arrangements in place.

Results of Operations for our Years Ended August 31, 2023 and 2022

Our net income (loss) and comprehensive income (loss) for our year ended August 31, 2023, for our year ended August 31, 2022 and the changes between those periods for the respective items are summarized as follows:

| |

|

Years Ended |

|

|

|

|

| |

|

August 31, |

|

|

August 31, |

|

|

|

|

| |

|

2023 |

|

|

2022 |

|

|

Change |

|

| Revenue |

$ |

- |

|

$ |

- |

|

$ |

- |

|

| General and administrative |

|

110,783 |

|

|

65,931 |

|

|

(44,851 |

) |

| Investor relations |

|

63,293 |

|

|

47,917 |

|

|

(15,376 |

) |

| Consulting fees |

|

181,258 |

|

|

262,880 |

|

|

81,622 |

|

| Fees and dues |

|

89,733 |

|

|

57,332 |

|

|

(32,401 |

) |

| Exploration expenses |

|

464,665 |

|

|

212,348 |

|

|

(252,317 |

) |

| Research and development |

|

156,561 |

|

|

808,800 |

|

|

652,239 |

|

| Professional fees |

|

158,286 |

|

|

111,027 |

|

|

(47,259 |

) |

| Other expense (income) |

|

607,593 |

|

|

(3,540,642 |

) |

|

(4,148,236 |

) |

| Net loss (income) |

$ |

1,832,178 |

|

$ |

(1,974,407 |

) |

$ |

(3,806,585 |

) |

Our consolidated financial statements report no revenue for the years ended August 31, 2023, and August 31, 2022. Our consolidated financial statements report a net loss of $1,832,178 for the year ended August 31, 2023, compared to a net income of $1,974,407 for the year ended August 31, 2022. Our net income has decreased by $3,806,585 for the year ended August 31, 2023, primarily due to the decrease in Other expense (income). Our operating costs were lower by $341,651 for August 31, 2023, compared to August 31, 2022, primarily due to increase costs of our drilling program of $325,170 offset by reduced research and development technology costs of $156,561 compared to $808,800 in the prior year). The increase of exploration costs by $252,317 is primarily due to the exploration drilling activities of the Company in our West Tonopah property. Other expense (income) for the year ended August 31, 2023 primarily consisted of realized losses and realized foreign exchange losses on the sale of marketable securities of $564,346 and $41,735, compared to unrealized losses and unrealized foreign exchange losses on marketable securities of $923,533 and $62,388, respectively, and a gain on the sale of a mineral property of $4,532,382 in the prior year.

Liquidity and Financial Condition

| Working Capital |

|

August 31, |

|

|

August 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Current assets |

$ |

1,347,708 |

|

$ |

3,203,141 |

|

| Current liabilities |

|

332,600 |

|

|

357,855 |

|

| Working capital |

$ |

1,015,108 |

|

$ |

2,845,286 |

|

| |

|

August 31, |

|

|

August 31, |

|

| Cash Flows |

|

2023 |

|

|

2022 |

|

| Cash flows used in operating activities |

$ |

(1,212,225) |

|

$ |

(970,033) |

|

| Cash flows from investing activities |

|

854,599 |

|

|

1,099,564 |

|

| Cash flows from financing activities |

|

2,000 |

|

|

131,390 |

|

| Net (decrease) increase in cash during year |

$ |

(355,626 |

) |

$ |

260,921 |

|

Operating Activities

Net cash used in operating activities was $1,212,225 for the year ended August 31, 2023 compared with cash used in operating activities of $970,033 in 2022. The increase in net cash used in operating activities is due to the overall increase in cost as described above.

Investing Activities

Net cash provided in investing activities was $854,599 for the year ended August 31, 2023 compared to $1,099,564 in the same period in 2022. During the year ended August 31, 2023, the net cash was provided by the sale of the Century Lithium stock compared to the prior year being the result of the sale of Clayton Valley, Nevada claims.

Financing Activities

Net cash provided in financing activities was $2,000 for the year ended August 31, 2023, compared to $131,390 in the same period in 2022.

Contractual Obligations

As a "smaller reporting company", we are not required to provide tabular disclosure obligations.

Going Concern

Our consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States applicable to a going concern, which contemplates the realization of assets and the satisfaction of liabilities and commitments in the normal course of business. The Company had a working capital of $1,015,108 as at August 31, 2023 (2022 - $2,845,286). As at August 31, 2023, the Company has incurred cumulative losses of $14,526,485. We require additional funds to maintain our existing operations and to acquire new business assets. These conditions raise substantial doubt about our Company's ability to continue as a going concern. Management's plans in this regard are to raise equity and debt financing as required, but there is no certainty that such financing will be available or that it will be available at acceptable terms. The outcome of these matters cannot be predicted at this time and the financing environment is exceptionally difficult.

The Company's consolidated financial statements do not include any adjustments to reflect the future effects on the recoverability and classification of assets or the amounts and classification of liabilities that might result from the outcome of this uncertainty.

At this time, we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock or through a loan from our directors to meet our obligations over the next twelve months. We do not have any arrangements in place for any future debt or equity financing.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

Critical Accounting Policies