TIDMFARN

RNS Number : 7673S

Faron Pharmaceuticals Oy

08 November 2019

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH

AFRICA, SINGAPORE, HONG KONG OR ANY OTHER JURISDICTION IN WHICH

SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

Faron Pharmaceuticals Oy

Results of Placing and Issue Price

Issue of Equity and Total Voting Rights

PDMR dealing

Capitalised terms used in this announcement have the meanings

given to them in the announcement made at 16.51 GMT on 7 November

2019 regarding the proposed placing of new ordinary shares in the

company (the "Launch Notice"), unless the context provides

otherwise.

TURKU - FINLAND, 8 November 2019 - Faron Pharmaceuticals Oy

("Faron" or the "Company") (AIM: FARN), the clinical stage

biopharmaceutical company, is pleased to announce that the

Bookbuild, announced on 7 November 2019, is now closed and the

Company has accepted subscriptions for 3,935,500 Placing Shares,

which number also corresponds to the minimum number of ordinary

shares initially intended to be issued in the Placing. The Placing

comprises the issue of 3,935,500 Placing Shares at an Issue Price

of GBP 190 pence per Placing Share. This is equivalent to an Issue

Price of EUR 2.198 per Placing Share.

The Placing Shares to be issued amount to approximately 10.0 per

cent. of the issued shares and votes in the Company, immediately

prior to the Placing. The Company raises aggregate gross proceeds

of GBP 7.48 million (EUR 8.65 million) in the Placing.

The Placing Shares will confer a right to dividends and other

shareholder rights from their registration with the trade register

kept by the Finnish Patent and Registration Office (the "Trade

Register") which is expected to be on or about 12 November 2019

("Registration"). Following Registration, the Placing Shares will

subsequently be entered in the book-entry system maintained by

Euroclear Finland Oy and registered in the book-entry accounts of

each investor. Trading in the Placing Shares is expected to

commence on the AIM market of the London Stock Exchange on or about

14 November 2019.

Following issue and Registration of the Placing Shares, the

number of shares in Faron will be 43,290,747 ordinary shares with

voting rights attached. The Company has no shares in treasury;

therefore the total number of voting rights in Faron will be

43,290,747 (the "New Number of Shares and Votes"). This figure may

be used by shareholders as the denominator for the calculations by

which they will determine whether they are required to notify an

interest in, or a change to their interest in, the New Number of

Shares and Votes of the Company.

Commenting on the successful Placing, Dr Markku Jalkanen, CEO of

Faron, said: "We are very pleased to have received such a

tremendous support from new and existing shareholders, employees

and Company directors in this transaction. We are very happy to

have a significant number of new Nordic shareholders. This

financing will allow us to further progress our clinical programme

on Clevegen with a view to clarifying its full potential, either

alone or in combination with existing cancer treatments. This is

very important as many, if not all, cancer patients have reduced

immune capacity to defend them against cancer spread and may

potentially be focal information in terms of specifying our goals

for the ongoing partnering discussions."

Use of Proceeds

The net proceeds raised in the Placing will be used to further

the clinical development of Clevegen(R) as described in the Launch

Notice. The net proceeds of the Placing are expected to provide the

Company with twelve months' working capital.

Related Party and PDMR Transactions

Timo Syrjälä, an existing shareholder in the Company, has

subscribed for 113,282 Placing Shares in aggregate (subscribed for

through Acme Investments SPF Sarl ("Acme"), an entity wholly owned

by Mr Syrjälä), for an aggregate subscription value of EUR 248,994

(GBP 215,235) at the Issue Price. Following the Placing, Mr

Syrjälä's total holding in the Company's shares, which includes his

indirect holding through Acme, will be 6,086,855 shares,

representing 14.06 per cent. of the New Number of Shares and Votes.

Mr Syrjälä is a "Substantial Shareholder" in the Company for the

purposes of the AIM Rules for Companies (the "AIM Rules"). His

subscription for Placing Shares pursuant to the Placing is a

related party transaction for the purposes of the AIM Rules. The

independent directors for the purpose of the Placing, being Gregory

Brown, John Poulos, Leopoldo Zambeletti, Markku Jalkanen and Matti

Manner, all of whom are independent of Mr Syrjälä, having consulted

with Panmure Gordon, the Company's nominated adviser for the

purposes of the AIM Rules, consider the terms of the participation

by Mr Syrjälä in the Placing to be fair and reasonable insofar as

shareholders are concerned.

Dr Frank Armstrong, chair of the Board of Directors, has

subscribed for 9,063 Placing Shares at the Issue Price. The

beneficial interests of the directors in the issued shares and

votes of the Company is set out below:

Before the Placing Following the Placing

Holding as Number of Holding as a

Number of a % of the Placing Shares Number of % of the Company's

ordinary Company's shares subscribed ordinary New Number of

Director shares held and votes for shares held Shares and Votes

Dr Frank Armstrong 55,729 0.14% 9,063 64,792 0.15%

The participation of Dr Frank Armstrong in the Placing

constitutes a related party transaction for the purposes of the AIM

Rules. The independent directors for the purpose of the Placing,

being Gregory Brown, John Poulos, Leopoldo Zambeletti, Markku

Jalkanen and Matti Manner, have consulted with the Company's

nominated adviser, Panmure Gordon, and consider that the terms of

the related party transaction are fair and reasonable insofar as

the shareholders are concerned.

Other persons discharging managerial responsibilities ("PDMRs")

also participated in the Placing; these include Maria Lahtinen,

Toni Hänninen and Yrjö Wichmann who subscribed for 2,226; 6,797 and

6,797 Placing Shares respectively. Further details are provided

below.

In addition to the subscriptions made by the directors and PDMRs

above, members of the personnel of the Company have also subscribed

for 14,046 Placing Shares.

Exchange rate

Unless otherwise specified, this notice contains certain

translations of euros into amounts in pounds sterling for the

convenience of the reader based on the exchange rate of EUR 1 = GBP

0.86442, being the published exchange rate by the European Central

Bank at the close of business on 7 November 2019 (the latest

practicable date prior to the date of this notice).

The information contained within this notice constitutes inside

information stipulated under the Market Abuse Regulation (EU) No.

596/2014.

For more information please contact:

Faron Pharmaceuticals Oy

Dr Markku Jalkanen, Chief Executive Officer

investor.relations@faron.com

Carnegie Investment Bank AB, Financial Adviser

Mika Karikoski (Corporate Finance)

Phone: +358 9 6187 1295

Panmure Gordon (UK) Limited, Nomad and Broker

Emma Earl, Freddy Crossley (Corporate Finance)

James Stearns (Corporate Broking)

Phone: +44 207 886 2500

Consilium Strategic Communications

Mary-Jane Elliott

Phone: +44 (0)20 3709 5700

E-mail: faron@consilium-comms.com

Westwicke Partners, IR (US)

Chris Brinzey

Phone: 01 339 970 2843

E-Mail: chris.brinzey@westwicke.com

Notification of a Transaction pursuant to Article 19(1) of Regulation

(EU) No. 596/2014

1 Details of the person discharging managerial responsibilities/person

closely associated

----- ----------------------------------------------------------------------------------------------

a. Names (Position) Frank Armstrong (Chair)

Maria Lahtinen (Director, Supplier Management)

Toni Hänninen (CFO)

Yrjö Wichmann (Vice President, Financing

and Investor Relations)

---------------------------------------------------------

2 Reason for notification

----------------------------------- ---------------------------------------------------------

a. Position/Status Persons discharging managerial responsibilities

----------------------------------- ---------------------------------------------------------

b. Initial notification/ Initial Notification

Amendment

----------------------------------- ---------------------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

----------------------------------------------------------------------------------------------

a. Name Faron Pharmaceuticals Oy

-----------------------------------

b. LEI 7437009H31TO1DC0EB42

----------------------------------- ---------------------------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

----- ----------------------------------------------------------------------------------------------

a. Description of Ordinary shares

the financial

instrument, type ISIN: FI4000153309

of instrument

Identification

Code

----------------------------------- ---------------------------------------------------------

b. Nature of the Purchase of ordinary shares

transaction

----------------------------------- ---------------------------------------------------------

c. Price(s) and Price(s) Volume(s)

volume(s)

----------------------------------- -------------------------

EUR19,921.99 9,063

EUR4,981.05 2,266

EUR14,940.94 6,797

EUR14,940.94 6,797

------------------------- -----------------

Aggregated information

- Aggregated

Volume 24,923

d. - Price EUR54,784.93

----------------------------------- ---------------------------------------------------------

e. Date of the transaction 8 November 2019

----------------------------------- ---------------------------------------------------------

f. Place of the Turku

transaction

----------------------------------- ---------------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCBPBFTMBIMMIL

(END) Dow Jones Newswires

November 08, 2019 02:00 ET (07:00 GMT)

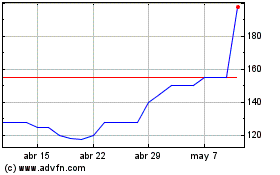

Faron Pharmaceuticals Oy (LSE:FARN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Faron Pharmaceuticals Oy (LSE:FARN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024